General information

Reverse charge is a mechanism transferring the obligation to calculate tax on a concluded transaction from a vendor to a customer. The list of items for national transactions which are covered by the reverse charge procedure is included in Appendix no. 11 to the VAT Act. Additionally, the list of services covered by the reverse charge procedure is included in Appendix no. 14 to the Act.

Configuration of reverse charge

- In Company Structure → Company, it is necessary to select the parameter Handle reverse charge

- In Configuration → VAT Rates, it is necessary to define a VAT rate for reverse charge

- If reverse charge is to be used in connection with a customer/vendor, it is necessary to select the Reverse charge parameter on that customer’s/vendor’s form

- If an item is to be covered by the reverse charge mechanism, it is necessary to select the Reverse charge parameter on that item’s form. Once it is selected, the system displays an additional field containing the list of active values from a generic directory which enable the classification of reverse charge for particular item types. Such values may be defined in Configuration → Generic Directories → (General) → Reverse Charge Classification.

Handling of reverse charge in documents

The following document types may register the handling of reverse charge:

- Quotes

- Orders

- Advance invoices and their corrections

- Invoices (generated from a document and manual ones) and their corrections

- SO releases and their corrections

- PO receipts and their corrections

The Reverse charge parameter responsible for the handling of reverse charge in documents is available:

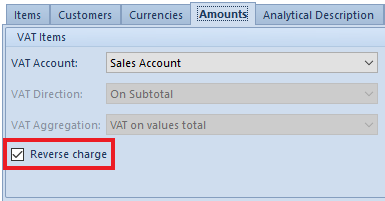

- On the Amounts tab – the parameter value is either retrieved to a document from a customer/vendor form or can be selected manually if the following conditions are met:

- The document status must be Initiated or Unconfirmed

- The transaction type must be set as National. Changing the type to EU or Non-EU deselects the parameter and makes it impossible to edit it.

Note

In the case of national transactions, setting Export in the VAT Rates field does not update VAT rates for items to be covered by reverse charge. For such items, a VAT rate is retrieved according to VAT rate settings for reverse charge.

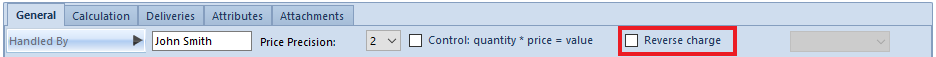

- In document item details – the parameter value is either retrieved from a relevant item form or it can be selected manually, provided that the Reverse charge parameter has been selected on the Amounts Once it is selected, it is no longer possible to change a VAT rate for a document item. Deselecting the parameter retrieves a VAT rate from a relevant item form.

Transfer of the Reverse charge parameter’s settings upon document generation

| Generation | Value of Reverse charge parameter for 1:1 generation | Value of Reverse charge parameter for n:1 generation |

|---|---|---|

| SQ → SO PQ → PO SO → SI SO → SOR PO → PI PO → POR | The parameter value is retrieved from a source document with a possibility to change it. | If a final document (e.g. SO) is generated from several source documents (e.g. SQ1, SQ2), the parameter will be selected in the header of the generated final document (SO) if it has been selected in at least one of the source documents (SQ1, SQ2). |

| SO → ASI PO → API | The parameter value is retrieved from a source document with no possibility to change it. | Not applicable. |

| SI → SOR PI → POR POR → PI SOR → SI | The parameter value is retrieved from a source document with no possibility to change it. | If a final document (e.g. SI) is generated from several source documents (e.g. SOR1, SOR2), the parameter will be selected in the header of the generated final document (SI) if it has been selected in at least one of the source documents (SOR1, SOR2). |

| Corrections issued to documents | The parameter value is retrieved from a source document, with no possibility to edit it. | Not applicable. |