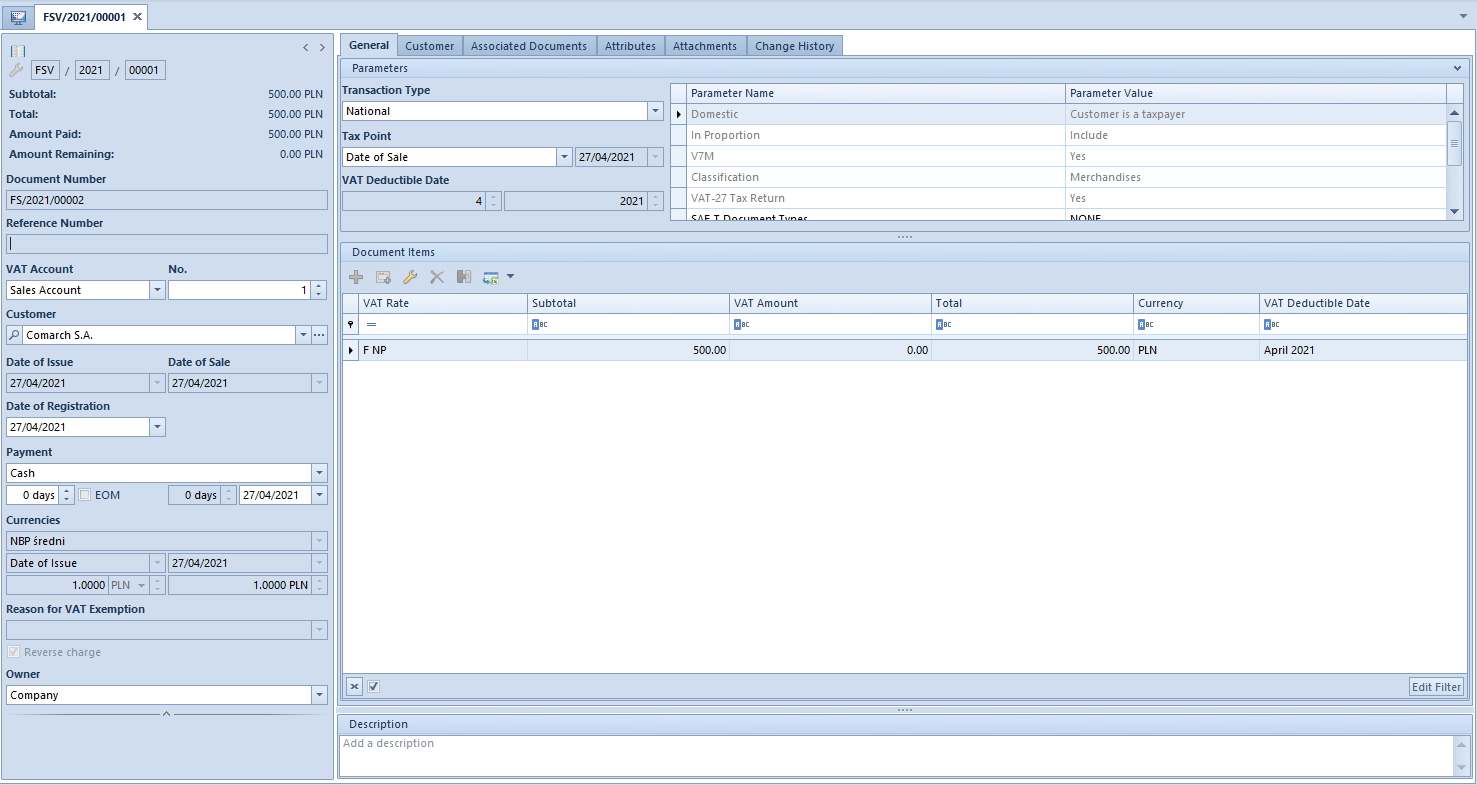

On VAT sales invoices and VAT sales invoice corrections generated automatically to a trade document on which parameter Reverse charge was checked, information parameter Reverse charge is displayed (provided for information purposes). It is grayed out and cannot be edited.

Additionally, for VAT invoice items included in reverse charge value of parameter Domestic is set as Customer is a taxpayer.

Note

Sales invoice items included in reverse charge and invoice items for which in field VAT Rate is set value: E ENS, are included separately on a VAT sales invoice.

In case of VAT purchase invoice regarding reverse charge, it is possible to issue internal documents: VSI and VPI which do not generate payments and are only used for calculating and deducting VAT.