Contents

General information

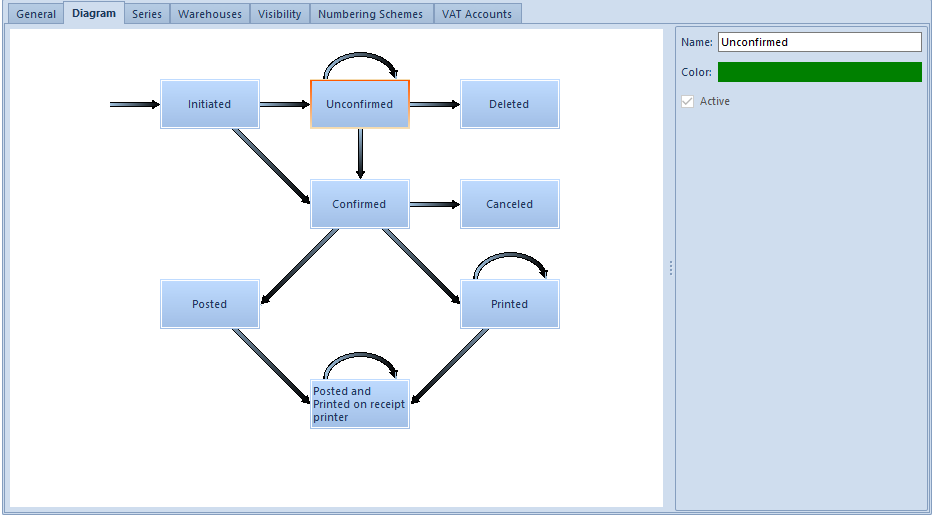

In Comarch ERP Standard system, it is possible to design a diagram of statuses in VSI, VPI, VSIC, and VPIC document definitions.

In tab Diagram of a document definition, it is possible to define which of the statuses will be activated. This option is only available until the first document of a given type is issued.

When editing status Unconfirmed/Canceled, parameter Active is available. Checking it results in activation of status being edited. Moreover, activation/deactivation of Unconfirmed (Canceled) status automatically checks/unchecks Canceled (Unconfirmed) status.

In databases created in French, Unconfirmed and Canceled statues are checked as active, by default. In databases created in other language versions, both statuses are deactivated, by default.

Adding VAT invoice with active status Unconfirmed and Canceled

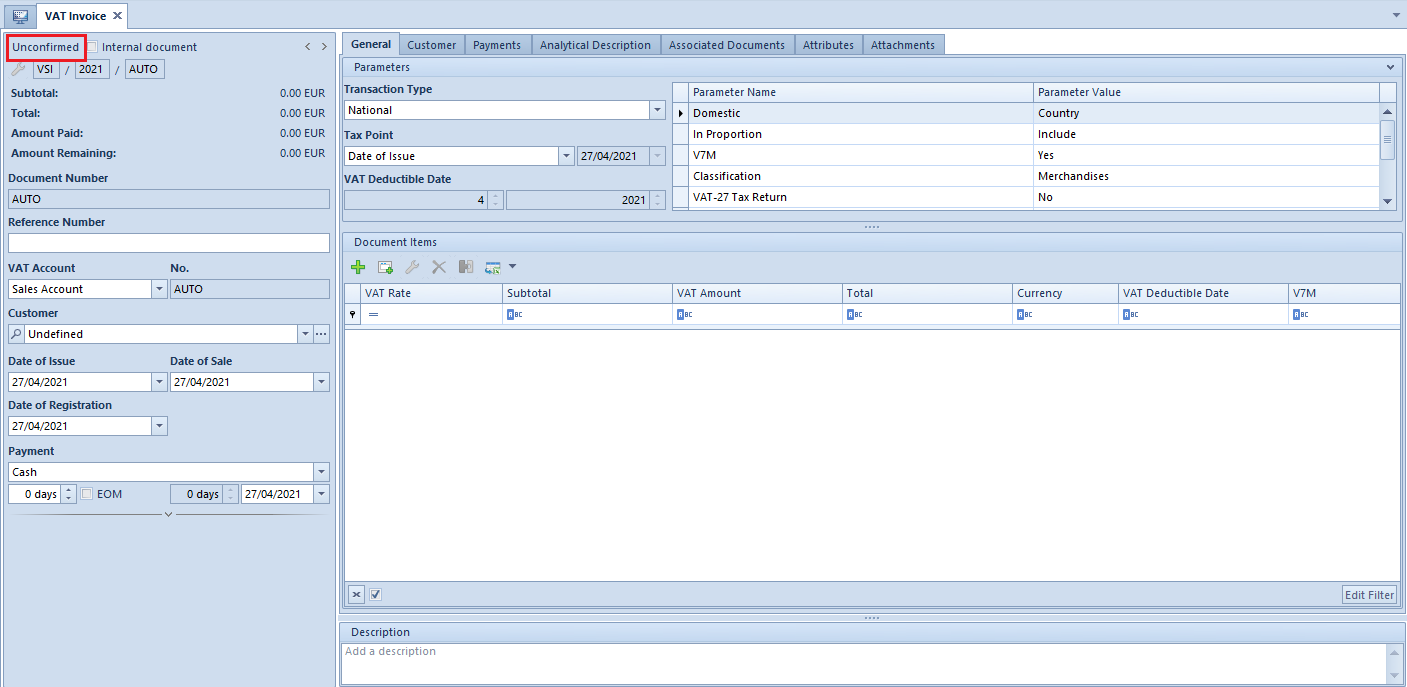

A VAT invoice which can adopt each status available in the diagram is added the same way as an invoice on which Unconfirmed and Canceled statuses have not been activated (see article Adding VAT invoice in system currency).

However, there are additional fields available on the form of such invoice, which indicate status of document.

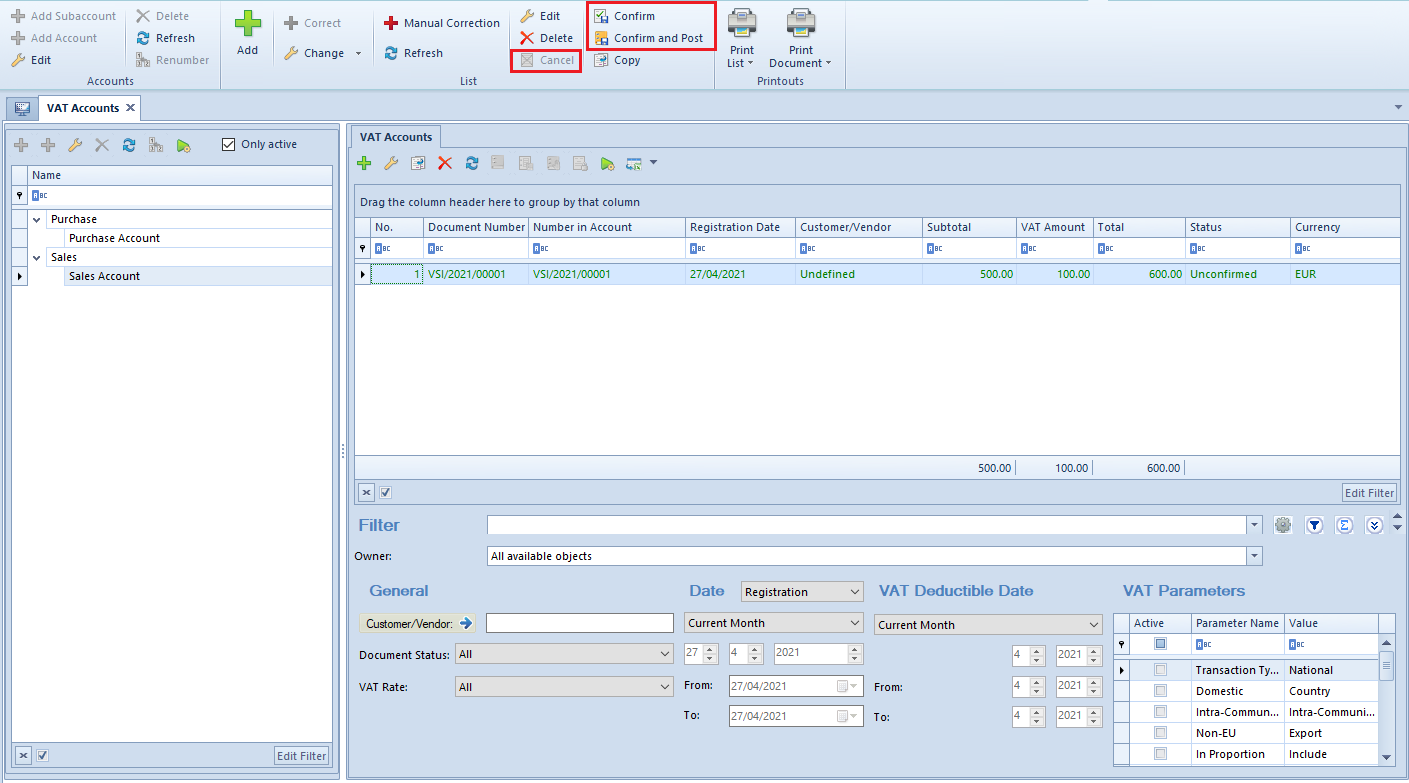

Additionally, both in the Ribbon menu of the invoice list and in the VAT invoice form, the following additional options are available: Confirm, Confirm and Post and Cancel.

- Unconfirmed VAT invoices are subject to completion until they are confirmed. In this regard, the system operates the same way as in case of trade documents

- VAT invoices generated from trade documents can be canceled only by canceling trade documents

- Only unposted documents can be canceled

- If the parameter Require a reason for document cancellation is selected in the definition of SIT or SITC document, then when canceling a SIT or SITC document added from the level of a VAT account, a window for specifying the reason for document cancellation is displayed. The specified reason is then presented on the form of SIT or SITC in the field Reason for Document Cancellation. If SIT or SITC was generated from a trade document, then the reason for cancellation in the VAT document is completed on the basis of the reason selected during cancellation of the trade document.

- Canceled VAT invoices are not included in tax returns

- Tax returns include both confirmed and unconfirmed documents

- A trade document to which an unconfirmed VAT invoice was generated cannot be posted until the VAT invoice is confirmed

Generating VAT invoices on the basis of trade documents

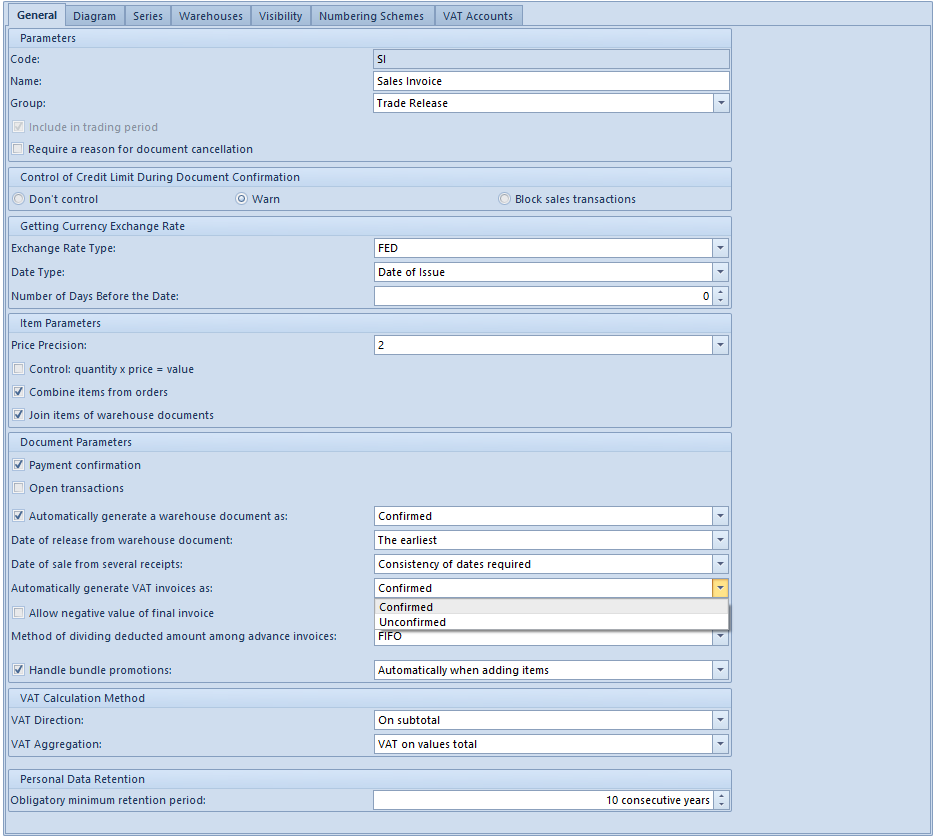

After status Unconfirmed/Canceled is activated for VAT documents, additional parameter Automatically generate VAT invoices with status: Unconfirmed/Confirmed becomes available in definitions of trade documents (Configuration → Company Structure → Company → Documents) on the basis of which a document is generated in VAT account. Appropriate setting of this parameter determines what status an automatically generated VAT invoice adopts.