In VAT-ZD tab, it is possible to search for historical document payments classified as Domestic transactions and with regard to payment status: paid, open, not subject to payment in historical approach.

Operations which can be performed in the VAT -ZD tab:

- Adding an account – button [Add Account]

- Adding a subaccount – button [Add Subaccount]

- Editing an account and subaccount – button [Edit]

- Deleting an account and subaccount – button [Delete]

- Editing the entire VAT document – button [Edit], option [Edit Document]

- Editing a selected payment – button [Edit], option [Edit Payment]

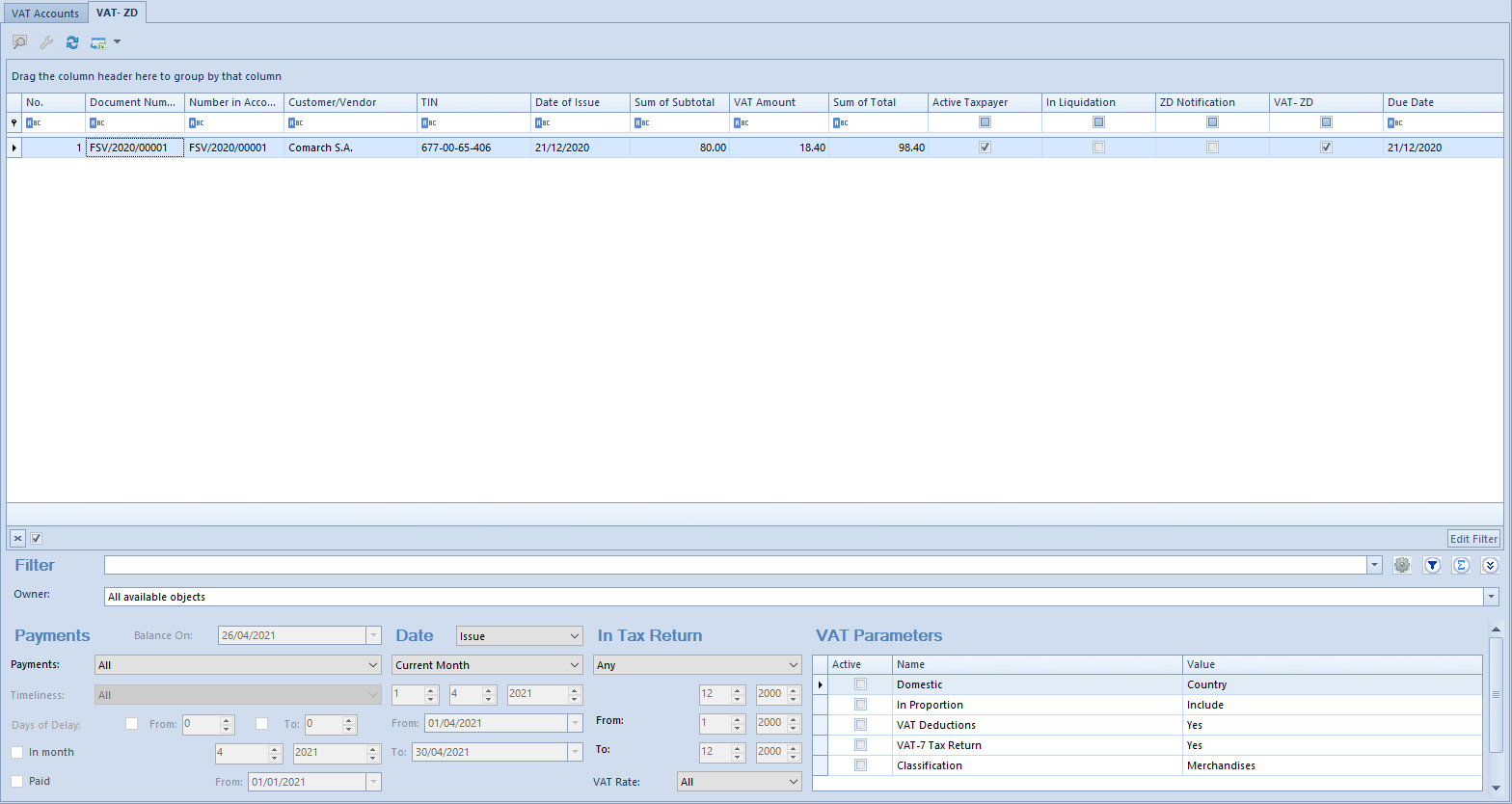

The VAT-ZD tab is divided into three sections:

- Accounts Tree – presents the structure of sales and purchase accounts and subaccounts

- VAT Invoices – depending on marked account/subaccount, appropriate documents or document payments registered in the selected VAT account are displayed in the list

- Filter panel – allows for filtering list of VAT invoices

VAT accounts tree

Description of this section can be found in article <<List of VAT accounts>>.

List of VAT invoices in the VAT-ZD tab

The list of VAT invoices displays the VAT documents or document payments classified to Domestic type of transactions and registered in the selected account available on the accounts tree.

The list of VAT invoices in the VAT-ZD tab is composed of the following columns: No., Document Number, Number in Account, Customer/Vendor, TIN, Date of Issue, Sum of Subtotal, VAT Amount, Sum of Total, Active Taxpayer, In Liquidation, ZD Notification, VAT-ZD, Due Date.

On the list of VAT invoices, it is possible to select additional columns, such as: Days of Delay, Reference Number, Status, Currency.

Settings of the parameters Active Taxpayer and In Liquidation are consistent with the data specified on customer/vendor form at the time of issuing an invoice.

In the Customer/Vendor column, a customer/vendor details are presented in compliance with a source document even if a payer is changed in document payment.

Selection of the check box in the column VAT-ZD depends on the value selected in field VAT-ZD in a document payment. If option Yes or Beyond the system is selected in the invoice payment – the check box is selected, if option No is selected – the check box remains deselected.

Selection of the check box in the column ZD Notification depends on inclusion of an invoice in a ZD notification. If it is included in the notification, the check box is selected. Otherwise, the check box is deselected.

Value presented in the Days of Delay column determines the number of days after due date for both applied and open payments. In the case of open payments, that value determines the difference between the date specified in the Balance On field and the due date of a given payment. In the case of applied payments, it presents the difference between the due date and the latest date of the applied payment dates until the date specified in the Balance On field.

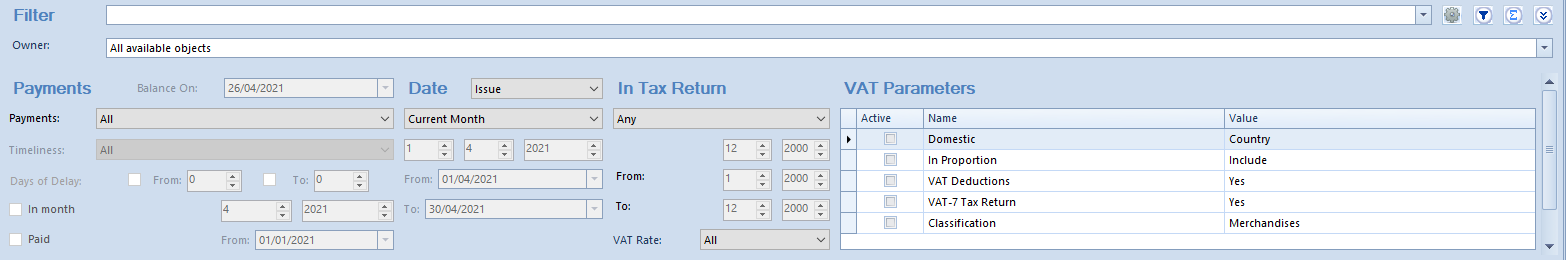

Filter panel

Detailed description of functioning of the filters can be found in category <<Searching and filtering data>>>

Owner – allows filtering the list of VAT invoices by their owners

The filtering panel is divided into four basic sections:

Payments – allows filtering the list by:

- Balance On – this option is activated upon selecting Open/Partially Open or Applied/Partially Applied option under the Payments filter. After specifying a date, data can be presented on the list historically.

- Payments – options possible to select are: All, Open/Partially Open, Applied/Partially Applied, Not Subject To Payment. In case of selecting All or Not Subject To Payment options, the filter options Balance On and Paid in this section are inactive.

- Timeliness – this filter option is active and changeable when Payment option is selected in filter and Applied/Partially Applied or Open/Partially Open is selected in the Payments filter. Available values of this filter are All, Overdue, Not overdue.

- Days of Delay – this option is activated when the option Timeliness is set to Overdue; it is used to specify the number of overdue days.

- In month – this option is activated when the option Timeliness is set to Overdue and the option Days of Delay is selected. If this parameter is deselected, then all open documents in the case of which it has already been 90/150 days since they due dates will be listed on the list and if it is selected, then the listed documents will be the open documents in the case of which it has already been 90/150 days since their due dates in a selected month.

- Paid – this option is activated upon selecting Applied/Partially Applied option under the Payments filter. Selecting the Paid check box makes possible to specify a range of dates From and To, within payment associations/compensations made to a document payment will be verified.

Variant A

Options Payments: Open/Partially Open, Balance ON: current date are selected

Timeliness: Overdue, Days of Delay from: 10 – the VSI will be displayed on the list twice in amounts resulting from the open payments.

Variant B

Options Payments: Applied/Partially Applied, Balance On: current date,

Timeliness: Overdue, Days of Delay from: 3 – the VSI will be displayed on the list twice in amounts resulting from the open payments

Date – allows for filtering the list according to one of the available dates.

For purchase accounts these dates are the following:

- Registration

- Issue

- Receipt

- Purchase

- Vendor’s Tax Point

- Right To Deduct

For sales accounts these dates are the following:

- Registration

- Issue

- Sales

- Tax Point

Time ranges available for selection are the following:

- Current Month

- Day

- Month

- Year

- Range of Dates

- Previous Month

- Any

Other fields are used for specifying of appropriate time ranges for filtering.

InTax Return – allows for filtering the list according to a time range within which documents were registered in a tax return. Time ranges available for selection are the following:

- Current Month

- Month

- Year

- Previous Month

- Range of Dates

- Any

VAT Rate – (it is possible to select a rate from VAT rate group assigned to a company to which a user is logged-in)

VAT Parameters – allows for filtering the list by VAT parameters. To filter the list of VAT invoices, the checkbox available in the Active column should be checked by the parameters which must be included in the searched VAT invoices Additionally, the list can by filtered by the following options:

- Domestic with options: Country, Tax free, Customer is a taxpayer, Country or Customer is a taxpayer

- In Proportion with options: Include, Exclude, In the denominator only

- VAT Deductions with options: Yes, No, Conditionally

- VAT-7 Tax Return with options: Yes, No

- Classification with options: Merchandises, Services, Costs, Fixed assets, Means of transport, Real estate, Services payable to customer, Merchandises/Services, Fuel, Purchase of cash register device, Physical inventory