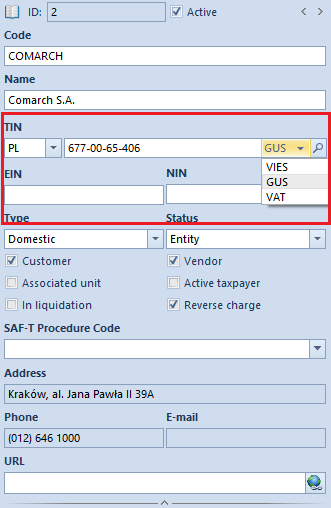

When defining a customer/vendor with Entity status, a user can verify its TIN number in Central Statistical Office of Poland (GUS) service and VIES service. It can be done with the use of a list placed next to the TIN field, in the header of a customer/vendor form, which contains the following options: GUS, VIES and VAT

Verification of TIN number in GUS and VIES database

Upon entering an appropriate value in the TIN field in the header of a customer/vendor form, it is necessary to select from the drop-down list the service from which the data is to be retrieved. For Polish customers/vendors, verification in GUS and VIES databases is available, whereas for UE customers/vendors only verification in VIES database is available. The option of verification is not available for non-EU customers/vendors or in case of entering an invalid TIN number format.

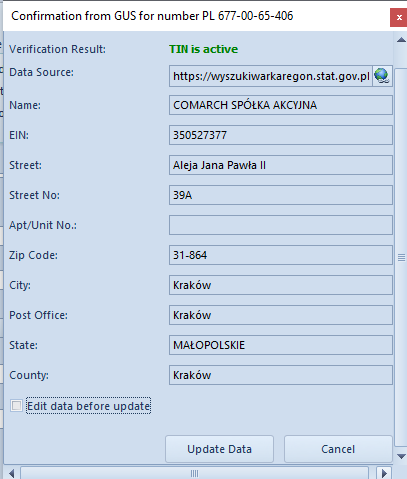

After a correct verification of a TIN number, the system displays a window confirming the verification.

Checking the parameter Edit data before update allows for editing data on the form.

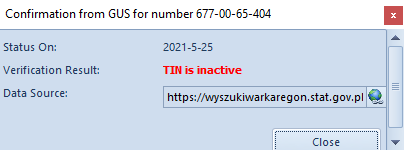

In case of a negative verification, the system displays the following window:

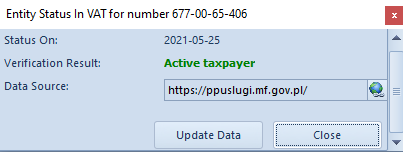

Verification of entity’s VAT status

For Polish entities, besides the TIN number verification, it is also possible to perform verification of VAT status. It can be done with the use of VAT option, available on the drop-down list placed next to the TIN field.

In case of a negative verification, the system displays an appropriate information in Verification Result field.