Statement of Retail Sale (SRS) and Correction of Retail Sale (CRS) are the documents presenting the total value of retail sales recorded by means of receipts as well as their corrections within a specified time interval in a given company/center.

SRS/CRS documents register sales broken down into the subtotal, total as well as VAT rate values.

As a result of confirming an SRS/CRS a VAT sales invoice/VAT sales invoice correction is automatically generated. This way, the sales value registered with receipts/receipt corrections is recorded in a VAT account.

Functionalities relating to the statement of retail sale and corrections of retail sale are available from the level of the tab Sales → SRS/CSR.

The list of documents has been described in article List of documents.

Automatic generation of SRS/CRS documents

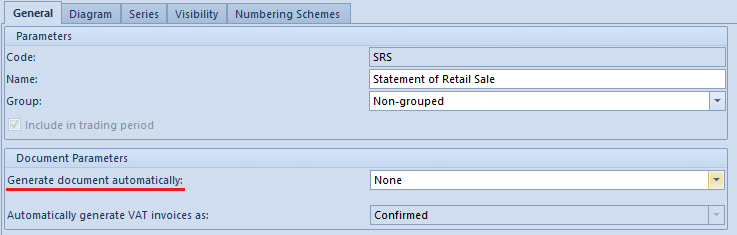

In the system it is possible to set the frequency of creating SRS/CRS documents separately for each center. The parameter determining method of generating SRS/CRS is available from the level of Configuration → Company Structure → Company → Documents.

The parameter can assume the following values:

- None

- For each document

- Everyday

- Every month

After a user selects an option different than None, when adding a new R/RQC/RVC, the system verifies whether exists an SRS/CRS to which a given document can be added.

If it exists – the system adds the document being issued to it

If it does not exist:

- the system creates an SRS/CRS in the background and sets the range of dates according to selected option of automatic generation

- saves such document as unconfirmed

- adds to it newly created documents fulfilling criteria specified on it

Manual generation of SRS/CRS documents

In case an SRS/CRS document is created manually, a user can add receipts/corrections from different centers of the same company.

In order to add receipts/corrections to a statement, a user:

- has to click on button [Add] on the form of an SRS/CRS document

- select from the list confirmed receipts/corrections which have been issued within a defined range of time

Only those receipts are displayed on the list that have not been included in another statement.

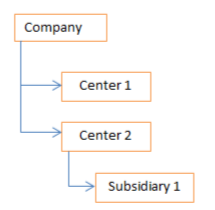

Example 1:

When SRS/CRS is issued with owner set as:

- Company – all receipts/corrections/tax free documents are added whose owner is Company, Center 1, Center 2, Subsidiary 1

- Center 1 – all receipts/corrections/tax free documents are added whose owner is Center 1

- Center 2 – all receipts/corrections/tax free documents are added whose owner is Center 2 and Subsidiary 1

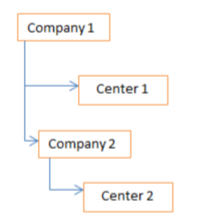

Example 2:

When SRS/CRS is issued with owner set as:

- Company 1 – all receipts/corrections/tax free documents are added whose owner is Company and Center 1

- Center 1 – all receipts/corrections/tax free documents are added whose owner is Center 1

- Company 2 – all receipts/corrections/tax free documents will be added whose owner is Company 2 and Center 2

Combine all document types on CRS

In definition of CRS document (available in Configuration → Company Structure → Company/Center → Documents), there is parameter Combine all types of documents.

- It decides whether a correction of retail sales should contain quantity and value corrections of receipts and TAX FREE documents

- It can be edited if an option different than None has been selected in the field Generate document automatically

- It is checked by default

Additionally, in the CSR document, there is a parameter Document type which allows for indicating the documents that should be included in a statement, it is possible to select one of the following options:

- <All>– default option; value and quantity receipt corrections as well as tax free documents are included in CRS Receipt Quantity Correction Receipt Value Correction Tax Free

- Receipt Quantity Correction

- Receipt Value Correction

- Tax Free

Value of the parameter can be changed until the first document is added onto CRS form.

Blockade of attaching receipts/receipt corrections to SRS/CRS

If on the form of the company within which the SRS document is being added, parameter Invoice to a receipt according to Polish regulations is checked, then, on the list of receipts to be added to the SRS, the following documents are not presented:

- with indicated customer’s TIN number,

- with the total value lower or equal to 450 PLN.

Also, the above-mentioned documents will not be included during the automatic addition of receipts to SRS.

When adding receipt corrections to CRS, the system verifies whether the source receipt fulfills the conditions of the simplified invoice – the value of the correction will not be taken into account by the verification mechanism.

Adding receipts/receipt corrections being simplified invoices to SRS/CRS

On the forms of SRS and CRS documents (tab General → VAT Parameters), there is parameter Include simplified invoices when attaching documents. It is presented only if in the configuration of the company being owner of the document, the parameter Invoice to a receipt according to Polish regulations is checked.

Depending on the setting of the parameter:

- On the list of the receipts to be added to SRS (and of their corrections to be added to CRS), receipts/invoices marked as simplified invoices are not displayed – parameter unchecked.

- On the list of receipts to be added to SRS (and of their corrections to be added to CRS), are displayed receipts/invoices marked as simplified invoices for which no VAT invoice was generated – parameter checked.

The functioning described above is the same for the automatic addition of receipts/corrections to SRS/CRS.