Advance sales and purchase invoices are trade documents recorded as a result of receiving or paying cash against a future sale/purchase. When clearing a sales/purchase transaction of merchandise or services, the value of a sales or purchase invoice is decreased by values of the advance invoices registered earlier. They result in calculation of subtotal and total values, VAT tax and generate payments.

Advance sales invoices are located in module Sales in the same list as sales invoices, and advance purchase invoices in module Purchase in the same list as purchase invoices.

Characteristic properties of the advance sales and purchase invoice

A saved (unconfirmed) advance invoice:

- is partially editable

- can be deleted

- can be confirmed from the level of a document form or a list of invoices

- cannot be posted

- generates uncleared payment

A confirmed advance invoice:

- is not subject to edition – it is only possible to preview details of a document or of an item, without a possibility of editing it

- cannot be edited, but only canceled

- can be posted

- generates payment which, depending on selected payment form, can be cleared or uncleared

- generates an entry in VAT accounts

- it is possible to generate a value correction to it

Generating advance invoice

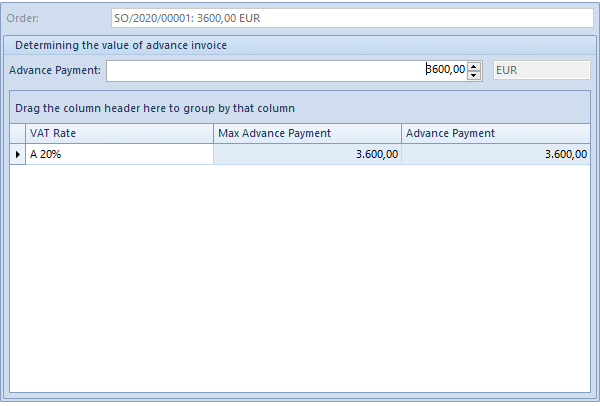

Advance invoices are generated from a sales/purchase order which is confirmed or being executed. It is possible by selecting an order on a list of orders and clicking on button [ASI]/[API] from the group of buttons Generation. This action results in opening of a new window which enables determining the value of advance payment.

In the window it is necessary to define the total value of advance payment for the entire document or for individual VAT ratesV included in the order collected/transferred towards a future sale/purchase of items from the sales/purchase order.

Generating advance invoice is also possible on the basis of open cash/bank transactions, available from the level of the list of customer/vendor payments, in the tab Finances. This operation is available from the level of a list of operations limited to a specific customer and an appropriate type of an operation of a release type. Generating advance sales/purchase invoice is possible only on the basis of cash/bank entries registered in a currency corresponding to the currency of the order to which the invoice is to be issued.

In order to issue a new advance sales/purchase invoice, it is necessary to select a cash/bank transaction from the list of customer or vendor payments and click on the button [ASI]/[API] placed in the Generation button group.

Editing advance invoice

The majority of fields of a generated advance invoice is filled in, by default, with the data from the source document. The following fields are not subject to edition:

- transaction type

- VAT rates

- document currency

- order items

- method and conditions relating to the due date

- VAT table in advance purchase invoice

VAT direction and VAT aggregation always take on value on total and VAT on values total, regardless of the setting on the sales/purchase order, therefore advance payment value is always presented as total value.

Parameter Collect VAT on ASI/API

In a database created in French, on item form, item group form and on advance invoices, there is parameter Collect VAT on ASI/API available.

When generating an advance invoice to an order, additional column Collect VAT is available on the invoice form in tab Order Items. For a national transaction, this parameter setting is retrieved, by default, from a given item form, however, it is possible to edit it until the advance invoice is confirmed.

If Transaction Type on advance invoice form is set to:

- National – value of parameter Collect VAT is copied from item form. It can be edited on the advance invoice.

- Intra-Community and Non-EU – parameter Collect VAT is always checked and is noneditable

If parameter Collect VAT is unchecked on the list of order items on an advance invoice, the system operates in the following way:

- an item is treated as it was not subject to VAT; value of this item in the VAT table has NS (not subject)

- VAT rate assigned a total value of order for which an advance invoice is generated is taken into account for calculating the maximum advance payment

- checking/unchecking Collect VAT parameter on an advance invoice results in dividing the advance payment amount into individual VAT rates once again

Deducting an advance invoice on a final invoice

The VAT table (available in tab Amounts) on a final invoice contains VAT rates included in this final invoice as well as VAT rates from advance invoices marked to be deducted (those by which parameter Deduct was checked in tab Amounts). Amounts for VAT rates from included advance invoices assume a negative value thereby decreasing the value remaining to be paid.

In the tab Amounts on a final invoice there is also Advance Invoices section containing a list of advance invoices issued to the same order to which the final invoice is being issued. From the level of this list it is possible to:

- open an order or selcted advance invoice for editing

- check amount to be deducted

- set deducted amoun manually, however it can only be lower or equal than the value of the advance invoice

- exclude an advance invoice from deduction by unchecking the parameter Deduct

In a database created in French, after deducting advance invoices from the final invoices, Total and Subtotal values presented in the tab General do not change. The total value of advance payment which has been deducted can be found in the field Advance Invoices located under the total value of the document.