Contents

Changes within the National System of e-Invoices

The functionality of importing invoices from the National System of e-Invoices (KSeF) has been extended as of 2022.5 release with a new invoice list and the option of generating VAT invoices in a VAT account.

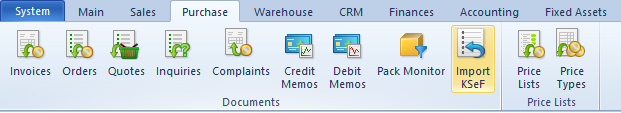

Import of invoices

In the Purchase menu, there is a new list Import KSeF under the button group Documents. This list is used to import invoices from the National System of e-Invoices.

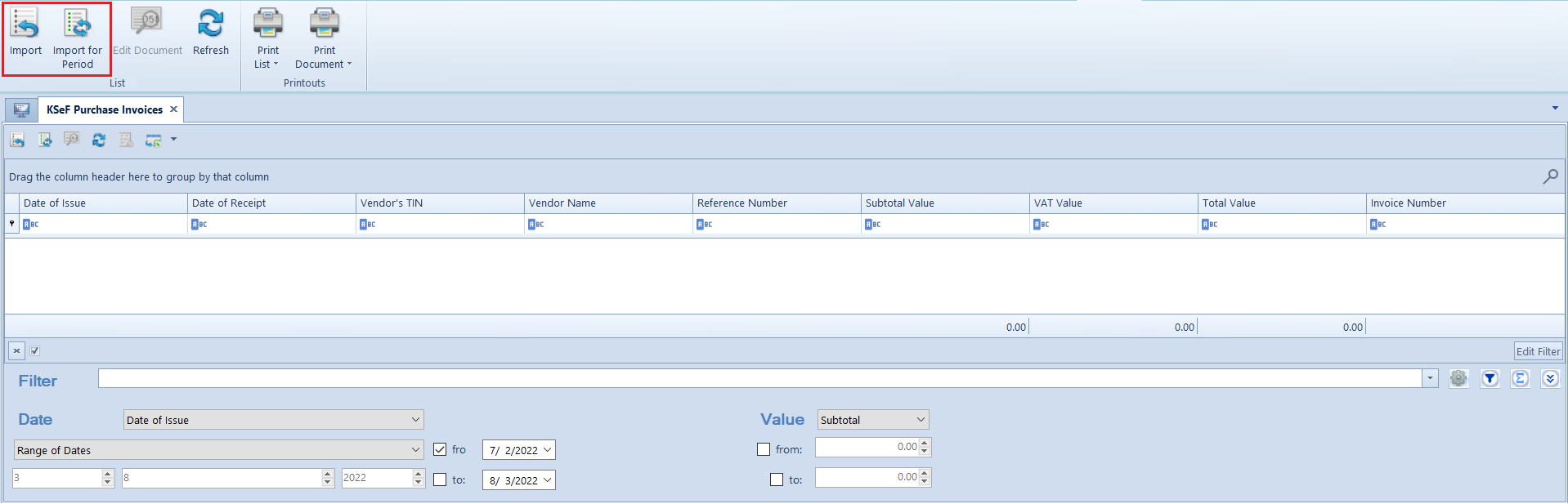

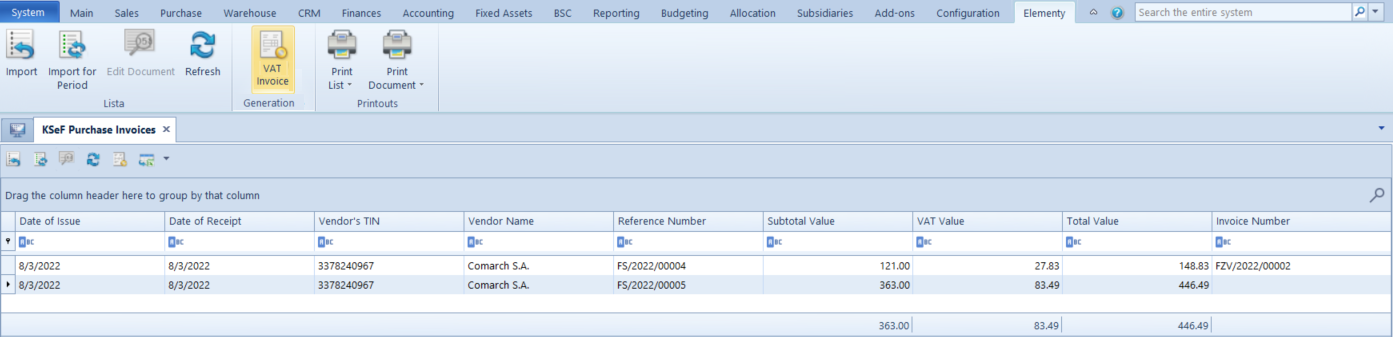

Selecting this button opens a list of purchase invoices imported from KSeF. The list is composed of such columns as:

- document date of issue and date of receipt,

- vendor’s TIN and name

- reference number

- invoice values

On this list you can ergonomically manage the process of importing PI from KSeF, view invoices or control possible document duplication.

Buttons available above the list:

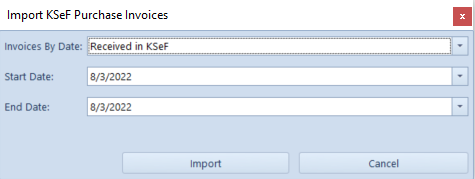

- Import

- Import for Period – filters the document list to the specified date range by the invoice upload or receipt date

After invoices are imported from KSeF, an XML file is downloaded to create a purchase invoice. This file is added as an attachment to an existing document in the ERP system.

Generation of VAT invoices

The functionality of National System of e-Invoices (KSeF) management is used not only to export but also to import invoices. The new list KSeF Purchase Invoices in Comarch ERP Standard has been added to facilitate the management of integration with KSeF in this scope. This is where you can decide whether to import a specific invoice as VAT invoice directly to a VAT purchase account.

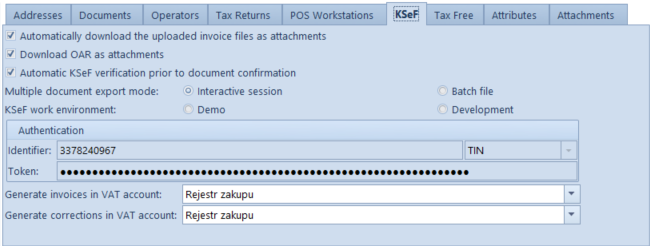

VAT account settings

A new tab KSeF has been added on the form of center of Company type with the following dedicated fields:

- Generate invoices in VAT account – account in which VAT invoices are to be generated

- Generate corrections in VAT account – account in which corrections are to be generated

After the Use KSeF parameter is selected under Configuration → Company Structure → Company, the account set as default in a specific center is retrieved into the above fields. If no VAT account is selected under configuration, it will not be possible to generate VAT invoices (the VAT Invoice button on the KSeF Purchase Invoices list will be insensitive).

Import of invoices from KSeF to a VAT account

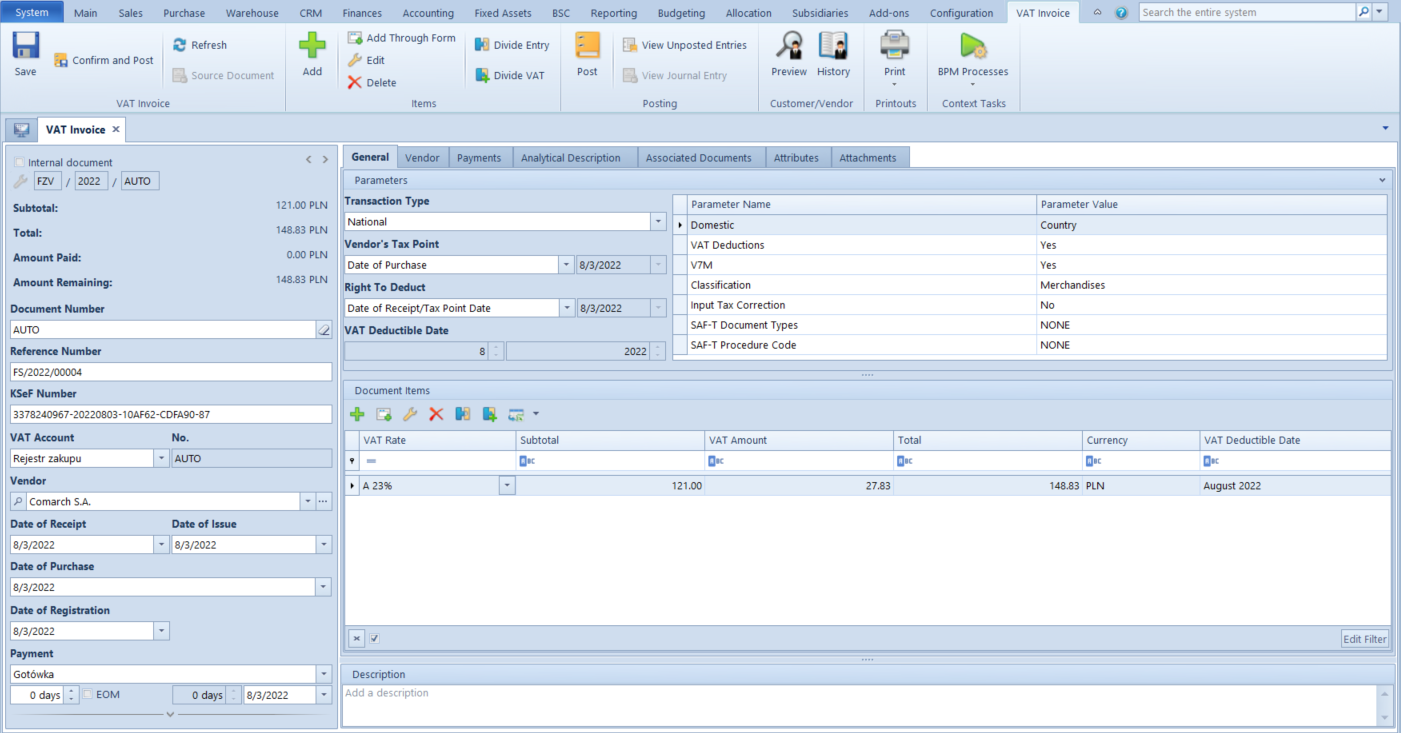

A button VAT Invoice has been added in the Generation button group on the KSeF Purchase Invoices list to generate a VAT purchase invoice.

Upon selecting this button you can generate a VPI and a VPIC depending on the data provided in the imported document. After a VAT invoice is generated, a relevant window VPI/VPIC opens, where you can save the generated document.

VAT invoice can be deleted if it is not:

- confirmed

- posted

- paid

- added into a debt collection document

- added into SRO

E-mail message informing about an issued invoice

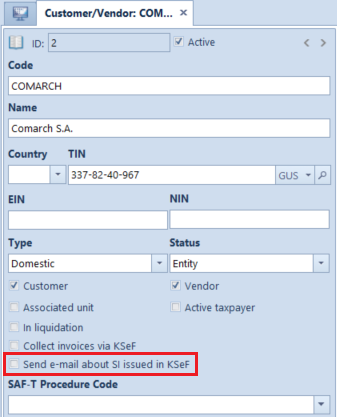

After an invoice is issued and then uploaded to KSeF from which the invoice number is received, it is possible to send an e-mail message to inform the customer about the KSeF invoice number. A parameter Send e-mail about issued SI in KSeF has been added for this purpose.

After e-mail messages are configured in Comarch ERP Standard and the parameter is selected, an e-mail message informing about an issued invoice is sent to the specified e-mail account when receiving an OAR and a KSeF invoice number.

New KSeF-related columns

The following columns were added to facilitate the ergonomic aspects of work in the KSeF field:

- Invoice Number – it presents the system number of the generated PI on the list of invoices imported from KSeF

- KSeF Status – available on the SI list, it presents the value from the corresponding field on the invoice form