Contents

General information

Before getting started with the Fixed Assets module, it is necessary to define an accounting period (if depreciation areas are associated with it), a fixed asset classification and fixed asset groups according to a company structure and its requirements as well as to configure the key parameters that are available in the main system configuration window and on the form of the center of Company type.

Parameters specified in the system configuration window

The depreciation area-related parameters are configured in the system configuration window from the level of System → Configuration → Fixed Assets.

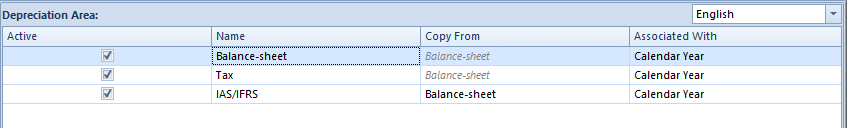

In the system, there are three predefined depreciation areas available in the system:

- Balance-sheet

- Tax

- IAS/IFRS

The names of depreciation areas can be modified for the available language versions of the system. By default, they are displayed in the application language version to which the use is logged in.

The depreciation areas that are activated by default are balance-sheet and tax. Values of a fixed asset are copied automatically from the balance-sheet area to the tax area. In case it is necessary in a company to depreciate fixed assets in compliance with the IAS/IFRS regulations, then in the system configuration window (menu System → Configuration → Fixed Assets), it is possible to activate the IAS/IFRS area and to specify its base area in the column Copy From. In this column it is necessary to decide whether the values of fixed asset parameters must for the IAS/IFRS area be completed on the basis of the balance-sheet area, the tax area or whether they must not be copied at all. The base area for the balance-sheet and tax areas is set by default to non-editable Balance-sheet.

Each depreciation area can be associated with a calendar year or accounting period. Such option is important in the case of companies with customized accounting period necessary for generating depreciation plan, calculation of write-offs and presentation of amounts on lists.

Parameters specified on the company form

In the side panel of the form of a center of Company type, in Fixed Assets section, there are the following parameters:

- 360 days in a year for straight-line method

This parameter is selected by default in the French and Spanish language version of the system. In case depreciation starts in the course of a month while the parameter is activated, write-offs will be generated proportionally to the number of depreciation days in the month for which a write-off is being calculated. If the parameter is deactivated, write-offs will be calculated for the entire month.

Depreciation start date: 01.05.2019

- Deselected parameter 360 days in a year for straight-line method

Write-offs for January will be amounting to 33.33 USD.

- Selected parameter 360 days in a year for straight-line method

Write-offs in January will be amounting to 17.78 USD and the depreciation period will be extended by one month. In the last month, the system will generate a write-off for the amount of 15.55 USD.

- Round-off amount added last month

This parameter is selected by default in the French and Spanish language version of the system. If selected, write-offs are then calculated for particular months in the same amount, whereas the remaining decimal part of the amount is added up to the write-off for the last month of the accounting/calendar period. If deselected, then the decimal part of the amount is included in the write-off for the month for which write-offs were calculated mathematically.

Fixed asset: Car, depreciation method: straight-line, depreciation rate: 20%, coefficient: 1, initial value: 5000.00 USD.

Depreciation start date: 01.01.2018

- Deselected parameter Round-off amount added last month

Write-offs will be calculated as follows:

| Month | Write-off |

|---|---|

| January | 83.33 |

| February | 83.34 |

| March | 83.33 |

| April | 83.33 |

| May | 83.34 |

| June | 83.33 |

| July | 83.33 |

| August | 83.34 |

| September | 83.33 |

| October | 83.33 |

| November | 83.34 |

| December | 83.33 |

- Selected parameter Round-off amount added last month

Write-offs will be calculated as follows:

| Month | Write-off |

|---|---|

| January | 83.33 |

| February | 83.33 |

| March | 83.33 |

| April | 83.33 |

| May | 83.33 |

| June | 83.33 |

| July | 83.33 |

| August | 83.33 |

| September | 83.33 |

| October | 83.33 |

| November | 83.33 |

| December | 83.37 |