Contents

General information

Clearing is an association between two single-sided entries registered on a clearing account. The basis for clearing single-sided entries are payments (receivables, payables) which are generated by source documents. Based on posted payments, single-sided entries can be cleared on book accounts. Clearings provide information on unpaid journal entries affecting the balance of a clearing account.

Payments are completed on the level of document payments, whereas clearings are made on the level of single-sided entries. Payment completions and clearings are an integral whole, which is why a transaction is completed only once – either from the level of payments or single-sided entries.

Journal entries dedicated for clearing are generated as a result of:

- posting of receivables or payables, originating from documents, with the use of a posting scheme in which the amount primitive – Payment – has been used to post a receivable or payable

- adding single-sided entries directly in a ledger onto clearing accounts

It is possible to clear both unconfirmed and confirmed single-sided entries. Clearing amount is the lower amount of the amounts remaining to be cleared. Clearing operation can be initiated if amounts being cleared:

- have the same signs and are registered on the opposite sides of an account (Debit/Credit)

- have the opposite signs and are registered on the same side of account

Clearing operations can be performed both from the level of the Clearings list and from the tab Clearings DR/Clearings CR of a journal entry. Adding a clearing from the level of a single-sided entry has the same results as in the case of adding it from the level of the list Clearings.

Mechanisms of creating clearings

Clearings can be created automatically or manually. Automatic clearings are created without additional interference of a user. Note that using the option Automatic Clearing, which is available from the level of the Clearings list or the tab Clearings DR/Clearings CR of a single-sided entry, is also a form of creating manual clearings.

Creating clearing automatically

Automatic clearing refers to single-sided entries generated as a result of posting a document payment.

A clearing is created automatically when:

- completing/compensating posting documents

- posting the second of the completed/compensated documents

Creating clearing manually

Manual clearing can be created from the level of:

- Clearings list

- tab Clearings DR/Clearings CR of a single-sided entry

Clearing of single-sided entries, generated as a result of posting of a document, is accompanied by automatic completion/compensation of source documents.

Mechanism of adding a compensating single-sided entry

Regardless of the way in which single-sided entries are cleared (automatically or manually), a compensating single-sided entry can be generated along with a clearing operation.

A compensating single-sided entry is generated due to accountancy rules. In case of associating two entries registered on two different accounts, an appropriate amount is posted to one account and unposted from another. A compensating single-sided entry associates two clearings accounts to which payments are posted.

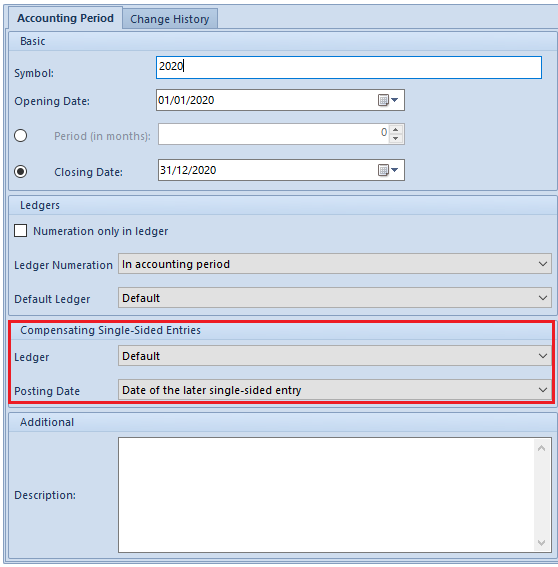

Configuration settings relating to compensating single-sided entries

In definition of a particular accounting period, there are configuration parameters relating to generation of compensating single-sided entries and applicable in a given accounting period. These parameters apply to the setting of such information as:

Ledger – ledger in which generated compensating single-sided entries are registered

Posting Date – date of posting a compensating single-sided entry, that is the date under which a compensating single-sided entry is registered in the books, Possible dates to select are: Date of the later single-sided entry or System date.

Clearing date

An important information when clearing single-sided entries is a date under which cleared single-sided entries are registered and hence considered as cleared.

Clearing date is not the same as the date of physical clearing of single-sided entries. Clearing date is a posting date of a latter (the most recent) of the cleared single-sided entries – it is determined on the basis of a posting date from the header of a journal entry. If a compensating single-sided entry is part of the clearing process, a date of that single-sided entry has also an impact on determining a clearing date.

A single-sided entry PK/1/2020, amounting to 10 000 USD and registered on Dr side (posting date: 05/12/2020, date of issue: 05/10/2020, date of transaction: 05/08/2020) is cleared with a single sided entry PK/2/2020, amounting to 2 000 USD and registered on Cr side (posting date: 05/20/2020, date of issue: 05/18/2020, date of transaction: 05/12/2020).

Clearing date: 05/20/2020 (posting date of the latter single-sided entry)

In this case:

- On 05/12/2020, the single-sided entry PK/1/2020 is presented as uncleared (amount remaining = 10 000 USD)

- On 05/18/2020, the single-sided entry PK/2/2020 is presented as uncleared (amount remaining = 10 000 USD)

- On 05/12/2020, the single-sided entry PK/1/2020 is presented as partially cleared (amount remaining = 8 000 USD)

- On 05/20/2020, the single-sided entry PK/2/2020 is presented as cleared

Clearings of single-sided entries registered in different periods

In the system, it is possible to clear single-sided entries registered in different accounting periods. To be able to clear such single-sided entries, it is necessary to associate the accounts selected in particular accounting periods in the single-sided entries being cleared. Association of accounts ensures continuation of transactions in subsequent accounting periods. It is independent of the numbers of accounts at the turn of accounting periods. In case of changing an account number between accounting periods, it is necessary to ensure that these accounts are associated.