Contents

General information

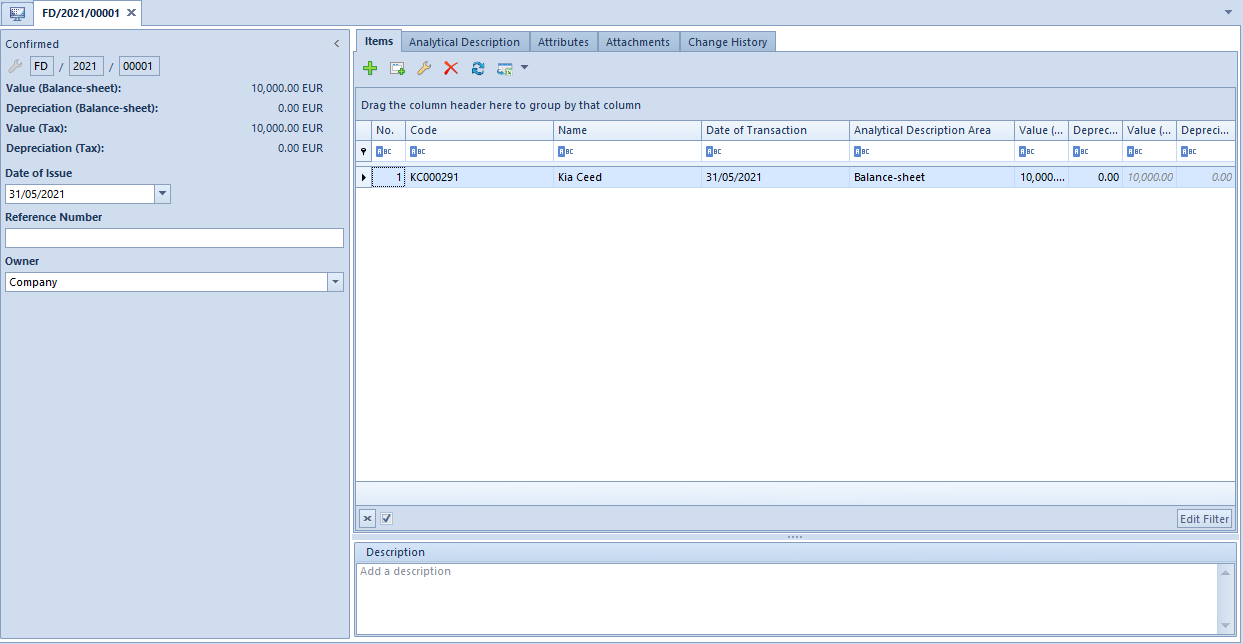

A FD document is registered in the system when a fixed asset is partially or entirely disposed

An FD document can be added:

- automatically upon selecting first the parameter Date of disposal/Date of sale available on the form of fixed asset

- automatically on the basis of an inventory, upon selecting [FD] button available in Generation group of buttons, if there are shortages resulting from the inventory

- manually

A FD document is generated automatically while saving a fixed asset of Fixed Asset or Intangible Asset type, provided that the parameter Date of Disposal/Date of Sale has been selected on the fixed asset form. Disposal of a fixed asset blocks the option of editing or deleting the documents generated for that asset as well as the option of changing its depreciation-related parameters. Moreover, on a FD document, the parameter Date of Transaction, available on item details, is not subject to edition.

A FD document can be added from the level of:

- the menu Fixed Assets → Fixed Asset Documents

- the menu Fixed Assets → Fixed Assets, upon selecting first particular fixed asset records

- the Fixed Asset Documents tab on the form of fixed asset

To add a FD document, select the button [Add Document] followed by the option Disposal available in the drop-down list. A form for entering data will be opened.

The form of FD document is composed of the following elements:

Side panel

Number – entered by the system according to the document numbering definition

Value (Balance-Sheet/Tax/IAS-IFRS) – fields of information purpose. Their visibility depends on the activated depreciation areas in the system configuration window. They present total values of items for particular depreciation areas.

Depreciation (Balance-Sheet/Tax/IAS-IFRS) – fields of information purpose. Their visibility depends on the activated depreciation areas in the system configuration window. They present total item values from the column Depreciation for particular depreciation areas.

Values provided in a FD document into the columns Value (Balance-Sheet/Tax/IAS-IFRS) affects in the subsequent period the fixed asset total value as well as its value updated at the beginning of period, whereas value provided into the columns Depreciation (Balance-Sheet/Tax/IAS-IFRS) affects the asset’s write-off values.

Date of Issue – for a FD issued manually, current date is set by default, with a possibility of changing it. For a FD generated automatically, the date from the Date of Disposal/Date of Sales is set by default, with a possibility of changing it

Reference Number – number entered by the user for the purpose of additional identification of a document

Owner – by default, center to which the user registering a document is assigned. This field is not editable.

Tab Items

In this tab, it is possible to add, edit, copy, delete as well as to export to a spreadsheet the items of a FD document.

A document item can be added into a document in two ways: directing in the table or through form.

Adding FD document item in the table

To add an item directly in the table, select the button [Add] from the button group Items. A new row for entering data will appear in the item table. Here it is necessary to select a fixed asset as well as to complete the following columns: Date of Transaction, Analytical Description Area, Value (Balance-Sheet/Tax/IAS-IFRS), Depreciation (Balance-Sheet/Tax/IAS-IFRS) and Description and Fixed Asset Attachment columns which are hidden by default. Provided data will also be updated on the fixed asset form.

Adding FD document through form

To add FD items through form, it is necessary to select button [Add Through Form] from Items group of buttons.

It opens Item Details window which contains the following fields:

Side panel

Code – fixed asset code retrieved from the fixed asset form

Name – value completed automatically on the basis of the fixed asset form. The names of fixed assets are displayed in the system logon language.

Date of Transaction – by default, the date from document header is retrieved, with a possibility of changing it for documents added manually. For FD documents generated automatically, the field is not subject to edition.

Analytical Description Area – selectable from among the depreciation areas activated in the system configuration window. Depending on the selected options, the document can be described analytically according to the values of the indicated depreciation area.

Value (Balance-Sheet/Tax/IAS-IFRS) – available options that can be completed depend on the depreciation areas activated in the system configuration window and on the fixed asset form. The value that is specified first for one of the active areas is copied automatically to other areas (both active and inactive). Changes to either of the active values are not copied to other active areas.

Depreciation (Balance-Sheet/Tax/IAS-IFRS) – available options that can be completed depending on the depreciation areas activated in the system configuration window and on the fixed asset form. The values are calculated automatically on the basis of the generated write-offs. They are calculated proportionally to the fixed asset’s disposed value and they are editable.

Recognition Date – this date is available only in the document item details window. It is, by default, set to the first day of the month following the date of transaction. It determines the date on which the value of the fixed asset subject to depreciation must be changed.

Description – section for additional information on a given document item.

Tab Attributes and Attachments

Detailed description of the tabs Attributes and Attachments can be found in articles Tab Attributes, and Tab Attachments.

Fully disposed fixed asset Fixed asset: Delivery truck purchased and received to utilization on 2/15/2017, initial value: 50 000.00 USD, depreciation method: straight-line, depreciation rate: 20%. Write-off were generated for a total amount of 19 166.66 USD: A decision to dispose the fixed asset was taken on 2/19/2019. In order to generate a FD document automatically, in the side panel of the fixed asset form it is necessary to select the parameter Date of Disposal and set the date to 2/19/2019. A reason for disposal can also be selected from the relevant generic directory and a disposal document can be attached. After the fixed asset form is saved, the fixed asset will be presented on the fixed asset list in orange and the system will generate automatically a FD document with the date of issue 2/19/2019 and for the following amounts: Partially disposed fixed asset Fixed asset: Delivery truck purchased and received for utilization on 2/15/2017, initial value: 50 000.00 USD, depreciation method: straight-line, depreciation rate: 20%. Write-off were generated for a total amount of 19 166.66 USD: A decision to dispose partially the fixed asset was taken on 1/31/2019 – amount: 20 000 USD. In order to dispose partially the fixed asset, it is necessary to generate manually a FD document for the amount of -20 000 USD. Write-offs will be calculated proportionally to the disposed value of the fixed asset and will be amounting to -7 666.66 USD. This amount is editable. From February 2019, write-offs will be generated in the value descreased by the disposed value of the fixed asset. From the level of document item, in the field Analytical Description Area it is possible to specify a depreciation area by which the values of analytical description can be completed in fixed asset documents from. Depreciation areas can be selected from among the areas activated in the system configuration window. Detailed description of the functionality can be found in article Analytical Description. Detailed description of the tabs Attributes, Attachments and Change History can be found in article Tabs Discount Codes, Analytical Description, Attributes, Attachments and Change History.

Tab Analytical Description

Tabs Attributes, Attachments and Change History