As a rule, financial reports are prepared in Poland in Polish PLN. Because of that, all the assets and payables of an entity, which are denominated in foreign currencies (both international and national), must be recalculated to Polish PLN. On a balance sheet day, this calculation is made according to an effective average exchange rate published for a given currency by the National Bank of Poland (Narodowy Bank Polski – NBP). In the case of clearings, clearings subject to recalculation on a balance sheet day are those which have not been settled.

The obligation of recalculating the values of assets and liabilities results from the Article 30.1.1 of the Accounting Act.

| Positive exchange rate differences arise if: | Negative exchange rate differences arise if: |

|---|---|

| the exchange rate on the day of arising (posting) a receivable is lower than the average exchange rate of the NBP on the balance sheet day | the exchange rate on the day of arising (posting) a receivable is greater than the average exchange rate of the NBP on the balance sheet |

| the exchange rate on the day of arising (posting) a payable is greater than the average exchange rate of the NBP on the balance sheet | the exchange rate on the day of arising (posting) a payable is lower than the average exchange rate of the NBP on the balance sheet |

The regulations relating to balance sheet calculations determine neither the date nor the method of registration of the exchange rate differences fixed at the end of a financial year. In practice, there are three methods of registering those exchange rate differences applied, that is:

- generating a contra entry to the exchange rate differences, fixed at the end of a financial year, on 1st January of the following year

- generating a contra entry to the exchange rate differences, fixed at the end of a financial year, on the day of payment

- registering only paid exchange rate differences fixed between the exchange rate from the balance sheet calculation and the exchange rate from the date of payment

Once selected registration method should be included in the accounting policy and applied continuously.

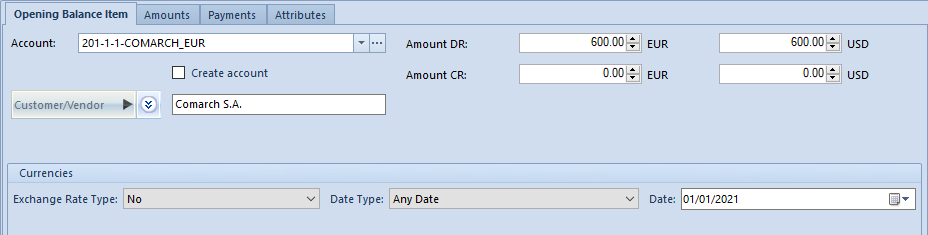

In connection with the above, it is possible to register unpaid exchange rate differences, calculated on a balance sheet date (so-called statistical exchange rate difference), in the form of a journal entry of an opening balance document and an accounting note (an OB document is used the moment at which we start working with the system, whereas an accounting note document is used in subsequent accounting periods). When registering an exchange rate difference to an opening balance document and an accounting note, the value is registered on a currency account and most often on financial revenues/costs account only in the system currency (the value in a foreign currency equals to zero). In addition, the beginning balance of a journal entry in the opening balance document can be composed of the values of many documents which can have different currency exchange rates. The user knows the value of such entry in foreign and system currency but does not know the average exchange rate (it results from many exchange rates).

In the documents:

- Opening balance

- Accounting note

- Journal entry

it is possible to choose an exchange rate of <none> type for a currency account. Upon selecting this type of exchange rate, the section, in the currency panel, relating to the value of exchange rate is hidden. Thanks to that it is possible any value into the fields with foreign currency and in the system currency. The system does not multiply the value in a foreign currency by an exchange rate in order to obtain a value in the system currency. On a currency account it is also possible to register only the values in the system currency (the value in a foreign currency equals to zero).

In the Polish version of database, from the level of the list Clearings, an auxiliary printout Currency Revaluation, which presents historical data, i.e., data including the balance on the day specified by the user. It is generated for clearing accounts. It presents the value of uncleared single-sided entries expressed in the currency after they are recalculated by the exchange rate on the day of their entry in the books as well as the value of those single-sided entries recalculated by the exchange rate effective on the balance sheet day, including calculation of positive or negative exchange rate differences. Exchange rate differences should be included in books manually, by the user.

In order to prepare a correct Currency Revaluation printout, it is necessary to specify the following parameters:

- Currency – drop-down list of currencies different than system currency

- Value in Foreign Currency – denominator of currency exchange rate in foreign currency

- Exchange Rate Value in System Currency – denominator of currency exchange rate in system currency

- Balance On – date on which printout is being prepared

- Show Single-sided Entries – if option Yes is selected, particular single-sided entries of a given account will be presented in printout along with detailed calculations. Otherwise, only a collective balance for a given account will be presented.

- Print System Number – if option Yes is checked, on the printout, besides the number in the general ledger and the number of the document from the single-sided entry, also the source document number is presented. Otherwise, such number is not presented.

- Account From/Account To – parameters for selecting account(s) for which printout is being prepared. Accounts which will be presented in the printout from among the selected accounts will only be those whose currency is the same as the currency selected in the printout parameter: Values of those parameters can be empty – if this is the case, all accounts associated with the currency selected in the parameter: Currency will be included in the printout.

System date: 12/31/2019

Currency revaluation printout – balance on: 8/31/2019

The single-sided entry relating to the SI document will be included in printout as uncleared.

Currency revaluation printout – balance on: 9/30/2019

The single-sided entry relating to the SI document will be included in printout as partially cleared. The amount to be revalued will be the amount remaining to clear: 400 EUR.

The SI document was paid in full on October 22, hence, the related single-sided entry was cleared in full. Exchange rate differences were posted at the document date of issue.

Currency revaluation printout – balance on: 10/31/2019

The single-sided entry relating to SI will not be included in the printout.