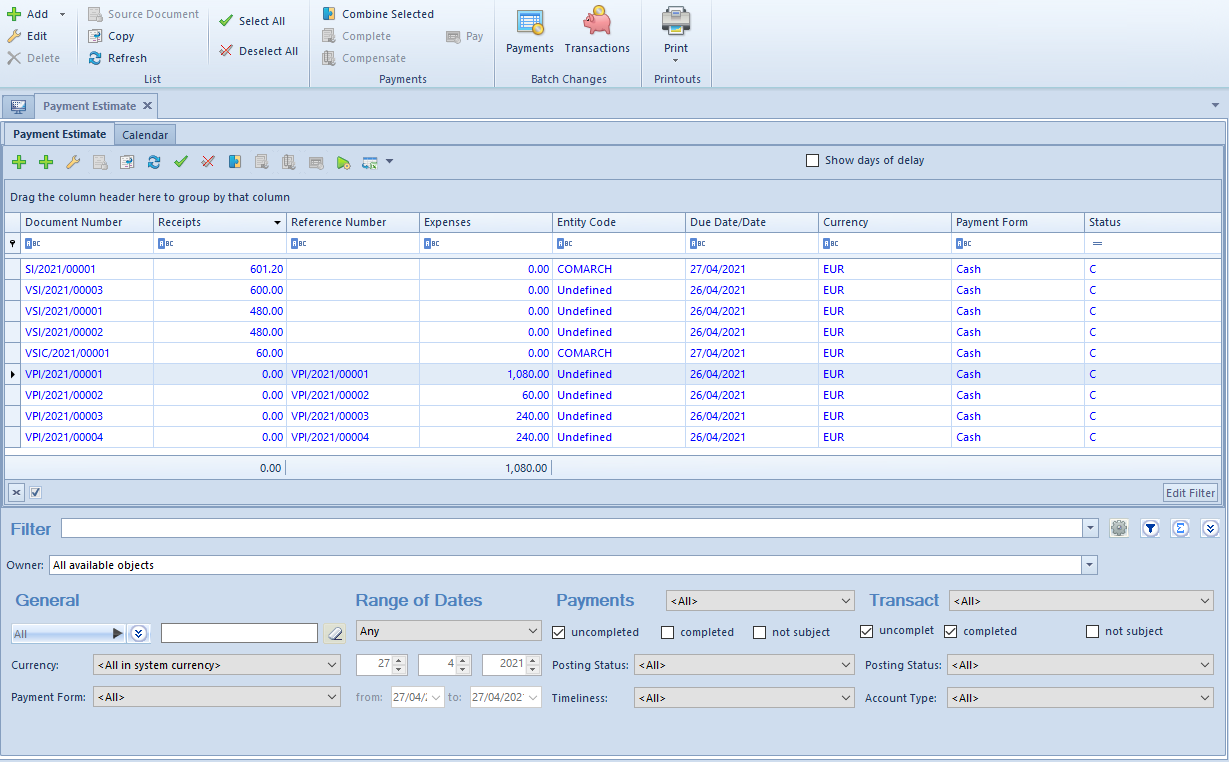

Tab Payment Estimate allows for analyzing status of payments and cash/bank transactions, as well as for making payments.

- [Add] − opens a drop-down list with payment types: Credit, Debit Payments added from the level of a payment estimate are not subject to completion.

- [Source Document] − allows for previewing the source document of a payament selected in the list

- [Combine Selected] − completes selected payments

- [Complete] − allows for completing a given payment

- [Compensate] − allows for compensating a given payment

- [Pay] − opens a form Payment Confirmation, by means of which it is possible to make a payment by automatic creation of a cash/bank transaction

- [Compensations] − generates a compensation document for selected payments

- [Payments] − allows for making batch changes for selected payments. The button is active only if the operator belongs to a group with granted permission Batch changes to payments, which is available in the tab Other permissions. The user can decide about details contained in log displayed during the change. The same rules apply for batch changes as in the case of payment edition. The following elements can be changed:

- Payment form

- Due date

- Account

- Payer

- Payer’s bank account

- Deleting of settlements and compensations (permissions Application of payments/Making compensations are required)

- [Transactions] − allows for making batch changes for selected operations. The button is active only if the operator belongs to a group with granted permission Batch changes to transactions, which is available in the tab Other permissions. The user can decide about details contained in log displayed during the change. The same rules apply for batch changes as in the case of payment edition. The following elements can be changed:

- Payment form

- Due date

- Account

- Payer

- Payer’s bank account

- Deleting of settlements and compensations (permissions Application of payments/Making compensations are required)

In the upper right corner of the list, parameter Show days of delay is available. Checking it results in showing an additional column Days of Delay in the list of payments. The column presents number of days passed since the due date of an unpaid credit/debit.

[Attributes] – allows for batch update of attributes for selected payments. After clicking on this button, a window where it is possible to specify batch change parameters, is displayed.

The list Payment Estimate is composed of the following columns:

- Document number

- Reference Number − number entered by a user for providing an additional identification

- Entity Code − payer’s code and code of entity for transaction

- Receipts − amount of credit or revenue

- Expenses − amount of debit or expense

- Due Date/Date − payment due date or date of document for c/b transaction

- Currency − document currency, depends on the settings in the filter

- Payment Form

- Status

- C − Completed

- U − Uncompleted

- NS − Not Subject

and columns hidden by default:

- Document/Transaction Date − in the case of payment, it is the date of document from the form of registered payment and in the case of transaction, it is the date from a transaction from

- Days of Delay − number of days passed from the due date of an uncompleted credit/debit. After selecting parameter Show days of delay the column appears automatically in the list.

- Cash Register/Bank − number of account indicated in the document

- VAT Amount − displayed only for payments and bank transactions with checked parameter Split Payment

- Receivable − amount of a payment of Receivable type or of an expense transaction

- Receivable – To Be Applied – receivable amount to be applied

- Entity Code − payer’s name indicated on payment and entity’s name indicated on transaction

- Entity’s TIN

- Voucher Number − number of voucher indicated on payment or transaction

- Description – description of payment for payment and value of the field For for cash/bank transaction

- Document Description – description of payment source document and description of transaction for cash/bank transaction

- Transfer Orders − number of the SRO document in which a given payment has been included

- To Be Applied − transaction/payment amount remaining to be applied. Receivables are presented with plus signs and payables with minus sings, according to the data presented in the following table:

Object Type Amount Type Sign

Planned payment (of a source document Receivable > 0 Receivable, plus sign

Planned payment (of a source document) Payable > 0 Payable, minus sign

Cash/bank transaction Revenue > 0 Payable, minus sign

Cash/bank transaction Expense > 0 Receivable, plus sign

- Voucher Sort − sort of voucher indicated on payment or transaction

- Applied − amount cleared by now

- System currency − currency of the company in which the document was issued

- Value − value of payment or c/b transactions from the payment’s point of view (a receivable with plus sign and a payable with minus sign)

- Debt Collection – number of debt collection document in which a given payment is included

- Owner − center of the company structure which is the issuer of a document

- Affects Balance − indicates whether a given payment affects the balance of the account

- Arrears – if a given payment (days of delay > 0), an exclamation mark will be displayed in this column

- Payable − amount of a payment of Payable type or of a revenue transaction

- Receivable – To Be Applied – receivable amount to be applied

Filtering on Payment Estimate tab

The tab Payment Estimate contains the following filtering areas:

- General − allows filtering by:

- Entity indicated on payment/transaction − All, Customer, All customers, Employee, All employees, Institution, All institutions, Bank, All banks, None

- Currencies − <All>, <All in system currency> and active currencies defined from the level of Configuration →

- Payment forms − active payment forms

- Tax correction − VAT, Income tax, None. After selecting VAT value and filtering the list, only payments will be displayed and the following additional columns will appear: VAT Due Date and VAT Days of Delay (value with minus sign indicates the number of days remaining to apply payment, and with plus sign, indicating the number of days after due date, respectively). It allows to obtain information about payments which should be completed in order to avoid the adjustment of input tax or about those payments, which have not been completed by customers/vendors and, hence, grant the right to decrease the output tax. After selecting in selecting the value Income Tax, only payments of Payable type will be displayed and the following two additional columns will appear: Income Tax Due Date and Income Tax Days of Delay (values with minus sing indicates the number of days remaining to apply payment, and with plus sign, indicating the number of days after due date, respectively).

- Range of Dates − allows for filtering by due date for payments and by document date for c/b transactions. The following values are available within the filter: Any, Day, Month, Range of Dates, Previous Month, Current Month. The range of dates allows for selecting a specific time interval.

- Payments − allows for filtering by:

- Payment type – <All>, Account Receivable, Account Payable, None

- Payment settlement status − uncompleted, completed, not subject

- Document status − <All>, Posted, Unposted

- Split payment parameter on payment − filter visible only if in the definition of a relevent center of the Company type, for the parameter Split payment according to Polish regulations, value In accounting module or In accounting and trade modules is specified.

- Timeliness − <All>, Not overdue, Overdue, Today’s

- Transactions − allows for filtering by:

- Transaction type − <All>, Deposits, Withdrawals, None

- Transaction settlement status − uncompleted, completed, not subject

- Document status − <All>, Posted, Unposted

- Split payment parameter on transaction − filter visible only if in the definition of a relevent center of the Company type, for the parameter Split payment according to Polish regulations, value In accounting module or In accounting and trade modules is specified. Values available within the filter: <All>, No, No + Payments, Payments, VAT Transactions, Payments + VAT Transactions.

- Account Type − all accounts available in a given center are displayed. The value All indicates all accounts available in the current center, whereas the values <Cash>, <Bank> indicate all accounts of a given type in the current center.

Detailed description of functioning of the filters can be found in category Searching and filtering data>

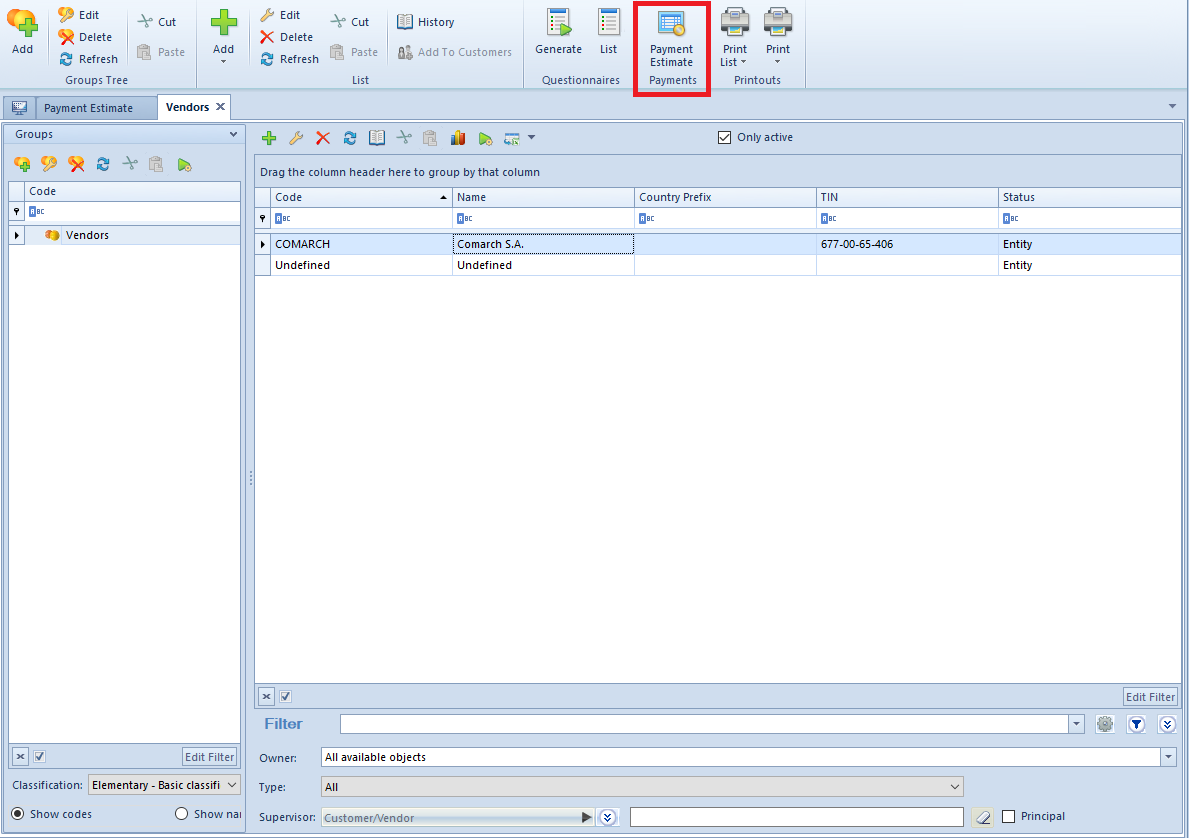

Reference to the payment estimate from the level of the list of customers/customer form

From the level of the list of customers or of the form of a given customer, by means of the [Payment Estimate] button, it is possible to open the payment estimate window, where payments and transactions are displayed for a given customer. A user can freely modify the list of payments and make settlements and compensations.