General information

In Comarch ERP XL system it is possible to generate the following advance payment invoices:

In domestic trade:

- Sales advance payment invoice (ASI) for sales order with marked (on tab: General) type of transaction: Domestic

- Purchase advance payment invoice (API) for purchase order with marked (on tab: General) type of transaction: Domestic

- Export advance payment invoice (EAI) for sales order with the following type of transaction: Domestic

In foreign trade:

- Export advance payment invoice (EAI) for sales order with the following type of transaction: Intra-community or Other foreign

- Purchase advance payment invoice (API) for purchase order with the following type of transaction: Intra-community or Other foreign (a regular purchase invoice is settled with such an invoice)

Foreign trade advance payment invoices are invoices that have been generated for a sales/purchase order with the following type of transaction indicated: Intra-community or Other foreign.

The generated advance payment invoice (EAI) will be very similar to an export invoice. As with domestic trade, the differences are that such a document has no items and the user cannot generate a warehouse document from it.

When generating a sales order (with transaction type: Intra-community or Other foreign) the user should pay attention to the parameter: VAT C (0%), located on the tab: Header, which determines that the export VAT rate of 0% will be applied to the goods on the order. The selected parameter determines that export VAT will be charged on the advance payment invoice.

Setting the VAT parameter on the EAI document will be transferred to the final ESI document without the possibility to change it.

If the parameter is unchecked, a document charging VAT at domestic rates will be generated. It should be remembered, however, that when generating an invoice correction (EAIC), it is also possible to correct the VAT rate. If the document contains goods with different VAT rates, then after the correction of VAT rates for all goods, one VAT rate shall be charged at the maximum (domestic) rate applied to the goods on the document (the rates defined for the goods on the product card shall be taken into account).

On the sales order, with the type of transaction: Intra-community, goods were entered with rates of 22% and 7%. On the order, the following option remains checked: VAT C (0%). An advance payment invoice has been generated for the order, and then a correction (EAIC) has been generated for this invoice. The VAT rate has been corrected on the correction, which will cause the EAIC document to include 22% as the highest rate for the goods that have been entered into the order.

For more information on correction of an export advance payment invoice, see: Generating advance payment invoice.

For the documents listed below, the following corrections can be generated:

- To sales advance payment invoice (ASI) – Corrective sales advance payment invoice (APSI)

- To the purchase advance payment invoice (API) – Correcting purchase advance payment invoice (APPI) – also in foreign trade (when the transaction is marked as: Intra-community or Other foreign)

- To the export advance payment invoice (EAI) – Correcting export advance payment invoice (EAIC)

Advance payment invoices are issued to the part of the payment resulting from the order (to the advance payment). This advance payment is defined on the order, on the tab: Payments/Advance payments, in the panel: Payment schedule (more in chapter: Payment breakdown/Generating advance payments). The paid amount resulting from the advance payment invoice will be included in the final commercial document with which the order will be processed.

Advance payment invoice ASI cannot be settled with a receipt; therefore it is not possible to fulfil an order for which an advance payment invoice has been issued with a receipt, unless the advance payment invoice has been settled in whole with another document.

As of version 7.0, advance payment invoices have their own document definitions.

Issuing EAI and ASI documents is possible only for the types of contractors that are defined in the definition of a given document.

Advance payments in a currency other than system currency

It is possible to generate advance payments in a currency other than the system currency – if the advance payment amount is defined as:

- a percentage of the order total – if the payment on the order is specified in a currency other than the system currency

- value – it is possible to choose the currency regardless of the currency in which the payment on the order was defined.

The advance payment invoice document created for such an advance payment will be converted and expressed in the system currency, and the resulting payment will be expressed in a foreign currency.

Since version 7.1 of Comarch ERP XL system, a possibility was introduced to issue ASI to sales order with the following transaction type: Domestic, and a header currency other than the system currency.

Generating advance payment invoice

Regardless of the type of advance payment invoice – whether it is generated for domestic or foreign trade, the mode of its issuance is the same and proceeds in the following steps:

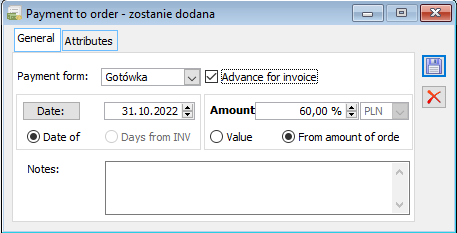

- on the confirmed order, on the tab: Payments/Advance payments, the advance payment can be added

- after selecting the registered advance payment, click [Add invoice based on advance payments]. A new window will open: Advance payment invoice – if it concerns domestic trade it will be ASI (Sales advance payment invoice) or API (Purchase advance payment invoice), if it concerns foreign trade it will be EAI (Export advance payment invoice) or API (Purchase advance payment invoice).

It is also possible to generate an advance payment invoice for an unrealised order as well as for a partially realised order.

For details on how to generate an advance payment invoice, please refer to the chapter: How to issue advance payment invoice for an order.

Issuing and generating a document will be possible only for those types of contractors who are defined in the definition of a given document.

Modification of the “VAT table” when generating an advance payment invoice.

When generating an advance payment invoice for the specified order payment(s), the system creates a VAT table on the invoice based on the tax rates used on the order items, dividing the amount between these rates according to the proportion of the order items’ value in these rates. This functionality supports the scenario where the order concerns goods covered by a single VAT rate.

When the order concerns goods covered by different VAT rates, in case the customer makes an advance payment for only one of them (such an example is an order for a flat and land for this flat and the necessity to pay an advance payment only for the flat), we can indicate what part of the advance payment is to be assigned to a given VAT rate, with the possibility to completely exclude the “given rate” from the advance payment.

At the moment of EAI/ASI generation when the order concerns goods covered by different VAT rates, a window appears: Determine the advance payment invoice value.

The editing of values is available only if there are different VAT rates on the items of the order, in the case of a single rate, the existing functionality is maintained.

The upper part of the window shows the symbol and the full order number of the order, for which the advance payment invoice is generated, as well as Total payments (the sum of selected payments for which the advance payment invoice is generated, converted into the currency of the order header) and the currency symbol of the order header. For ASI/API documents, the amounts are presented in PLN.

Records appropriate for particular VAT rates present on the order are displayed broken down into:

- VAT rate symbol

- gross value set for a given VAT rate, which can be edited from 0 to the value corresponding to the sum of selected payments.

The Total record with the value calculated as the sum of gross values for all VAT rates is presented under the records appropriate for VAT rates. This field is not editable, as the value of the advance payment invoice is consistent with the sum of payments for which it is generated.

After changing the value for a given VAT rate, the values for other VAT rates will be recalculated accordingly, so that the Total value will still be consistent with the sum of payments for which the advance payment invoice is generated, that is the principle will be maintained, according to which, as a result of editing the value for a given VAT rate, the system will change the values for those VAT rates which have not yet been edited according to the proportions of their values. If there are no more such rates that were not editable, then the system will change the value on the editable rates according to the proportion of their value, and in case they all have the value of 0, then according to the proportion from the order. Whether the value for a given rate was editable will be recognised by whether the value for this rate is consistent with the value determined from the order.

The ![]() [Recalculate] button – when activated, the gross value for all VAT rates will be recalculated based on the proportion of the value of the order items.

[Recalculate] button – when activated, the gross value for all VAT rates will be recalculated based on the proportion of the value of the order items.

After the ![]() [Save] button is clicked, the operation of generating an advance payment invoice will be started.

[Save] button is clicked, the operation of generating an advance payment invoice will be started.

If there are rates that have not been edited by the operator, then:

- the value for each of the above-mentioned rates will be established proportionally (gross value for a given VAT rate / sum of gross values for rates)

- if for all VAT rates the value is set to 0, then proportions will be set based on the value from the order

The value will be appropriately increased (in case the operator decreases the value on one of the VAT rates) or decreased (in case the operator increases the value on one of the VAT rates) for the VAT rates according to the established ratio (“change amount” x proportion coefficient).

In order to exclude rounding error, it is necessary to check if the Total value is consistent with the sum of the payments, if not, then the last of the VAT rates should be “modified” accordingly.

If there are no “unedited” VAT rates, then:

- the value for all of the above-mentioned rates (apart from the edited one) will be established proportionally (gross value for a given VAT rate / sum of gross value for rates)

- if for all VAT rates the value is set to 0, then proportions will be set based on the value from the order

The value will be appropriately increased (in case the operator decreases the value on one of the VAT rates) or decreased (in case the operator increases the value on one of the VAT rates) for the VAT rates according to the established ratio (“change amount” x above-mentioned proportion coefficient).

The initial “VAT table” defined when generating advance payment invoice looks as follows: A 22%: 20.00 B 7% 30.00 C 0% 60.00 In total: 110.00 Now the operator sets the value for the B7% rate to 0, that is decreases by 30, with the result that the system must increase the value for rates accordingly: A22% and C0% as follows: A22%: 30.00x[20.00/80.00]=7.50, that is increases the value for the rate A by 7.50 C0%: 30.00x[60.00/80.00]=22.50, that is increases the value for the rate C by 22.50 Meaning the “VAT table” after change looks as follows: A 22%: 27.50 B 7% 0.00 C 0% 82.50 In total: 110.00 If the operator now changes the value for the rate A22%, then the system will correct only the rate C0% accordingly (because the rate B7% was edited).

Setting the VAT table and the value of the generated document is done according to the following rules:

For EAI document:

The gross value in the document currency of the VAT table record is set for each VAT rate at the value set in the window: Determine the advance payment invoice value (for given rate, subject to the following:

- Those VAT table records, for which the value set in the form is 0, are omitted.

Based on the values of other VAT table records (VAT on gross, net…)

Determining the header value of the document based on the created VAT table

For ASI/API document

The value for a given VAT rate, set in the form: Determine the advance payment invoice value, is converted into the system currency according to the rate from the SO/PO or table, subject to the following:

- Those VAT table records, for which the value set in the form is 0, are omitted.

The value calculated in this way is taken as the gross value for a given rate.

VAT and net value are calculated from the above-mentioned value and the VAT table records are determined on the basis of the above-mentioned value.

The net and gross value of the document is calculated in PLN.

Partial settlement of advance payment invoices

General considerations

Advance payment invoices are issued to the part of the payment resulting from the order. Consequently, the payment on such an invoice is part of the payment on the final invoice with which the order is executed. The amount of the advance payment to be settled on the final document is available for editing. The initial advance payment amount to be settled will be the sum of all amounts to be settled, resulting from advance payment invoices settled by the final document. After editing the settlement amount on the final invoice, the system will re-establish the settled amounts from the individual advance payment invoices, settling them in the order in which they were collected for settlement.

Changing the settled value by the operator – example

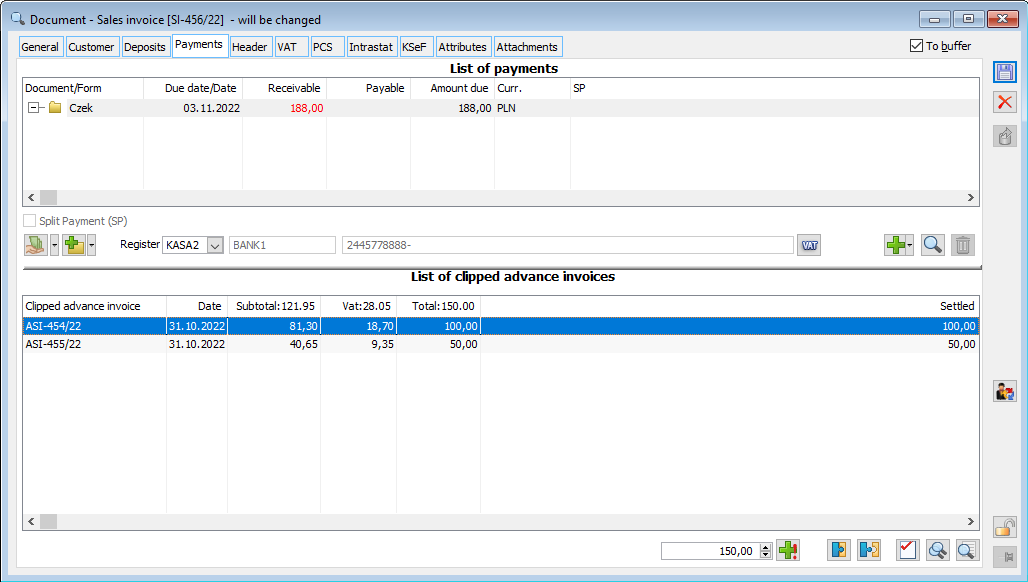

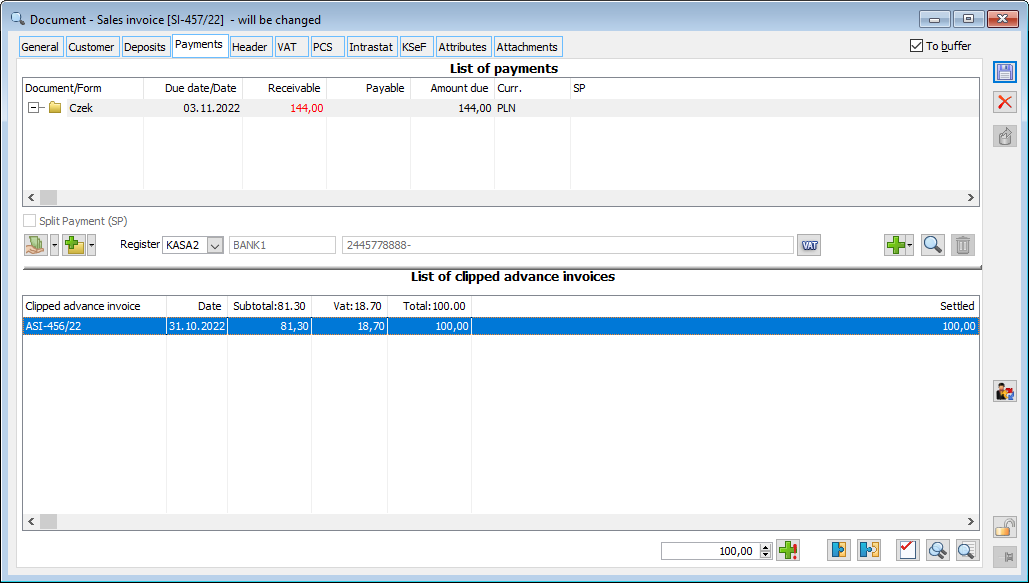

An order has been issued for a value of PLN 488 (gross). Two advance payment invoices were issued for the order: for PLN 100 and PLN 50. Then a final invoice was generated for this order. The settled value (displayed on the tab: Payments) resulting from the advance payment invoices included in the final invoice is: PLN 150.

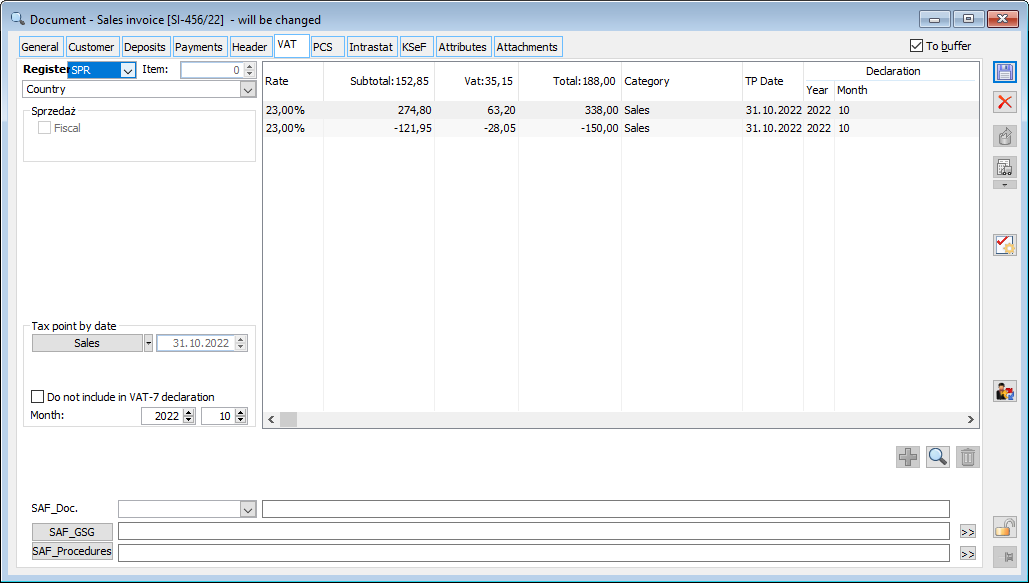

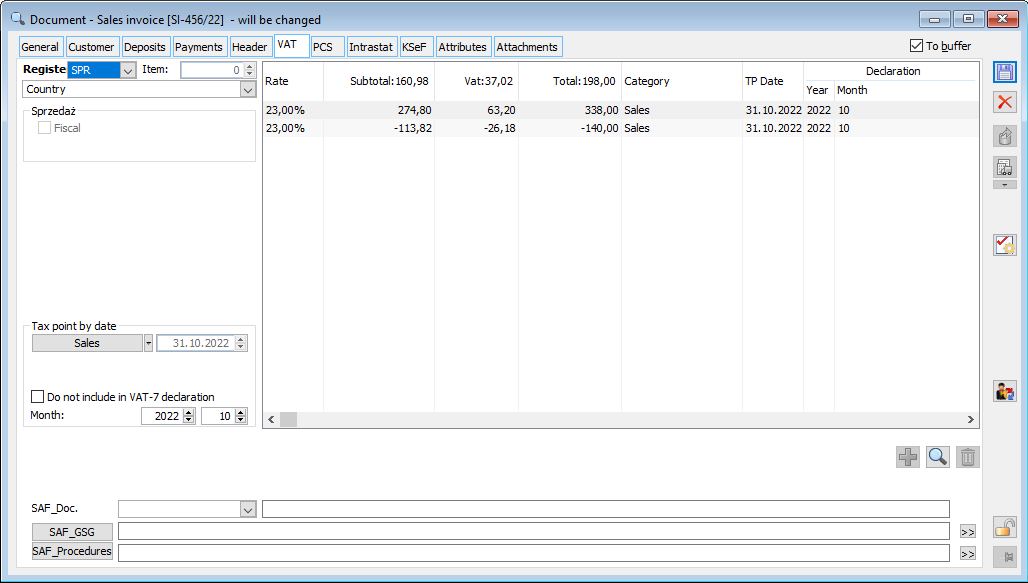

This value is taken into account on the tab: VAT.

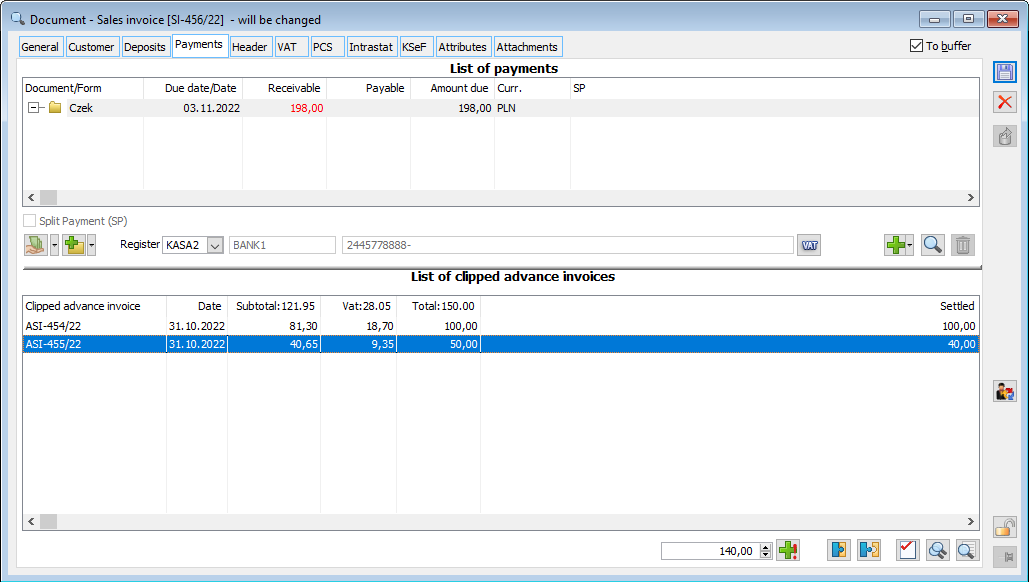

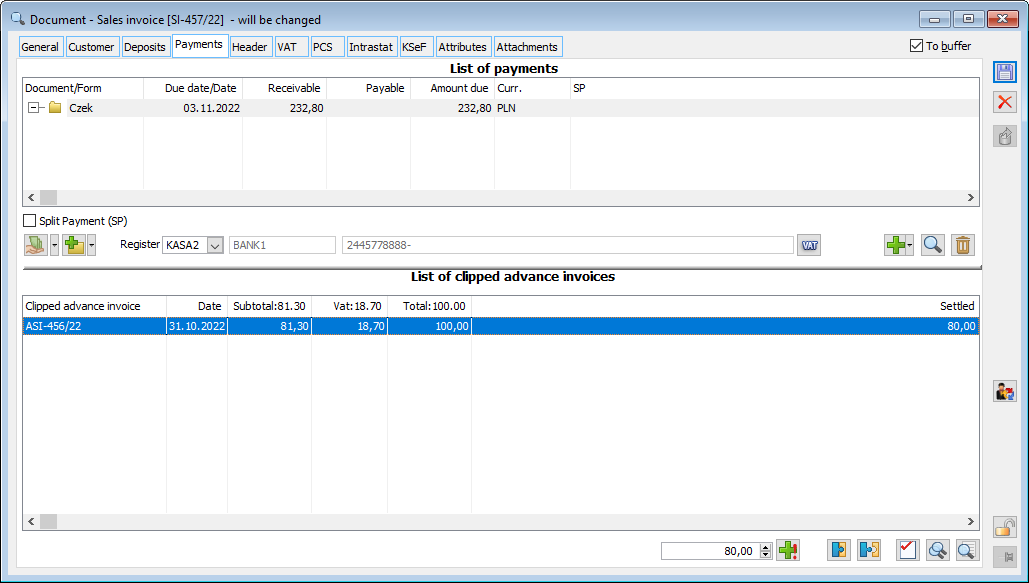

This amount may be reduced – depending on the operator’s decision. In the example it has been reduced to PLN 140 (edition of the parameter: Settled value on the tab: Payments).

The reduction of the settled value taken into account from the advance payment invoices has resulted in a payment of PLN 10 on the final invoice.

The edition has also been included on the tab: VAT.

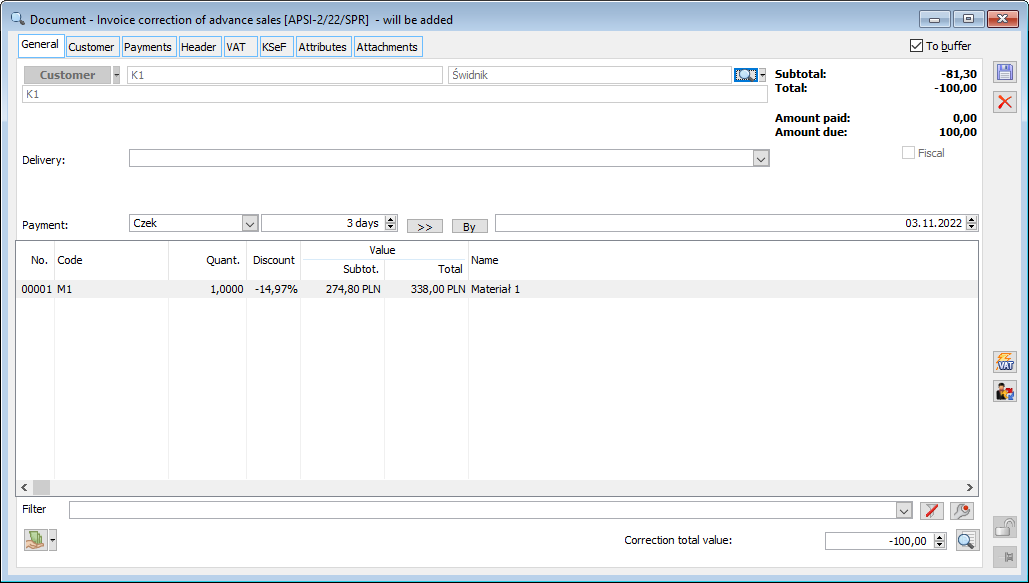

Button: ![]() [Settle all] enables the maximum settled value resulting from the advance payment invoices to be restored, allowing for a possible correction if it turns out that the operator’s modification of the settled value was unnecessary. If the modified settled value is left, it is possible to generate a correction to the advance payment invoice the value of which has been reduced. To generate it, select on the tab: Payments, the advance payment invoice whose cleared value has been reduced and click:

[Settle all] enables the maximum settled value resulting from the advance payment invoices to be restored, allowing for a possible correction if it turns out that the operator’s modification of the settled value was unnecessary. If the modified settled value is left, it is possible to generate a correction to the advance payment invoice the value of which has been reduced. To generate it, select on the tab: Payments, the advance payment invoice whose cleared value has been reduced and click: ![]() [Correction].

[Correction].

Changing the transaction conditions on the final invoice

When the conditions of the transaction are changed on the final invoice – for example, the quantity of goods or its price is edited, which causes the modification of the document value, such a situation can be handled by the system.

In this situation, if the operator has not edited the settled value, the system will recalculate the settled values after the change of transaction conditions. However, if the operator modified the above-mentioned value, then the transaction value will change, while the settled value will remain unchanged.

A sales order was generated for a value of PLN 244 (gross), to which an advance payment invoice for PLN 100 was issued. Then, a final invoice was generated from the order. The invoice includes the previously issued advance payment invoice. As a result, the payment on the final invoice will be calculated after taking into account the value settled by the advance payment invoice. Then the operator modifies the value settled with the advance payment invoice to PLN 80. After this change, the sales price on the final invoice was changed, which increased the document value by PLN 68.80. Despite this, the advance payment invoice value is not increased and remains at the level of PLN 80, as set by the operator.

It is also possible that the transaction value will be reduced. In this case, the system will recalculate the settled value resulting from the advance payment invoice if this value decreases to such an extent that the settled value needs to be depleted.

Advance payment invoice corrections

Advance payment invoice corrections generating

Corrections to advance payment invoices are generated from the level of document lists:

- Corrective purchase advance payment invoice (APPI) from the list of purchase documents (List of commercial documents, tab: Purchase/PI)

- Corrective sales advance payment invoice (APSI) from the list of sale documents (List of commercial documents, tab: Sale/INV)

- Corrective export advance payment invoice (EAIC) from the list of export documents (List of commercial documents, tab: Export/ESI).

Moreover, it is possible to generate correction to advance payment invoices from the level of:

- Final document to the advance payment invoice (tab: Payments)

- Orders to which the advance payment invoice was generated (tab: Payments/Advance payments).

Corrective purchase advance payment invoice (APPI)/Corrective sales advance payment invoice (APSI)

It is possible to make a partial value correction to APSI and APPI documents. This is done by editing the amounts on the tab: VAT or values on the tab: General, of the correction document. The correction takes place after entering in the field: Correction gross value, the appropriate value (within the limits of the possible correction).

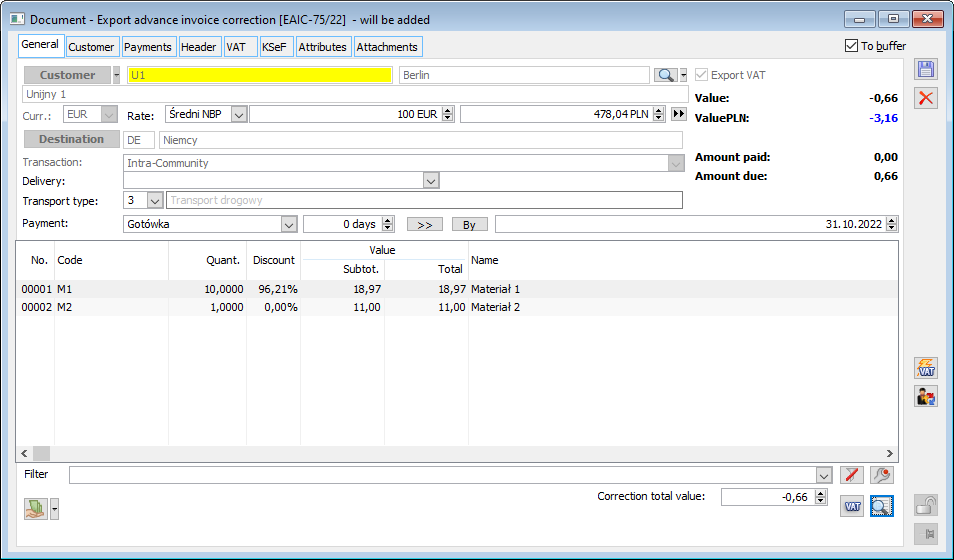

Correction of export advance payment invoice (EAIC) for transactions of the type Intra-community/Other foreign.

EAIC document is used to make a correction of an advance payment invoice by:

- Document gross value correction

- Change of VAT charging on document

Document gross value correction

The correction of the gross value with the EAIC document is made in the same way as for APSI or APPI – on the tab: VAT and on the tab: General, there is a field made available for editing: Correction gross value.

Change of VAT charging on document

To change the VAT calculation on a document, use the function: ![]() [Change VAT calculation], located on the tab: General, of the document: Correction of export advance payment invoice.

[Change VAT calculation], located on the tab: General, of the document: Correction of export advance payment invoice.

Correction of export advance payment invoice (EAIC) for domestic transaction

Unlike the EAIC document for the Intra-community/Other foreign transaction, on the domestic EAIC document we have:

- Domestic VAT rates

- “Export VAT” unchecked and displayed in grey

- On the VAT tab in the menu under the register, the “Domestic” and “The buyer is the tax payer” options are available.

- Trn_ExpoNorm, TrV_ExpoNorm is at the level 1 (domestic) or 20 (The buyer is the tax payer)

- The parameter “Do not include in VAT-EU return” is hidden

- Button “Change VAT calculation” is displayed in grey