General information

This chapter describes the parameters available in the window: Sales/purchase advance payment invoice. As the parameters are analogous in these documents and the differences are only due to their specifics, the advance payment invoice window will be described using the sales advance payment invoice as an example.

Please note that the advance payment invoice documents: ASI, API, and EAI have their own definitions, available from the module: Administrator, that define the right of the users to use these documents.

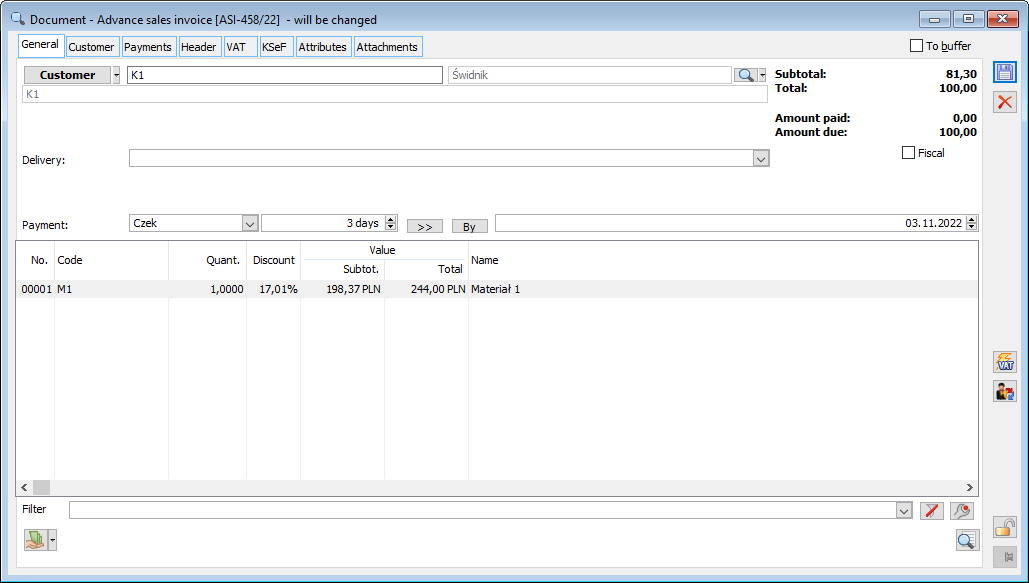

Sales advance payment invoice, tab: General

The tab contains the following fields:

Contractor – indicates the contractor registered in the order. This field cannot be edited; once the following button is clicked: ![]() [Select contractor], the contractor card will be displayed for preview.

[Select contractor], the contractor card will be displayed for preview.

Delivery – in this field the user selects the manner of delivery of the transaction subject.

Payment method/due date – payment method and due date for the transaction.

Moreover, on the tab there are the following buttons:

![]() [Payment] – initiates the process of advance payment being paid. When the following button is clicked:

[Payment] – initiates the process of advance payment being paid. When the following button is clicked: ![]() [Expands the menu of available options], a list from which the method of payment can be selected will be displayed.

[Expands the menu of available options], a list from which the method of payment can be selected will be displayed.

![]() [Preview] – allows for preview of the order item indicated on the tab.

[Preview] – allows for preview of the order item indicated on the tab.

Sales advance payment invoice, tab: Contractor

The tab contains the data of the contractor registered on the source order. There are three tabs on the tab, that contain the data of the main contractor, the target contractor and the payer. Button: ![]() [Select contractor] allows for the preview of the card of the contractor displayed on the tab

[Select contractor] allows for the preview of the card of the contractor displayed on the tab

Payer on the document: ASI, EAI, API will be the same payer as those indicated on the source order.

More information on payer on documents is available in the module documentation: Sale.

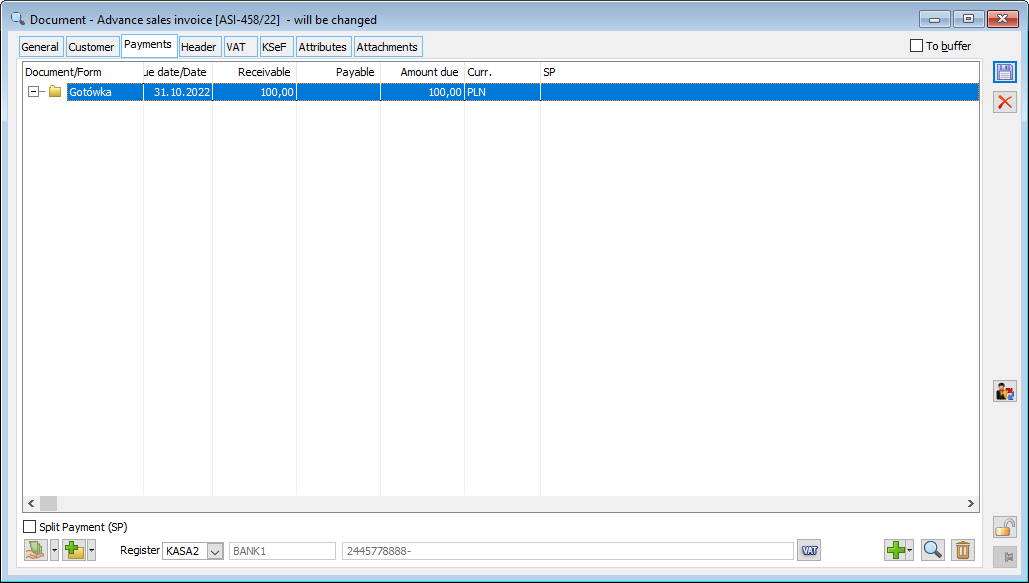

Sales advance payment invoice, tab: Payments

On the tab there is a list a list of advance payments. The method and due date of payment results from the method and due date of payment indicated on the source document (method and due date of payment on the tab: Payments/Advance payments).

The tab also contains the following field:

Register – a register of bank operations to which the payment associated with a document will go. The bank account number assigned to the register is displayed next to it.

It should be noted that on each SOR, EOR, POR document, clearing an advance document, also one that does not generate payments (that is in the document definition, with the parameter unselected: Generates payments) the following tab is presented: Payments, where the user will find a section with a list of cleared advance invoices. The same principle also applies to the clips for these documents. On the clips, the settlement of advance payment invoices is also visible in the VAT table, where both the values resulting from the transaction value and the values resulting from the settled advance payment invoices are presented, and the value of the clips is calculated as their difference.

Payment on an advance payment invoice may be expressed in a currency other than the system currency – in a foreign currency. This is the case when the advance payment for which the invoice was generated is denominated in that foreign currency

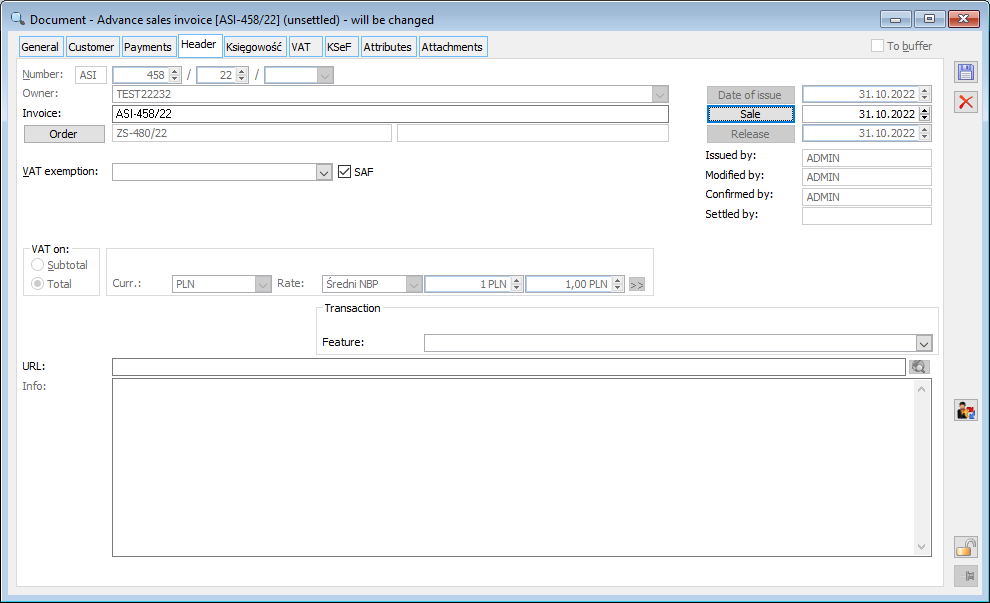

Sales advance payment invoice, tab: Header

The tab contains the following fields:

Number – invoice number. By default, a consecutive free number is assigned, which can be changed to another free number.

Owner – the centre where the invoice was issued. It is possible to select another centre than the one from which the source order originates.

Invoice – supplier’s invoice number.

Order – the source order number.

Dates:

- Issue date – the date on which the document was issued,

- Date of sale – date of sale,

- Release date – date the good were released. This will be the default date of issuing the warehouse document.

Modified by, Issued by, Approved by, Settled by – operator who performed the said activities.

VAT from – this parameter’s value is transferred from the source order. Only the selection of the following option: Gross, allows the invoice to be fiscalised as a sales advance payment invoice. Fiscalisation of the first advance payment invoice is independent of the VAT calculation method setting on the source order (net/gross).

Currency, Exchange rate – fields the value of which is copied from the order and is unavailable for editing.

Trait – in this field the trait of the document can be assigned.

URL – the URL can be entered in this field. After entering it, the following button will be activated: ![]() [Website address], triggering a connection to the indicated website.

[Website address], triggering a connection to the indicated website.

Description – in this field, the user enters a description of the document.

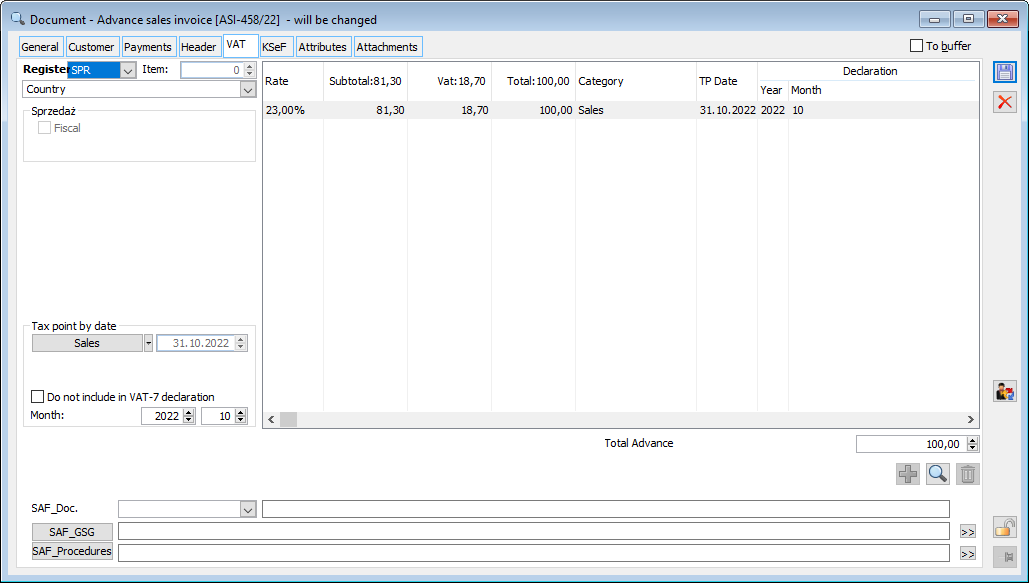

Sales advance payment invoice, tab: VAT

The tab contains the following fields:

Register – the VAT register in which the document will be recorded. It can be selected from the list of VAT registers for purchase defined in the configuration. The default VAT register for the document depends on its series, as it is assigned to it.

Transaction type – we have an option to choose:

- Domestic

- Taxpayer is the buyer.

These parameters are also available for APSI.

Sales – ticking the box: fiscal, enables the fiscalisation of an advance payment invoice. This option can be selected for the first, unapproved advance payment invoice. The selection of this option depends on the VAT calculation method on the document – it will not be possible to select this option if the following option was selected: VAT from, Net. Fiscalisation of the document is possible only if VAT is calculated on the gross amount. The option: Fiscal, it will be transferred to subsequent advance payment invoices and to the final invoice (if it includes advance payment invoices).

Do not include in the VAT return – if selected, the transactions from the document will not be included in the VAT 7 return, more precisely, they will have the parameter, which can be changed from the VAT register level, set appropriately.

Gross sum of the advance payment – the gross sum of the advance payment, conforming to the value of the advance payment specified on the source order, on the tab: Payments/Advance payments.

Sales advance payment invoice, tab: Attributes

The tab is used to assign attributes for the document. For this to be possible, attributes must first be assigned to the object: ASI ([Commercial documents].[ ASI]). Attributes are assigned according to general rules.

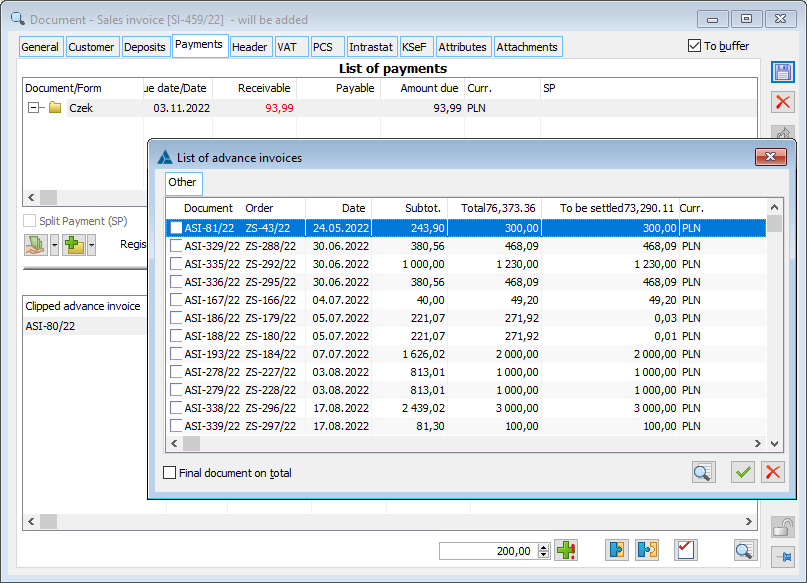

Ergonomics of deducting advance payment invoices

Deduction of advance payment invoices generated for an order other than the one being fulfilled

Previously, advance payment invoices registered for a specific order could only be deducted during the transaction that completed that order. For many customers, however, the acceptance of advance payments takes place at a time when the exact items that will be ordered by the customer are not known, and often the customer makes an advance payment towards future orders. Previously, to handle such a case, the operator would register an order for A-Vista or service items and register an advance payment invoice for it. When the customer specified the details of the order, a “proper” order was registered, but when the order was processed, the operator had to find and indicate the “original” order to be able to deduct the advance payment invoice.

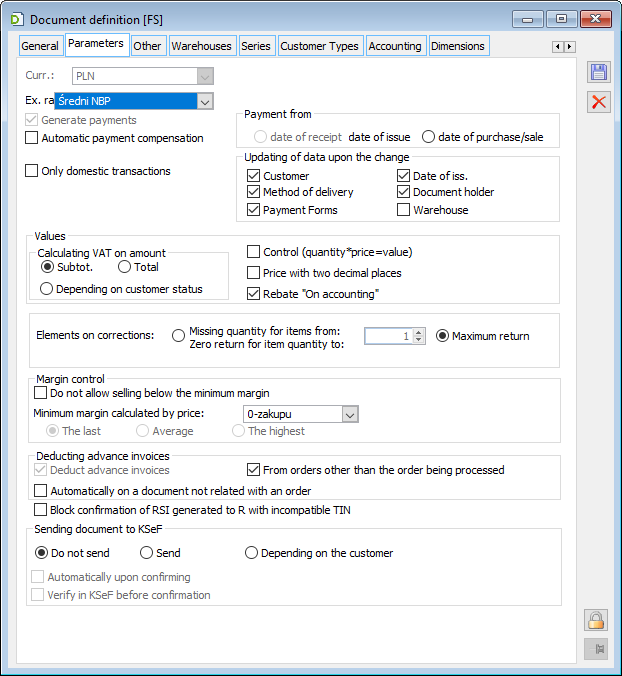

As of version 2016.3, such a deduction can be made regardless of which of the Contractor’s orders is being processed. This functionality is parameterised on the definition of the generated document – parameter: “Deduction of advance payment invoices – from orders other than the one being fulfilled”.

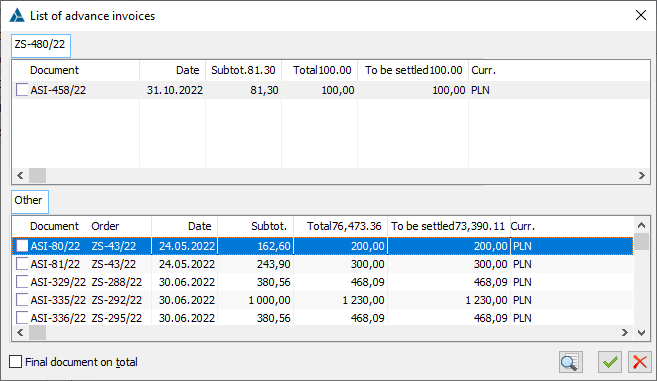

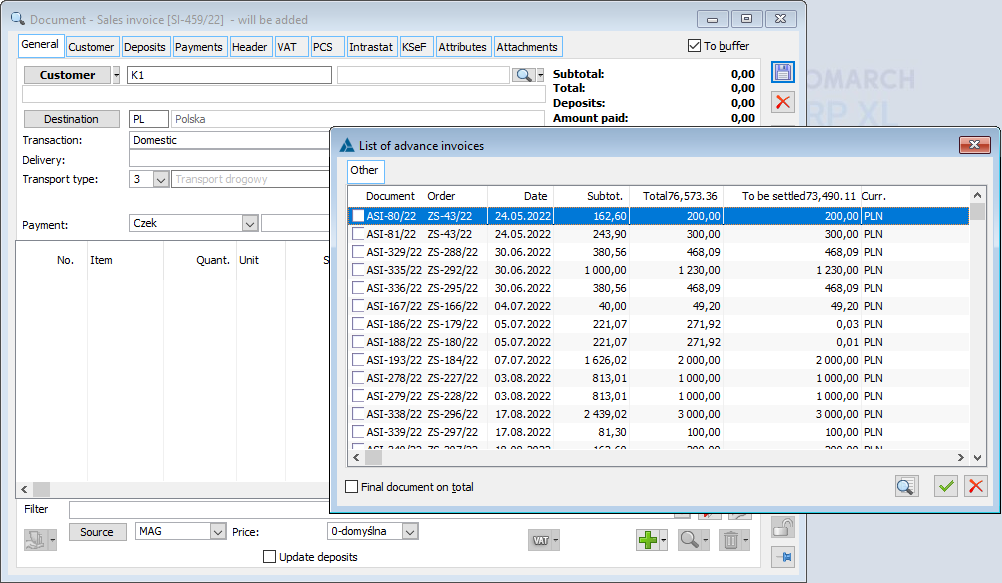

If the above-mentioned parameter is enabled, then when generating a document from an order, the System will propose not only advance payment invoices issued to this order, but also advance payment invoices from other orders. Documents from the current order are presented in the top list, while documents from orders other than the on-going ones are presented in the bottom list.

Indicating an advance payment invoice from an order other than the one being carried out does not mean that it will also be carried out, but only that the advance invoice issued for it will be used. The aforementioned functionality can be used especially in situations where the Contractor makes an advance payment for future deliveries, when their specification is not yet determined, so an advance invoice is registered for a “technical” order on the item of service/cost type or goods A-vista, and then during the execution of specific orders it is gradually deducted.

The above functionality is available on SI, SOR, ESI, EOR sales documents and on POR and PI purchase documents.

Deduction of advance payment invoices independently of orders

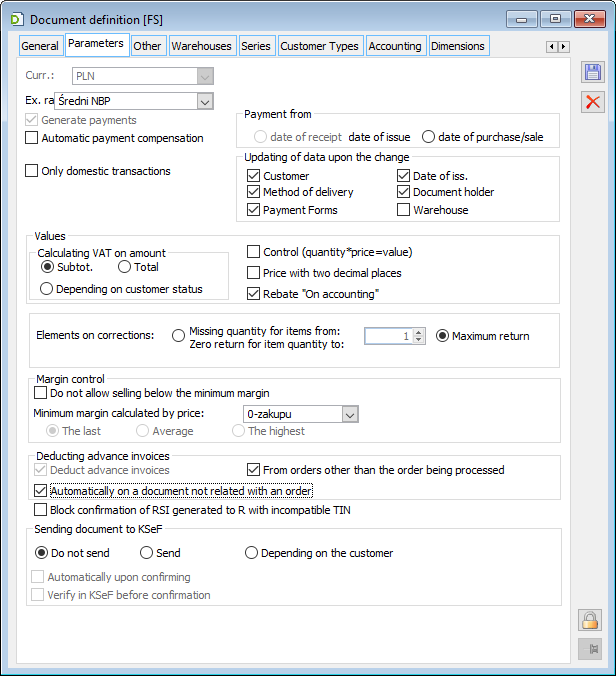

In addition to the above-described ability to deduct advance payment invoices from orders other than those executed with the current final document, as of version 2016.3, the deduction of advance payment invoices when recording a transaction unrelated to the execution of orders has also been made available. This deduction can be automated by enabling the relevant parameter on the SI, SOR, ESI, EOR, POR, PI document definition.

The previous functionality for settling advance payment invoices required the final document to be derived from the order to which the advance document was issued. When sales were made independently of orders, the operator knew nothing about the existence of advance payment invoices issued to the customer to whom the sale was made, so it was not possible to reduce the value of the document by advance payments already paid and invoiced.

As of version 2016.3, it is now possible to take into account advance payment invoices when registering the expenditures/revenues in the usual mode of issuing a document that does not fulfil an order. If the relevant parameter has been enabled in the document definition, then advance payment invoices will be proposed immediately after entering the contractor into the document, and regardless of this, the Operator on the {Payments} tab of the document will be able to clip/unclip the advance payment invoice from the document.

If in the definition of a given document the parameter “Deduction of advance payment invoices/ Automatically on a document not related to an order” is enabled, then after entering a contractor into a document, for example SI, the System finds advance payment invoices registered for this contractor and proposes them for deduction.

Regardless of the above automation, the user is able to attach or detach an advance payment invoice at any stage of registering or editing an unapproved document. This is done on the tab {Payments} of the sales document SI, SOR, ESI, EOR and the purchase document PI, POR. Downloading an advance payment invoice for deduction on a given document does not mean, however, that the order for which it was issued will be completed.