On the documents of Sales offers and Sales orders, it is possible to specify the type of transaction “Taxpayer is the Buyer”. This will be particularly helpful for those Users who trade in goods for which the reverse charge procedure has been introduced and which exceed PLN 20,000 for transactions of commercially uniform character. Such a “transaction of commercially uniform character” may be registered by means of a sales order, as a result of which subsequent documents generated from it will have the correct transaction type and VAT rates appropriate for this procedure.

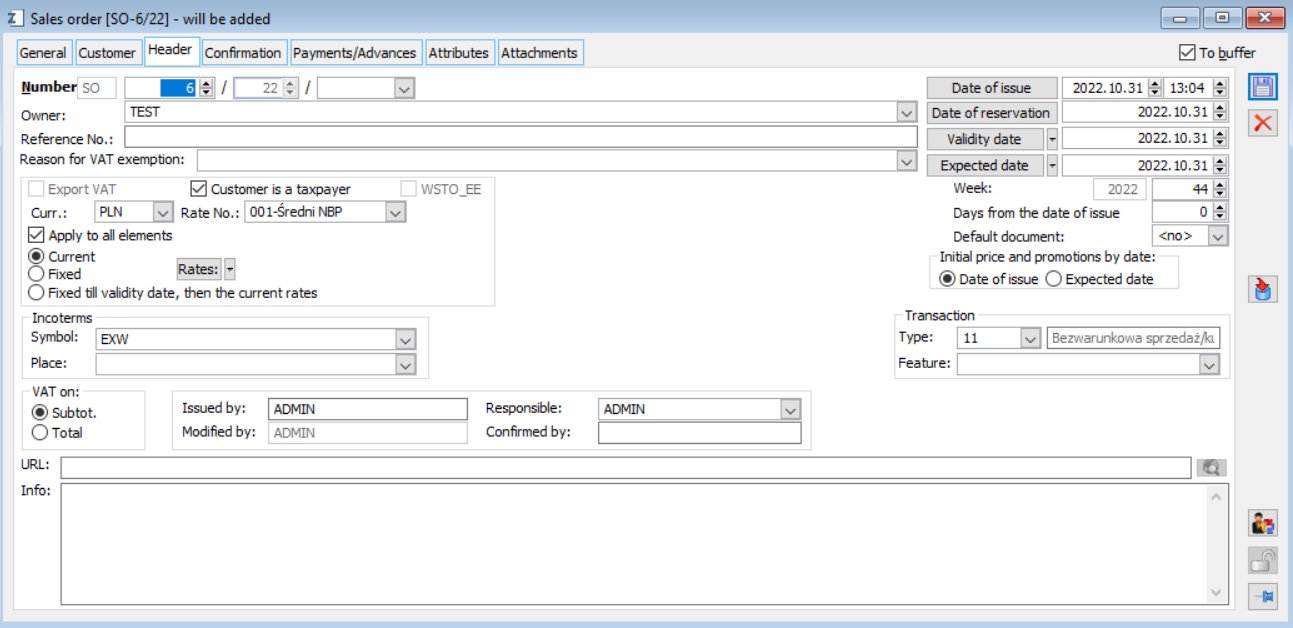

Assigning to the SQ/SO the above transaction is done by checking the parameter “Taxpayer is the Buyer” on the {Header} tab. By default, the parameter is selected if the SQ/SO is registered to a contractor marked as “Taxpayer is the buyer”.

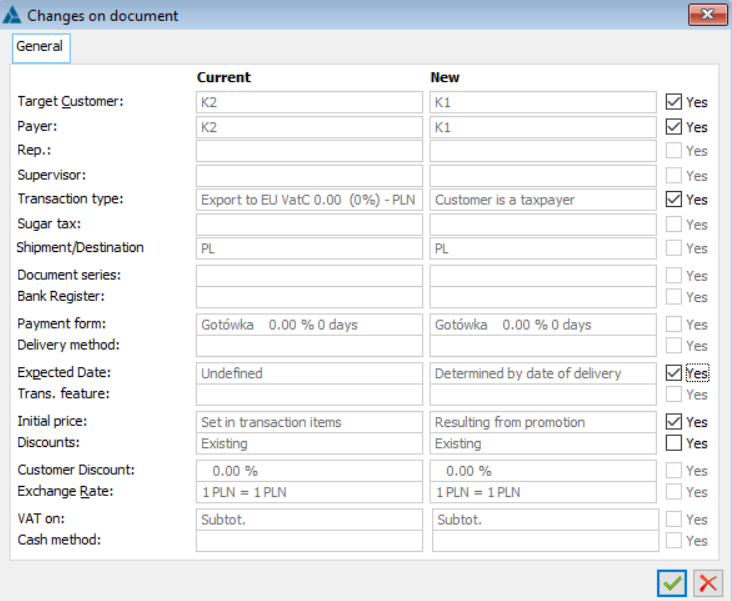

When a contractor is changed on a document, the new transaction type is shown in the New column in the document change window.

On the items marked “reverse charge” and “reverse charge/limit” added to the SQ/SO documents with the above transaction type, the System will determine the rates applicable to the reverse charge. It will also change them during the change of the transaction type made by the Operator as well as by the System (made as a result of a change of contractor or an affirmative question about a change of transaction asked by the System). The change of the transaction type to “Taxpayer is the buyer” will result in setting the rate applicable to the reverse charge on the order items of the reverse charge type and the limit of reverse charge. Changing the transaction type to “domestic” will set the rate applicable to the limit of reverse charge on the items of the reverse charge type and restore the rate from the product card on the item of the limit of the reverse charge type. In case of a change to a type other than the aforementioned, all the items shall be subject to the same rules, that are the rate from the product card shall be set on them, or “export” rate, depending on the selection of “Export VAT” parameter in the SQ/SO.

If a correction is made to an order document to which an advance payment is attached, the system checks the consistency of the type of transaction: on the new SO and on the ASI/EAI attached to the order being corrected, with the proviso that in the case of the transaction “domestic” on the SO, the condition is deemed fulfilled, if the ASI/EAI is of the type “domestic” or “Taxpayer is the buyer”. In the case of a SO with type “Taxpayer is the buyer”, both the ASI/EAI with type “domestic” and “taxpayer is the buyer” will be copied.

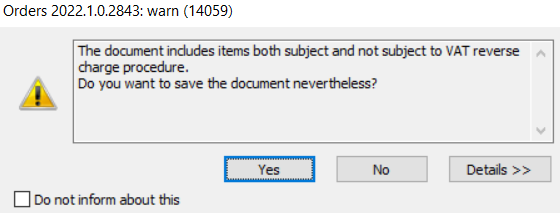

In the case of approval of a document with the selected “taxpayer is the buyer” parameter and goods subject to reverse charge and regular, a window with the message will appear.

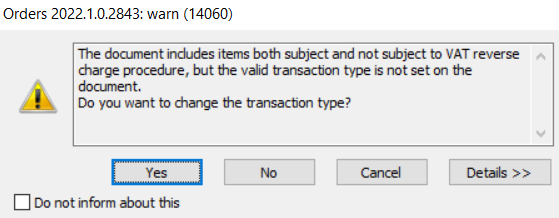

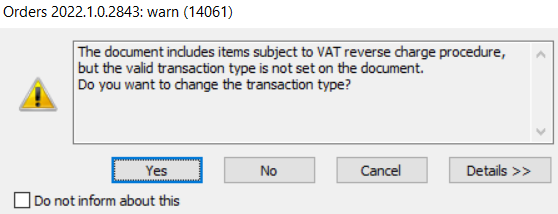

If the parameter “Taxpayer is the buyer” is unchecked on the document, and the transaction is domestic, and the document items include reverse-chargeable goods and ordinary goods, a warning message will appear prompting to change the transaction type. If the user selects Yes, the “Taxpayer is the buyer” parameter will be selected. The answer No will not save the document as is. If the user selects Cancel, the document will not be saved, and no changes will be made to it.

If the “Taxpayer is the buyer” is selected on the document, the transaction is domestic and the document contains reverse-chargeable goods, a message appears with a warning and a question about changing the type of transaction. If the user selects Yes, the “Taxpayer is the buyer” parameter will be selected. The answer No will not save the document as is. If the user selects Cancel, the document will not be saved, and no changes will be made to it.

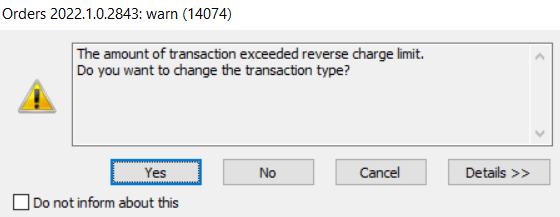

If the “Taxpayer is the buyer” parameter is unchecked on the document, the transaction is domestic, and the document contains reverse-chargeable goods with the “reverse-charge limit” parameter selected on the product card, then a warning message shall appear, stating that the reverse charge limit has been exceeded and asking to change the transaction type. If the user selects Yes, the “Taxpayer is the buyer” parameter will be selected. The answer No will not save the document as is. If the user selects Cancel, the document will not be saved, and no changes will be made to it.

The following documents can be generated from SO documents with the transaction type “Taxpayer is the buyer”:

- From a SO document to which a EAI document has been created it is possible to generate WR-, WRO, R, ESI, EOR documents

- From a SO document to which a ASI document has been created it is possible to generate SI, SOR, WR-, WRO, R documents,

- From a SO document to which no advance payment documents have been created it is possible to generate SI, SOR, IR-, WR-, WRO, R, ESI, EORC, ISI documents.