Functional changes introduced in Comarch ERP XL, version 2023.0

Framework schedule for Comarch ERP XL version in 2022.

| Version number | Version type | Release date | Notes |

| 2023.1 | Version | February 2023 | |

| 2023.2 | Version | June 2023 | |

| 2024.0 | Version | December 2023 |

Planned software release dates are continuously updated on the Comarch Community (Społeczność Comarch): https://spolecznosc.comarch.pl/news/planowane-wersje-comarch-erp-xl-na-rok-2022-68716

Summary of applications that Comarch ERP XL 2023.0 cooperates with

| Application | Version | Notes |

| Comarch IBARD | 6.5.1 | |

| wszystko.pl | Current version of www.wszystko.pl | |

| Comarch e-Sklep | 2023.0 | |

| Comarch B2B | Information in the documentation of the new version | |

| Comarch Mobile

(Management (Zarządzanie), Sales (Sprzedaż), Monitoring (Monitorowanie), Service (Serwis)) |

2022.2.2 | |

| Comarch WMS

(Management (Zarządzanie), Warehouse Manager (Magazynier)) |

2023.0.0 | |

| Comarch Warehouse Manager (Comarch Magazynier) | 2022.0.0 | |

| Comarch ERP XL HR | 2023.1.1 | |

| Comarch HRM | 2023.0.1 | |

| Comarch DMS

(Offline – stationary (stacjonarny), web (WWW)) |

2022.0.3 | |

| Comarch ERP XL Business Intelligence

(Report book, Management panel, Configurator) |

2023.0 | |

| Comarch ERP XL Business Intelligence

(BI Point) |

12.6 | |

| XL2XML data migration | 10.0 | |

| Comarch MES | 2023.0 | |

| Comarch e-Reports (e-Sprawozdania) | 2023.0.0 | |

| Comarch POS | 2023.0 | |

| Comarch Shipping | Current version of shipping.comarch.com | |

| Comarch Apfino | Current version of apfino.pl | |

| Comarch sPrint | 0.5 | Beta version |

As of version 2022.1, due to changes in the core libraries of Comarch ERP XL, we are removing the possibility to convert databases older than version 2018.0. If you need to convert a database older than version 2018.0, the conversion must be performed in two steps:

1. First, convert the database to one of the versions in the range 2018.0–2022.0

2. Then convert to version 2022.1

Logistics

National e-Invoice System (Krajowy System e-Faktur, KSeF)

In terms of integration with the National e-Invoice System, version 2022.1 of the System provides functional elements of a demonstrative nature, aimed at familiarising Users with the planned handling of this integration. Version 2023.0 provides full integration with KSeF for exporting invoices and invoice corrections to both the Demo and production environments.

On December 1, 2022, a draft law amending the Value Added Tax Act and certain other acts, introducing mandatory invoicing in the National e-Invoice System and a proposal for the next version of the FA(2) e-invoice schema, was published on the website of the Government Legislation Centre.

The integration with KSeF, introduced in version 2023.0 of the System and described in this document, is based on existing regulations and the FA(1) schema

Invoice submission on the Demo environment serves to prepare the Company for the planned KSeF system becoming mandatory from 2024. Submitting an invoice to the production environment, on the other hand, is tantamount to introducing such an invoice into the economic circulation and should be done in a prudent manner.

The functionality for exporting invoices to KSeF is available under one of the following licensing methods:

-

-

- Comarch KSeF licence

- OCR package

-

During the promotional period until June 30, 2023, the function of exporting documents to the National e-Invoice System is free of charge.

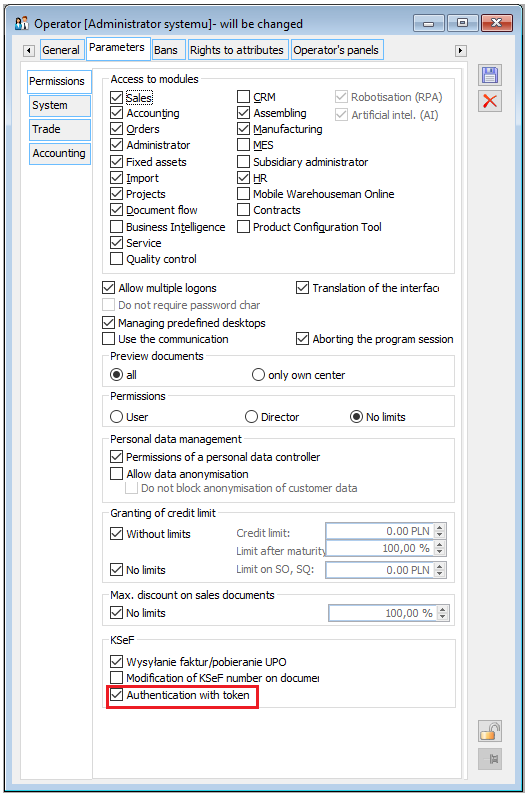

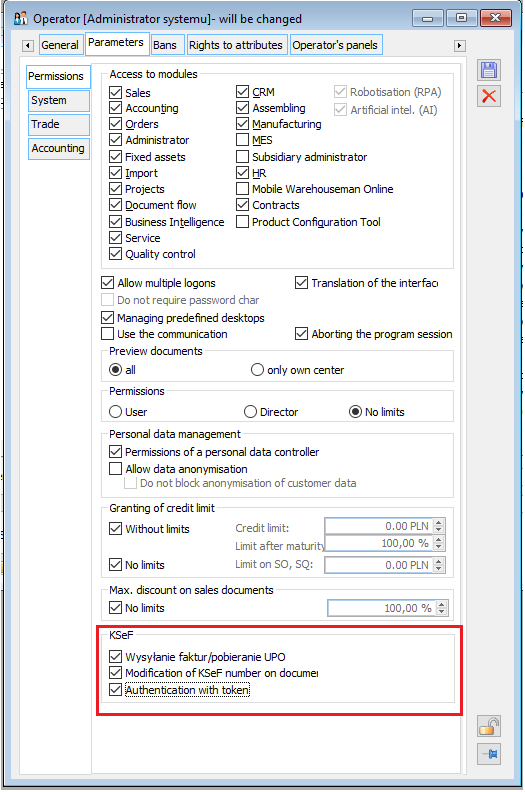

User authentication in KSeF

Communication with the KSeF System requires appropriate authentication of the User on the KSeF platform. In Comarch ERP XL, it is possible to perform such authentication with a token and with a certificate. The relevant parameter on the User’s card determines which of the aforementioned methods is used.

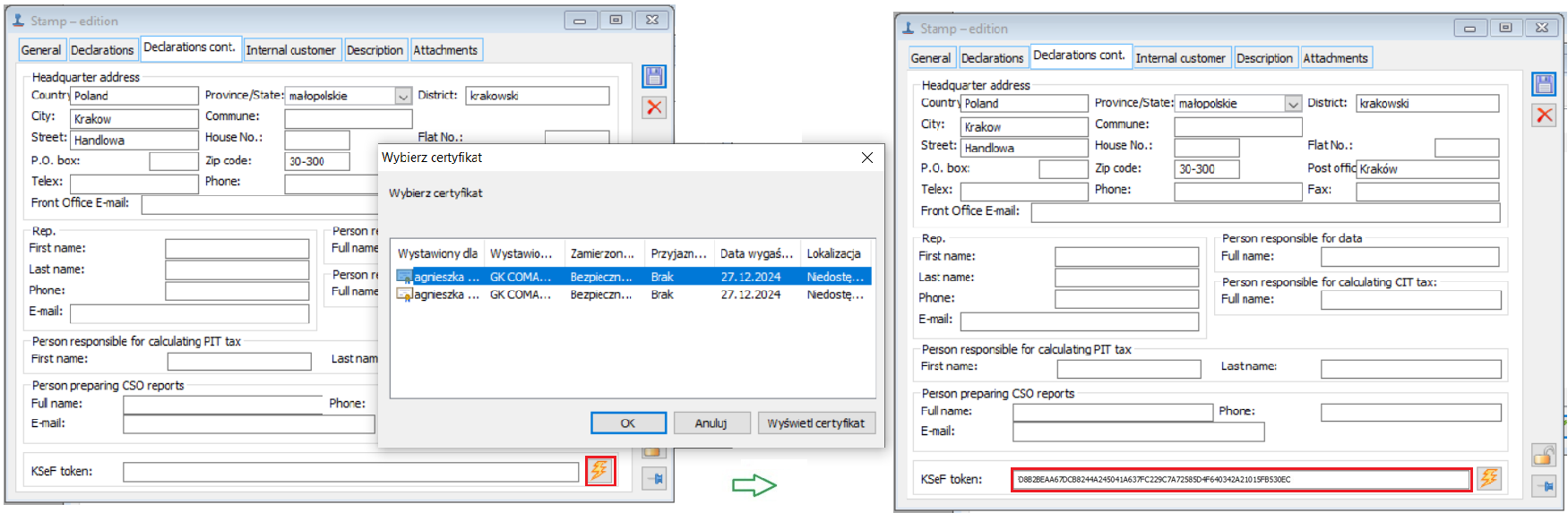

Tokens are assigned on individual company stamps. Users have the option of entering/pasting a token generated directly in KSeF themselves, as well as the option of generating one using the Generate operation, available on a non-archival stamp on which a VAT ID (NIP) is given and on which no such token has yet been generated/assigned.

The token is generated based on the VAT ID (NIP) of the stamp and the certificate indicated by the User. The token generated in this way is given all the roles: accessing invoices, issuing invoices, viewing permissions, managing permissions.

|

Note: When generating a token, whether for the Demo environment or the Production environment, the actual certificate must be authenticated, but must be generated separately for each of the above environments. |

The User has the option of removing the token from the stamp by deleting the contents of the Token KSeF control. Removing this token from the stamp is not equivalent to deactivating it in KSeF. Such deactivation should be done directly in KSeF, e.g. at https://ksef-demo.mf.gov.pl/ and https://ksef.mf.gov.pl/ provided by the Ministry of Finance.

The token is copied onto the stamp created by archiving the previous stamp and when copying the stamp using the <Ctrl>+<Insert> method. However, simply changing the token does not archive the stamp.

The VAT ID (NIP) is not editable on a stamp with an assigned token, so in order to change the VAT ID (NIP) on it, the token must first be removed from the stamp.

If a token has been assigned to the company stamp assigned to the centre in the context of which the User is logged in and the Authentication with a token parameter is enabled in this Operator’s card, then such an Operator is authenticated in KSeF automatically. If a centre has not been assigned a stamp, the token assigned on the main centre’s stamp is used for authentication.

If the aforementioned parameter of the Operator card is disabled or no token has been defined on the stamp, then the User is required to indicate the certificate before the operation of submitting an invoice or downloading UPO.

The certificate indicated by the User is remembered by the System until the module is closed or the Operator’s working context is changed.

|

Note: An exception and at the same time a limitation in submission using a token concerns the serial submission of invoices made in batch mode, which is addressed in more detail in the System configuration section. KSeF does not then provide for authentication with a token. An indication of the certificate is required for such submission. |

KSeF sessions

Communication with the KSeF System takes place within the specific KSeF session of the respective User. In the case of an interactive submission, i.e. one made for a single document or a serial submission made with the Interactive session option of the Export multiple documents section referred to in the System configuration section, the session is established when the first document is submitted after logging in to Comarch ERP XL application. The submission of further invoices takes place within this session until it is closed. The session is closed during/as a result of:

Closing modules of Comarch ERP XL system

Change of Operator

Change of the Operator’s context

Closing of the session at the Operator’s request

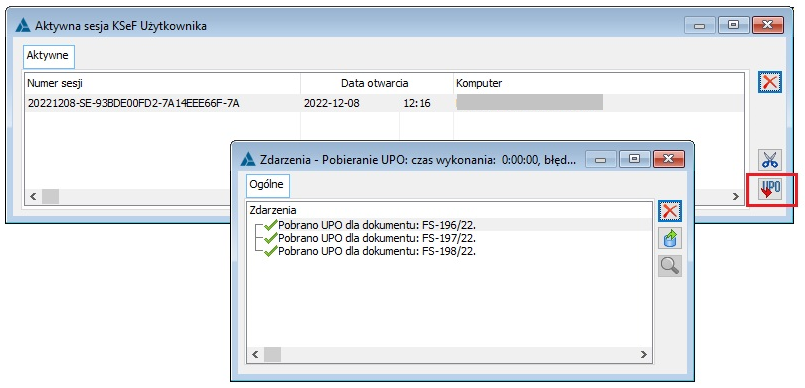

Downloading UPO for the session in question

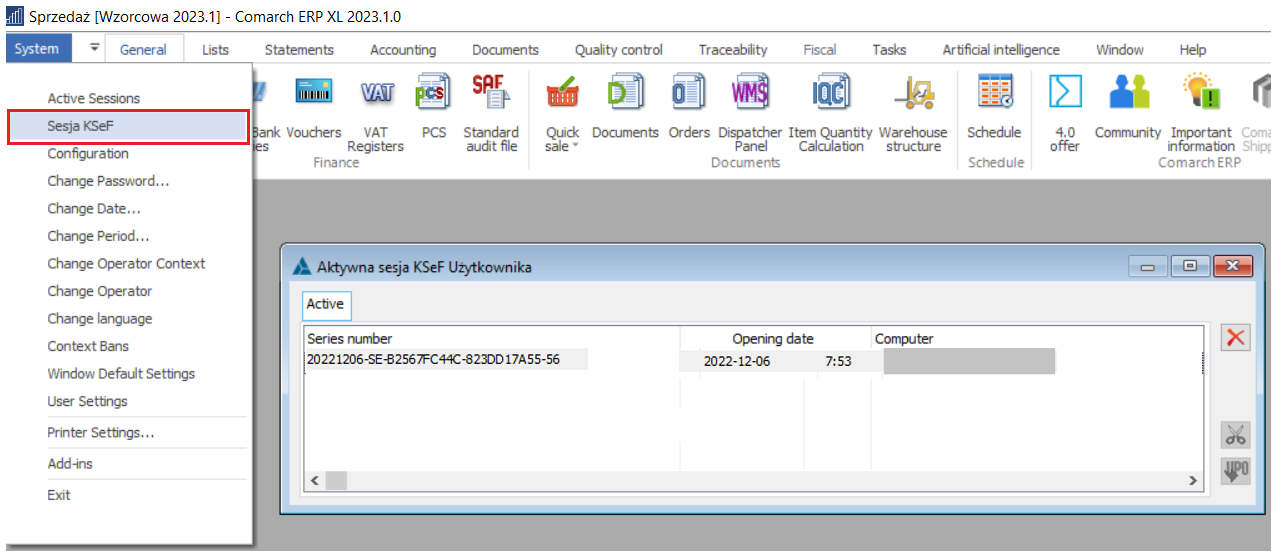

Information on the current interactive session of the current Operator is available in the System/KSeF session menu. Here, the User may terminate the session themselves or download UPO for documents submitted during the session.

In the case of a batch submission, i.e. a serial submission performed with the Batch file option of the Export multiple documents section, referred to in the System configuration section, each submission is performed in a separate session.

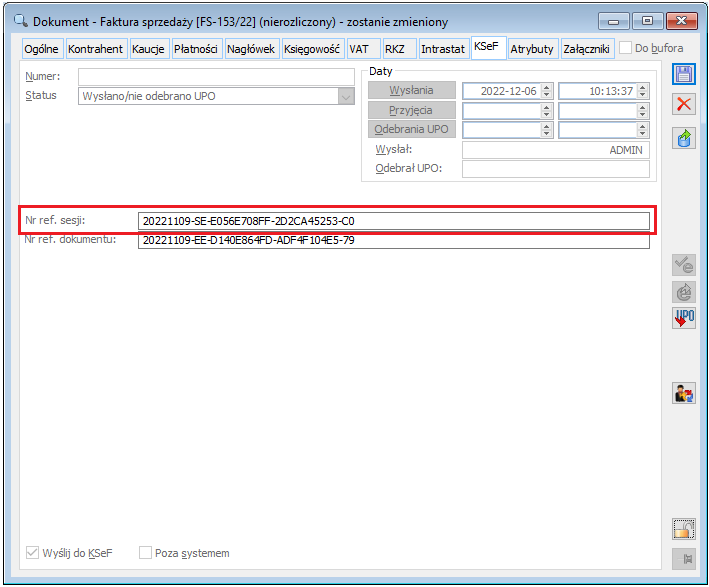

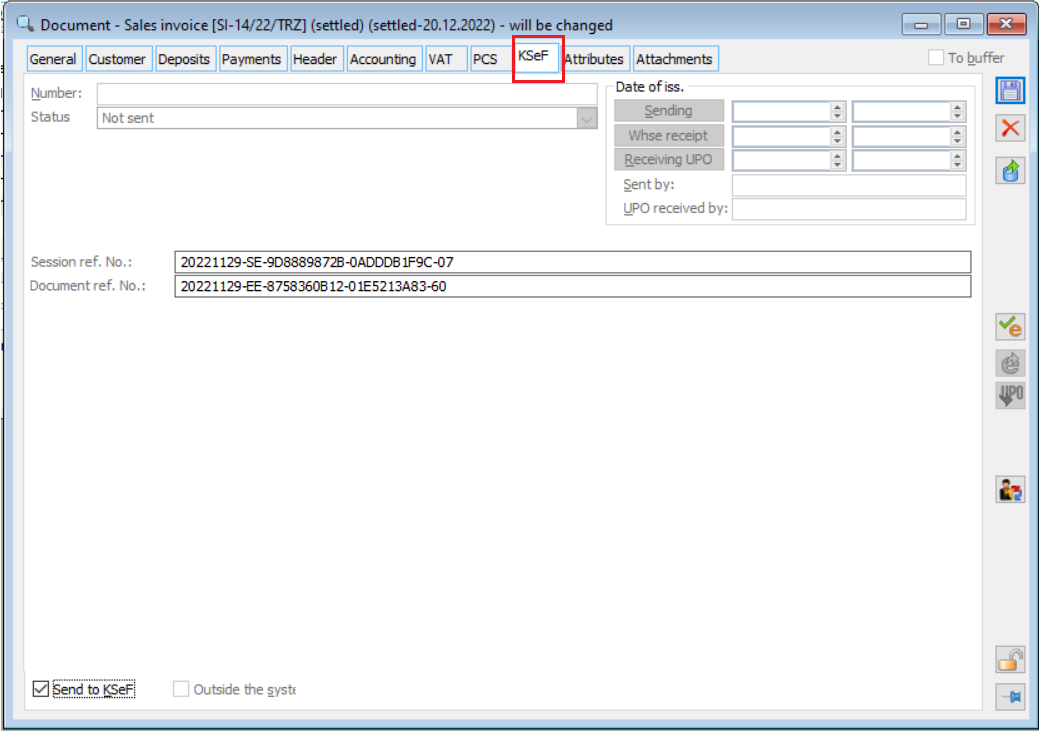

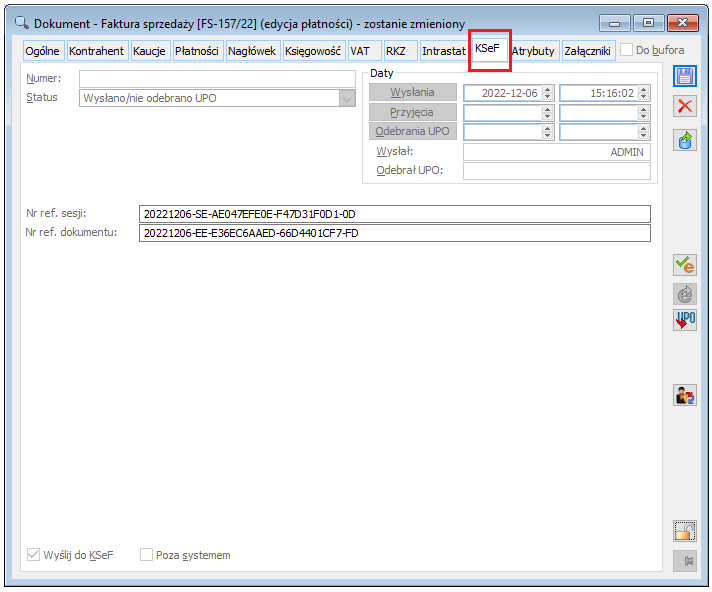

The number of the KSeF session within which the document was submitted is presented on the [KSeF] tab of the document form.

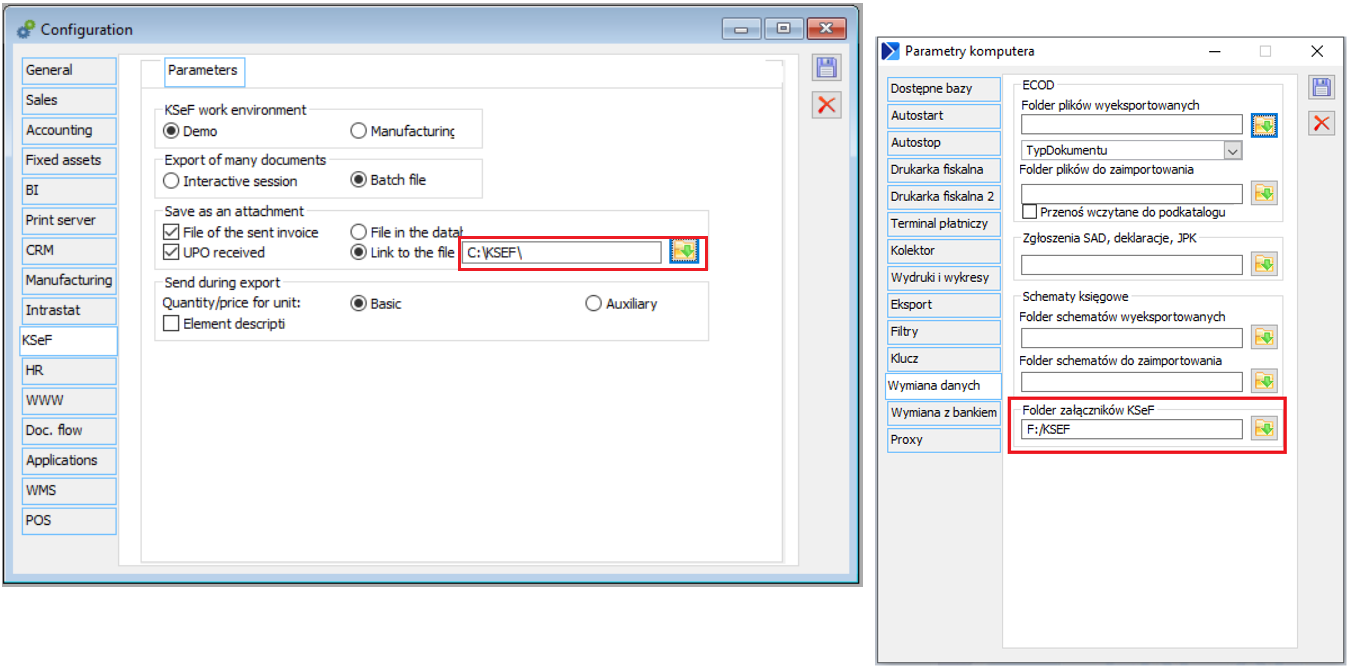

KSeF parameters in the System configuration

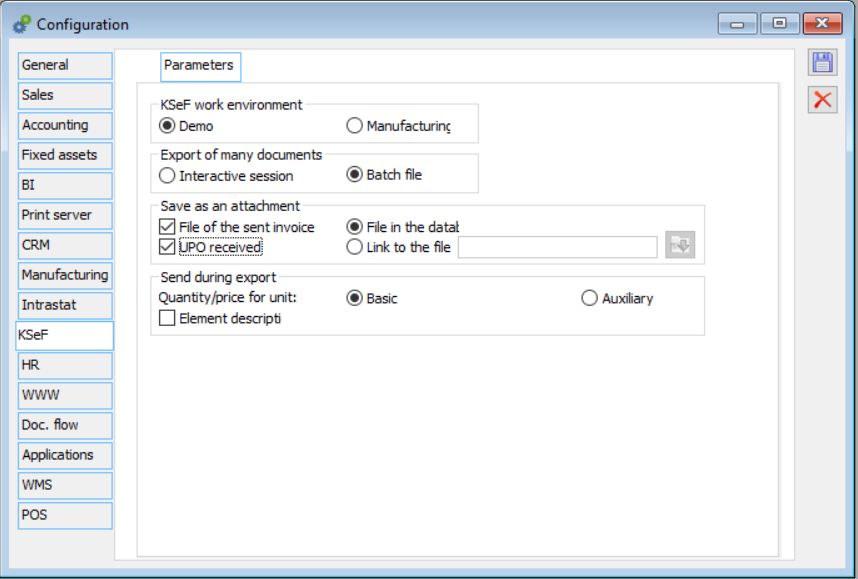

A new tab [KSeF] is now available in the Configuration window, with parameters for integration with the National e-Invoice System.

The aforementioned option determines whether the Company only tests the functionality of invoice submission to KSeF by working on the Demo version, i.e. by submitting invoices to the demo server of the Ministry of Finance, or whether it uses this functionality production-wise, i.e. by registering a fully structured e-invoice and submitting it to the production server of the Ministry of Finance.

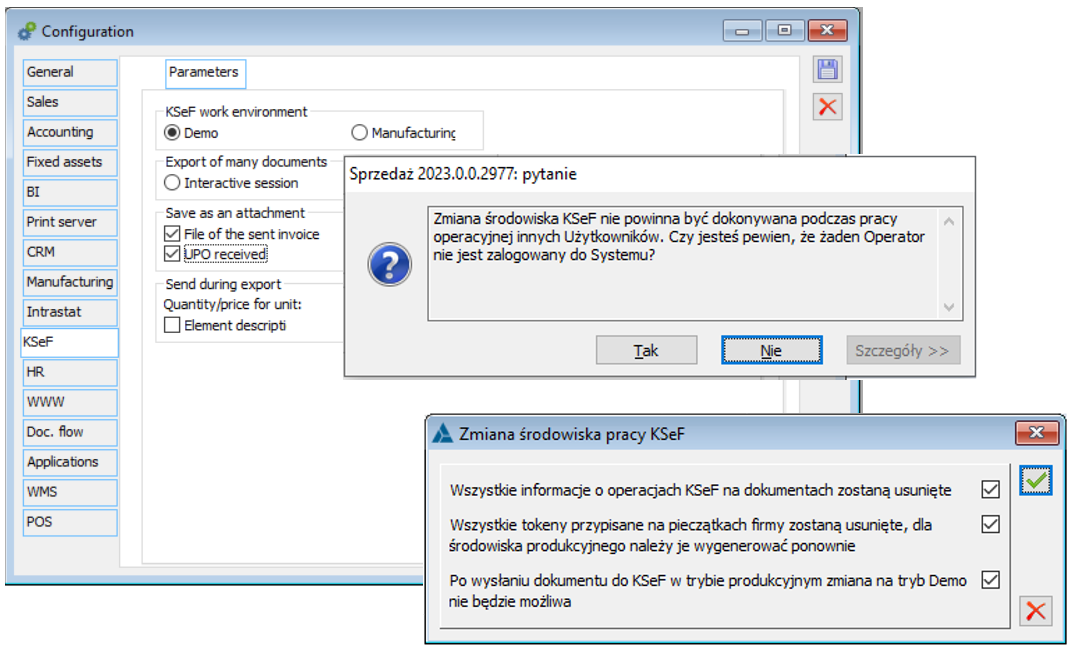

Changing from the Demo environment to the Production environment should be a conscious decision on the part of the User, as submitting an invoice to the production environment means entering the invoice into the business cycle. When changing the environment to production, the System removes all defined tokens from the stamps as well as all information relating to existing KSeF operations on documents. Once an invoice has been sent to the KSeF production environment, it is no longer possible to change the environment back to Demo. Changes to the KSeF environment must be made when no other User is working in the System. The operator who changes the KSeF environment to production must confirm to be aware of the above operation.

Option determining how to export multiple documents simultaneously

When submitting a single document to KSeF, such a submission is made in an interactive session. During serial submission of multiple selected documents, however, the setting of the option in the Export multiple documents section determines how this submission is performed. Selecting the Interactive session option means that each of the selected invoices will be submitted in a separate file, while selecting the Batch file option means that they will all be submitted in one package.

|

Note: In the case of batch submission, it must be taken into account that if one/any of the invoices is deemed incorrect by KSeF, the entire document package will be rejected. |

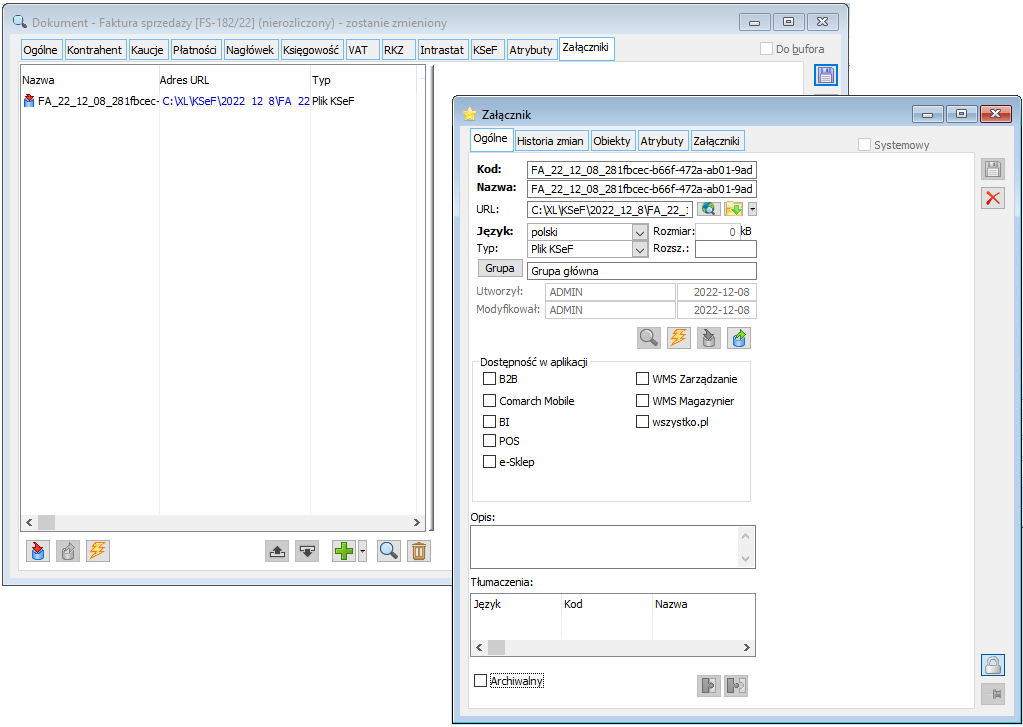

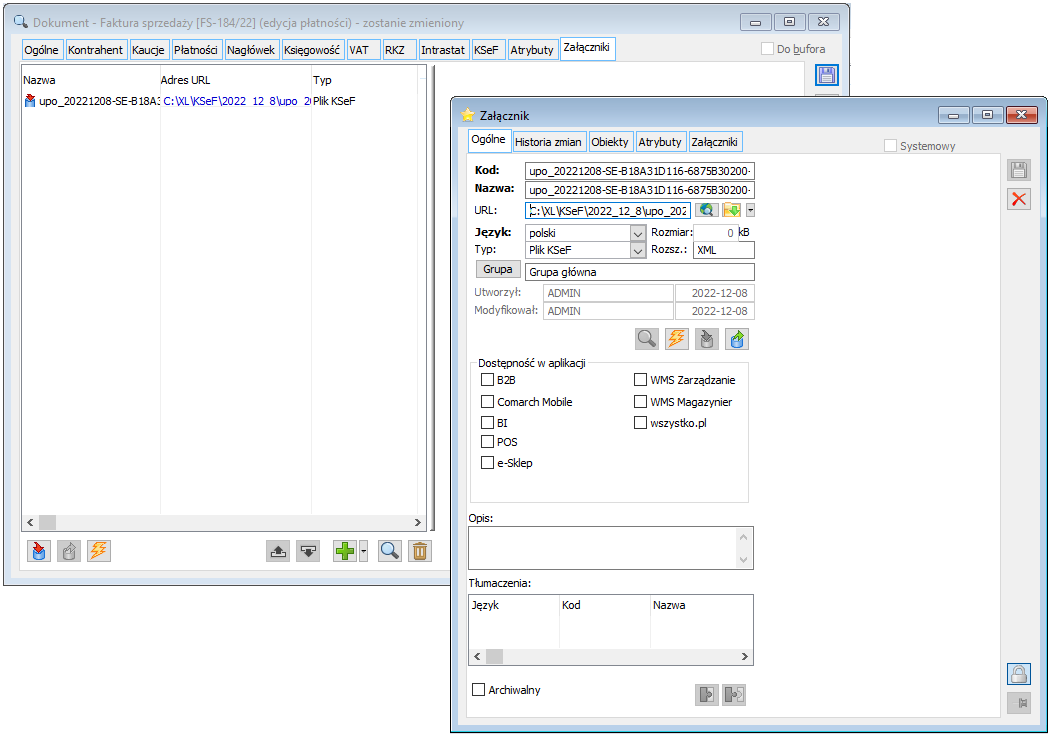

Parameters for saving the file of the invoice submitted and the downloaded UPO as an attachment to the invoice

Version 2023.0 supports the functionality of attaching the .xml file of the submitted invoice and the .xml file of the downloaded UPO as invoice attachments. These attachments are created if the relevant parameter of the Save as attachment section is activated. Attachments created in this way are labelled with a new attachment type – KSeF file.

If the User decides to create the aforementioned attachment(s), then they have the option of choosing whether to save it in the database or as a link to a file saved on a drive. In the latter case, the User can indicate the directory in which these files are to be saved. This directory can also be indicated in Computer parameters/[Data exchange].

The principle of saving files is as follows: the file created is saved in the directory indicated for the User in Computer parameters, and if it is not indicated there, then in the general directory indicated in the system Configuration. If this path is not indicated either, then these files are placed in a directory named KSeFXML of the Comarch ERP XL installation directory. In the directories indicated above, subdirectories are created for each date with which files are created and they are placed in these subdirectories.

Parameters of the Submit during export section

In the aforementioned section, the User decides whether, for each invoice element, the quantity/price is to be sent for the main unit or the auxiliary unit used on the element, and also has the option to indicate whether the System is to submit a description from the invoice element in the file.

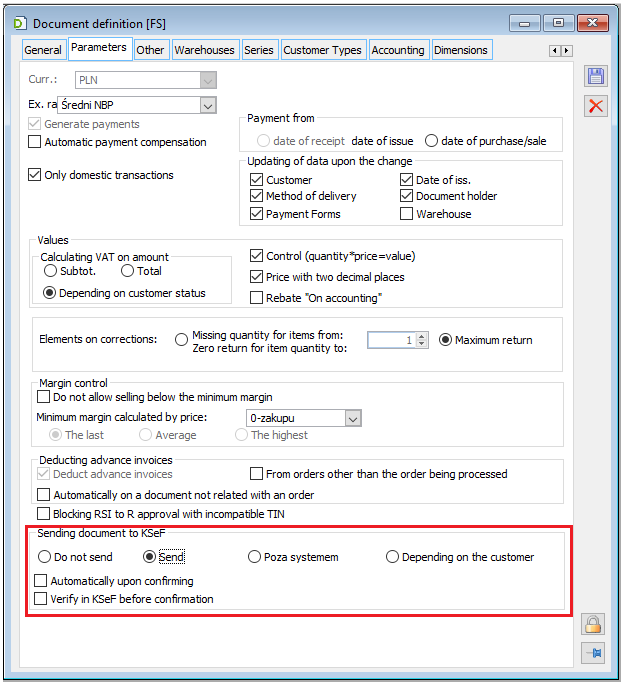

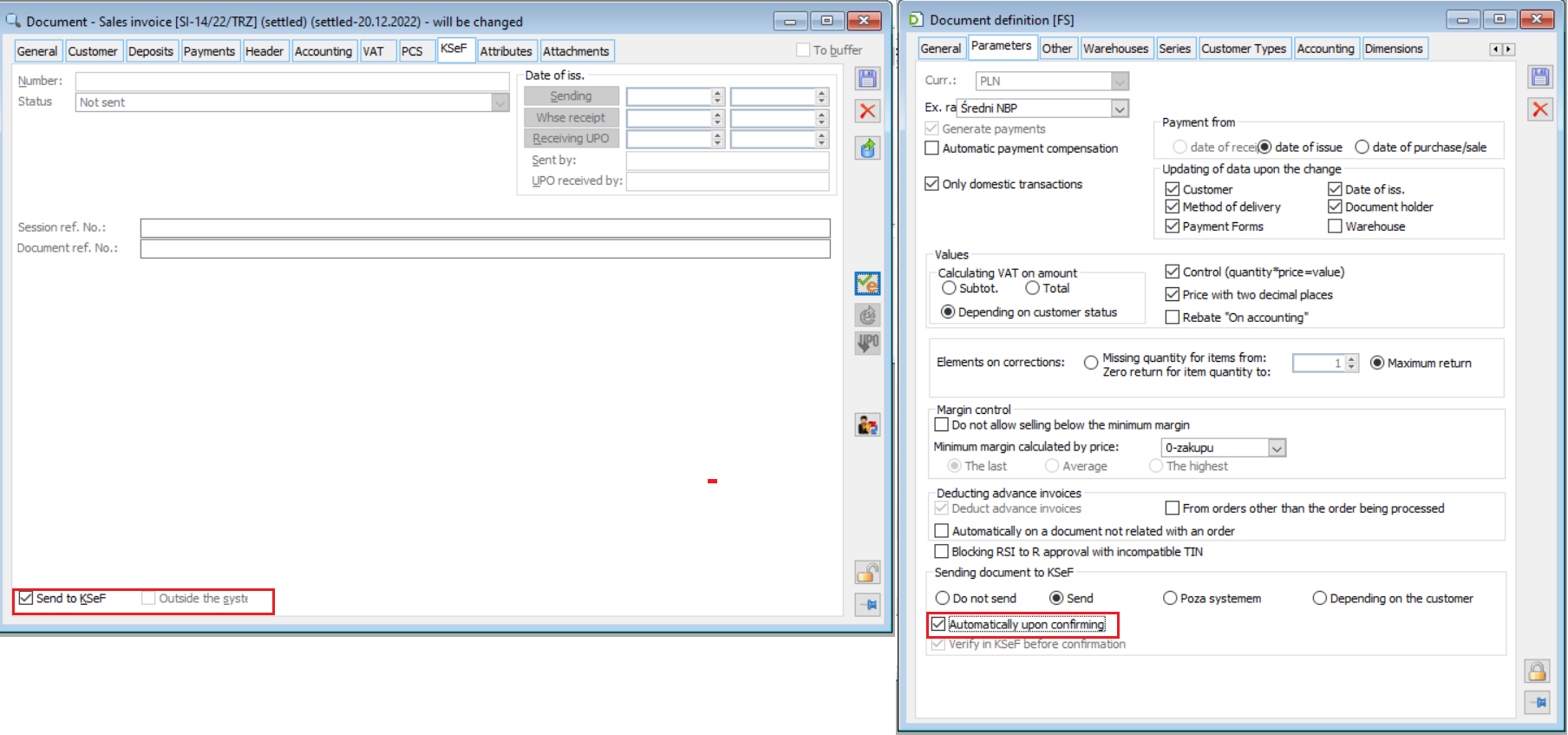

KSeF parameters on the document definition

Relevant parameters are added to the definition of FS, FSE, FSL and FEL documents for the handling of this type of document in the respective centre with regard to submission to KSeF.

The relevant option determines whether, by default, a document of this type is to be marked as subject to submission to KSeF. The User can choose from four options:

The Do not submit option means that these types of documents in a centre are not subject to submission to KSeF

The Submit option means that all documents of this type registered at the centre are to be marked as subject to submission to KSeF by default

The Outside the system option means that the documents are subject to submission to KSeF, but it will be performed outside the Comarch ERP XL System

Depending on counterparty option

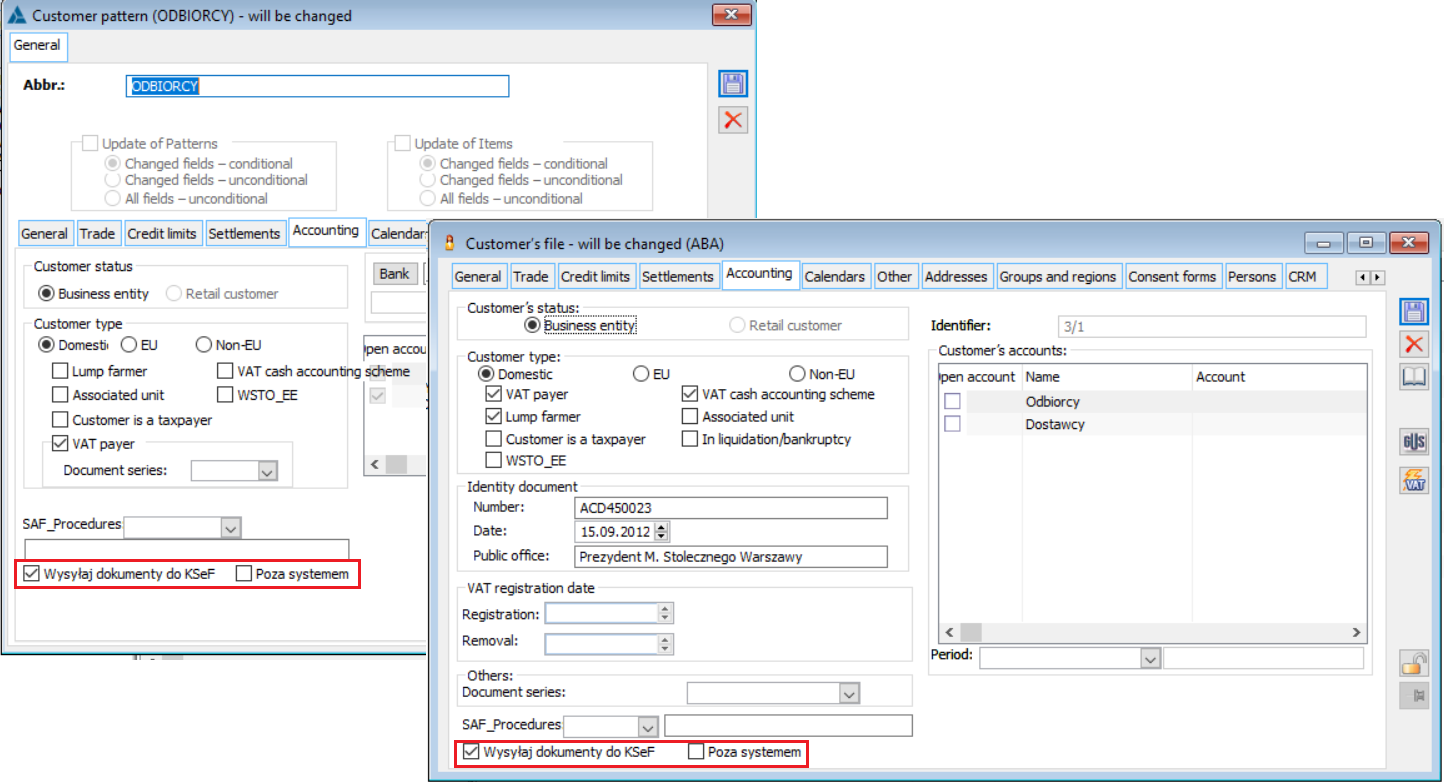

The last option, in combination with the parameters on the counterparty’s card, determines whether the invoices recorded for the counterparty are subject to submission to KSeF, and if so, whether this will be done from within or outside the Comarch ERP XL System. By default, the Submit documents to KSeF of counterparty cards parameter is enabled, while the Outside the system parameter is disabled. The User can change their setting either directly on the counterparty card(s) or using the counterparty template.

The Automatically when approving parameter of the document definition, as the name suggests, determines whether a document should be automatically submitted to KSeF when it is approved either from a form or from a list. An optional semantic validation check of the document with the KSeF schema before approval is also supported. This is performed as long as the Verify in KSeF before approval parameter is enabled on the document definition. As the System first pre-verifies the correctness of the document before submitting it to KSeF, the KSeF verification parameter is automatically switched on when the submission parameter is selected during approval.

KSeF permissions on the operator card

Not every Operator can submit documents to KSeF/download UPO from KSeF. This possibility is determined by the Submitting invoices/Downloading UPO permission on their card. The Editing KSeF number parameter, on the other hand, determines whether the Operator can enter the KSeF number of the document and other information on the document’s submission to KSeF. Such editing is only possible on those documents that are marked as having been submitted to KSeF outside the system (e.g. they were sent by another system/application), as discussed later in this document. The Authentication with a token parameter determines whether the Operator is to be authenticated with a token, as described above.

KSeF parameters on sales invoice and correction forms

The [KSeF] tab is now available on the sales invoice and sales invoice correction forms, where the following information on document submission to KSeF is presented.

-

-

- Submit to KSeF parameter to determine whether the document is subject to submission to KSeF

- Outside the system parameter to indicate that the document has been/will be submitted to KSeF, but this will be done outside Comarch ERP XL

-

The aforementioned parameters are set by default based on the option selected in the Submitting a document to KSeF section of the document definition. If the option Do not submit is selected on the definition, then the aforementioned parameters are disabled by default, if the option Submit is selected, then the parameter Submit to KSeF is enabled and Outside the system is disabled, if the option Outside the system is selected on the definition, then both parameters on the document are enabled. If, on the other hand, the Depending on counterparty option is selected on the definition, then the parameters are determined by the KSeF parameter setting on the counterparty card for which the invoice is being recorded.

The aforementioned principle of setting parameters on the basis of the document definition also applies to the creation of a new document by copying <CTRL>+<Insert>, while on corrections the aforementioned parameters are set on the basis of the document being corrected.

Editing of the Submit to KSeF parameter is possible under the following conditions:

-

-

- The Operator is authorised to edit the document of this centre

- Document status is other than cancelled

- The Outside the system parameter is deactivated

- The document has not yet been submitted to KSeF

-

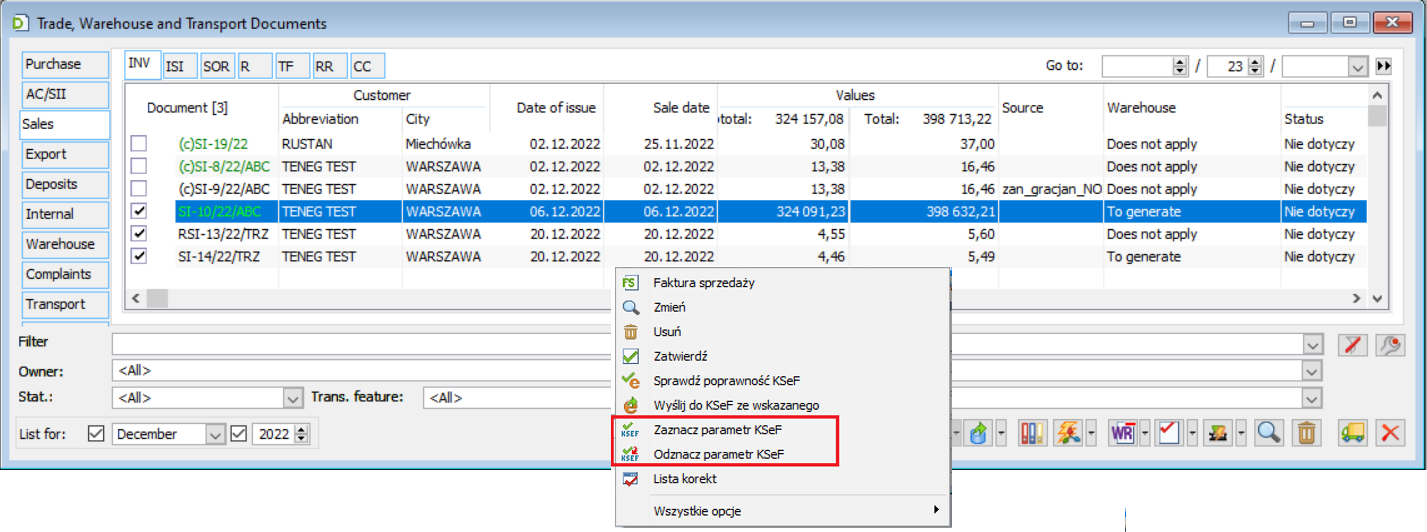

The User can also change the setting of the aforementioned parameter in a serial manner using the relevant context menu options of the FS/FSE list.

Editing of the Outside the system parameter is possible on a document that has not yet been submitted to KSeF, whereby:

-

-

- the parameter can be enabled as long as the Submit to KSeF parameter is enabled

- on an approved document it may only be edited by an Operator with the Editing KSeF number on documents permission

-

Selecting the Submit to KSeF/Outside the system parameter on the document means that the document has been/will be sent to KSeF outside the Comarch ERP XL System. On a document marked in this way, the Operator with the Editing KSeF number on documents permission can enter the following KSeF data themselves: the document KSeF number, the KSeF status, the session number, the document reference number and the dates of submitting/accepting/receiving the UPO.

-

-

- Document KSeF number

-

The aforementioned number is an invoice identification number, assigned by KSeF and recorded on the document after downloading the UPO.

-

-

- Document KSeF status

-

The KSeF status is changed automatically during the invoice submission and UPO download operations and can take one of the following values:

-

-

- Not submitted

- Submitted/UPO not received

- Submitted/UPO received

- Rejected

- Date and time of document submission to KSeF and identifier of the Operator who performed the submission

- Date and time of receipt of the document in KSeF, determined after the UPO has been downloaded

- Date and time the UPO was downloaded and the identifier of the Operator who downloaded it

- Session reference number of the invoice submission

- Document reference number, recorded only if the document was submitted in interactive mode

-

The aforementioned tab is available on the forms of the following document types:

-

-

- FS, (s)FS, (S)FS, (A)FS, FSL

- FSE, (s)FSE, (S)FSE, FEL

- RA, RAKFSK, (s)FSK, (S)FSK, (Z)FSK, (A)FSK, KSL

- FKE, (s)FKE, (S)FKE, (Z)FKE, KEL

-

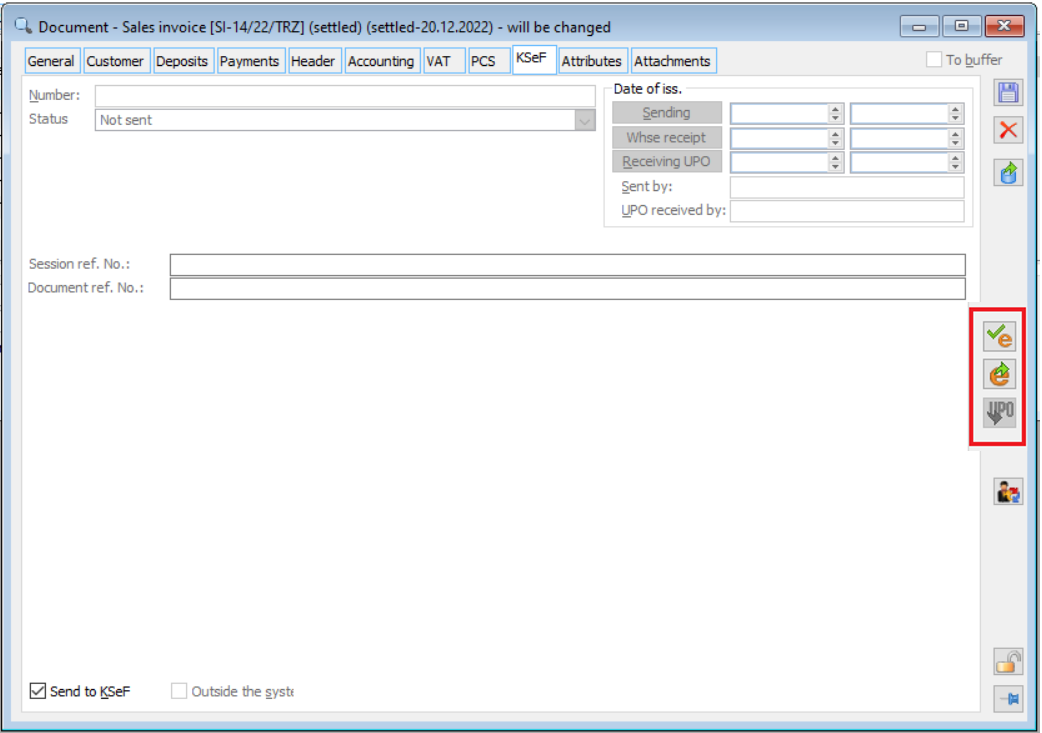

The User can perform the following operations directly from the form of the aforementioned documents. The relevant options available on the right-hand side bar of the [KSeF] tab of the document serve this purpose. These operations are discussed in the further part of this document.

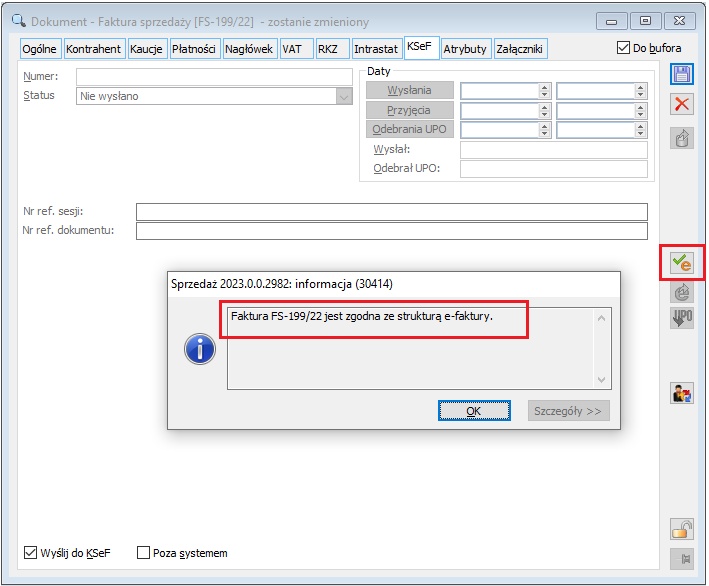

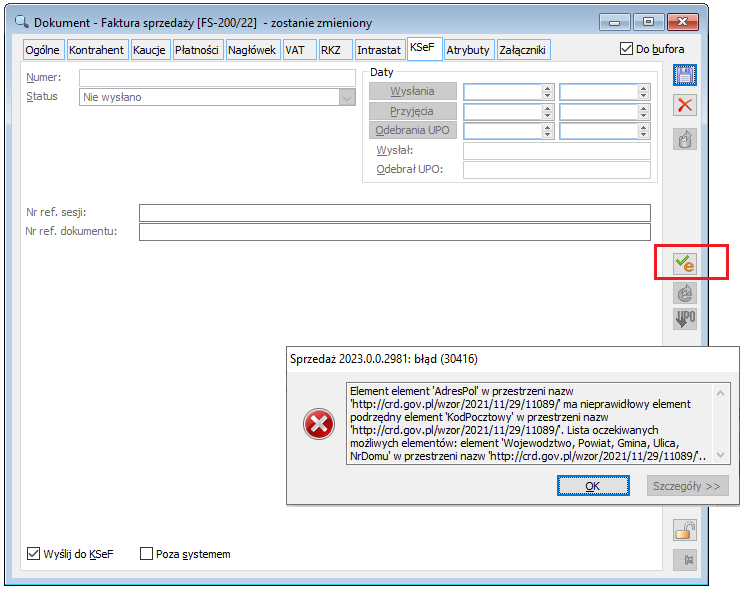

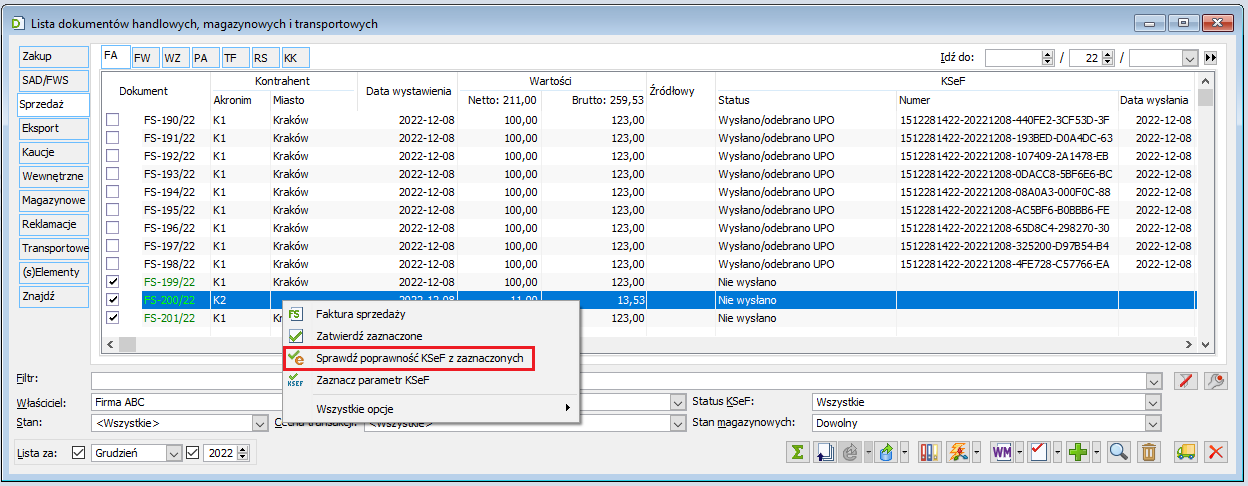

Check correctness in KSeF operation

Submit to KSeF operation

Download UPO operation

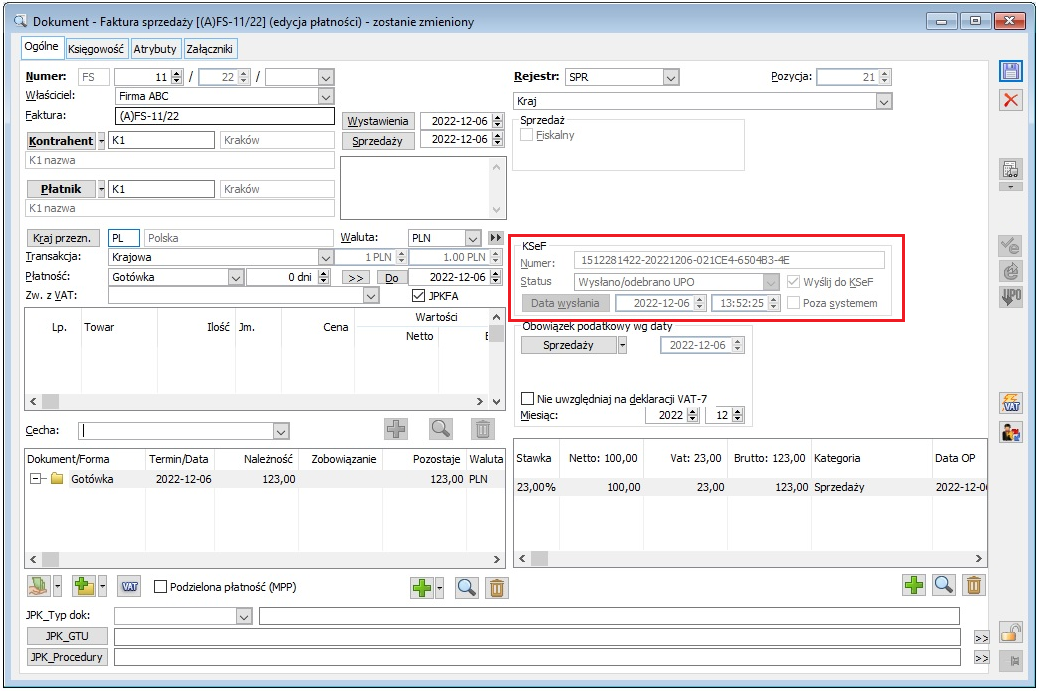

On the simplified (A)FS document form, the basic KSeF data is presented in the KSeF section of the [General] tab, and the aforementioned verification/submission to KSeF/UPO download operations are available from each tab of this form. Submission, including serial submission from the VAT Register list, is planned in one of the future versions.

Submitting invoices to KSeF

Submitting documents to KSeF includes the following document types:

-

-

- FS, (s)FS, (S)FS, (A)FS, FSL

- FSE, (s)FSE, (S)FSE, FEL

- RA, RAK

- FSK, (s)FSK, (S)FSK, (Z)FSK, (A)FSK, KSL

- FKE, (s)FKE, (S)FKE, (Z)FKE, KEL

-

Whether the submission is a test submission, aimed only at verifying the correctness of the data entered in the Comarch ERP XL System, the correctness of their interpretation, the correctness of the procedures implemented in the Company, or whether it is the actual entering of the invoice into the business cycle, is determined by the above described setting of the Work environment option on the [KSeF] tab of the System configuration.

Only an Operator with the Submitting invoices/Downloading UPO permission may submit a document to KSeF.

Submitting a document can be done by one of the methods described below.

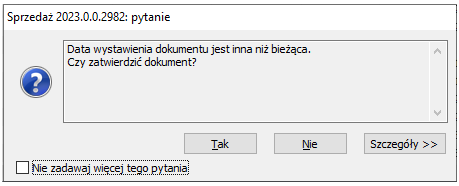

Automatic submission of invoices during approval

The automatic submission operation is performed if on the definition of this type of document the parameter Automatically during approval is enabled and the document is marked as subject to submission in the Comarch ERP XL system, i.e. the parameter Submit to KSeF is enabled and the parameter Outside the system is disabled. Such submission is carried out both when approving a document from its form and when approving it using the context menu option of the document list, including serial approval of multiple selected documents.

Before a document is approved with automatic submission, the System verifies its date; if the document’s date of issue is different from the current date, an appropriate question/warning is presented.

If the Operator does not have the right to submit invoices to KSeF, then it is not possible to approve a document marked as subject to automatic submission to KSeF, similarly, if the document to be approved does not pass the initial verification of compliance with the e-invoice schema.

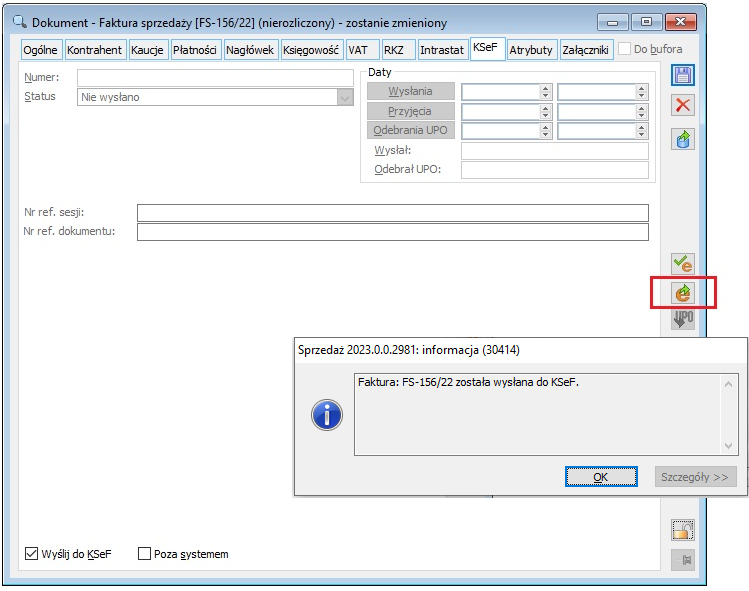

Invoice submission from its form

The Submit to KSeF operation is available on the [KSeF] tab of the sales invoices and corrections invoice forms, and on the simplified (A)FS A-vista invoice form on each of them. The button is available provided that all the following conditions are met:

-

-

- The document has been approved (not applicable to A-vista invoices)

- The document is marked as subject to submission in Comarch ERP XL System

- The document has not yet been submitted to KSeF or has been rejected in KSeF

- The Operator has the permission to submit documents to KSeF

-

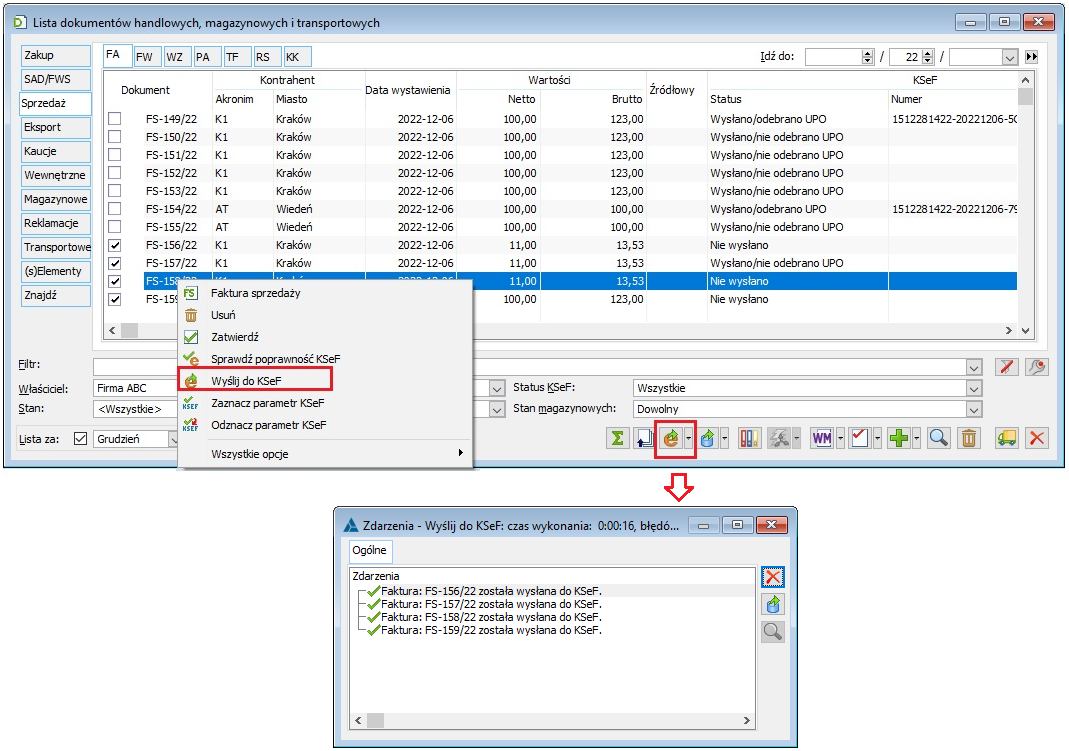

Serial submission of invoices from the FS/FSE list

The User can submit the invoice using the relevant button under the document list and using the Submit to KSeF option of the context menu of the FS/FSE list, including serially for multiple selected documents.

The aforementioned button under the list of FS/FSE documents is active as long as the cursor is pointing to an approved document and the Operator has the permission to submit documents to KSeF, the other conditions necessary for submitting a document are already checked when the operation is launched. However, the rules for the availability of options in the context menu are identical to those described for the document form button.

Conditions for the effective submission of a document to KSeF

The system performs the submission of the document in question, provided that all the following conditions are met. The fulfilment of some of these determines the availability of the submission option, while some are checked after it has been invoked. Below is a full list of the conditions:

-

-

- The operator has the Submitting invoices/Downloading UPO permission

- Document status: submission applies to documents that have already been approved and have not been cancelled (not applicable to A-vista (A)FS/FSK invoices)

- Document KSeF status: submission applies to documents that have not yet been submitted to KSeF or have been rejected in KSeF

- A document is marked as subject to submission in the Comarch ERP XL System, i.e. the Submit to KSeF parameter is enabled and the Outside the system parameter is disabled

- For manual FSK/FKE corrections – the User has entered the KSeF number of the original – more on this later

- In the case of A-vista (A)FS/FSK invoices, an element or record of the VAT table has been entered on the document

- The document complies with the prerequisites for compliance with the FA(1) scheme

-

The document is only submitted to KSeF if all the above conditions are met. If the initial verification of compliance with the schema is negative, the User is informed and should correct the relevant data either on the document or on related objects such as the Company stamp, counterparty card, address card, commodity card, etc.

A positively verified document is submitted to KSeF. When such a submission is made, the document KSeF status is changed to Submitted/UPO not received and, in addition, the reference number of the session in which it was submitted, the document reference number (for interactive submissions only) and information about the date of submission and the Operator who performed the submission are recorded on the document.

|

Note: For Multi-branch companies using multiple stamps and VAT IDs, it is important that the User submitting the document is logged in at the centre that registered the document. |

Optionally, an .xml file created from the invoice to be sent can be included as an attachment. More details are provided in the System configuration chapter. This functionality is only available for submissions made in interactive mode.

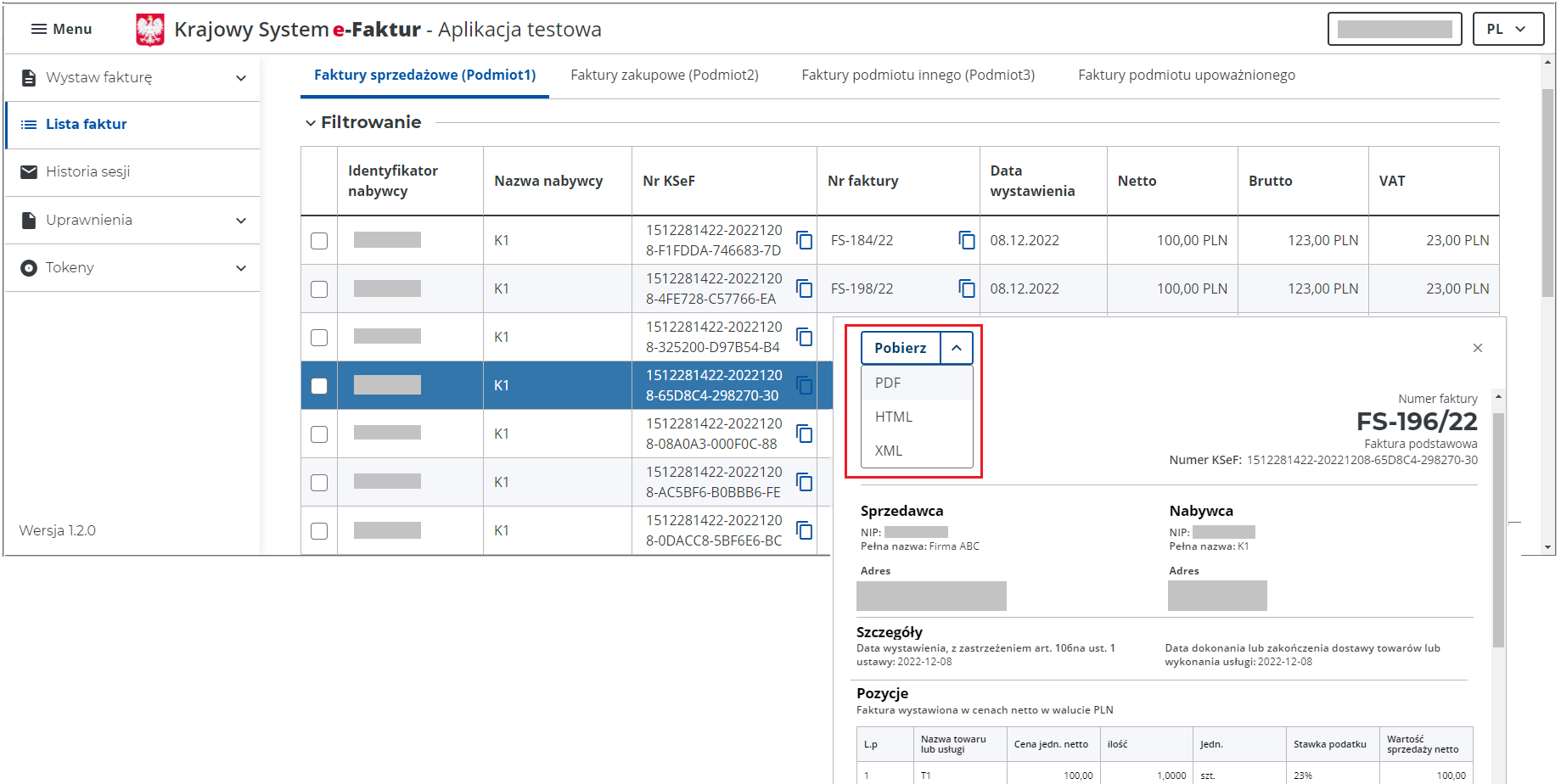

Invoices submitted to KSeF are available in the taxpayer application provided by the Ministry of Finance at https://ksef-demo.mf.gov.pl/ and https://ksef.mf.gov.pl/.

Each submitted invoice can be viewed and downloaded there.

Data mapping to logical structure of e-invoices according to FA(1) schema

|

Note: On December 1, 2022, a draft law amending the Value Added Tax Act and certain other acts, concerning the operation of e-invoicing during the period of mandatory use of KseF and a proposal for the next version of the FA(2) e-invoicing schema, was published on the website of the Government Legislation Centre.

The integration with KSeF, introduced in version 2023.0 of the System and described in this document, is based on existing regulations and the FA(1) schema. |

All data submitted by the System to KSeF is established by means of relevant functions/procedures, which can be modified accordingly by the Partners/IT teams to suit the needs of the specific Customer.

Detailed information on how to map data entered in the Comarch ERP XL System to the logical structure of e-invoices will be described in a separate document. This chapter describes only those that require special attention by Users.

Invoice number

A foreign number of document is submitted as the invoice number. The same principle as for JPK_FA, CUK and other declarations has been adopted here. The System behaviour will be parameterised in this respect in one of the future versions and either an own (system) number or a foreign document number will be submitted.

Seller details

The aforementioned data is determined from the stamp assigned to the document, and if the document does not have a stamp assigned, then from the stamp assigned to the main centre of the Company’s structure. The name and address are taken from the [Declarations] and [Declarations cont.] tabs, i.e. according to the rules applicable to JPK_FA and other declarations. On invoice printouts, the Seller details are taken from the [General] tab of the stamp, so Users should ensure that these details are consistent on individual tabs of the stamp. In the case of a Seller who is a natural person, the value from the Name field followed by the first comma is taken as the surname, and the value between the first and second comma of the Name field is taken as the first name.

First and last name of the Purchaser who is a natural person

In the case of a purchaser who is a natural person, the Purchaser’s first and last name is submitted, each in a separate field. As this data is stored in the System in one control/one field, the following rules have been adopted for determining this data: the value from the Name control of the counterparty address form up to the first space is treated as First name, while the value after the first space as Surname. Such mapping is imperfect in the case of unusual data, e.g. the Purchaser’s use of two first names. Therefore, the determination of these data was additionally served on the basis of the attributes named KSEF_Purchaser_FirstName (KSEF_Nabywca_ImiePierwsze), KSEF_Purchaser_Surname (KSEF_Nabywca_Nazwisko) assigned to the document to be submitted. The system first retrieves data from the aforementioned attributes and, if they are not defined, then from the Name field, mapping them according to the aforementioned rules.

The new version of the FA(2) e-invoice schema, published on December 1, 2022, and currently under consultation, provides for the transmission of purchaser data (full name or company name of purchaser) in a single field, so that after its introduction, the aforementioned conventional mapping of purchaser data will no longer be necessary, the data will be taken directly from the Name control.

Purchaser’s address

The e-invoice scheme envisages submitting data on the street, house number and apartment number in separate lines, while in Comarch ERP XL these data are saved in one field of the counterparty’s address form. An appropriate function is used to map address data, extracting the street, house number and apartment number from the entire contents of the address field. This function is not perfect, e.g. in cases where the street name contains digits, and in the case of localities where streets are not distinguished. To enable Users to handle such specific cases, additional identification of the above address components based on the relevant attributes assigned to the document header is supported: KSEF_Purchaser_Street (KSEF_Nabywca_Ulica) (including with the value None, which means that the street name is to be left blank), KSEF_Purchaser_HomeNumber (KSEF_Nabywca_NrDomu), KSEF_Purchaser_ApartmentNumber (KSEF_Nabywca_NrLokalu). The System first retrieves data from the aforementioned attributes and, if they are not defined, then from the Street field, mapping them according to the aforementioned rules

The aforementioned additional mapping of data from the System to the e-invoice schema will no longer be necessary if the planned FA(2) schema comes into force, according to which all Purchaser address data will be sent in one field.

Elements-commodities on the invoice

Whether the System will submit to KSeF the quantity and price for the primary or secondary unit of a transaction element is determined by the applicable option in the System configuration, discussed earlier in this document.

|

Note: The FA(1) e-invoice schema does not provide for the possibility of submitting the price with 4 decimal places, so it is rounded to 2 decimal places during submission. In the planned FA(2) schema, this inconvenience will no longer exist. |

The section containing information on the form and date of payment and the Seller’s bank account will be handled in one of the future versions

Additional information can be included in the Description of either the invoice header or its elements and/or in the footer assigned to the document definition. The description from the header is always submitted, whereas the description of the document element is submitted if the Element description parameter is enabled in Configuration/KSEF/Submit during export

Clips containing corrections for commodity returns vs. KSeF

Users using KSeF should avoid clipping to the (S)FS/FSE/RA documents of the WZK/WKE/PAK other than a quantitative plus correction, as the System does not perform any grouping of elements, but submits each of them separately, which in the case of the aforementioned clipped corrections means sending a zero or negative element quantity. For such WZK/WKE/PAK, it is recommended to register (S)FSK/FKE/RAK or, for such cases, to register the (s)FS, (s)FSE elements clip instead of the header clip.

Correction of a counterparty/counterparty’s VAT ID (NIP)

According to the explanatory notes to the schema, an invoice to the wrong counterparty (or a mistake in its VAT ID (NIP)) should not be recorded and sent as a data correction, an overall correction and a new invoice should be issued.

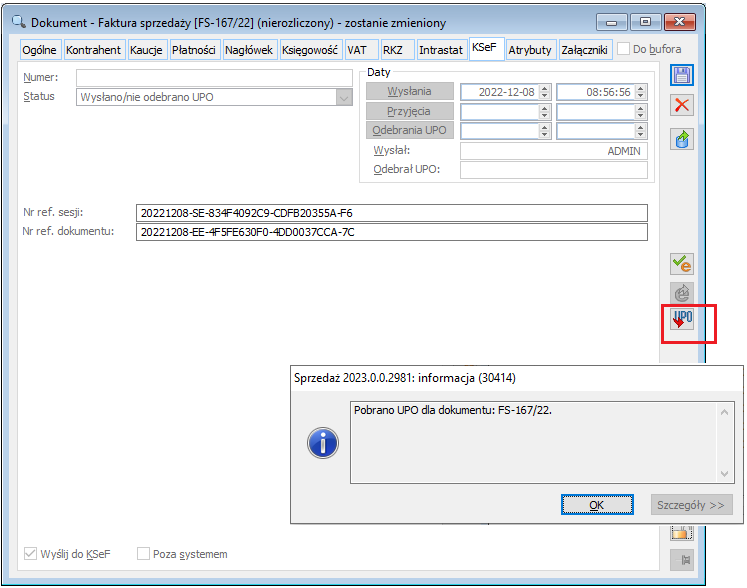

Downloading an official acknowledgement of receipt – UPO

The User obtains certainty and confirmation that the invoice has actually been received in the KSeF System upon receipt of the UPO. The KSeF number of the document is then recorded on the invoice and the status of the document is changed to Submitted/UPO received.

UPO can only be downloaded by the Operator with the Submitting invoices/Downloading UPO permission, and this can be performed by one of the methods described below.

Downloading UPO from the document form

The Download UPO operation is available on the [KSeF] tab of the sales invoice and sales invoice correction forms, and on the simplified (A)FS A-vista invoice form on each of them. The button is available provided that the following conditions are met:

-

-

- The document has been submitted to KSeF and no UPO has been downloaded for it yet

- The Operator is authorised to download UPO

-

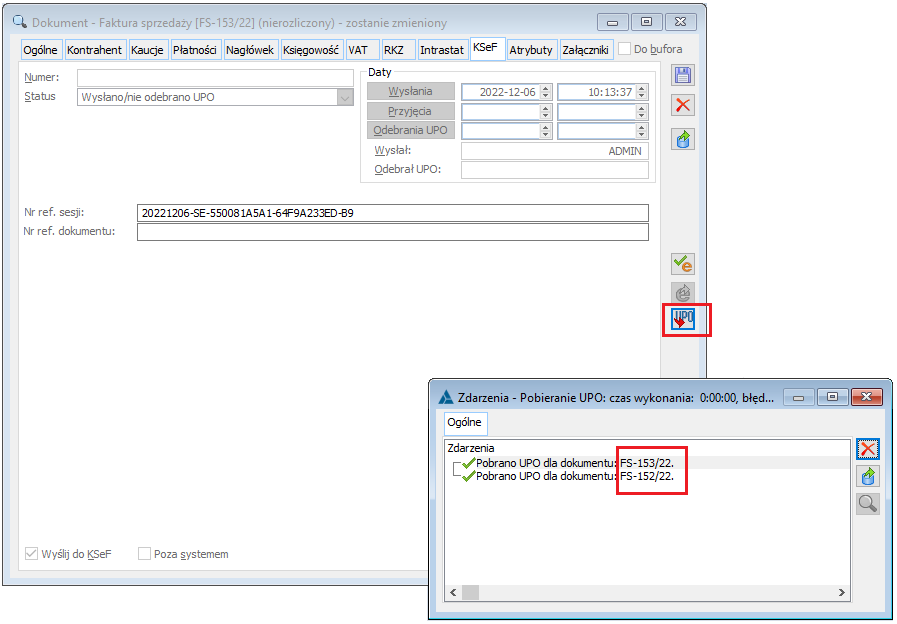

The UPO is downloaded in the KSeF session context within which the document was submitted. It is downloaded sequentially for all documents submitted within this session. Thus, even if the UPO download operation is invoked from the document form, the System will download the UPO not only for this document, but also for other documents submitted in this session, as illustrated by the second figure below.

Once the UPO has been downloaded, the System records the following data on the invoice(s) to which the UPO relates:

Document KSeF number

Date of receipt by KSeF

Date on which the UPO was downloaded and the identifier of the Operator who performed the download

The document KSeF status is set to Submitted/UPO received

Optionally, the .xml file of the downloaded UPO can be included as an invoice attachment. More details are provided in the System configuration chapter.

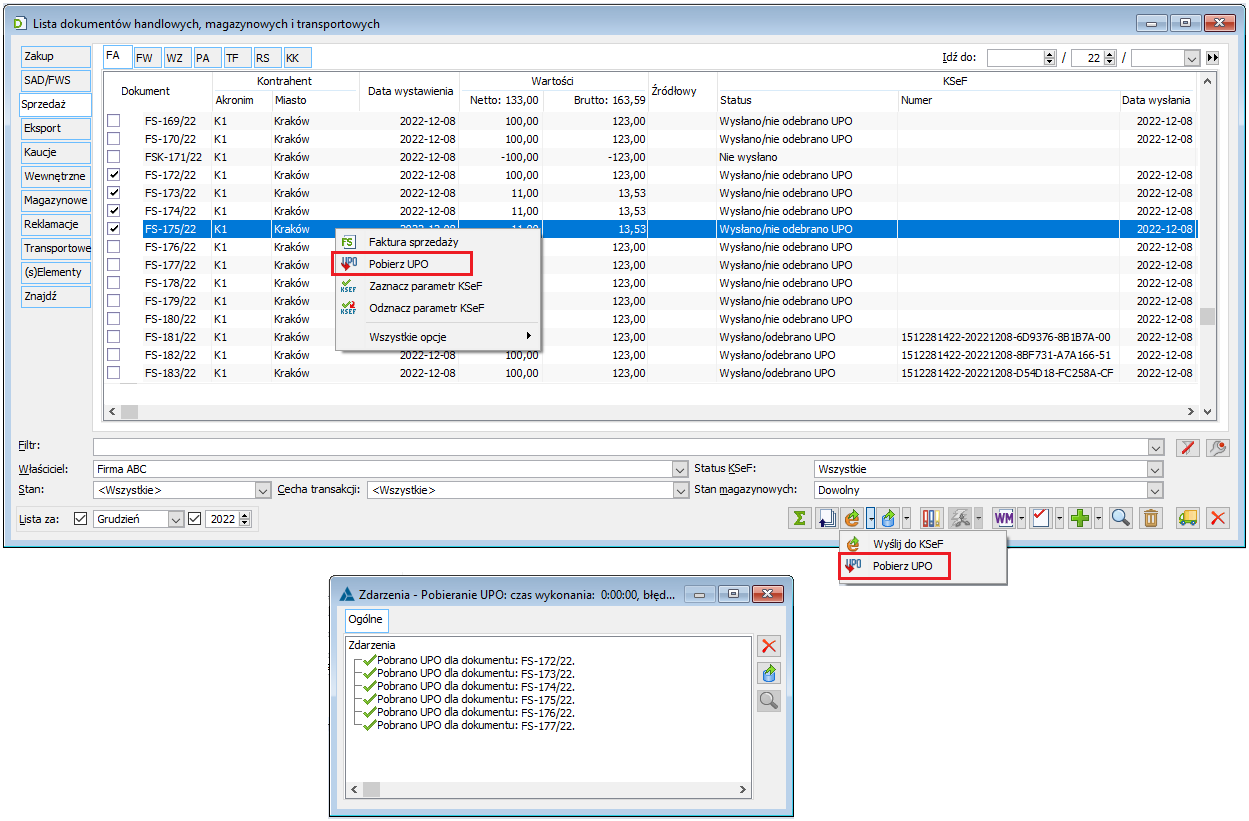

Downloading UPO from FS/FSE list

The User can download UPO using the relevant button under the document list and using the Download UPO option of the context menu of the FS/FSE list, including serially for multiple selected documents.

The aforementioned option in the context menu remains active if the cursor points to a document with a status of Submitted/UPO received and the Operator is authorised to download UPO. The activity of the option next to the button, on the other hand, is conditioned by the abovementioned Operator’s permission and the status of the document (document approved), the document KSeF status is verified after the operation has been triggered.

As already mentioned above, the UPO is downloaded in the context of a specific KSeF session, i.e. for all documents submitted within that session. The operation of downloading UPO from the list of documents, including for multiple marked documents, therefore consists of downloading the UPO for the documents submitted within those sessions to which the marked documents point. Thus, it may happen, for example, that the User selects several documents, but the UPO is downloaded for more than a dozen. The User is informed of each document for which UPO has been downloaded.

Downloading UPO for current KSeF session

UPO can also be downloaded for the User’s current KSeF session, i.e. all documents that have been submitted within this session. This is done using the Download UPO button of the form available in the System/KSeF session menu.

Invoice validation according to KSeF schema

The Check correctness in KSeF operation consists of checking the semantic correctness of the document, i.e. compliance with the e-invoice schema.

With this functionality, the User is able to verify the document before it is approved.

The aforementioned functionality is available on sales invoice forms and sales correction forms, as well as in the context menu of the FS/FSE list.

Automatic document validation according to the KSeF schema during document approval is also supported. This is done if the document is marked as subject to submission and the Verify in KSeF before approval parameter has been activated on the document definition.

If the document validation is successful, then document approval continues; in the event of a negative validation, document approval is not possible.

As part of the aforementioned document validation, the System checks the date of the document; if the document’s date of issue is different from the current date, an appropriate question/warning is presented.

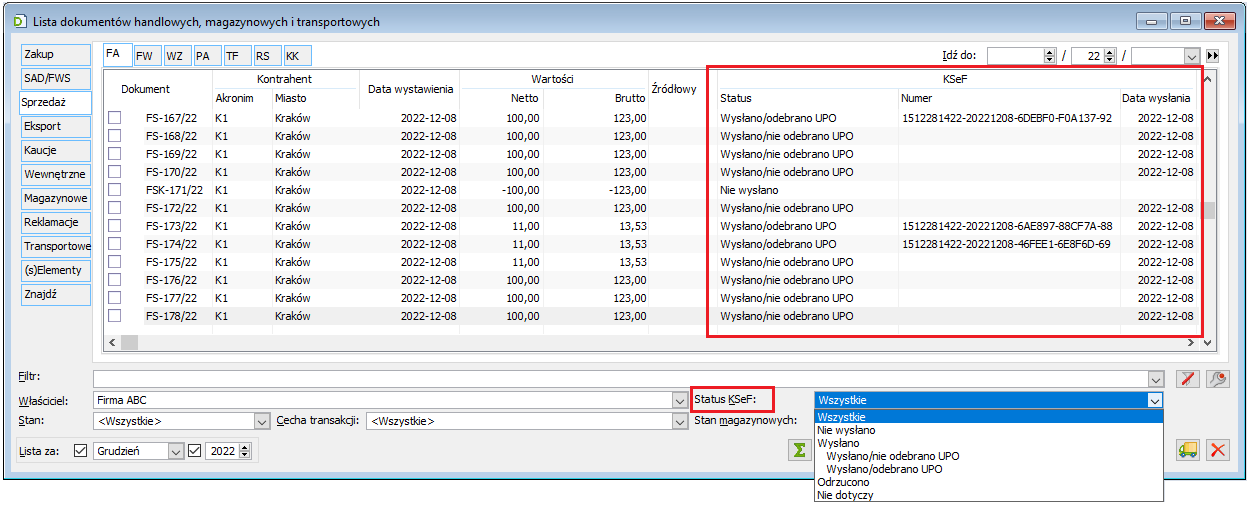

KSeF information in the invoice list

In the list of commercial documents, new columns with information on KSeF integration have been made available on the [FA] and [FSE] tabs: Status, Number, Date of submission.

Documents can take one of the following KSeF statuses:

Not applicable. Invoices that are marked as not subject to submission to KSeF receive this status.

Not submitted. This is the status of documents marked for submission that have not yet been submitted.

Submitted/UPO not received is the status of a document submitted to KSeF for which UPO has not yet been downloaded.

Submitted/UPO received is the status of a document submitted to KSeF for which UPO has been downloaded.

Rejected. This status is given to documents that have been sent to KSeF but have been rejected by KSeF.

A filter has been made available to restrict the list of documents by KSeF Status. The filter provides the aforementioned values and, in addition, the value Submitted, which includes all documents that have been submitted regardless of whether UPO has already been downloaded for them or is yet to be downloaded.

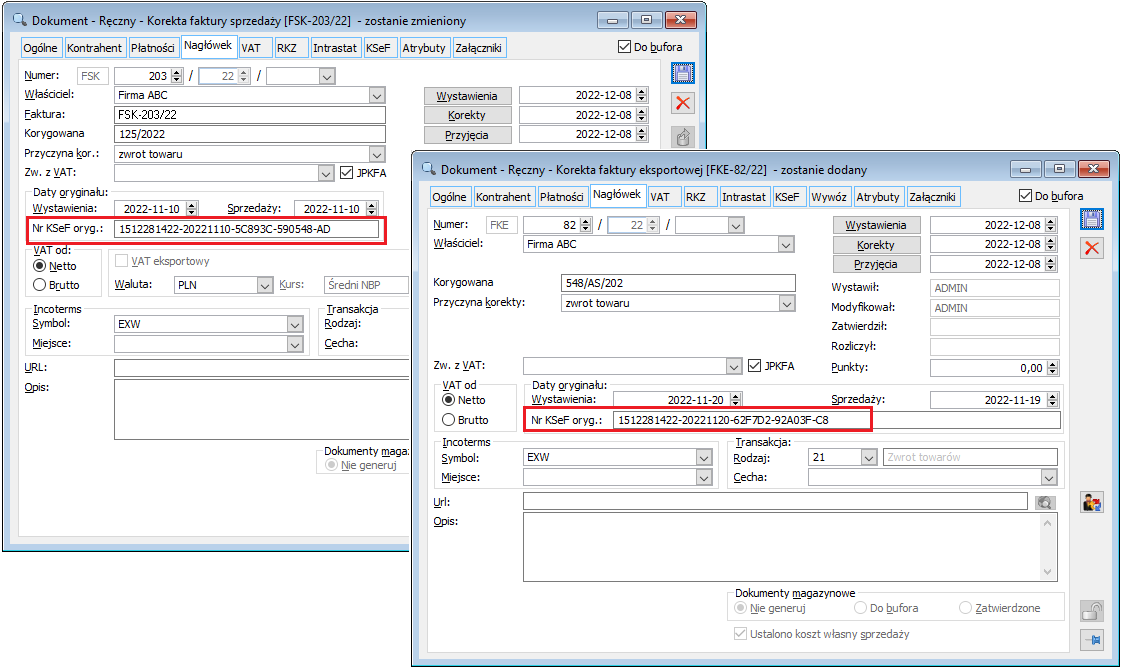

KSeF number of the original on manual correction

On the form of manual correction of FSK/(A)FSK/FKE, a control has been made available which allows the User to enter the KSeF number of the original, registered outside the Comarch ERP XL System. On a non-approved document, this number can be entered by any Operator with the permission to edit that document, whereas once a document has been approved, an Operator with the Editing KSeF number on documents permission can do so. The editing of the control is blocked once the document has been submitted to KSeF.

Document KSeF number on printouts of sales invoices and their corrections

An invoice submitted to KSeF can only be considered to have been successfully issued once the UPO for it has been received and the number assigned to that invoice has been received in KSeF. From the publications to date, including answers to the most common questions available on the Ministry of Finance’s website https://www.podatki.gov.pl/ksef/pytania-i-odpowiedzi-ksef/, it appears that submitting an invoice via the KSeF System does not mean that it cannot also be submitted to the Purchaser in the traditional way, either on paper or electronically, through the channels that entities have used so far. However, the sequence of operations is crucial, i.e. the traditional transmission of the invoice to the Customer should take place after the KSeF number has been assigned to the invoice, as only then can the invoice be regarded as having been issued and only then does it enter into economic circulation. Perhaps the above-mentioned rules will be changed once the KSeF System becomes mandatory.

The Comarch ERP XL System does not provide for any form of blocking of invoice printing or warning against such printing, it is up to the Users to adopt appropriate procedures for sending/printing invoices.

To make it easier to implement/comply with the above procedures, optional printing of the document KSeF number has been supported on sales invoice printouts and their corrections. Whether such a number is to be printed is determined by the setting of the Print document KSeF number parameter in the print parameters window. This parameter is available if the Company submits to the KSeF production server.

The printing of the KSeF number is supported on the basic printouts available for the following document types:

-

-

- FS, (s)FS, (S)FS, (A)FS, RA

- FSE, (s)FSE, (S)FSE

- FSL advance invoices, FEL

- Final invoices: FS, (s)FS, (S)FS, FSE, (s)FSE, (S)FSE

- Corrections to the above documents, with the exception of manual corrections, collective corrections, and data corrections

-

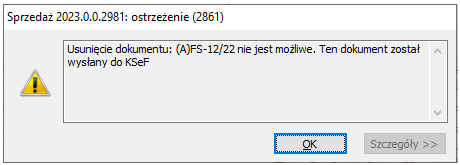

Restriction on editing a document submitted to KSeF

-

-

- Documents submitted to the KSeF production environment cannot be cancelled and A-vista documents cannot be deleted. The system blocks such an operation with a corresponding message:

-

-

-

- Previously, an authorised User could change the below mentioned data on approved sales documents. This data is part of the information submitted to KSeF and, therefore, if a document has been submitted to the KSeF production environment, it can no longer be edited. This data is:

- Sale date

- Document foreign number

- Address of the main counterparty/target counterparty/payer

Documents recorded in the Retail (Detal) application vs. KSeF

The KSeF integration functionalities described above are not available in the Retail application. Regardless of the document definition, there is also no validation of the KSeF or automatic submission of the document. Documents recorded in Retail should be submitted to KSeF from the Sales module.

Emergency mode for recording invoices

The draft act amending the Goods and Services Tax Act and certain other acts, published on December 1, 2022, concerning the operation of e-invoicing during the period of mandatory use of KSeF provides for the following rules for dealing with KSeF system failures and other special situations:

-

-

- Inaccessibility of the KSeF related to the maintenance of this system

-

Taxpayers are to be informed in advance of planned maintenance work and the associated unavailability of KSeF. The system unavailability is expected to be short-term. No invoices or correction invoices will be issued during this period.

-

-

- KSeF failure

-

Information about the KSeF failure will also be published with messages on the MF BIP. During the failure period, the taxpayer will use the same invoice template that will be widely used after the implementation of mandatory e-invoicing. The invoice template filled in by the taxpayer, together with the invoice date entered in field P_1, will constitute a fully-fledged invoice, which the taxpayer is then obliged to pass on to the purchaser in the manner agreed therewith. Following the KSeF failure, invoices issued during this period will be required to be submitted by the issuer to KSeF within 7 days of the end of the KSeF failure.

-

-

- Events not related to system failure – emergencies

-

In the aforementioned situations, correction invoices/invoices can be issued and delivered to purchasers according to the existing rules, i.e. in paper or electronic form.

Further plans for integration with KSeF

Further development of the KSeF integration functionality is planned for future versions of the System, including:

-

-

- Development of the submission mechanism:

- Submission of documents from the VAT Register

- Provision of an external API for submission

- Successive handling of optional information in KSeF submission

- Import of purchase invoices from KSeF

-

Other changes

New columns in the lists of commercial and import documents

The list of commercial and import documents has been enriched with new columns. They are hidden by default, so if the User wishes to use them they should enable them on the list form they are using.

|

Note: Due to the changes made in version 2023.0 to the lists of commercial and import documents, Users who use their own columns should change their position according to their own preferences after converting the database, as their own columns will be placed at the end of the list of columns by default. |

VAT ID (NIP) [Prefix] and [VAT ID] number of the main counterparty

The aforementioned columns have been made available on all those lists of TraNag and ImpNag documents where the counterparty is presented.

VAT ID (NIP) [Prefix] and [VAT ID] number of the target counterparty

The aforementioned columns have been made available in all those lists of TraNag and ImpNag documents where the target counterparty is presented, provided that the presentation of the target counterparty is enabled in the Configuration

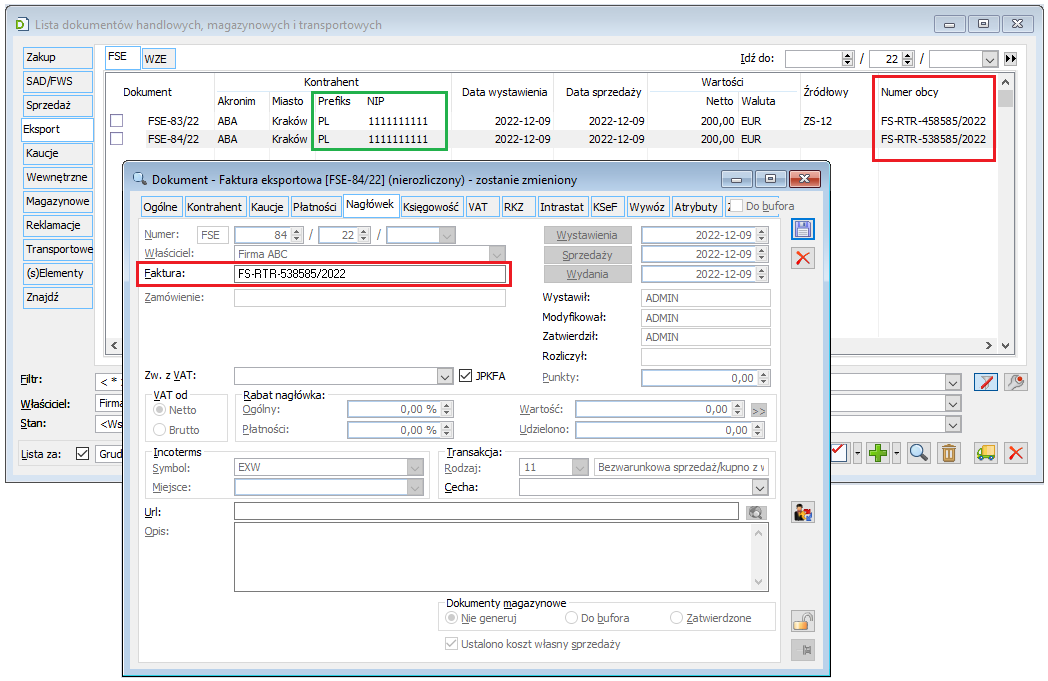

[Foreign number] of the document

The aforementioned column has been made available in the lists of sales documents: FS, FW, WZ, FSE, WZE, WKA and is filled in with the value entered in the Invoice control of the sales document form. For the aforementioned document types, this control defaults to the document’s system number, so this column will be useful for those Users who change this number, e.g. accounting offices.

The aforementioned column is not available in the lists of purchase documents, as its role is largely fulfilled by the current Source column.

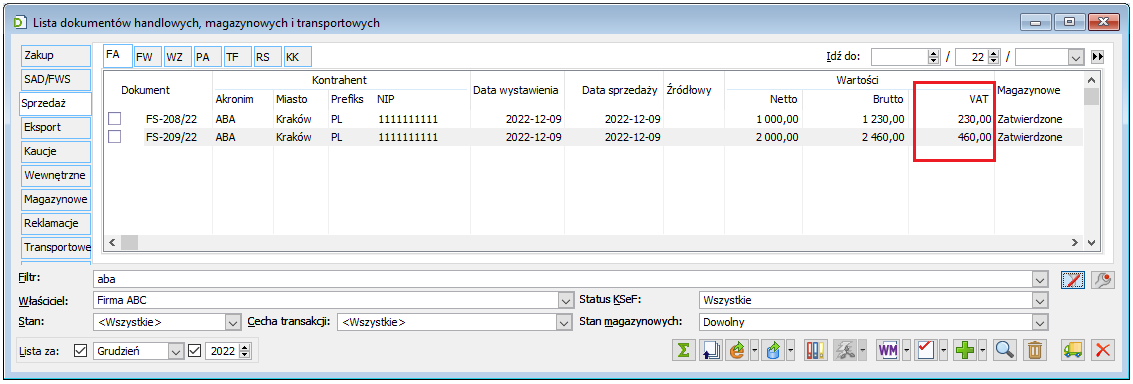

The [VAT] value of the document

The aforementioned column has been made available on lists of those commercial documents the value of which presented in the list is always expressed in the system currency, i.e. on documents other than export/import documents.

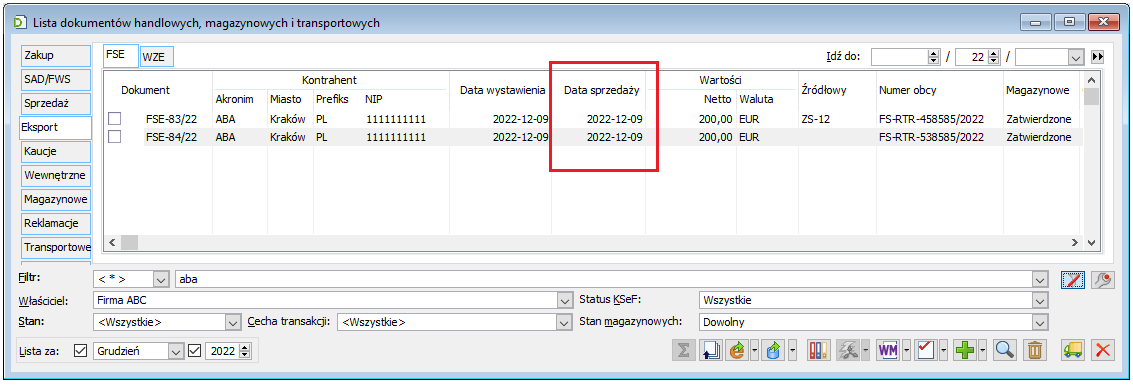

[Sale date]

Up to now, the sale date was not presented in the FSE and WZE document lists; in version 2023.0, it has also been made available for these lists. For FSE/WZE documents, it is filled in with the sale date and for corrections with the date of correction.

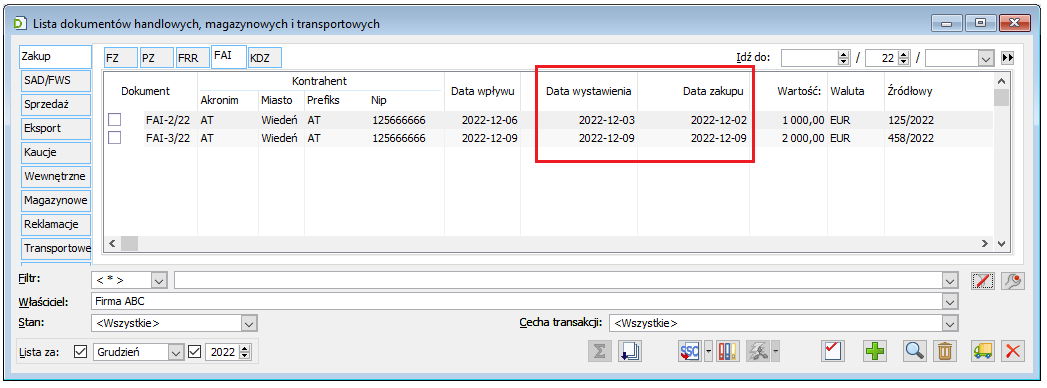

[Date of issue]

The date of issue has been made available on the lists of FZ, PZ, PKA and FAI documents, where it was not previously present.

[Date of purchase]

The date of purchase has been made available on the lists of FZ, PZ, FRR and FAI documents, where it was not previously present. For FZ, PZ, FRR, and FAI documents, it is filled in with the date of purchase and for corrections with the date of correction.

Once available, the columns described above are available in the lists shown in the table below. The columns and lists supported in version 2023.0 are highlighted in colour

| List | Main counterparty | Target counterparty | Foreign number | VAT | Sale date | Date of issue | Date of purchase | ||

| Prefix | VAT ID (NIP) | Prefix | VAT ID (NIP) | ||||||

| FZ | + | + | + | + | – | + | – | + | + |

| PZ | + | + | + | + | – | + | – | + | + |

| FRR | + | + | + | + | – | + | – | + | + |

| FAI | + | + | + | + | – | – | – | + | + |

| FS | + | + | + | + | + | + | + | + | – |

| FW | + | + | + | + | + | + | + | + | – |

| WZ | + | + | + | + | + | + | + | + | – |

| PA | + | + | + | + | – | + | + | + | – |

| TF | + | + | + | + | – | – | – | + | – |

| KK | + | + | + | + | – | + | + | – | |

| FSE | + | + | + | + | + | – | + | + | – |

| WZE | + | + | + | + | + | – | + | + | – |

| WKA | + | + | + | + | + | – | – | + | – |

| PKA | + | + | + | + | – | – | – | + | – |

| PW | + | + | + | + | – | – | – | + | – |

| RW | + | + | + | + | – | – | – | + | – |

Determination of prices and values on the copied offer and order

Version 2023.0 tidies up the rules for establishing prices and values on the elements of offers and orders resulting from the operations listed below, as the System has so far behaved inconsistently in this regard:

-

-

- copying an element of an offer/order

- copying the entire offer/order document

- creating an offer variant

-

The following rules apply when carrying out the above operations:

-

-

- The type of initial price (OS, ZS) is determined by the item being copied

- The level of initial price (OS, ZS, OZ, ZZ) is determined by the item being copied

- The final price and the final value are determined depending on the discount method used by the User

- In the case of discounts calculated from the price (enabled Discounts calculated from price parameter in Configuration/Sales/Discounts and special offers), the final price is copied from the source item, while the value of the item and the discount are calculated on the basis of the initial price, the final price and the quantity, so they can be different from those on the item being copied

- In the case of discounts calculated from value (the aforementioned parameter is deactivated), the final value is copied from the source item, while the price and the discount are calculated based on the initial value, the final value and the quantity, so they may be different from those on the item being copied

-

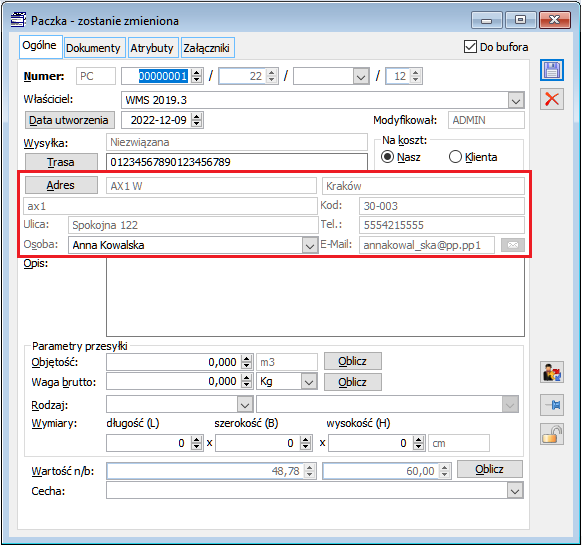

Address details and contact person on the Parcel document

On the Parcel document, the [General] tab presents the address and contact details that are assigned thereto. Until now, only the acronym of the associated address was displayed.

The address on the parcel is set on the basis of the documents linked thereto, provided that the Check conformity of delivery address of parcel documents parameter is selected in the configuration of the Configuration/Sales/Parameters 2 module.

As of version 2023.0, this setting also determines whether counterparty is added to the parcel. The person is selected automatically on the basis of the related documents. This can also be done independently by selecting the relevant record from the list of persons assigned to the counterparty.

Currently, when an address is retrieved for a parcel from related documents (always from the [Target counterparty] tab) and counterparty is filled in on these documents (on the same tab), then this is also retrieved for the parcel. Since a different person may be set on each document, the method of retrieval is as follows:

-

-

- When parcels are created, the person in the document list is taken from the first document in the queue on which it is completed.

- When attaching documents to parcels, the person is also taken from the first document in the queue on which it is completed. Here, it may not be retrieved if the person on the parcel is already completed.

-

When deleting a document link to a parcel, the person is not modified until the last linked document is deleted. This is because the address and hence the contact person is removed from the parcel.

As long as the Parcel document is not approved, the counterparty can also be completed, deleted or modified on its own by selecting any person from the list of all counterparty persons. It is only important that any document is linked beforehand, on the basis of which the counterparty for the parcel is established.

Along with establishing a contact person, their contact details can also be retrieved on the parcel: telephone and e-mail. This is of particular relevance to the collaboration with Comarch Shipping, which is covered in more details in the chapter with the same title.

By default, the data from the address associated with the parcel were treated as contact details for the parcel. Now, with the appropriate setting in the configuration of the Sales module (Configuration/Sales/Parameters 2) of the new Contact details on the parcel from the counterparty parameter, it can be made to be retrieved from the contact person on the parcel, if one is selected on the parcel. Then the contents in the Phone and Email controls are replaced immediately on the parcel, so we can see directly which contact details are valid for the parcel.

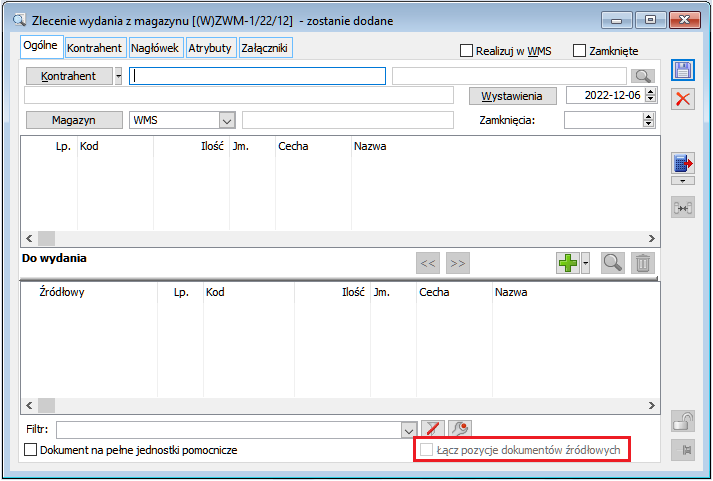

Including commodities inventoried on stock documents – blocking

The following operations were blocked on AWD/ZWM and (W)AWD/(W)ZWM documents that had items added for commodities subject to inventory:

-

-

- Blocking of submission of a document for execution (unchecking the To buffer parameter)

- Blocking the closing of a document (unchecking the Closed parameter).

-

When generating such documents, it is also necessary to check that the source items are not for commodities that are currently subject to inventory. If they are, then such items will not be added to the stock document.

Ergonomics of operations on agreements

Taking into account users’ demands for agreements, the following improvements have been made:

-

-

- Copying of conclusion and completion dates when copying an agreement. It does not matter if the dates from the source agreement are earlier or later than the current date, they will always be transferred to the new agreement.

- Removal of selected items from the agreement.

-

CRM

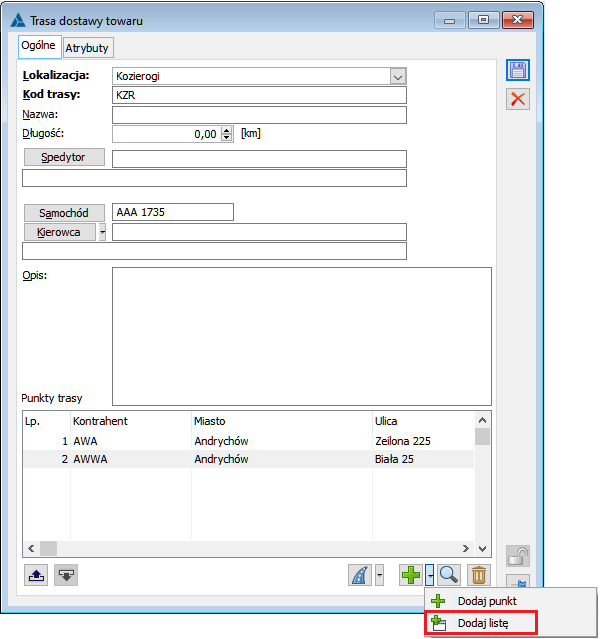

On the Commodity delivery route form, the ability to add waypoints in series has been added. A drop-down menu with two options is available next to the Plus button: Add point and Add list.

Command to add waypoints in series

The Add point command allows you to add a single point by filling in the waypoint form (action as before for “plus”).

The Add list command invokes a list of counterparties in selectable mode, where multiple records can be selected. Once the selection is accepted, the counterparties are added as further waypoints and the counterparty’s current address is set as the address.

Archived counterparties and those already added as a point for this route (provided they have been added with a current address) are not included in the serial addition. The rules for adding points in a serial operation are therefore the same as for adding a single waypoint.

Production

Pausing the execution of launched operations

It has been made possible to pause an operation, i.e. to stop and resume the running execution of a production order operation. Thus, in the event that work on an operation is to be temporarily halted, a pause can be recorded and the duration of such a pause will not be included in the duration of the operation and optionally may also not be included in the settlement time of the completed operation.

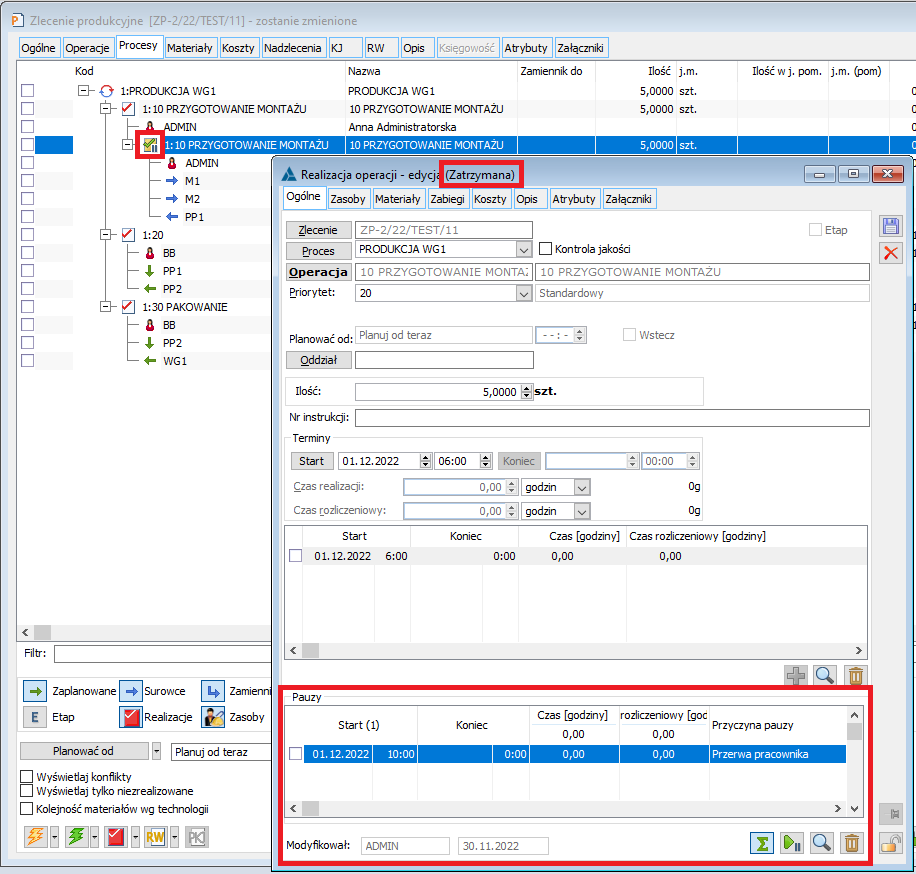

List of Pauses in the Operation execution window

In the Operation execution window on the [General] tab, a Pauses section has been added to display all pauses added for execution. From the pauses list, the User can add a new pause (when the operation is not currently paused), end a pause (when the operation is currently paused), and edit or delete a pause.

The pause list, in the operation execution window, is made up of the following columns:

-

-

- Start – the column shows the pause start date (date and time)

- End – the column shows the pause end date (date and time)

- Time [unit] – the column shows the duration of the pause, in the same unit as set for the operation execution time

- Settlement time [unit] – the column shows the pause settlement time, in the same unit as set for the operation execution time

- Pause reason – the column shows the pause reason

- Added by – the column displays an identifier of the operator who added the pause

- Added – the column displays the date the pause was added, together with the time

-

In the list of pauses, the following options were made available in the operation execution window:

-

-

Enable/disable summing – this option can be used to enable or disable summing up in the list

Enable/disable summing – this option can be used to enable or disable summing up in the list Pause – this option adds a pause (stopping the operation). Button available when no pause is currently in progress for the operation, otherwise the Resume button is available instead

Pause – this option adds a pause (stopping the operation). Button available when no pause is currently in progress for the operation, otherwise the Resume button is available instead Resume – the option is used to add an end to the pause (resumption of the operation). Button available when no pause is currently in progress for the operation, otherwise the Pause button is available instead

Resume – the option is used to add an end to the pause (resumption of the operation). Button available when no pause is currently in progress for the operation, otherwise the Pause button is available instead Change – this option can be used to edit the indicated pause. The pause is edited using the edit-in-place method, in the pause record

Change – this option can be used to edit the indicated pause. The pause is edited using the edit-in-place method, in the pause record Delete – this option can be used to delete the indicated pause

Delete – this option can be used to delete the indicated pause

-

|

Note: From the Operation execution window, a pause can also be added on a completed operation execution, whereby it is added immediately as completed, i.e. with the Start and End dates completed, for which the current date is prompted.

From all other locations in the system, it is possible to pause and resume only running operation executions. |

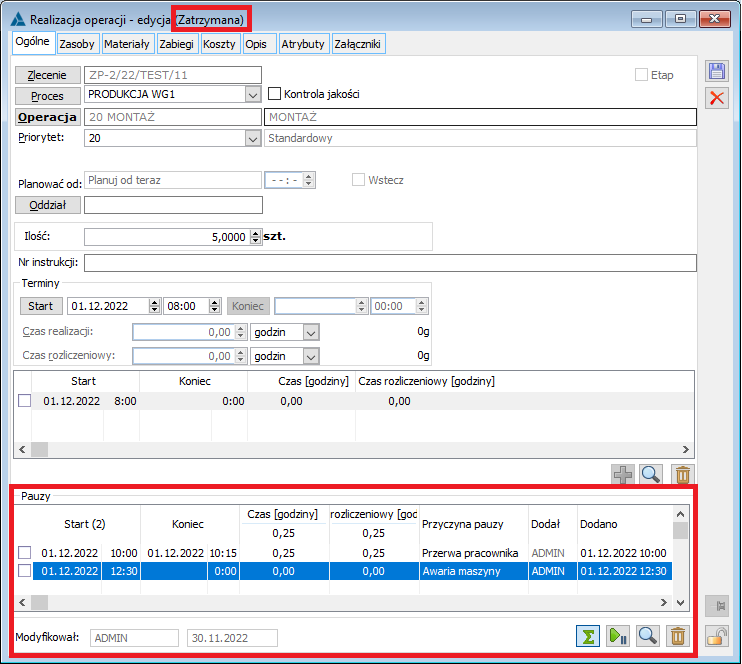

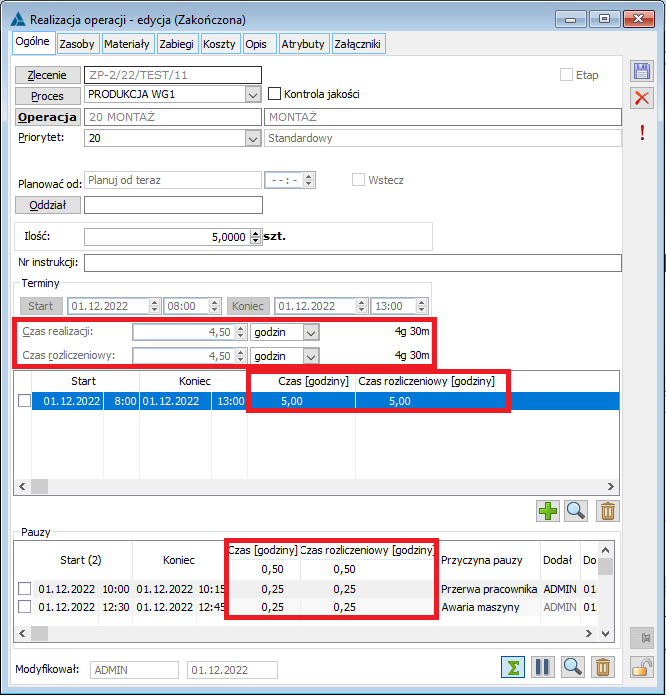

On the completed execution of an operation, where pauses are added to it, the duration of the pause and the settlement time of the pause are deducted from the aggregate execution time and the settlement time, to the extent that it falls within the operation dates.

|

Example: The operation was carried out between 8:00 a.m. and 1:00 p.m., i.e. the execution and settlement time of the deadline is equal to 5 hours. During the operation, two pauses were recorded: the first from 10:00 to 10:15 (with a duration and settlement time of 0.25 hours) and the second from 12:30 to 12:45 (with a duration and settlement time of 0.25 hours). The aggregate execution and settlement time of the operation is calculated as 4.5 hours, as 0.5 hours of the execution and settlement time of both pauses are subtracted from the 5 hours of the execution and settlement time of the operation. |

|

Note: When the pause term is only partly contained in the execution deadline of the operation, only that part of the duration will be deducted from the execution and settlement time of the operation and the proportionally calculated part of the settlement time of the pause that is contained in the execution duration. |

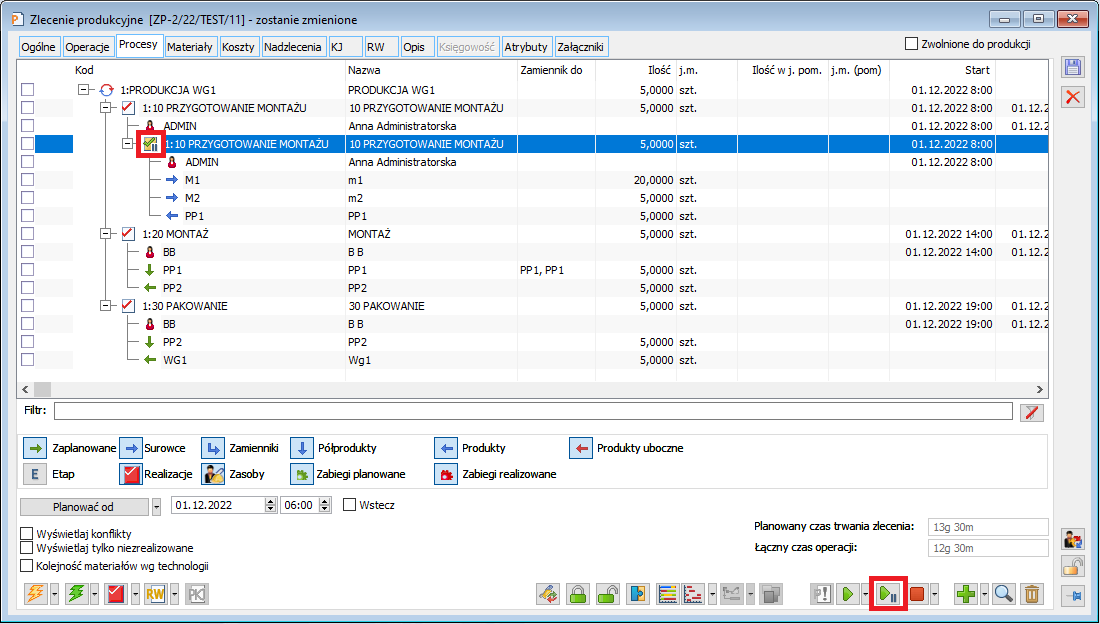

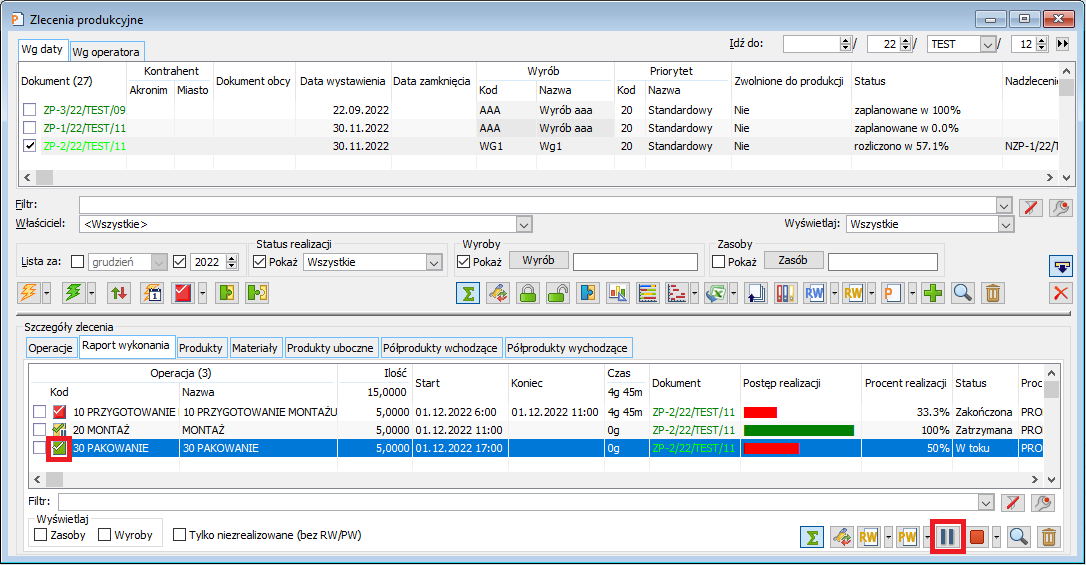

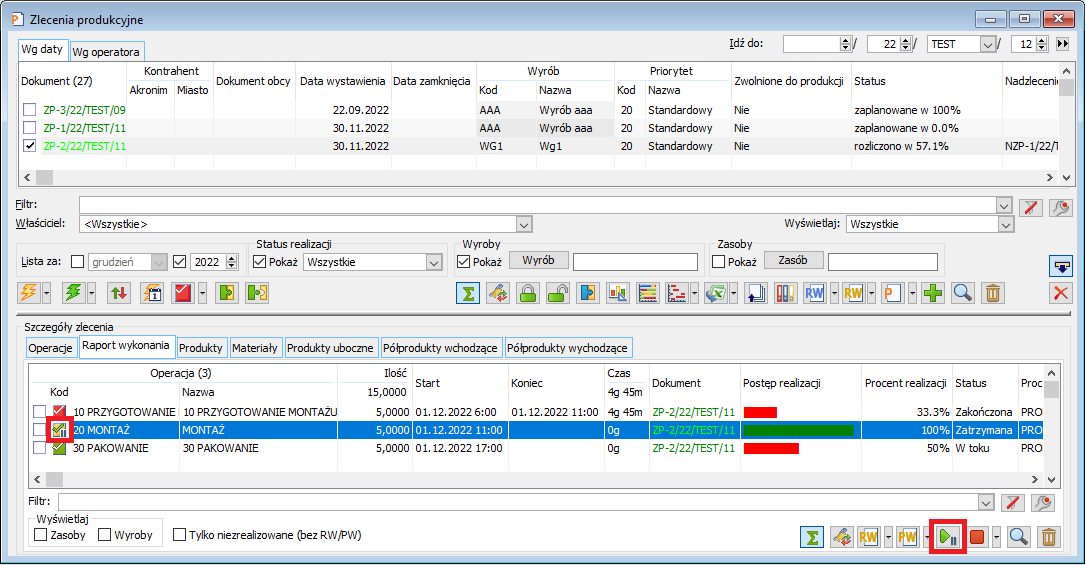

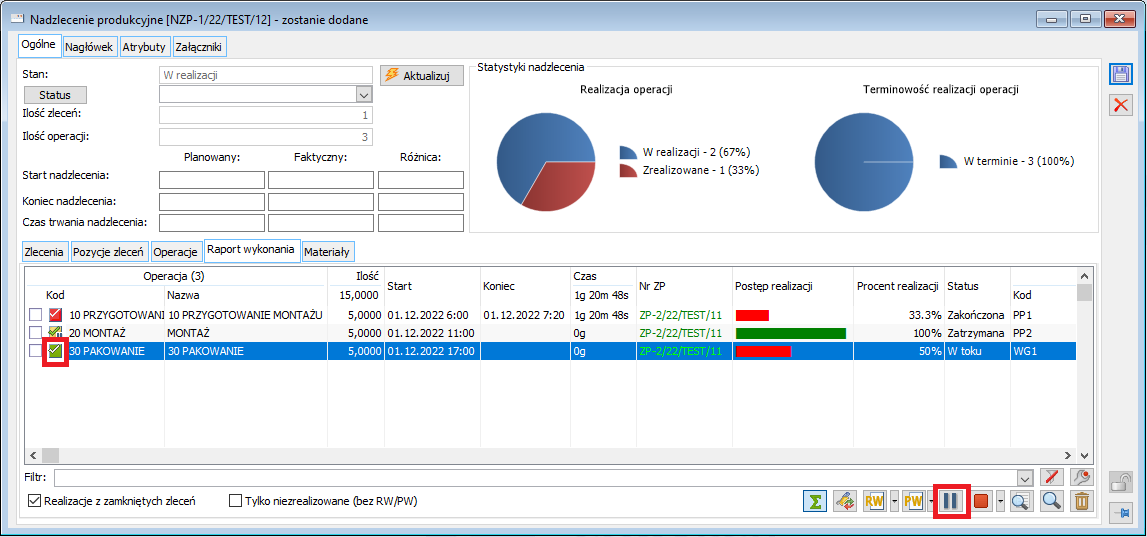

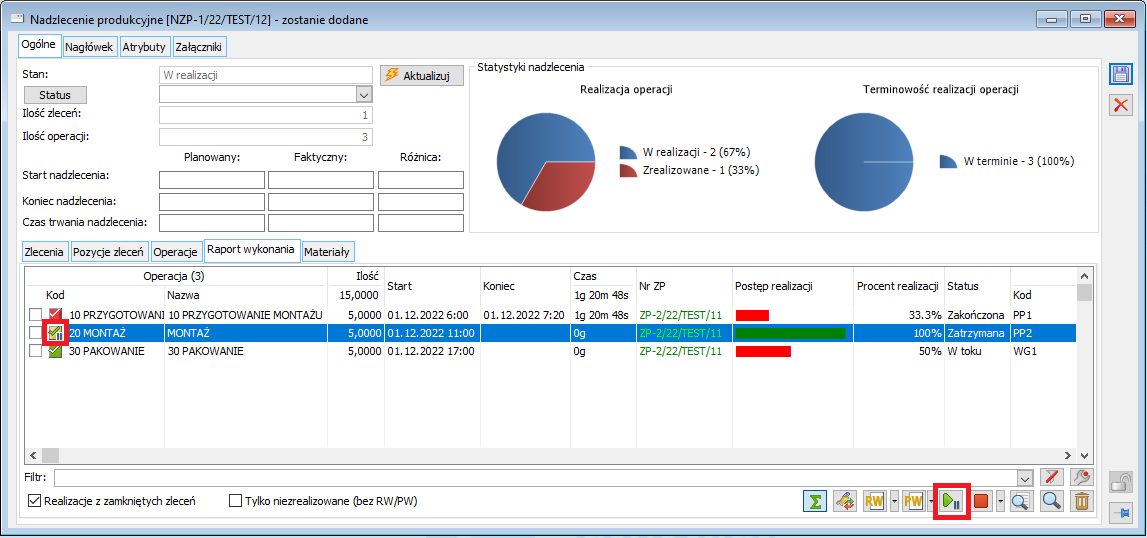

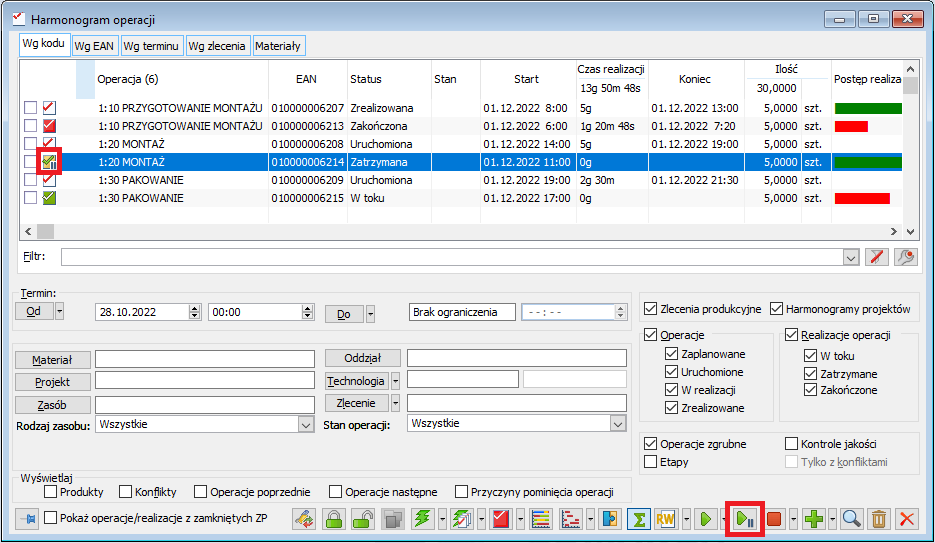

Pausing and resuming a running operation from lists

The pause can be added or ended from the Operation execution window (3.1.1). In addition, a pause can be added or ended with a new dedicated ![]() Pause or

Pause or ![]() Resume button available by highlighting a running execution with the corresponding status (if the running execution does not have a pause in progress then the Pause button is available, and if a pause is currently in progress for it then the Resume button is available) from the level of:

Resume button available by highlighting a running execution with the corresponding status (if the running execution does not have a pause in progress then the Pause button is available, and if a pause is currently in progress for it then the Resume button is available) from the level of:

-

-

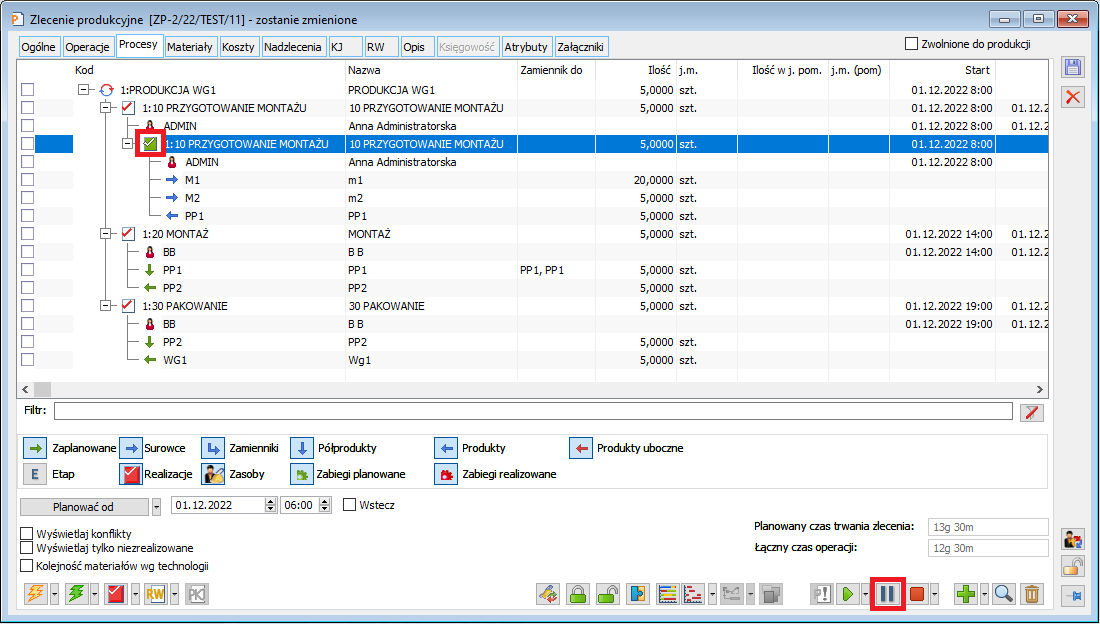

- Production order window, from the [Processes] tab

-

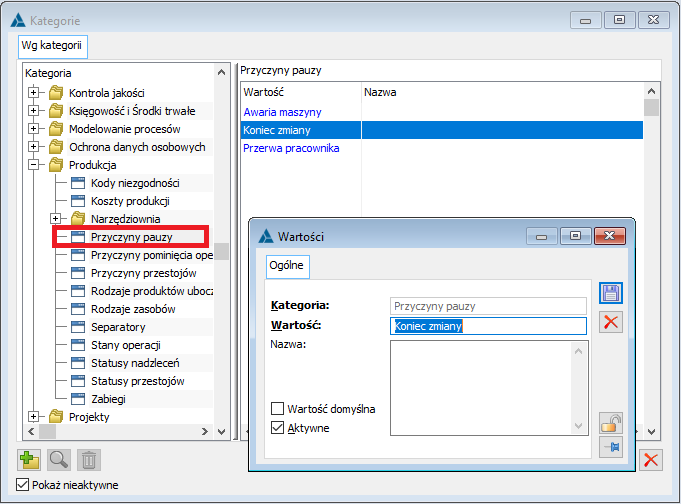

New dictionary: Pause reasons

For the purposes of the above functionality, a new dictionary has been added in the Administrator module, under Lists/Category dictionaries/Production: Pause reasons. Predefined values have been added to this dictionary: Machine failure and Employee break. In addition, the User can define own values to indicate for the pause to be recorded.

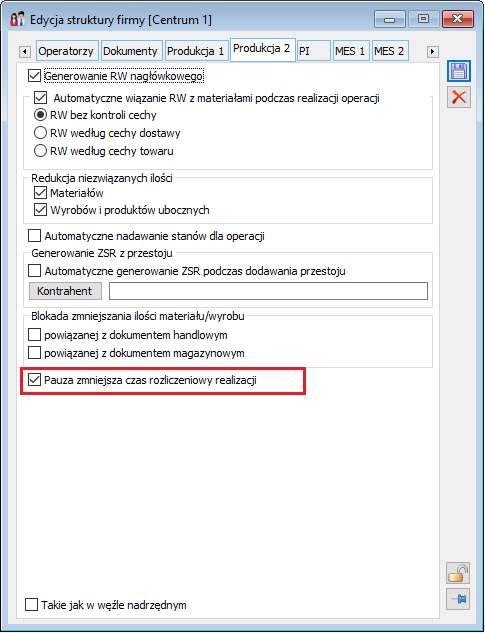

Parameterisation of the automatic calculation of the pause settlement time, which reduces the settlement time of the operation execution

In the Edit company structure window, on the [Production 2] tab, a new parameter has been added: Pause reduces the execution settlement time.

With the Pause reduces the execution settlement time parameter selected, adding the end for a pause will automatically calculate the pause settlement time based on the duration of the pause and the ratio of execution time to operation settlement time set on the technology.

If the Pause reduces the execution settlement time parameter is unselected, when adding the end for a pause, the pause settlement time will be 0.

|

Note: Regardless of the setting of the Pause reduces the execution settlement time parameter, at the end of a pause the User will always be able to manually modify the pause settlement time and if this time is greater than 0 it will be deducted from the execution settlement time, as long as the pause date is within the operation execution date in whole or in part. |

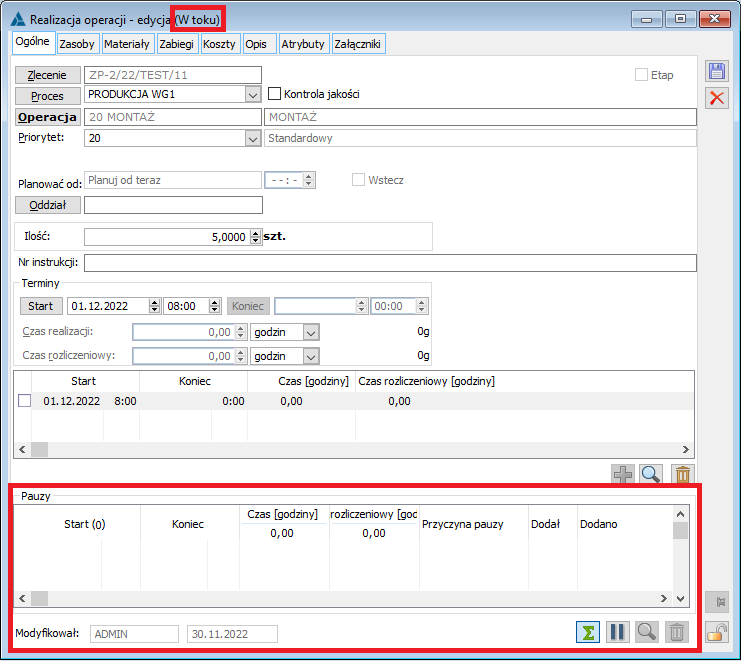

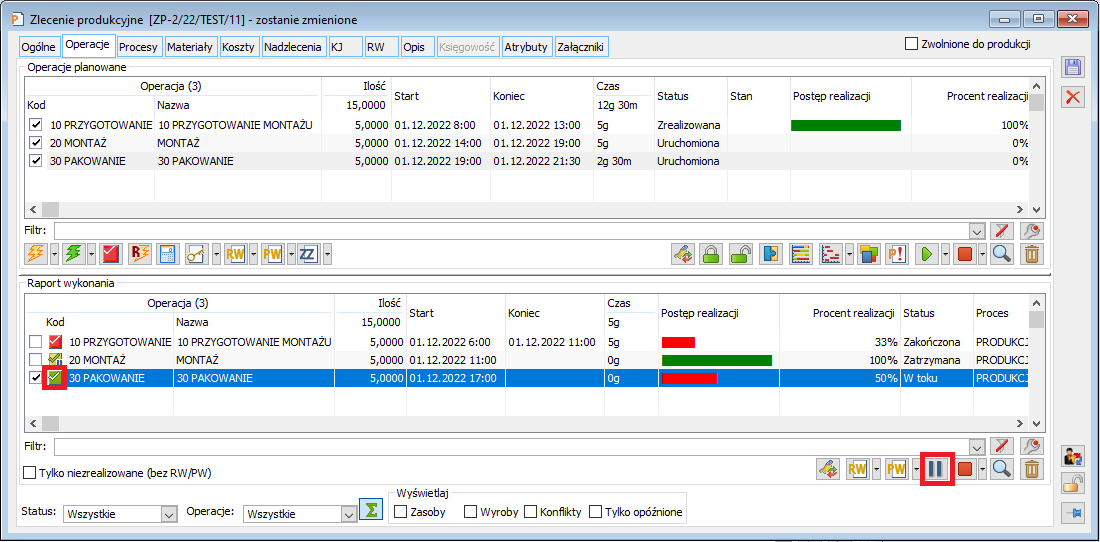

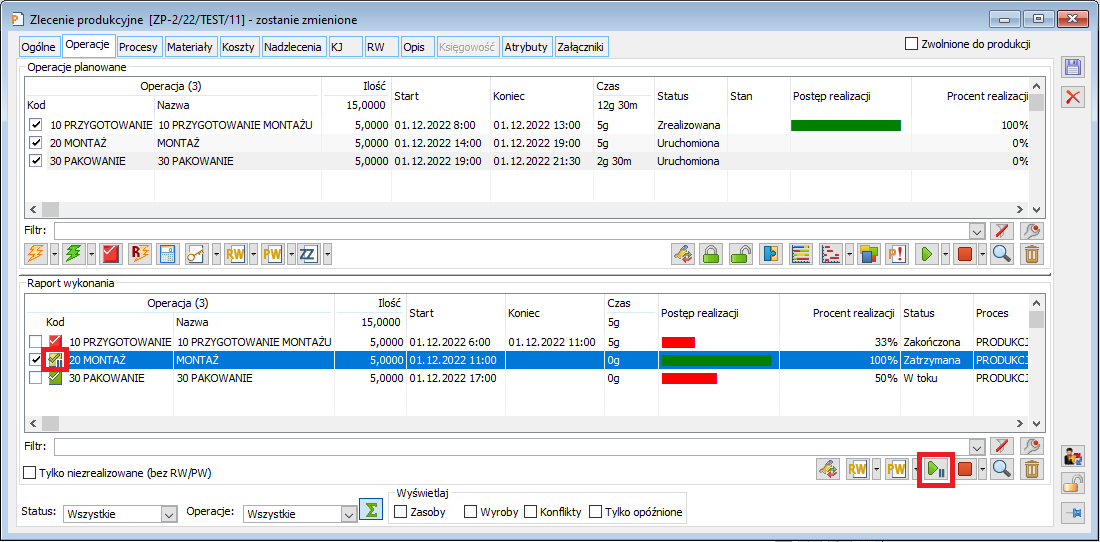

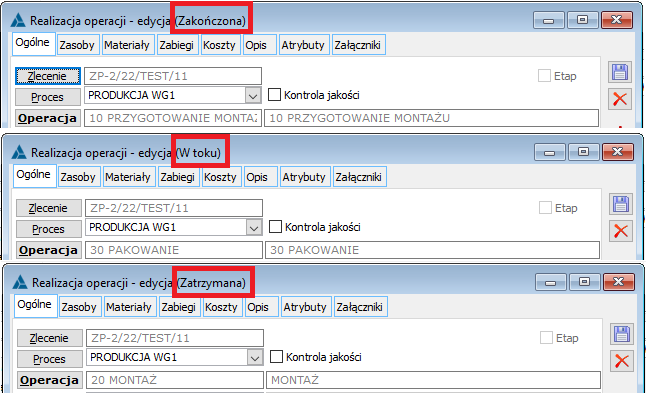

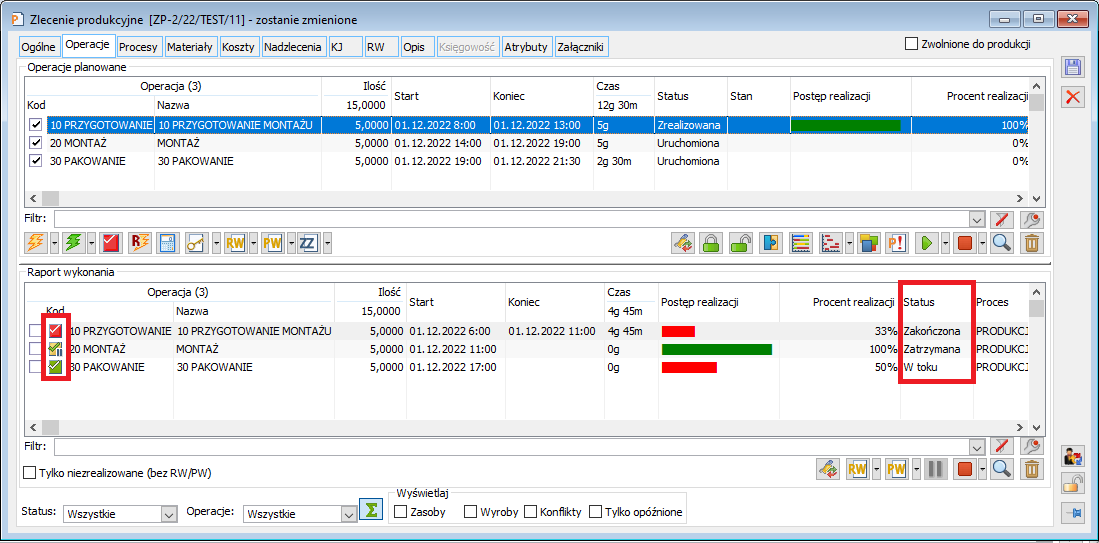

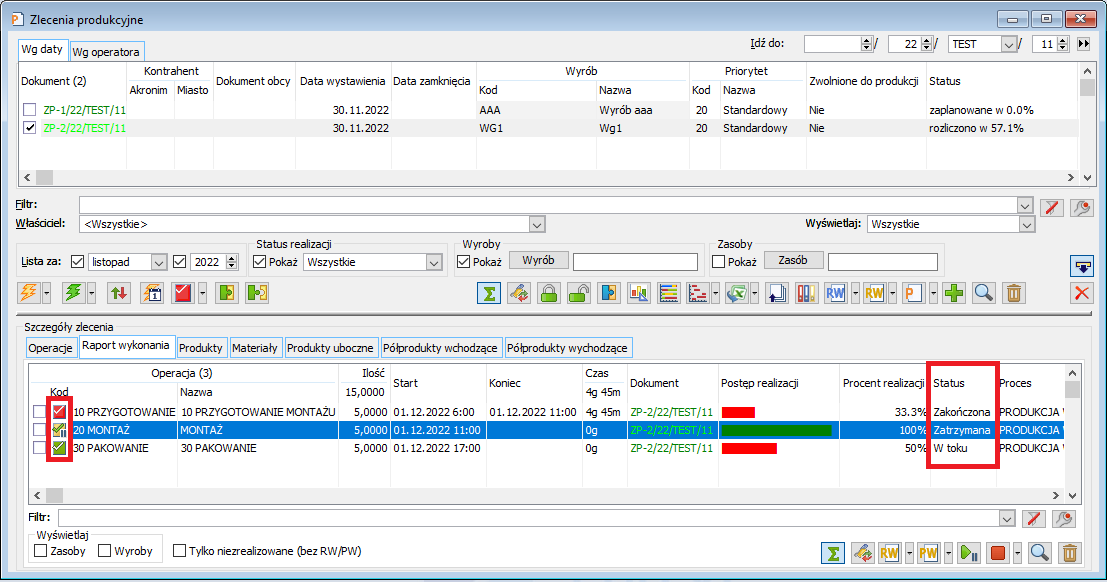

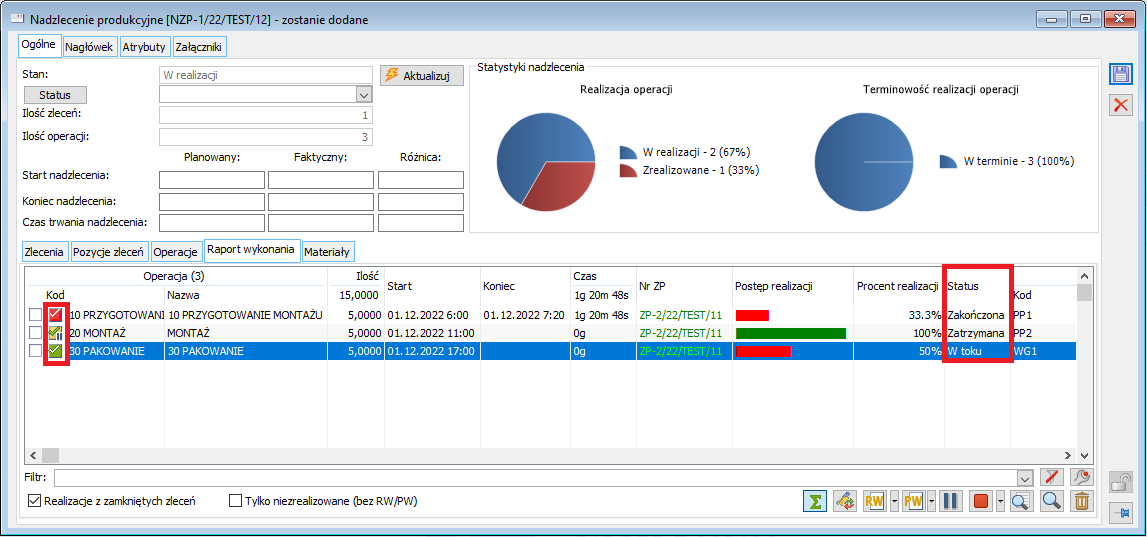

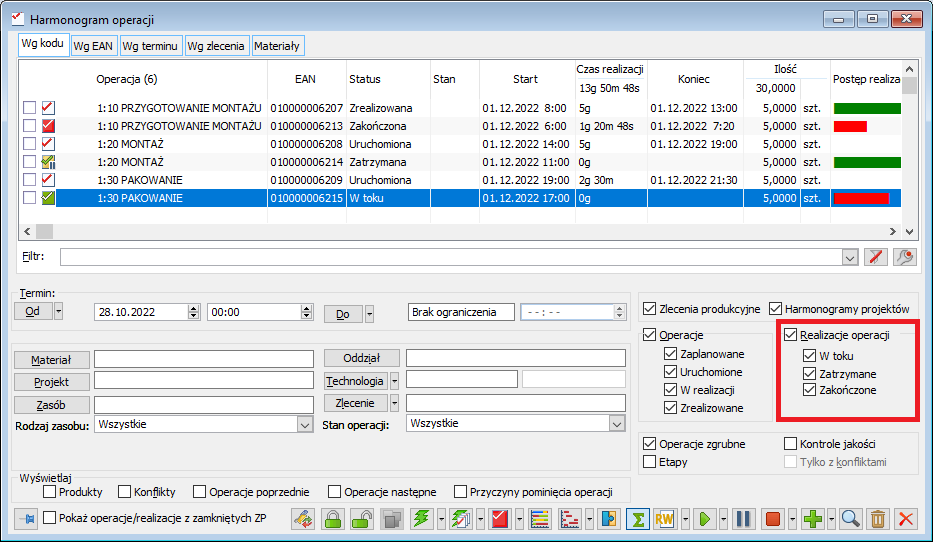

Statuses of operation execution

Until now, statuses were only given to planned operations. With the addition of the pause functionality for operations, the assigning and displaying of statuses has also been supported for operation execution.

In the case of triggered executions, they may be given the following statuses: In progress (if the running execution has no pause in progress i.e. no pause has been added or all pauses are ended) or Paused (if the running execution has a pause currently in progress i.e. has a pause added that has not yet been completed). In contrast, completed executions will always have a status: Completed.

Based on the status, different icons are also displayed for executions in various lists. Until now, there were two icons: ![]() for running (currently displayed for executions with status In progress) and

for running (currently displayed for executions with status In progress) and ![]() for completed executions (currently displayed for executions with the status Completed). In this version, a third icon

for completed executions (currently displayed for executions with the status Completed). In this version, a third icon ![]() has been added for paused running executions (for executions with the status Paused).

has been added for paused running executions (for executions with the status Paused).

Operation execution statuses are displayed in the following locations:

-

-

- In the header of the Operation execution window

-

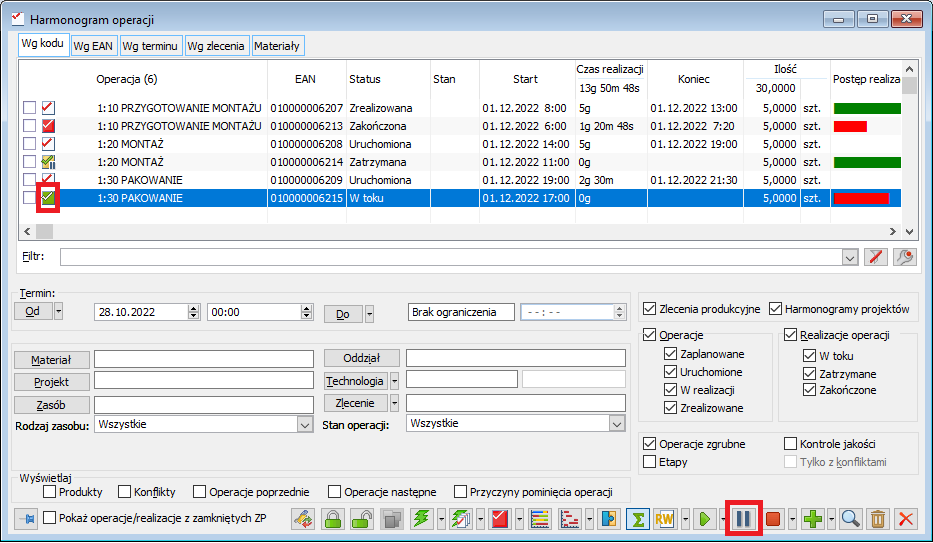

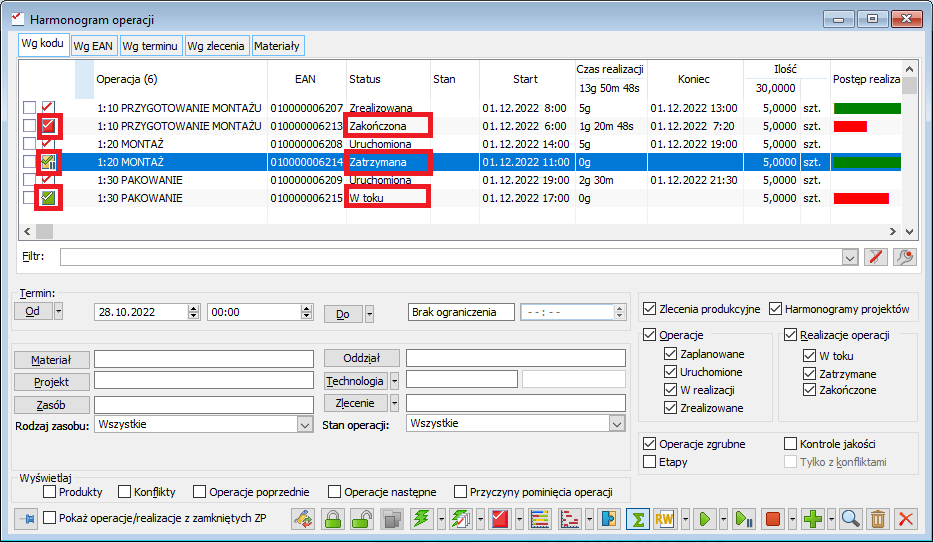

New filters in the Operations schedule window

In connection with the handling of statuses for operation executions, filters have been added to the Operations schedule window, allowing the list of operations to be narrowed down to executions with a specific status. Under the existing filter: Operation executions responsible for displaying the execution in the list, sub options have been added:

-

-

- In progress – when this option is selected, the list displays executions with the status In progress

- Paused – when this option is selected, the list displays executions with the status Paused

- Completed – when this option is selected, the list displays executions with the status Completed

-

Due to the addition of new filters, the arrangement of the existing filters has been partly changed.

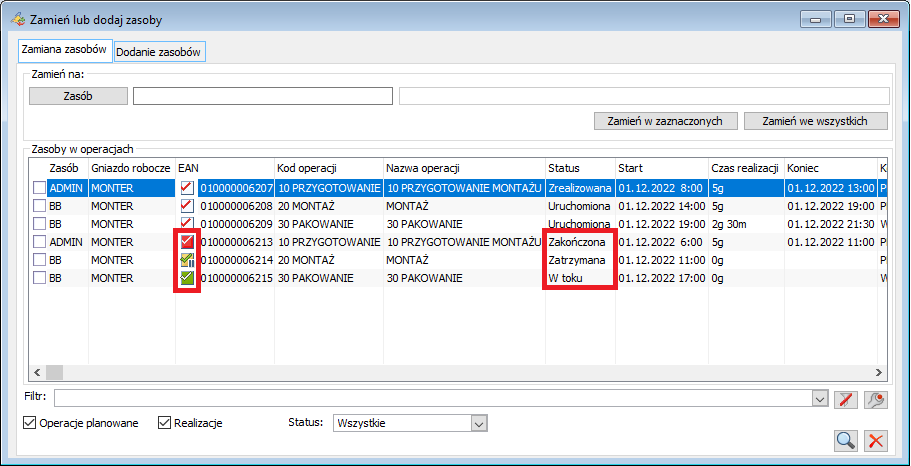

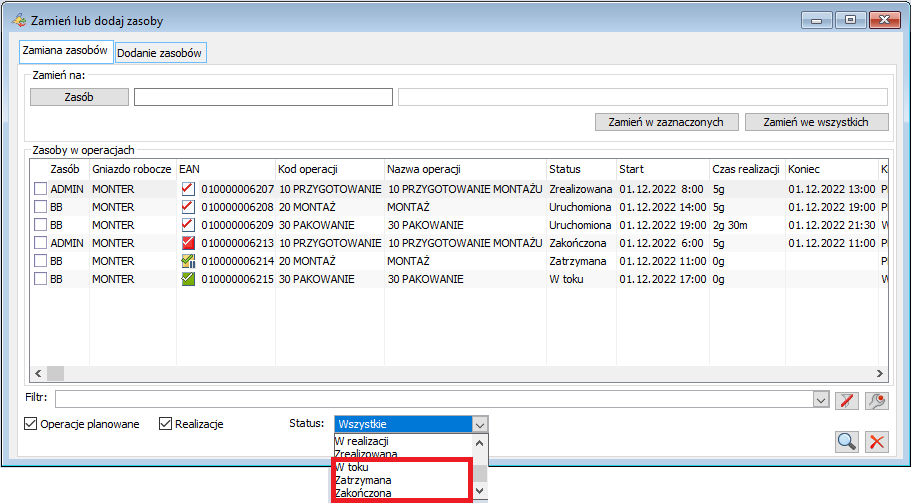

Expansion of the Status filter in the Change or add resources window

In connection with the handling of statuses for operation executions, new options have been added to the Status filter in the Change or add resources window: In progress, Paused and Completed, allowing the list of operations to be narrowed down for execution with a particular status.

The operation of the existing options has also been modified: Started, In execution and Completed, which previously searched for all planned operations with the indicated status and their executions, but now only searches for planned operations with the given status (without their executions).

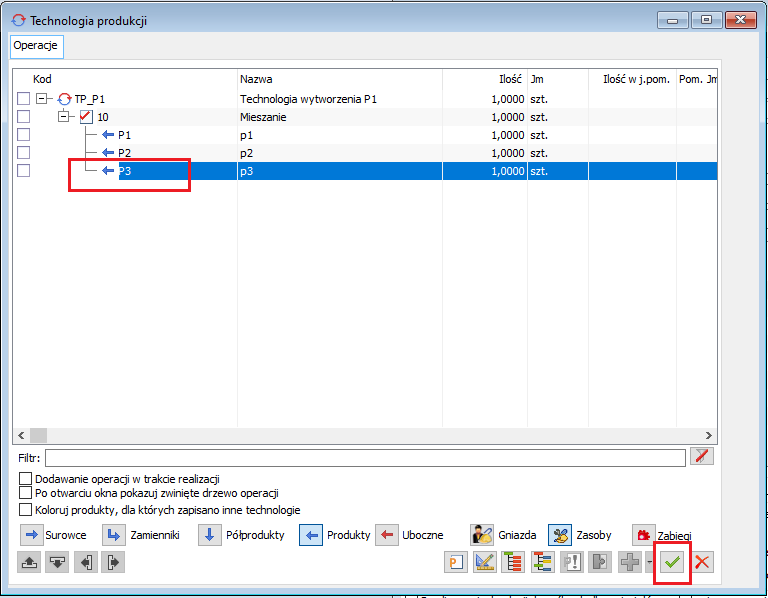

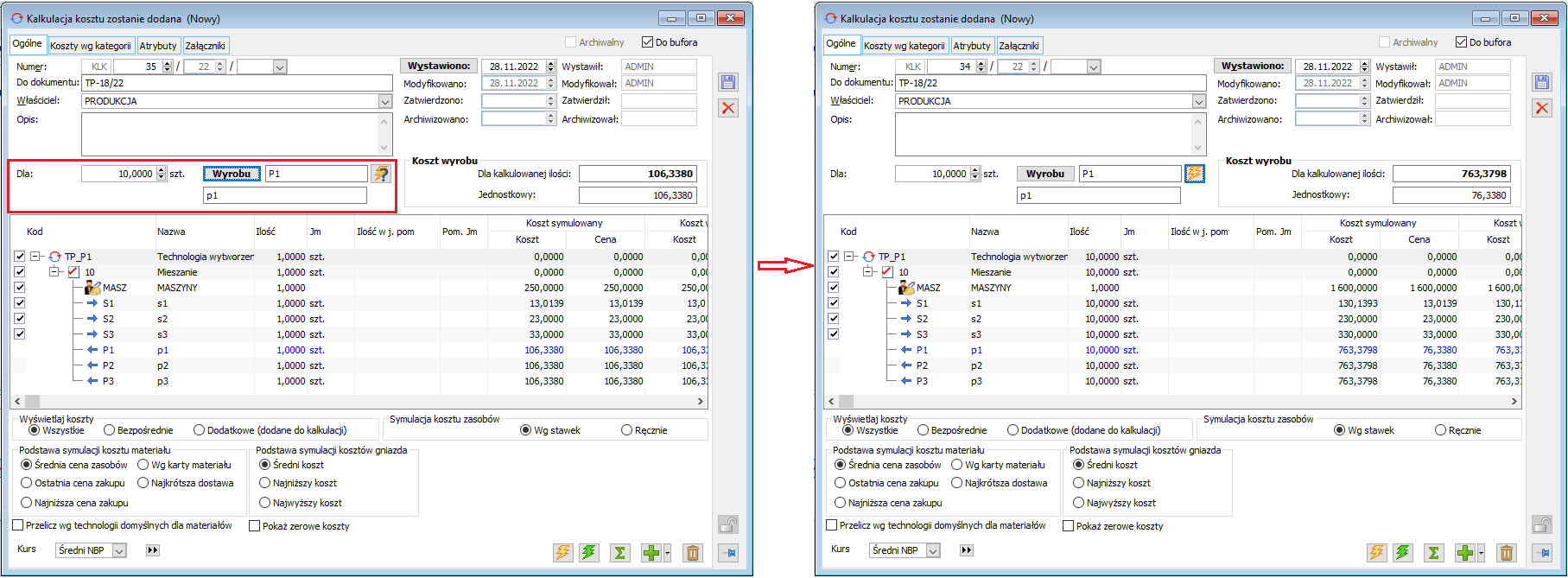

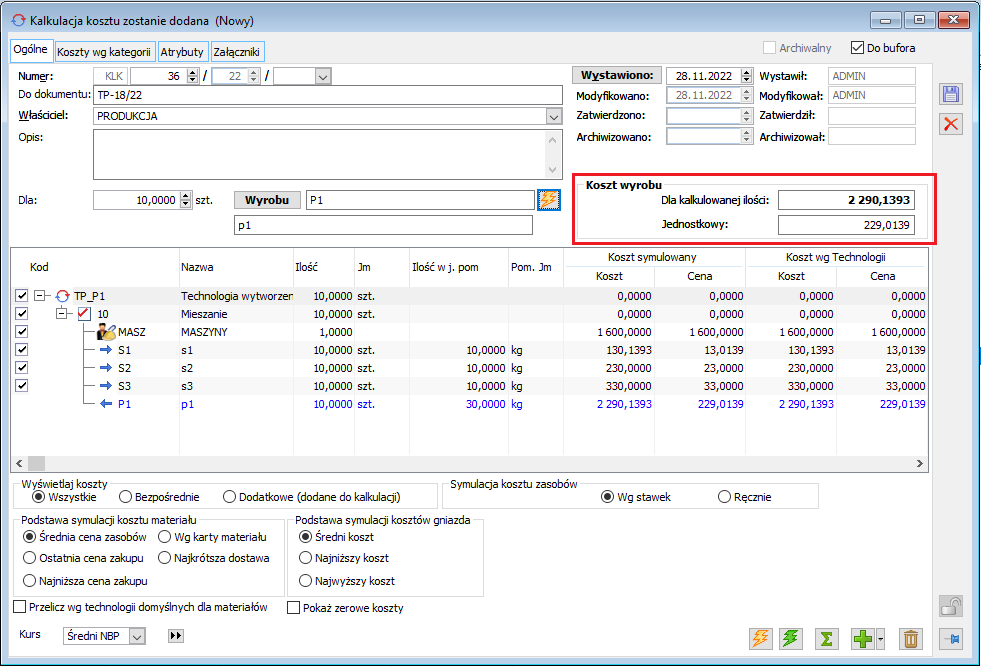

Calculation of cost for any quantity of product

From version 2023.0 of Comarch ERP XL system, it is possible to recalculate cost calculations for any quantity of a product from a technology.

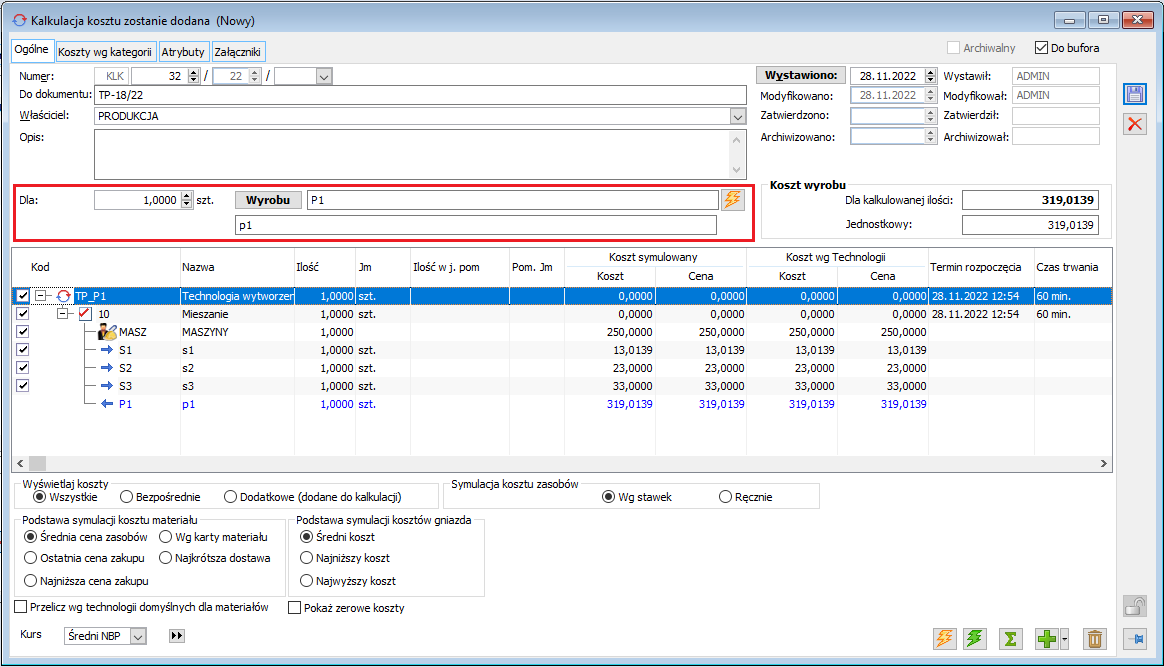

New options and parameters in KLK

New fields have been added to the cost calculation where it is possible to indicate for which quantity and which product from a given technology the calculation is to be recalculated.

In the field: ![]() you can specify the quantity of the product for recalculation. This quantity is expressed in the basic unit of the product.

you can specify the quantity of the product for recalculation. This quantity is expressed in the basic unit of the product.

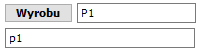

In the  field, you can indicate the product, for which recalculation will be performed. The product can be selected from the technology already loaded onto the KLK document.

field, you can indicate the product, for which recalculation will be performed. The product can be selected from the technology already loaded onto the KLK document.

It will be possible to change the product on the KLK document when this document is generated or added on the basis of a technology or ZP. If the KLK is created on the basis of a ZS, OS, ZW document, it will not be possible to change the product and product quantity thereon.

To indicate on the KLK the product for which the recalculation is to be performed, press the ![]() button and then select the relevant product from the open product list of the technology in question.

button and then select the relevant product from the open product list of the technology in question.

Next to the fields for entering the product code and name on the KLK document, there is a ![]() Recalculate button that can be used to perform recalculation for any quantity of the selected product.

Recalculate button that can be used to perform recalculation for any quantity of the selected product.

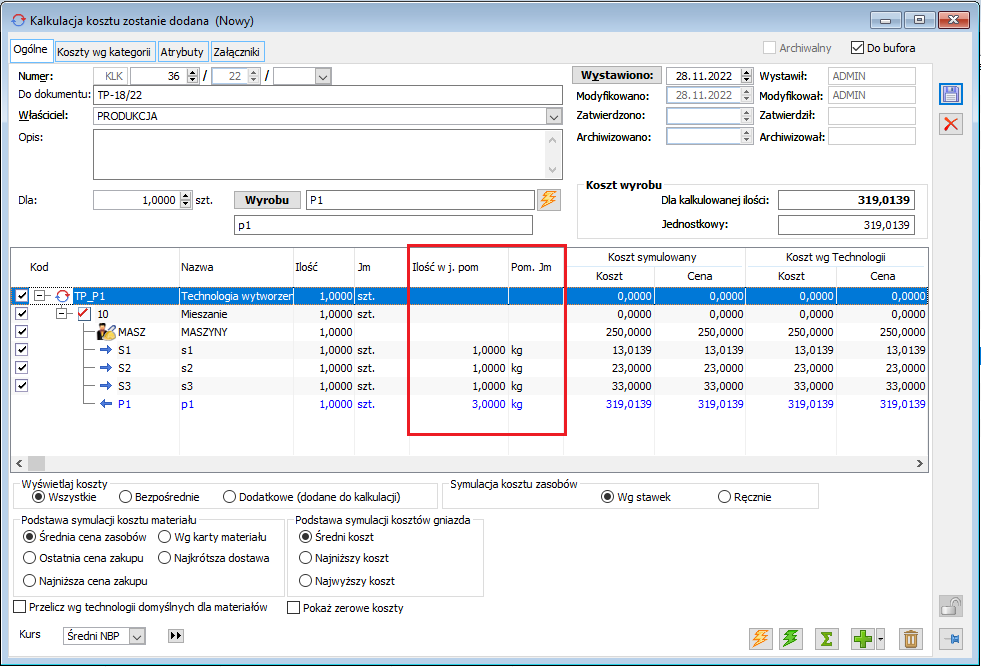

New columns on KLK

New columns have been provided on KLK to show the quantity of materials and products, expressed in the auxiliary unit.

Recalculation of KLK for any quantity of product

The first opening/reading of the KLK should work as before. For the default loaded quantity, the corresponding cost of the products should be calculated. Subsequent recalculation of the KLK document using the new ![]() Recalculate button or using the existing

Recalculate button or using the existing ![]() Recalculate report using the selected simulation/rate options will recalculate the KLK for the selected product and the quantity specified for it, taking into account other current parameter settings found on the KLK. Individual quantities and costs will be calculated on the basis of the indicated technology in proportion to the quantity of product stated on the KLK.

Recalculate report using the selected simulation/rate options will recalculate the KLK for the selected product and the quantity specified for it, taking into account other current parameter settings found on the KLK. Individual quantities and costs will be calculated on the basis of the indicated technology in proportion to the quantity of product stated on the KLK.

When recalculating the KLK, the minimum quantities specified in the technology will not be taken into account.

Other changes to KLK

-

-

- Product cost area

-

A new area has been introduced on the KLK document in which the calculated value of the product and its unit cost is presented.

In the field For calculated quantity: the product cost is presented, which is also visible in the column: Simulated cost/Cost. In the Unit field, on the other hand, the product’s unit cost is presented (e.g. cost of 1 item), which is also visible in the Simulated cost/Price column.

-

-

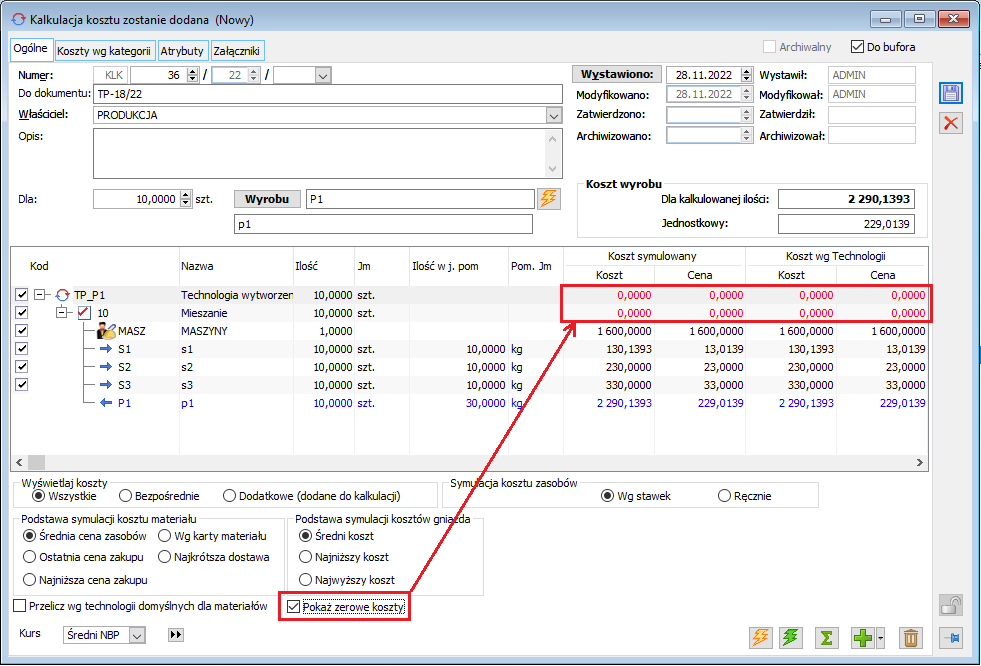

- Show zero costs parameter

-

An option has also been made available with which zero prices or costs can be highlighted on KLK.

If the Show zero costs parameter is selected, zero costs and prices will be highlighted on the calculation. These will be displayed in red on the document.

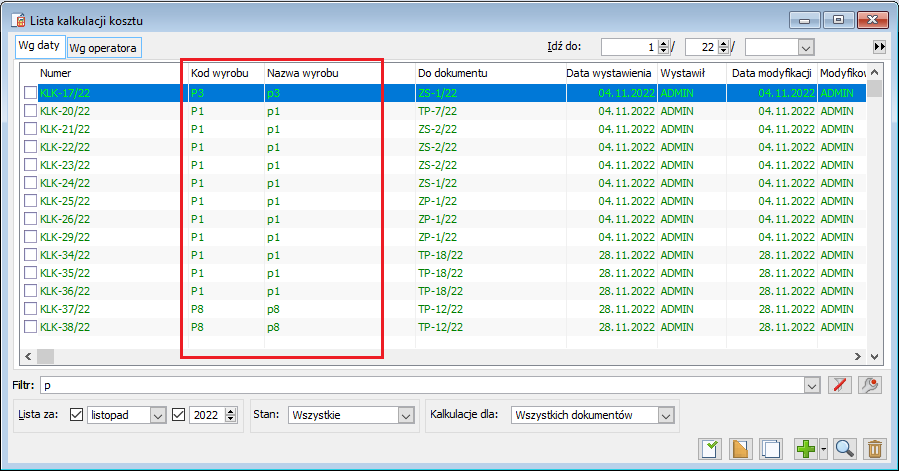

New columns have been added to the KLK list to show the code and name of the product to which the KLK document relates.

Other changes

Starting and stopping operations in the Operations schedule window

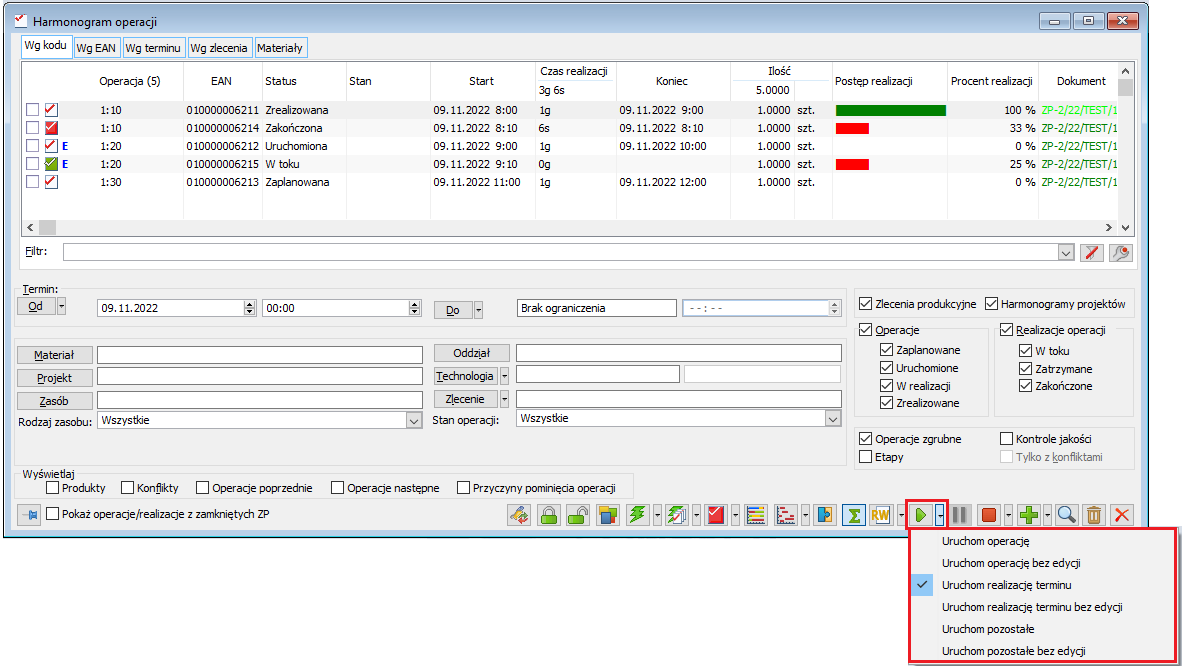

Dedicated buttons have been added to the Operations schedule window: ![]() Start term execution with options to start operations and

Start term execution with options to start operations and ![]() Execute term with options to add operation execution. These are the same functions as, among others, in the Production order window, on the [Processes] tab, for starting or executing a planned operation highlighted in the list.

Execute term with options to add operation execution. These are the same functions as, among others, in the Production order window, on the [Processes] tab, for starting or executing a planned operation highlighted in the list.

Within the options under the button to start operations, the following options are available:

-

-

- Start operation

- Start operation without editing

- Start term execution

- Start term execution without editing

- Start remaining

- Start remaining without editing

-

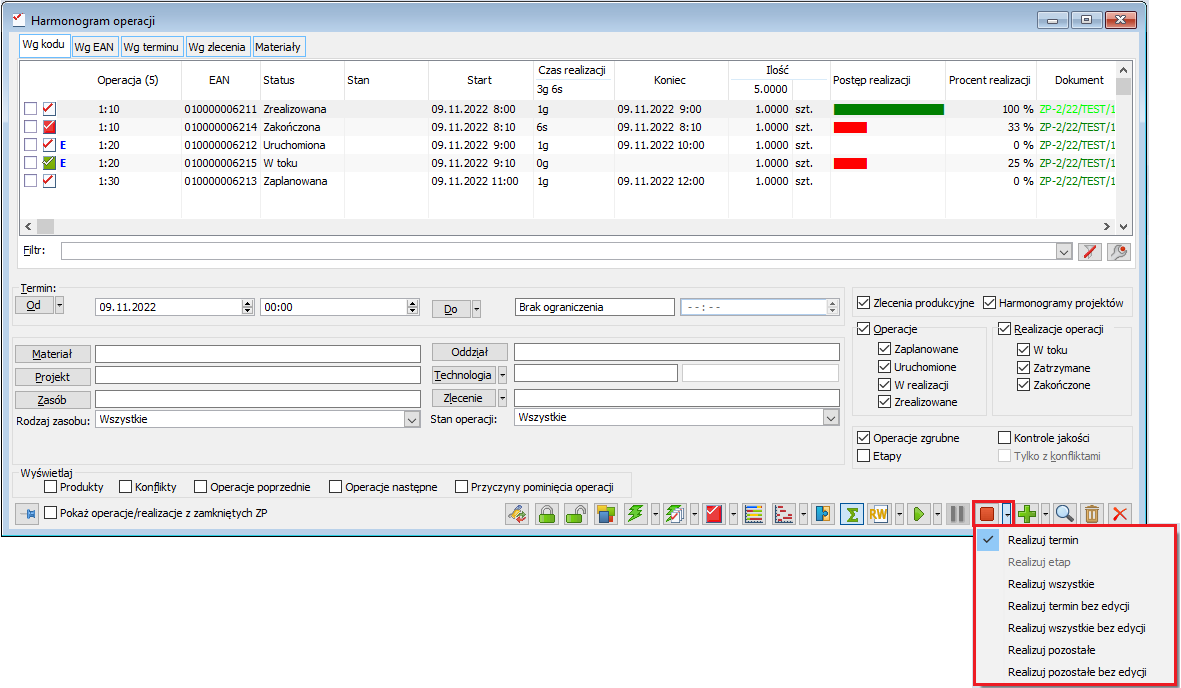

Within the options under the button to execute operations, the following options are available:

-

-

- Execute term

- Execute stage

- Execute all

- Execute term without editing

- Execute all without editing

- Execute remaining

- Execute remaining without editing

-

In the same way as for the same buttons available in the Production order window, among others, on the [Processes] tab, the settings selected in the listed fields determine which option is activated by default directly under the button to start ![]() or execute

or execute ![]() operations: Default execution start and Default execution completion on the Production order document definition, on the [Production] tab.

operations: Default execution start and Default execution completion on the Production order document definition, on the [Production] tab.

Accounting

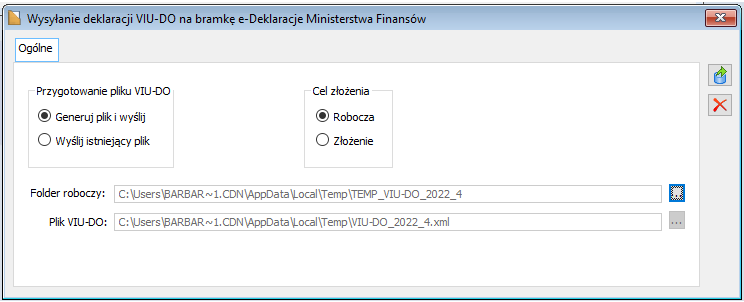

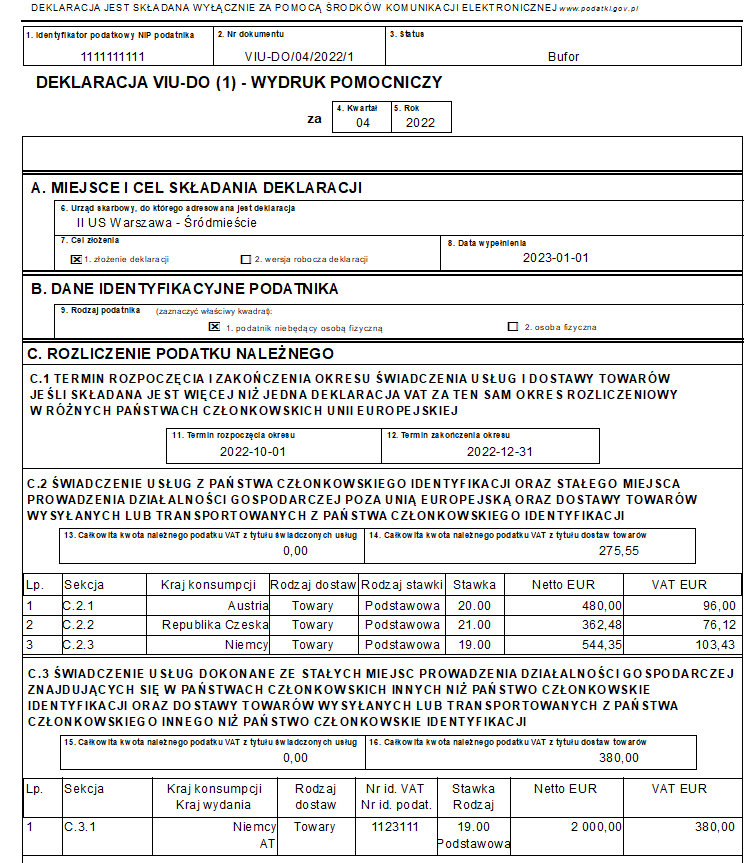

VIU-DO declaration

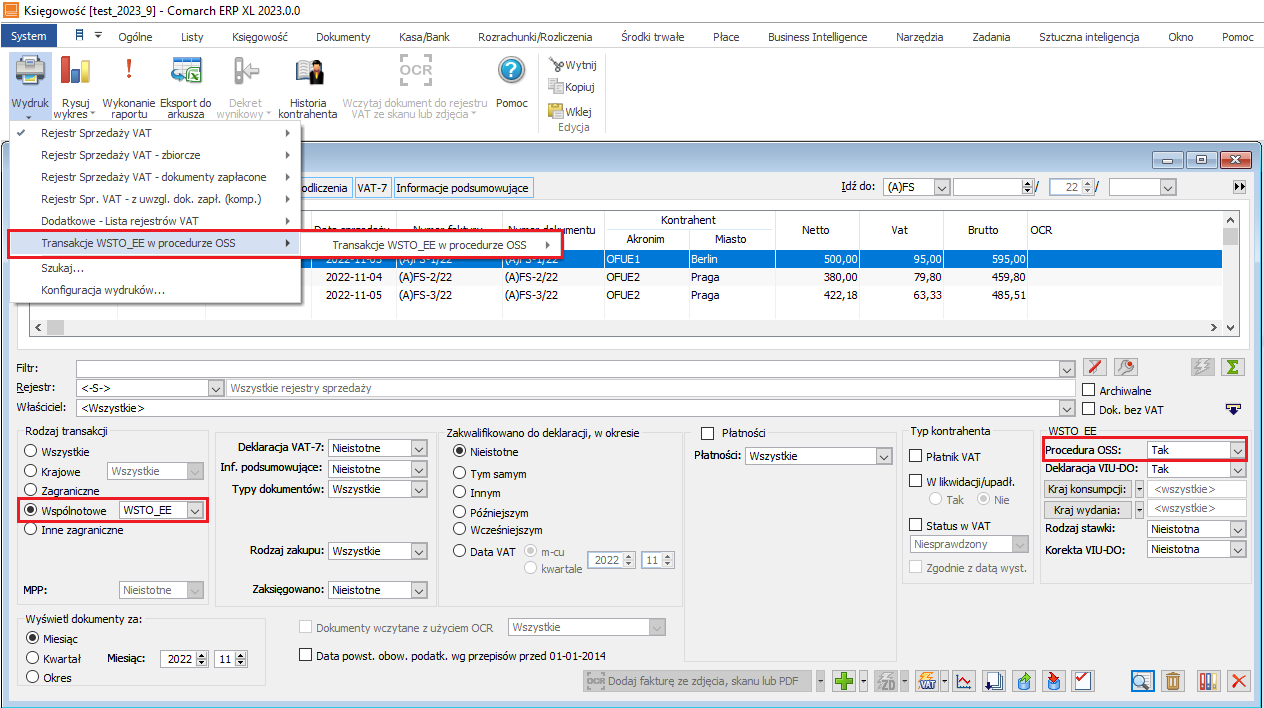

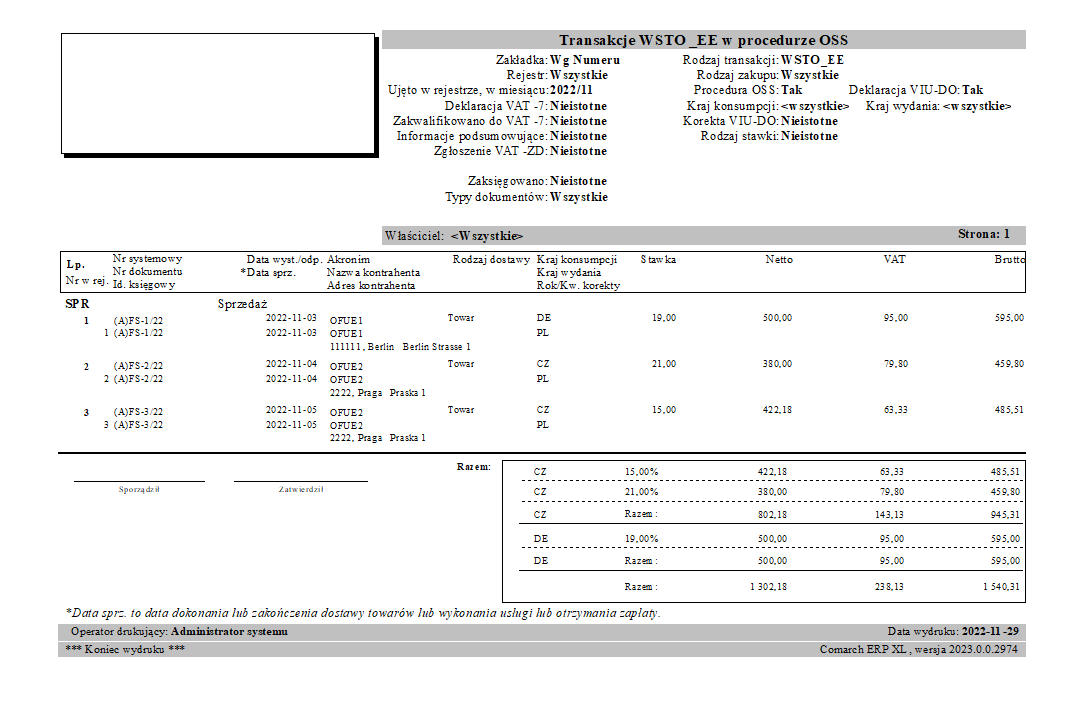

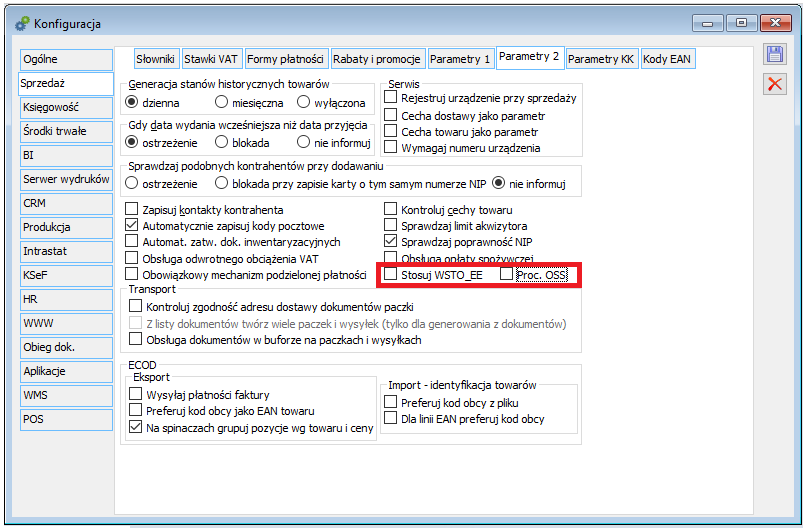

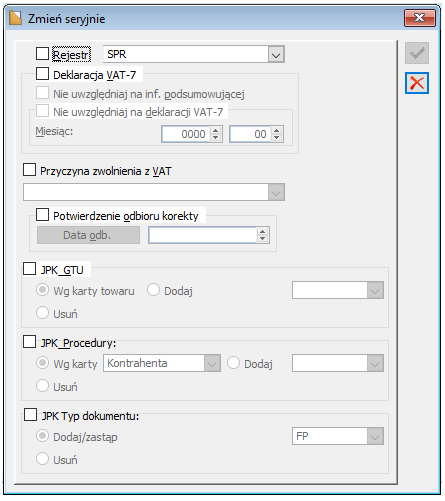

New parameters on sales invoices

The news document prepared for Comarch ERP XL 2022.1 describes new parameters, introduced on sales invoices, on the [VAT] tab for the VIU-DO declaration.

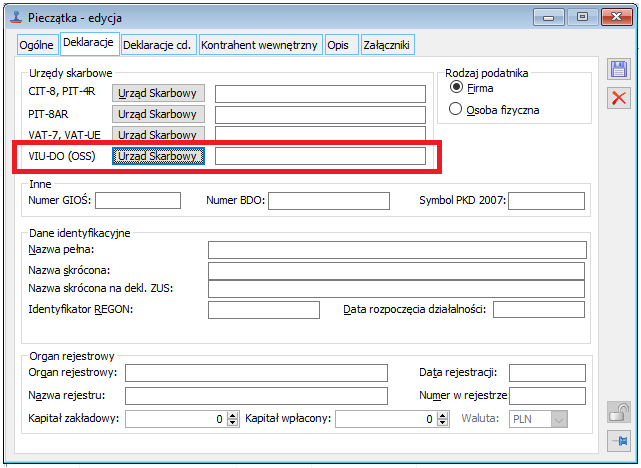

Changes to the company stamp

In the company stamp, a field called VIU-DO (OSS) has been introduced on the [Declarations] tab. In this field, indicate the tax office which is the addressee of the VIU-DO declaration. The office entered here will automatically appear on the VIU-DO declaration form.

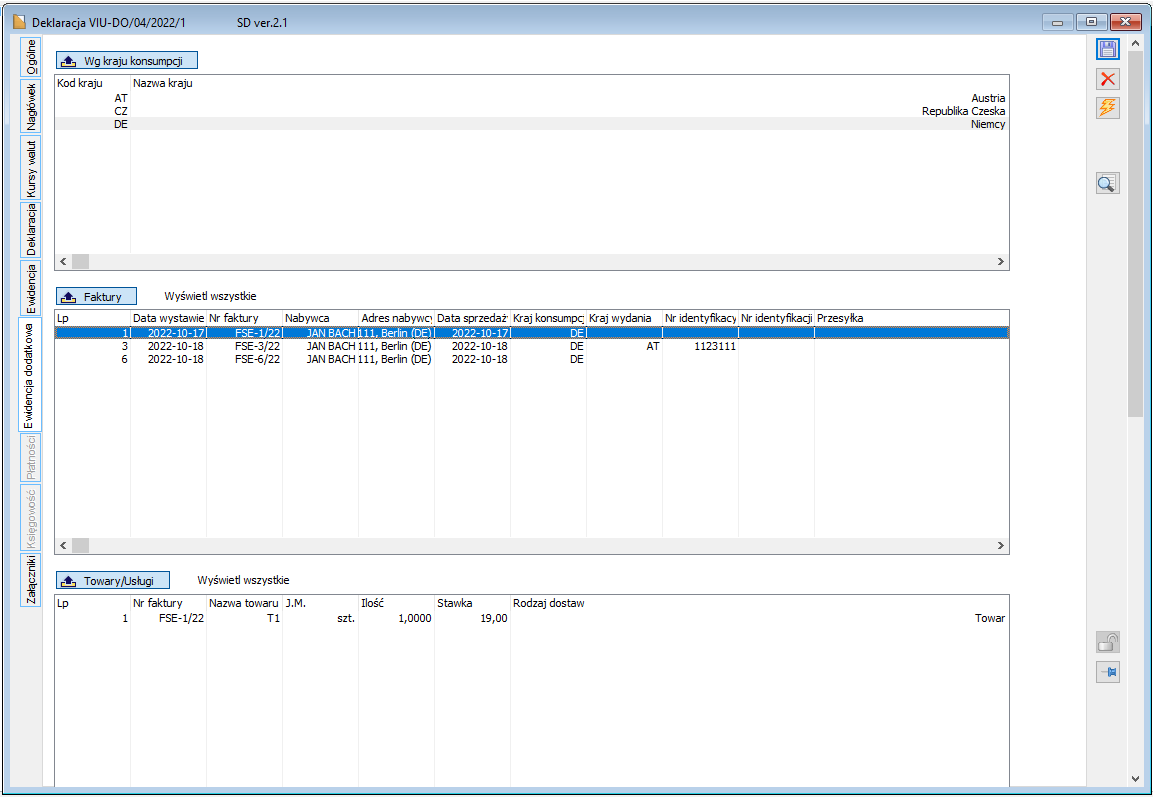

VIU-DO declaration form

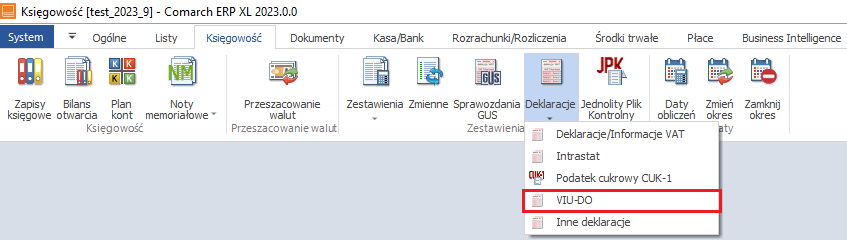

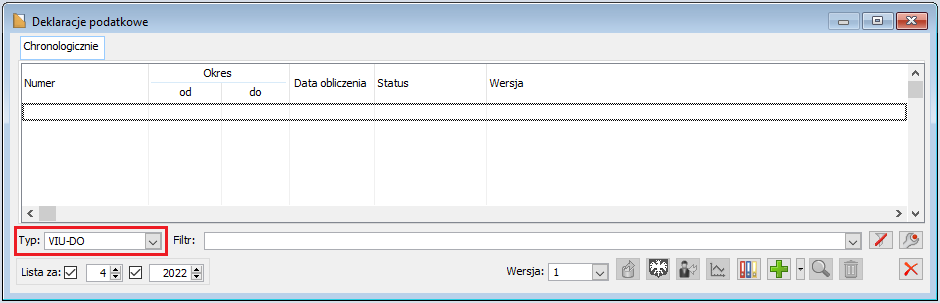

Location of the VIU-DO declaration

In Comarch ERP XL 2023.0 version, the VIU-DO declaration form has been made available in the Ribbon, Declarations/VIU-DO menu.

To view the VIU-DO declaration and to add a new form, select VIU-DO. In the Tax returns window, the list will be narrowed down to VIU-DO declarations only.

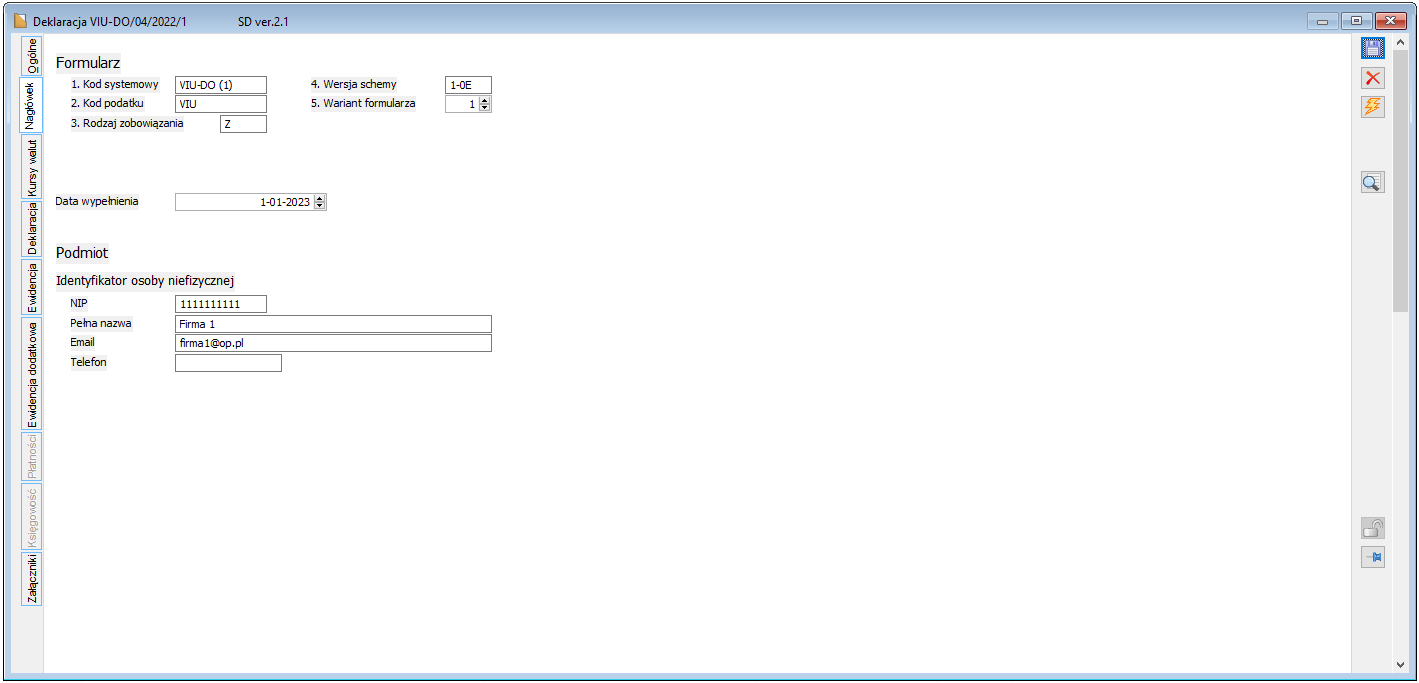

Structure of the VIU-DO declaration form

The VIU-DO declaration form consists of the following tabs:

General

Header

Exchange rates

Declaration

Record

Additional record

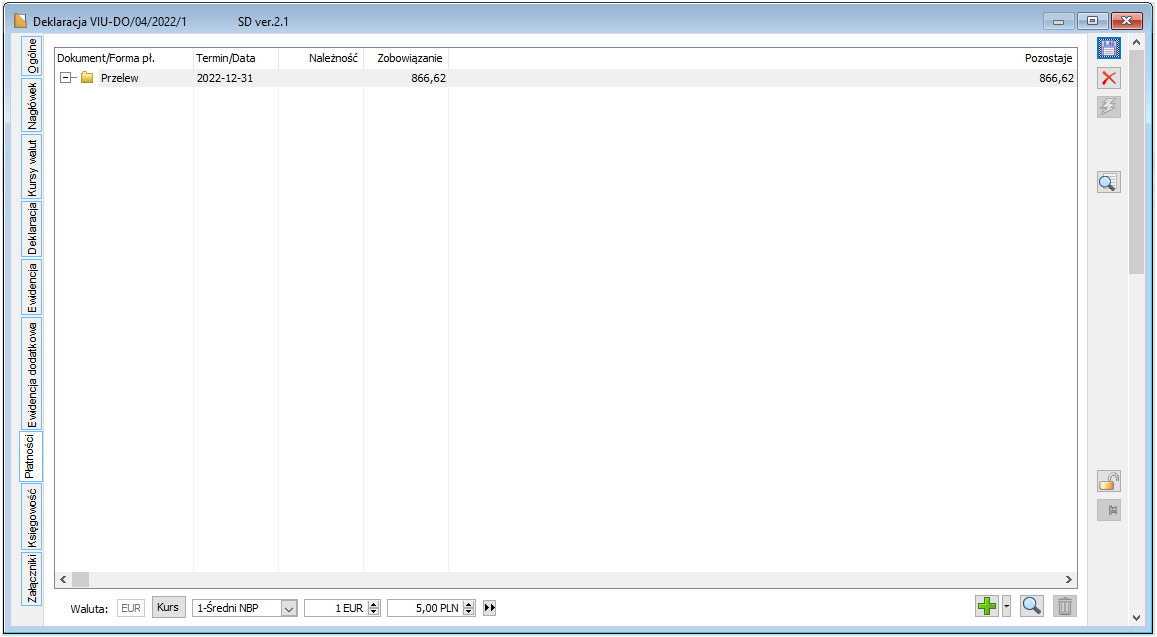

Payments

Accounting

Attachments

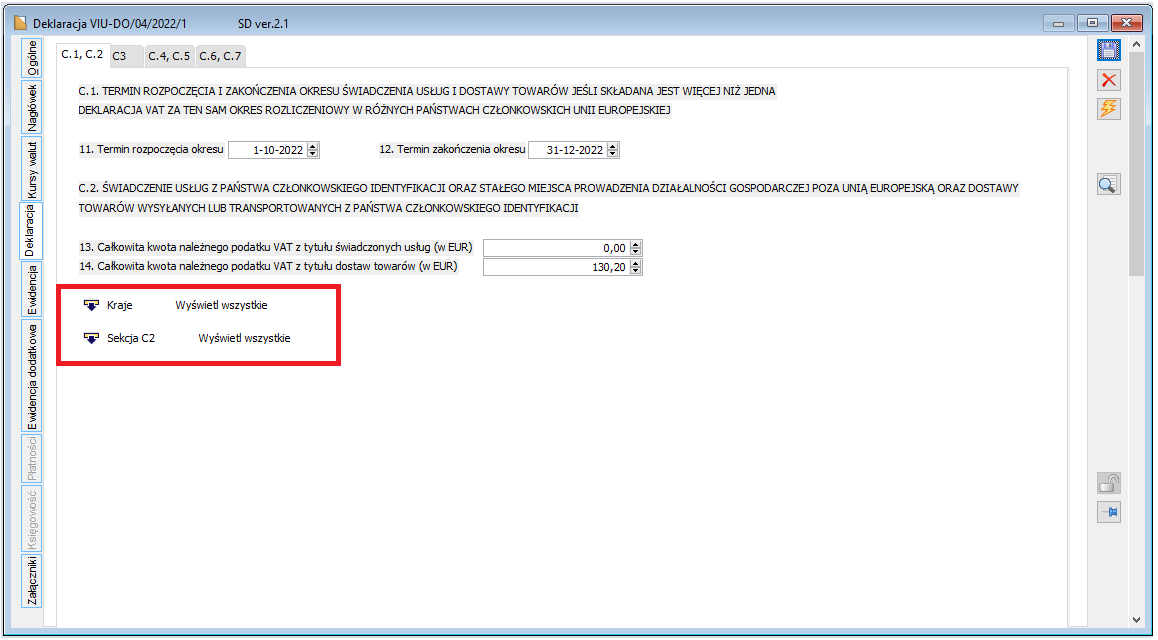

In a nutshell, the VIU-DO declaration form comprises a declarative and a record part.

-

-

- The declarative part is the equivalent of the VIU-DO declaration, on the basis of which an xml file is generated for submission to the Ministry of Finance’s e-Declarations (e-Deklaracje) gateway.

- The record part consists of two parts, from the tab level:

-

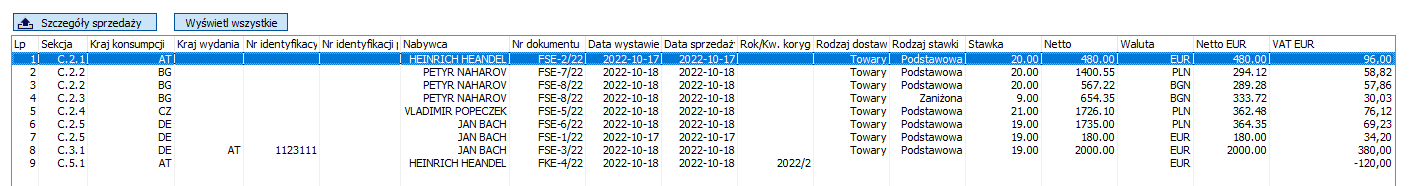

Record – the documents that are the source of the generation of the various sections on the VIU-DO declaration are presented

Additional record – for invoices listed on the Record tab, information on sold commodities, provided services is additionally presented

The export of data to Excel from both records should facilitate the taxpayer’s preparation of the records referred to in the Vat Act, Article 130 and Article 63c of the EU Council Implementing Regulation 2019/2026.

The records are not subject to submission to the Ministry of Finance’s e-Declarations (e-Deklaracje) gateway.

VIU-DO declaration statuses

In accordance with the adopted standard, four statuses were made available on the VIU-DO declaration:

-

-

- Buffer

-

Full data editing

Ability to calculate declarations – active Recalculate button

Possibility of trackless deletion of declarations

Possibility to submit draft declarations

No possibility to submit declarations in the final version (Submission)

-

-

- Accepted

-

No possibility to calculate declarations – inactive Recalculate button

Editing limited to [Payments], [Accounting], [Attachments] tabs

Possibility to submit draft declarations

Possibility to submit declarations in the final version (Submission)

No change of status to approved after submitting a declaration in draft version, upon receipt of a valid UPO

After sending the final declaration as Submission and receiving the correct UPO, automatic change of the status to Approved

-

-

- Confirmed

-

No possibility to calculate declarations – inactive Recalculate button

Editing limited to [Payments], [Accounting], [Attachments] tabs

Possibility to submit draft declarations

Possibility to submit declarations in the final version (Submission)

-

-

- Cancelled

-

According to the adopted standard, possibility to cancel a declaration with the status Approved

Rules, way of cancelling the VIU-DO declaration form analogous to e.g. JPK_V7 files

No possibility to submit draft and final declarations

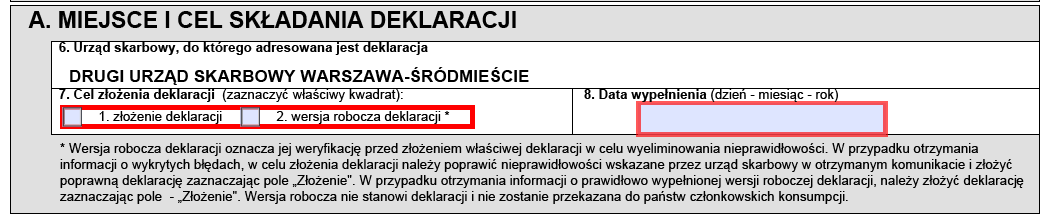

VIU-DO declaration form – “General” tab

On the General tab, the following data is available:

-

-

- In the Period section, the accounting year, quarter, which is suggested by default based on the year, quarter set in the list of declarations

- In the Number field – the sequence number of the form.

- In the Version field – the structure’s version number.

- In the Status field in selectable mode, options:

-

Buffer – default status

Accepted

Approved

Cancelled – status available on approved form

-

-

- In the Office field – the office indicated in the company stamp – see section on changes to the company stamp for details

- In the Entered by field – the code of the operator adding the form for the first time

- In the Modified by field – the code of the operator modifying the form

- In the Approved by field – the code of the operator approving the form

- In the Submitted by – the code of the operator, who submitted the form

- In the E-declaration verification, e-declaration status fields, depending on the type of submission, the information status

-

If the declaration is submitted as a draft and there is no verification information:

| Field | Information type |

| e-Declaration (e-Deklaracja) verification | In progress |

| e-Declaration status | Draft version |

If the declaration is submitted as draft and verification is correct:

| Field | Information type |

| e-Declaration (e-Deklaracja) verification | Correct |

| e-Declaration status | Draft version |

If the declaration is submitted as draft and verification is negative:

| Field | Information type |

| e-Declaration (e-Deklaracja) verification | Negative |

| e-Declaration status | Draft version |

If the declaration is immediately sent as a submission, enter None in the e-Declaration Verification field. Type of information displayed in the e-Declaration Status field analogous to JPK_V7

| Field | Information type |

| e-Declaration (e-Deklaracja) verification | None |

| e-Declaration status | According to the standard adopted on JPK_V7 |

Analogously to the JPK_V7 file form, the following fields are also presented:

-

-

- Reference number

- Registration date

- Confirmation date.

- URL

- Notes

-

A new feature is the UNR field. In this field, enter the unique reference number that the taxpayer receives when the declaration is submitted. The value of this field should be used in the title of the transfer. An example UNR for the EU OSS procedure is: PL/PLXXXXXXX/Q3.2022

More information here: https://www.podatki.gov.pl/vat/wyjasnienia/rozliczanie-podatku-vat-w-ramach-procedury-unijnej-oraz-nieunijnej-oss-i-procedury-importu-ioss/

VIU-DO declaration form – “Header ” tab

The [Header] tab contains the following data:

-

-

- In the Form section:

-

System code – “VIU-DO (1)”

Tax code – “VIU”

Liability type – “Z”

Schema version – “1-0E”

Form version – “1”

-

-

- Completion date – in this field, when the Recalculate button is selected, the current date is set, unless the current date is earlier than the date of the last day of the accounting quarter. In this case, the system will set the date of the last billing quarter + 1 day. This is evident from the explanation in the schema, which reads:… “The date of submission of the declaration or correction to the system must be no earlier than the day after the end of the quarter to which the declaration relates and no later than 3 years after the submission deadline”.

- Entity

-

If a non-natural person is selected in the company stamp, the following fields are made available on the form:

-

-

-

- VAT ID (NIP)

- Full name

- Phone

-

-

If a natural person is selected in the company stamp, the following fields are made available on the form:

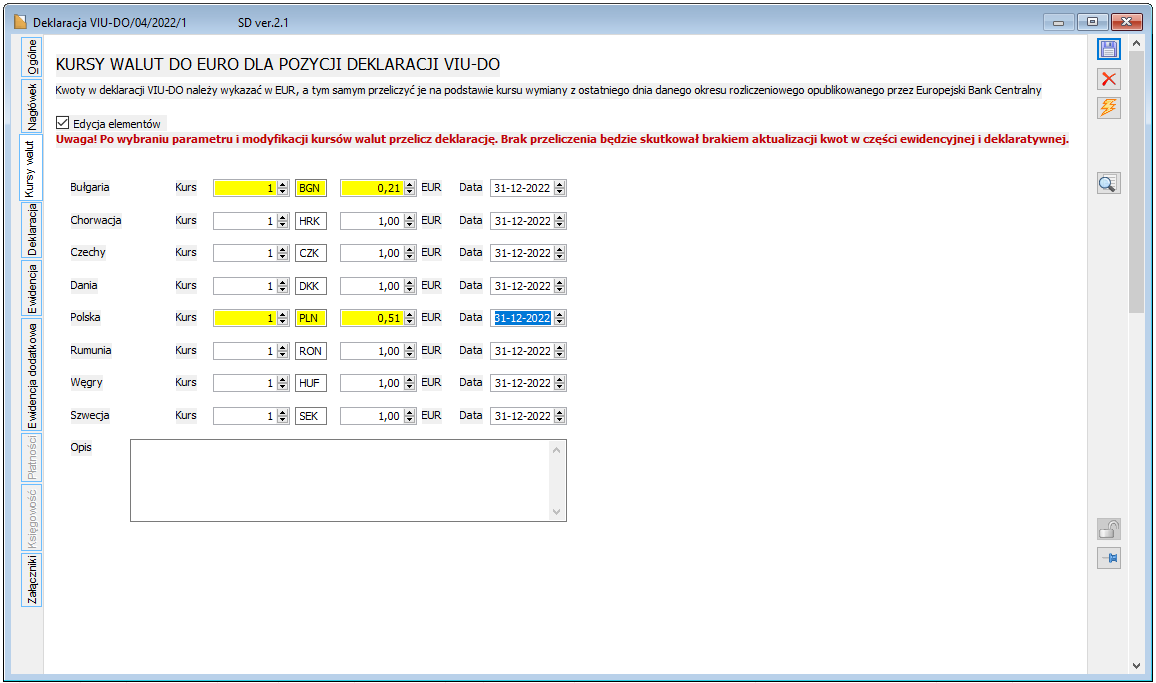

VIU-DO declaration form – “Exchange rates ” tab

Transaction amounts on the VIU-DO declaration (Net, VAT) are expressed in Euros and are not subject to rounding.

If payments for the supply of goods or services were made in currencies other than Euro, the exchange rate published by the European Central Bank (ECB) on the last day of the relevant accounting period, or if not published on that day, the exchange rate published on the following day, shall be used for their conversion into Euro.

From the [Exchange rates] tab, it is now possible to enter exchange rates for transactions expressed in currencies other than Euro. It features:

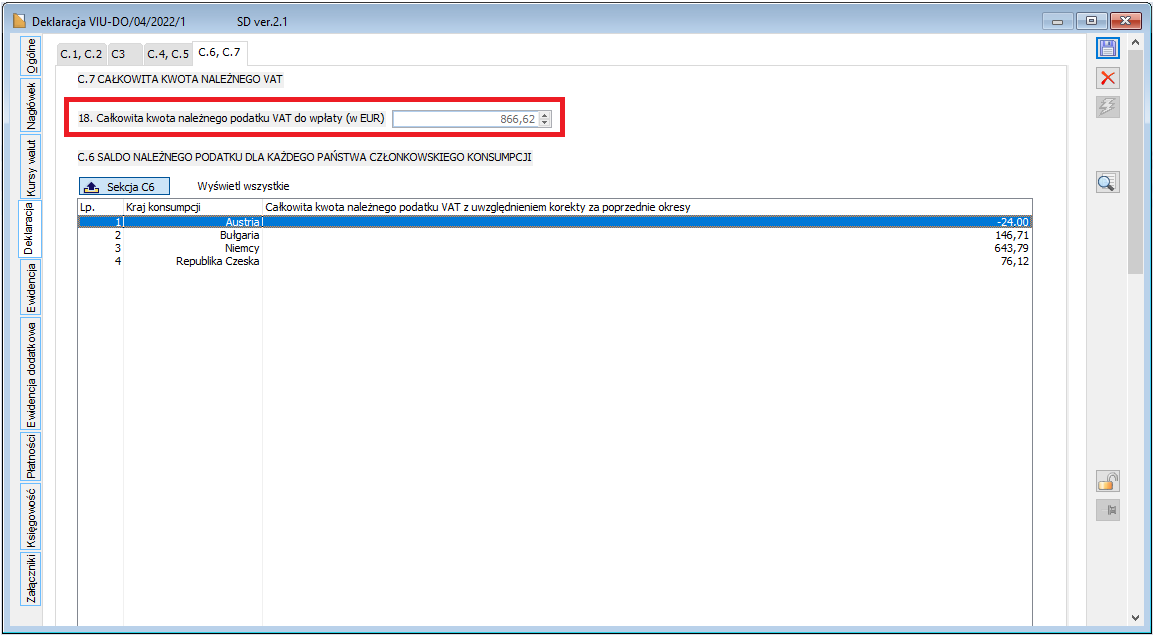

-

-

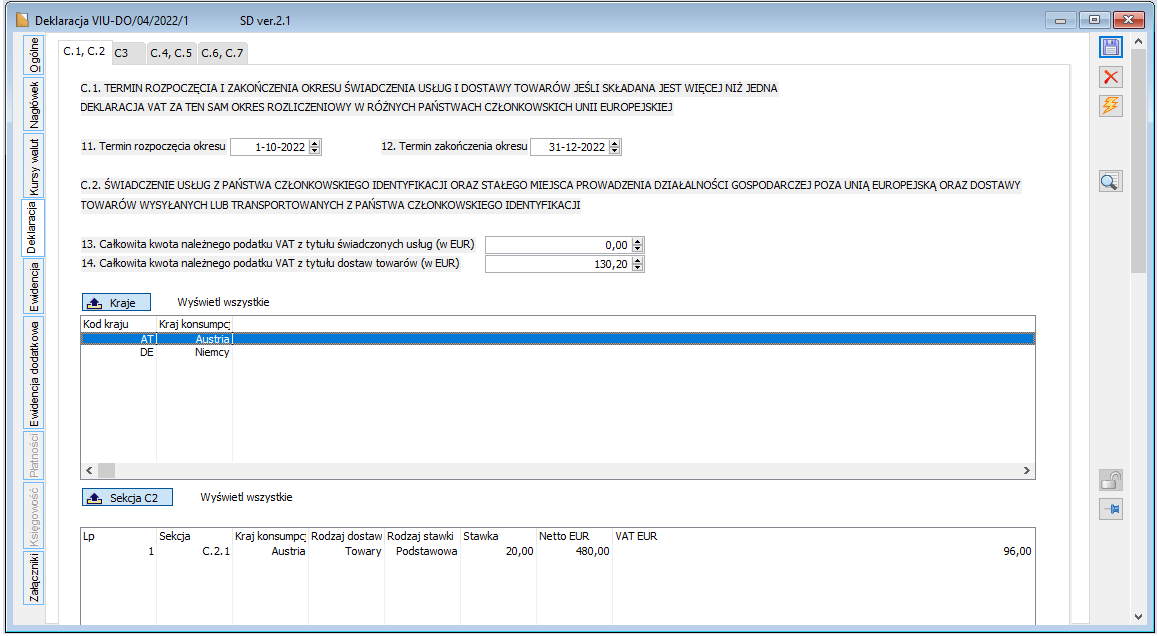

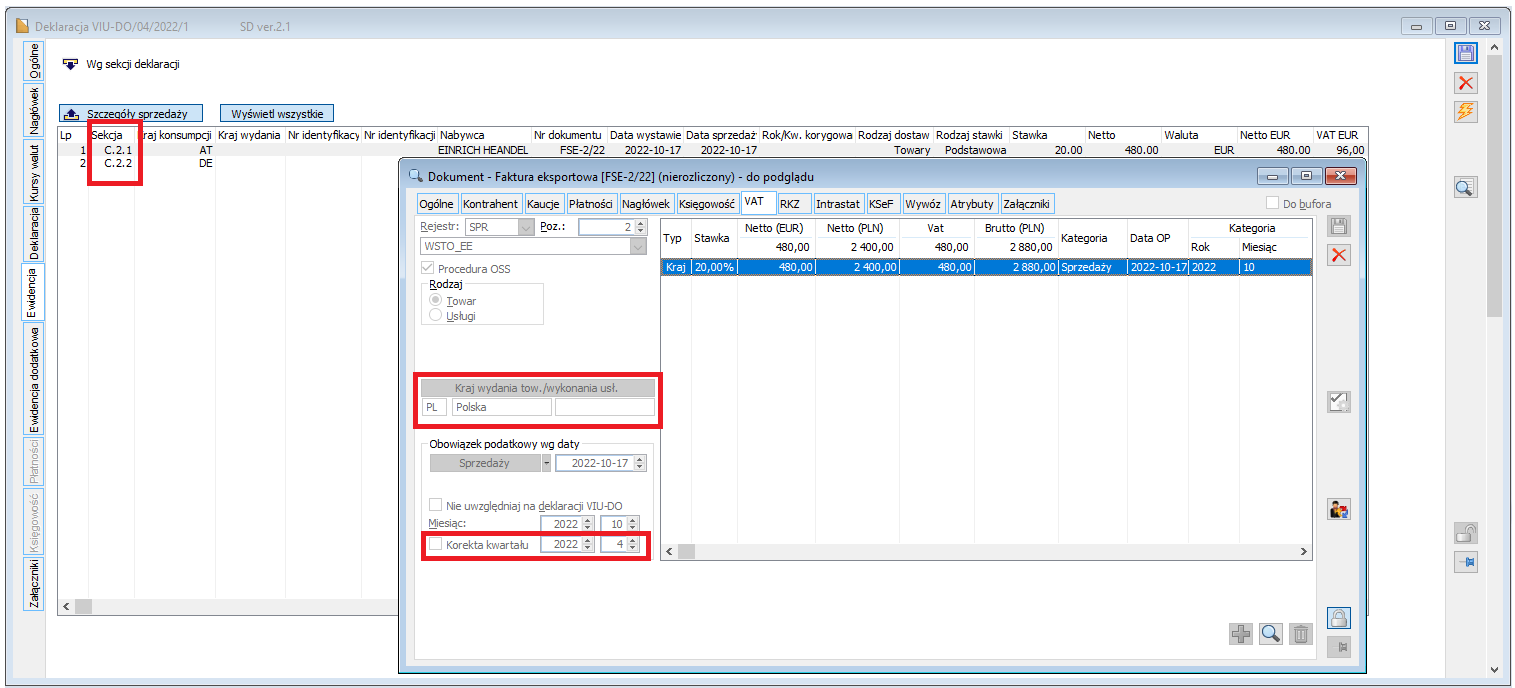

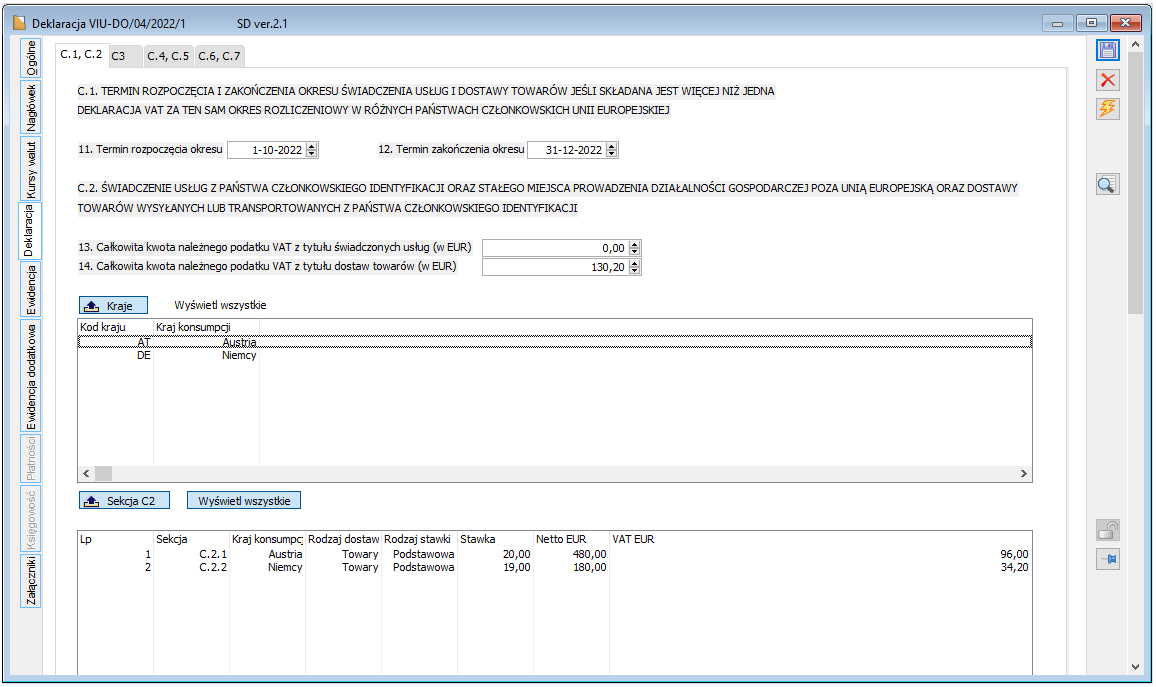

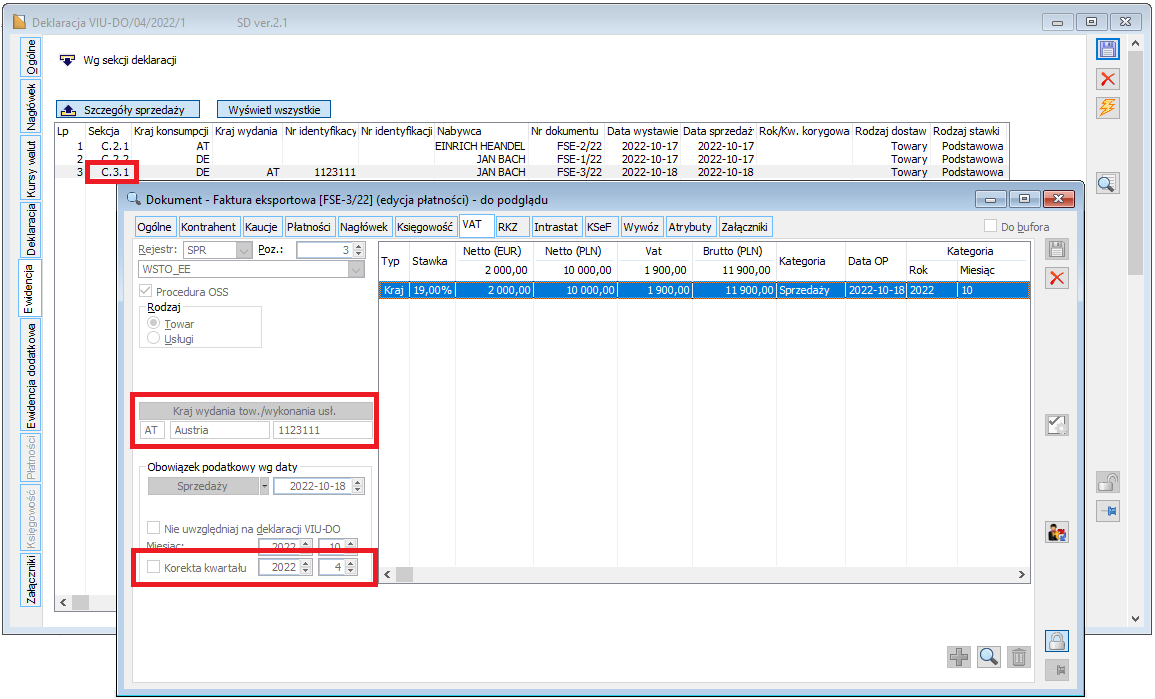

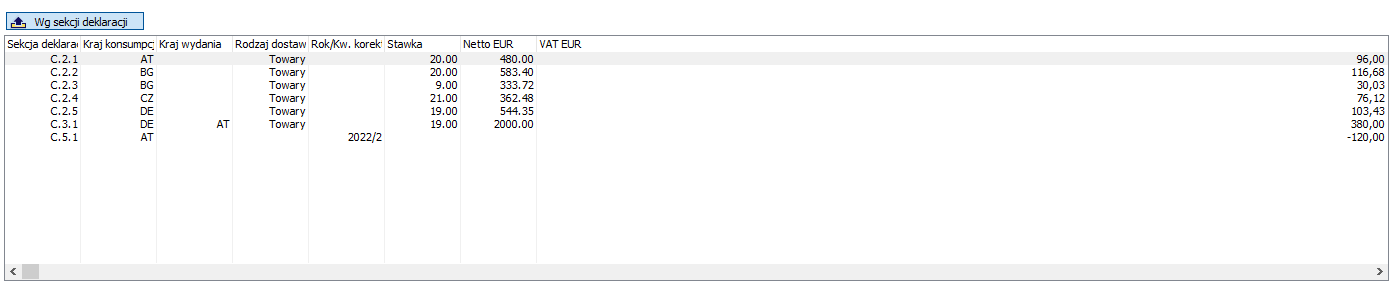

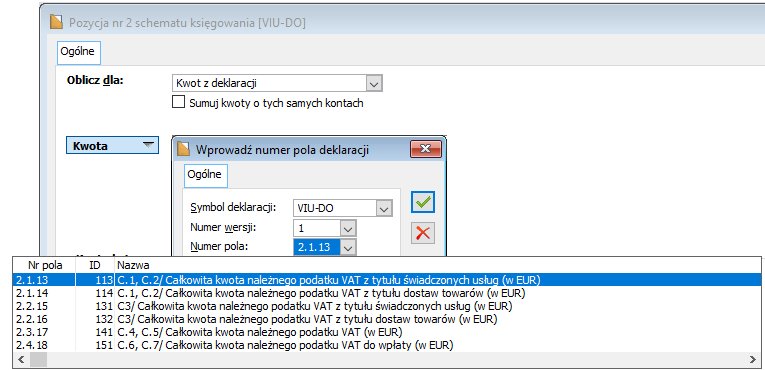

- Editing parameters parameter. Selecting this activates fields which allow to enter rates of exchange to Euro for the eight currencies of the countries which have not joined the Monetary Union