General information

Before starting to work with the Sales module, it is necessary to configure it, i.e. to define the basic parameters necessary for registering sales transactions. This article describes the meaning of each parameter and the way in which they can be adjusted.

To begin configuring the module, select the System option from the main menu. Next, click the Configuration button on the drop-down list. The Configuration window will be opened.

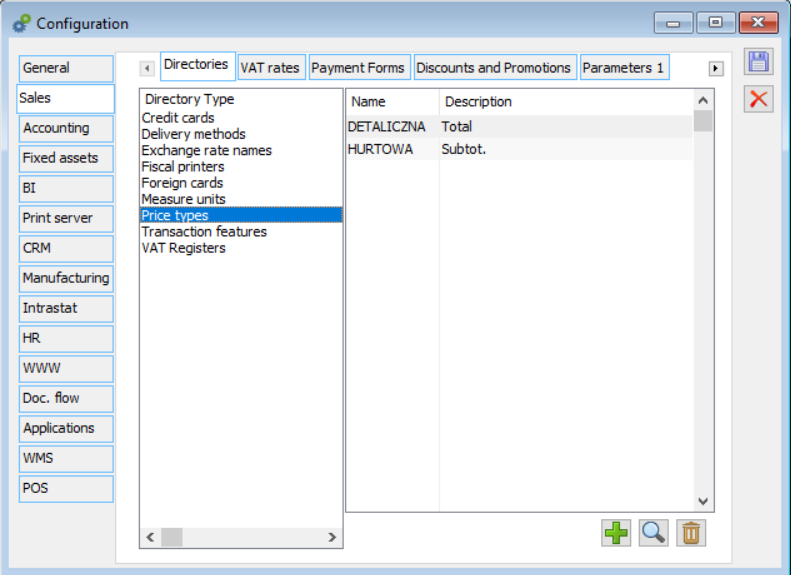

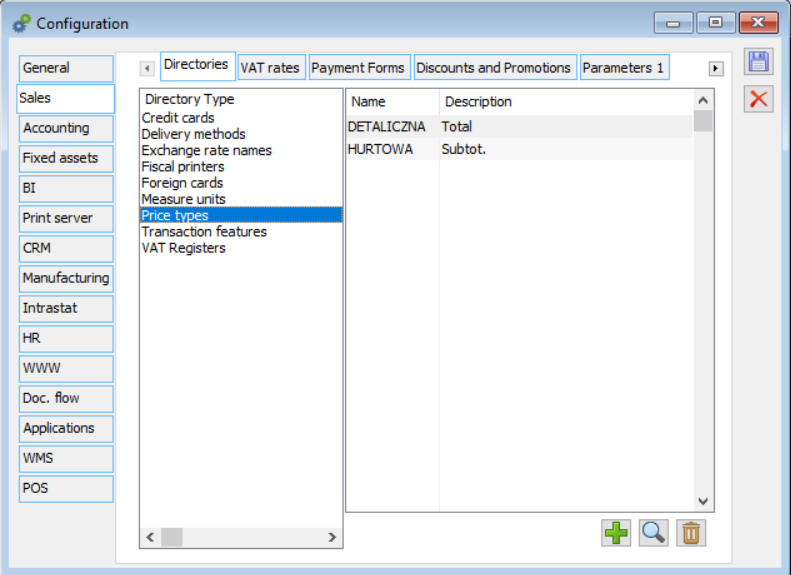

Configuration, Sales/Directories tab

Directories are the lists of parameters available for selection when entering data. When the user works with the Sales module, directories appear as the lists of available values that can be entered. Users with sufficient permissions may add, edit, and delete directory items.

The Directories tab is divided into two panels. The left panel displays directory names, while the right one – the content (items) of a currently selected directory (name and description). Most directories contain items consisting of a name and description only.

In order to add a new directory item, it is necessary to:

select a directory, highlighting it in the left panel of the window:

select the ![]() [Add element] button, enter data in the new directory item window, and save the item using the

[Add element] button, enter data in the new directory item window, and save the item using the ![]() [Save] button.

[Save] button.

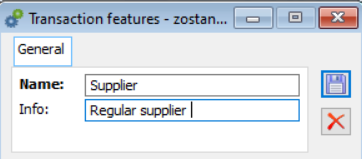

Transaction features: parameters of the Description type that can be assigned to trade and warehouse documents. They make it possible for such documents to be further distinguished in analyses.

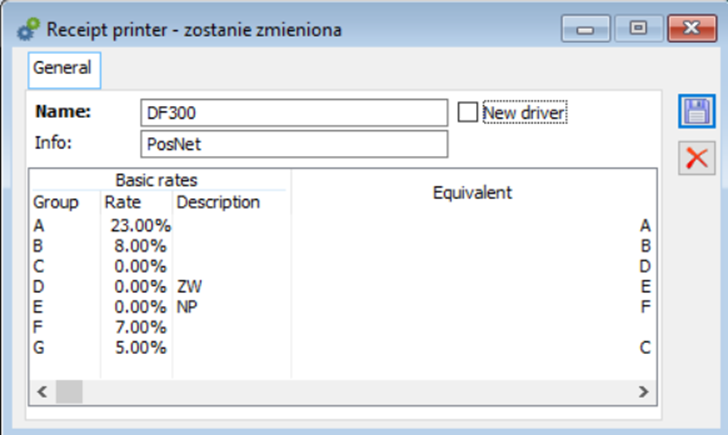

Fiscal printers: receipt printers available in the system. Apart from their name and description, it is also possible to edit VAT rate codes used by a given printer. They can be different than rate codes used in the system (VAT rate definitions). In the editable column Equivalent, it is possible to change a rate code, which, by default, is consistent with the system code. The correct assignment of VAT rate codes is necessary for the proper integration of the system and a receipt printer (or, more precisely, its driver). The system supports two types of receipt printers: Posnet and Elzab. If Posnet driver is selected, the system will find DF300 name on the list of available printers and will read VAT rate codes (from the Equivalent column). Elzab driver retrieves VAT rate codes after searching FP600 name. If printers of these types are used, printers named DF300 and FP600 should be defined in the system. A driver for a given workstation may be selected with the use of the option Computer configuration in the Administrator module. If a driver name is not given in the Fiscal printer window, a notification about the missing configuration of VAT rates for the printer is displayed when attempting to print.

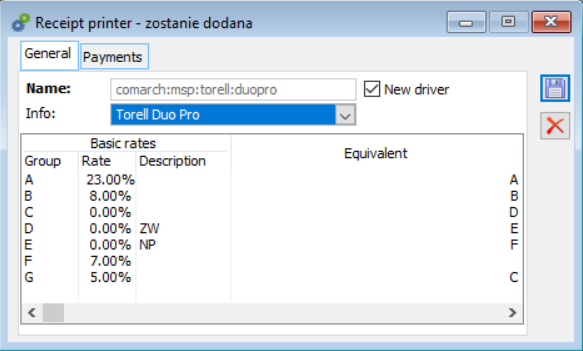

Version 2013.5 of Comarch ERP XL has introduced additional drivers for receipt printers, or the so-called New drivers. In connection with their introduction, changes have been made in Comarch ERP XL interface:

In the system configuration, on the tab Sales/Directories/Fiscal printers, a parameter New driver has been added. If the parameter is selected, an additional field is activated in the Description field, containing the list of receipt printers used in the terminal mode (marked with the word Terminal at the end of their name),

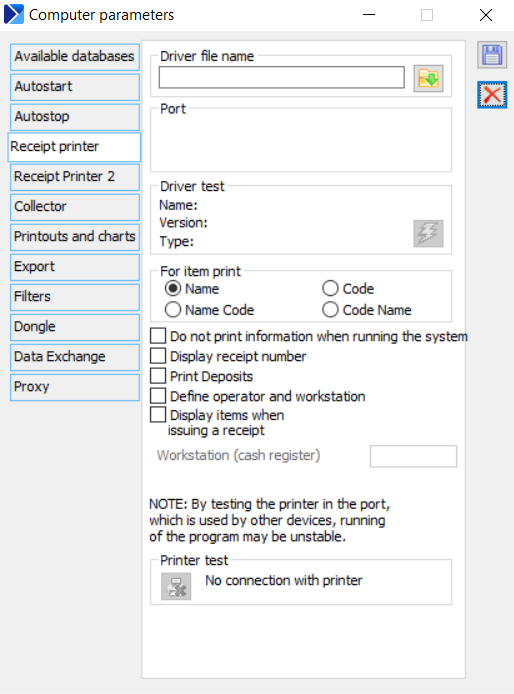

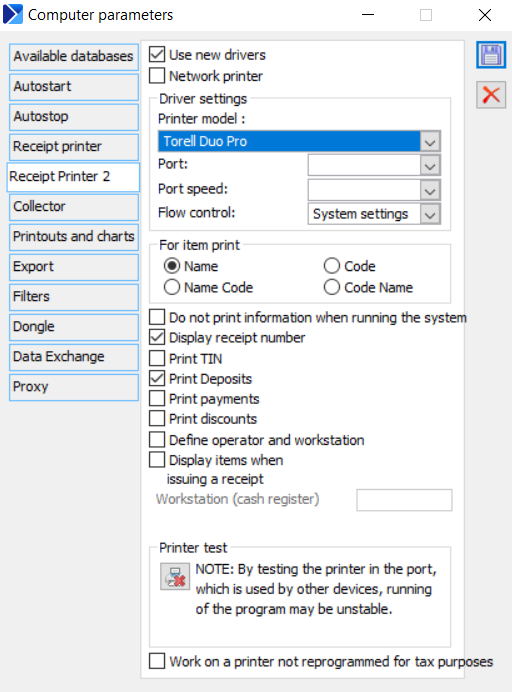

In the computer configuration, a new tab Receipt Printer 2 has been added. In order to make use of the so-called New drivers, it is necessary to select the option Use new drivers and choose an appropriate printer. Depending on the printer, it is necessary to configure driver settings (enter a port, its speed, define flow control parameters), select one of the options to be sent to the printer for items (name, code, name code, code name) and adjust other options (similar as in the case of drivers configured on the Receipt printer tab). Additionally, it is necessary to determine whether it should be possible to work on a printer not reprogrammed for tax purposes.

After configuring the abovementioned options and connecting the printer physically, it is necessary to perform a printer test (as shown in the screenshot below).

Measure units: units used to record item quantities.

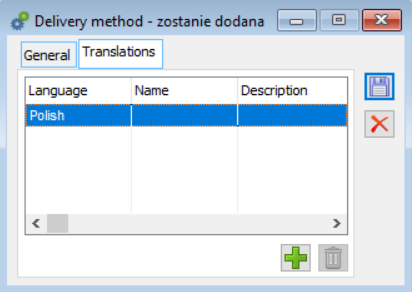

The window Measure unit is composed of two tabs: General and Translations. On the General tab, it is possible to enter the name and description of a unit, while the Translations tab makes it possible to add the translation of a given name into a specific language. After selecting the [Add] button, the user needs to select in the Language column a language predefined in the category directory and enter a name and description.

Credit cards: types of credit cards used by customers/vendors.

Exchange rate names: the system makes it possible to define multiple exchange rates for a single currency. In this place, the user can define exchange rate names to be used in transactions. The values of particular exchange rates for each currency are entered in the currency table.

Foreign cards: types of customer cards issued by third companies. Foreign cards may be used to identify a customer/vendor; the type and number of a foreign card can be saved on the customer/vendor form.

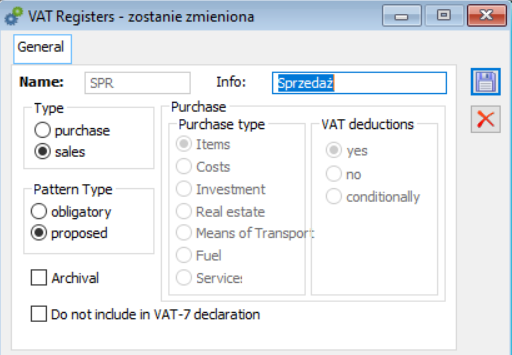

VAT Registers: a VAT register is a record in which transactions subject to VAT are registered. Each document subject to VAT must be stored within one of such registers. VAT registers have names, descriptions, and parameters. At least two VAT registers must be defined in the system: one for sales, and one for purchase transactions.

General parameters:

- Type – purchase and sales register

- Pattern Type – the settings of parameters discussed below, adjusted for particular register types (Sales and Purchase), are transferred into a trade document directed to a given register. If the option obligatory is selected, these parameters cannot be edited on the document form.

Parameters for Purchase register type

- Purchase type: selecting this parameter allows the user to differentiate register items into ones including item purchases, cost purchases, and investment purchases (of fixed assets). The distinction between the purchase of items and the purchase of fixed assets is reflected in the items of the VAT 7 tax return.

- VAT deductions:

- Yes – the tax will be deducted; more precisely, it will be included in the VAT 7 tax return as part of the item for purchases related to taxable sales only.

- No – the tax will not be deducted; more precisely, it will not be included in the VAT 7 tax return.

- Conditionally – the tax will be deducted if it is allowed by the proportion of taxable to exempt sales; more precisely, it will be included in the VAT 7 tax return item for purchases related to taxable and exempt sales.

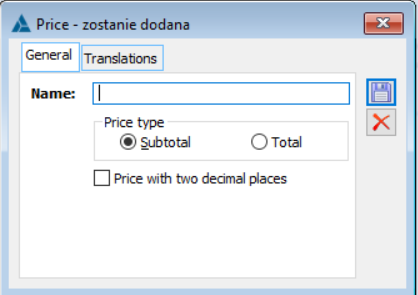

Price types: the system makes it possible to determine multiple price types. In this place, the user can define prices to be used in transactions. Next, the prices are assigned to centers, item groups, and items.

The Price window is composed of two tabs: General and Translations. When adding a price, it is necessary to specify its type (Subtotal/Total). It is also possible to decide whether the price should be determined in cents (to 2 decimal places) or not (to 4 decimal places). In configuration, the user can also change these parameters for an already existing price. A price can be deleted from configuration only in the case where the selected price type has not been assigned to any item.

On the Translations tab, it is possible to enter a translation of a price name. To do so, the user needs to select the [Add] button, choose a langage defined in the category directory, and enter a translated name. It is possible to enter translations in multiple languages; they will be displayed on the list.

Delivery methods: the system makes it possible to add multiple delivery methods. In this place, it is possible to define the name of a vendor, a description, and translations.

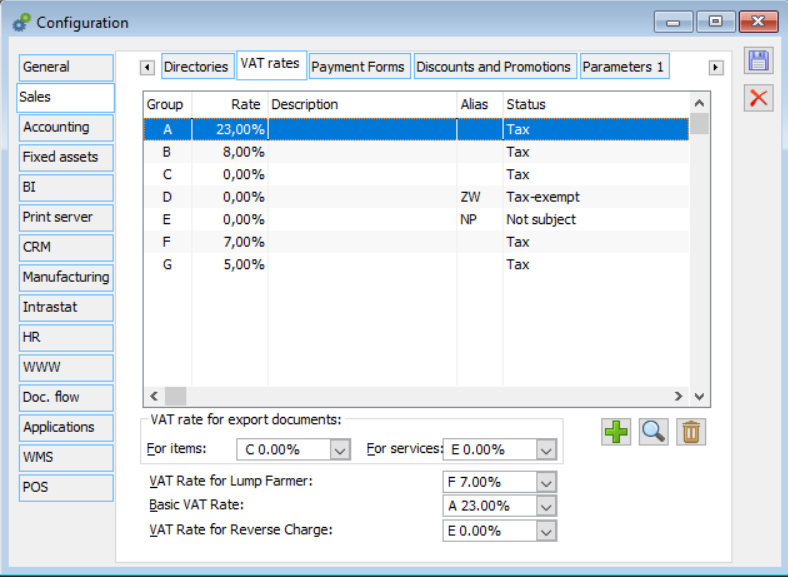

Configuration, Sales/VAT rates tab

There are 9 predefined VAT rates in the system. The user can edit them or add new ones. The system makes it possible to assign a letter designation appropriate for a specific receipt printer to all defined VAT rates. In practice, these designations coincide with the “system” tags; however, the user is free to change them and the system allows the assignment of the same designations to different rates, which may be particularly useful if the new VAT rates are assigned the same letter designations as before. Therefore, the adopted “freedom” of designations allows the parallel use of, for instance, such rates as A 22%, A 23%. Upon the creation of a new database, VAT rates binding from 01-01-2011 are displayed.

One of the VAT rates may be selected as a rate for export documents:

For items – tax with a 0% rate

For services – not taxable

Rates for export documents are later used in:

Export documents – if the Export VAT parameter is selected

Other trade documents – if the VAT 0% parameter is selected

The VAT rate for a lump (flat-rate) farmer is a special rate used when dealing with this type of entity. The rate is entered by default in VAT RR (FRR) invoices documenting purchases from flat-rate farmers (more information on the VAT RR invoice may be found in the VAT RR invoice chapter).

The basic VAT rate is used to set a default VAT rate in a-vista documents registered by adding values directly to the VAT table.

The VAT rate for reverse charge is used to set a default VAT rate to be suggested for items added to documents. In order for the VAT rate for reverse charge selected in the configuration to be applied to document items, it is necessary to select the Reverse charge parameter on the item form and the Handling of VAT reverse charge parameter in the configuration (on Parameters 2 tab).

As of version 2019.2, the method of mapping VAT rates for newly added fiscal printers has changed. The default assignment of letter designations for fiscal printers is in accordance with the Regulation of the Minister of Finance on cash registers dated April 29, 2019, and looks as follows:

- A – 23%

- B – 8%

- C – 5%

- D – 0%

- E – 0% ZW

- F – 0% NP.

A purchase invoice received from a vendor should be issued using the NP VAT rate; a relevant item is then not included on the tax return. In this correct situation, only internal sales and purchase invoices are included on the tax return.

It is important to check that a correct VAT rate is set on the list of VAT rates following a conversion.

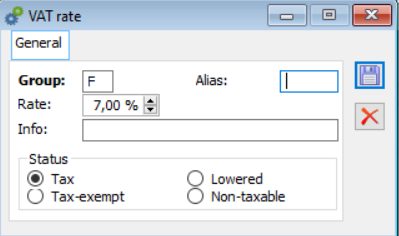

Parameters:

Alias: an additional, user-defined rate code, displayed along with the primary letter designation.

Status:

- Tax – a rate for items subject to VAT

- Tax-exempt – a rate for items exempt from VAT

- Lowered – a rate lower than the statutory rate, applied on the basis of an administrative decision

- Not subject – a rate for items not subject to VAT

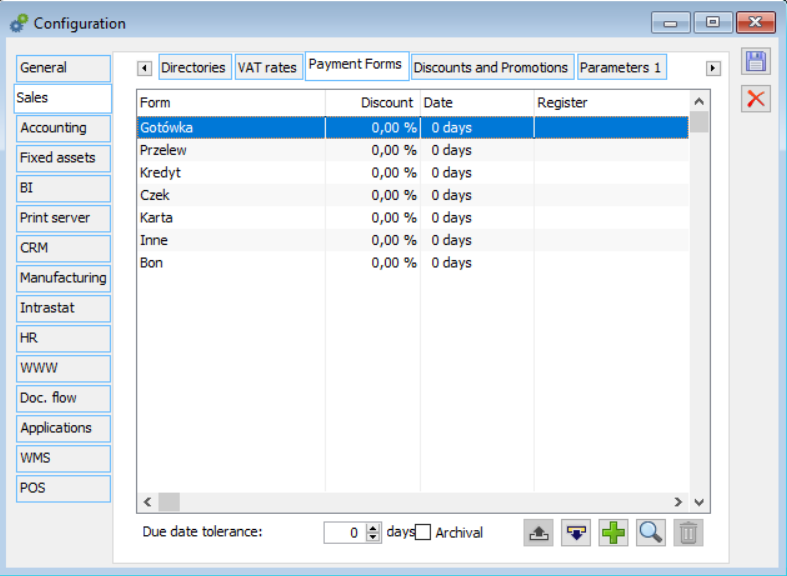

Configuration, Sales/Payment Forms tab

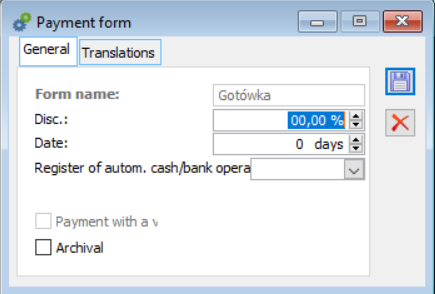

Payment forms are used when issuing trade documents and can be assigned to customers/vendors. The system contains 6 predefined payment forms grouping other, user-defined forms. Each payment forms is characterized by the following parameters:

Discount: if a percentage discount is assigned to a given payment form, it will be additionally applied in transactions using this payment form, according to a discount calculation method used.

Date: a default due date for a given payment form.

Register of automatic cash/bank operations: assigning a register (account) to a payment form makes it possible to register deposits at the level of a trade document.

Due date tolerance: a uniform value for all payment forms, expressed in days; it is only applicable when calculating the allowable amount of overdue customer/vendor receivables, according to the parameter Delayed on the customer form. A payment is overdue if its due date has been exceeded by a number of days greater than the tolerance value.

Archival – when this parameter is selected, the list also shows payment forms marked as Archival.

The option to archive payment forms has been introduced in version 11.0. Payment forms marked as archival cannot be selected in the following areas of the system:

- Customer/vendor form – sales/purchase payment form fields

- Customer/vendor group pattern – sales/purchase payment form fields

- Customer/vendor form – Pay form field

- Payment windows

- Payments register entry form – Payment form field

- Trade document form – Payment form field

- Payment definition

- Company structure – Payment Forms tab

The Payment Forms tab in the Company structure window contains the Archival parameter. When this parameter is selected, the list also shows payment forms marked as Archival.

Other parameters

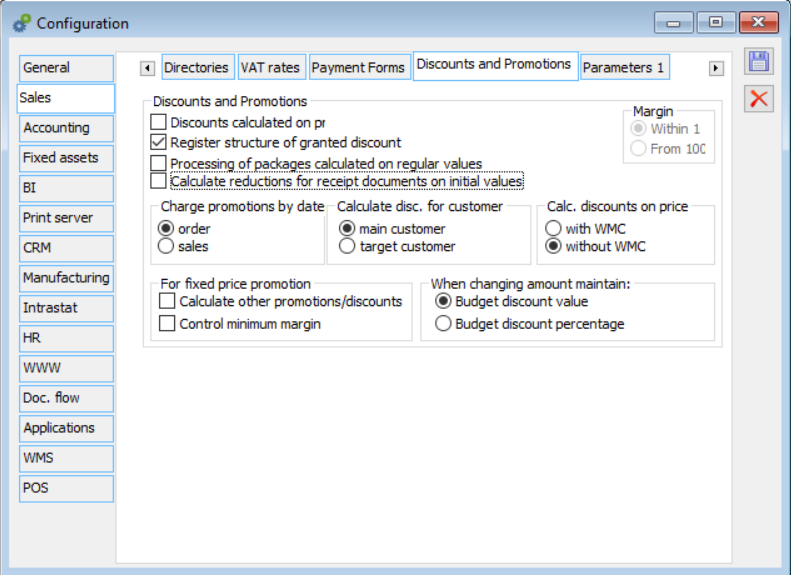

Configuration, Sales/Discounts and Promotions tab

The tab contains the following fields:

Margin

Within 100: according to the formula:

100 x (sales price – purchase price) / sales price (values: – ∞…100)

From 100 (mark-up): according to the formula:

100 x (sales price – purchase price) / purchase price (values: -100…+∞)

The parameter is editable only until the registration of the first transaction.

Charge promotions by date – selecting one of the options:]

- order

- sales

affects the calculation of promotions when converting an order, e.g. to a sales invoice. The system will then calculate discounts effective on the date of issue on either the order or sales invoice, depending on the parameter.

Calculate disc. for customer – selecting one of the options (main customer, target customer) affects the calculation of promotions for customers selected in documents.

Calc. discounts on price – adjusting this option affects the method of calculation of an effective discount. If:

The option is selected – discounts will be calculated on the basis of a price with WMC. First, the system will calculate a price (based on a regular price including a WMC rate and effective discount); then, it will calculate a value (price multiplied by quantity).

The option is deselected – discounts will be calculated on the basis of a price without WMC. First, the system will calculate a value (based on a regular price less a WMC rate, quantity, and discount); then, it will calculate a price (value divided by quantity).

WMC rates are defined in category directories in the Administrator module (Transactions branch). In the WMC rate window, the user may define the following parameters: Code, Name, Subtotal Rate (to two decimal places). The rate is expressed in the system currency.

More information on discounts may be found in the Promotions and discounts chapter.

In the case of fixed price promotions, selecting the parameter Calculate other promotions/discounts makes it possible to calculate other promotions or discounts on a given item. The latter parameter pertains to the control of minimum margin for fixed price promotions.

Processing of packages calculated on regular values – if this parameter is selected, the system will save and display information on applied discounts based on regular values.

Register structure of granted discount – if this parameter is selected, the system will save and display information on applied discounts in the window Structure of granted discount

Calculate reductions for receipt documents on initial values – if this parameter is selected, discounts in documents issued for received items will be calculated based on regular (initial) price/value, as in the case of documents issued for released items.

Segments of warehouse address – address segments are terms used to identify warehouse locations. The user may enter custom names in the fields, editing the default ones.

When changing amount maintain:

- Budget discount value – upon a change to an item quantity, the system maintains the amount of an applied budget discount

- Budget discount percentage – upon a change to an item quantity, the system maintains the percentage of an applied budget discount

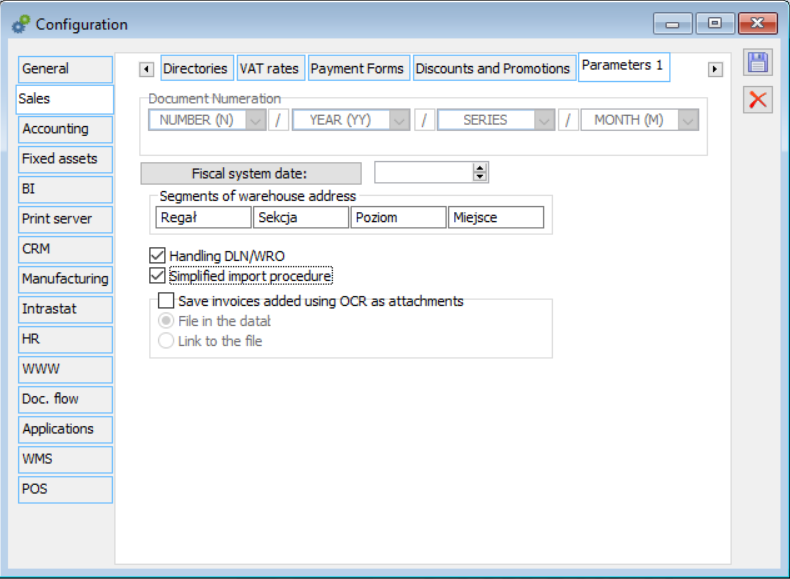

Configuration, Sales/Parameters 1 tab

The tab makes it possible to adjust the following parameters:

Document Numeration – the document numbering (identification) scheme. It is composed of either 3 segments: subsequent number, year, and series, or 4 segments: subsequent number, year, series, and month. The user can determine the order and format of these segments. The scheme is editable only until the registration of the first document.

Fiscal system date – if the date has been determined and is earlier than the current date, confirming a receipt or fiscal invoice results in the printing of such a fiscal document. If communication with a fiscal (receipt) printer cannot be established (and the printout cannot be made), it will not be possible to confirm the receipt. The date is editable only until the registration of the first fiscal document.

Simplified import procedure – it allows the user to issue documents according to the simplified import procedure.

Handling DLN/WRO – selecting this parameter activates the list of warehouse release order and delivery note documents in WMS Dispatcher Panel window. If the parameter is selected, DLN/WRO warehouse documents will be generated by default in Comarch ERP XL.

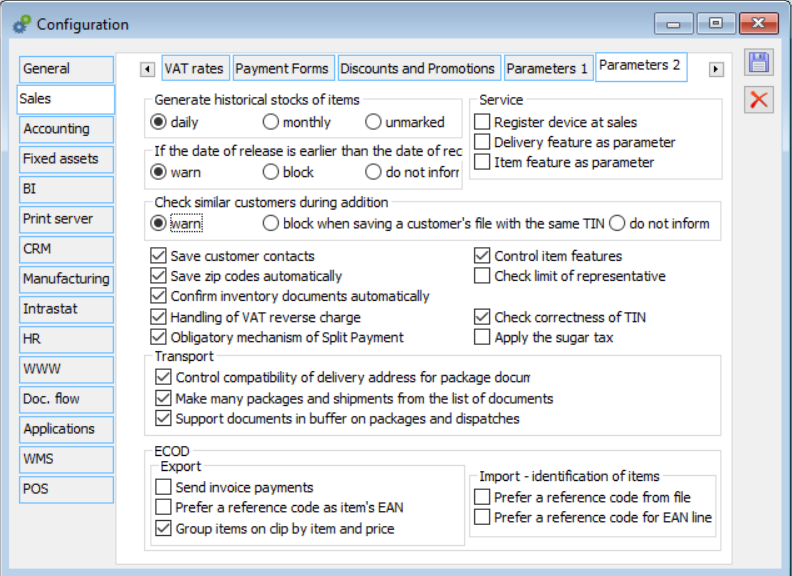

Configuration, Sales/Parameters 2 tab

Generate historical stocks of items: depending on this parameter, the system may (or may not) provide information about the stock levels of each item at the end of any day or any month. If the user selects the daily or monthly option, each operation involving the change of an item’s status results in a corresponding change of the historical stock level of this item at the end of the operation’s day or month. If a change-of-stock operation is performed retroactively, historical stock levels for subsequent days or months are recalculated, if saved. Therefore, historical stock levels for the current day or month are always tantamount to the current stock levels.

If the date of release is earlier than the date of receipt: depending on the setting, an attempt to add an item with a purchase date later than the date of sale to a sales document, the system will display a warning, block the attempt, or ignore it (allow the addition).

Control item features – items with the same code may be additionally differentiated when recording turnover (issuing trade documents) if they have the appropriate settings for the control of features. Providing the features of such items when issuing trade documents will be optional or mandatory, depending on the Control item features parameter. If the parameter is selected, a warning message will be displayed when an attempt is made to confirm a document without specifying a feature for an item (transaction element) for which the feature is required. If the feature control is not used, it should be disabled in order to improve system performance.

Save customer contacts – it enables the feature of saving contacts on the customer form upon the issuing of a sales document for an item for which the Cont. w. customer parameter has been selected on the item form.

Check similar customers during addition – if the parameter is selected, the list of customers/vendors with similar data (name and city) is displayed when adding a new customer/vendor (if such similar customers/vendors are available in the system). The check is not performed if the user adds a unique TIN number of the new customer/vendor.

Confirm inventory documents automatically – discrepancies reported in inventories are corrected with the use of IR+ documents (receipt of surplus items) and IR- documents (release of shortages). The documents are generated upon the confirmation of an inventory sheet. If the parameter is selected, the documents will be generated as confirmed and non-editable.

Control compatibility of delivery address for package documents – the parameter is used for the purpose of handling shipments. If it is selected, a package can only be created from items destined for one recipient, shipped to the same address. With this setting, the system allows the user to assign to a single package only those trade documents that have the same delivery address.

Due to changes related to Comarch Shipping this control has been made more precise so that documents without a specified customer will always be assigned to a single package; in turn, documents with a specified customer will be assigned to different packages.

Example: the parameter Control compatibility of delivery address for package documents is selected in the configuration. Several documents have been selected on the list of receipts, two of which have no customer assigned. The remaining documents are directed to the same customer (one with the same address). After the user chooses the option to generate packages from the selected documents, the system generates two packages with the parameter Documents with the same address activated: one package contains receipts with no customers , and the other one contains the remaining receipts.

Make many packages and shipments from the list of documents (only for document generation) – the parameter can be selected after selecting the previous one, i.e. Control compatibility of delivery address from package documents. Selecting this parameter changes the execution of the operation Dispatch out of indicated available in the context menu of the lists of trade, service, and order documents and on the list of packages. The operation will first create packages with the activated parameter Documents with the same address, and then a separate dispatch is created for each of these packages.

Support documents in buffer on packages and dispatches – selecting the parameter determines whether unconfirmed documents will be supported for packages and dispatches.

Check limit of representative – the limit is the maximum credit amount that all customers associated with a representative can have in total. A customer marked as a representative may have an assigned list of credit limits. If the parameter is selected, it will be necessary to enter a representative when issuing a sales document. If a limit is exceeded, the system will react according to the user’s permissions, or more specifically, according to the settings in the document definition: it will either prevent the transaction from being registered or will display a warning.

Save zip codes automatically – this parameter determines whether a new zip code will be automatically recorded on the list of codes when it is entered on the customer/vendor form.

Handling of VAT reverse charge – selecting the parameter activates mechanisms enabling items subject to the reverse charge procedure to be registered in the system. It activates the parameter Generation of ISI document in the PI document definition, as well as the option of generating ISI documents to PI on the list of purchase invoices.

Check correctness of TIN – an optional verification of the correctness of TIN numbers with regard to the number and type of characters used (in relation to Polish tax identification numbers). If this parameter is selected and the user enters an incorrect TIN number of a domestic customer/vendor as part of that customer’s/vendor’s form or address, an appropriate message will be displayed and the user will not be able to save the form. Moreover, it will not be possible to save a company stamp for a PL company with an incorrect TIN. If the parameter is selected, a relevant question/warning will also be displayed upon an attempt to save an employee form with an incorrect TIN number. Deselecting this parameter is useful when Comarch ERP XL system is installed outside Poland.

Service – the section includes parameters used for the automatic registration of a device used for service jobs. More information on the functionality of these parameters may be found in the Service module documentation.

ECOD – Export:

Send invoice payments – this parameter determines whether the <Payments> section specifying the type and number of payments on an invoice will also be sent when an SI document (INVOICE message) is exported to ECOD. The parameter is supported when exporting invoices in a format for retail chains.

Prefer a reference code as item’s EAN – the parameter determines whether the system should first search for the internal code or reference code of an item when the EAN line is being entered.

Group items on clip by item and price – if the parameter is selected, items on clips in ECOD files will be grouped according to the selected criterion.

ECOD – Import – identification of items:

Prefer a reference code from file – the parameter determines whether a reference code will be used to identify items.

Prefer a reference code for EAN line – the search order upon item identification based on EAN lines has been parameterized: the system will start either from internal codes or from reference codes. In either case, the system will first look for codes with an auxiliary unit assigned and if none are found, for codes with a basic unit.

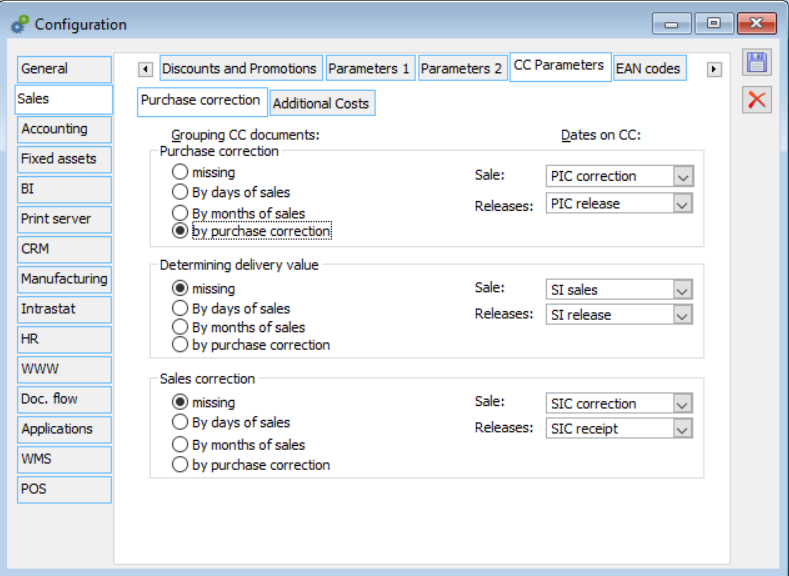

Configuration, CC Parameters tab

Purchase correction

Grouping CC documents and Dates on CC – options in these sections affect the grouping methods in CC documents and the dates of these documents.

Purchase correction:

Missing – selecting this option allows the user to select a relevant date for CC documents:

Sale: SI sales, PIC correction date

Releases: SI sales, SI release, PIC release

By days of sales – selecting this option allows the user to choose a relevant date for CC documents:

Sale: SI sales

Releases: SI sales, PIC release

By months of sales – in date fields in CC:

Sale: SI month of sales

Releases: SI month of sales, PIC release

By purchase correction – in date fields in CC:

Sale: PIC correction

Releases: PIC correction, PIC release

Determining delivery value:

Missing – selecting this option allows the user to select a relevant date for CC documents:

Sale: SI sales

Releases: SI sales, SI release

By days of sales – selecting this option allows the user to choose a relevant date for CC documents:

Sale: SI sales

Releases: SI release

By months of sales – in date fields in CC:

Sale: SI month of sales

Releases: SI month of sales

By purchase correction – in date fields in CC:

Sale: POR purchase

Releases: POR purchase, POR receipt

Sales correction:

Missing – selecting this option allows the user to select a relevant date for CC documents:

Sale: SIC correction

Releases: SIC correction, SIC receipt

By days of sales – selecting this option allows the user to choose a relevant date for CC documents:

Sale: SIC correction

Releases: SIC correction, SIC receipt

By months of sales – in date fields in CC:

Sales: SIC month of correction

Releases: SIC month of correction, SIC month of receipt

By purchase correction – in date fields in CC:

Sale: PIC correction

Releases: PIC correction, PIC release

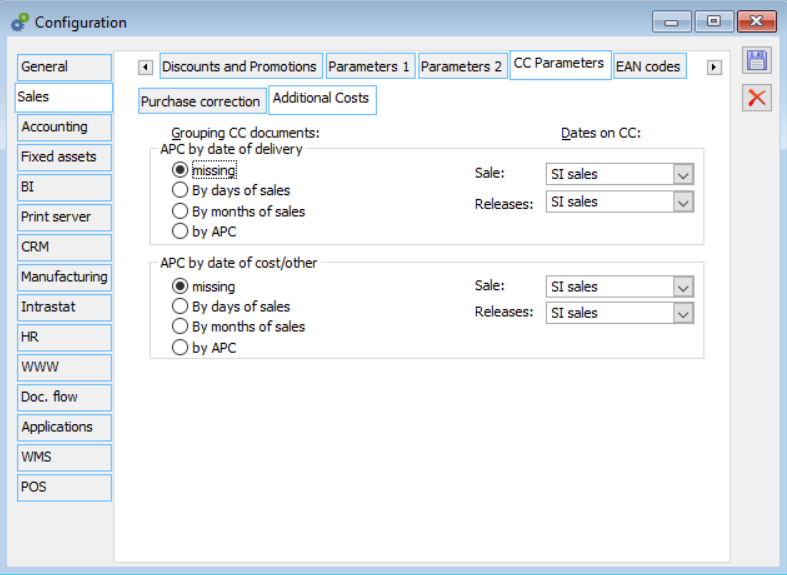

Additional Costs

Options available on this tab make it possible to determine the grouping methods in CC documents and the dates of these documents upon the registration of APC documents.

APC by date of delivery

Missing – selecting this option allows the user to select a relevant date for CC documents:

Sale: SI sales

Releases: SI sales, SI release

By days of sales – selecting this option allows the user to choose a relevant date:

Sale: SI sales

Releases: SI release

By months of sales – in date fields in CC:

Sale: SI month of sales

Releases: SI month of sales

By APC – in date fields in CC:

Sale: APC operation

Releases: APC operation

APC by date of cost/other

Missing – selecting this option allows the user to select a relevant date for CC documents:

Sale: SI sales, APC operation

Releases: SI sales, SI release, APC operation

By days of sales – selecting this option allows the user to choose a relevant date for CC documents:

Sale: SI sales

Releases: SI sales, APC operation

By months of sales – in date fields in CC:

Sale: SI month of sales

Releases: SI month of sales, APC operation

By APC – in date fields in CC:

Sale: APC operation

Releases: APC operation

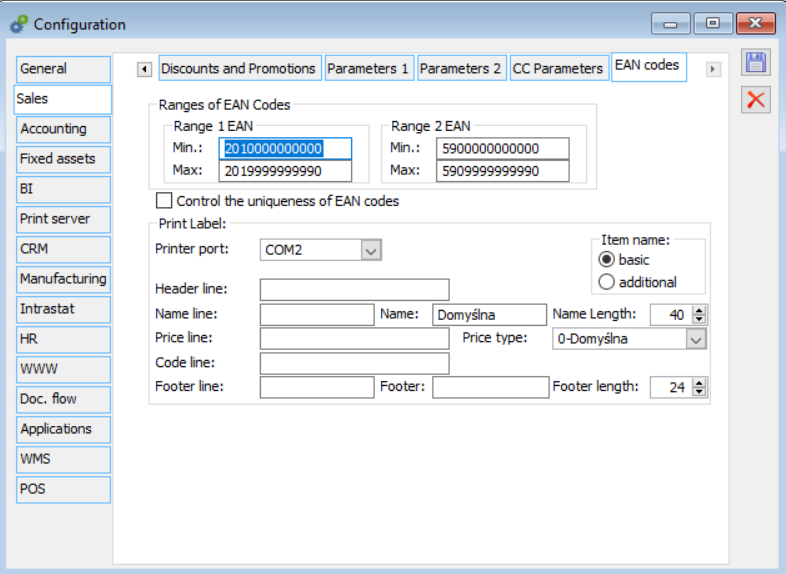

Configuration, Sales/EAN codes tab

The system generates barcodes according to the EAN/UCC-13 standard. It is possible to enter any EAN number (digits or letters, max. 40 characters) in documents, although the EAN/UCC-13 control is still active when entering 13 characters. Codes may be generated for items, resources, or units of measure of a given item. When generating a code, the user may select one of the two available code ranges. The generated code will be the first free code in the selected range. The code ranges can be defined in the configuration.

Range 1 EAN: by default, it is set as 2010000000000…2999999999990, which corresponds to the range of internal codes, according to EAN standards.

Range 2 EAN: by default, it is set as 5900000000000…5909999999990, which corresponds to the range of external codes available in Poland (590 prefix).

Control the uniqueness of EAN codes: if this parameter is selected, two identical EAN codes cannot be entered into the system. If the user attempts to do so, the system will display a relevant message. For a newly created database, this parameter is deselected by default.

Additionally, the setting of this parameter affects the type of information displayed in the logo obtained after the integrity test: Checking duplication of EAN codes.

The remaining parameters- can be used to configure the printouts of labels containing barcodes. They are only applicable when working with Pitney Bowes printers.

Advanced trade operations

The possibility to perform actions in the Sales module depends on the operator’s permissions and bans. A significant ban conditioning the operator’s work in the module is Advanced trade operations. The ban may be given, as in the case of other bans, in the Operator window on the Bans tab. More information on operator bans may be found in the Administrator module documentation.

- The ban: Advanced trade operations prevents the user from:

- Specifying a credit limit on the customer/vendor group pattern and on the customer/vendor form

- Unblocking a customer form blocked by another operator

- Changing an acronym and acronym mask on the customer/vendor form

- Changing a warehouse settlement method defined for item patterns and on item forms

- Changing an item code and mask on the item form

- Canceling trade/warehouse/import/SAD documents with a date other than the current date

- Using the feature of reprinting documents on a fiscal printer.