Data correction – general information

In the 2019.0 version of Comarch ERP XL, a new type of correction of the sales commercial document has been introduced: Data correction. With this document, the User can make correction for:

- changes of the main, target, and payer contractor

- changes to the data of the above-mentioned contractors, by changing the address/addresses for correction

- change to the payment method and/or date

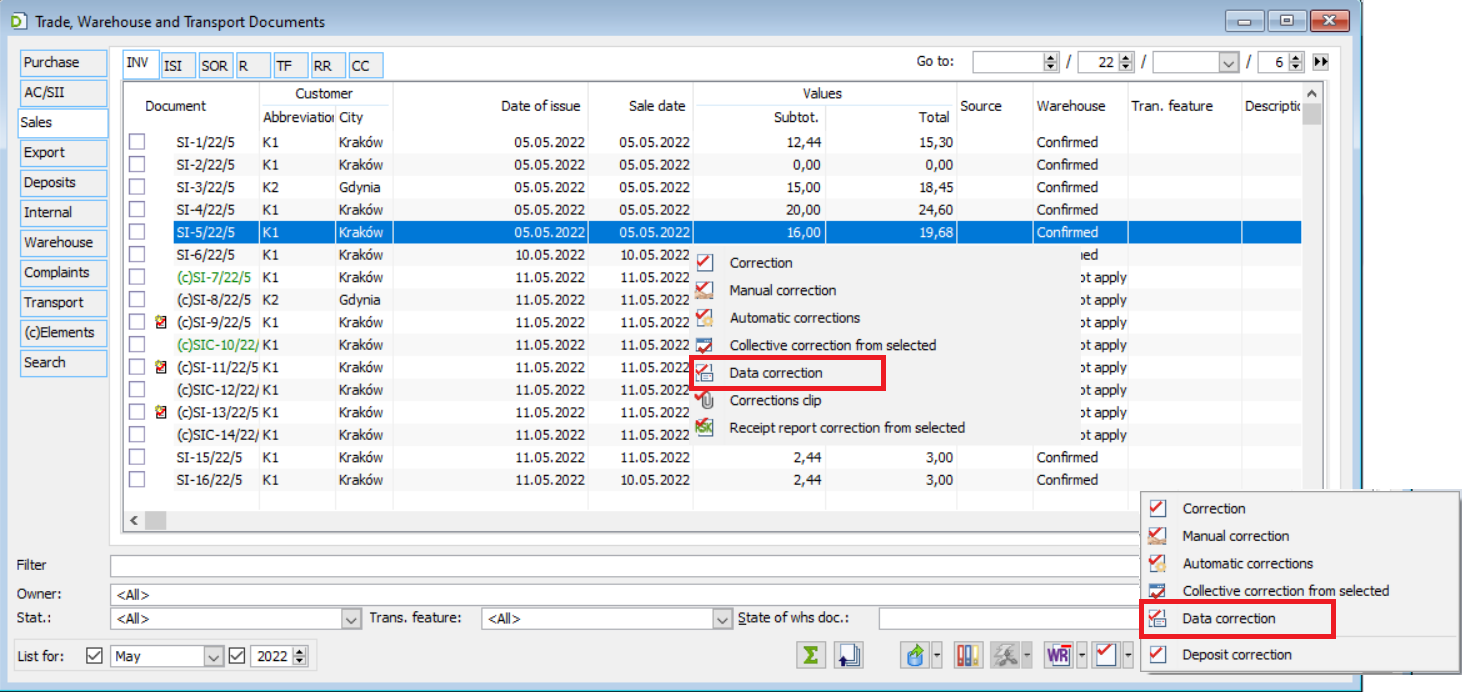

Data correction has been made available for sales invoices: FS, (s)FS, (S)FS, RA, FSL, FSE, (s)FSE, (S)FSE, FEL and editions: WZ, WZE, WKA. It can be done with the use of an appropriate option available on individual tabs of the commercial documents list and in the contractor’s history.

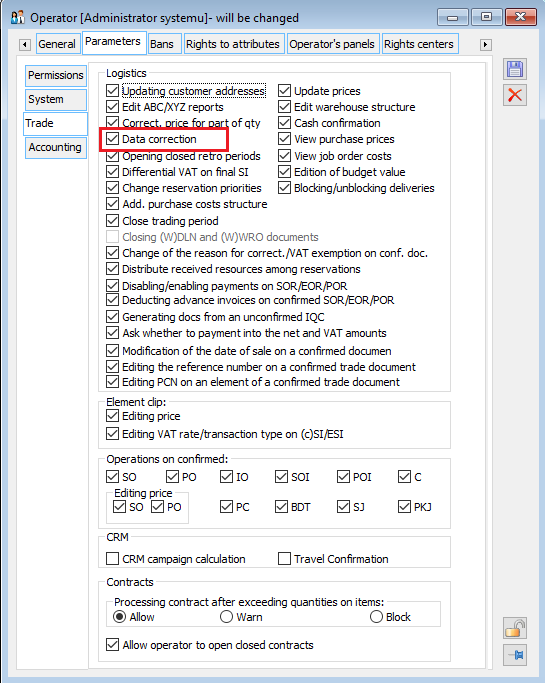

The option to record Data correction has been parameterised. Only a User with the Data correction permission on the Operator’s card can record this type of correction.

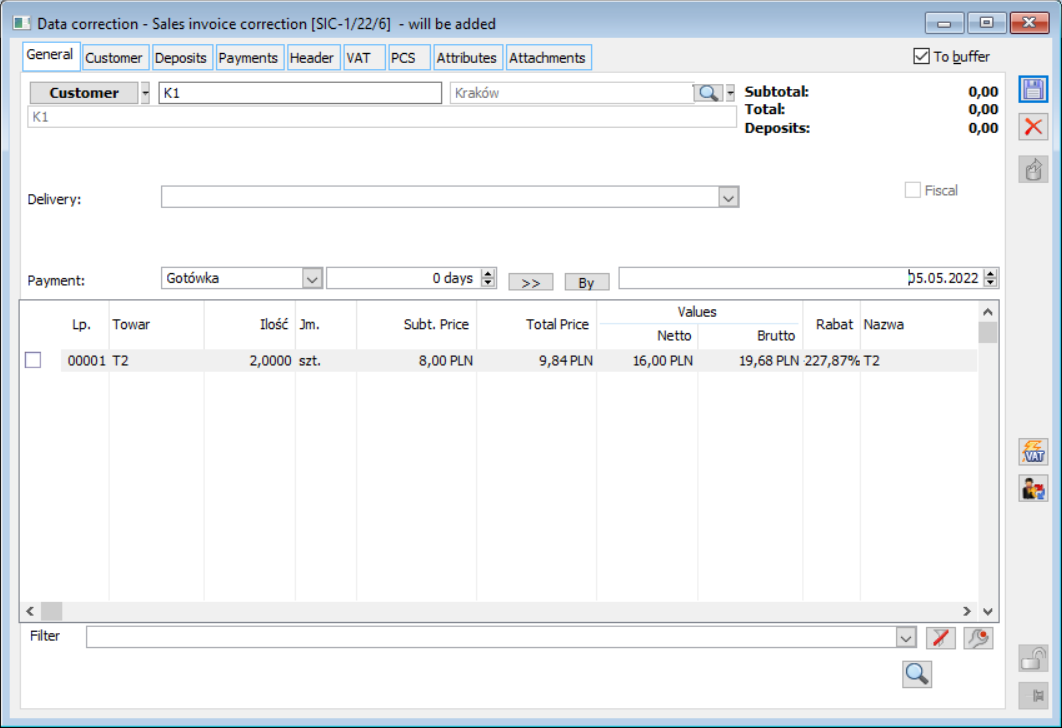

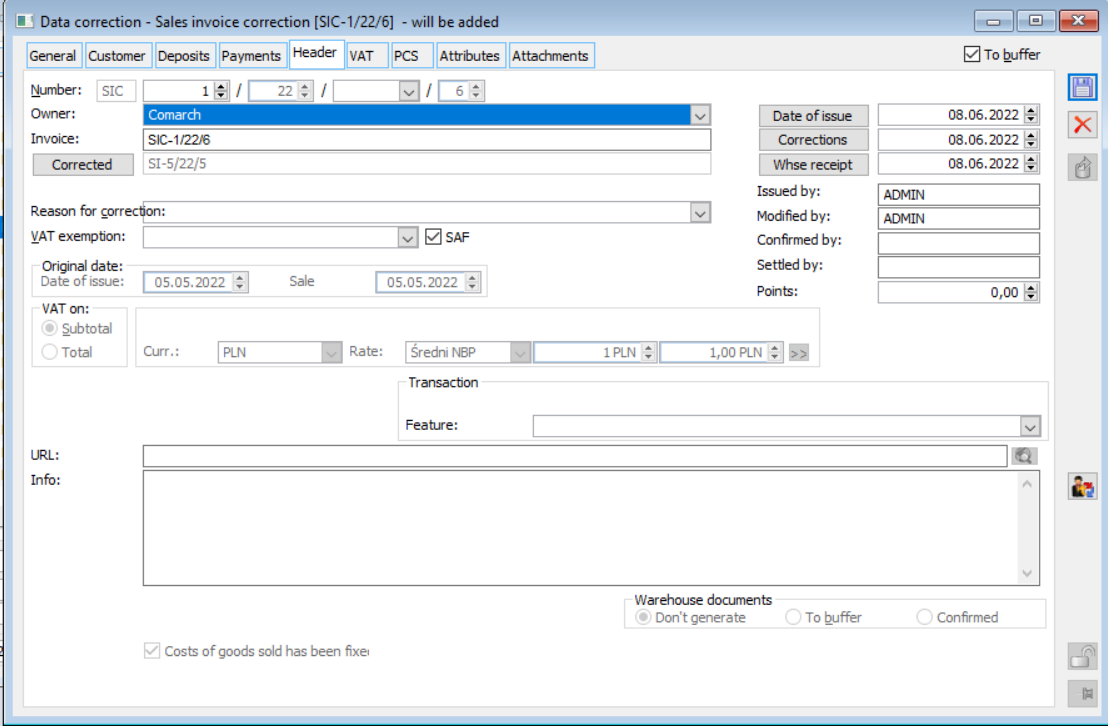

Data correction form

The data correction form differs only slightly from the regular correction form.

The differences concern the rules of availability or non-availability of particular controls and the operations that can be performed, or the rules of editing particular parameters on such a correction. The main distinctions of this type of correction are:

- Active controls with acronym of the main, target and payer contractor and buttons for changing them

- Active buttons with addresses of the aforementioned contractors

- Lack of own elements on data correction: this type of correction does not have its own elements, however, in order to provide the User with information on what the corrected transaction concerned, the data correction form presents the elements of the original, understood as follows

- FSK, (s)FSK, WZK, WKK, FSE, (s)FSE, WZE documents contain FS/(s)FS elements…

- KSL, KEL documents contain, as before, the elements of the order

- (S)FSK, (S)FKE, and RAK contain documents bound to (S)FS/(S)FSE/RA

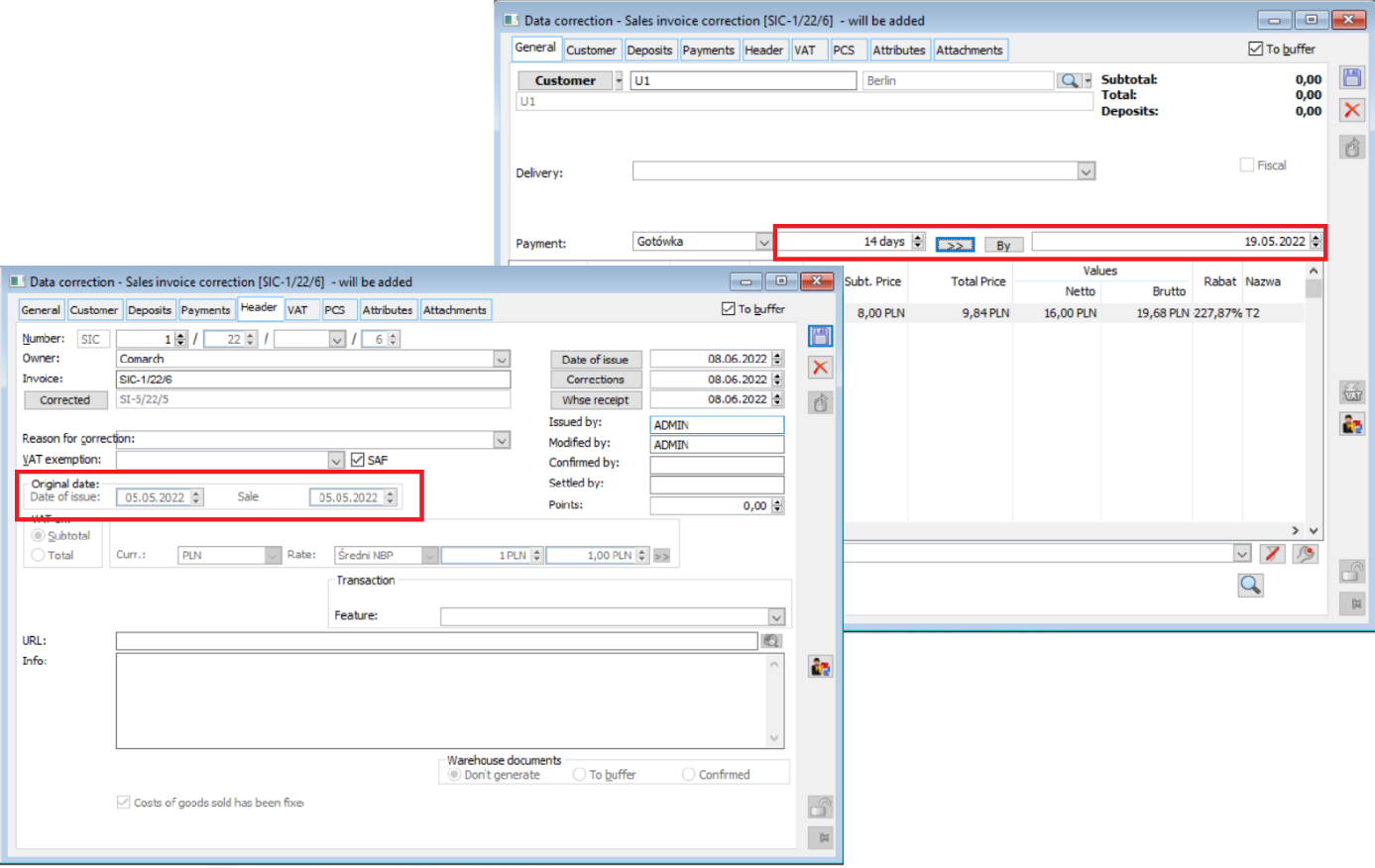

- Saving and presenting information about the date of issue and sale from the corrected document

- Payment term on the General tab of the data correction counted from the dates of the original copy

- Hidden unnecessary controls (warehouse, deposit update parameter, etc.)

Contractor’s and/or contractor’s data correction

The option of correcting the contractor is dedicated to the case when the transaction was physically carried out correctly, the goods were received by the correct contractor, but the wrong contractor was mistakenly entered on the sales document.

The sale was made to contractor K1 who received the goods, he also received an invoice which shows contractor K2 instead of him (K1). In this situation, he will receive a data correction, adjusting contractor K2 to K1. K2 contractor has never received either the goods or the invoice, so he will not receive any document.

If, on the other hand, the goods have been physically issued to the wrong contractor K2 (and invoice to K2), then the Operator should register an FSK to K2 for the full return of the goods and receive the goods from the former, then issue an FS to K1 and release the goods to the latter.

Data correction allows changing the main, target, and payer contractor. The main contractor may be changed only if no correction other than “data correction” has been recorded to the document. In the case of a change of target contractor and payer, such a restriction no longer exists.

The data correction does not change the type of transaction, even if a different type of transaction should be used for a “correct” contractor than indicated by the contractor incorrectly entered on the invoice. In such cases, the Users, in addition to data correction for a correct contractor, may generate another correction on account of a change in the VAT rate with the option of including it in jpkvat disabled. “Correcting” the type of transaction, on the other hand, can be done with A-vista documents recorded directly in the VAT Register.

The data correction may also apply to cases when the contractor used in the transaction is correct, but their data, e.g. address data, are incorrect. In such cases, the data can be “adjusted” on a correction by changing the contractor’s address on that correction. This is subject to the same rules as above, i.e. the address of the main contractor can be changed as long as no correction other than a data correction has been recorded so far.

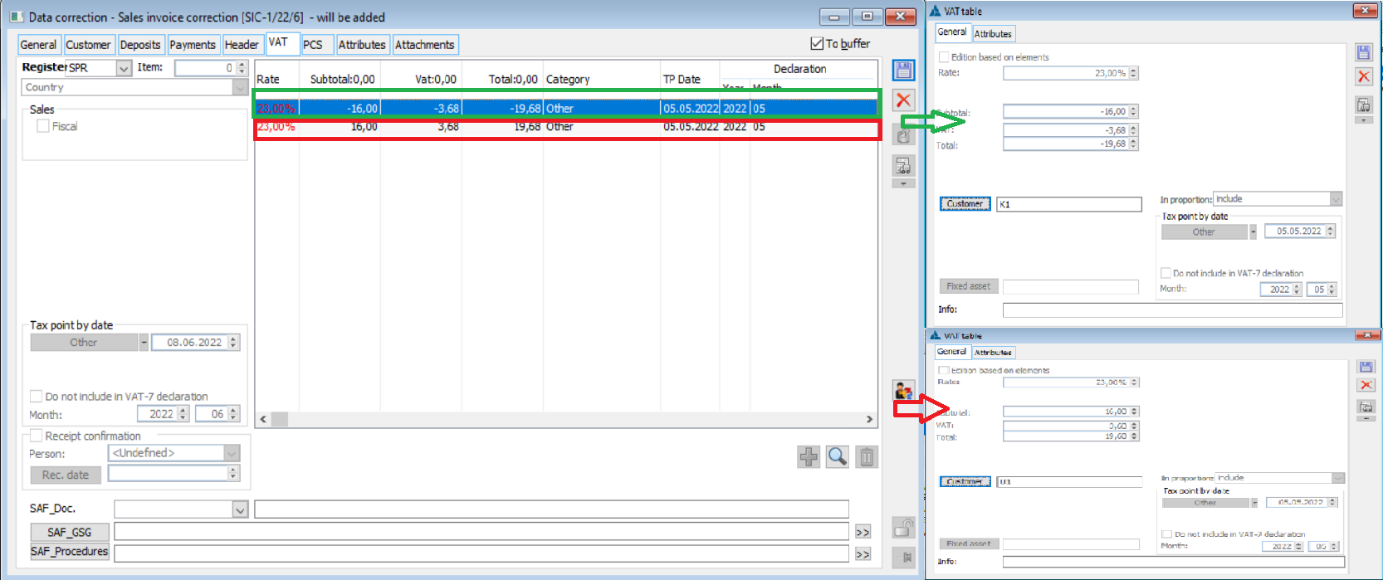

Contractor and address on TraVat records

To correctly handle the adjustment of invoices involving a change of the contractor and/or the contractor’s address for a given transaction on the VAT returns, such adjustments have double VAT table records: for the “wrong” contractor with a value opposite to the transaction value and for the “right” contractor with a value corresponding to the transaction value. To make this distinction of records for contractors possible, from version 2019.0 of Comarch ERP XL the information about the contractor and his address is recorded directly on the TraVat record, respectively in the fields: Trv_KntNumer and Trv_KnANumer. This information is also presented on the details of individual VAT table records.

The aforementioned Contractor’s ID and contractor’s address are recorded from version 2019.0 of Comarch ERP XL not only on the records of the Data corrections VAT table, but on all TraVAT records created on both sales and purchase documents on which the contractor appears.

By default, the parameters of the VAT table records created above, such as tax obligation date, month of inclusion in the VAT return, etc., are determined based on the document being corrected. The User can change them according to the general rules for editing these parameters.

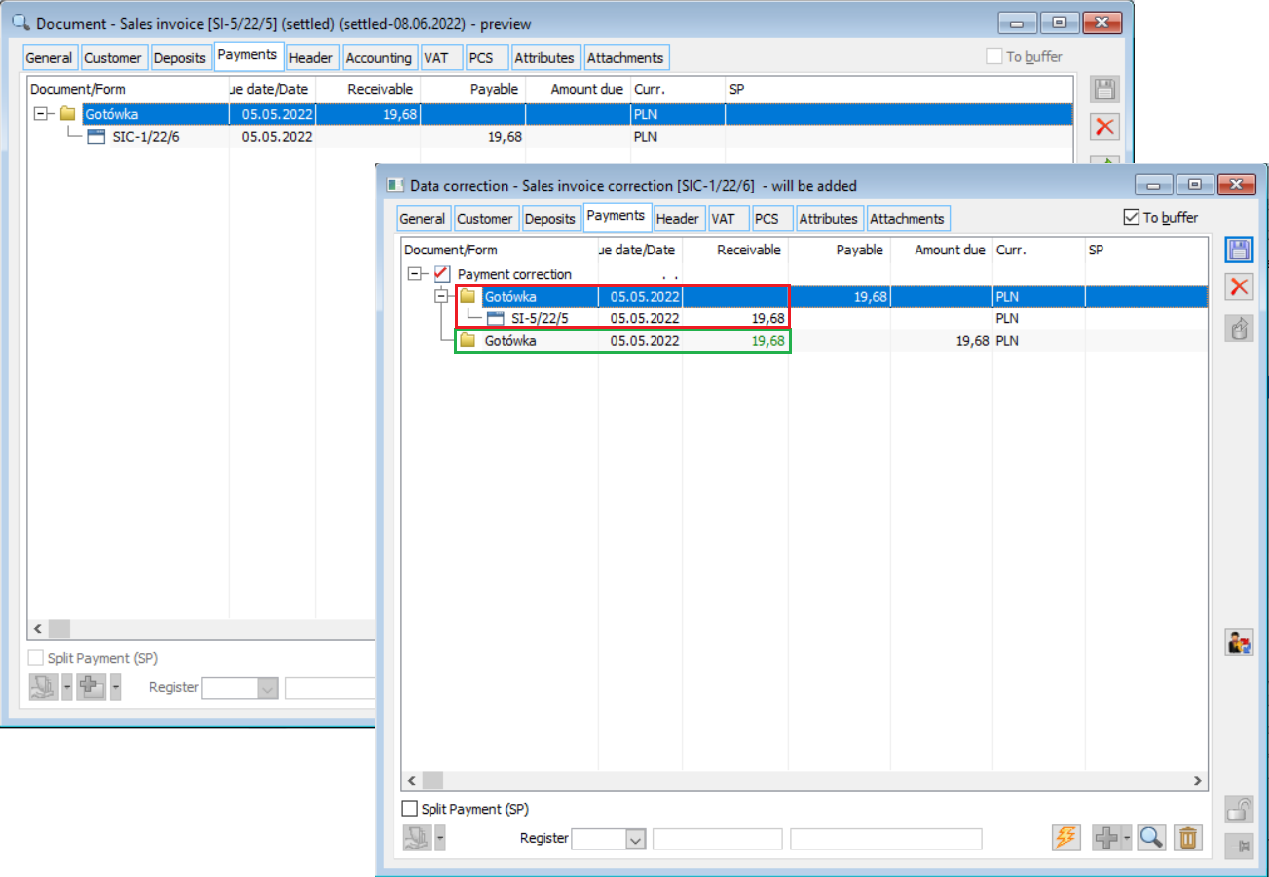

Payment on contractor’s and/or contractor’s data correction

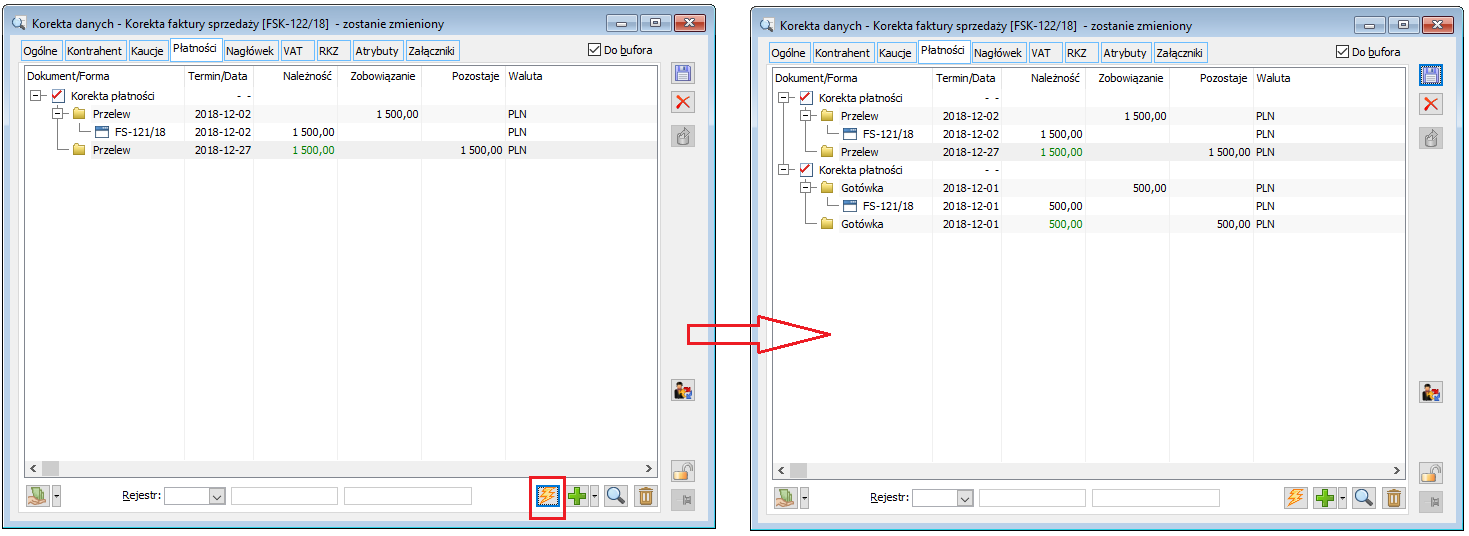

On data correction, the System automatically creates appropriate payment “pairs” on the basis of unsettled payments of the corrected document:

- Commitment to the “wrong” Payer, automatically offset against the payment of the corrected document

- The amount due to the “right” Payer

The above payment pairs are grouped accordingly, and the payment groups created in this way are presented on the data correction in the form of a tree. The number of branches in this tree depends on the number of payments on the corrected document.

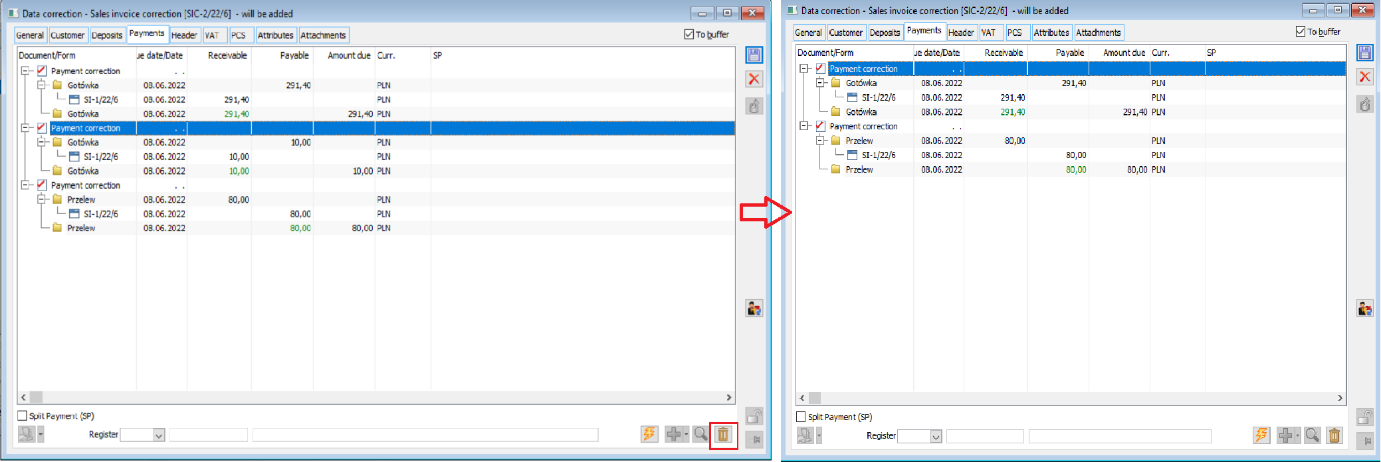

The amount of the above payments is determined based on the unsettled payment value of the corrected document. A payment of the liability type is not editable either in terms of Amount or Currency, and such payment cannot be deleted.

A payment to a correct Payer, i.e. the above-mentioned receivable, may be freely edited by the User, including splitting it into many payments of different forms, dates, or different Payers. To this end, it is enough to reduce the Amount of such payment, and when saving, the System will create a differential payment on which the User may set a different date, method of payment, etc. In turn, deletion of such a payment results in an appropriate increase in the Amount of another payment “after correction”, correcting the same original payment. Thus, if there is only one payment on the data correction that adjusts a particular payment of the adjustment invoice, then it cannot be removed from the data correction.

The above-mentioned editable payments “after correction” are marked in green on the unapproved data correction.

Contractor’s ID from the data correction on the corrected transaction

Registering a correction due to a change of a contractor or their address does not in any way affect the presentation of the contractor in the form of the original sales document or the contractor’s data on the printout of such a document, i.e. the original contractor is still presented/printed on it.

Payment method and/or form correction

Data correction also allows correcting the method or the date of payment of a transaction. Simply generate a data correction for the same contractor as the contractor on the original document and set the correct method or due date of payment on the General tab of the data correction or directly on its payments, on the Payments tab.

Data correction due to a change in the method/date of payment should be recorded if it was set incorrectly on the invoice. In this case, the correction of the data is intended to correct erroneously set payment terms. If, on the other hand, these parameters have been correctly specified on the invoice and the customer has been given permission to change them, e.g. to extend the payment deadline, then, instead of data correction, an Extension should be recorded.

Changing the method, term and/or date of payment on the General tab of the data correction and calling the payment update operation allows the above parameters to be changed on all payments “after correction”, marked in green on the document. The Term presented here is calculated from the date of the corrected document, i.e. from the date of its issue or sale, in accordance with the setting of the parameter Payment from date section in the definition of the corrected document. The aforementioned dates are presented on the data correction form.

The User can also correct the date, method, and other parameters on individual payments generated by the System when generating the data correction.

If there were multiple payments on the document to be corrected, and the correction is to concern only one/some of them, then the User may delete the payment in question, as a result of which the System automatically deletes the payment(s) adjusting them as well. Simply position the cursor on the Payment adjustment record or on the relevant Liability and use the Delete option, and the System will delete the entire tree relating to the payment being adjusted.

If the correction of a given payment, i.e. the operation of removing a payment from the data correction was performed incorrectly, the User may use the option Attach payments to be corrected, available on the data correction, as a result of which the System will generate “missing” payment pairs.

Data correction and related documents

Correction of data for clips and external release notes

For header clips and item clips, you can record both a contractor correction and a date and method of payment correction. The recording of such a data correction does not imply an automatic data correction for the documents bound in it. On the WZ/WKA/WZE, the contractor remains the original one. If the User wishes to change the contractor on these documents, he/she should record the data correction to the WZ/WKA/WZE by himself/herself.

The possibility of making a contractor correction for a WZ/WKA/WZE document depends on whether such a document creates its own payments and whether an invoice=clip has already been issued for it. Payment corrections for this type of document, on the other hand, are not available, regardless of the “status” of the document.

For those cases where the release data correction is not available, the User should record an invoice for the release, and thus determine the correct contractor and payment parameters, and if such an invoice has already been created and approved, then record the relevant data correction for that invoice.

Data correction to RA and Receipts

Data correction recorded to the receipt clip invoice: RA does not affect the contractor on the receipt bundled to it. Data correction is not available for receipts. If an incorrect contractor has been specified on the receipt, the User should register an RA invoice for such a receipt and specify the correct contractor and payment parameters, and if such an invoice has already been created and approved, then record the relevant correction of the invoice data.

Data corrections and advance and final invoices

A data correction registered to an advance invoice does not affect the contractor on the final document deducting that advance invoice, a contractor correction to the final document does not affect the advance invoice deducted on the final document. If there is such a need, the User should generate the data corrections to the final document or the pre-invoice by himself/herself.

However, the system takes into account data corrections during the automatic suggestion of advance invoices when recording new transactions, as well as during the operation of attaching the advance invoice itself on the Payments tab of the sales invoice.

In the FS document definition, the parameter Deduction of advance invoices/Automatically… An FSL-1/2018 was recorded for contractor K1, followed by a data correction where the main contractor was changed to K2. Scenario 1: The User records a sales invoice and enters contractor K1 on it, an advance invoice is not suggested. Scenario 2: The User records the sales invoice and enters the contractor K2 on it, the System suggests FSL-1/2018 for deduction.

Data correction and Deposits

Recording a data correction to a document to which a WKA deposit is bundled does not result in any changes to that deposit. If the User wants to make a contractor correction for a deposit, he should record the data correction to the WKA himself. If, on the other hand, a deposit document is generated for a document after a data correction has been recorded for it, then the System takes such correction into account, i.e. sets on the WKA document the contractor from the data correction.

An FS-1/2018 was recorded for contractor K1, followed by a data correction where the main contractor was changed to K2. The User generates a WKA from the aforementioned FS-1/2018, resulting in a K2 contractor being recorded on the document.

Data correction and WM/ZWM warehouse documents

Recording a data correction to a document to which a WM/ZWM warehouse document is related does not cause any changes to that warehouse document.

If, on the other hand, the warehouse document is generated to the document after a data correction has been registered for it, then the System takes into account such a correction, i.e. it determines the WM/ZWM of the contractor on the basis of the target contractor from the data correction document.

Subsequent correction to a document with data correction

The contractor’s correction is taken into account when the subsequent correction to the transaction is recorded. The contractor on such a correction is determined based on the contractor from the data correction.

Data correction and contractor’s presentation in document lists

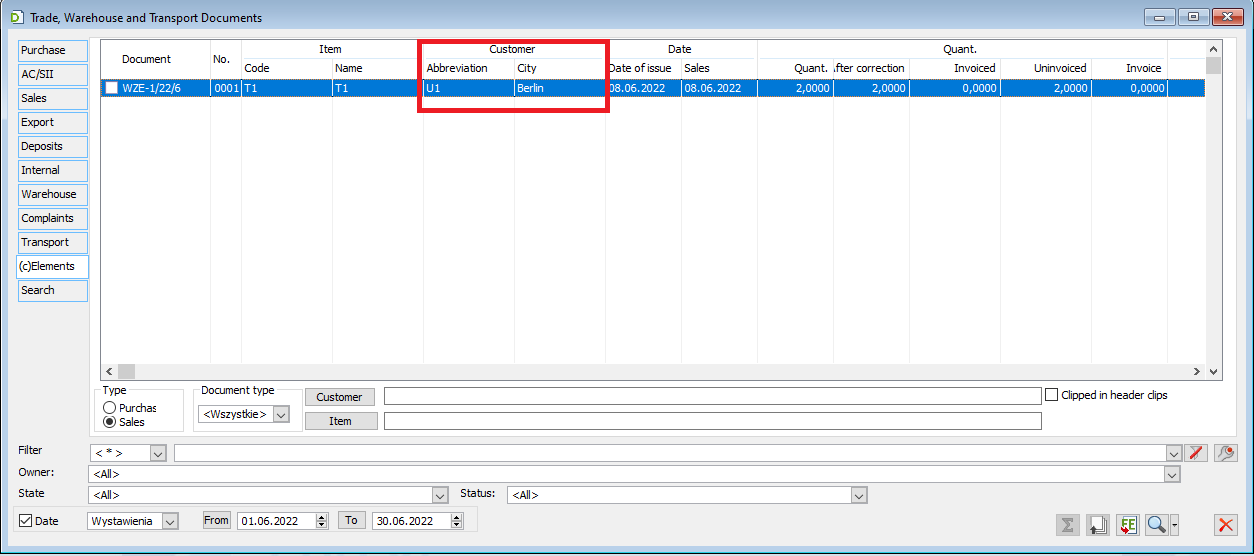

Recording a data correction for a change of contractor does not affect the presentation of the contractor from the corrected document in the list of documents, in the related list and other lists, i.e. the initial contractor is still presented in them. The exceptions are: the tab with the list of release items of the commercial document lists and the contractor and goods history.

- (S)Item on the list of commercial documents tab

The acronym and city columns in the list are filled in based on the contractor from the data correction recorded to the release document.

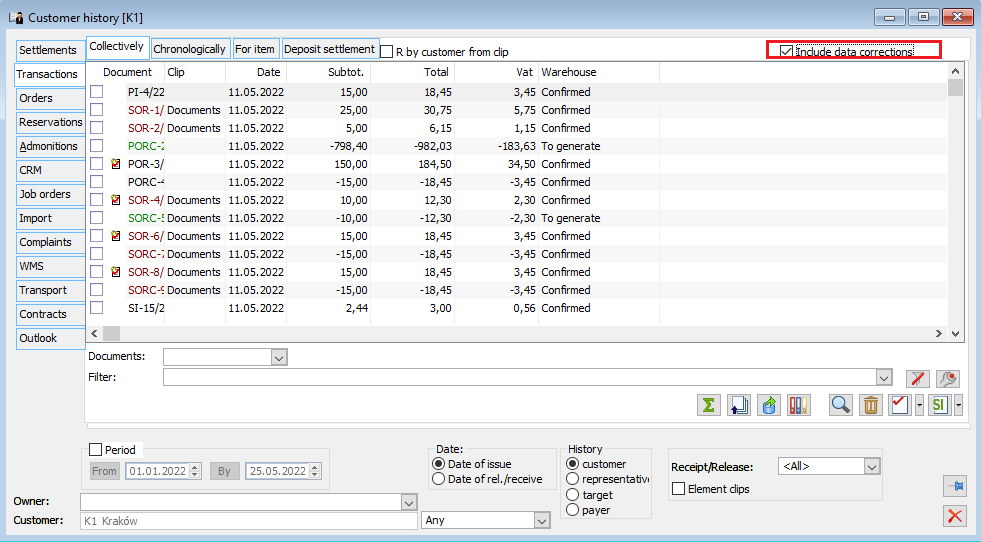

- Contractor’s history

An appropriate parameter has been made available in the contractor’s history, which determines whether the System is to present documents according to the contractor to whom they have been recorded or according to the contractor specified in the data correction. If the User wants to see on the list also those transactions which, although were not initially recorded for the Contractor, whose history he is watching, but which the Contractor was “introduced” to by an appropriate data correction, then he should activate the parameter Attach data corrections. Enabling this parameter means at the same time that the list will not include those transactions which, although they have been recorded for a given contractor, were subsequently changed “on them” by data correction.

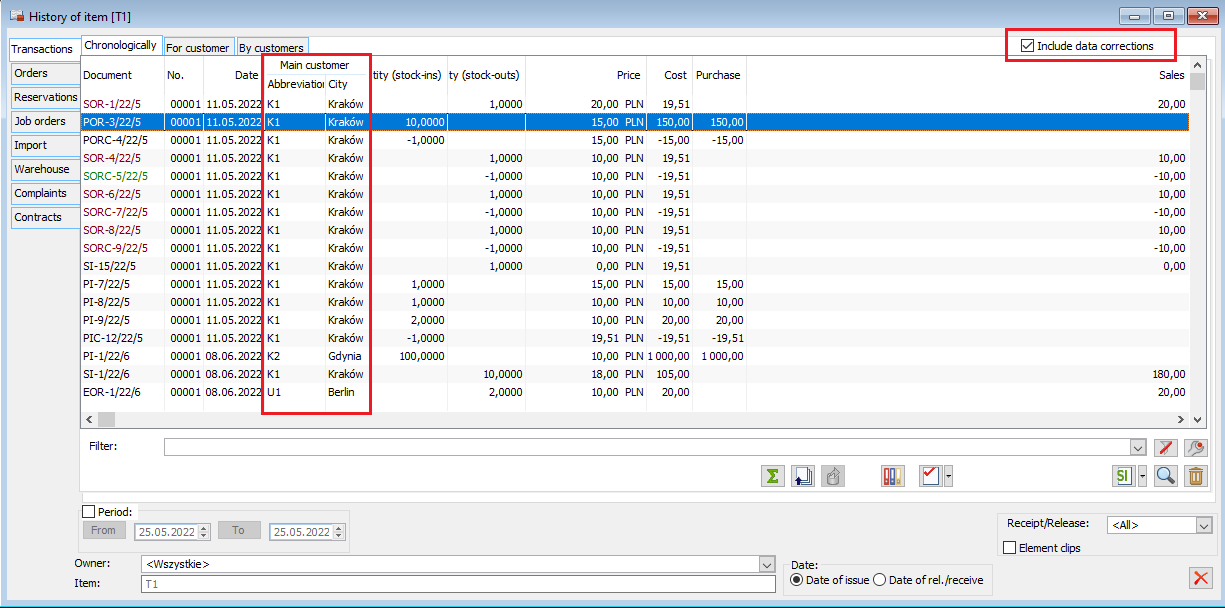

- Goods history

A similar parameter has been made available in the goods history, but in this case it does not affect whether a given document is presented in the list or not, but which contractor will be presented for each transaction. If the parameter is off, then it is the contractor from the initial document, while if the parameter is on, then it is the contractor from the data correction recorded to the given transaction.

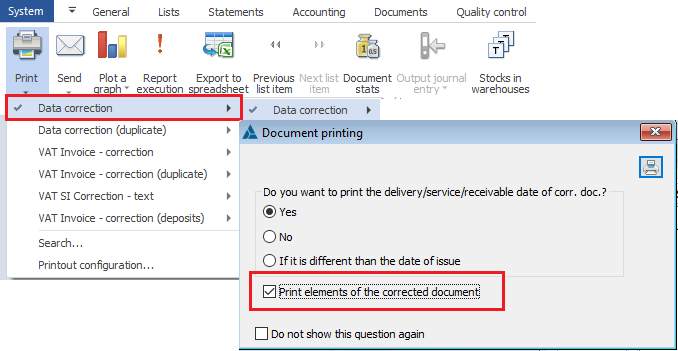

Data correction printouts

A new printout has been made available for documents of the data correction type. The content of this printout largely depends on what parameters have been corrected on a particular document:

- Contractors

If there is no correction of the contractor or its address on the data correction, then there is a standard section on the printout: Buyer and Recipient. If, on the other hand, a correction has been made to the contractor (main, target, payer) or its address, then the printout shall include the section Before the correction with the data of the Buyer and the Recipient from the corrected document and the section After the correction with the data of the Buyer and the Recipient from the printed data correction.

- Elements

Whether elements from the transaction being corrected are to appear on the data correction printout is determined by the relevant parameter presented in the parameters window when starting this printout. On the data corrections for advance invoices, the elements of the order are printed to which the corrected advance invoice was recorded, and on the remaining ones – elements of the corrected document.

- Instead of the VAT table, a “summary” of the items is printed if they are printed

- Payments

Payments are printed in two sections. In the Before correction section, the corrected payments are printed, and in the After correction section, the correcting payments are printed.

The printout does not have the usual Total payable/paid/remaining section. The data correction has a zero value and therefore does not trigger a payment for the transaction/correction of the transaction. Printing the above information could be confusing for the Customer, as it would duplicate the “total payable” amount on the initial and corrected data.