Export invoice (FSE)

An export invoice is very similar to a normal sales invoice, so the differences between the two will be discussed below.

The generation of an export invoice is recommended when an intra-community or other foreign transaction is to be recorded.

The default VAT rate for all export invoice items is the VAT rate for export documents specified in the configuration. The source of the goods may be warehouses or bonded warehouses. The document shall contain additional information on the customs declaration (SAD) associated with it.

The document can be issued only for the types of contractors that are defined in the definition of a given document.

An export invoice can also be issued to a domestic contractor. On such a document, the Transaction type is Domestic, and the VAT rates are Domestic. The export VAT parameter is not editable in this case. In the case of changing the contractor from domestic to foreign or changing the transaction type from domestic to intra-community or other foreign, VAT rates are changed and the export VAT parameter is editable. An export invoice can also be generated from Sales order or Warehouse release notes. KGO is not supported on the FSE document issued to the domestic contractor.

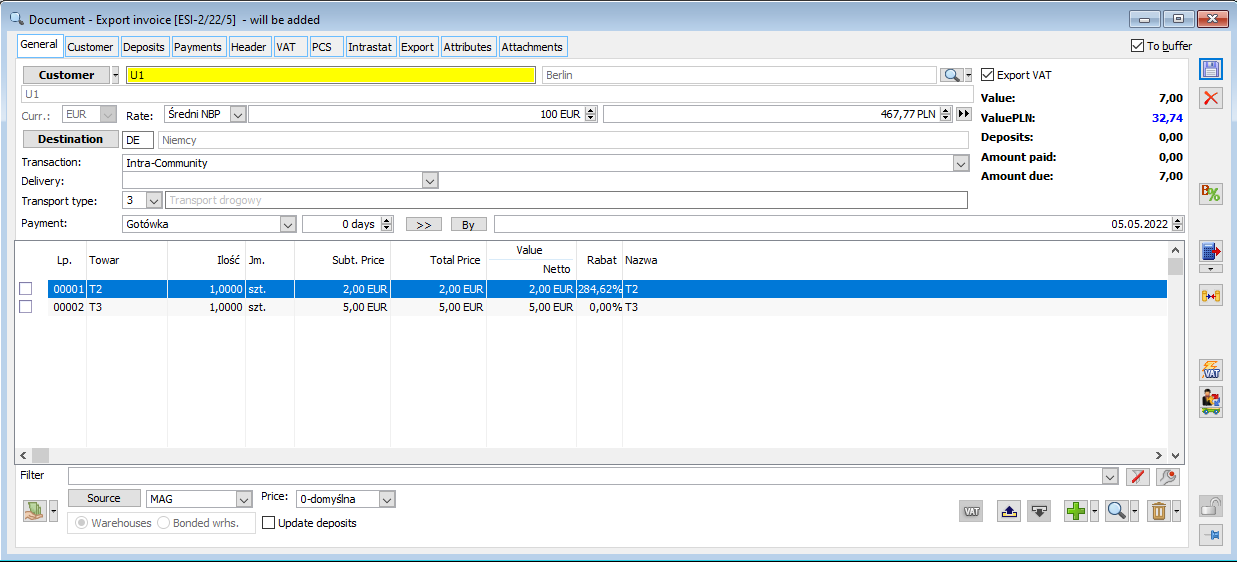

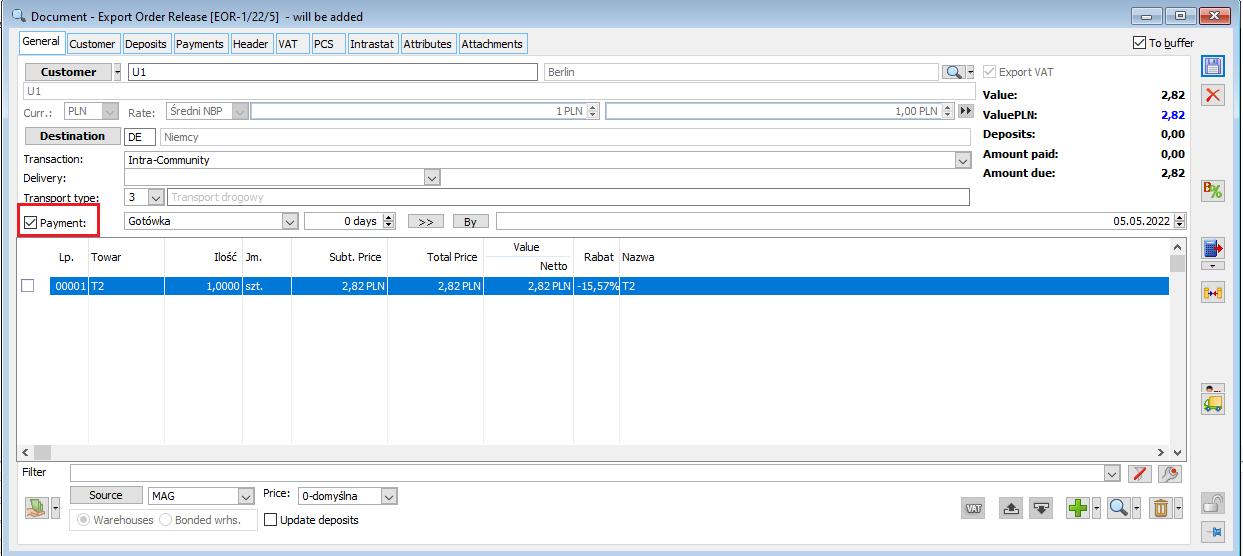

Export invoice, tab: General

The tab contains fields that do not appear on a regular sales invoice.

Export VAT – if this parameter is selected, goods added to the document will be assigned VAT by default:

- 0% VAT rate – for products or

- Not subject to – for services.

If this parameter is unselected, the rate defined in the product sheet shall be applied to the products on the document, but such a rate is modifiable. Assigning rates for export documents is done in the configuration, on the Sales/VAT rates tab. The parameter setting is taken from the document definition.

Deselecting the VAT export parameter on FSE will generate a VAT payment in system currency only if the document is approved. In the case of a document remaining in the buffer, the VAT payment will be generated in the currency of the header.

If the FSE document on which the parameter: VAT export is not selected, and this document settles prepaid documents, then changing the VAT rate on the item of such FSE is limited to national rates, i.e. 22%, 7%, etc., without the possibility of changing to the 0% rate.

It is possible to change VAT rates on FSE items if the parameter: VAT export is unselected.

Currency – prescribed from the contractor’s sheet, consistent for all invoice items. It can be changed before the first item is entered.

Exchange rate – used for conversion of prices in PLN into prices in a foreign currency. If the price in the product sheet is given in a foreign currency, its accounting value will be calculated according to the exchange rate. The rate will be taken from the day preceding the earlier of the sale/issue date of the document. If no such rate is specified, the latest of the previous rates will be taken.

When generating an adjustment to an export invoice, a window will be displayed: Select the rate for the update, allowing selection of the rate for the adjustment document.

Value – indicates the value of the product in the selected currency (in which the transaction is made).

Value in PLN – indicates the value of the transaction in PLN currency (converted in accordance with the given exchange rate).

Source of goods – the setting is taken from the document definition:

Warehouses – if checked, the goods will be taken from the warehouses as for a regular invoice. Bonded warehouses – if checked, goods will be taken from the bonded warehouse stock. Checking this option will display a box: Warehouse, where the warehouse from which the goods will be released, should be indicated.

The source of goods may only be selected before the first document item is added. All goods of an export invoice must come from the same source, i.e. either warehouses or bonded warehouses.

If the source of the goods is bonded warehouses, warehouse documents are not generated when the invoice is approved. Per FSE, it is possible to collect bonded warehouse stocks in any different currency.

From the {General} tab it is possible to change the columns using EiP (Edit in Place): Quantity, Net Price, Gross Price (irrespective of the setting of the VAT charging direction), Net Value, Gross Value, Discount, without having to open the item window (applies to non-approved documents).

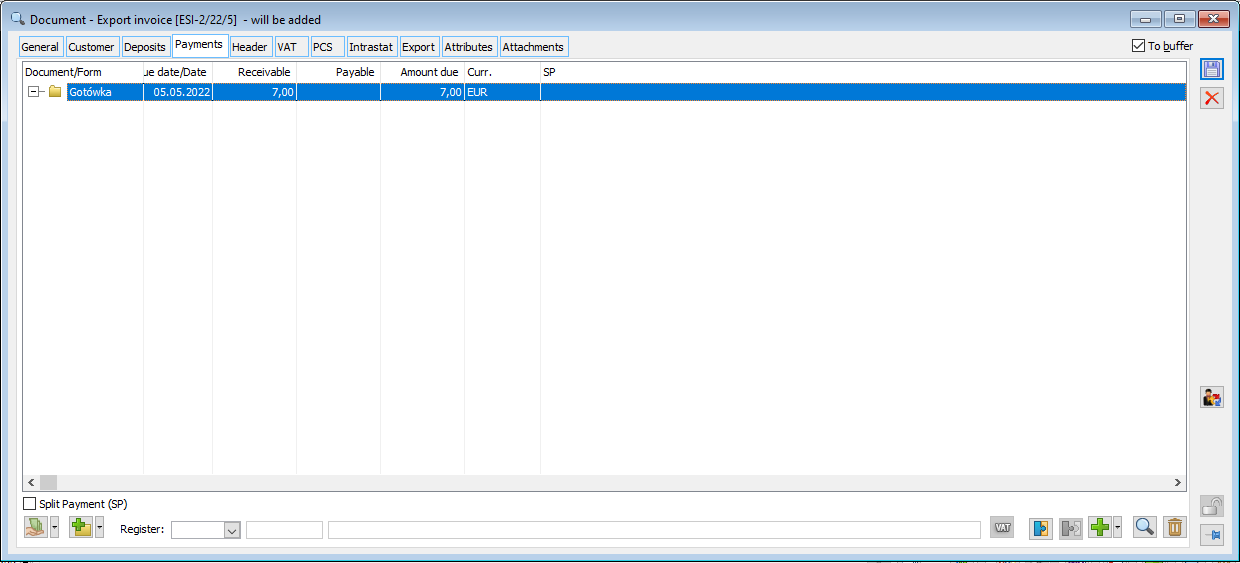

Export invoice, tab: Payments

The tab contains a list of payments and deposits related to the document. When the document is created, the list contains one item, i.e. the receivable for the full gross amount. The form of payment and the date are consistent with the settings in the contractor sheet (for sale). The payment term is calculated from the date of issue or sale (tab: Header), as set in the document definition. However, the payment proposed by the system can be spread over a number of different payments (e.g. instalments). Any modification to the payment list will automatically add a top-up payment to the full amount. It is highlighted in red in the list. This is also the nature of the original payment. Payments for which “Do not settle” parameter has been set are marked in grey, for example FSE payments for the amount of VAT charged at domestic rates due to failure to document the export of goods outside the country.

If the Split payment (MPP) parameter is checked, a comment will be added: “Split payment mechanism” on the printout of the invoice issued from this document. This option will be automatically selected if the relevant requirements are met (purchase date after 31/10/2019, goods have the Split payment (MPP) parameter selected, the contractor is a domestic contractor, and the gross amount is greater than or equal to PLN 15,000.00.

The tab also indicates a register of cash or bank operations to which the payment associated with a document will go. The bank account number assigned to the register is displayed next to it. This register will be loaded:

First, from the settings of the contractor sheet for which the document is issued (window: Contractor sheet, tab: Settlements, Assigned bank registers).

If no bank register has been added to the contractor sheet to whom the document was issued, it will be loaded by default from the centre where the document has been issued (parameter setting: Default bank register, on the tab: Registers, in the window: Company structure centre).

![]() [Conversion of payments with separation of VAT amount] – this function enables splitting the payment into the payment resulting from VAT and the remaining value resulting from the document.

[Conversion of payments with separation of VAT amount] – this function enables splitting the payment into the payment resulting from VAT and the remaining value resulting from the document.

According to Polish regulations, exchange rate differences accrued on the part of the payment that relates to the amount of VAT are not expenditures/revenues of the company; therefore, they should be accounted for differently. To avoid penny-wise differences between the total VAT amount on the document and the value of the payment converted into the system currency, the amount in the system currency will be determined by the sum of the VAT of all the records in the document’s VAT table, rather than by converting the foreign currency amount into the system currency. The format of such a payment will indicate that it is a payment generated on the basis of the VAT amount. On an approved document with a “domestic” transaction type, a payment will be generated in the currency of the document and with the “Do not settle” parameter unselected, i.e. differently to documents with a different transaction type.

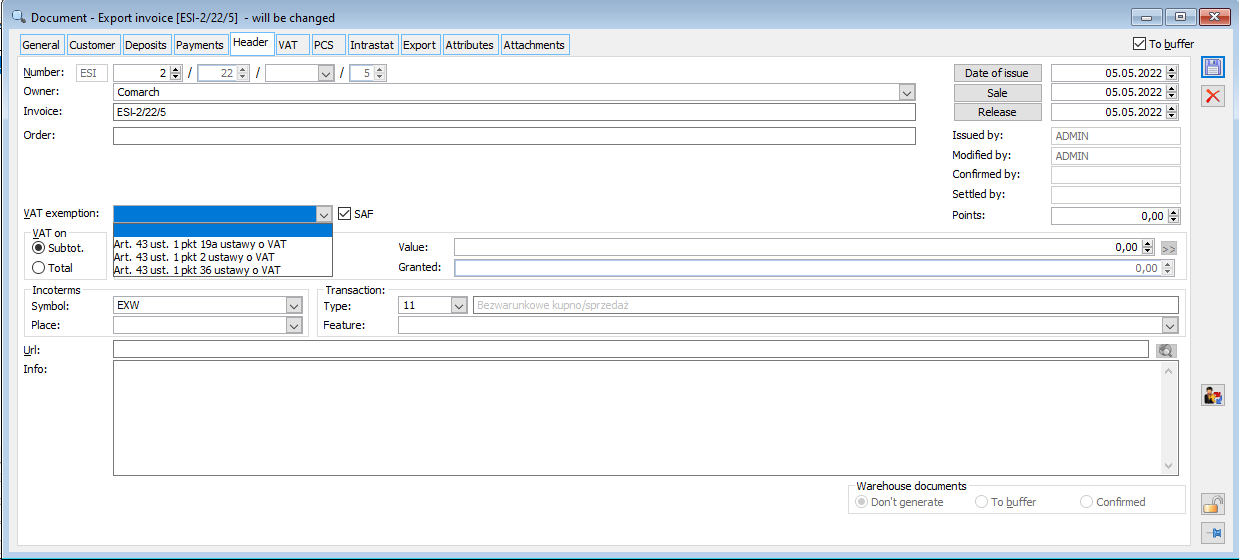

Export invoice, tab: Header

On this tab, unlike a regular sales invoice, it is possible to cancel 0% VAT after the document has been approved. It is possible to modify the date of sale, e.g. setting it as a date preceding the date of issue of the document. This is because the FSE document may also refer to services that are provided before the document is issued.

JPKFA-Parameter decides on placing an invoice with its items in a JPK_FA file.

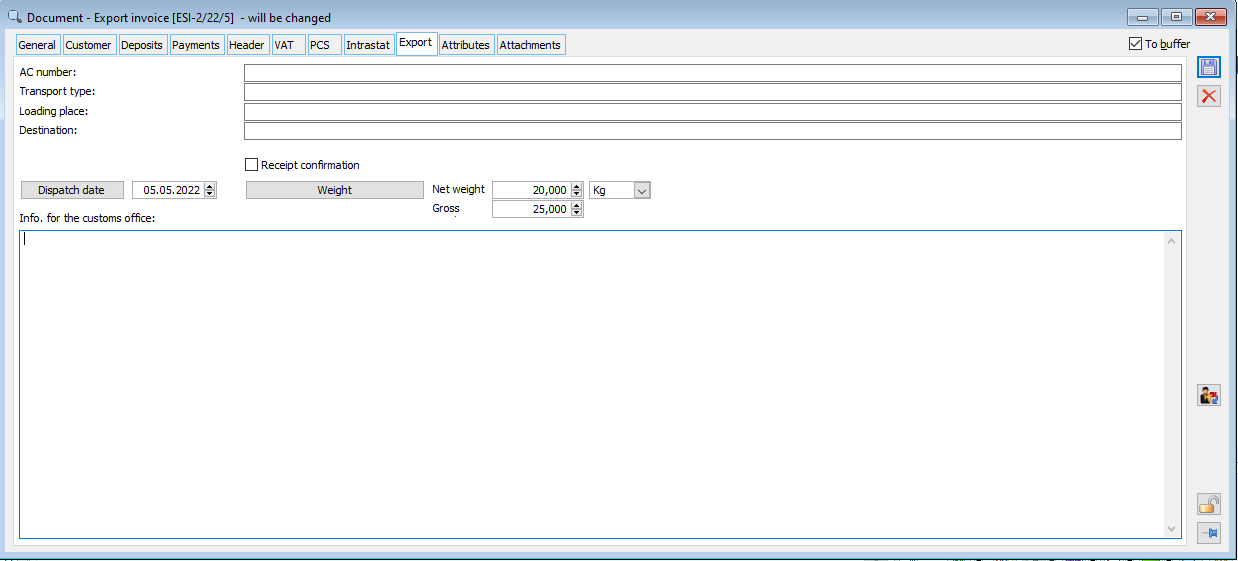

Export invoice, tab: Export

The tab does not appear on a regular sales invoice. It contains the following information:

SAD number – the number of the customs declaration related to the invoice.

Type of transport – space for entering the type of transport.

Loading place – indicates where the goods are loaded.

Destination – the final place of the goods delivery.

Acknowledgement of receipt – this box is checked if an acknowledgement of receipt has been received. This informs the User that it is possible to apply a zero VAT rate.

Acknowledgement date – date of acknowledgement of receipt.

Date of dispatch – the date on which the goods were dispatched.

Net, gross, unit – weight of the goods. The weight can be entered or calculated from the data of the product sheets by pressing the button: ![]() .

.

Information for the customs office – space for entering additional information for the customs office.

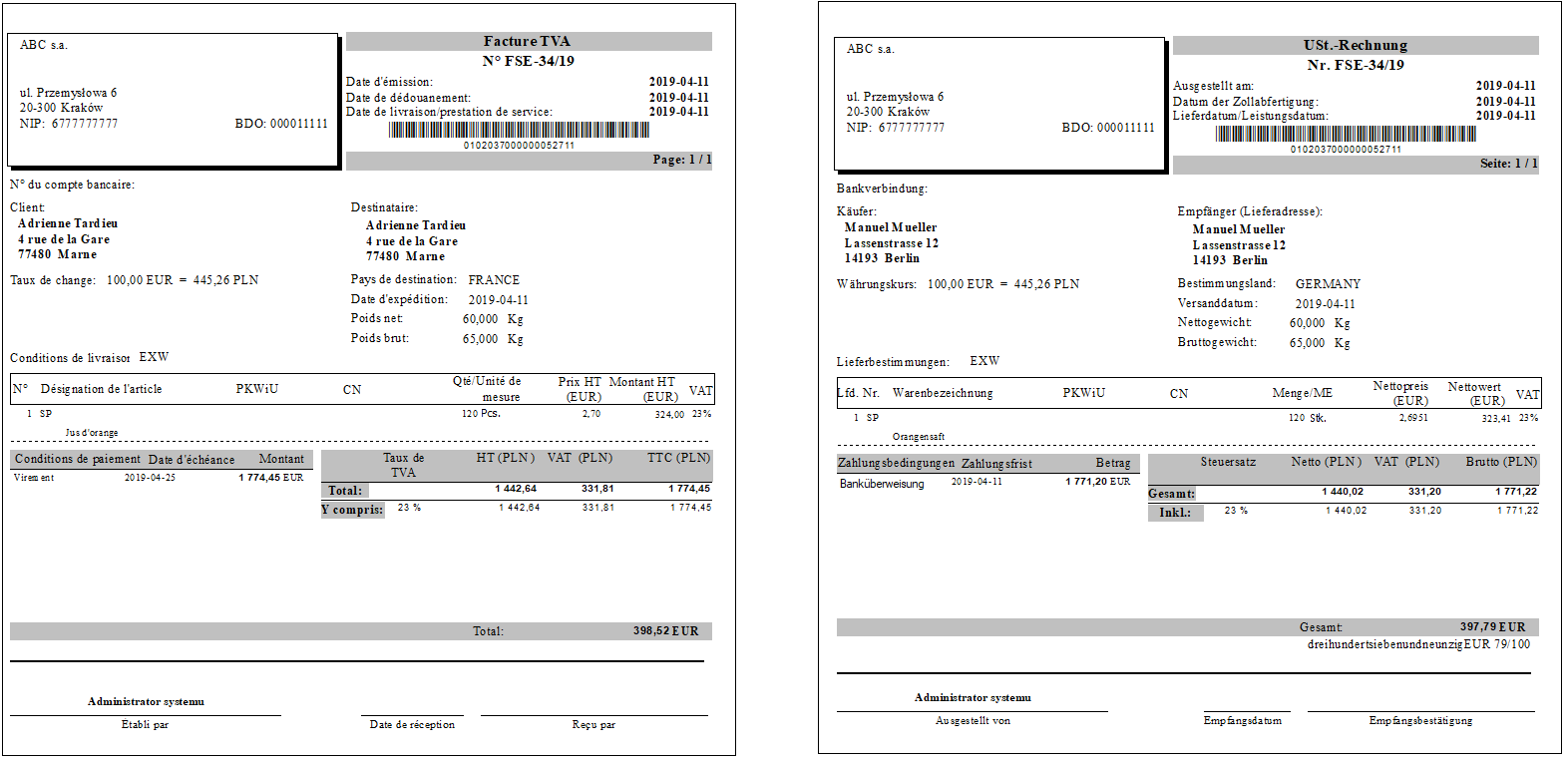

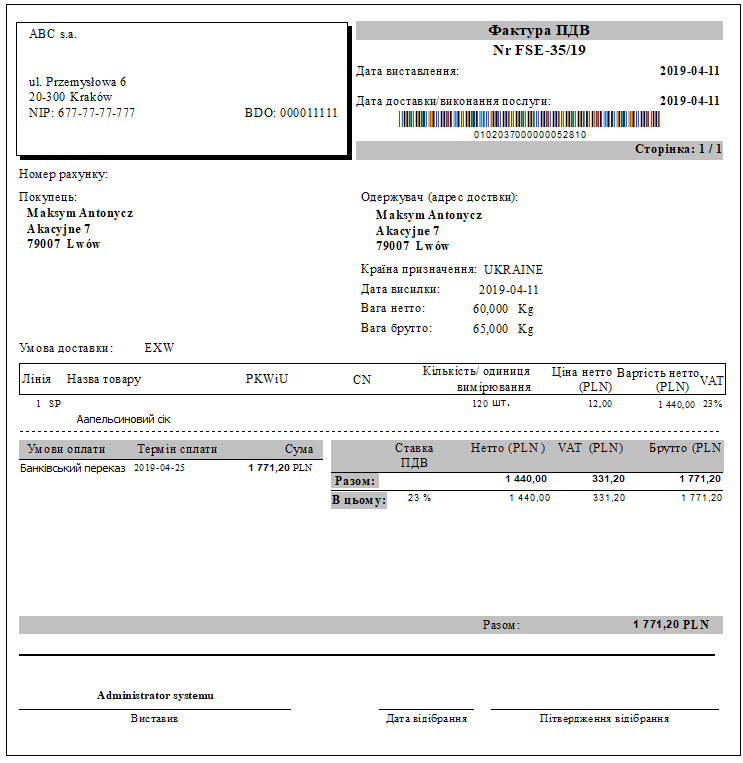

Printouts of export invoices in foreign languages (FSE)

For FSE, (s)FSE, (S)FSE, FEL export invoices and their adjustments, there is a group of Export invoice printouts (foreign language) available in the System, including document printouts in French, German, and Ukrainian.

The individual phrases on the above printouts shall be as follows:

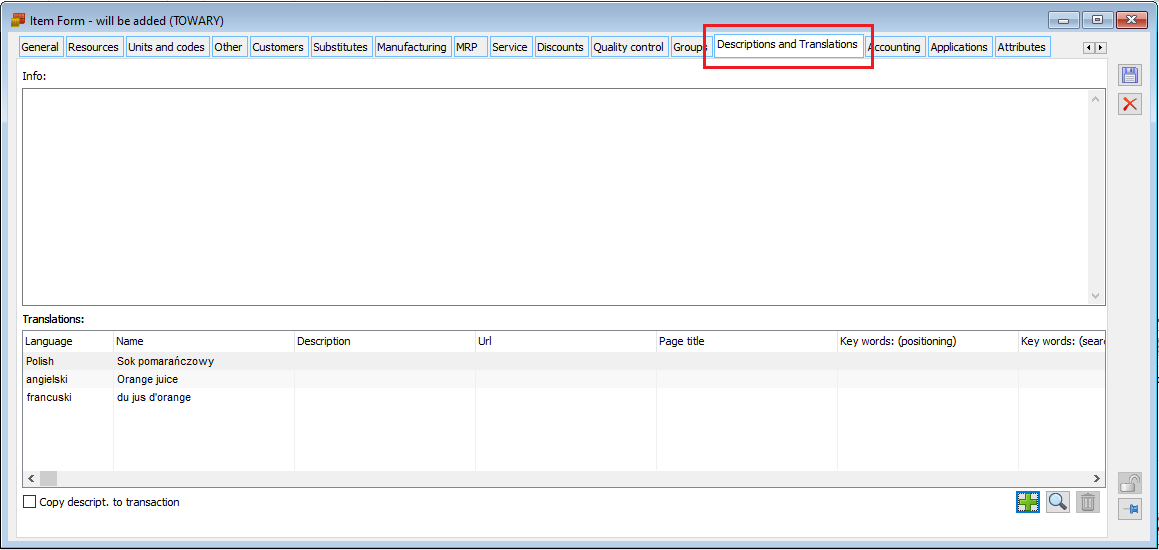

- Product name: if the translation of the product name in the language of the printout has been defined, the system prints the product name in that language, and if this translation has not been defined, then the Polish name of this product is printed

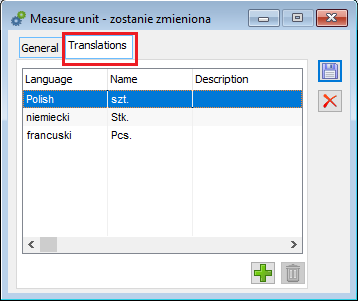

- Product unit symbol: if a unit translation is defined in the printout language, then the System prints the unit symbol in that language; if no translation is available, the system unit symbol is printed

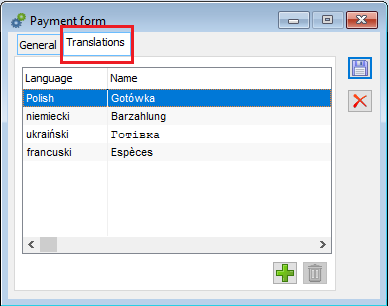

- Payment method name: if the name of the payment method used on the document has been defined, then a translation for the printout language is printed, otherwise the system name of this payment method is printed. Applied translations of standard payment forms in the above-mentioned languages have been added in the conversion and creation of the database, but the User may change them.

- Other phrases (fixed printout phrases): the translation is done directly on the printout

Export release note (WZE)

Functionally, the Export Release Note is very similar to an export invoice. It documents the release of goods to the customer, under certain conditions of sale. The main difference is that this is not a document recorded in the VAT register and by default it does not generate a payment, although such a setting in the document definition is possible. Both functions are fulfilled by the WZE binder, which is an export invoice issued to one or more WZE documents. Such a document takes over the items from the source document, does not generate any movement of goods, and creates payment and entries in the VAT register.

It should be noted that on a WZE document, clearing an advance document, also one that does not generate payments (i.e. in the document definition, with the parameter unselected: Generates payments) the following tab is presented: Payments, where you will find a section with a list of cleared advance invoices.

The document can be issued only for the types of contractors that are defined in the definition of a given document.

The System’s version 2018.2 allows the User to decide, with the accuracy of a specific transaction, whether the payment for it is to be created already at the stage of receipt/release of goods or only at the stage of its invoicing. By default, the behaviour of the System results from the setting of the parameter “Generates payments” of the given centre’s document definition, while an authorised Operator may change this behaviour by enabling or disabling the Payments parameter on a specific non-approved WZE document.

The aforementioned functionality is dedicated especially to those Customers who have postponed the moment of creating/accepting payment to the invoicing stage, and want to handle special, occasional cases when making a transaction with a given Customer due to, for example, exceeded credit limits, is conditioned by collecting payment already at the stage of releasing goods.

From the {General} tab it is possible to change the columns using EiP (Edit in Place): Quantity, Net Price, Gross Price (irrespective of the setting of the VAT charging direction), Net Value, Gross Value, Discount, without having to open the item window (applies to non-approved documents).

An export release note can also be issued to a domestic contractor. On such a document, the Transaction type is Domestic, and the VAT rates are Domestic. The export VAT parameter is not editable. In the case of changing the contractor from domestic to foreign or changing the transaction type from domestic to intra-community or other foreign, VAT rates change, the export VAT parameter is not editable – along with the change of the transaction type, VAT also changes from domestic to export or from export to domestic. The Export Release Note document can also be generated from Sales order or Warehouse release note.