General description

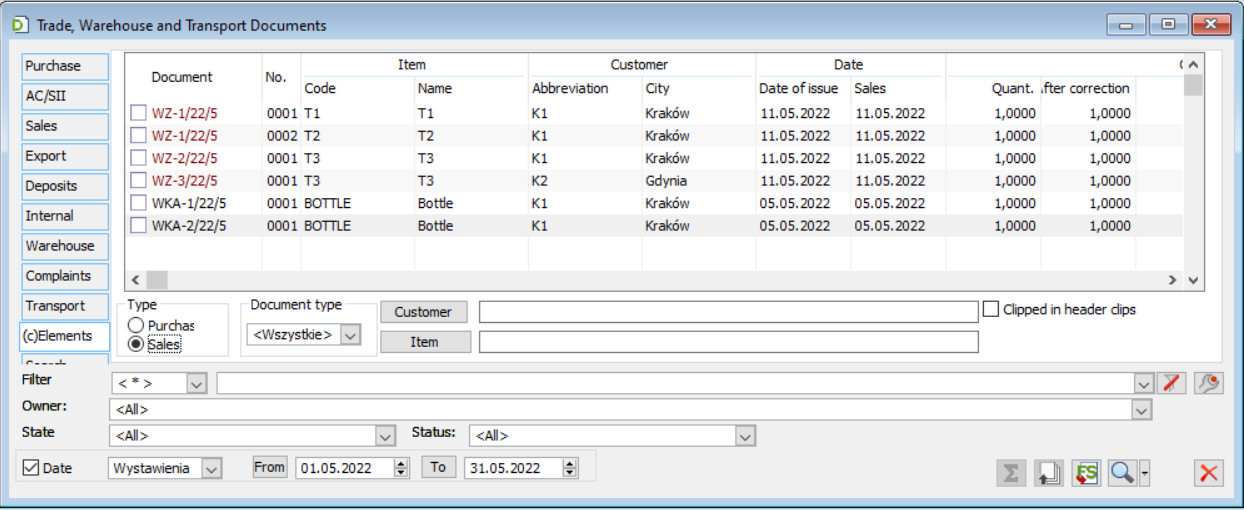

Module: Sale enables the issuing of the following documents:

Commercial

- Purchase invoice (FZ)

- Received note (PZ) – also from a flat-rate farmer

- Flat-rate farmer VAT invoice (FRR)

- Import received note (PZI)

- Purchase invoice adjustment (FZK)

- VAT RR invoice adjustment (FRK)

- Received note adjustment (PZK)

- Sales invoice (FS)

- Receipt (PA)

- Sales report (RS)

- Sales report adjustment (RSK)

- Export invoice (FSE)

- Internal document (FW)

- Release note (WZ)

- Export release note (WZE)

- Sales invoice adjustment (FSK)

- Receipt adjustment (PAK)

- Export invoice adjustment (FKE)

- Internal document adjustment (FWK)

- Release note adjustment (WZK)

- Export release adjustment (WKE)

- Tax free

- Sales complaint (RLS)

- Purchase complaint (RLZ)

Internal

- Internal income (PW)

- Internal release (RW)

- Inter-warehouse transfer release (MMW)

- Inter-warehouse transfer receipt (MMP)

- Internal revenue adjustment (PWK)

- Internal release adjustment (RWK)

- Depreciation (DP)

- Cost adjustment (KK)

Deposits

- Deposit release (WKA)

- Deposit receipt (PKA)

- Deposit release adjustment (WKK)

- Deposit receipt correction (PKK)

Warehouses

- Warehouse receipt (PM)

- Warehouse release (WM)

- Intra-warehouse transfer (MP)

Transport

- Package (PC)

- Dispatch (WYS)

Commercial and internal documents are of the quantity and value type. Commercial documents can be placed in the VAT register and can create payments. Warehouse documents are quantitative and are used to record the movement of goods in the warehouse (receipt and release). Commercial and internal documents do not change the stock of goods. Only warehouse documents change that.

To fully record the transaction and the related movement of goods in the warehouse, it is always necessary to have a pair of documents: commercial or internal and warehouse. The basic document sequence is therefore in the case of sales: FS/FSE/PA/FW – WM, in the case of purchase: FZ – PM. A commercial document is issued first, followed by a warehouse document. However, it is possible to reverse this sequence, i.e. to record the release/receipt of goods first, and then issue the commercial document.

Search for goods on documents by EAN code:

On commercial outgoing documents (FS/WZ, etc.), WM:

The entered character string is searched first as the product code, then as the EAN of the product, then as the EAN of the product auxiliary unit, then as the EAN of the stock. If the latter has occurred, the retrieved stock is taken.

On commercial revenue documents (FZ/PZ, etc.), PM:

The entered character string is searched first as the product code, then as the EAN of the product, then as the EAN of the product auxiliary unit. Stocks and supplies are not searched.

In a situation where the EAN is on delivery and the stock has been sold out, and it is not on the product sheet or on the unit, the goods may not be found in the above-mentioned situations.

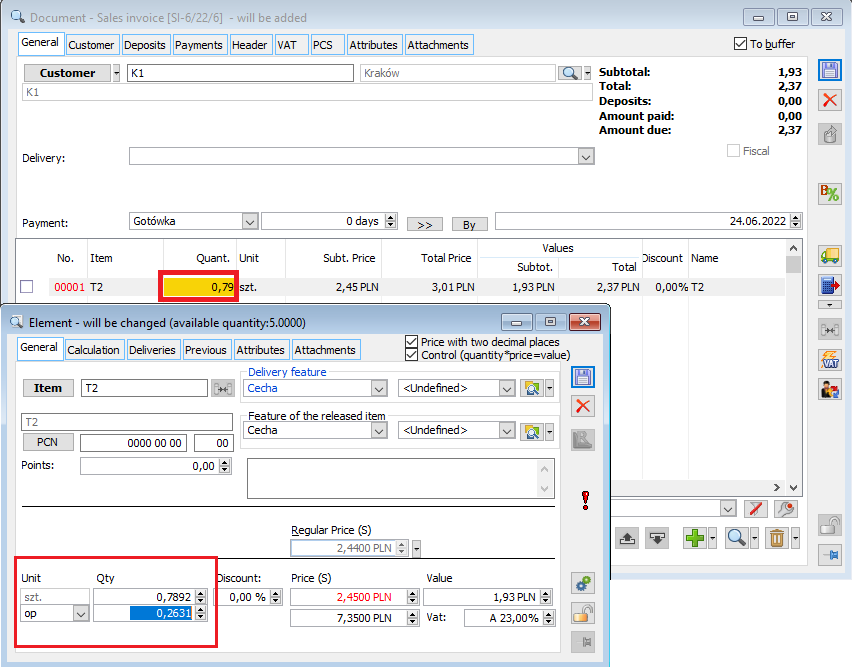

In the list of transaction items, it is possible to edit the price and quantity in Edit-in-place mode. This means that double-clicking on a price or quantity item activates editing of the corresponding figure. Double-clicking on another column brings up the transaction item editing window.

Documents can be issued by using the keyboard shortcut Ctrl+Ins. Issuing a document in this way involves copying data from the source document with the possibility of editing them.

The operator has issued a sales invoice to customer K1, for goods T1. After some time, a transaction is again concluded with this contractor, for this good. To save the time to issue a new sales invoice, the operator can copy the data from the previous document onto the new one. This is done by selecting the previous sales invoice and using the keyboard shortcut: Ctrl+Ins. A new sales invoice will be created with the source document details automatically entered. The new document is issued to the buffer; hence it is possible to modify all the fields.

When issuing a document via Ctrl+Ins, the field setting “Update deposits” from the source is transferred to the new document.

To issue a document via Ctrl+Ins:

- select the source document in the document list, from which the data will be transferred to the new document.

- press Ctrl+Ins shortcut on your keyboard. A new document will be issued and registered in accordance with the document registration rules.

When issuing documents by using the shortcut Ctrl+Ins, the current date is entered on the copied commercial or import document, as when creating a new document. Other values such as document items, expected payment date, etc. are taken from the copied document.

Entering goods on the document directly after selecting the contractor

When issuing commercial and warehouse documents, it is possible to enter goods directly after selecting a contractor. With all the other parameters on the document set to default, this reduces the time it takes to issue the document. To enter the goods into the document directly after entering the contractor, use the keyboard shortcut: Alt+L.

An FS document is issued. The contractor is selected on the document, and then the User is going to enter the goods that are the subject of the transaction. For this purpose, after entering the contractor, use a keyboard shortcut: Alt+L, which will cause the cursor, from the field: Contractor, take you directly to the panel where the list of FS document items is displayed.

Clips

Another option to record a transaction is by using an intermediate document, i.e. WZ/WZE in the case of sale and PZ in the case of purchase. Example document sequences in this case will be as follows: Either WZ – WM – FS, PZ – PM – FZ or WM – WZ – FS, PM – PZ – FZ. The WZ and PZ documents are quantity and value documents and can generate payments. However, they may not constitute final documents recording the transaction. It is necessary to issue the appropriate sales (FS/FSE/PA/FW) or purchase (FZ) document. The final document thus issued is called in the system: Clip. It differs from an ordinary document in that it takes over items from the source document as transactions, i.e. items for which issue/receipt operations have already been carried out. The clip itself does not create new transactions and cannot cause goods to move (no warehouse documents can be created for it). It is a different type of document, containing transactions that have already been recorded.

The sales invoice issued against the receipt, as well as the RS (Sales report) and RSK (Sales report adjustment) documents, whose components are respectively: receipts and receipt adjustments (for more information, see chapters: 1.14.8 Sales report (RS) and 1.14.9 Sales report adjustment (RSK)) are of clip nature.

Clip can be a sales invoice and a purchase invoice. A clip document is distinguished by adding “(S)” before the type code ((S)FS, (S)FZ). Clips can be issued to multiple WZ/PZ documents, including those with different contractors – in this case, the clip will be generated for the contractor from the first clipped document. The same rule applies when creating a clip of adjustments. So if, for example, the order of the adjustments is the opposite of the source documents, the contractor on the adjustment created as a binder may be different from that on the adjusted (source) clip. When creating an adjustment clip, the contractor will be taken from the clip being adjusted.

The address on the clip will be of the type that was selected on the first document to be clipped, e.g. if on the WZ document, which is clipped as the first one, the shipping address of the contractor was selected, then this address will be prompted on the clip.

It is possible to bind documents with an undetermined cost of sales to the S(FS) document. In this case, checking the parameter: Fixed cost of sales on S(FS), will set this parameter also on bound documents. When binding documents that have a fixed cost of sales, the parameter: Fixed cost of sales on S(FS) will automatically be checked.

Similarly, clips are generated for adjustments to WZ and PZ documents, i.e. WZK/PZK. The clips of these documents are documents marked as: (S)FSK and (S)FZK. It is possible to generate a clip of adjustments to multiple WZ/PZ documents if the source documents have been clipped to one clip ((S)FS, (S)FZ). The generation of a single clip of adjustments to multiple WZ/PZ documents is also available when the source documents are issued to different contractors. The clip will be generated on that contractor from the first source document that was clipped.

Please note that only the adjustment whose source document is a component of the clip may be attached to the clip. It will be impossible to detach a source document from the clip if there is an adjustment to that document on the clip.

Multiple warehouse documents can be issued for a single commercial/internal document. A single commercial/internal document can be issued for multiple warehouse documents. One clip (FS/FZ) can be issued for multiple WZ/PZ documents.

On the clip, there is no date of release/receipt from the warehouse.

Only documents with the same type of transaction may be clipped to the clip. This parameter cannot be edited on a clip.

When clipping one WZ/PZ/PA to a clip, these will be attributed to it:

- Manner of delivery

- Transaction feature

- Document description

- Order number

- Country of dispatch

- Transaction type

- Delivery type code

When more documents are bound, the due date and form of payment will be copied from the first document to be bound.

On the clip, on the tab: General, there is a button: ![]() [Update the payment date and method]. It is used to update the due date according to the date specified on the clip. In the case of WZ/PZ/PA which have payments and from which a clip was created, the date will be modified for them as well.

[Update the payment date and method]. It is used to update the due date according to the date specified on the clip. In the case of WZ/PZ/PA which have payments and from which a clip was created, the date will be modified for them as well.

If there is no payment on the WZ/PZ/PA, then on the clip:

- the date of issue will be indicated in accordance with the current date

- the date of receipt will be indicated in accordance with the current date

- the date of sale/purchase will be copied from the clipped document

- the method and term of payment will be copied in accordance with the settings on the contractor card (window: Contractor card, tab: Commercial, field: Method). This data can be modified

Bound documents will have payments if the parameter has been selected in their document definition: Generates payments (module: Administrator, window: Document definition [WZ], tab: Parameters).

In the case of clipping WZE export documents and WZE adjustments, when generating a clip, a window will be displayed in which the exchange rate according to which the values will be displayed on the generated document should be selected. It is possible to choose a currency:

- Current from the exchange rate table (User-defined)

- From the first bound document.

- This exchange rate can be modified on the generated clip.

Currency and exchange rate on clips

It is possible to clip WZ, PZ documents to one clip when a currency other than the system currency is indicated in their headers – also when a different currency is selected in their header. The currency that will be found after binding documents with different currencies, on the tab: Header, clip S(FS) and S(FZ), is the currency from the first document being clipped. Once it has been entered on the document, it will no longer change. However, it is possible to change the exchange rate on the clip.

When the rate on the clip changes, the payments for the clip (not the components) will be updated.

When creating an adjustment to S(FS) and S(FZ) clips in a currency, the currency and exchange rate from the document being adjusted will also be transferred to the adjustment, without being editable. As with adjustments to other documents, changing the date on an adjustment will not change the rate on it and update the payment.

The VAT amount on the clip is not the sum of the VAT amounts from the components, but is calculated from the net value of the clip for a given VAT rate.

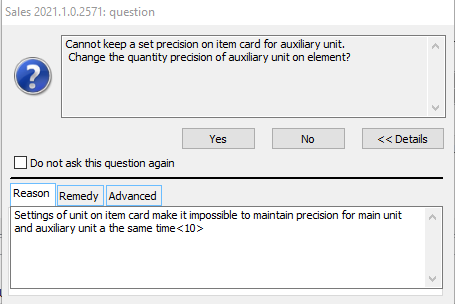

Item clips (S)FZ/FRR/FS/FSE

Thanks to the functionality of creating, on the basis of external receipts/releases, clip invoices containing own elements, the User can issue invoices for particular items of receipt/release documents or even for specific quantities of those items. In this way, a given receipt/release document can be “invoiced” on multiple invoices.

The above functionality is envisaged for PZ, PKA documents, for which multiple (s)FZ/(s)FRR documents can be created, for WZ, WKA documents, for which multiple (s)FS can be created and for WZE documents, for which (s)FSE can be created. For the time being, the aforementioned functionality does not apply to receipt clips, i.e. the RA document will still be created for headers and not PA document items.

This functionality is an alternative to creating invoices based on the header of the receipt/release document. It will depend on the specifics and needs of a given company which model of working with clips the Customer will use.

Items clip invoice (s)FZ/FRR/FS/FSE

Items clip (s)FZ/FRR/FS/FSE

Items clip invoice (s)FZ/FRR/FS/FSE is a document with its own items and sub-items, created on the basis of items/sub-items of receipts/releases. These documents will be made available in formats appropriate for “regular” invoices. To distinguish them, they will be marked with a prefix (s) both in the document format and in the lists of documents. The purchase items clip will be marked: (s)FZ and (s)FRR, while the sales items clip: (s)FS, (s)FSE. In addition, for such a document, information about the source documents/items/sub-items will be available, presented in the list of linked documents, in the list opened by the “Clipped documents” button on the {Header} tab of the document, as well as on the {Deliveries} tab of the clip item.

(s)FZ/FRR/FS/FSE documents will not operate on warehouses, i.e. they will not receive/release stocks, neither will the warehouse PM/AWD, WM/ZWM documents be generated for them, these operations will still be performed by PZ/PKA/WZ/WKA/WZE documents. Cost adjustments will continue to be generated to issue documents and their adjustments, not to (s)FS/FSE clips.

One (s)FZ/FRR/FS/FSE document can clip multiple items from multiple receipt/release documents, each receipt/release document can be clipped to multiple (s)FZ/FRR/FS/FSE clips.

Generating items clip (s)FS/FRR/FS/FSE

Apart from the existing options for generating a “header” clip, an operation for generating an items clip has been made available. This option is available in the list of commercial documents and in the history of goods/contractor. An appropriate option has also been added to the context menu of the ZZ/ZS order list, and its operation consists in generating an items clip to WZ/WZE/PZ documents generated from the indicated order. In addition, the generation of this type of clip will be possible from the new tab {Clipped items} of the commercial documents list dedicated to it.

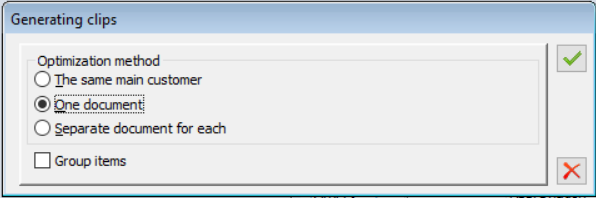

During operations for multiple documents, the User will decide whether the System should generate a separate invoice for each indicated document, whether to generate invoices according to the correspondence of the contractors on the indicated documents, or whether to generate one invoice regardless of the contractors on the indicated documents. The latter option will be possible only if in the definition of the generated document the parameter requiring the contractor on the items clip to be compliant with the contractor from the receipt/release document has not been activated.

Additional conditions necessary to generate items clip

In addition to the standard conditions that a receipt/release document must meet to generate an invoice from it, such as appropriate document type status, appropriate document state, etc., additional conditions must be met, such as

- PZ/PKA/WZ/WKA/WZE document cannot generate payment

- PZ/PKA/WZ/WKA/WZE document must have a defined cost

- The aforementioned document cannot deduct prepaid invoices

- The aforementioned document may not be clipped to the (S)FS/FZ header clip…

- All adjustments to the source document must be approved before the items clip is generated

- Before generating an items clip to the above, all previous items clips in which the item is clipped must be approved, i.e. if any sub-item of item X is clipped in an unapproved clip, then that item cannot be generated/clipped to a subsequent clip

When generating an items clip from multiple documents, the System will, by default, verify that the currency, VAT direction, transaction type, etc. match the documents already clipped, as it does for “header” clips with the exceptions below:

- It will be possible to create a common invoice for a WZ/WZE document with a “domestic” and “Taxpayer is Buyer” transaction

- Optionally, the System will require the rate on the generated invoice and the source document to match. This will be determined by the relevant parameter “Require rate consistency” in the definition of the generated document.

(s)FZ/FRR/FS/FSE document items

Generating/attaching/adding items to (s)FZ/ FRR/ FS/ FSE

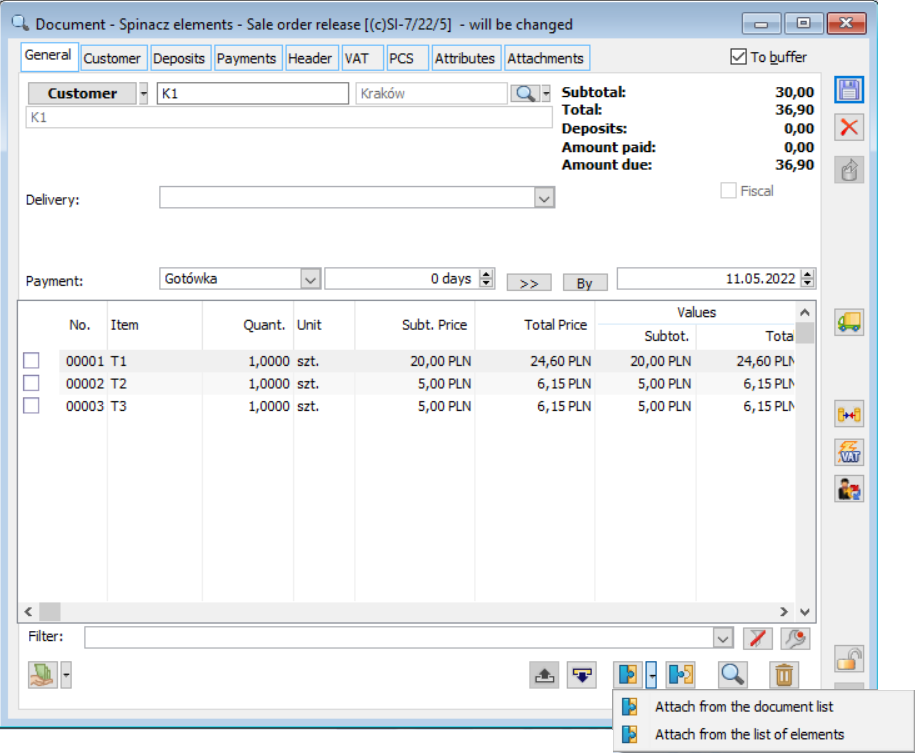

Apart from the operation of generating items clips from the list of PZ/PKA/WZ/WKA/WZE documents, the User can perform the operation of attaching items directly from the (s)FZ/FRR/FS/FSE document form. This is done using the “Attach from documents list” and “Attach from items list” operations.

- “Attach from documents list”

The above operation opens the list of documents in multiple selection mode. The system will create the items on the (s)FZ/FRR/FS/FSE clip based on the items of the indicated documents.

- “Attach from items list”

The above operation opens a new tab {Clipped items} of the list of commercial documents, where the User will be able to select specific items of PZ/PKA/WZ/WKA/WZE documents, which he wants to clip to the current clip, and also specify for each of them the quantity to be “invoiced” with the current clip.

The “Add” and “Remove” options are not available on the clip format, it is possible to attach or detach elements. The magnifying glass button is active regardless of the document status as long as the items list is not empty.

It is also possible to change the quantity/price on items (EiP). After a change in quantity or price is made, an adjustment to the WZK (PZK) is automatically created, which averages the price of the remaining quantities. In the list of documents, such an adjustment will be visible with a description, e.g. “Document automatically generated after approving a clip invoice with a price different from the price on the source item”.

(s)FS/FSE/FZ/FRR item form

The clip items are presented on the forms used on “regular” invoices, except for the {Deliveries} tab, which differs from what the System presents on FS/FSE/FZ/FRR items. The remaining tabs contain the same data, only the editing rules may be different, which will depend on whether a given item is linked to the source item(s) of the WZ/WZE/PZ, etc. or not, and whether the Operator editing them has permissions to change the price on the clip items.

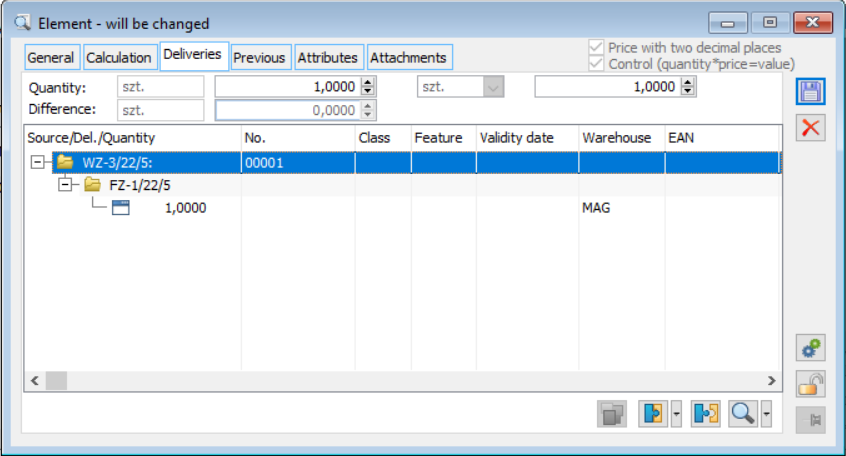

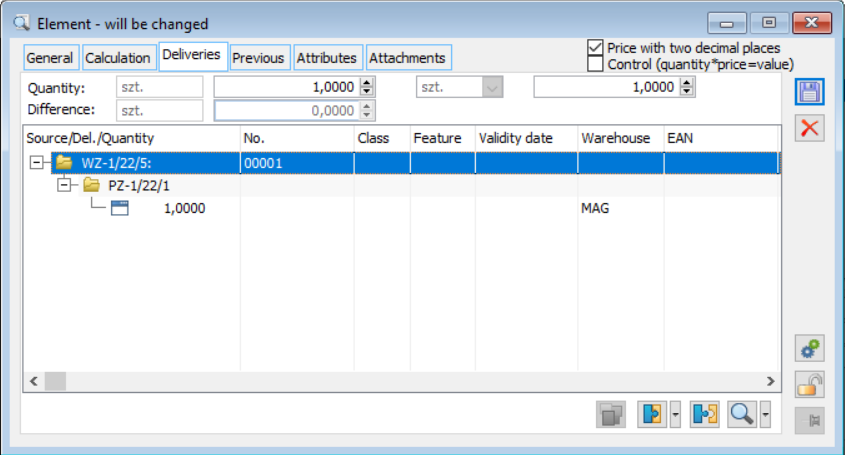

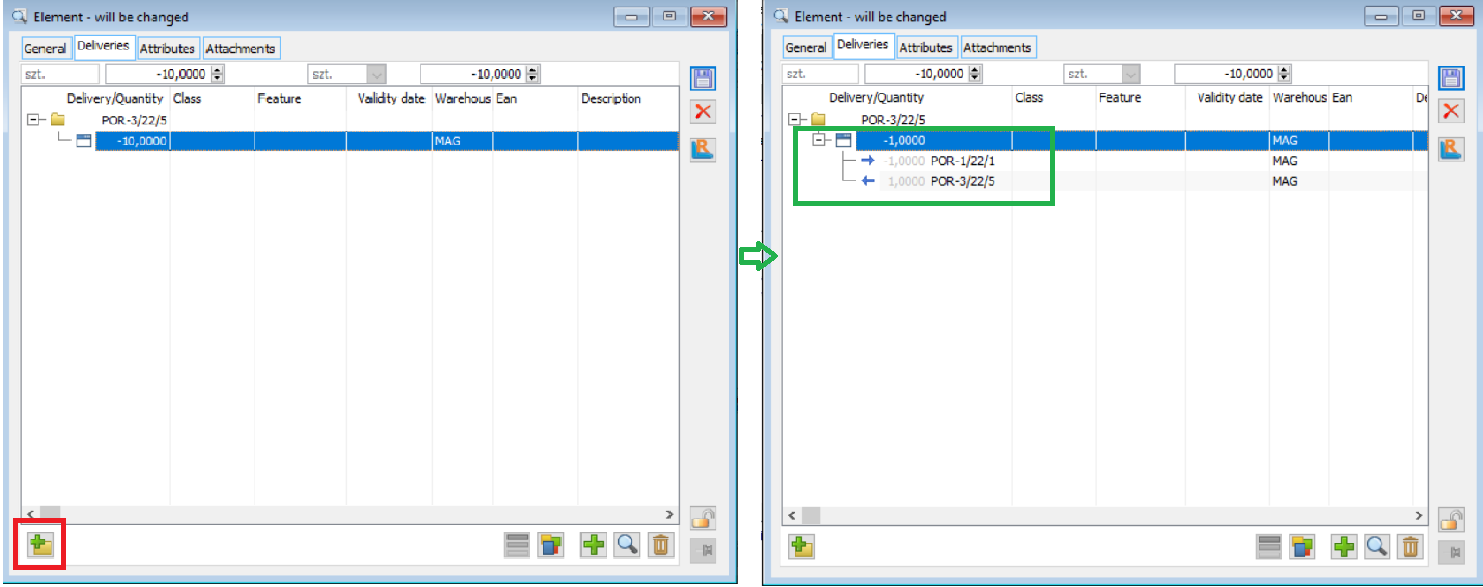

On the Deliveries tab, the sub-items are presented as a 3-level tree.

The clip’s sub-items are grouped according to the correspondence of the WZ/WZE/PZ, etc. document to which the source sub-items for the clip sub-items point, within each of the groups thus created, there is an additional grouping according to the correspondence of the delivery to which the source sub-items point. From this level, it is also possible to change the quantity/price (EiP) and to add or remove items.

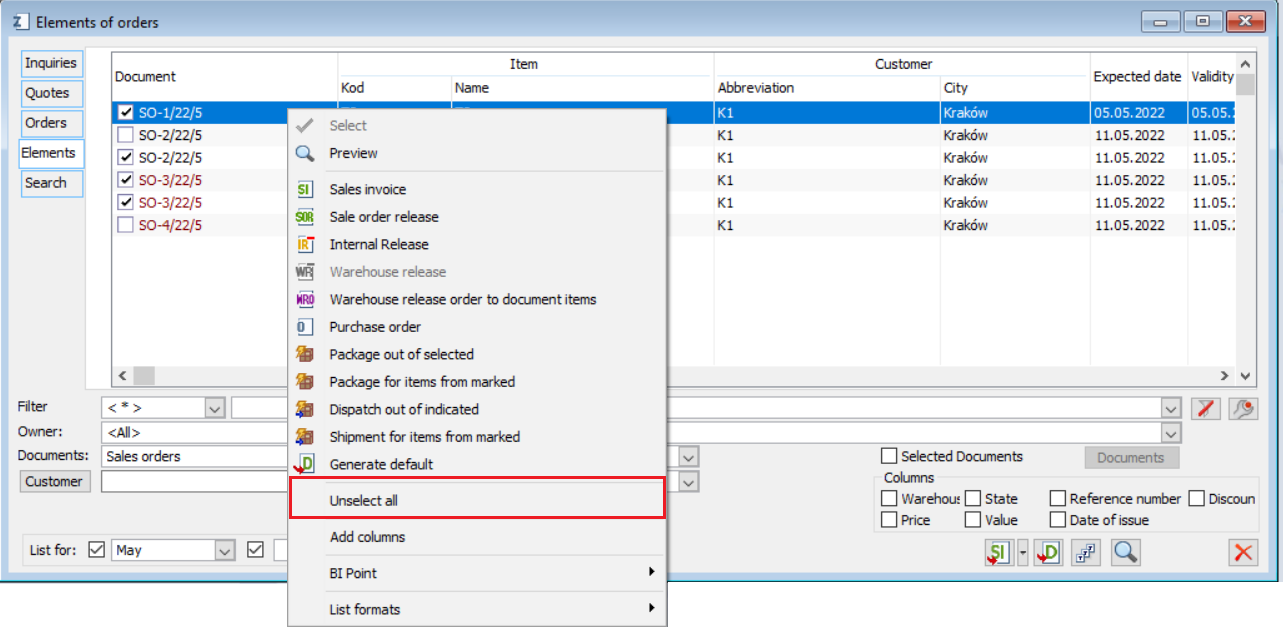

(s)Items tab on the list of commercial documents

To enable quick search for bound items, a new {Clipped items} tab has been made available in the list of commercial documents. It will present a list of PZ/PKA/WZ/WKA/WZE items. For each of them, information will be presented about the number, dates of the document to which it belongs, the contractor to which it relates, the quantity/value on the item, the quantity/value after adjustment, which will be the basis for invoicing the given item, the quantity/value already invoiced and the remaining to be invoiced.

The items of PZK/PKK/WZK/WKK/WKE adjustments will not be presented in the aforementioned list, as they will be taken into consideration during the presentation of the quantity/value after the adjustments for the receipt/release items.

The system saves the selected records in the list, even if individual records disappear from the list as a result of applying a specific filter. The exception is the Documents filter, which, because it changes the type of items presented, still automatically disables selections.

Thanks to the above-mentioned functionality of remembering selections, Users can easily identify, for example, the order items they want to execute using various filters. The selected records are also saved after the document is generated, which allows registering first an invoice and then a parcel from the same selected order items.

If the User wants to resign from the saved selected records, he/she can use the “Deselect all” option available in the context menu.

New configuration parameters

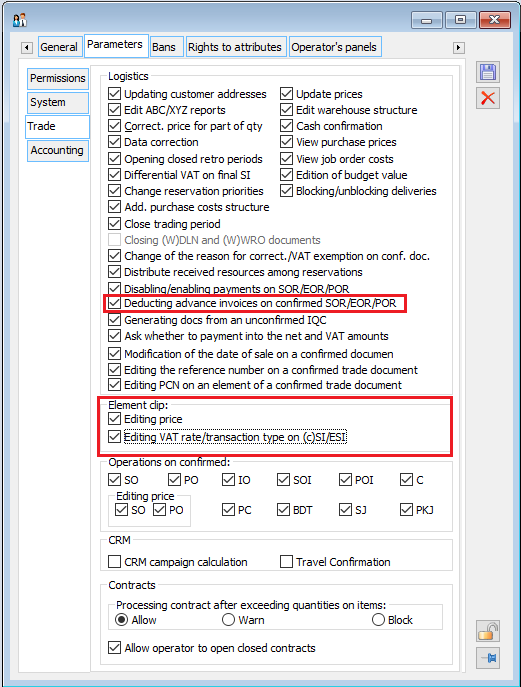

New parameters on the Operator card

Parameters have been added to the Operator card, Operator template, and multi-operator editing form:

- “Deduction of advance payment invoices on a confirmed WZ/WZE/PZ”,

An operator with such a permission will be able to attach/detach a prepaid invoice to a WZ/WZE/PZ document that has already been confirmed but not yet posted or bound. This will allow you handling the situation where

the User wants to generate a clip of items for WZ/WZE/PZ, which deducted the advance invoice. In this case, it will not be possible to create this type of clip, so to do so, the authorised Operator will be able to detach the advance invoice from the WZ/WZE/PZ, then create an (s)-type clip and deduct the advance invoice therefrom,

On the WZ/WZE/PZ document, the advance invoice was not deducted, then a header clip (S) was created from it, on which the advance invoice will no longer be deducted, as on this clip type, the deduction is “inherited” from the clipped documents. To “fix” this situation without having to cancel the WZ/WZE/PZ, the authorised Operator will be able to “attach” an advance invoice on the document before it is clipped, so that when the WZ/WZE/PZ is clipped to the (S) clip, it will be correctly deducted.

In addition, to enable the Operator to perform the above-mentioned operation also on those WZ/WZE/PZ, which, according to their definition, do not generate payment, and therefore do not have a {Payments} tab where there is an option of attaching an advance invoice, it will be presented to Operators with the permission “Deduction of advance payment invoices on a confirmed WZ/WZE/PZ”.

Advance invoices cannot be attached to/detached from approved invoices. After the document has already been included in the VAT return, perhaps printed, etc., its value may not be changed.

- The “Items clip” section, with the following parameters

- Edit price

- Edit VAT rate / transaction type on (s)FS/FSE

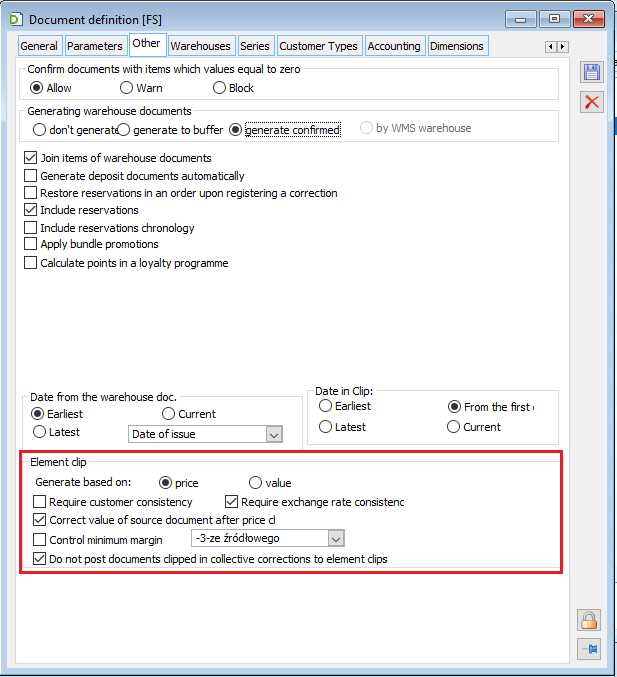

New parameters on the document definitione

The “Items clip” section on the document definition

The Items clip section contains the following parameters

- Generate based on options: price/value

- Checkbox “Require contractor matching”

- Checkbox “Require rate matching”

- Checkbox “Adjust source value after price change”

- Checkbox “Control minimum margin”

- A button next to the aforementioned checkbox with a menu structured as follows.

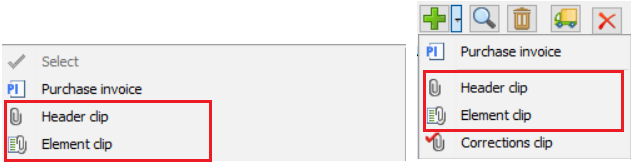

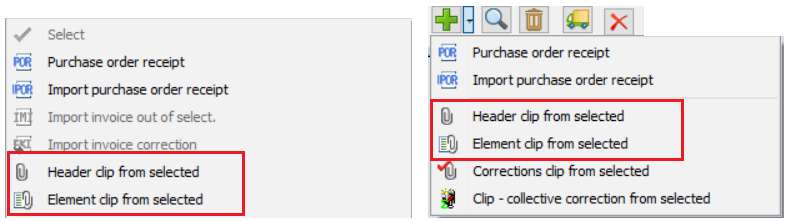

Changes to the context menu and the “Add” option menu of the document list

In the context menu of the FZ list and in the menu next to the “Add” button, options have appeared: Header clip and Items clip (similar to FS).

In the context menu of the PZ list and in the menu next to the “Add” button, options have appeared: Header clip from the indicated and Items clip from the indicated (similar to WZ).

Adjustments to (s)FSK/FKE/FZK/FRK clips

As far as the adjustment of transactions invoiced with such clips is concerned, it has been assumed that the adjustment should be made by registering the adjustment to the clip, i.e. by creating (s)FSK/FKE/FZK/FRK, and consequently, the System will generate the relevant WZK/WKE/PZK adjustments to the WZ/WZE documents… clipped on the adjusted clip.

The only case when the System will allow the Operator to issue “on his own” a WZK/PZK, etc. adjustment to the transaction covered by the above-mentioned clip will be the possibility of returning that part of the document/item/sub-item of the source WZ/PZ, etc. which has not been invoiced yet.

The above “duality” of the adjustments is dictated by the fact that the sub-items of the (s)FS/FSE/FZ/FRR clips will not affect the warehouse (because this would cause duplication of operations already made by WZ/PZ, etc.), and consequently the adjustments of the clips will not do so either. Therefore, in the case of those adjustments which take stock from the warehouse (plus outgoing quantity adjustment, minus revenue quantity adjustment), the System would not be able to make such a collection from the warehouse directly on the (s)FSK/FKE/FZK/FRK, so it would not be able to control the quantity that could be collected. For this reason, the generation of an (s)FSK/FKE/FZK, etc. adjustment will result in the simultaneous creation of a WZK/WKE/PZK/WKK/PKK to those WZ/WZE/PZ/WKA/PKA documents whose sub-items indicate the adjusted clip.

Editing of the (s)FSK/FKE/FKZ/FRK adjustment item/sub-item will result in a parallel change on the WZK/WKE/PZK etc. and the scope of this edition will be determined, on the one hand, by quantity possible to be adjusted on a given (s)FSK/FKE/FZK sub-item and, on the other hand, by the quantity that can be adjusted on the “related” sub-item(s) of the WZK/WKE/PZK, etc., including in terms of the amount of resources that can be retrieved by the edited item.

Such “accompanying” WZK/WKE/PZK, etc. documents may not be edited outside the (s)FSK/FKE/FZK/FRK form, deleted, approved, etc. Its approval, deletion, cancellation will take place during the approval/deletion/cancellation of the clip adjustment.

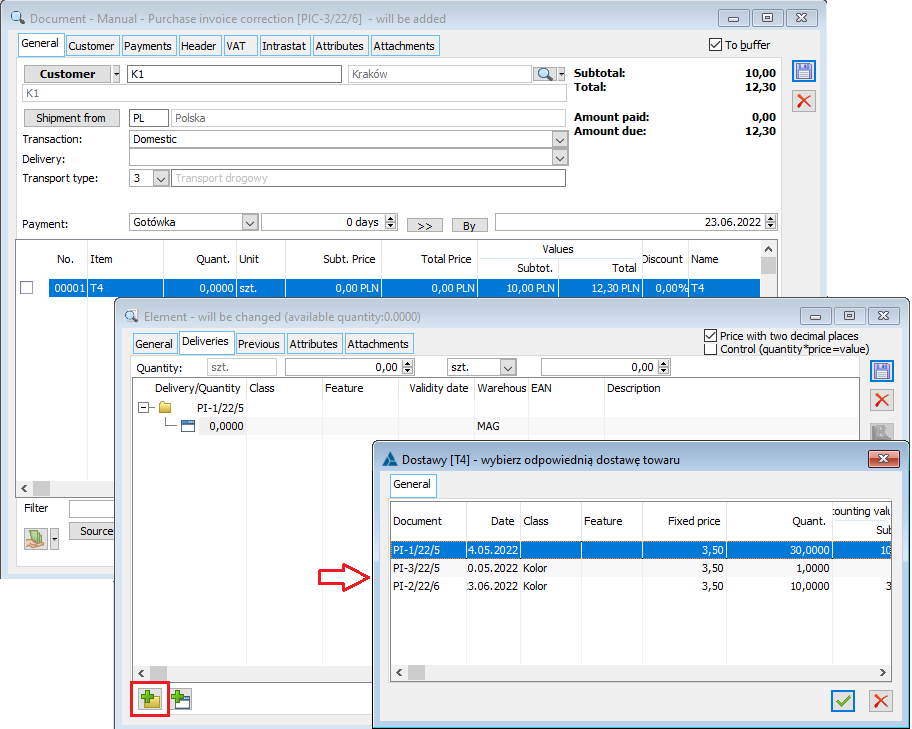

Change of delivery on (s)FZK/FRK

Version 2020.0 of Comarch ERP XL allows the User to change the delivery from which the goods are to be returned on (s)FZK/FRK and PZK/PKK documents accompanying such adjustments. To do this, place the cursor on the sub-item in question and use the Change delivery button.

Information about the substitution of the delivery, either by the System in the case of a sale of the original delivery or by the User himself, is duly presented on the above-mentioned adjustments of the item clips.

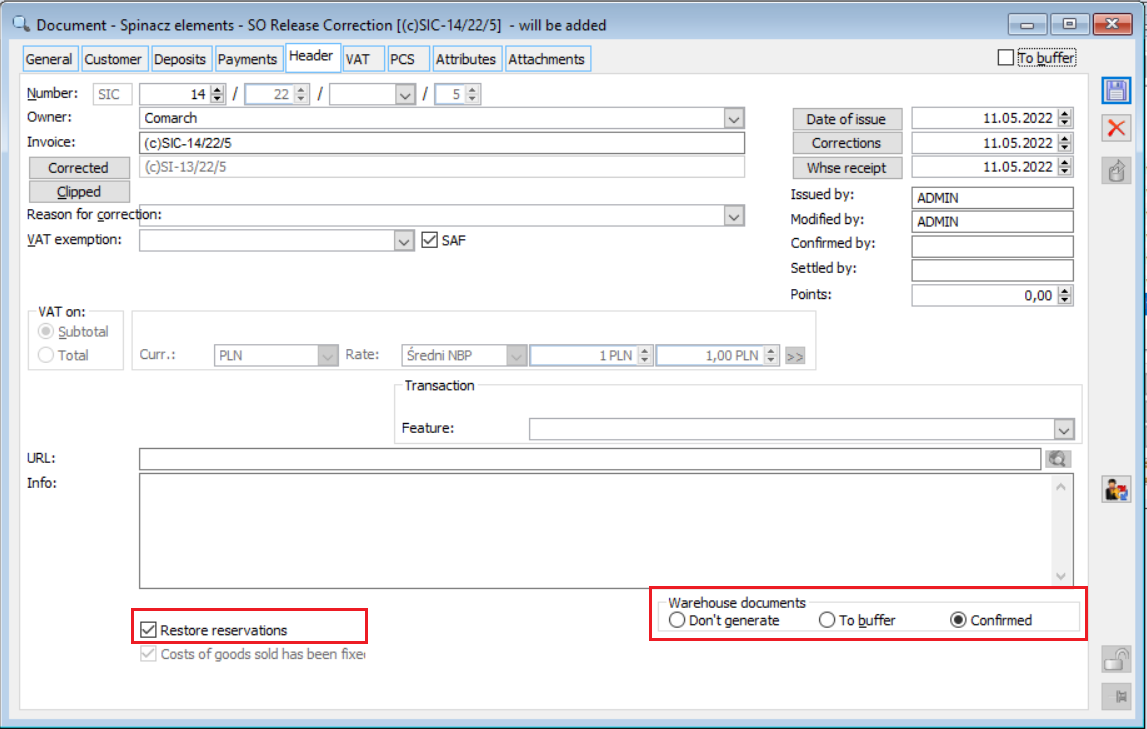

Parameter for generating stock and restoring reservations on items clip adjustments

The Warehouse documents section has been made available on the (s)FSK/FKE/FZK/FRK items clip adjustment forms. The setting of the parameter in this section is copied onto the WZK/PZK documents created as a result of registering a clip adjustment and determines whether warehouse documents are to be generated when they are approved and, if so, in what state.

This functionality is especially useful in situations when the return of goods is initiated with a warehouse document PM/AWD, WM/ZWM, and only later a commercial document is registered, clipped with this warehouse document. In such cases, the User will disable the generation of warehouse documents on the clip adjustment.

A similar feature applies to the provision of the Restore reservations parameter. Items clip does not make ZS/ZZ reservations, as this is done by the WZ/PZ documents from which the clip is generated. Consequently, the adjustment of an items clip does not restore the reservation, the associated WZK/PZK can do that. To facilitate the control of the parameter by the Users, it has been made available on the items clip adjustment forms, its setting/changing on the clip adjustment is reflected on the related WZK/PZK.

Bulk adjustments and items clip

In release 2018.0, the bulk adjustment functionality is not available for transactions that are recorded using items clip. Until it becomes available, Users can register adjustments individually to particular invoices or by registering an A-vista (A)FSK/FZK adjustment, supporting the retro discount functionality to this end. In this case, however, it should be borne in mind that the adjustment recorded in this way will not affect the value of stocks/cost of sales, nor will it be taken into account in any subsequent adjustments to these transactions.

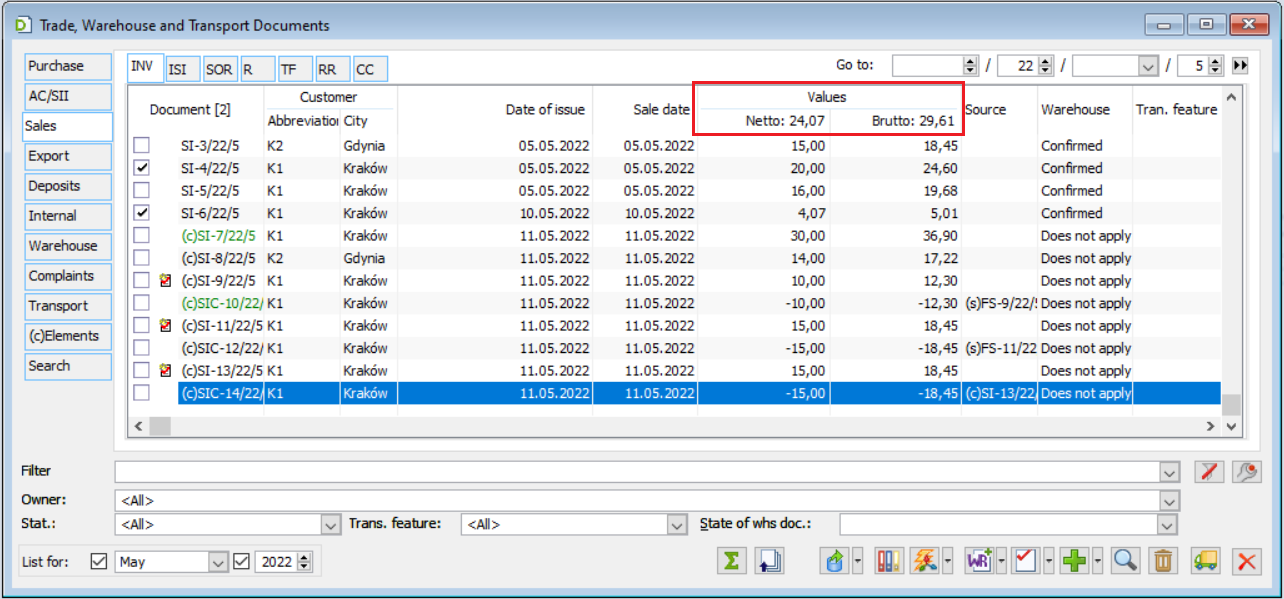

Summing up the values of the selected commercial documents

The list of commercial documents supports summing up of values of items selected on the list. This functionality is available on tabs: [Purchase], [Sale], [Export], [Deposit] and [Internal] list of commercial documents.

Other

(s)FS/FSE/FZ/FRR clips and advance invoices

For commercial transactions for which the receipt/release will be invoiced by items clip (i.e. for PZ/WZ/WZE- (s)FZ/FS/FSE scenarios), a rule has been adopted whereby the deduction of advance invoices should only be made on the clip, not on the receipt/release document. Furthermore, if an advance invoice has been deducted on a PZ/WZ/WZE document, it will not be possible to create an items clip for it. The definition of the WZ/WZE/PZ document will allow unselecting the “Deduct advance invoices” parameter so that the System does not suggest advance invoices for deduction in those branches of the Company that later generate clips from them according to items.

Attaching an advance payment to a clip is possible both at the time of issuing the clip and after issuing the clip, using the option Attach advance invoice on the Payments tab.

Clip items and limited, budget, stock, package, and WTR promotions

Above types of promotion will be provided on receipt/release documents, on (s)FZ/FRR/FZ/FRR clip items, information about such promotions will not be transferred, nor will such promotions be given on an items clip. This does not mean, however, that the System will therefore increase the price on the generated clip, as the price will be respected, except that in the structure of the granted discount it will be replaced by the “operator discount”.

Only the Operator with the relevant permission to change the price on the clip will be able to change the price himself.

In case of change of significant parameters of an invoice-clip such as: contractor, sale/purchase date, centre-owner, payment method, method of delivery, the System’s behaviour in terms of recalculation of promotions will depend on the setting of parameters in terms of change of price/discounts in the change window presented during changes on the document, and the availability of these parameters will depend on the above-mentioned operator’s permission to change prices on clips. It will therefore be up to the Operator whether the System recalculates the clip items or leaves them unchanged.

Retrospective discounts vs. items clip

The retro sales discount will not be calculated for WZ/WZE clipped to items clip, but for the same clips and their items. So if the goods were released by means of a WZ/WZE document in e.g. July, and part of it was invoiced in August and the rest in September, and the discount is settled on a monthly basis, then the discount will be calculated in August on the basis of the (s)FS/FSE from August and then in September on the basis of the clip from September. Similar rule has been adopted for the retro purchase discount, i.e. for PZs clipped to (s)FS/FRR, the discount will not be calculated, but will be calculated based on the (s)FZ and its items/quantity/value.

Chargeback procedure and items clip

In the case of purchase transactions, the chargeback procedure has been handled as for “ordinary” purchase invoices, i.e. the System will generate FWS documents for them based on (s)FZ items, while FKS documents, based on (s)FZK items, for the FWS documents generated for the adjusted clip.

The “Limit o.o.” control of PZ/WZ/WZE documents shows the “remaining” value of trade in goods subject to the above-mentioned procedure. After exceeding, the o.o. procedure should be applied. The change in the calculation of that value is that in order not to duplicate the turnover recorded in the path PZ/WZ/WZE – (s)FZ/FS/FSE, the System will not take into account PZ/WZ/WZE documents clipped to this type of clips, but these clips. When determining the value of “Limit o.o.” those PZ/WZ/WZE documents which are clipped (partially or completely) by items (those for which TrN_SpiTyp<0) will be omitted.

Credit limit and items clip

According to the concept adopted, items clip may only be created from receipt/release documents that do not generate payments. Thus, if the User does not enable the parameter of including the WZ/WZE/PZ without payment in the calculation of the used credit limit, then there is no risk that the transaction recorded in the WZ—(s)FS path will be included in it twice.

Intrastat and items clip

In the case of PZ/WZ/WZE documents clipped to the items clip, it is these documents, i.e. the items of these PZ/WZ/WZE that will be included in the Intrastat declaration as standard. In order not to duplicate the quantity/value to be shown, neither the items clip of the (s)FS/FSE/FZ/FRR, nor those of the (s)FSK/FKE/FZK/FRK adjustments will be included on this declaration. This has been achieved by setting the parameter “Include in Intrastat declaration” unchecked on them without the possibility of changing it.

Items clip and Processes

Header clips are handled in processes by the “Attaching to clip” action, for which the document type is specified on the {Parameters} tab, e.g. for an action attached to WZ an FS is specified, for an action attached to WZE an FSE is specified, and for PZ an FZ or FRR is specified. As a result of the above-mentioned action, the System finds an unapproved clip of a given type and attaches a WZ/PZ document, etc. to it, provided that other standard conditions for attaching it are met. If such a clip does not exist, the System creates a new clip header and attaches the document to it. If an incorrect clip type is specified as a parameter, the clip will not be created.

For items clip, similar rules will be applied and will be achieved by adding new clip types i.e. (s)FZ, (s)FRR, (s)FS and (s)FSE to the list of possible Parameters of the above-mentioned “Attaching to clip” action.

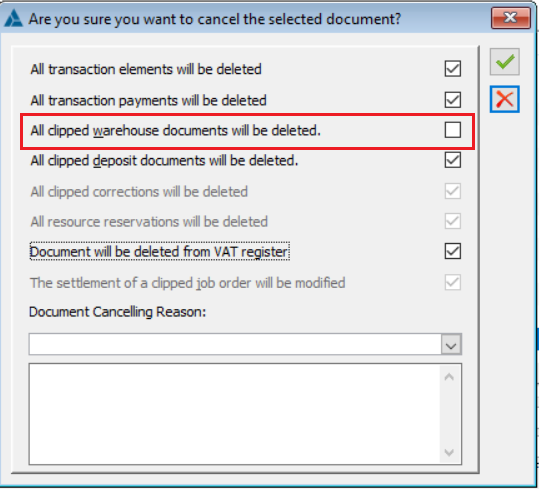

Cancellation of a commercial document processing multiple orders without warehouse cancellation

Previously, if a sales commercial document fulfilled multiple orders, then when it was cancelled, the System also cancelled the warehouse document associated with it. This caused a number of problems for Users, who often only wanted to cancel the commercial document because the issue had been registered correctly. In the 2020.0 version, the aforementioned inconvenience has been removed. Currently, it is possible to cancel such a document without having to cancel the WM/ZWM warehouse document at the same time, it is enough to leave the above parameter disabled.

List of related documents for clips

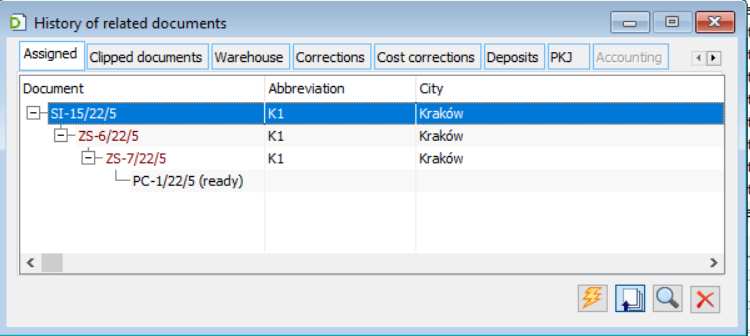

List of clipped items for clips and their adjustments

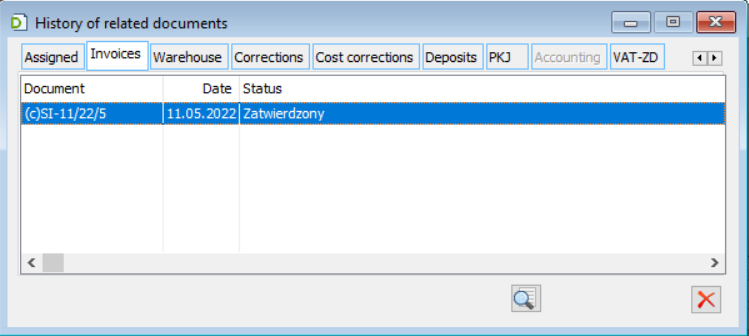

The {Bound} tab shows, underneath the clip, all the release/acceptance/receipt documents clipped in the given clip. These documents will be visible when setting the “before” direction for the list (Clipping direction). This allows the System to show not only release/receipt documents, but also the orders, from which they were generated or the packages to which they were clipped.

Thanks to the above presentation of individual releases/receipts as separate records in the list, the User will be able to call up the “Generate list” operation for a given release/receipt and in this way obtain information about the documents linked to it.

Due to the fact that the release/receipt documents will be treated as documents “before” the clip, it will not be possible on this tab to obtain information about all warehouse documents related to all release/receipt documents at the same time but for each release/receipt separately. Aggregate information about all warehouse documents related to documents clipped in a given clip will be made available on the {Warehouse documents} tab for the clip, similarly the tabs {Cost adjustments} and {Deposits}.

The Package document is currently shown in the linked list as a document “before” the commercial document, this will not be changed and means that the packages for releases/receipts will be shown according to the rules as orders linked to releases/receipts.

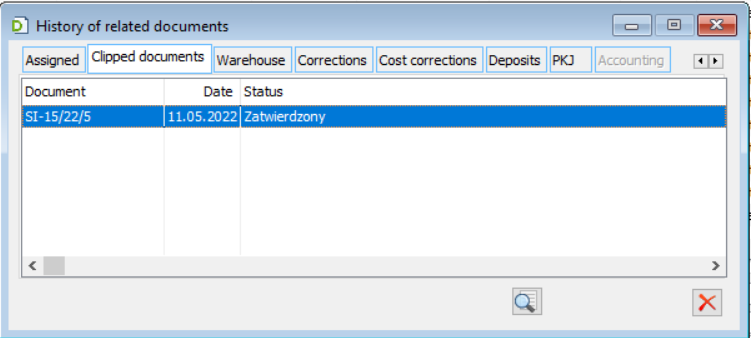

In addition to presenting a list of documents clipped directly to the {Bound} tab, they will also be presented on a new tab {Clipped documents}. Although this tab will duplicate the information currently available on the {Bound} tab, it seems that there is no point in hiding it, such duality is already in place for warehouse documents.

List of clipped documents for Release/Acceptance/Receipts and their adjustments

In order to ensure some kind of “continuity” in the list of clips and documents clipped with them, for documents that can be clipped, i.e. for WZ/WZE/PA/WKA/PZ/PKA and their adjustments on the {Bound} tab, a clip/list of clips in which the document is clipped will be presented as a separate record(s). Thanks to this, after calling the list of clips, then after generating a list for one of the documents clipped in it, the User, having a clip on the list, will be able to return to the list for the clip and so on.

In addition, the {Invoices} tab has been supported for the above-mentioned documents.

Functionality of the bound list

The “Binding direction” ![]() button causes the System to show either the documents generated “before” or “after” the document on which the cursor is placed, i.e. the document to which the cursor is pointing is placed as the 1st record, and below it the documents generated “before it” or “after it”, respectively. The direction is shown by the position of the arrow on this button (up or down arrow).

button causes the System to show either the documents generated “before” or “after” the document on which the cursor is placed, i.e. the document to which the cursor is pointing is placed as the 1st record, and below it the documents generated “before it” or “after it”, respectively. The direction is shown by the position of the arrow on this button (up or down arrow).

The “Generate list” ![]() button generates a list for the document to which the cursor is pointing, i.e. this document is placed first in the list, and below it there are documents generated either before or after it, depending on how the above-mentioned option concerning the direction is set (whether the arrow is up or down).

button generates a list for the document to which the cursor is pointing, i.e. this document is placed first in the list, and below it there are documents generated either before or after it, depending on how the above-mentioned option concerning the direction is set (whether the arrow is up or down).

In the subsequent tabs of the Bound list (Warehouse tab, Adjustments, etc.), documents are presented contextually, for the document to which the {Bound} tab cursor points.

The {Bound} tab shows documents which in a way implement the given sales/purchase path, whereas when it comes to “auxiliary” documents, e.g. those registered to secure the generation path, the System’s behaviour is not uniform, e.g. we do not show ZZ/ZW generated for the purposes of ZS, but we show MMW moving the goods for the purposes of implementing ZS, as well as ZK, ZP.

For those Customers who register transactions to which different rates apply: for VAT and for income tax, and who use the CDNAVAT application for this purpose, an additional link between the source document and the A-vista invoice created for it has been introduced. The A-vista invoice is presented on the {Other} tab of the bound documents list of the commercial document.

Numbering

Document numbering

The document number consists of 3 segments: consecutive number, year and series. The order of segments and their format is set in the configuration as common for all modules. This scheme can only be changed until the first document is issued.

When creating a new document, the system assigns it a number in accordance with the numbering scheme defined in the configuration. Two segments are available for editing: consecutive number and series. If the number is changed to an existing number, the change will be ignored when saving the document. Changing the number to one larger than the number assigned by the system will not cause a gap in the numbering, as the system first suggests available numbers between documents issued on the current day. The document series can also be changed, but only by selecting from the series allowed for the document. If a document has a definition, the permitted series are defined in the definition of that document in the centre of the permission structure to which the operator belongs. For documents without definitions, the series available to the centre of the permission structure are allowed. When creating a new document, the system assigns it a series that matches the default series in the document definition, if the definition exists and the default series is specified. Otherwise, the series defined as default for the centre of the permission structure to which the operator belongs will be assigned.

As a document adjustment series, the adjustment series specified in the definition of the document to be adjusted, on the tab, will be entered by default: Series, in the field: Adjustment series. If the option is selected in this field: <adjustment series>, then a series of adjustment documents will be entered on the adjustment document (from the window: Series), defined for the series selected on the document. For more information, please refer to the module documentation: Administrator.

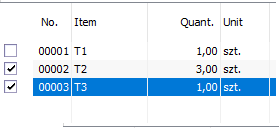

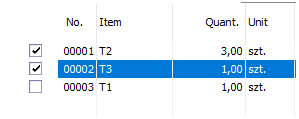

Items numbering on documents

The item number on the documents is displayed in the tab: General for these documents, in the column: No. If one of the items in the document is deleted, the remaining items will be automatically renumbered.

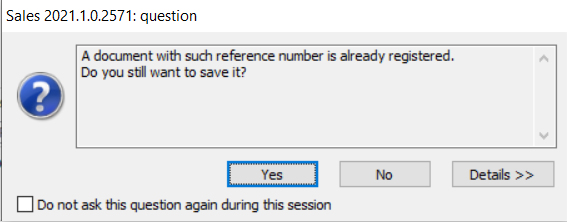

External document number control

On FZ, FZK, PZ, PZK, PKA, PKK, FAI, FKI documents, it is possible to enter a number of external document, e.g. on a purchase invoice, the number of a sales invoice issued by the seller is entered. The system controls the repeatability of entering an external document number – if an external document number is entered on a document of the same type, with the same contractor, which was entered on an earlier document, when saving such a document a warning message will be displayed that the same external document number has been entered again.

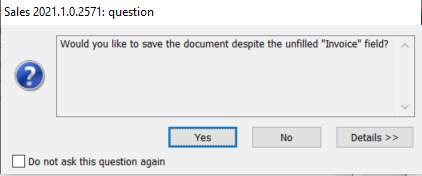

It is possible to save a document on which the same external document number has been re-entered. To save such a document, press the button: Yes.

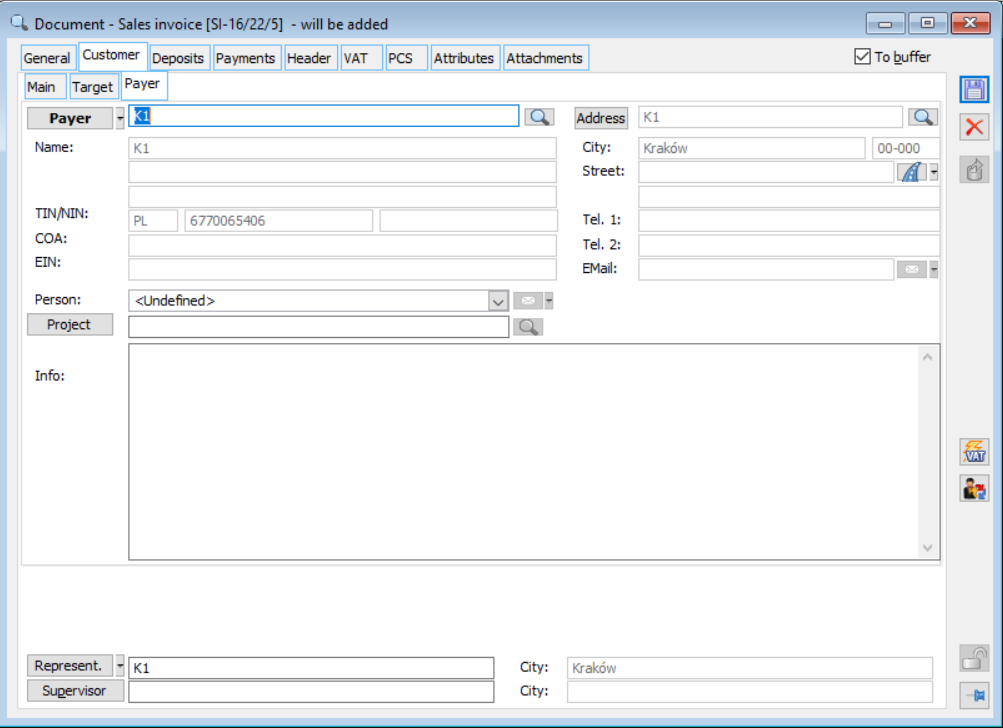

Payer on documents

It may happen that the payer for the transaction is not the contractor, but its payer, being a separate entity (contractor). The system provides for such a possibility by introducing the payer functionality on the document.

The payer may be determined:

as a regular payer for the contractor, indicated on its card, on the tab: Commercial (for more information, see chapter: Contractor card, tab: Commercial). Depending on the parameter setting on the contractor’s card: The form and date of payment as well as the credit limit from the card, the following will be entered on the documents issued for the contractor: the method, date of payment, and the credit limit of the contractor or his payer. However, the payer can be changed on each document, and the method and date of payment are always subject to editing.

as a payer selected on a specific document for a specific transaction in the tab: Contractor/Payer. The selection is made after pressing the button: ![]() [Select payer]. After selecting the payer, the method of payment and the payment date will be entered on a specific document, specified in the card of the contractor who is the selected payer.

[Select payer]. After selecting the payer, the method of payment and the payment date will be entered on a specific document, specified in the card of the contractor who is the selected payer.

The payer’s data is displayed in the tab: Contractor/Payer, on each document that can generate a payment.

It is possible to preview the Payer’s card using the button ![]() [Edit payer].

[Edit payer].

From the General tab on documents that can generate a payment it is also possible, using the drop-down menu next to the button ![]() [Edit contractor], to select, in particular, viewing and editing the payer’s card. Payer assigned to a payment method versus payer assigned to a contractor

[Edit contractor], to select, in particular, viewing and editing the payer’s card. Payer assigned to a payment method versus payer assigned to a contractor

Each payment method, registered in the system, can have a payer assigned to it. This payer will be entered on the document if the contractor to whom it is issued:

on the contractor’s card, in the tab: Commercial, has the specified payment method for which the payer is assigned (field: Method);

as a payer, on the contractor’s card, in the tab: Commercial, the contractor is set up for himself (field: Payer).

However, if the contractor has a payer other than himself assigned, then the payer assigned to the payment method is omitted, and the data of the payer assigned to the contractor are entered on the document.

Price update

When making a transaction, it is possible to update the purchase price and the sale price. For such an update to be possible, the following conditions must be met:

On the price tab to be updated (window: Price, launched from the product sheet, tab: General, after pressing the button: ![]() [Change]) the parameter has been checked: Update the price on a new delivery.

[Change]) the parameter has been checked: Update the price on a new delivery.

On the document definition: Purchase invoice, the parameter has been checked:

Last purchase price – if the last purchase price is to be updated,

Purchase price from supplier – if the last price from the supplier is to be updated (set on the product sheet, on the tab: Contractors),

Sale price – if the sale price is to be updated.

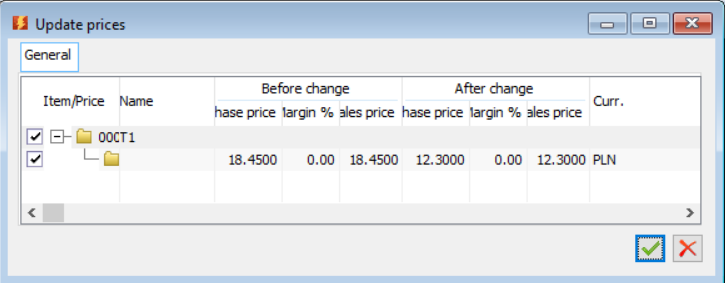

Update of the sale price

Updating the sale price means that the sale price entered by default on the sales transaction item will be taken according to the method selected on the price (last purchase price or supplier’s price), after taking into account margins and discounts. Obviously, this price can be modified. The price update shall take into account the Rounding and Adjustment parameters selected in the Price list of goods. In addition, if the Rounding and Adjustment parameters change the value when calculating the new price of an item, the value shall be displayed in yellow.

On the TW1 product sheet, for the price: PRICE01, the parameter has been selected: Update the price on a new delivery, and the parameter is selected on the purchase invoice document definition: Price update – sale price. The purchase of goods T1 was then made. The purchase price was PLN 10. When saving the FZ documenting this purchase, a window will be displayed: Price update. The order in which the goods are presented in this window is the same as the order on the revenue document. In the window, in addition to the code and name of the goods and the updated price, the following values are displayed: Purchase price, Margin, Sale price (before and after the change) and currency. The margin value before the change is calculated based on the previous purchase price and the current (not yet changed) sale price. Margin values and prices after the change are available for editing. A change in margin triggers a change in price (and vice versa). After placing the mark:

![]() next to the product code and price and pressing the button:

next to the product code and price and pressing the button: ![]() , the sale price will be updated. The new price value will be displayed on the product sheet and will be entered as default (after taking into account margins and discounts) on the sales invoice recording the sale of commodity TW1 (Fig. below).

, the sale price will be updated. The new price value will be displayed on the product sheet and will be entered as default (after taking into account margins and discounts) on the sales invoice recording the sale of commodity TW1 (Fig. below).

Updating the last purchase price

Updating the last purchase price means that when the revenue document is approved (depending on the setting on the document definition), the purchase price from this document will be saved as the last historical purchase price. It will also be entered by default on the purchase document for a contractor who does not have a fixed purchase price for this product (suppliers available from the product sheet, tab: Contractors).

If the price in a foreign currency is entered in the revenue document, this price or the resulting price in the system currency can be entered as the last purchase price when the document is approved. This will be determined by setting options in the definition of this revenue document accordingly: Last purchase price in foreign currency or Last purchase price in PLN.

Updating purchase price from suppliers

Updating the last purchase price from suppliers is based on the fact that at the moment of confirming the FZ or PZ (depending on the parameter set on the document definition: Updating the last purchase price from the supplier) the purchase price from the suppliers specified in the window will be updated: Product card, in the tab: Contractors (for the product being the subject of the transaction).

The update also depends on selecting the parameter: Count the discounts for revenue documents from the initial values (window: Configuration, tab: Sales/Parameters1) – if the parameter is not selected, the prices will be updated, otherwise the initial prices will be displayed.

Contractor data update

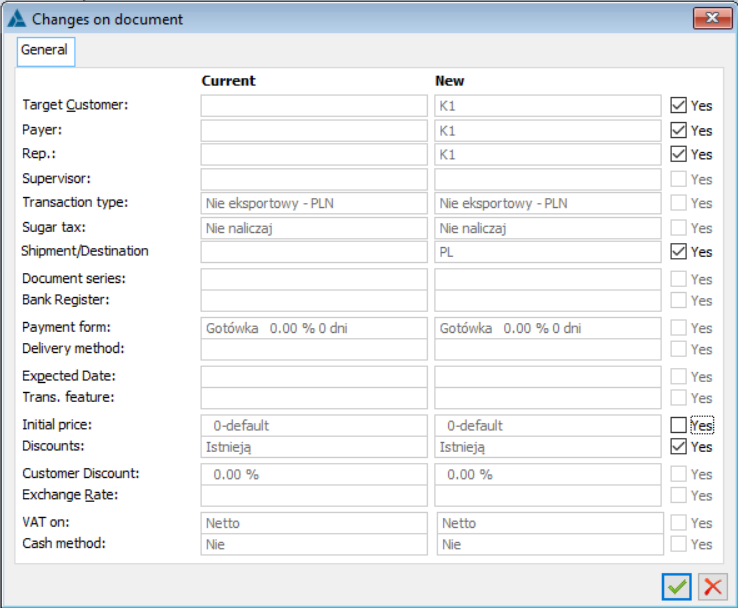

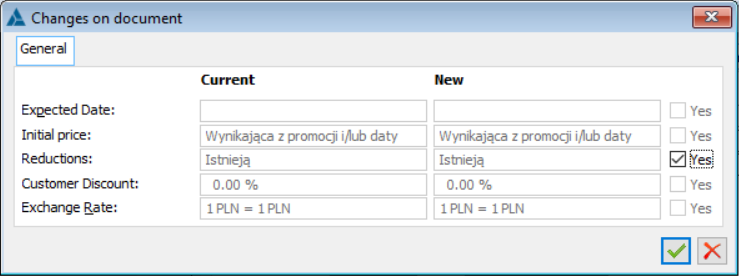

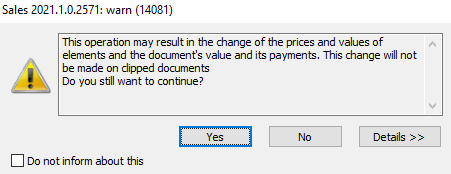

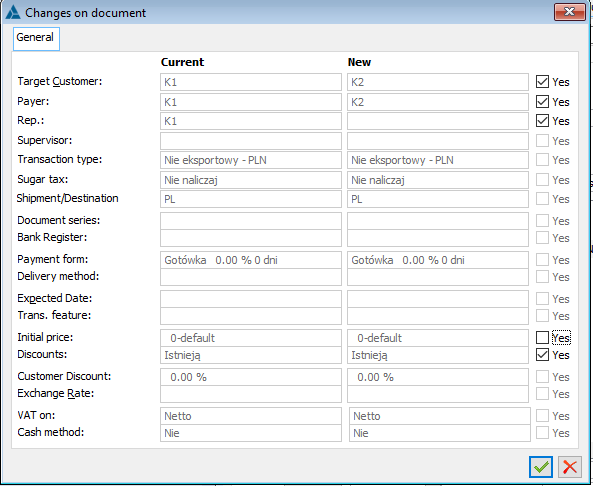

It is possible to change the contractor on the commercial documents. The following parameter has a direct impact on updating contractor data: Contractor, from the document definition from the parameter group: Data update after change.

If this parameter is selected, the following window will open when the contractor is changed in the document: Changes to the document and depending on the parameter settings in this window, the data on the document will be updated.

If the parameter is unselected, then only the data of the main contractor will be changed when the contractor is changed.

Changes to the document

When changing the following parameters on the document: Delivery method, Payment methods, Dates, Document owner, a window will open, which will allow determining whether you want to change a value on the document other than the value being changed.

If in the document definition in the parameter group: Data update after change, a given parameter will be unchecked, this will result in the fact that if someone changes a given parameter, only its value should be changed.

If there is a possibility that the initial price will change, then in the line: Initial price, the following messages will be displayed:

- In the field: Current – Fixed in transaction items,

- In the field: New – Resulting from a promotion.

- In general, the availability of parameters depends on:

- Delivery date – only available for orders,

- Initial price and Contractor discount – available on the documents on which the promotions operate,

- Currency rate – available on documents where it is possible to select a currency and change the exchange rate in the items or in the header. The update of the exchange rate for FZ and PZ documents will take place only if the date indicated on the definition of its centre on the Parameters tab in the field Date type is changed.

Parameter: Domestic transactions only, on document definition

On the document definition, tab: General, there is a parameter: Domestic transactions only. If this option is selected, some options unnecessary for purely domestic transactions will be hidden on issued documents:

- Country of destination/dispatch,

- Transport type,

- Transaction type code,

- Incoterms symbol and place,

- Option group: Import/Export.

At the same time, the transaction type will always be set to: Domestic, without the possibility of its edition. Please note that the above properties apply to documents issued only in this centre for which the document definition has been modified.

Parameter setting: Domestic transactions only, will not deactivate the fields where you specify the currency and rate (on the tab: Header). This is due to the fact that on each document a functionality is provided which allows selecting any currency and exchange rate.

VAT Register parameters introduced in version 5.0

In version 5.0, for documents:

FS Sales invoice, including A-vista sales invoice

- FSK Sales invoice adjustment, including A-vista sales adjustment, also manual adjustment

- FSE Export sales invoice

- FKE Export sales invoice adjustment

- FEL Advance export invoice

- KEL Advance export invoice adjustment

A parameter has been made available: Delivery taxed outside the country (provided that on the listed documents, on the tab: General, the transaction type is selected: Intra-community or Other foreign).

For the document: A-vista sales invoice (including A-vista sales adjustment) parameter has been made available in the VAT register: Tax Free, provided that on this document, on the tab: General, the transaction type has been selected: Domestic.

New parameters are included in the new VAT 7 return, supported by Comarch ERP XL version 5.0 (more information in the module documentation: Accountancy).

Documents approval

The document may be freely edited (to the extent available to it) until it is approved. Unapproved documents, referred to as “in the buffer”, are marked green in the list. They have an option checked in the top right corner: To the buffer. This is visible on every tab of the document.

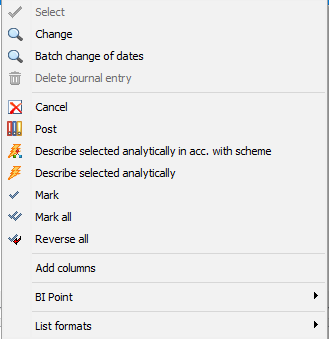

Unchecking this option and saving the document will result in its approval. After this operation, it cannot be edited any further. Once approved, the document can be posted and its analytical description edited. For documents that have the parameter selected on the definition: Document description is allowed in the buffer, the analytical description is available for editing before the document is approved. Approval of a document usually involves an additional operation, such as updating the purchase prices from the supplier. Documents can also be approved from their list by selecting the appropriate option from the context menu.

Approval of a document by an operator is only possible if the option is checked on the definition of the document to be approved: Permission to approve documents. This option is selected in the module: Administrator, in the window: Document definition, on the General tab.

Comarch ERP XL system features printing of sales documents at the moment of their approval. Parameter: Print on approval is available in the module: Administrator, in the window: Document definition, on the General tab.

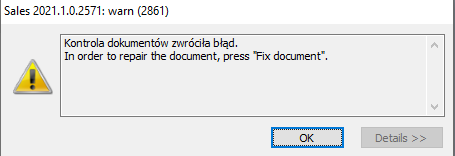

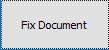

When approving a document (unchecking the check: To the buffer and saving with a floppy disk), a check is made on the consistency of the value of the VAT table and the header of the document. In case of discrepancies in this respect, the system shall inform the User with an appropriate message.

After confirming the message, the user is automatically transferred to the VAT tab where the button is activated:  , the use of which results in the repair of the document.

, the use of which results in the repair of the document.

Currently, the aforementioned document repair mechanism applies to the following documents: FS, WZ, PA, PZ, PZI.

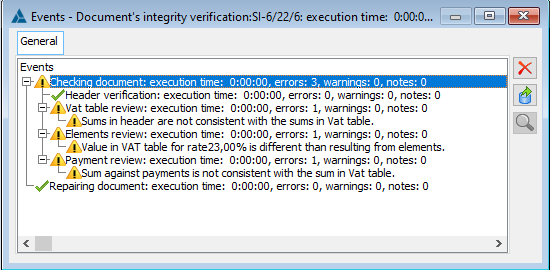

Document statistics

Window: Document statistics is displayed when selecting a document and pressing the button on the toolbar: ![]() [Document statistics].

[Document statistics].

The window is informative and displays information about the basic data of the document, such as the amount of the margin, the global value of the discount granted (the value of the discount is expressed in the currency of the header), and the weight and volume of the goods subject to the transaction. The information displayed is arranged on two tabs: General and Units. This information is different for different types of documents, e.g. for warehouse documents only information concerning the weight and volume of the goods is presented.

If the operator is not authorised: Can see the purchase price (window: Operator, tab: Parameters/General), then no information about the margin will be displayed for him.

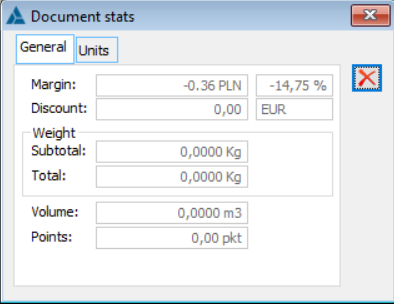

Information on previous transactions

Document items have tabs that display information about previous transactions. This makes it possible to use an already defined item template on the current document. For such information to be displayed, the parameter must be selected on the document definitions for which it is to be displayed: Preview of previous transactions (window: Document definition, tab: General).

Selecting a product for a transaction item

When selecting a product for a transaction item:

- the opened product list will indicate the item with the code currently entered in the transaction item (e.g. after pressing the Product button, when the code entered in the transaction item – Alt+T);

- the opened product list shall be set to the last selected code in case no product has been selected yet for the item;

- the list will be opened in search mode (placeholder) when the code, entered on the transaction item, is not found;

- in the product list, prices will be displayed net or gross by default, depending on the VAT calculation setting; (set in the document definition).

- using the tree list, the product list will open at the level of the last used group; the last expansion of the tree by the operator will be remembered.

There is a placeholder on the Product column on commercial, warehouse, and order documents that allows searching for an item in item lists on documents.

The limiting placeholder function used in the document item list overrides the sorting. The sorting method before switching on the placeholder is not remembered and restored after resetting the limit.

Corrections

All commercial documents recording sales or purchases can be corrected. The quantity, value, or VAT rate of the document item can be adjusted. It is also possible to adjust the price for part of the quantity of a transaction element by means of a quantity-value adjustment. Value adjustment can be made by changing the price, using all the tools available when issuing the source document. In addition, the entire document can be corrected by a preset value, broken down into all or selected items, and values can be adjusted by changing the discount of all items by a selected value. Only approved documents can be corrected. Multiple adjustments can be made to a single document. The subsequent adjustment always concerns the quantity or value after the last adjustment.

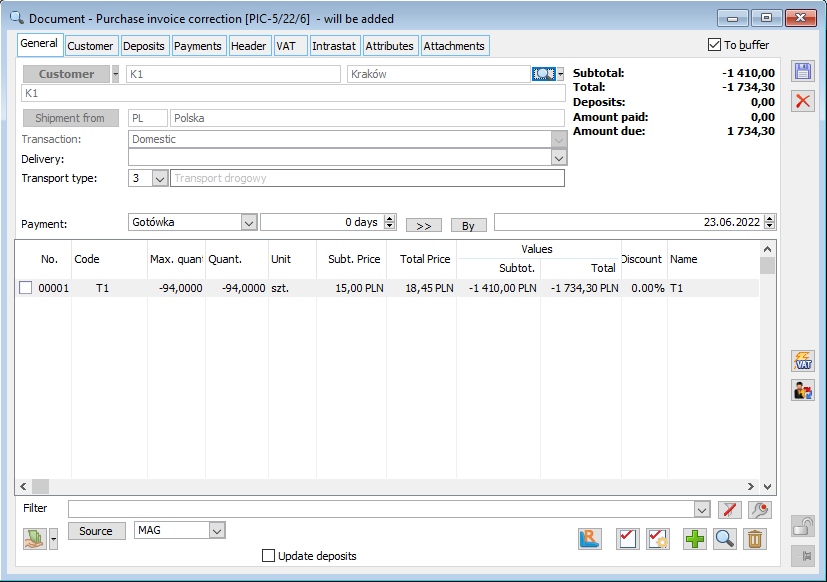

It is possible to adjust quantities both “positively” and “negatively”. This means that on an adjustment it will be possible either to increase the quantity in relation to the original quantity or to decrease this quantity. In the case of a “positive” adjustment, the element of that adjustment will behave like the original document, i.e. for example, the sales invoice adjustment item will take stocks, the purchase invoice adjustment item will create them.

It is not possible to make a positive quantity adjustment if the document is already fiscalized.

Due to the lack of possibility to enter information about the original items, the printing of an adjustment invoice issued to an unregistered source document (manual adjustment) is not compliant with the Regulation of the Minister of Finance.

Only a document approved in terms of value can be adjusted.

The following types of adjustments can be generated:

Adjustment – adjustment document, generated when the following function is selected: ![]() , from the context menu, or from the drop-down menu using the button:

, from the context menu, or from the drop-down menu using the button: ![]() [Expands the menu of available functions], in the window: List of commercial documents. From this document level, it is possible to make:

[Expands the menu of available functions], in the window: List of commercial documents. From this document level, it is possible to make:

- Value adjustment – adjustment made in the window: Adjustment of document value, opened by pressing the [Document value adjustment] button, on the adjustment’s General tab. The adjustment will automatically apply to all items.

- Transaction item adjustment – an adjustment made in the window: Transaction item, opened by pressing the [Change] button. It allows making adjustments to each item separately.

- Quantity and value adjustment – an adjustment made in the window: Price adjustment for a part of the quantity after pressing the [Price adjustment for a part of the quantity] button on the document to be adjusted.

Manual adjustment – (for FZ, FS, and FSE),

Automatic adjustments – (for FS and WZ),

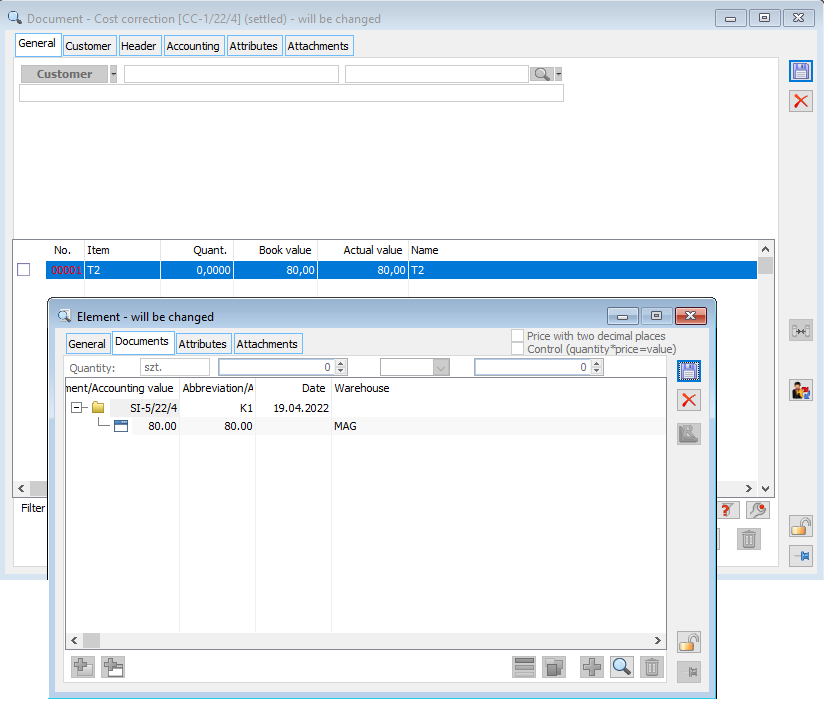

Cost adjustment – automatically generated when creating a value adjustment to a purchase invoice (FZ) or an external receipt (PZ).

Any address from the contractor’s address list can be selected for the adjustment document (both for the main and target contractor). If the basic address was entered on the document to be adjusted, the address current at the time of the adjustment will be entered on the adjustment document by default. If, on the other hand, a shipping address has been entered on the document to be adjusted, then that address will be entered by default on the adjustment document.

Document value adjustment

In the window, a value adjustment can be made to the entire document. The adjustment made here will automatically apply to all items.

The possibility of making a value adjustment to a document depends on the setting on the definition of this document, on the tab: General, parameter: Edit prices and discounts on items – this parameter should be selected.

If a manual adjustment is to be made to each item separately, then the adjustment should be made in the transaction item window, opened with the button: ![]() [Change] located in the window: Adjustment of … (of a document), in the tab: General.

[Change] located in the window: Adjustment of … (of a document), in the tab: General.

Window: Document value adjustment, is opened with the button: ![]() [Document value adjustment], in the window: Adjustment … (of the document).

[Document value adjustment], in the window: Adjustment … (of the document).

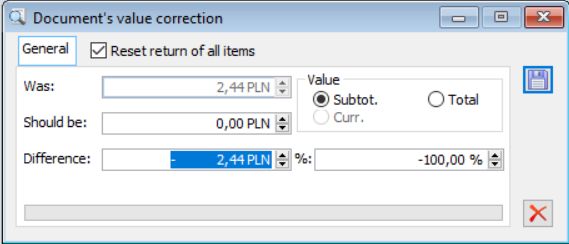

In the window: Document value adjustment, there are fields:

Reset all items return – the box is checked by default. Unchecking is possible when at least one of the items in the list has been reset. Value in the field: Difference, will thus be reduced by the value of the previously zeroed position.

Previous – the value of the source document.

Expected – the value that the adjusted document should have.

Difference – the amount by which the document value is to be changed. The difference may be given as an amount or as a percentage. This amount shall be broken down into the document items.

Value – the adjustment may concern net or gross value. The selection is made by checking the appropriate item.

After entering the appropriate values, save them by pressing the button: ![]() [Save]. The adjusted value will be broken down into document items.

[Save]. The adjusted value will be broken down into document items.

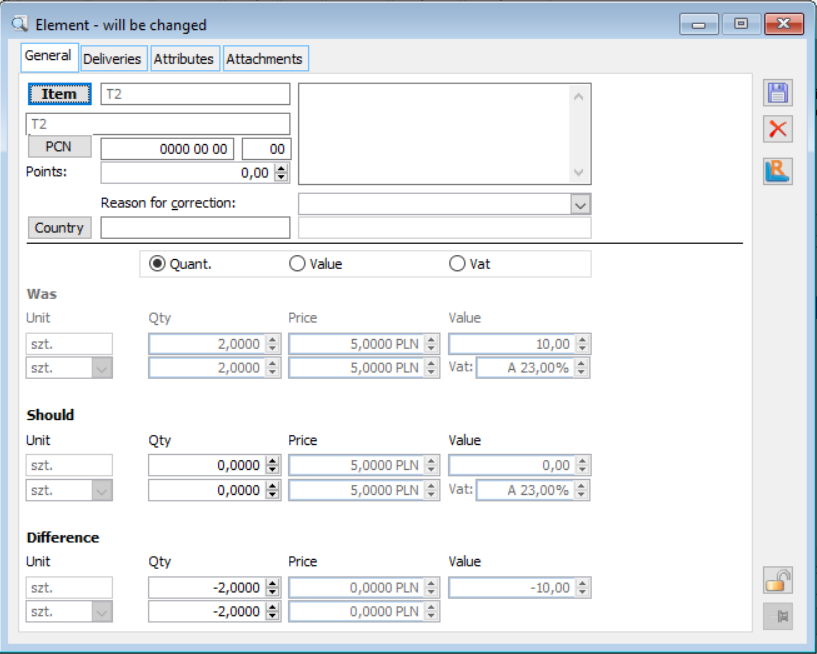

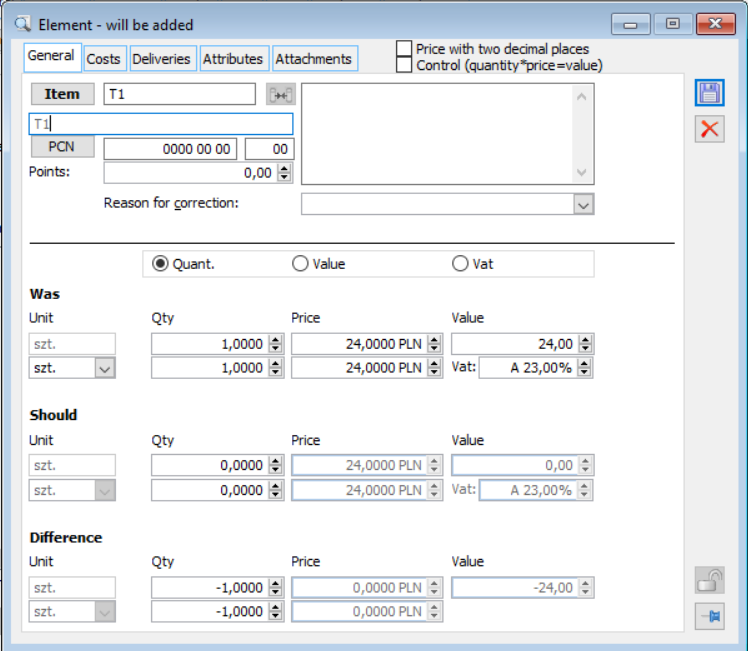

Transaction item adjustment

In the window, it is possible to make a manual adjustment of a given document item.

It is also possible to add and remove items on the commercial document adjustment. These operations are available if on the definition of the adjustment document the above described option “None…” was selected in the Items on adjustments section, otherwise all items are on the adjustment, so there is no need to add/remove them.

If in the document definition, in the “Items on adjustments” section, the “Maximum return” option has been selected, then when adjusting the document, the System will automatically add items on the adjustment for the maximum possible return quantity, regardless of how many items the document being adjusted contains.

On the FZ definition, the option “Maximum return” was selected in the aforementioned section. Two purchase invoices are recorded as in the example above, followed by an adjustment to each of these invoices. The system generated them with the items as below: FZK to FZ-1/2019: T1 -2 pcs. T2 -3 pcs. FZK to FZ-2/2019: T1 -2 pcs. T2 -3 pcs. T3 -1 pc. T4 -2 pcs. T5 -1 pc.

If in the document definition, in the “Items on adjustments” section, the “None/Zero return…” option has been selected, then when adjusting a document that contained at least the number of items indicated in the control on the document definition, the System will create an adjustment without elements. On the other hand, in the case of adjusting a document containing less than the number of items indicated in the aforementioned control, although all the items will be added on the adjustment, no number will be suggested on it.

On the FZ definition, the option “None…” was selected in the aforementioned section and a quantity of 4 was given. Two purchase invoices were registered with the items as follows: FZ-1/2019: T1 2 pcs. T2 3 pcs. FZ-2/2019: T1 2 pcs. T2 3 pcs. T3 1 pc. T4 2 pcs. T5 1 pc. The operator generates adjustments to each of the above invoices in turn, as a result of which the System generates the FZK as follows: FZK-3/2019 to FZ-1/2019 T1 0 pcs. T2 0 pcs. FZK-4/2019 to FZ-2/2019: (no items)

The above feature was supported for FZK, PZK, PKI, PKK, PWK, FRK, FSK, FWK, WZK, PAK, FKE, WKE, WKK, RWK. The feature has not yet been supported on FKI and items clip adjustments.

The above mentioned parametrisation of creating adjustment refers to the ordinary mode of their registration, it does not apply to operations of automatic adjustment creation, collective adjustment, deposit adjustment created based on a commercial document adjustment, adjustments generated from ZP/ZK orders, from a complaint, or PKI generated from FKI/SAD/FWS.

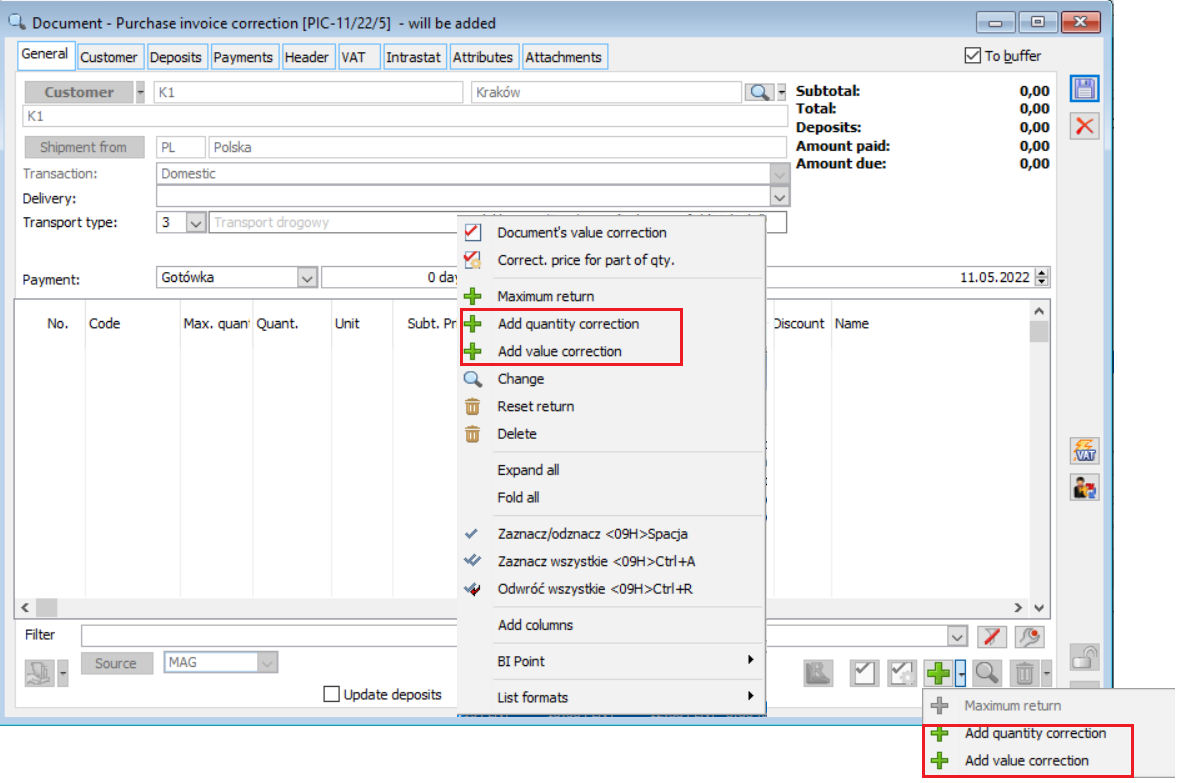

When adding item(s) for adjustment, the User can immediately determine their nature by selecting one of the two options available both at the plus button, and in the context menu for adding the item:

- Add quantity adjustment: on adjustment items added with this option, the System defaults to the maximum possible return.

- Add value adjustment: if this option is selected, a “zero” return is set on the adjustment items to be added.

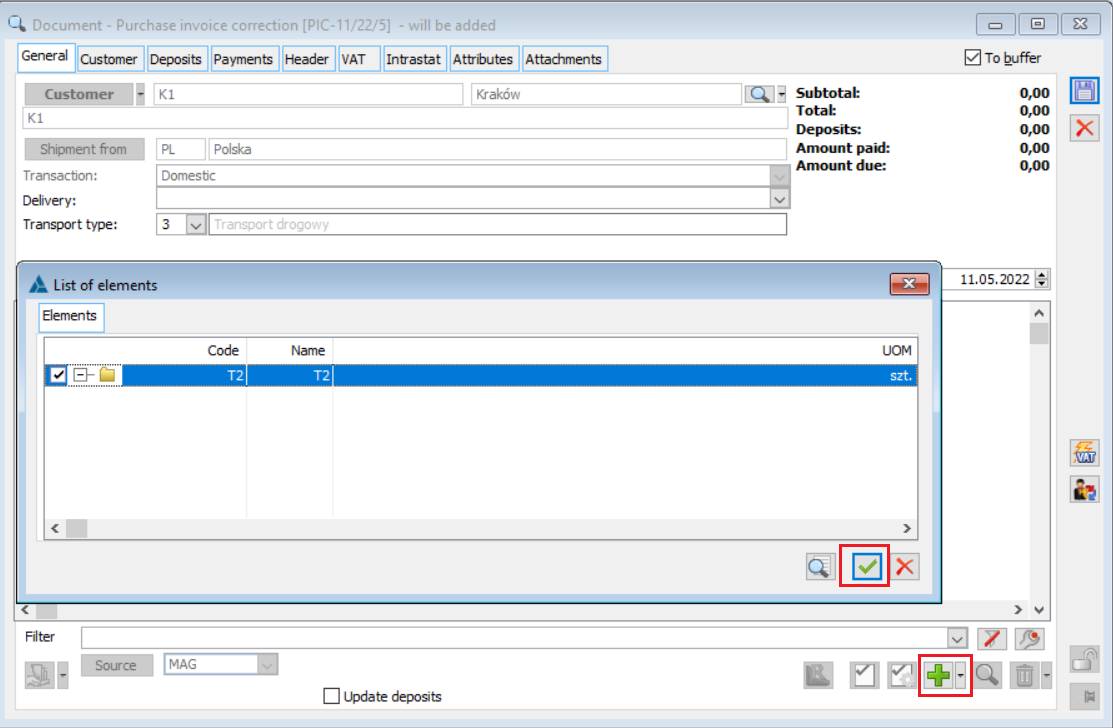

The operation of adding an item for adjustment opens a list with those items of the adjustment document that have not yet been added for adjustment. This list is provided with a placeholder in the Code column.

When adding an item to an expenditure document adjustment, the System sets the warehouse on its sub-items (makes a return to the warehouse) based on the warehouse set in the adjustment header, while in the case of a revenue document adjustment, the sub-items are added with the original warehouse (goods are taken from the original warehouse), regardless of the warehouse set in the correction header. If you wish to change the warehouse from which the goods are to be returned, you should do so only after adding the items to the adjustment.

Adding items using one of the above options does not ultimately determine its nature. By default, the User can edit the adjustment item in terms of adjustment of quantity, value price, etc.

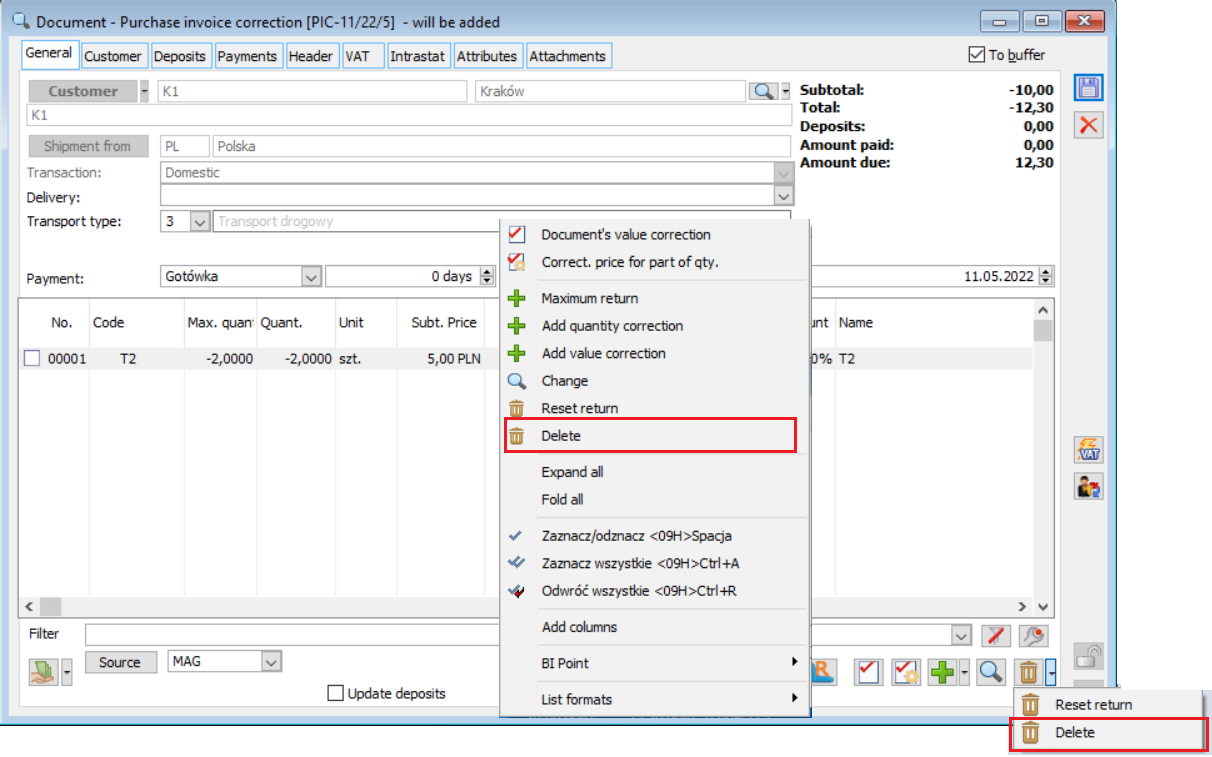

The User may also remove items from such an adjustment. This is done using the Delete option available on the Bin button and in the context menu.

On such an adjustment, the usual Maximum return and Reset return operations for the indicated/selected items are still available, except that they must be selected from the menu of buttons, Plus and Bin respectively, as on such an adjustment these buttons support, by default, the addition/deletion of an item.

It is also possible to adjust a document by a certain value, using the option Document value adjustment. In this case, the System will break down the requested adjustment value into those items that are on the adjustment.

The above functionality can be used to record an amount discount given as an adjustment to only some items of a transaction. Simply add these items to the adjustment and use the „Document value adjustment” operation.

Tab: General

The tab allows editing the quantity or the value. Entering a negative quantity will result in a corresponding reduction in the quantity in the stock created by the adjustment documents when the document is approved.

The tab contains the following fields:

Product – the button opens the product sheet for review.

Type of adjustment – it is possible to select one of the types of adjustment:

- Quantity

- Value

- VAT

Depending on whether a quantity or value adjustment has been selected, indicate the value of the adjustment in the relevant fields and save the changes with the button: ![]() [Save].

[Save].

The item window also contains fields relating to KGO. For these fields, the values are presented in the same currency as recorded on the source document in order to maintain consistency between the value of KGO in the adjustment and in the source element. In the “Previous” section, the KGO field displays the unit value of KGO in the currency of the initial price from the document item. In the “Difference” section, the KGO field displays the unit value of the KGO from the adjustment item with the opposite sign. The “Expected” section displays the difference of the totals from the KGO fields in the Previous and Difference sections.

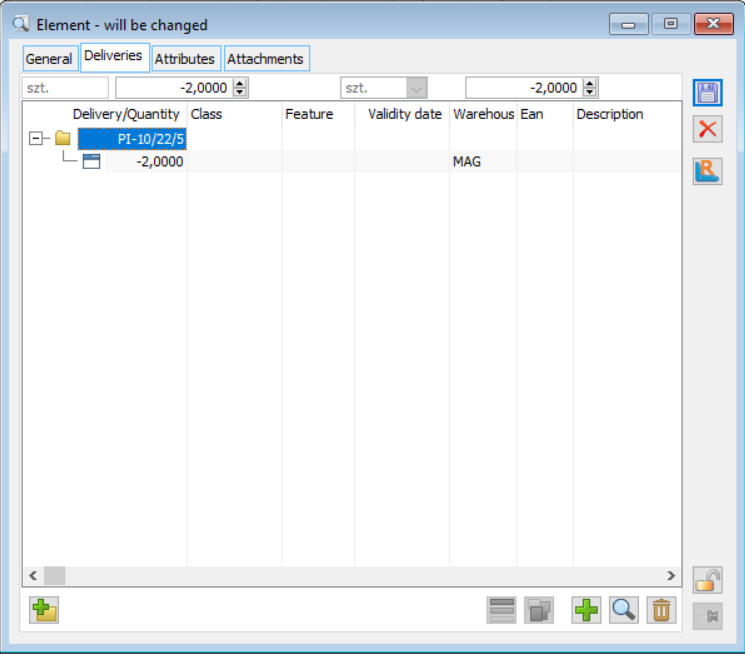

Tab: Deliveries

The tab contains the flowing buttons:

![]() [Change delivery] – opens a list of goods’ stocks (deliveries) and allows selecting a delivery. This can be any delivery, including those not established by the source PZIs. In the case of value adjustments, substitution of deliveries is not possible – sub-items of such adjustments always indicate the same deliveries as sub-items of the source documents.

[Change delivery] – opens a list of goods’ stocks (deliveries) and allows selecting a delivery. This can be any delivery, including those not established by the source PZIs. In the case of value adjustments, substitution of deliveries is not possible – sub-items of such adjustments always indicate the same deliveries as sub-items of the source documents.

![]() [Add item] – pressing will change the quantity of the highlighted item to the largest possible.

[Add item] – pressing will change the quantity of the highlighted item to the largest possible.

![]() [Change] – opens the delivery editing window.

[Change] – opens the delivery editing window.

![]() [Delete] – pressing will reset the quantity in the highlighted item to zero.

[Delete] – pressing will reset the quantity in the highlighted item to zero.

Tab: Attributes

This tab is for assigning attributes to the adjustment item. It is only possible to assign attributes to a specific item that have been assigned to the object: Items (for the adjustment of the corresponding document). Attributes are assigned according to general rules.

Currency and exchange rate on adjustments

Adjustments to documents issued in a foreign currency will have the same currency and exchange rate as on the source document. The exchange rate will also not be changed if the date of issue of the adjustment is different from that of the source document, and, consequently, the payment will not be updated.

When creating an adjustment to S(FS) and S(FZ) clips in a currency, the currency and exchange rate from the document being adjusted will also be transferred to the adjustment, without being editable. As with adjustments to other documents, changing the date on an adjustment will not change the rate on it and update the payment.

Manual adjustment

Manual adjustment in Comarch ERP XL system has been designed for correcting documents not registered in the system.

To generate a manual adjustment:

select the function: manual adjustment

- From the context menu (drop-down with the right mouse button after clicking on the document list)

- From the drop-down menu in the list of documents using the button that expands the menu of available options, located next to the [Adjustment] button (on the tab Purchase/FZ, Purchase/FRR, Sale/FA and Export/FSE, Deposits/WKA).

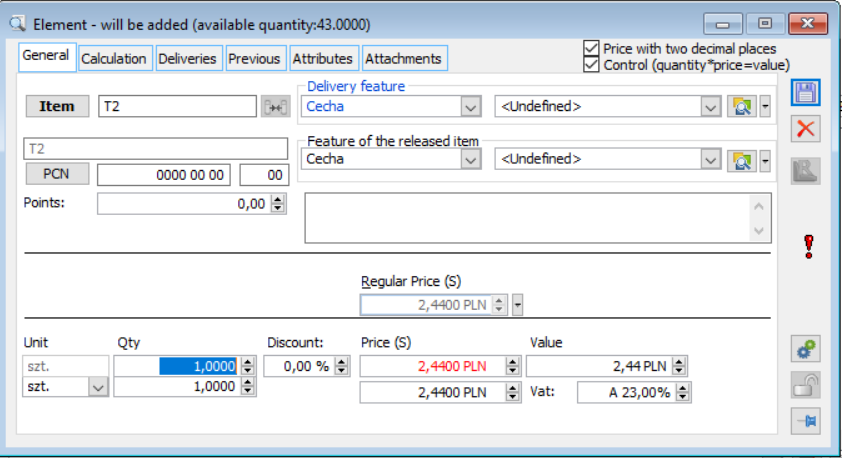

A window will open: Manual – adjustment purchase/sales invoice. After filling in the fields on the document, save the adjustment by pressing the button: ![]() . A manual adjustment of a purchase invoice / VAT RR invoice has the same fields as a regular purchase invoice / VAT RR invoice. On the other hand, a manual adjustment of a sales invoice / export invoice / deposit release has the same fields as an adjustment of a sales invoice / adjustment of an export invoice / adjustment of a deposit release, with the proviso that on the adjustment transaction item it is possible to specify values in the Previous section allowing the entry of information on quantity, price, value, and tax rate on the adjusted transaction which was registered outside the System. For manual FSK and domestic FKE, it is possible to adjust the VAT rate.

. A manual adjustment of a purchase invoice / VAT RR invoice has the same fields as a regular purchase invoice / VAT RR invoice. On the other hand, a manual adjustment of a sales invoice / export invoice / deposit release has the same fields as an adjustment of a sales invoice / adjustment of an export invoice / adjustment of a deposit release, with the proviso that on the adjustment transaction item it is possible to specify values in the Previous section allowing the entry of information on quantity, price, value, and tax rate on the adjusted transaction which was registered outside the System. For manual FSK and domestic FKE, it is possible to adjust the VAT rate.

In addition, it is possible to specify parameters for manual FS/SKE/WKK adjustments:

- Price to the nearest grosz

- Control (quantity*price=value)

Issuing a manual adjustment is possible only in the list of documents, on the tab Purchase/FZ, Purchase/FRR, Sales/FA, Export/FSE, and Deposit/WKA.

Printouts of manual adjustment documents issued in versions earlier than system version 2014.0, due to the impossibility to determine at that time the information regarding the original items on this type of document, differ from printouts in the current version. In the Previous section, they have information determined from the final data entered.

Manual value adjustment of the sold-out delivery

The System allows recording a manual value adjustment of the FZK/FRK to a delivery that has already been completely sold out.

If there is no stock of a particular product, the System searches for its delivery and, if it exists, a zero quantity item is created, pointing to this sold-out delivery in the sub-item. This allows the Operator to make a value adjustment to such delivery. The value of such an adjustment is determined by the value of the adjusted delivery. When approving such an adjustment, the System appropriately adjusts the cost of sales using a KK (cost adjustment) document.

The User has the option to change the delivery on the element of manual value correction FZK/FRK, i.e. to adjust the value of the delivery other than the default set by the System, including also indicate the delivery that is completely sold out. Use the Change delivery operation performed on the [Deliveries] tab of the FZK/FRK manual item.

The prerequisite for recording this type of adjustment is the prior registration of the delivery of the goods in question.

If no delivery of goods has been recorded in the System so far and the customer has received a value adjustment from the Supplier, then the delivery should be recorded, fully released (e.g. using PW-RW (internal receipt/release) documents), and then a manual adjustment should be recorded.

Automatic adjustments

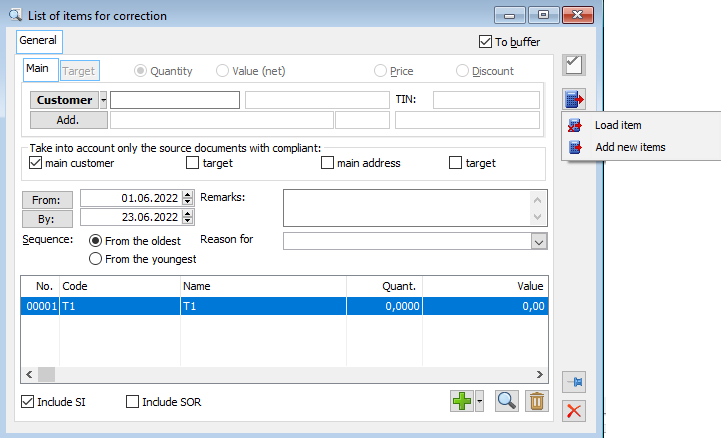

Option: Automatic adjustments, enables the creation of quantity (return) and value adjustments to source documents. The source documents may be expenditure documents: FS, WZ, and WKA. These documents can be defined by selecting a contractor and a product. You can specify independently: main contractor, target contractor, main contractor’s address, target contractor’s address and select, also independently, which of these data are to be consistent on the adjusted source documents. As a result, it is possible, for example, to narrow down the list of invoices to be adjusted to those involving a given main contractor and a given address of the target contractor. The system itself will find the relevant documents to correct.