Introduction

The Comarch ERP XL 2016.3 version has been supplemented with an option to indicate the reason for the application of the exempt rate in a given transaction.

In version 2016.3, in the case of documents synchronised from external systems, the reason for exemption should be indicated manually after importing the document in Comarch ERP XL.

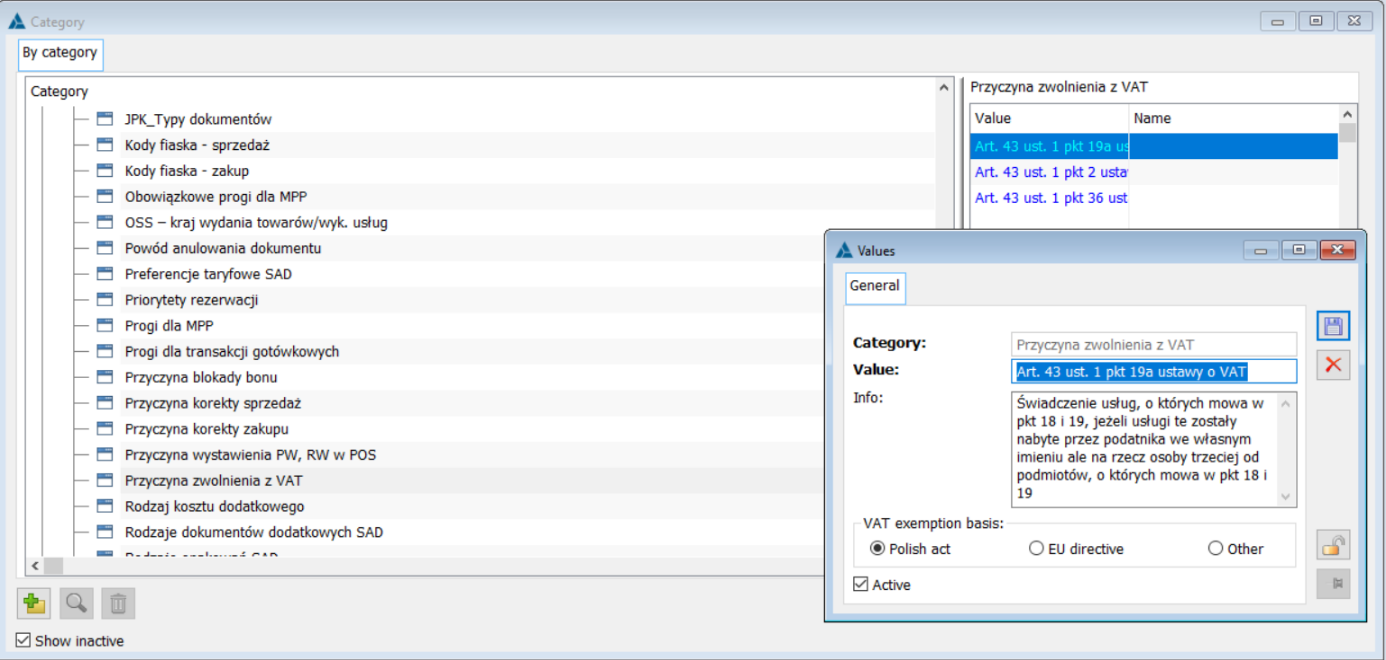

Dictionary of reasons

The reason for the VAT exemption was based on a closed dictionary of categories, added in the branch: Transactions as “Reason for VAT exemption”. On the form, in addition to indicating the reason for the exemption (Value), understood as a specific legal provision, you can indicate the basis for the exemption, i.e. the exemption is due to a Polish law, an EU directive or other basis.

At the same time, three predefined causes have been made available

Assignment on documents

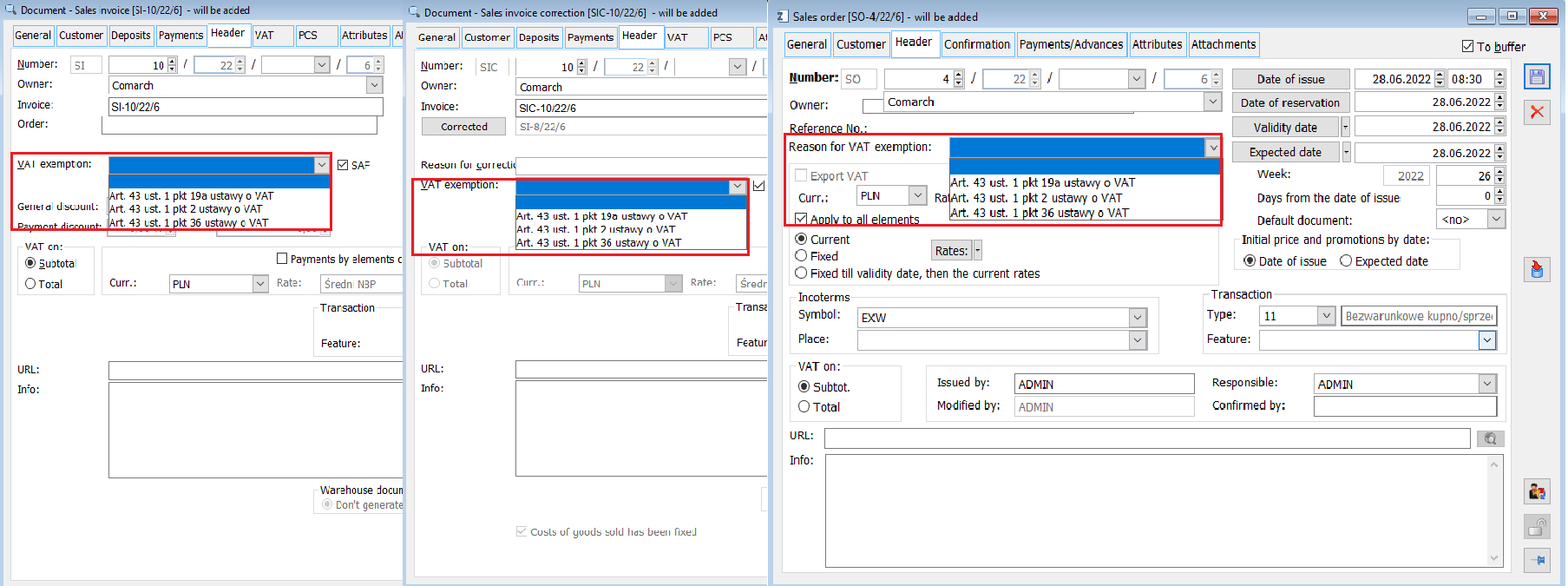

The assignment of the reason for the application of the rate is on the document header and applies to all items with such a rate on the document. You cannot manually enter values from the document level, i.e. apart from the empty value you can choose from a closed dictionary list. A control for indicating the reason for VAT exemption, it is always available on the document header, by default with a blank value. When adding an item with a VAT rate, the user can (before or after adding the item) indicate a specific reason for exemption from the VAT rate.

The first version assumes that there will be no mixed reasons for exemption on one document. The JPK_FA scheme was also prepared for such a solution

This was handled on documents as follows

- OS, OZ, ZS, ZZ

- FZ, (S)FZ, (A)FZ, PZ, PZI, FRR – also on the simplified form of A-vista invoices

- FS, (S)FS, RA, (A)FS, FW, (A)FW, WZ, PA – also on the simplified form of A-vista invoices

- FSE, (S)FSE, WZE

- WKA, PKA

- And their adjustments

When adding a new document, a blank value will be set as the reason for exemption, in addition:

- on a copied document – on the basis of a copied document

- on the basis of the corrected document

- on a generated – from “source” (e.g. ZS)

- on clips – based on the first clipped document with a non-empty value

- on collective corrections – based on the first document bundled with a non-empty value

- on documents generated e.g. for collective corrections, if there is a clip header first and only then e.g. a WZK is generated, then on these WZK according to the clip header

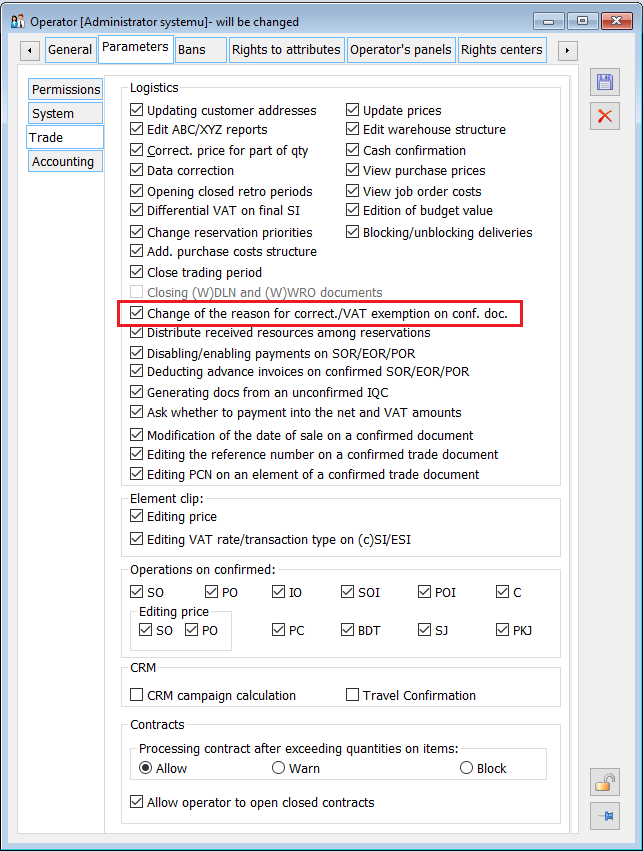

Change of reason on approved document

In addition, authorised users can change the reason for exemption on an approved document. The relevant authorisation is granted on the operator’s card as common for both the operation of changing the reason for correction and changing the reason for VAT exemption. The relevant parameter is available on the {Parameters/General} tab as “Change of the reason for the correction/VAT on approved document”.

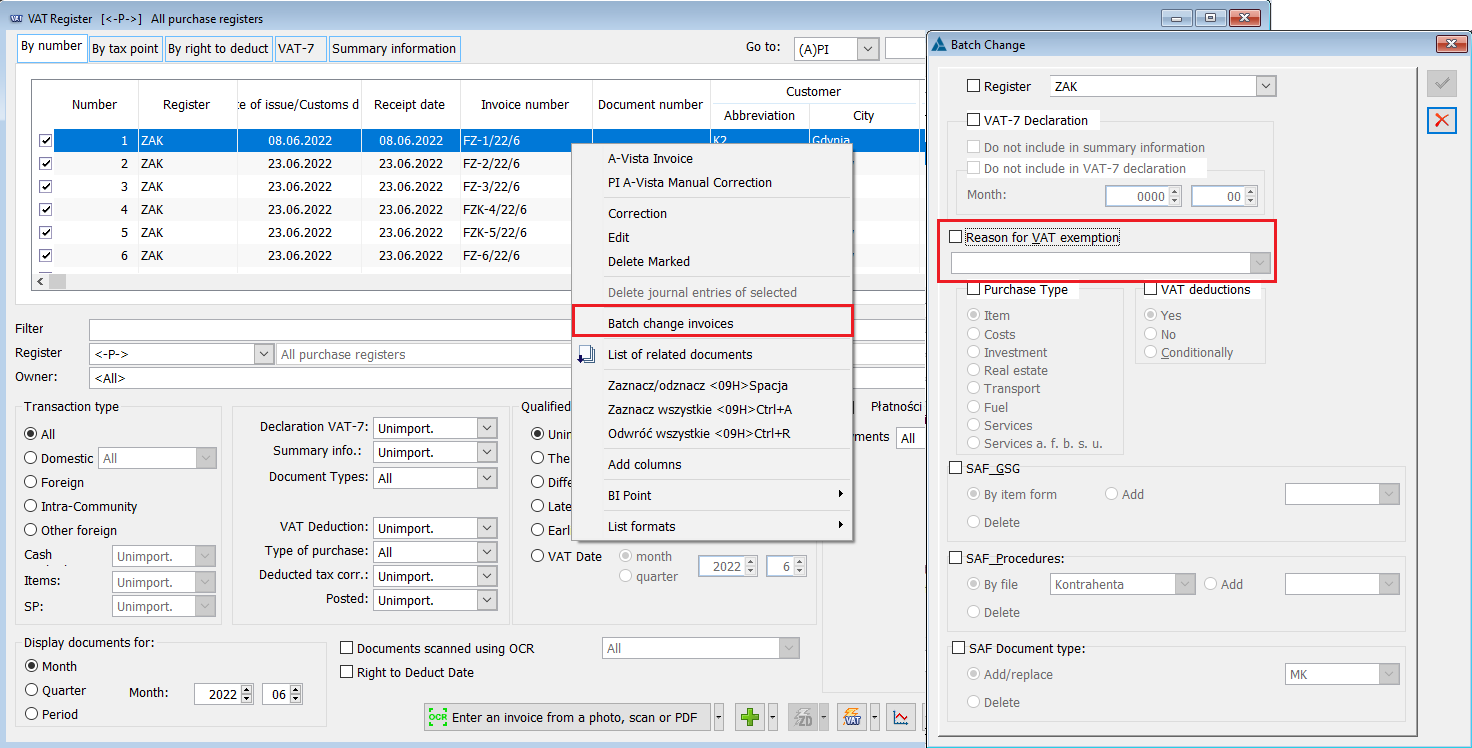

Serial determination of the reason for VAT exemption

At the same time, the option to serially determine the reason for VAT exemption on approved documents has been made available. It is available from the VAT register as another parameter for the option: Change serial invoices available from the context menu in the VAT register list.

Setting a new value of the reason for VAT exemption, similarly to the change in the document header, is possible for operators with the authorisation: Change of the reason for the correction/VAT on approved document.

Printouts

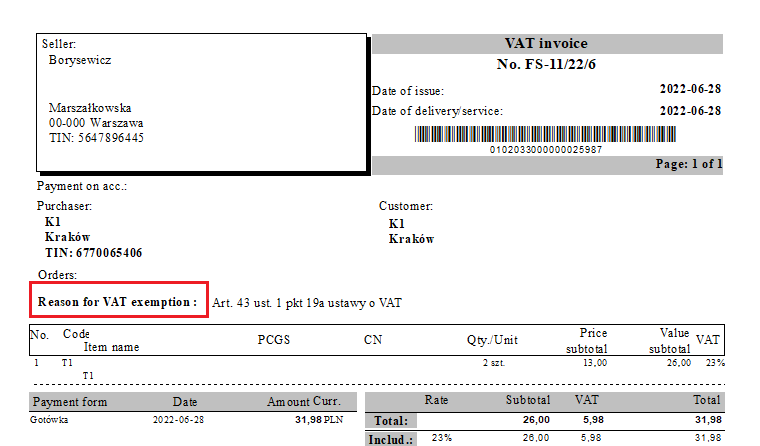

The reason for VAT exemption is also printed on sales and purchase invoices printouts and their corrections.

The indication of the reason for the exemption is required on invoices and their corrections, and therefore the modification applies to the printouts of these documents. Printouts of other documents were not changed.

Additional information appears on the printouts: Reason for VAT exemption. This section provides information on the reason for applying the exempt rate and, as in the header, refers to the elements with a ZW rate on that document. Information is printed when the reason for the exemption in the document header is not empty. Otherwise, the section is not printed. Below is a list of modified printouts:

FS, (A)FS, (S)FS printouts

- VAT invoice VAT invoice (additional item description)

- VAT invoice (with discount)

- VAT invoice (code group)

- VAT invoice (simplified)

- VAT invoice (duplicate)

- VAT invoice (simplified duplicate)

- VAT invoice (text)

- VAT invoice (deposit)

- VAT invoice (text) – deposit

- VAT sales invoice (code group)

- VAT sales invoice (code group – deposits)

FSK, (A)FSK, (S)FSK printouts

- VAT invoice – adjustment

- VAT invoice – adjustment (additional item description)

- VAT invoice – adjustment (simplified)

- VAT invoice – adjustment (duplicate)

- VAT invoice – adjustment (simplified duplicate)

- FS VAT adjustment – text

- VAT invoice – adjustment (deposit)

- Adjustment of an unregistered FS

- Adjustment of an unregistered FS (model 2)

- VAT sales invoice (code group)

- VAT sales invoice (code group – deposits)

FZ, (A)FZ, (S)FZ printouts

- Purchase invoice

Printouts of FZK, (A)FZK, (S)FZK adjustments

- Purchase invoice – adjustment

- Purchase invoice – adjustment of an unregistered invoice

Printouts of collective (Z)FSK corrections

- VAT invoice – collective correction (source documents)

- VAT invoice – collective correction (source documents – duplicate)

- VAT invoice – collective correction (source documents and goods)

- VAT invoice – collective correction (source document and goods – duplicate)

- VAT invoice – collective correction

- VAT invoice – collective correction (duplicate)

- VAT invoice – collective correction (items)

- VAT invoice – collective correction (items – duplicate)

Printouts of collective (Z)FZK corrections

- VAT invoice – collective correction (source documents)

- VAT invoice – collective correction (source documents and goods)

- VAT invoice – collective correction

- VAT invoice – collective correction (items)