Handling VAT reverse charge – general information

The mechanism enabling the recording of goods subject to the reverse charge procedure in the system is an optional functionality. Parameter: Handling VAT reverse charge, accessible from the program configuration / Parameters 2, allows enabling/disabling this utility.

SII and PII documents, which will be generated to the PI purchase invoice document, have been used in the system for charging/deduction of VAT by the purchaser of goods marked as “reverse charge”.

Since the SII/PII documents are generated for the FAI import invoice by default and require a licence for the import module, the mechanism for generating internal invoices for purchase invoices has been parameterised accordingly so that intra-community acquisitions can no longer be recorded using this option without using the import module.

Transaction type for the reverse charge of VAT

The sales invoice for the VAT payer of goods subject to the reverse charge procedure should be marked with the “The taxpayer is the buyer” transaction type. It is possible to determine this type by default on the basis of the main contractor from the document, if it has been marked with such a parameter. However, the contractor card parameter “works” on every sales invoice, regardless of the type of goods sold. Therefore, it is recommended to mark a contractor with the “taxpayer is the buyer” parameter only if all transactions with this contractor relate to the reverse charge procedure, otherwise it should not be used. In such a case, the correct transaction type will be determined during “normal” sales, and in the case of sales of goods subject to the above procedure only, the system will present information on the incorrect transaction during document saving/approval and will suggest changing it.

When generating documents from orders, the transaction type is determined by the order, and as the type is not present on the orders, it is also not present on the generated document. Only when saving the document, an appropriate message appears regarding the use of a VAT rate other than that assigned to the goods.

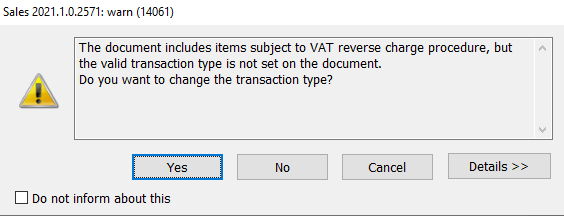

When approving a document with goods subject to the reverse charge procedure, a message about an incorrect transaction type appears with the Country transaction type:

The document contains elements subject to the reverse charge VAT procedure, and the correct type of transaction has not been set on it.

Should I change the type of transaction? YES/NO/CANCEL.

If you select YES, the type of transaction will change to the correct one (Taxpayer is the Buyer).

Generating an internal invoice for SII sales to PI

In order to generate an internal sales invoice SII to a purchase invoice PI in the Sales module, goods subject to the reverse charge procedure must be recorded as follows:

- selecting the parameter: {Handling VAT reverse charge} in the system configuration,

- type of transaction: national,

- the contractor in the transaction is a VAT payer,

- at least one element that appears on the PI has been marked as reverse charge and has a VAT rate that matches the VAT rate assigned in the configuration as the reverse charge VAT rate.

The PI received from the supplier should be issued at NP rate, and then such an item is not included in the declaration. In this correct situation, only the SII and PII are included on the declaration. It is important to check that the correct rate is set in the conversion in the VAT rates list.

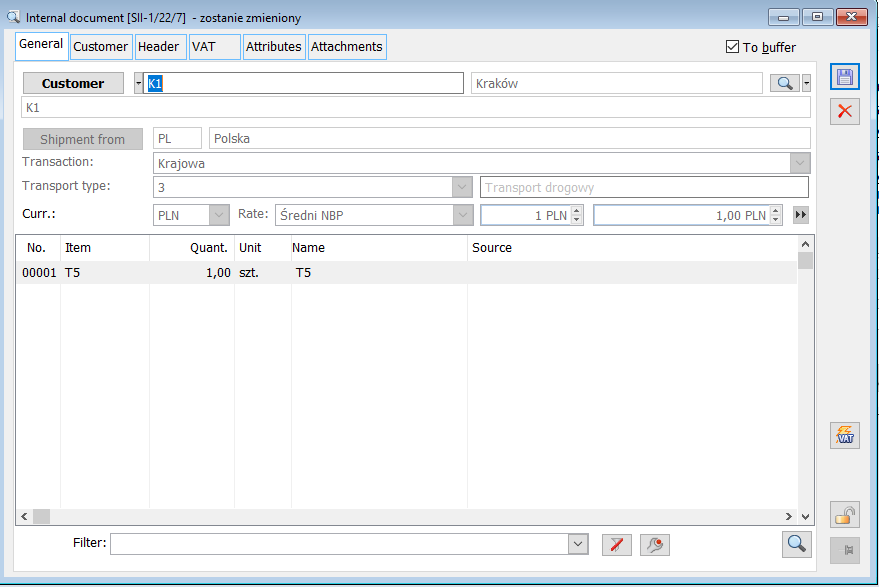

SII, tab: General

On the SII document that is generated from the PI, the field values are transferred from the source document.

The General tab of the SII document contains the following fields:

![]()

– transferred from PI, which can be changed,

Country of dispatch, Transaction, Type of transport – values taken from PI, cannot be changed

Currency – value transferred from PI, cannot be changed

Currency exchange rate – type and value of exchange rate transferred from PI, changeable

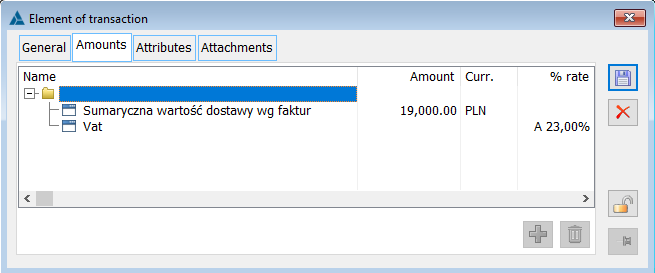

Window: Transaction item

The SII document generated from PI shall include only those items that have the reverse charge option selected in the product card.

On the tab: Amounts displayed are: Total delivery values by invoice and changeable VAT. The option to add a set of amounts has been locked.

SII, tab: Contractor

The tab displays the main and target contractor data. Until the document is approved, it may be changed.

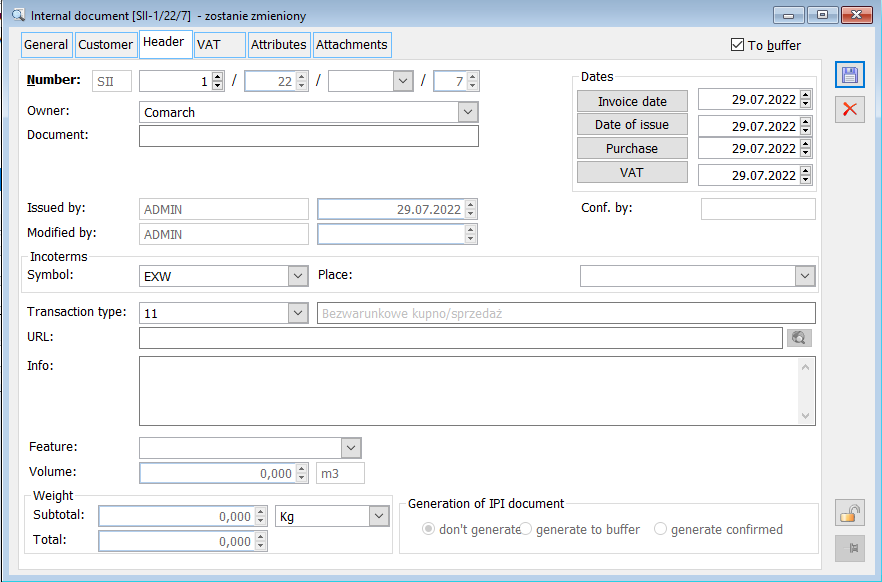

SII, tab: Header

The Header tab contains the following data:

Number – the number of the document. By default, a consecutive number is assigned, but this can be changed to another available number.

Dates of:

- Issue – current date,

- Purchase – date of purchase from PI,

- VAT – date of issue from PI

Issued by – the code of the operator issuing the document

Modified by – the code of the operator who last modified the document

Approved by – the code of the operator who approved the document

Transaction type – transaction type code, defined in the window: Category dictionaries. The adjacent field describes the type of transaction.

URL – website address with information related to the complaint. If it is entered, the button next to it is active:

![]()

[View page]. Pressing it will launch the default browser and attempt to display the page with the address entered.

Description – a field with transaction description

Feature – an attribute that distinguishes transactions, selected from the dictionary: Transaction features

Volume – the volume of a product expressed in cubic metres

Weight n/g – net and gross shipping weight in units

Generate PII document – this parameter is responsible for generating PII document from SII document. The default setting of this option is copied from the document definition for the permission structure centre to which the operator belongs.

SII can be generated:

- from the context menu and from the drop-down menu next to the PM generation icon,

- from multiple selected PI, if on selected documents there is the same contractor and the same currency, transaction type: domestic,

- when the PI document and correction(s) to this PI are selected, a differential SII will be generated,

- from the (C)PI clip, it is additionally required to indicate as a source document the POR document on which the item subject to the reverse charge procedure was added. On the Header tab, it is possible to indicate whether the SII document is to be generated automatically (to the buffer, approved) or not

The FKS adjustment can be generated from the context menu and the drop-down menu. The option of generating an adjustment available in the menu is active if the PIC or (C)PIC document is selected. When the cursor is set to PI or (C)PI, the option to generate SIC is deactivated.

Generating an internal invoice for the purchase of the PII to the SII

The internal purchase invoice PII can be generated to the internal sales invoice SII in the Sales module, if the SII document was generated to the purchase invoice PI. The PII document can be generated automatically when approving the SII, if in the SII on the Header tab the option concerning the generation of the PII: to buffer or confirmed has been selected. The default setting of this option is copied from the document definition for the permission structure centre to which the operator belongs. When generating an PIC to SIC document, it is checked whether the transaction relates to the reverse charge procedure and whether there is a licence for the Sales module.

Recording on a single invoice both sales subject to the reverse charge procedure and sales not subject to the reverse charge procedure.

Due to a lack of clear interpretations whether one invoice may include sales of both goods subject to the reverse charge procedure and goods not subject to this procedure, changes have been introduced to the printouts of such sales documents, namely if both the above-mentioned types of goods appear on the document after the “Reverse charge” marking, the printout will list No. of the items from the document to which the reverse charge applies.

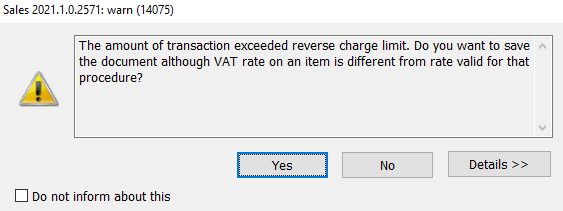

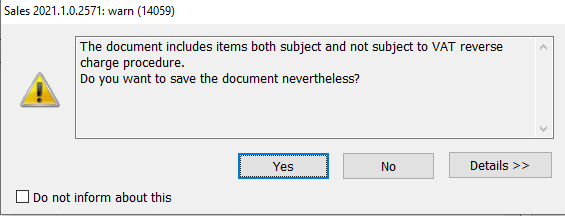

When a document with goods subject/not subject to the reverse charge procedure is saved, an appropriate message appears:

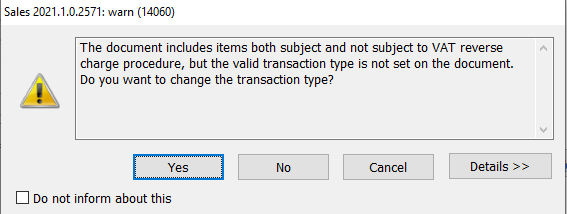

“The document contains both items subject to reverse charge VAT and items not subject to reverse charge VAT, and the correct type of transaction has not been established on the document.

Should I change the type of transaction?” YES/NO/CANCEL.

When YES is selected, the transaction type changes to Taxpayer is the Buyer (VAT tab).

Turnover limit for reverse charge procedure

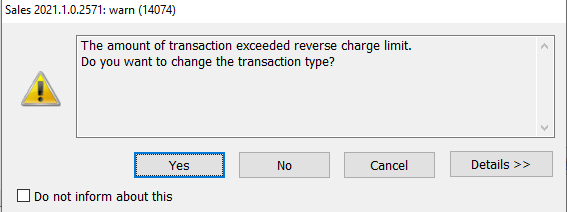

The amount of the limit will be presented on commercial documents and will be calculated by comparing the value of 20,000.00 specified in the Act with the net sum of transactions made with this type of goods on a given day with a given contractor. When recording transactions with reverse-chargeable goods above a certain value, the unapproved commercial document, on which such goods are included, shows the remaining limit under which the reverse charge procedure is not applied. A negative value of this limit informs that VAT rates appropriate for the reverse charge limit should be applied to the transaction and that the type of transaction (sales documents) should be changed, or the VAT rate should be changed on the elements (ipor, POR document). The transaction total amount will be calculated on the basis of sales or purchase items (depending on which document it will be calculated for) that relate to this type of goods and are found on documents registered to the same contractor with the same sale/purchase date as the date on the current document. The status of these documents will not be relevant, i.e. already unapproved documents will reduce this limit. The type of document shall be taken into account for setting the limit: SI, SOR, ISI, ESI, EOR, (C)SI, PI, POR. The state of the document is not relevant for the calculation of the limit. The main contractor is checked and must match the main contractor of the document on which the limit is presented. The value of the limit is determined according to the date of sale or purchase on the document.

Reverse charge – information and warnings on document generation

In the case of approval of a document with the selected “taxpayer is the buyer” parameter and goods subject to reverse charge and regular, a window with the message will appear.

If the parameter “taxpayer is the buyer” is unchecked on the document, and the transaction is domestic, and the document items include reverse-chargeable goods and ordinary goods, a warning message will appear prompting to change the transaction type. If you select yes, the “taxpayer is the buyer” parameter will be selected. The answer will not save the document as is. If you select cancel, the document will not be saved, and no changes will be made to it.

If the “taxpayer is the buyer” is selected on the document, the transaction is domestic and the document contains reverse-chargeable goods, a message appears with a warning and a question about changing the type of transaction. If you select yes, the “taxpayer is the buyer” parameter will be selected. The answer will not save the document as is. If you select cancel, the document will not be saved, and no changes will be made to it.

If the “taxpayer is the buyer” parameter is unchecked on the document, the transaction is domestic, and the document contains reverse-chargeable goods with the “reverse-charge limit” parameter selected on the product card, then a warning message shall appear, stating that the reverse charge limit has been exceeded and asking to change the transaction type. If you select yes, the “taxpayer is the buyer” parameter will be selected. The answer will not save the document as is. If you select cancel, the document will not be saved, and no changes will be made to it.

Recording the purchase document and the reverse charge procedure

When adding goods marked with the “reverse charge limit” parameter to the IPOR/POR, the system establishes the national VAT rates on the items, regardless of whether the reverse charge limit of PLN 20,000.00 was exceeded or not. It is the Operator who, seeing a “negative” limit on the document, should change the rates by editing individual items or using the option of serial setting of the reverse charge rate on the document items. However, if the User fails to do so, the System will display an appropriate warning when saving/approving such a purchase document, if the limit has been exceeded, but there are still elements subject to the above-mentioned limited procedure, on which the rate applicable to the reverse charge has not been used.

The information is therefore displayed when all of the following conditions are met:

- The parameter “Reverse charge handling” has been enabled in the configuration

- The main contractor of the document is a VAT payer

- The transaction on the document is “Country”

- There is a document item marked with the “Reverse charge limit” parameter for which the VAT rate is different from the rate marked in the configuration as “Reverse charge VAT rate”

- The amount of the outstanding reverse charge limit is a negative value