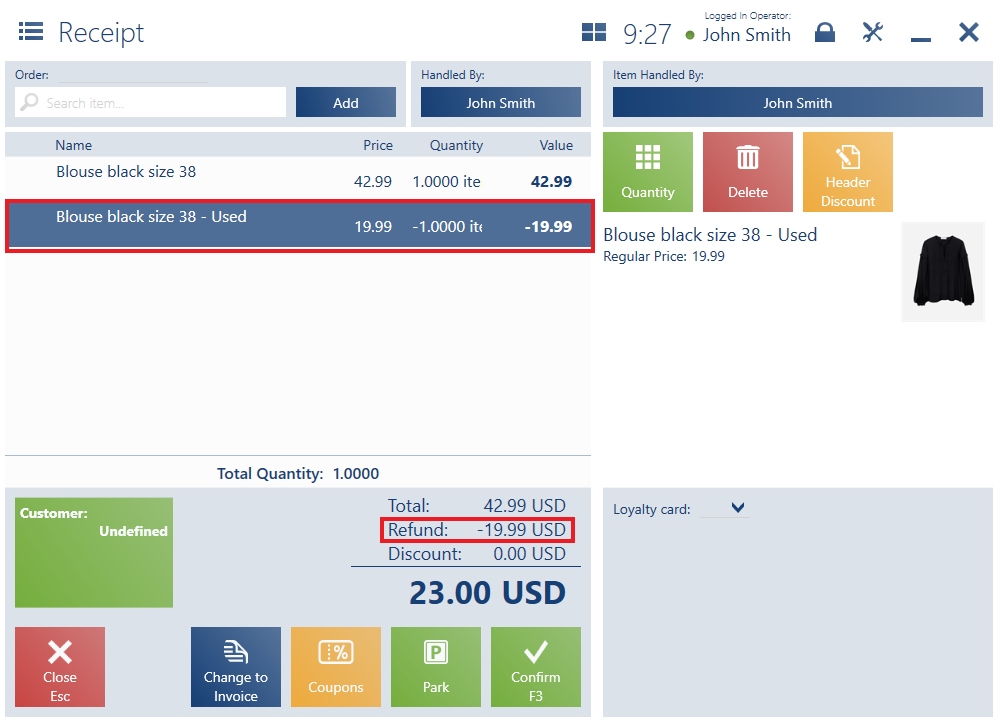

Comarch Retail POS application allows the user to handle the buy-back of selected items.

Items to be bought back need to be entered by the user in a trade document. A document item related to a buy-back reduces the amount due for a transaction registered with the document.

At the moment of document confirmation, items subject to a buy-back are transferred to an automatically generated document of manual quantity correction. As a result, the issued receipt/invoice does not contain items related to the buy-back. The payments of both the documents are compensated after the synchronization of these documents with the ERP system.

Items of the Buy-back type:

- Are not subject to trade discounts or user discounts

- Cannot be used in the exchange process

- Cannot be used in sales quotes and orders. After adding an item of the Buy-back type in such a document, the item will be presented with a positive value.

The following items have been added in the system:

- Shirt – price 100 EUR, not subject to buy-back

- Used shirt 10 – price 10 EUR, subject to buy-back

- Used shirt 20 – price 20 EUR, subject to buy-back

After receiving a used shirt from a customer, the user grants a 20 EUR discount and adds the items Used shirt 20 and Shirt in a trade document. The customer now needs to pay 80 EUR for the transaction. After the user confirms the payment window, the application generates a receipt for 100 EUR and a manual quantity correction for 20 EUR.