The functionality of credit limit allows the user to issue trade documents for a customer who has been granted a specified credit limit, with no obligation to collect a payment.

Information on a customer’s credit limit is presented in following locations:

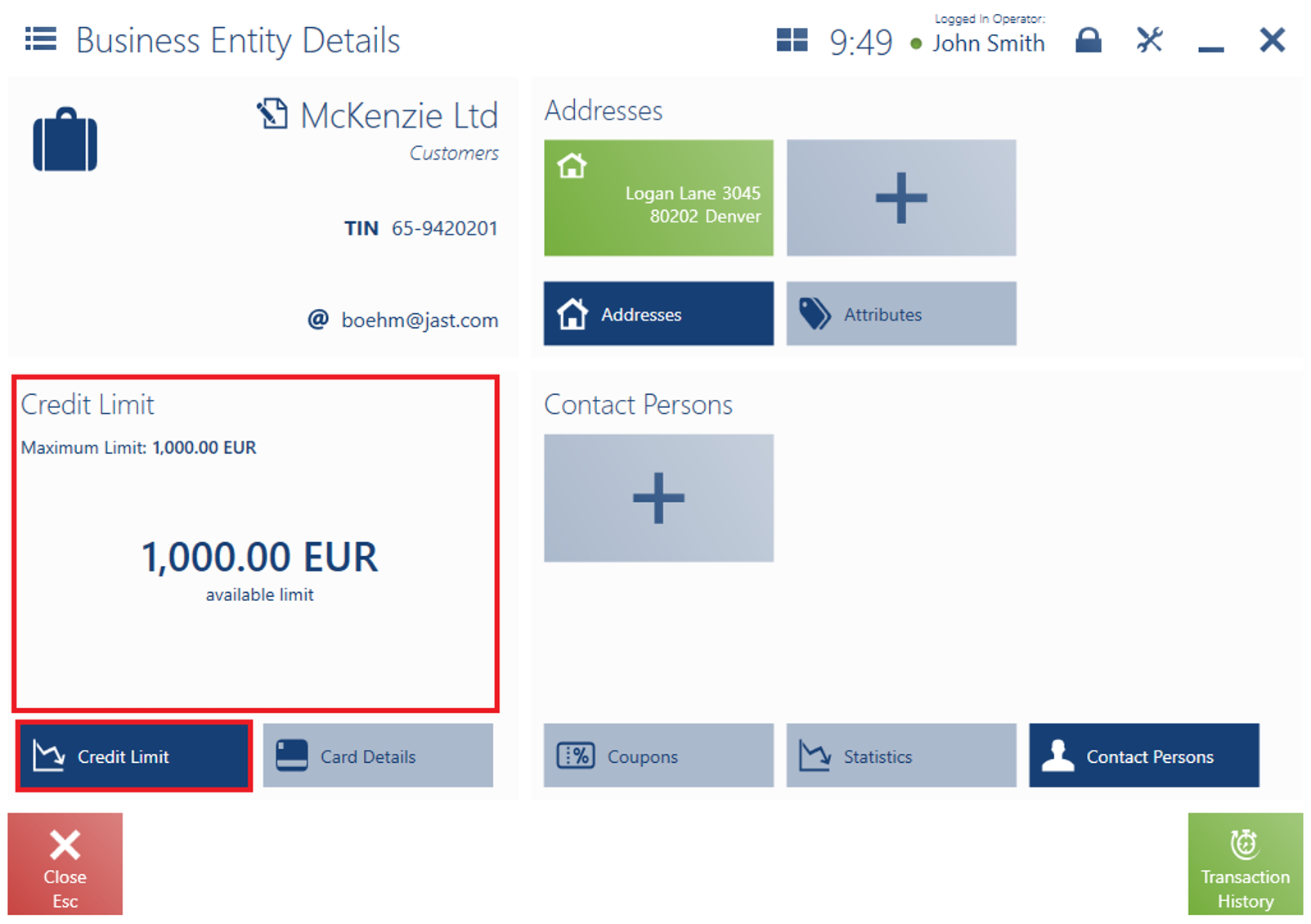

- On the tab Credit Limit, in the window Customer/Business Entity Details – it presents a maximum and available limit

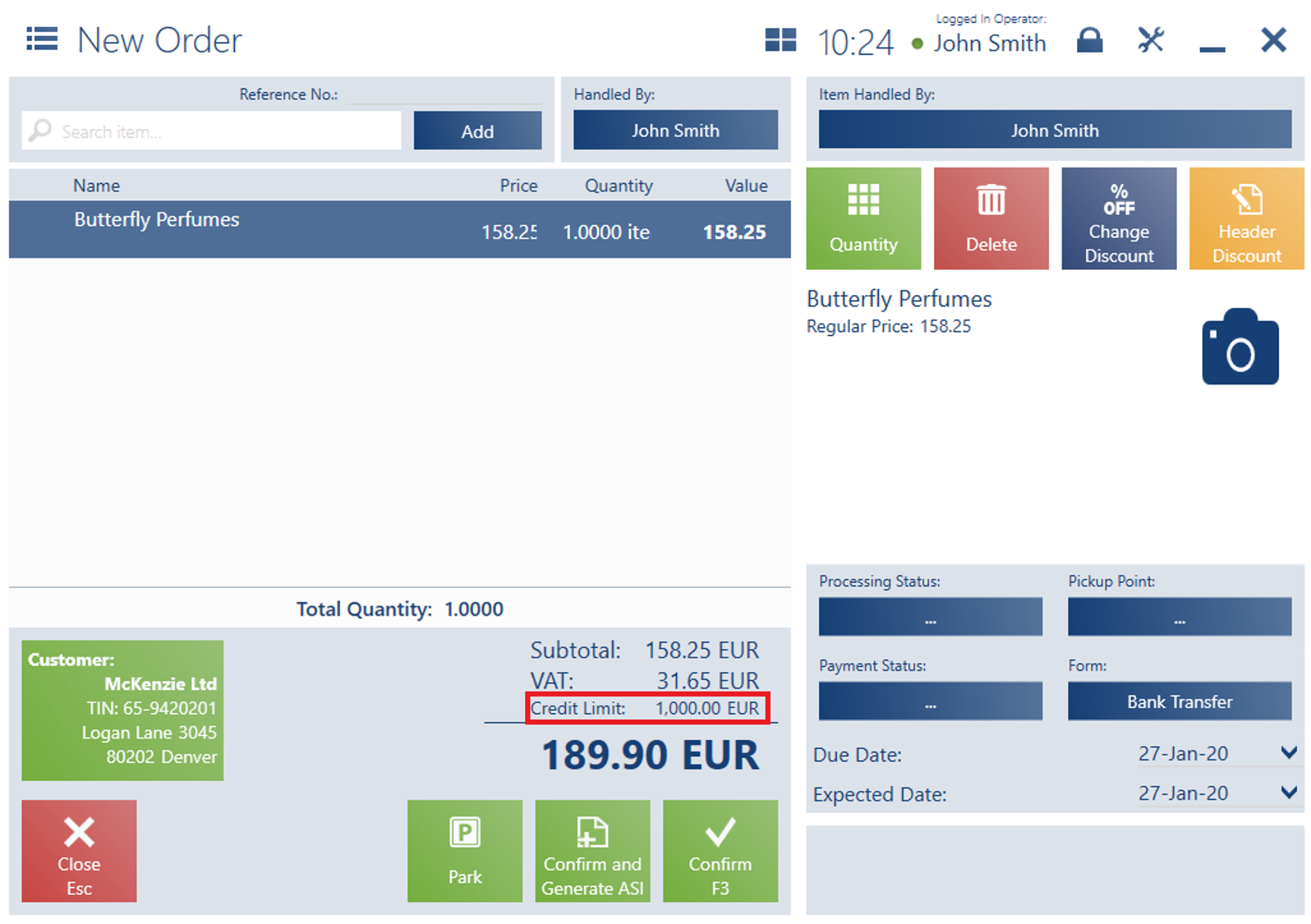

- In a document – depending on configuration in the ERP system, an available limit may be presented after considering the value of a given document, without taking the value into consideration, or may not be presented at all

- In the payment window – it presents an available limit

In order to properly configure the functionality, the following settings need to be defined for the POS workstation on the ERP system’s side:

- At least one payment form of the type Bank or Check needs to be shared

- It is necessary to specify payment forms without deposit

The application makes it possible to:

- Grant a specific, valid credit limit with the option Limited – the available limit will then be presented as a relevant amount reduced by unpaid receivables

- Not grant a valid credit limit with the option Limited – the following notification will then be presented for credit limit: No credit limit has been granted

- Grant an unlimited credit (the option Open) – the available limit will then be presented as Open

Credit limit can be used in the following documents:

- R

- SI

- SO

In the ERP system, the user can specify a method of control to be used in case a credit limit is exceeded (it refers to R, SI, and SO documents):

- Don’t control – even if there is no connection to the data synchronization service, it will always be possible to confirm a document or select a payment form without deposit in the payment window

- Warn – in the case where a credit limit is exceeded, confirming an SO document or selecting a payment form without deposit in the payment window will display a relevant notification

- Block sales transactions – if a credit limit is exceeded, the application will make it impossible to confirm an SO document or select a payment form without deposit in the payment window

Confirming an SO document does not decrease a customer’s credit limit. The limit will only be decreased once a payment form without deposit is confirmed in the payment window.

The payment window may:

- Present payment forms without deposit only for customers with a credit limit granted (if the handling of credit limit is activated). Conversely, such payment forms are not presented for customers who have not been assigned a defined credit limit (no active credit limit with the option Limited).

- Present payment forms without deposit for each customer (if the handling of credit limit is not activated)

In the case of RQC/SIQC corrections, the value of a credit limit amount displayed in the payment window is increased according to the document value.

If the POS workstation has no connection to the data synchronization service and a customer’s credit limit cannot be verified, the application presents additional information on the period of time since the last update.

An XYZ company handles credit limits on POS workstations. Customers who have been granted a credit limit are obliged to settle their payments within two months after a receivable is created.

The control option selected for trade documents in the ERP system is Warn.

A regular customer who has been granted a monthly limit of 1000 EUR comes to the point of sale. The operator issues an invoice for the amount of 1250 EUR. In the payment window, the user selects the payment form Bank Transfer without deposit. After the amount 1250 EUR is assigned to the payment form Bank Transfer, the application displays a notification informing the user that the customer is to exceed the available credit limit. The operator asks his manager for advice. The shop’s manager may decide whether it is the whole invoice amount or only the amount corresponding to the granted limit (1000 EUR) that should be settled with the payment form without deposit.