Contents

Adding a journal entry

Journal entries can be created in three ways:

- By posting a source document − e.g. with the use of a posting scheme or through a contra entry, if such option is available for a given document. The result of posting operation is generation of a journal entry (journal entry document). Detailed description of the functionality can be found in category Document posting.

- By manual addition of a journal entry in ledger − a user enters an entry into the list of journal entries and defines its parameters manually

- Automatically − journal entries are generated by the system, e.g., correcting single-sided entry (when deleting a confirming journal entry), compensating single-sided entry (it assigns single-sided journal entries entered onto two different clearing accounts)

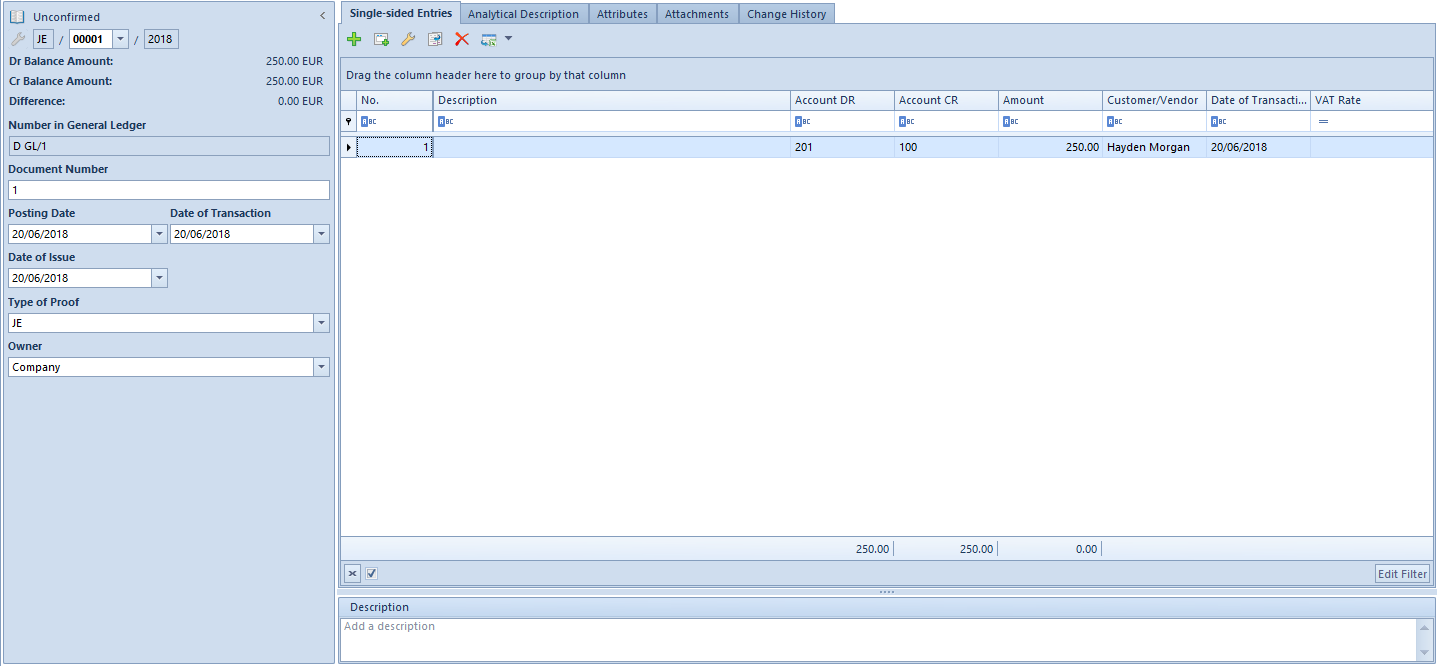

To add a journal entry manually, it is necessary to select button [Add], placed in the List group of buttons, which is available from the level of Accounting → Ledger. A form of a journal entry is opened.

The form is composed of the following elements:

Side panel

- Document Status − displayed after a document is saved. Depending on the document status, it takes one of the following values: Unconfirmed, Confirmed or Reversed

- Number – generated automatically by the system according to settings of a document numerator

- Dr Balance Amount – information field, it presents a total of items registered on a debit side of balance-sheet accounts

- Cr Balance amount – information field, it presents a total of items registered on a credit side of balance-sheet accounts

- Difference – information field, it presents a difference between a total amount of items registered on debit side of balance-sheet accounts and a total amount of items registered on credit side of balance-sheet accounts

- Number in General Ledger – successive number of a journal entry in the general ledger. This number is entered automatically and it cannot be edited. Confirmed entries receive respectively the following numbers: 1,2,3. Draft documents receive prefix defined in the system configuration and the successive number. If parameter Numeration only in ledger has been checked in the accounting period definition, it is possible to select particular ledger within the number During a manual addition of a journal entry the field is, by default, filled in with the ledger symbol defined in field Default ledger on accounting period form.

- Number in Ledger − successive number of a journal entry within a ledger. This field is available if the parameter Numeration only in ledger available in the accounting period definition, is unchecked. After expanding the list, all ledgers defined in a current accounting period are displayed. During a manual addition of a journal entry the field is, by default, filled in with the ledger symbol defined in field Default ledger on accounting period form. The second part of the field, the part after slash (/), is the ordinal number that is entered automatically by the system.

- Document Number – number entered by a user. In case a journal entry was generated as a result of posting a document, this is the reference number of the document from which the journal entry originates and if a reference number is missing – it is a system number of a given document. After changing a document number in journal entry header, the system asks whether to update the document number on the journal entry’s items.

- Posting Date – document date of registration in the books

- Date of Transaction – actual date of business event (date of sale in an invoice can be different than the date of issue indicated in invoice). In case of entry resulting from posting of a document, transaction date is set according to the date of sale/purchase selected in the posted document or the date of transaction in case of posted CD/CW.

- Date of Issue − journal entry date of issue. The date is set on the basis of the date resulting from posted document or the document date in case of posted CD/CW.

- Type of Proof – value in this field informs about a document on the basis of which a journal entry was generated. When registering a journal entry manually from the level of general ledger, a value JE – Journal Entry is set by default. Values of a predefined generic directory Type of Proof are the following:

- Invoice

- Warehouse document

- JE

- Bank Statement

- Cash Report

- Exchange Rate Difference

- Debit Collection Document

- Compensation

- Periodical Report from Receipt Printer

- Account Closing

- Technical Reposting

A user can add own values from the level of Configuration → Generic Dictionaries → General → Type of Proof.

- Owner − company structure center to which a user adding a journal entry is assigned. It is possible to change the entry owner to other center of a given company.

- Description − section with description of a JE document. In a journal entry generated as a result of posting of a document, value presented in this field is the value selected in the header of the posting scheme with which the document was posted. In a journal entry generated as a result of posting a cash-bank transaction through a contra account, value presented in the field Description is the number of the posted cash-bank transaction.

Single-sided Entries tab

The system allows for adding single-sided entries in two ways:

- directly in table

- through form

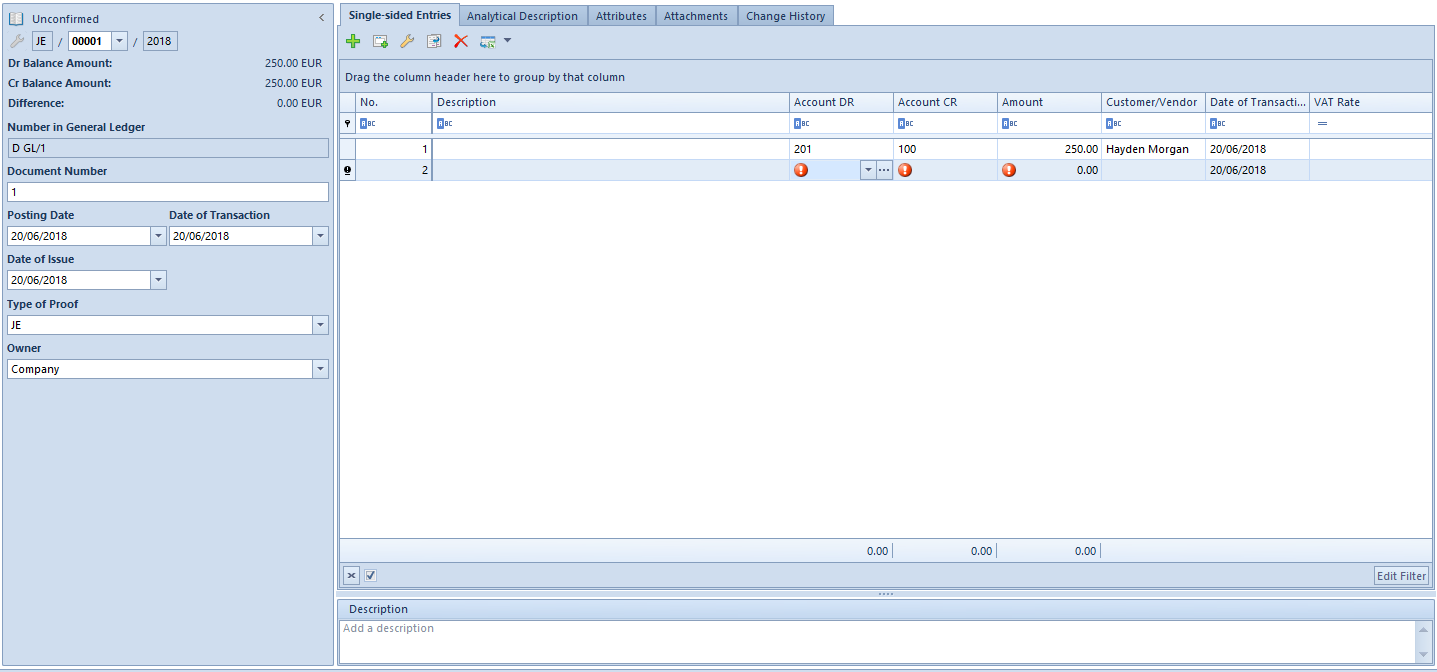

Adding a single-sided entry in table

To add an item in table, it is necessary to click on [Add] button placed in Single-Sided Entry group of buttons. A row for entering data appears in the table. A user must fill in the following columns: Account DR, Account CR, Amount, Date of Transaction, and optionally VAT Rate, Description, and Customer. There are also hidden columns available: Amount in Currency, VAT %, Currency. When adding a subsequent single-sided entry, amount presented in the Amount field is calculated as a differential value so that a document balanced within balance-sheet accounts.

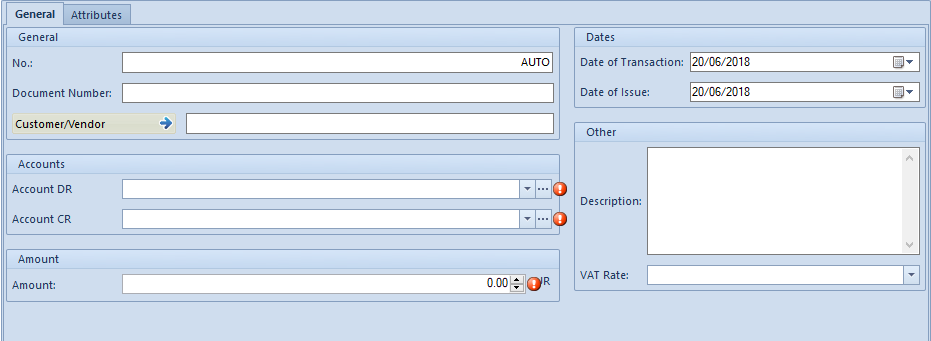

Adding a single-sided entry through form

To add an item to cost allocation in table, it is necessary to click on [Add Through Form] button placed in Items group of buttons. A single-sided entry form appears.

Single-sided Entries → General

The tab General of a single-sided entry form is composed of the following elements:

Section General

- No. − field filled in by system automatically. It cannot by edited.

- Posting Scheme − scheme, by means of which a document has been posted. This field is visible if a single-sided entry was created as a result of posting of a source document.

- Document Number − reference number of a document from which a single-sided entry derives and if such number is missing – system number of the given document. It can be also entered manually.

- Customer/Vendor − allows for selecting a customer/vendor associated with a given single-sided entry.

Section Accounts

- Account DR − mandatory field. Debit side of an account.

- Account CR − mandatory field. Credit side of an account.

- Entity − field displayed upon selecting a dictionary account associated with an entity. The entity associated with a given dictionary account is displayed in this field.

Section Amount

- Amount − mandatory field. Single-sided entry value. When adding a subsequent single-sided entry, amount presented in the Amount field is calculated as a differential value so that a document balanced within balance-sheet accounts.

- Amount in Currency − field available only for single-sided entries registered on account in a currency different than the system currency.

Section Currencies

Section available only for those single-sided entries which are registered on account in a currency different than the system currency. It allows for selecting an exchange rate according to which a journal entry should be recalculated. In case a single-sided entry was created as a result of posting of a document, the section is not editable.

Section Dates

- Date of Transaction – in case of single-sided entry resulting from posting of a document, transaction date is set according to the date of sale/purchase selected in the posted document or the date of transaction in case of posted CD/CW.

- Date of Issue – in case of single-sided entry resulting from posting of a document, date of issued is set on the basis of the date of issue of the posted document or the document date in case of posted CD/CW.

Section Other

- Description − in case of a single-sided entry generated as a result of posting a document, description in this field is copied from the element of a posting scheme through which a given document was posted. In the case of a journal entry generated as a result of a posted cash/bank transaction, description in this field is copied from the field For of a cash/bank transaction.

- VAT Rate – allows for the selection of VAT rate included in VAT rate group assigned to a company to which a user is logged-in. In the case of journal entries created as a result of posting documents with a posting scheme, the system sets a relevant value posting the amount of VAT, depending on the setting of the parameter Save VAT rate which is available on posting scheme item. Detailed description can be found in article Adding posting scheme.

Section Clearings

Section available only for those single-sided entries which are added to a clearing account. It defines the status of a single-sided entries: Subject to clearing/Not subject to clearing

If the parameter is unchecked, regardless of whether a posted transaction/report is subject to clearing or not, a single-sided entry created after posting is subject to

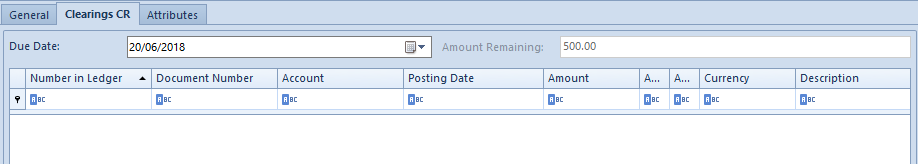

Single-sided Entries → Clearings DR and Single-sided Entries → Clearings CR

The tab is available, if a clearing account has been used in a single-sided entry. The name of the tab depends on the side of single-sided entry in which the clearing account was used.

The tab Clearings of a single-sided entry contains a table with information regarding a single-sided entry which clears the given single-sided entry.

The tab is composed of the following fields:

- Due Date − set depending of the source of a single-sided entry:

- For single-sided entries associated with a payment (created after posting a payment) − on the basis of the field Due Date of document payment

- For single sided entries associated with a cash/bank transaction − on the basis of the field Document Date on the cash/bank transaction

- For single-sided entries added manually − on the basis of the date of posting of the journal entry

- For single-sided entries created after posting an exchange rate difference document − on the basis of the date of issue of the document

- Remaining − amount remaining to be cleared

- Presentation Currency − Takes one of the following values:

- System currency − in columns Amount, Remaining DR, Amount Remaining CR amounts presented are expressed in the system currency. It regards both single sided-entries in system currency and in a foreign currency. The column Currency contains the symbol of the system currency.

- Account currency − in columns: Amount, Remaining DR, Amount Remaining CR amounts presented are expressed in the account currency, that is in the single-sided entry’s account. It regards both single sided-entries in system currency and in a foreign currency. The column Currency contains the symbol of the single sided entry’s currency.

- System and account currency − in columns Amount, Amount Remaining DR, Amount Remaining CR amounts presented are expressed in the account’s currency. The column Currency contains the symbol of the currency of a journal entry. Additionally, the following columns are presented: Currency [], Amount Remaining DR [], Amount Remaining CR [], where in [], the symbol of the system currency is presented. The value of the parameter is used for currency accounts only.

Single-sided Entries → Attributes

Detailed description can be found in article Attributes

Tab Analytical Description

The system allows for entering analytical description on the level of a journal entry. Detailed description of the functionality can be found in article Analytical description on accounting documents.

Tabs Attributes, Attachments, Change History

Detailed description of tabs can be found in article Tab Discount Codes, Analytical Description, Attributes, Attachments and Change History.

Saving/confirming journal entry

After completing all mandatory fields, it is necessary to save a document by clicking on one of the buttons:

- [Save as Unconfirmed] − a document saved as unconfirmed is not binding. It can be freely edited and deleted.

- [Save and Confirm] − permanent saving. Upon a journal entry is confirmed, it becomes binding, then it can be neither edited, nor deleted (it is only possible to preview the data included in such entry). It is also possible to generate a correcting or reversing entry to it. Upon doing so, the entry will still be visible on the list of journal entries in the ledger. The reversing document is displayed in red. Contra entry of journal entry can be also confirmed or saved as unconfirmed.

102 – off-balance sheet account

Journal entry only to an off-balance sheet account.

| Dr Side | Cr Side | Amount |

|---|---|---|

| 102-off-balance-sheet | 1000 |

The control of balancing is not verified. The system allows for the registration of a one-sided journal entry.

101 – balance sheet account

102 – off-balance sheet account

Journal entry only to an off-balance and a balance sheet account.

| Dr Side | Cr Side | Amount |

|---|---|---|

| 102-off-balance sheet | 101-balance sheet | 1000 |

The system blocks registration of the journal entry because total amounts on Dr side of the off-balance sheet accounts does not equal to 0 and on Cr side it is 1000.

100 – balance sheet account

101 – balance sheet account

102 – off-balance sheet account

Journal entry only to an off-balance and a balance sheet account.

| Dr Side | Cr Side | Amount |

|---|---|---|

| 100-balance sheet | 101-balance sheet | 1000 |

| 102-off-balance sheet | 5000 |

The journal entry can be registered because total amounts on Dr and Cr sides of the balance sheet accounts equals to 1000. The balance of journal entry registered on off-balance sheet account is not verified.