A check is a document that orders a bank to pay a specific amount of money to the person in whose name the check has been issued. The money is paid from the check drawer’s account. An order to pay money is unconditional. An order to pay money is unconditional.

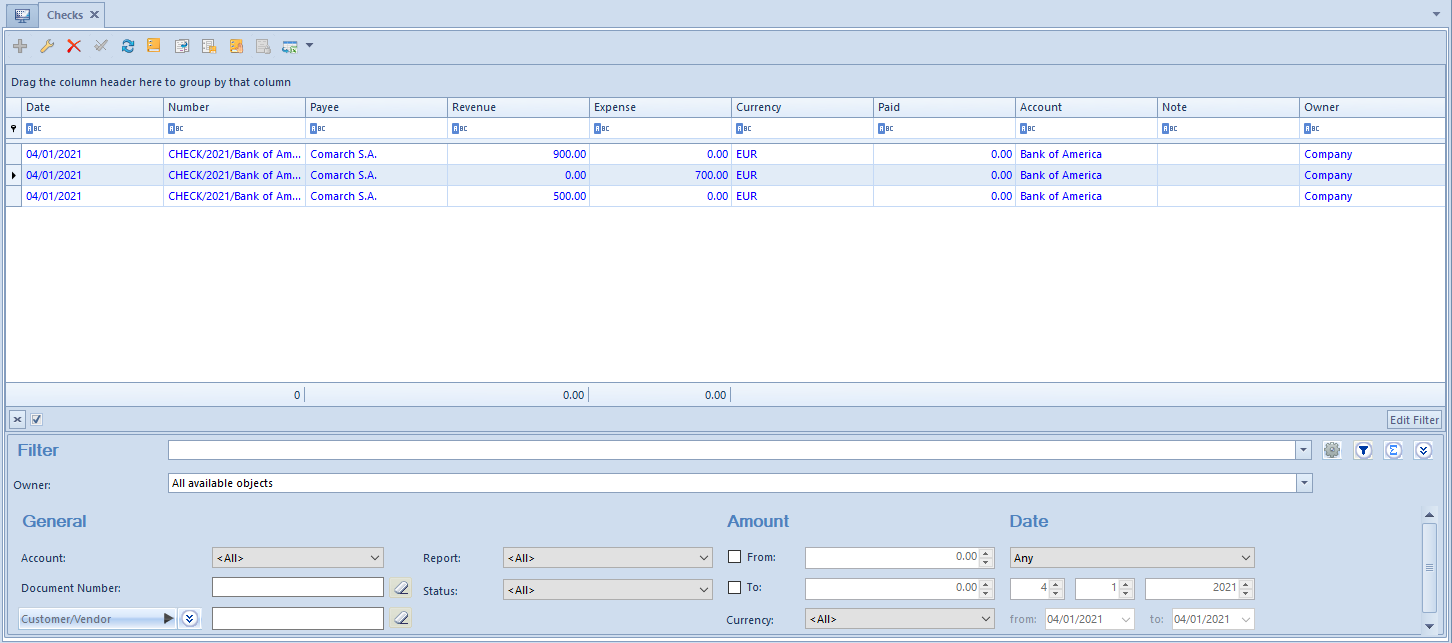

List of checks

The list of checks is available from the level of menu Finances, upon clicking on [Checks] button.

The list of checks is composed of the following columns:

- Date − check issuance date

- Number − introduced manually by a user or automatically by the system in accordance with numbering tool definition, depending on the method of adding a check

- Payee − person a check is made out to

- Revenue − value of a check of Deposit type

- Expense − value of a check of Withdrawal type

- Currency – currency in which check was issued

- Paid − check amount already paid

- Account − cash register or bank account in which a given check will be registered

- Note

- Status

- Owner − center of the company structure which is the issuer of a document

The list contains standard buttons which have been described in article Standard buttons>>.

Detailed description of functioning of the filters can be found in category Searching and filtering data>>.

Adding check

A check can be added to the system by means of the following buttons:

- [Add Deposit] or [Add Withdrawal] – check number is introduced by the system automatically, according to the definition of numbering tool and it is not editable

- [Add Manual Deposit] or [Add Manual Withdrawal] − check number is completed by a user

The method of filling in check forms is the same both for deposits and withdrawals.

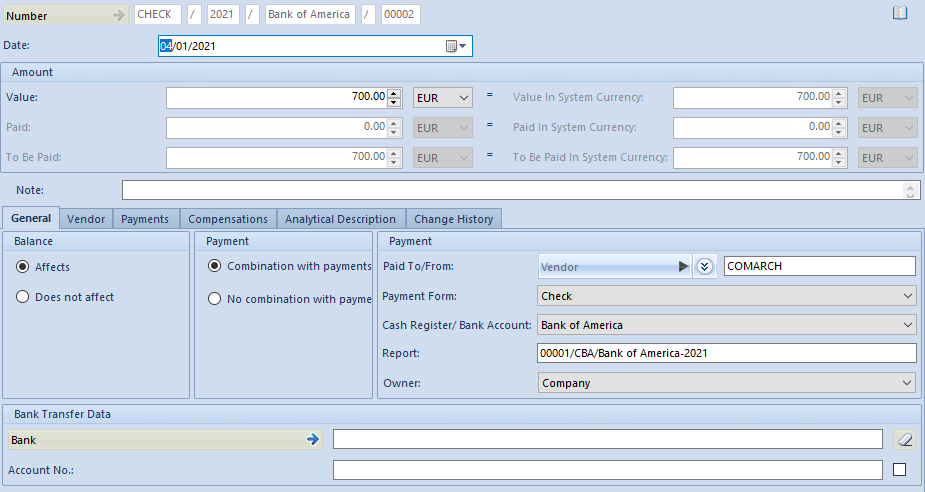

In order to add a withdrawal check, it is necessary to select button [Add Deposit] from List group. A form for entering data appears.

- Number − number completed automatically in the case of checks added by means of buttons [Add Deposit] or [Add Withdrawal] or completed by a user in the case of checks added by means of buttons [Add Manual Deposit] or [Add Manual Withdrawal]. The field is mandatory.

- Date − the system date is suggested automatically, with the possibility of changing it

- Value − check amount and currency The field is mandatory.

- Paid − check amount already paid The field is not subject to edition.

- To Be Paid − amount calculated as a difference between the value of the check and the paid amount. The field is not subject to edition.

- Note – field for providing description of a check. When printing a check, the value of the field is transferred onto the printout.

Tab General

- Balance

- Affects − when the parameter is checked, the check amount will affect the report ending balance

- Does not affect − when the parameter is checked, the check amount will not affect the report ending balance

- Payment – refers to the status of payments associated with a given check.

- Combination with payments − if checked, the amount of a check is subject to payments

- No combination with payments − if checked, the amount of a check is not subject to payments

- Paid From/Paid To – field for entering Customer, Secondary Vendor or Employee the check is assigned to.

- Payment Form – only payment forms of Check type can be selected. The field is mandatory.

- Cash Register/Bank Account – account in which a report will be registered. The field is mandatory.

- Report – the field is completed automatically with the number of the report assigned to a selected account and compliant with an indicated date. If such a report does not exist, the field remains empty. Additionally, button Add Report becomes active, by means of which a user can add a report in which a given check will be registered. The field is mandatory.

- Owner − center of the company structure which is the issuer of a document

- Currencies − this section is visible only if the check currency is different than the system currency. The following parameters are available in the section:

- Exchange rate type

- Date type

- Date

- Bank Transfer Data − information regarding bank and bank account. This field refers only to checks for which an account of Bank type has been selected.

- Bank − name of the payer’s bank which is to be selected from a list of banks defined in the system.

- Bank Account − number of payer’s bank account.

Tab Customer

This tab contains address and identification data of the Customer for whom a check is issued.

Tab Analytical Description

Detailed description of the tab Analytical Description can be found in article Analytical description on object forms