Contents

General information

Depreciation is a type of cost related to gradual wear and tear of fixed assets and intangible assets. However, it does not generate cash outflow.

Generating depreciation

A FA document can be generated either automatically when saving a fixed asset form or manually. For detailed information, refer to article Depreciation (FDP).

A depreciation document can also be generated using the option [Depreciation/Amortization] available in the menu Fixed Assets → Fixed Assets in the button group Generation for the fixed assets selected on the list.

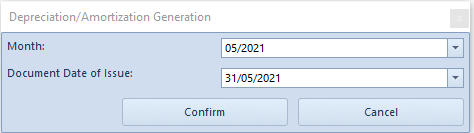

After selecting the button [Depreciation/Amortization], it is necessary to specify the month and year for which a depreciation document will be generated as well as to specify the document date of issue. After changing a depreciation month, a date in the field Document Date of Issue is, by default, set to the last day of a given month. The date of issue is editable.

Upon completing the process of generating a depreciation document, a log containing information about the process is generated. It presents the code of the fixed asset and the values of generated depreciation write-offs.

If a fixed asset is not subject to depreciation or was fully depreciated, disposed or sold, or if write-offs generation was suspended or if an asset is depreciated seasonally, the reasons for failure to generate write-offs for that asset will be presented in the log.

Generating depreciation plan

A depreciation plan presents anticipated write-offs for a specified period.

A depreciation plan is generated for the fixed assets selected on the list upon selecting the button [Depreciation Plan] that is available in the menu Fixed Assets → Fixed Assets in the button group Generation.

Selecting the button [Depreciation Plan] opens a window Depreciation Plan with the following parameters:

- Date Range – range of dates for which a depreciation plan must be calculated

- Ignore assets fully amortized – selecting this parameter activates the list of depreciation areas. The system will verify the selected depreciation areas in terms of whether a fixed asset has already been fully depreciated. A depreciated plan is generated for a fixed asset if the current subtotal value for the selected depreciation plan equals zero.

- Include disposed assets – parameters unchecked by default. After checking it, when calculating a depreciation plan, disposed or sold fixed assets are also taken into account. In case the parameter Ignore assets fully amortized is checked, the parameter Include disposed assets is deactivated and grayed-out by default.

After specifying the values of the parameters, it is necessary to collect the button [Recalculate] to generate a depreciation plan.

A depreciation plan is, by default, grouped by the column Code and is composed of the following columns:

- Code/Month

- Total Value (Balance-Sheet/Tax/IAS-IFRS) – total value at the beginning of period, calculated according to the date range for which the depreciation plan is being calculated

- Depreciation (Balance-Sheet/Tax/IAS-IFRS) – write-offs generated in particular months

- Planned Depreciation (Balance-Sheet/Tax/IAS-IFRS) – planned write-offs calculated according to the algorithms intended for depreciation methods

- Subtotal Value (Balance-Sheet/Tax/IAS-IFRS) – subtotal value at the beginning of period, calculated according to the date range for which the depreciation plan is being calculated

- Planned Subtotal Value (Balance-Sheet/Tax/IAS-IFRS) – forecast subtotal value of a fixed asset, if planned depreciation write-offs are generated

columns hidden by default:

- FAC

- Method (Balance-Sheet/Tax/IAS-IFRS) – depreciation method by which write-offs must be calculated for a given depreciation area

- Inventory Number

- Rate Coefficient (Balance-Sheet/Tax/IAS-IFRS) – depreciation rate specified for a given depreciation area

- Coefficient (Balance-Sheet/Tax/IAS-IFRS) – depreciation write-off specified for a given depreciation area