The system allows for sending tax returns directly to the Ministry of Finance portal and retrieving Tax Return Acknowledgement (TRA). A user can export a tax return with the use of so-called qualified or unqualified signature.

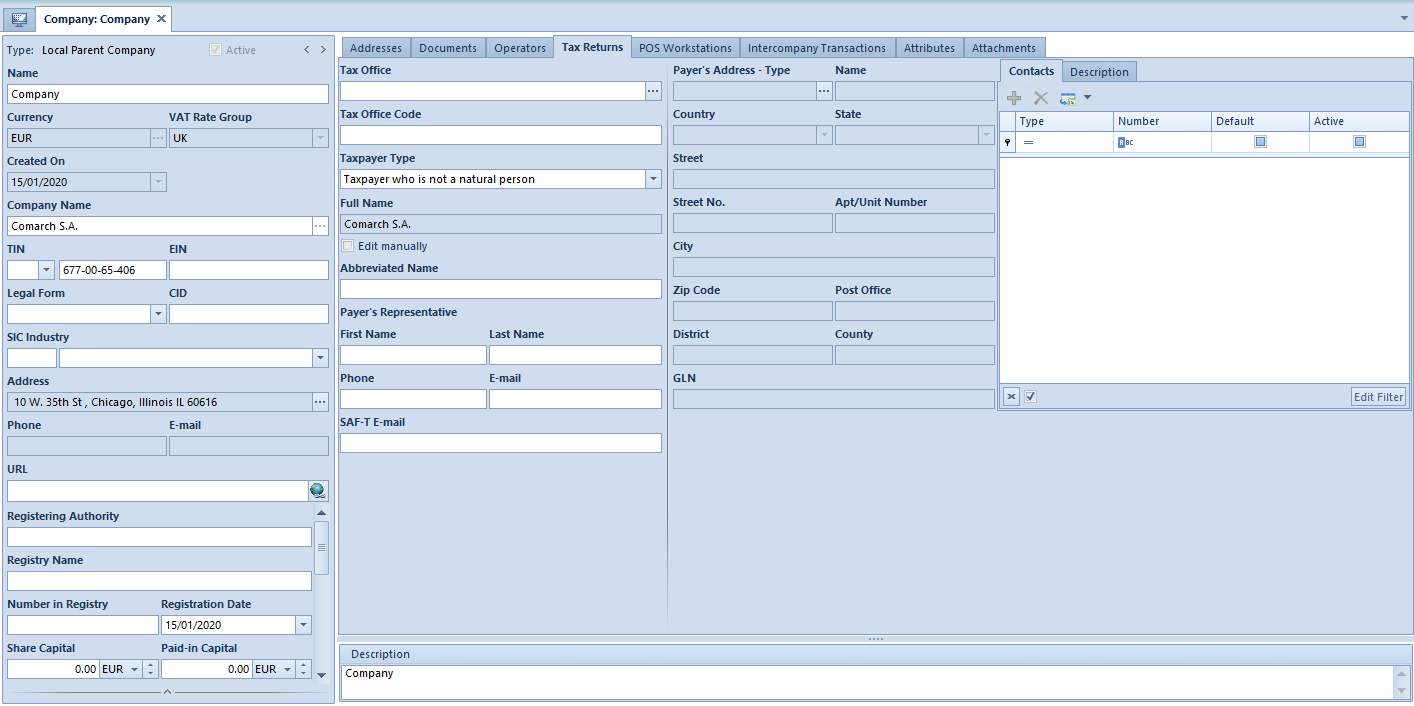

From the level of the menu Configuration -> Company Structure -> Company, in the tab Tax Returns it is necessary to indicate a tax office to which tax returns will be submitted as well as a taxpayer type. Detailed description of the tab Tax Returns can be found in article <<Company Structure – Company>>

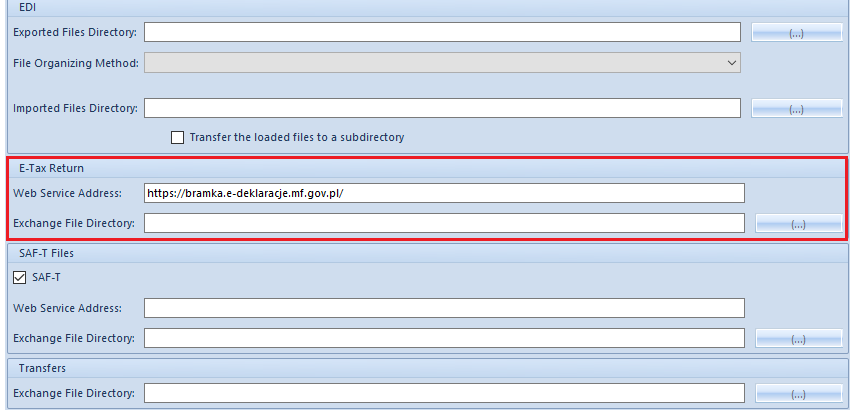

Before submitting a tax return, it is necessary to complete fields in section E-Tax Return (access from the level of the menu System → Configuration → Data Exchange.

- Web Service Address – address https://bramka.e-deklaracje.mf.gov.pl/ is set, by default.

- Exchange File Directory – directory in which exported e-tax returns and TRA will be saved

Information regarding ports which must be unlocked in order to enable tax return submitting can be found in document <<Comarch ERP Altum – Wykaz połączeń>>