Contents

General information

A financial statement can be:

- Added manually

- Generated automatically (only in the Polish language version of the system)

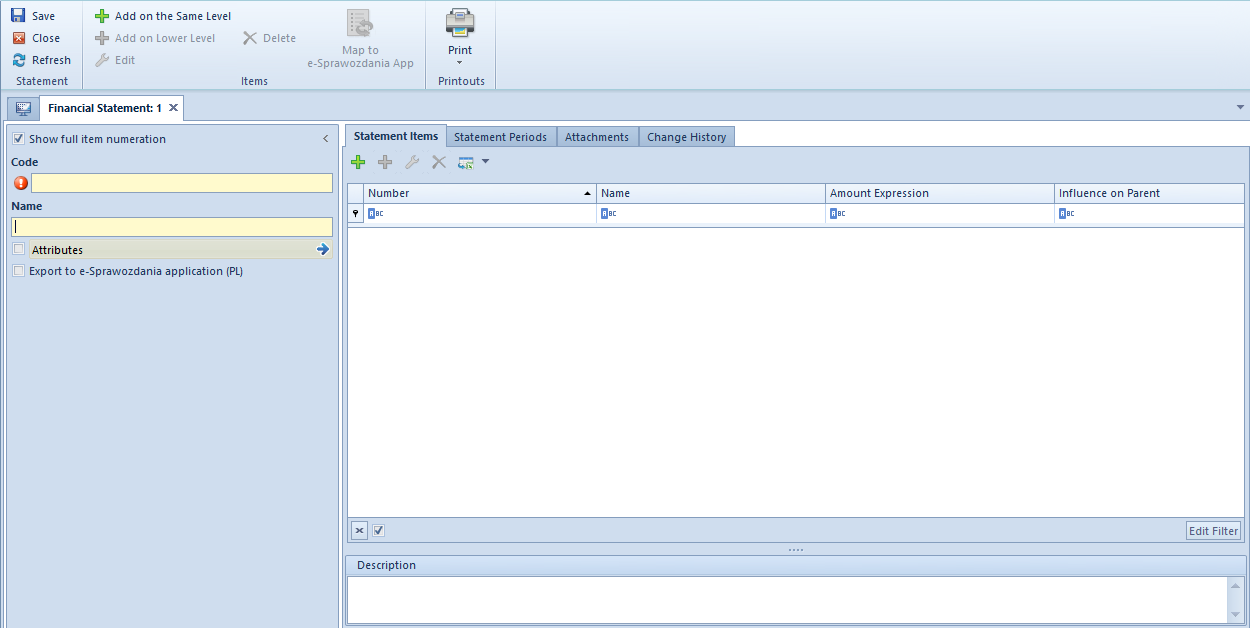

Adding a statement with the use of the button [Add]

From the level of the financial statement form, standard buttons described in article <<Standard buttons>> are available, and, additionally:

- [Add on the Same Level] − allows for adding a statement item on the same level as the cursor level.

- [Add on Lower Level] − allows for adding a statement item on the lower level against the selected item. The button is active, if there is a parent item.

- [Map to e-Sprawozdania App] − button available in Polish version of database. It is active, if in the side panel of a financial statement, the parameter Export to e-Sprawozdania application (PL) is checked. It allows for assigning a financial statement item to relevant items of an official financial statement according to the structure made available by the Ministry of Finance.

The form is composed of the following elements:

Side panel

Show full item numeration − if selected, an indicated numeration will fully be presented in the statement calculation and in the Statement Items tab

Code − mandatory field, allows for entering a unique statement code

Name − mandatory field, allows for entering statement name

Attributes − allows for including single-sided entries with specific attributes in calculation of accounting functions. Selecting the button [Attributes] opens Attribute conditions window, where it is possible to define appropriate conditions.

Export to e-Sprawozdania application (PL) − parameter available in the Polish version of database. If selected, it means that it will be possible to prepare an electronic version of a given financial statement in relevant logic structure and format published by the Ministry of Finance. Selecting it activates two additional fields:

- Statement Type − indicates a type of unit for which the a given statement is being prepared Available values: Other unit (default value), Small unit, Micro unit.

- Statement Element − mandatory field, used for specifying financial statement to which the statement refers. The list of displayed items depends on selected type of economic entity.

When attempting to change a type or an item of a financial statement, the following message is then displayed: “Changing e-statement item will clear the mappings of statement items. Would you like to change the item?”. Selecting the answer Yes deletes the value from the field e-Statement Item from the level of statement item.

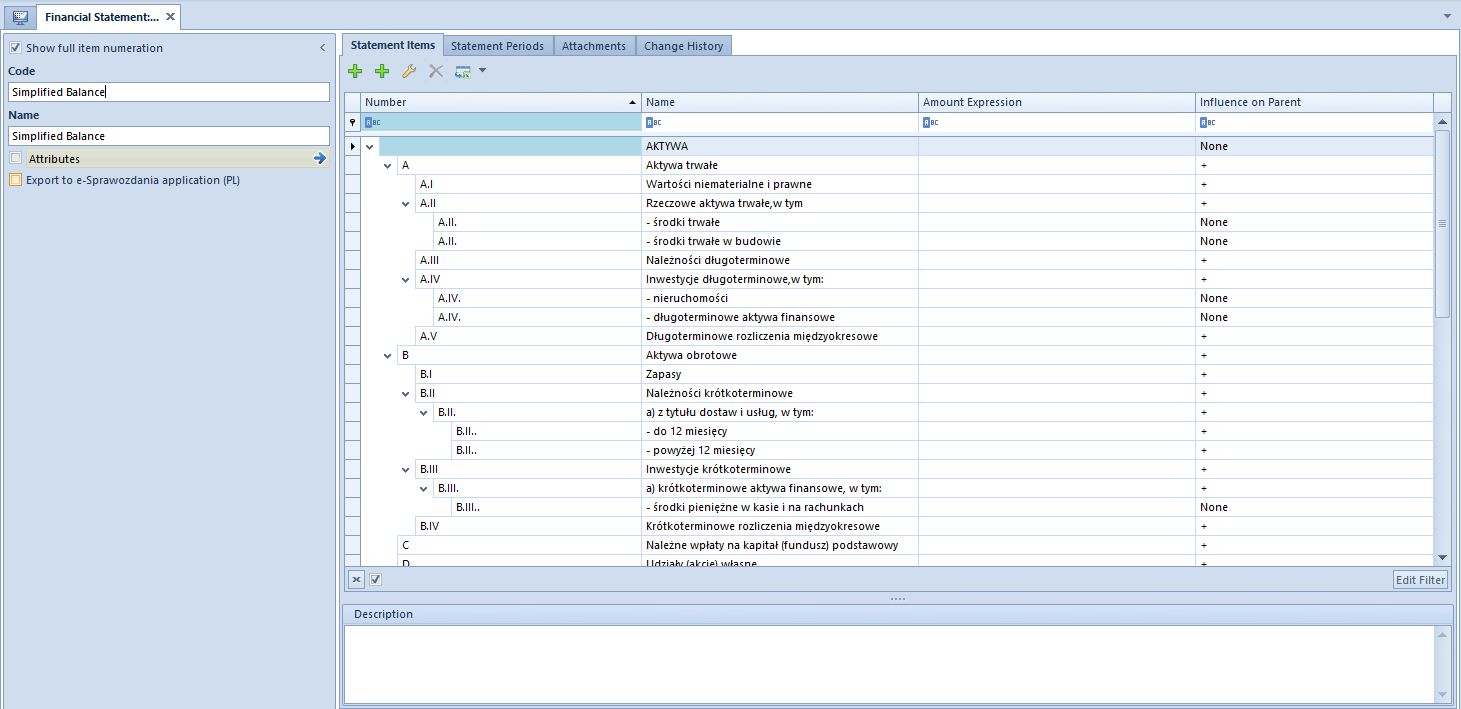

Tab Statement Items

This tab contains a list of items from the level of which it is possible to manage statement elements. The items are organized as a tree.

The list is composed of the following columns:

- Number

- Name

- Amount Expression

- Influence on Parent

- E-Statement Item (hidden by default, available in the Polish version of database)

After adding the first statement item, a user can specify item numeration scheme. Four predefined types are available:

- 1,2,3…

- I,II,III…

- a,b,c…

- A,B,C…

- And Without Numeration option

Description − section allowing for entering a statement description

To add a statement item, on the tab Statement Items, it is necessary to select the button:

- [Add on the Same Level] − opens a form which allows for adding a statement item on the same level as the cursor level. It will be the following item on the same level of the hierarchy.

- [Add on Lower Level] − opens a form which allows for adding an item on the next level against the cursor level.

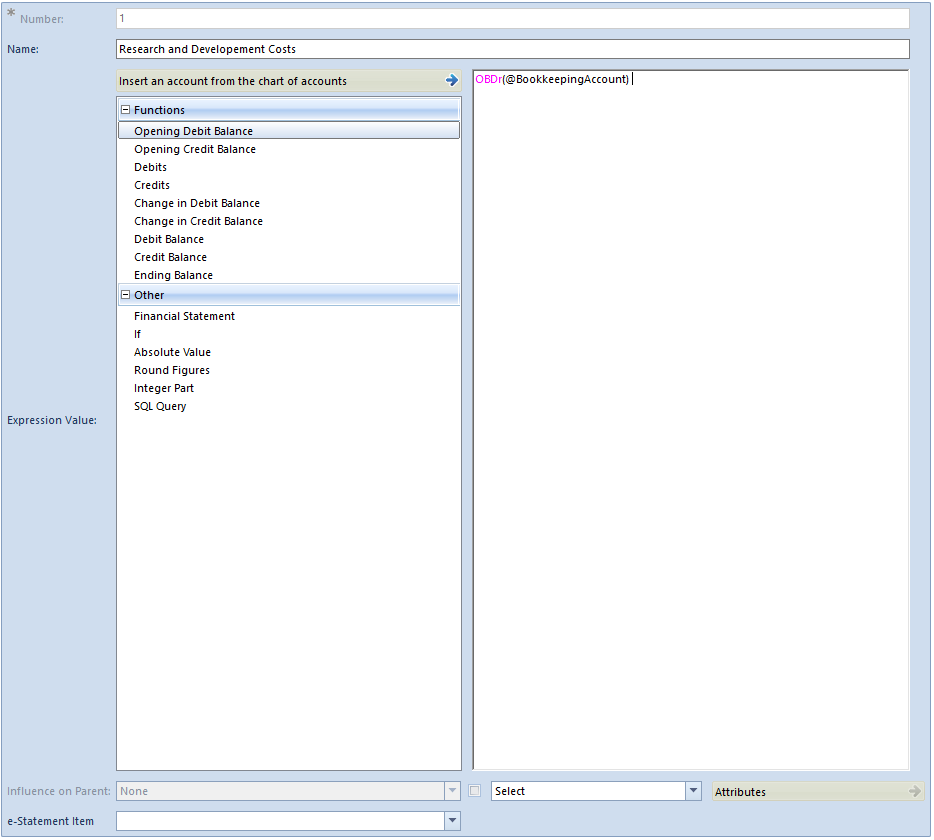

The form is composed of the following elements:

Name − mandatory field, allows for entering statement item name

Number − automatically generated, in accordance with selected numeration scheme

[Insert an account from the chart of accounts] − the button opens the chart of accounts where it is possible to select an account.

Expression Value − allows for defining amount expression on each level of an item. The amount can be entered manually (fixed value) or calculated on the basis of a function.

Functions:

- @OBDr( ) − Opening balance Dr

- @OBCR( ) − Opening balance Cr

- @SDT( ) − Debits

- @SCT( ) – Credits

- @DrBC( ) − Change in Debit Balance

- @CrBC( ) − Change in Credit Balance

- @DrB( ) − Debit Balance

- @CrB( ) − Credit Balance

- @OnB( ) − Ending Balance

After selecting the function in brackets, it is necessary to indicate an account. It can be selected manually, with the use of the button [Insert an account from the chart of accounts] or with the use of account format variables according to the same rules as when defining a recurring posting scheme. The functioning of account formats is described in article Account format in recurring posting operations.

Other:

- Financial Statement − retrieves data from another branch to the same statement or other statement defined in the system. Upon selecting this option, a list of branches defined under the registered financial statements is displayed. In order to change the statement from which data should be retrieved, it is necessary to use drop-down list of the field Statements.

- If − allows for using the IF function, for example: IF(CrB(“2000-100”) > DrB(“2001-100”), CrB(“2000-100”) – DrB(“2001-100”), 0). If the condition used in the function is fulfilled, then the first value is retrieved. Otherwise, the second value is retrieved.

- Absolute Value − allows for using the ABS function, for example: ABS(CrB(“2000-100”)). This function is used to extract an absolute value of a number.

- Round Figures − allows for using the ROUND function, for example: ROUND(SCT(“2000-400”),0), where decimal place informs how to round an amount

- Integer Part − allows for using the INTEGER PART function, for example: INT(SCT(100))

- SQL Query − allows for using a SQL query

FROM SecSales.Headers as h

INNER JOIN DT.DocumentTypes as dt ON dt.ID = h.DocumentTypesID

WHERE (dt.NamespaceEntry = N’FSV’)

AND (h.IsReverseCharge = 1)

AND (h.SellingDate between @DateFrom AND @DateTo))

where variables: @DateFrom AND @DateTo correspond to Date From and Date To specified for particular statement periods.

Influence on Parent − this parameter is used to specify whether a given branch must affect a parent branch. Available values determine how parent is influenced:

- [+] – increases parent branch value

- [-] – decreases parent branch value

- None – does not influence the parent branch

E-Statement Item − field available in the Polish language version of database. It is activated after selecting first the parameter Export to e-Sprawozdania application (PL) available in the side panel of a financial statement. It is completed upon selecting the [Map to e-Sprawozdania App] button or manually. The list of values in the field e-Statement Item depends on the value selected in the field Item in the side panel of the statement. A given item can be selected only once within a given statement. An Item providing details is an exceptional value as it can be assigned to each statement item. Selecting the value Item providing details as a statement item means that it will be imported to the e-Sprawozdania application, but it does not have its unique symbol in the schemes of the financial statements published by the Ministry of Finance.

Select/By default – in this field, a user can select one of two available options. If the option By default is selected, then, for a given statement items, attribute conditions defined in the statement header are taken into account and the button [Attributes] is inactive. In case the option Select is selected, a user can define conditions for a given item by using the [Attributes] button.

Attributes – button active only if in the field next to it, the option Select is selected. Clicking on the button opens Attribute conditions, where it is possible to define conditions including single-sided entries with specific attributes in calculation of accounting functions.

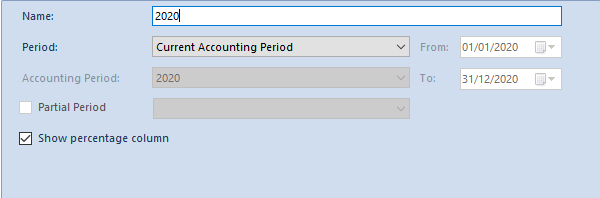

Tab Statement Periods

A user can define any number of periods, that will be taken into account in the statement value calculation.

To add a statement item, on the tab Statement Periods, it is necessary to select the button [Add]. A calculation period form will be opened.

The form is composed of the following elements:

Name – mandatory field, allowing for entering statement period name

Period − period for which the statement will be calculated. Available options:

- Any − allows for determining any range of dates in fields From, To. The dates must be included within one accounting period.

- Opening Balance − upon selecting this option, a calculation will include journal entries from an opening balance within the current accounting period

- Current Month − for functions calculated by activity, the system will calculate values on the basis of the current month. For functions calculated by balances, the system will calculate accrual values from the beginning of the accounting period, including the OB.

- Previous Month – for functions calculated by activity, the system will calculate the values only for the previous month. For functions calculated by balances, the values will be calculated on the basis of journal entries from the beginning of the accounting period to the last day of month preceding the current month, including OB.

- Current Period – if selected, all journal entries of the current accounting period will be included

- Previous Period – if selected, all journal entries of the previous accounting period will be included

- Accounting Period – this option allows the user to select any accounting period defined in the system

- Today – if selected, all journal entries from the current day will be included

- Yesterday – if selected, all journal entries from the previous day will be included

- Current Week – if selected, all journal entries from the current week will be included

- Previous week – if selected, all journal entries from the previous week will be included

Accounting Period − field active if value Accounting Period is selected in the field Period. Allows for selecting an accounting period from among the periods defined in the system.

Partial Period − this parameter is active if value Accounting Period has been selected in field Period and if partial periods had been defined within a selected accounting period.

Show percentage column − selecting the parameter activates a column presenting percentage share of each statement item against the entire statement.

On the list of financial statement periods it is possible to manage their order by using buttons [Move Up] and [Move Down].

Attributes, Attachments, Change History

The tabs have been described in articles Tab Attributes, Tab Attachments, History.

Generating financial statements automatically with the use of [Generate] button

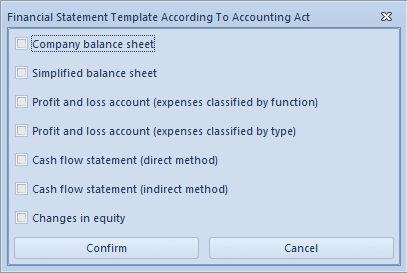

In order to generate statements, it is necessary to click on button [Generate], placed in the Statement group of buttons. Financial Statement Template According To Accounting Act will be opened, where the user can specify which financial statement elements should be created.

Code, Name, Statement Items and Statement Period are completed automatically with the possibility of changing it.