Cash and bank reports are the summaries of all cash and bank transactions made throughout a given period.

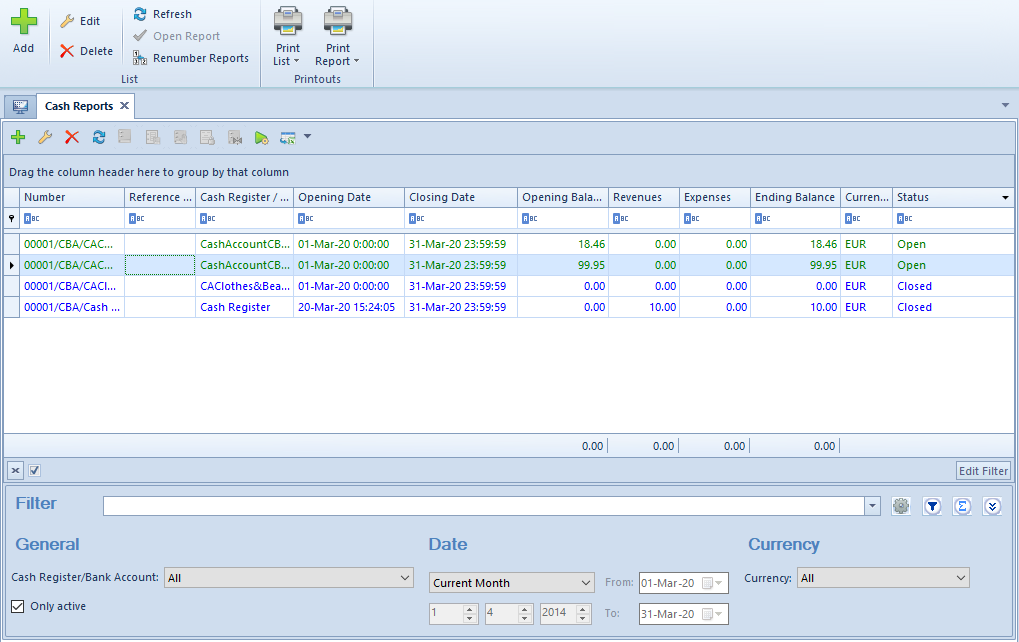

List of cash/bank reports

The list of cash/bank reports may be accessed in the menu Finances after selecting the button [Cash]/[Bank] in the button group C/B Reports.

Apart from the standard system buttons, the list contains the following buttons:

- [Open Report] – it is only active for closed reports; it allows the user to open a report selected on the list and to open reports entered to the same account with a later date

- [Renumber Reports] – it may be used to correctly renumber reports if there are gaps in the numbering

- [Post Through Contra Account] – it may be used to automatically post a closed report with the use of an account, ledger, and contra accounts selected in relevant transactions

The list only displays those reports which have been issued within accounts available to a given center.

The list of reports contains the following columns:

- Number – it is automatically filled in by the system according to the numerator’s definition

- Reference Number – it is a reference number for a cash report and a statement number for a bank report

- Cash Register/Bank Account – it displays an account to which a given report belongs

- Opening Date – a report’s opening date and time

- Closing Date – a report’s closing date and time

- Opening Balance

- Revenues

- Expenses

- Ending Balance

- Currency

- Status – it may be specified as Open, Closed, or Posted

- System Currency (hidden by default)

Adding a cash/bank report

Both cash and bank report forms can be filled in in the same way.

In order to add a new report, it is necessary to select the button [Add] in the button group List.

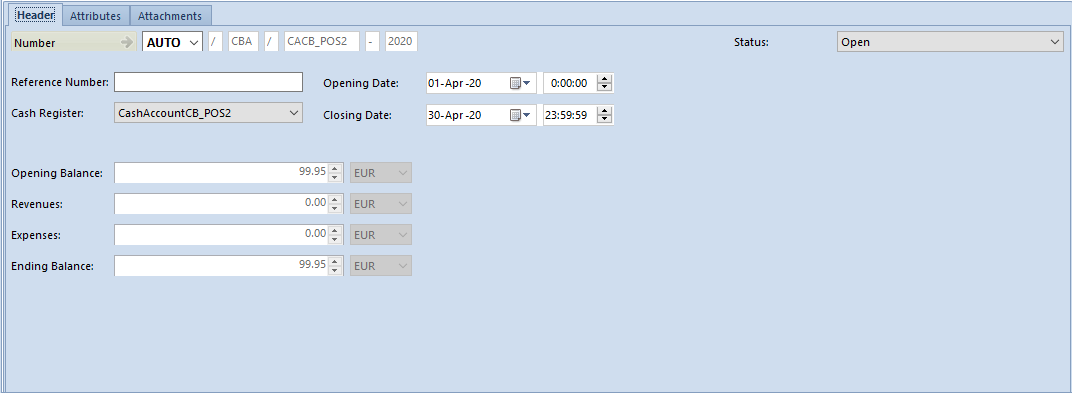

The report form consists of the following elements:

Header tab

- Reference Number/Statement Number – it allows the user to enter any kind of record number. For cash reports, it is a reference number, for bank reports – a statement number.

- Cash Register/Bank Account – it is an account to which a given report belongs. For cash reports, the system only suggests accounts of the Cash Register type, for bank reports – of the Bank The list is narrowed down to accounts which the user may access within a given company structure center.

- Opening Balance – it is a report’s opening balance. In the case of the first (oldest) report within a given account, the field is active and the user may enter an opening balance amount. In the first report, the Opening Balance amount may also be specified by selecting Add-ons → Special Features → Cash Balance Reconstruction. While adding subsequent reports, the field Opening Balance is grayed-out – the amount of a report’s opening balance is automatically filled in on the basis of the closing amount of the previous report within the same account, and cannot be edited. In the case of reports defined in a currency different than the system currency, a change of balance value for the first report is recalculated to a system value based on an exchange rate given on the form. If there are balance discrepancies, the user may correct them with the function Cash Balance Reconstruction.

- Revenues – it displays the amount of revenues in a report

- Expenses – it displays the amount of expenses in a report

- Opening Date – it displays the date and time of report opening

- Closing Date – it displays the date and time of report closing

- Status – it presents a report’s status as either Open or Closed

- 1 January 2019 (Monday)

- 2 January 2019 (Tuesday)

- 3 January 2019 (Wednesday)

- 4 January 2019 (Thursday)

- 5 January 2019 (Friday)

- 8 January 2019 (Monday)

- 9 January 2019 (Tuesday)

The system does not enforce the user to enter reports for 6 and 7 January.

A report period depends on settings in a given account’s definition. Reports may be created as daily, weekly, monthly, or freely defined.

There are no reports in the account. The user adds a new report, and its dates are suggested as follows:

- Opening date: 1 January 2019

- Closing date: 31 January 2019

The user changes the account’s report period to Week and adds another report; its dates are suggested as follows:

- Opening date: 1 February 2019 (Friday)

- Closing date: 3 February 2019 (Sunday)

The user adds yet another report; its dates are suggested as follows:

- Opening date: 4 February 2019 (Monday)

- Closing date: 10 February 2019 (Sunday)

Next, the user changes the account’s report period to Month again. As the user adds another report, its dates are suggested as follows:

- Opening date: 11 February 2019

- Closing date: 28 February 2019

- Opening date: 1 October 2018

- Closing date: 31 October 2018

The user adds a new report; its dates are suggested as follows:

- Opening date: 1 November 2018

- Closing date: 30 November 2018

- Opening date: 1 January 2019

- Closing date: 14 January 2019

The user adds a new report; its dates are suggested as follows:

- Opening date: 15 January 2019

- Closing date: 31 January 2019

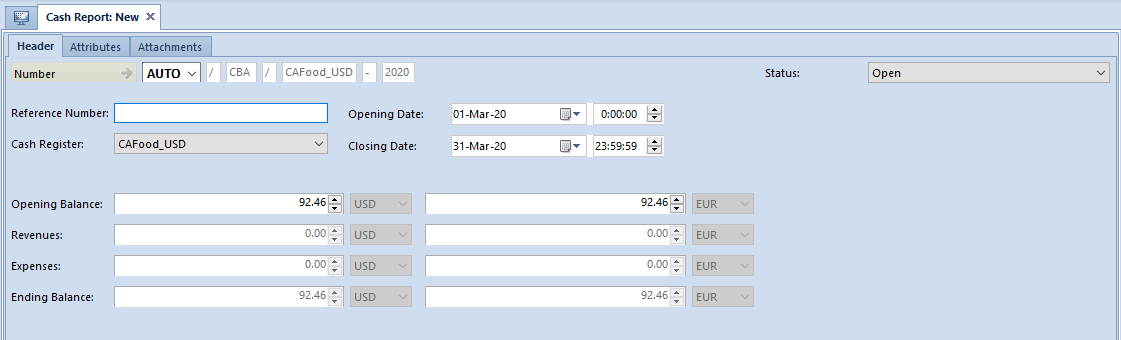

For a report belonging to an account created in a currency different than the system currency, the report form displays additional amount fields: Opening Balance, Revenues, Expenses, and Ending Balance, presenting values recalculated to the system currency.

Recalculating values from an account’s currency to the system currency is not possible if there is no exchange rate specified for a report’s opening date. While changing an exchange rate type, the user is informed that a given exchange rate is missing and the system makes it possible to define the exchange rate value of the account’s currency for the report’s opening date. The user may define an exchange rate for both sales and purchase exchange rate types.

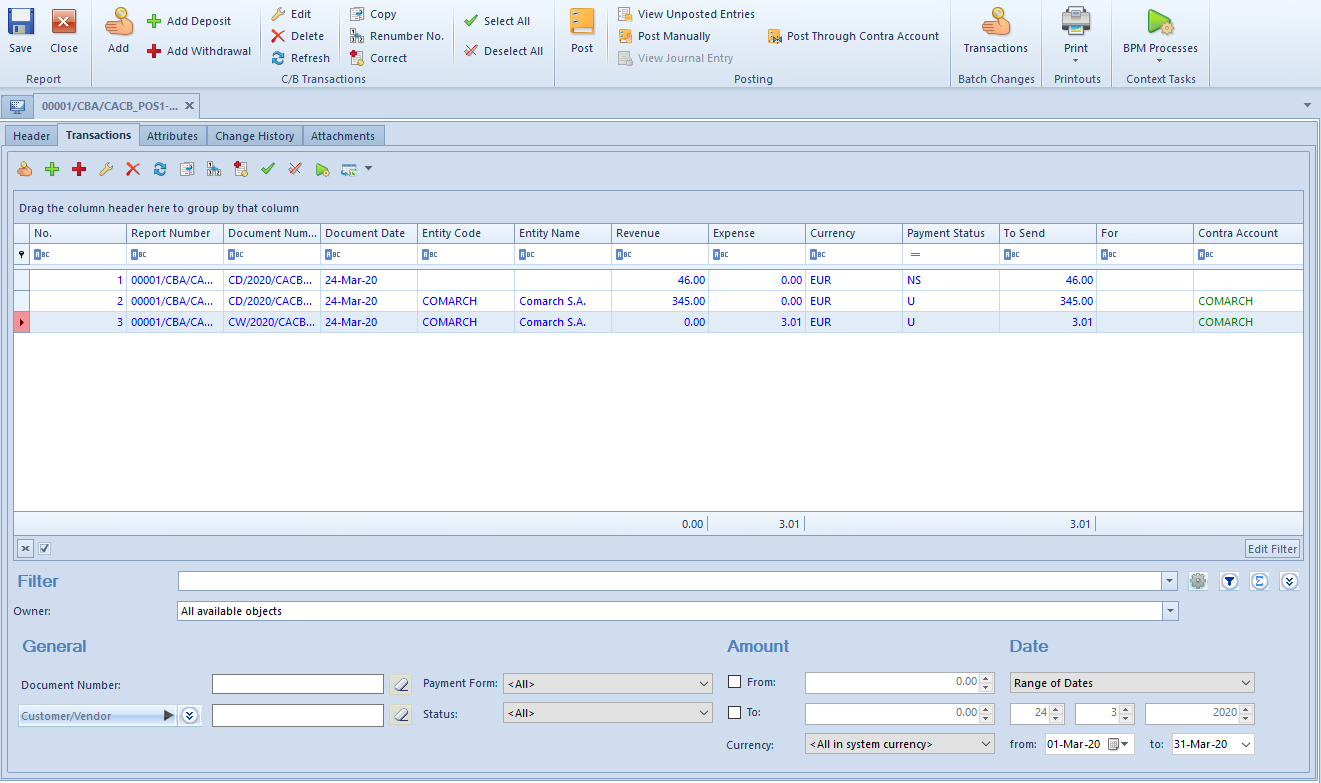

Transactions tab

On the Transactions tab, it is possible to add transactions directly to a given report, according to conditions described in the article Adding cash/bank transactions.

Data in the following columns is hidden for transactions unavailable within a given center:

- Document Number

- Entity Code

- Entity Name

- Availability

- Owner

- For

- Contra Account

- Payment Form

- Reference No.

- Description

- Voucher Sort

- Voucher Number

Attributes, Change History, and Attachments tabs

A detailed description of these tabs may be found in the article Tabs Discount Codes, Analytical Description, Attributes, Attachments, and Change History.