CN codes (Combined Nomenclature) are used for classifying items in international trade and are important for Intrastat declarations. CN codes defined by the user can be used on the forms of items and in document items.

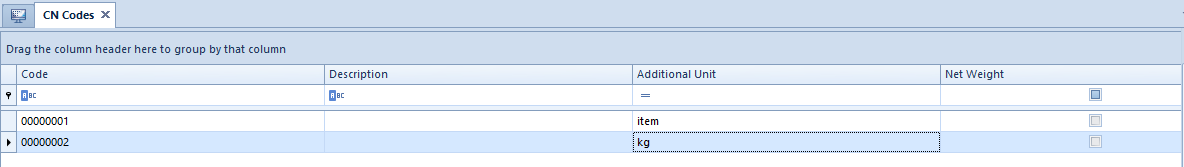

The list of CN codes contains the following columns:

- Code ─ unique 8-digits number

- Description ─ description of classified item

- Additional Unit ─ item unit of measure

- Net Weight ─ parameter specifying the use of net weight for particular CN codes

In the menu, there are standard buttons for adding/adding through form/modifying/deleting/saving a given object from the list as well as button for refreshing the list. Moreover, the user can handle printouts and reports and use option Import from file to quickly import many CN codes from an Excel file.

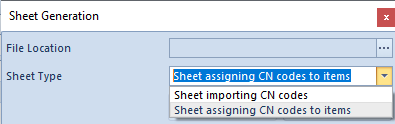

[Generate Import Sheet] ─ this button generates an empty Excel Sheet in a selected location. There are two options possible:

- Import CN Codes ─ sheet composed of the the following columns:

- CN Code

- Additional Unit

- Net Weight

- Description

- Upload to SENT

- UOM for SENT

- Assign CN Codes ─ sheet composed of the following columns:

- CN Code

- Item Code

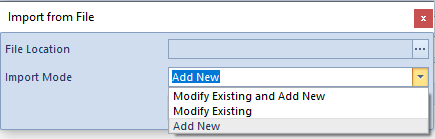

[Import] ─ button for importing data from an Excel File to Comarch ERP Standard system. Available import options:

- [Import CN Codes] ─ import in one of the following modes:

- Add New

- Modify Existing

- Modify Existing and Add New

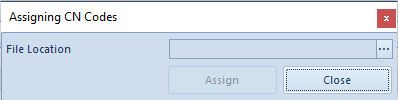

- [Assign CN Codes]─ assigns CN codes to items from a generated Excel file

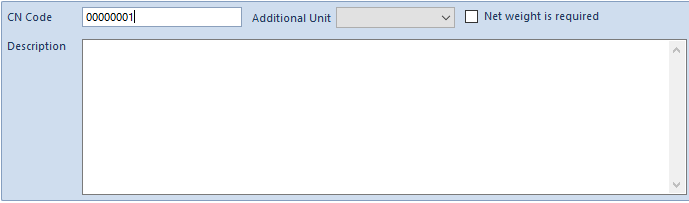

In order to define a CN code, it is necessary to select button [Add] from menu List and fill in data directly on the list or enter it through the form available upon clicking on button [Add Through Form].

CN Code is a mandatory field. From a drop-down list, available in field Additional Unit, the user can select a unit of measure. Some CN codes require information about item’s net weight in Intrastat declaration. In such case it is necessary to check parameter Enter net weight in code definition.

VAT Rate allows for assigning to a given code one of active VAT rates from the group of VAT rates attached to the company to which the center of the logged-on user belongs.

If a VAT rate is specified from the level of a CN code form, then, when changing/adding such CN code to an item form, the user has a possibility to update automatically the VAT rate (both sales and purchase VAT rate).

SAF-T Item Group and SAF-T Procedure Code allow for selecting one of predefined values from one of generic directories with the same names, which are used during the generation of JPK_V7M file.

For companies with checked parameter Upload to SENT fields Upload to SENT and UOM for SENT are available. Those parameters should be checked for items whose data can be sent to the PUESC (Platforma Usług Elektronicznych Skarbowo-Celnych) portal. Assigning such a CN code to an item or item group results in the automatic selection of the SENT parameter on the item form.