List of VAT rates

Configuration of VAT rates in the system allows defining tax rates according to which items or services are purchased and sold as well as payments are made.

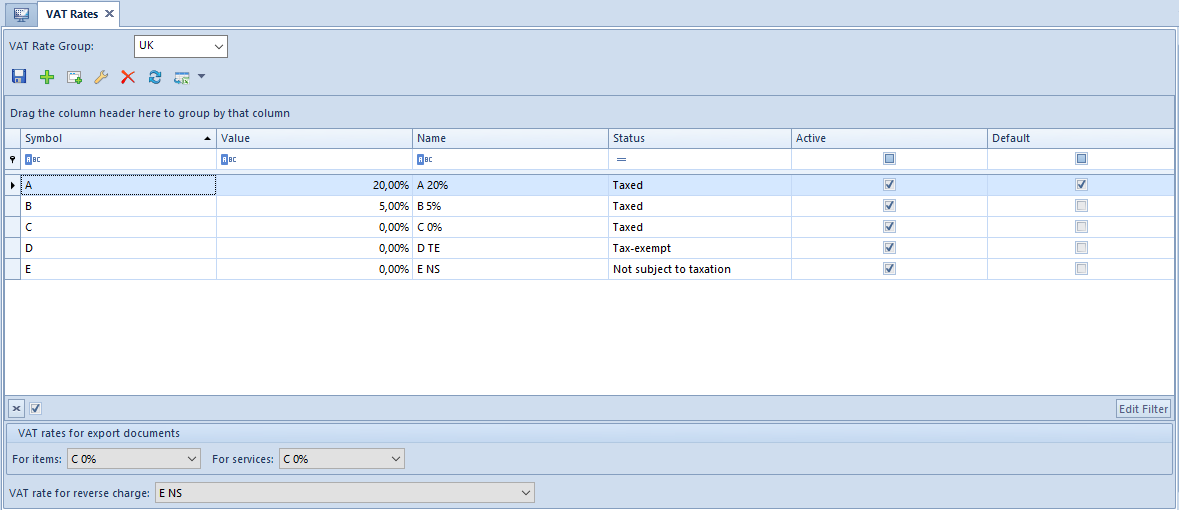

The field VAT Rate Group presents a default VAT rate group assigned to a company in which a user is logged in. Only the user logged in to the parent company can select groups available in the system from a drop-down list. Depending on indicated group, the list is completed with appropriate VAT rate values. Values presented on the list are retrieved from the generic directory VAT Rate Groups (Generic Directories Predefined list). Inactive groups are displayed in italics and it is not possible to edit values of VAT rates assigned to them.

The list of VAT rates contains the following columns:

- Symbol – VAT rate symbol

- Value – value assigned to a VAT rate

- Name

- Status– VAT rate characteristics. The following options are available for selection:

- Taxed

- Tax-exempt

- Not subject to taxation

- Active – parameter indicating whether a given rate can be used in the system.

- Default – parameter indicating whether a given VAT rate is a default rate. Only one rate can be defined as default.

For newly created databases, depending of a rate group, the following predefined VAT rates are available:

- Polish database – group PL

| Symbol | Value | Name | Status | Active | Default |

|---|---|---|---|---|---|

| A | 23,00% | A 23% | Taxed | Yes | Yes |

| B | 8,00% | B 8% | Taxed | Yes | No |

| C | 0,00% | C 0% | Taxed | Yes | No |

| D | 0,00% | D ZW | Tax-exemp | Yes | No |

| E | 0,00% | E NP | Not subject to taxation | Yes | No |

| F | 5,00% | F 5% | Taxed | Yes | No |

| G | 7,00% | G 7% | Taxed | Yes | No |

- English database – group UK

| Symbol | Value | Name | Status | Active | Default |

|---|---|---|---|---|---|

| A | 20.00% | A 20% | Taxed | Yes | Yes |

| B | 5.00% | B 5% | Taxed | Yes | No |

| C | 0.00% | C 0% | Taxed | Yes | No |

| D | 0.00% | D TE | Tax-exempt | Yes | No |

| E | 0.00% | E NS | Not subject to taxation | Yes | No |

- German database – group DE

| Symbol | Value | Name | Status | Active | Default |

|---|---|---|---|---|---|

| A | 19,00% | A 19% | Taxed | Yes | Yes |

| B | 7,00% | B 7% | Taxed | Yes | No |

| C | 0,00% | C 0% | Taxed | Yes | No |

| D | 0,00% | D SF | Tax-exempt | Yes | No |

| E | 0,00% | E NS | Not subject to taxation | Yes | No |

- German database (AT) – group AT

Symbol Value Name Status Active Default

A 20,00% A 20% Taxed Yes Yes

B 10,00% B 10% Taxed Yes

C 0,00% C 0% Taxed Yes

D 0,00% D SF Tax-exempt Yes

E 0,00% E NS Not subject to taxation Yes

F 12,00% F 12% Taxed Yes

- French database – group FR

| Symbol | Value | Name | Status | Active | Default |

|---|---|---|---|---|---|

| A | 20,00% | Taux normal 20% | Taxed | Yes | Yes |

| B | 10,00% | Taux ntermédiaire 10% | Taxed | Yes | No |

| C | 5,50% | Taux réduit 5,5% | Taxed | Yes | No |

| D | 2,10% | Tax super réduit 2,1% | Taxed | Yes | No |

| E | 0,00% | Taux exonéré 0% | Tax-exempt | Yes | No |

| NS | 0,00% | Non soumis | Not subject to taxation | Yes | No |

- Spanish database – group ES

Symbol Value Name Status Active Default

A 21,00% A 21% Taxed Yes Yes

B 10,00% B 10% Taxed Yes No

C 4% C 4% Taxed Yes No

D 0,00% D ZW Not subject to taxation Yes No

E 0,00% E NP Tax-exempt Yes No

F 0,00% F 0% Taxed Yes No

Below the VAT rates list, in the panel VAT rates for export documents it is possible to select appropriate VAT rates for export documents, separately for items and services.

In field VAT rate for reverse charge, it is possible to determine VAT rate applicable for documents subject to reverse charge.

Default settings:

- Group PL:

- Export documents (items) – C 0%

- Export documents (services) – E NP

- Reverse charge – E NP

- Group UK:

- Export documents (items) – C 0%

- Export documents (services) – C 0%

- Reverse charge – E NS

- Group DE:

- Export documents (items) – C 0%

- Export documents (services) – C 0%

- Reverse charge – E NS

- Group AT:

- Export documents (items) – C 0%

- Export documents (services) – C 0%

- Reverse charge – E NS

- Group FR:

- Export documents (items) – Taux exonéré 0%

- Export documents (services) – Taux exonéré 0%

- Reverse charge – Non soumis

- Group ES:

- Export documents (items) – F 0%

- Export documents (services) – F 0%

- Reverse charge – E NP

Defining VAT rate

In the system, there are two methods for defining a new VAT rate:

- [Add] – a new row appears on the list, where it is necessary to enter appropriate data. The values Name and Value must be unique. In the tab Value, the user must specify the value of the tax in a percentage form, e.g. 23%. In the column Status, the user selects one of the available options: Taxed, Tax-exempt, Not subject to taxation

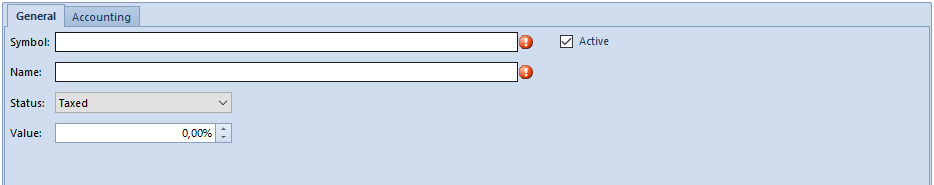

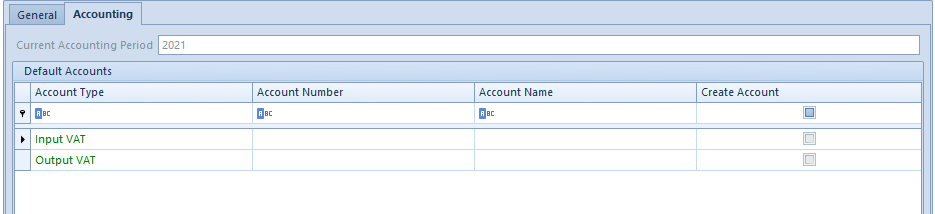

- [Add Through Form] – opens a form composed of two tabs: General and Accounting

- General – contains basic data, that is Symbol, Name, Status, Value and parameter Active

- Accounting – allows for assigning bookkeeping accounts to a given VAT rate. Default account types: Input VAT and Output VAT. The list of predefined account types are available in the generic directory VAT Rates under Types of Accounts group. Current Accounting Period – field provided for information purposes, cannot be edited.

Defining VAT rate in a multi-company structure

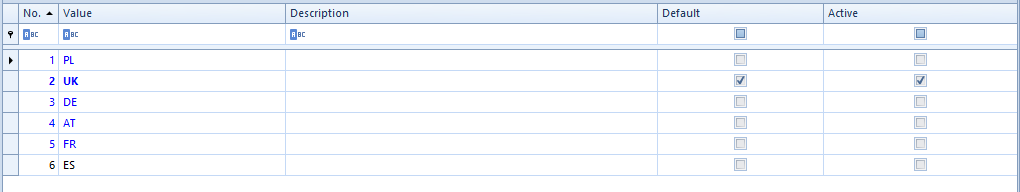

To be able to assign different groups of VAT rates to a given center of Company type, it is necessary to activate them in Generic Directories.

Depending on VAT rate groups attached to a company, the user can define different VAT rates for an item or item group.

Company1. Upon logging in to the parent company, on an item form in field Purchase TAX and

Sales TAX there is value A 23% displayed. Upon logging in to Company1, value Taux normal

20% is displayed for the same item in fields Purchase TAX and Sales TAX.

When adding an item in a document, VAT rate assigned to the item within VAT rate group attached to a company (or its center) being the document owner is retrieved.

When printing a document on a receipt printer, it is verified whether VAT rates used in the document have rates mapped for a fiscal printer, within the group in which they are included. If a rate mapping is missing, appropriate message is displayed.