QR codes for KSeF invoice online

The secondary legislation defines a verification code as a unique QR graphic code that allows the buyer to confirm the authenticity of an invoice in the National System of e-Invoices (KSeF). This code is used to verify whether the invoice issuer has actually registered an invoice in KSeF. The verification link is used to verify the invoice issued in KSeF in case the QR code generated in the printout is illegible for various reasons.

The rules for generating the verification code, including its uniqueness and how it is linked to the e-invoice, are legislated. The generated QR code, displayed in the e-invoice issued in KSeF, ensures that the document is consistent with the data uploaded to the system and complies with tax requirements. An invoice issued in the KSeF online mode is marked with a verification code in the form of a two-dimensional square QR graphic code compliant with ISO/IEC 18004:2015 and with a number identifying these invoices in the National System of e-Invoices.

Changes to generic directories

In the generic directory Attachment Type, there is a new system value with the following parameters:

- Value: QR KSeF

- Description: PNG image (*.png)|*.png

- Active: selected

- Default: deselected

- Compression: No

- Write: File in attachment folder or in database (if attachment folder was not selected as a location)

- Size: No limits

Changes to the system configuration

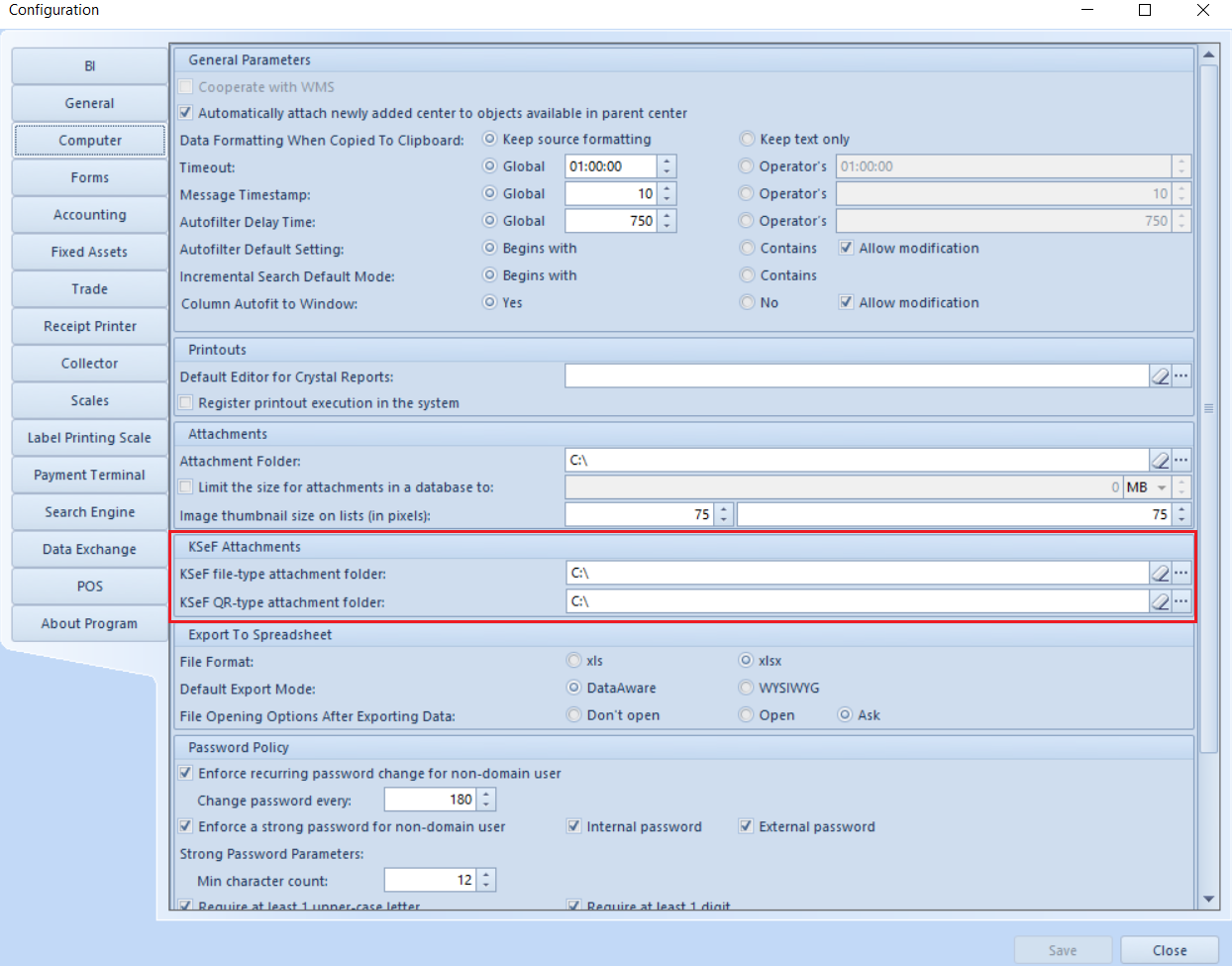

In the menu System → Configuration → Computer, a new section KSeF Attachments has been added.

The section has been added to include the following fields:

- KSeF file-type attachment folder – the location to which attachments of KSeF File type will be saved.

- KSeF QR-type attachment folder – the location to which attachments of KSeF QR type will be saved.

Generating QR code

To generate a QR code to a document, the document must have a KSeF number.

When downloading the AOR, the KSeF number is assigned and the QR code is generated. If for some reasons the code is not generated, you can generate one using a newly added button [Generate QR Code].

QR code generation is triggered when printing a document and sending it by email.

The generated QR code is added in the document under the Attachments tab as KSeF QR type.

KSeF QR code – new attachment type

QR code in the form of a file can be added:

- from the document item in the Attachments tab using the [Add] button.

- from the document item in the Attachments tab using the [Load from File] button.

- from the attachment list (Configuration/General/Attachments) by selecting:

- [Add] followed by [Load from File]

- [Add] under Batch Operations followed by a location: To Database, To Attachment Folder

QR code in the form of a file can be transferred or copied (Configuration/Attachments/Attachment list/Batch operations):

- from a database to an attachment folder

- from an attachment folder to a database

Changes to printouts in ERP Standard

With the introduction of the National System of e-Invoices (KSeF), taxpayers are obliged to add a QR code in the printout of an invoice when it is made available outside the KSeF system. The QR code can be used to immediately verify that the invoice data match the information stored in KSeF. The data is verified with a mobile device that, after scanning the QR code, reads the encrypted information and displays the invoice identification data along with information about their compliance with the original record in the KSeF system.

A QF code and a verification link have, therefore, been added to the following standard printouts:

- Final sales invoice

- Sales invoice

- Advance sales invoice

- Sales invoice correction (quantity and value)

- Sales invoice – VAT rate correction

- Advance sales invoice correction

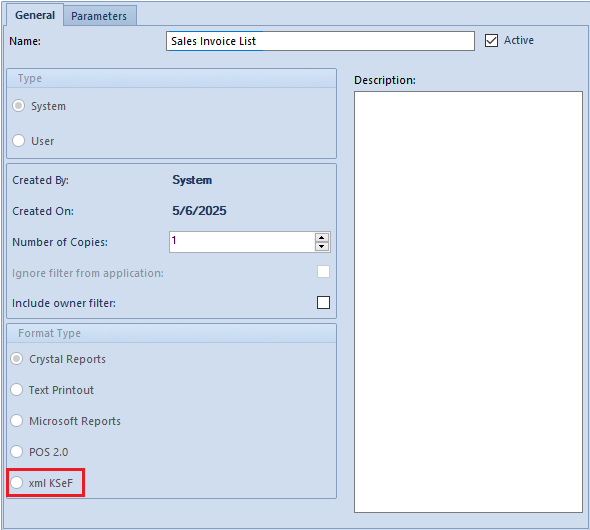

New printouts for structured KSeF invoices

In order to create a new printout, a new format type has been added for printouts – KSeF xml. It is available when KSeF is activated on the company form.

The following new printouts are not available in the standard version:

- KSeF structured invoice – printout for SI documents

- KSeF advance invoice – printout for ASI documents

- KSeF correction invoice – printout for SIQC, SIVC, SIVC documents and manual corrections

Printouts can be initiated when KSeF is activated and AOR for the document has been downloaded.

KSeF manual corrections

It is now possible to upload manual sales invoice corrections to KSeF. This includes the following types of documents:

- SIQC – sales invoice manual quantity correction

- SIVC – sales invoice manual value correction

- SIVC – sales invoice manual VAT rate correction

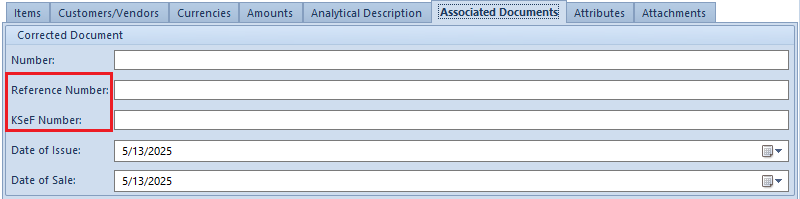

New development objects in sales invoice manual corrections

On the sales invoice correction form, in the Associated Documents tab → Corrected Document section, the following development objects have been added:

- Reference Number – reference number of the corrected document, uploaded to KSeF when document reference number is selected on the company form in the KSeF tab → Document Export section:

- KSeF Number – KSeF number of corrected document

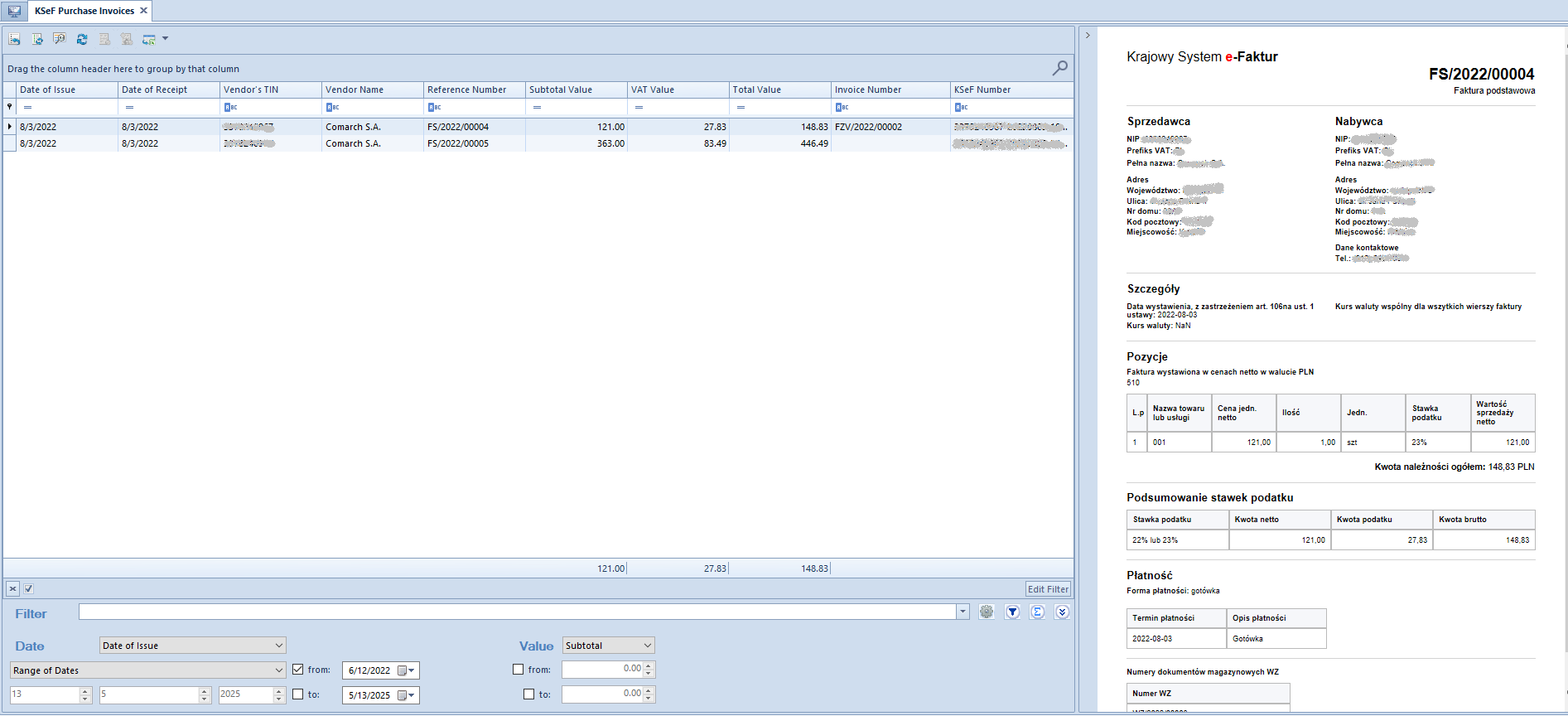

New view on the KSeF purchase invoice list

The view in the KSeF purchase invoice list under the menu Purchase → KSeF Import has been modified. Clicking on any item on the list opens an invoice preview that can be hidden at any time using the arrow in the invoice preview field. Selecting another item in the invoice list refreshes its preview in the list.

A similar preview of a structured invoice is presented when generating PI and corrections to invoices imported from KSeF.

Verification of amounts in generated documents

Selecting the Save/Confirm/Confirm and Post option for generated PI documents and corrections initiates the verification of amounts between the source document and the generated document. In case of a discrepancy, a message is displayed to inform about the discrepancy in amounts and to ask whether to continue the operation despite the detected difference.

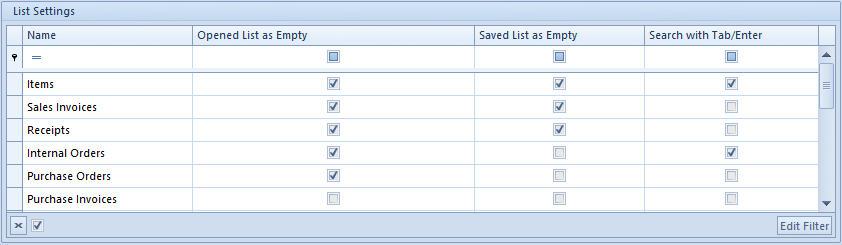

Object list settings

It is now possible to select how to open a list. For this purpose, a new section List Settings has been added under System/Configuration/General, where it is possible to set the parameters below for individual lists:

- Opened List as Empty

- Saved List as Empty

- Search with Tab/Enter

The list settings are applicable to the following documents:

- Item list

- Sale invoice list

- Receipt list

- Internal order list

- Purchase order list

- Purchase invoice list

- Sales order list

- Cash/bank transaction list

- Statement of retail sales

- Sales quote list

- WM- document list

- WM+ document list

- Purchase quote list

- Receivable list

- Payable list

- Customer/vendor list

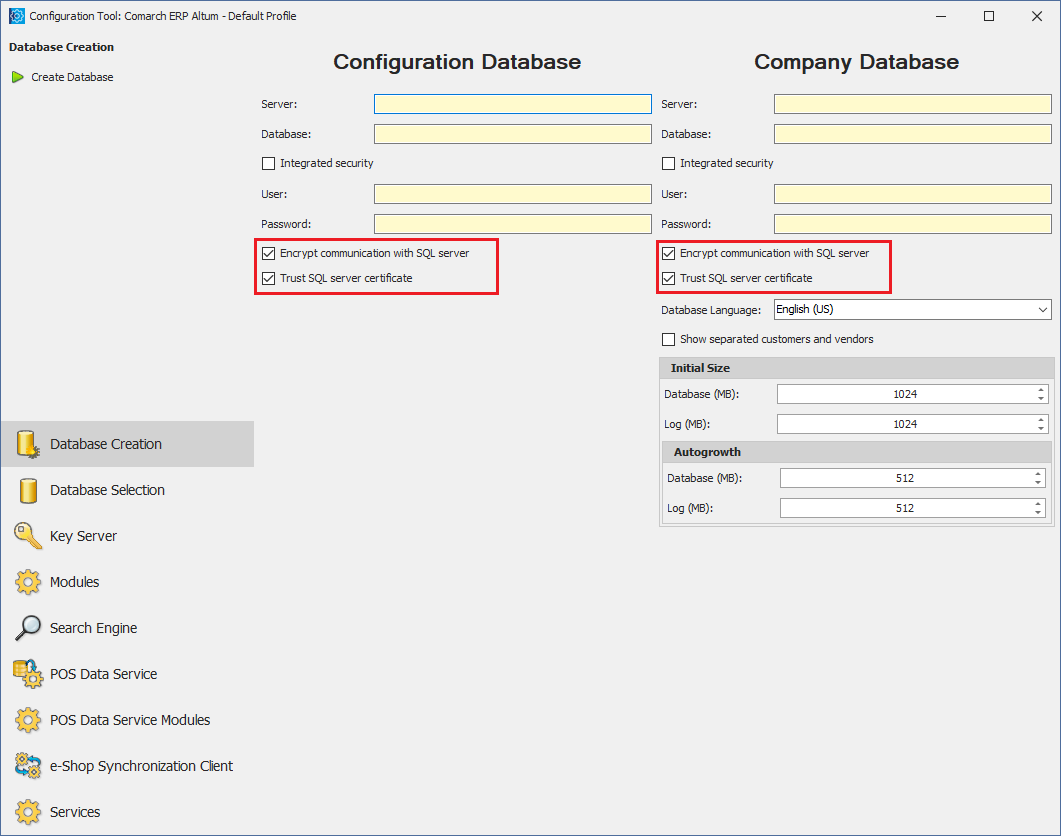

SQL database connection encryption

To improve security, communication with the SQL server is now encrypted. Therefore, the columns have been in the Database Manager:

- Encrypt communication with SQL server

- Trust SQL server certificate

Furthermore, the parameters have also been added in the NewAltumConfigurator and Comarch ERP Standard BPM applications.