General information

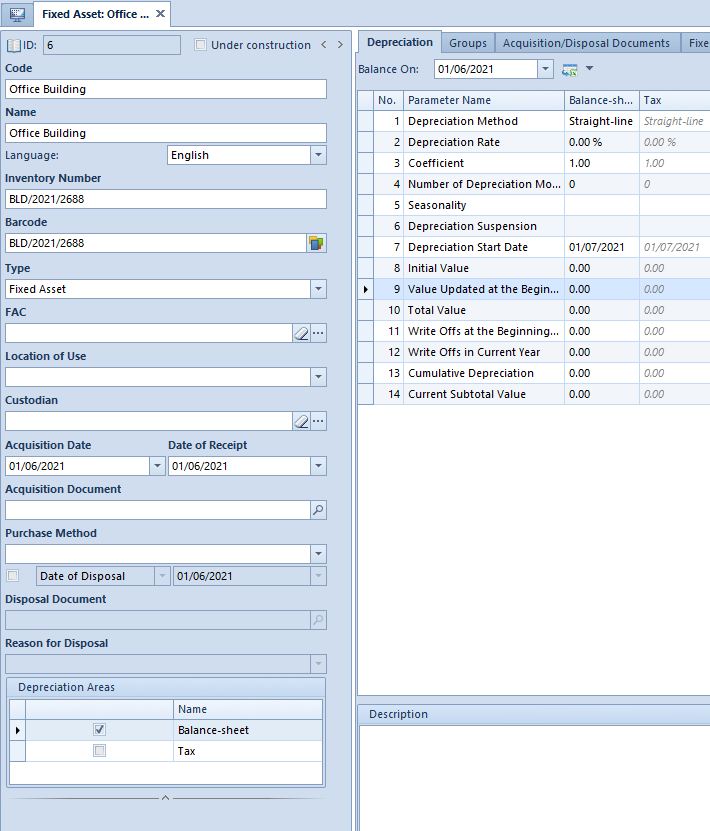

A fixed asset form is used to register a new asset, to preview already registered assets or to make necessary corrections and changes.

To add a new fixed asset, in the menu Fixed Assets → Fixed Assets select the button [Add] from the List button group. A new form for entering fixed asset data will open.

A fixed asset form is composed of the following elements:

Side panel

ID – a subsequent fixed asset number that is granted automatically and is non-editable

Under Construction – parameter specifying whether a fixed asset is complete or under construction. For a fixed asset u under construction, tab Depreciation is unavailable and fields Date of Receipt, Acquisition Date and FAC are inactive. Until the parameter gets unchecked for a fixed asset, FA document is not generated and it is not possible to generate depreciation write-offs and depreciation plan. To a fixed asset under construction, in tab Acquisition/Disposal Documents, it is possible to attach particular documents related to the investment. A fixed asset under construction can be disposed and in such case a FD document will be generated.

Code, Name, Inventory Number – mandatory fields; a fixed asset name can be provided in different languages supported in the system. Fixed asset names are displayed in the language selected as a logon language. Values in the fields Code and Inventory Number must be unique.

Barcode – field providing information about fixed asset barcode. The field can be completed:

- manually, on fixed asset form

- after clicking on [Generate code] button, which is available on the right side of field Barcode on fixed asset form – the field Barcode will be filled in with the value from Inventory Number field

- after clicking on [Generate Fixed Asset Barcode] button, which is available from the level of the menu Add-ons, in Special Features group of buttons, the field Barcode on a fixed asset for will be completed with the value retrieved from the field Inventory Number

Type − possibility of indicating one of three predefined options: Fixed Asset (predefined value), Intangible Asset and Equipment. Depending on selected type, different depreciation methods are available. Field active until FA document is generated.

FAC − fixed asset classification symbol selected from the fixed asset classification list. A tax depreciation rate is completed on the basis of the selected symbol. The field can be edited, if the parameter Under Construction is unchecked.

Location of Use – value selected from the relevant generic directory (menu Configuration → Generic Directories → Fixed Assets → Location of Use). This field is active until a FA document is generated. The location of use can be changed directly in the FA document or via a FLC document.

Custodian – employee responsible for a given fixed asset, who is selected from the employee list. This field is active until a FA document is generated. The custodian can be changed directly in the FA document or via a FLC document.

Acquisition date − field active, if the parameter Under Construction is unchecked. Until a FA document is generated, the date from a fixed asset acquisition document with the earlies date available in the tab Acquisition/Disposal Documents. As an acquisition date one of the following dates can be retrieved:

- purchase date − for purchase invoice and VAT purchase invoice correction

- correction date − for purchase invoice correction

- sales date − for VAT sales invoice

- transaction date − for accounting note

Date of Receipt – date on which a fixed asset was received for utilization. The date of receipt cannot be earlier than the acquisition date. The parameter is active until a FA document is generated and if the parameter Under Construction is unchecked.

Acquisition Document – value in this field is completed automatically with document numbers from the table Acquisition Documents available in the Acquisition/Disposal Documents tab. Selecting the magnifying glass symbol redirects the user to the tab Acquisition/Disposal Documents.

Purchase Method – value selected from the relevant generic directory (menu Configuration → Generic Directories → Fixed Assets → Purchase Method)

Date of Disposal (Sale) – after selecting this parameter, it is possible to choose one of two date types: Date of Disposal, Date of Sale. The date of disposal (sale) cannot be earlier than the acquisition date. To be able to tag an asset of Fixed Asset or Intangible Asset type as disposed or sold, it is necessary that a FA document be generated for that asset. Saving the asset form generates automatically a FD document. In the case of disposed/sold assets, it is no longer possible to edit their depreciation−related parameters and to delete the documents of a given fixed asset.

Disposal (Sale) Document – value in this field is completed automatically with document numbers from the table Disposal (Sale) Documents available in the Acquisition/Disposal Documents tab. Selecting the magnifying glass symbol redirects the user to the tab Acquisition/Disposal Documents.

Reason for Disposal (Sale) – value selected from the relevant generic directory (menu Configuration → Generic Directories → Fixed Assets → Reason for Disposal/Sale)

Depreciation Areas – selected from among the depreciation areas that have been activated in the system configuration window. When adding new fixed assets, the same depreciation areas are by default activated as the ones activated in the fixed asset group to which the fixed asset is assigned.

Tab Depreciation

In the tab Depreciation, the following fields and parameters are available:

Balance On – used to verify the data on a specified day

In case more than one depreciation area is selected in the system configuration window, the values of the parameters in the Depreciation tab can be copied to other depreciation areas respecting the rules described in article Configuration of parameters.

Depreciation Method – indicates the method of calculating write-offs for a fixed asset. Available depreciation methods depend on the type of asset:

- Straight-line – this method is available for assets of Fixed Asset or Intangible Asset A monthly write-off is calculated as asset’s current value multiplied by tax depreciation rate and by coefficient and then divided by 12 months. In the case of assets depreciated seasonally, the value of an annual write-off is divided by the number of months in which the asset is depreciated. This depreciation method takes into accounts the history of write-offs, that is in case a write-off is not calculated in one month or is calculated manually for a different value, then the difference will be compensated in a consecutive month. According to this method, a write-off is calculated on the asset’s current value. The system also controls the correctness of the values of cumulative write-offs from the beginning of a year.

- Declining balance – this method is available for assets of Fixed Asset or Intangible Asset A monthly write-off is calculated as asset’s current value reduced by the amortization value for the previous period. This value is multiplied by tax depreciation rate and by coefficient and then divided by 12 months. In the case of assets depreciated seasonally, the value of an annual write-off is divided by the number of months in which the asset is depreciated. This depreciation method takes into accounts the history of write-offs, that is in case a write-off is not calculated in one month or is calculated manually for a different value, then the difference will be compensated in a consecutive month. According to this method, a write-off is calculated on the asset’s current value decreased by the values of the write-offs from previous years. The system also controls the correctness of the values of cumulative write-offs from the beginning of a year. If an annual depreciation amount was to be lower in the case of the declining balance method than the amount of the write-offs calculated according to the straight-line method, the system will calculate write-offs according to the straight-line method.

- Activity – this method is available for assets of Fixed Asset or Intangible Asset A monthly write-off is calculated as asset’s current value multiplied by tax depreciation rate and by coefficient and then divided by 12 months. In the case of assets depreciated seasonally, the value of an annual write-off is divided by the number of months during which the asset is depreciated. This depreciation method does not take into account the history of write-offs, thus, the values of write-offs in the case of this method are always the same.

- One-time – this depreciation method is available for all types of assets. The program calculates a single write-off amounting to the current value of a fixed asset.

- Not subject – this depreciation method is available for all types of assets. No write-off is here generated.

Depreciation Rate – rate by which write-offs are calculated. It is completed automatically on the basis of the FAC. This parameter is not editable for One-time method (for this method, it is set to 100% by default) and for Not-subject method (for this method, it is set to 0% by default).

Coefficient – rate increasing coefficient by which a depreciation rate is multiplied. Methods One-off and Not subject are set, by default, to 1 and this setting is not changeable.

Depreciation Months – number of months during which a fixed asset will be depreciated. This parameter is editable only for the straight-line method. Value of this parameter is calculated on the basis of depreciation rate and coefficient.

Seasonality – this parameter enables the selection of months in which a fixed asset must be depreciated seasonally, that is only in the selected months of a year. It is editable for depreciation methods other than One-time and Non subject.

Depreciation Suspension – this parameter enables the selection of months in which depreciation of a fixed asset is suspended temporarily. Selecting the button opens the window Depreciation Suspension in which it is possible to specify the year during which the suspension applies. This parameter is editable for the depreciation methods other than One-time and Not subject.

Depreciation Start Date – date as of which write-offs will be generated. For particular methods, the program suggests the following dates, by default:

- One-time method – date of receipt

- Not subject method – empty record

- other methods – the first day of month following the month in which the asset was received for utilization

Initial Value – value of fixed asset acquisition or production. It can be completed manually. Otherwise, it will be calculated automatically on the basis of the values of the documents selected in section Acquisition Documents under the tab Acquisition/Disposal Documents.

Value Updated at the Beginning of Period – value of fixed asset on the first day of a given tax year or accounting year, taking into account all the fixed asset devaluations. Until the fixed asset form is saved the first time, this parameter is editable if:

- the date of receipt is earlier than the system date for the depreciation area associated with a calendar year

- the date of receipt is earlier than the current accounting period for the depreciation area associated with an accounting period.

Total Value – final value after taking into account all fixed asset devaluations on the day specified in the Balance On field. This value is calculated automatically and is not editable.

Write Offs at the Beginning of Period – value of write-offs generated in previous financial years. This parameter is editable on the same rules as the Value Updated at the Beginning of Period until the fixed asset form is saved the first time.

Write Offs in Current Year – value of write-offs generated in a given financial year up to the month being analyzed. This value is calculated automatically on the basis of depreciation documents.

Cumulative Depreciation – value of write-offs generated in a given financial year up to the month being analyzed as well as that of the write-offs at the beginning of the period. This value is calculated automatically on the basis of depreciation documents.

Current Subtotal Value – fixed asset value taking into account all its devaluations as well as the generated write-offs. This value is calculated automatically.

Tab Groups

Classification Categories – there is one predefined and non-editable classification category: Fixed Assets. No other classification categories can be added.

Groups – provides information about the code, name and location of the fixed asset group to which a fixed asset is assigned. A fixed asset can be assigned only to one group. Selecting the button [Edit] redirects the user to the fixed asset group, where it is possible to change the group to which the fixed asset must be assigned.

Tab Acquisition/Disposal Documents

Upon selecting the button [Attach] in tab Acquisition/Disposal Documents, it is possible to indicate the document list from which to attach documents. Available options are:

- Purchase Invoices

- Sales Invoices (available in section Disposal Documents/Sale Documents)

- VAT Accounts

- Accounting Notes

- Journal Entries

- Without Document – using this option it is possible to enter manually the number of the document on the basis of which a fixed asset has been registered

Documents selected in the Acquisition/Disposal Documents can be detached at any time with the help of the option [Detach]. If a FA document is already generated, then detaching a document does not affect the fixed asset’s initial value.

Sections Acquisitions Documents and Disposal (Sale) Documents provide information about a document number, date and value.

The column Document Number presents the number of a reference document and if it is missing – the document system number.

The column Document Date provides information about a document date of issue.

Depending on the document type, the column Document Value will present the value of:

- purchase invoice – sum of subtotal values in the system currency

- VAT purchase invoice – for the parameter VAT Deductions set to Yes or Conditionally, a subtotal value in the system currency is presented, whereas for the parameter VAT Deductions set to No, a total value in the system currency is presented

- VAT sales invoice – subtotal value in the system currency

- accounting note – entry amount from an accounting note

- journal entry – entry amount from a journal entry

- without document – value entered by the user

In the case of documents selected as acquisition documents, their values affect the initial value of a fixed asset, provided that the fixed asset was not associated with a FA document when attaching the documents.

Section Disposal Documents (Sale Documents) is activated upon selecting the parameter Disposal Date in the side panel of the fixed asset form. The section name changes depending on the date type: Date of Disposal, Date of Sale.

Tab Fixed Asset documents

In the tab Fixed Asset documents, a list of documents generated for a given fixed asset is displayed.

In this list, it is possible to add, review, delete and print documents of a particular fixed asset.

This tab works on the same rules as the list of fixed asset documents, which description can be found in article Fixed asset list.

Tab Accounting

The table Default Accounts available in this tab lists all the default bookkeeping accounts that are assigned to a given fixed asset. By selecting a checkbox in the column Create Account, it is possible to create an account for a given object if such account does yet exist. The table presents the accounts available in the company to which an operator is logged in within a given accounting period.

Tab Analytical Description

Analytical description improves the analysis of the company’s financial results. On the fixed asset form, it is possible to specify a depreciation area by which the values of analytical description can be completed in fixed asset documents. Depreciation areas can be selected from among the areas activated in the system configuration window.

To be able to assign analytical dimensions to fixed assets, first it is necessary to assign appropriate analytical measures to the object Fixed Assets (menu Configuration → Company Structure → Object Dimensions). After analytical dimensions are assigned, it is possible to define an analytical description on the form of both fixed asset group and fixed asset, itself.

Tab Availability

When adding a new fixed asset form, the center, to which an operator is logged in, is set as the object owner entitled to object modification. The operator can change the owner of the fixed asset, its availability in centers and manage the edit permissions.

Detailed description of this tab can be found in article Objects availability − general information.

Tab Attributes, Attachments, Change History

Detailed description of these tabs can be found in articls Tab Attributes, Tab Attachments and History.