The functionality allows for handling of tax returns for tourists – Tax Free. Natural persons without permanent place of residence within the European Union’s territory are entitled to receive a return of tax payed when purchasing items on a country’s territory, which were exported undamaged outside the European Union. A vendor issues a printable receipt to a customer, with tax calculated according to national rates. Moreover, a filled-in Tax Free document form is attached to the receipt, including items, their prices and paid tax amount.

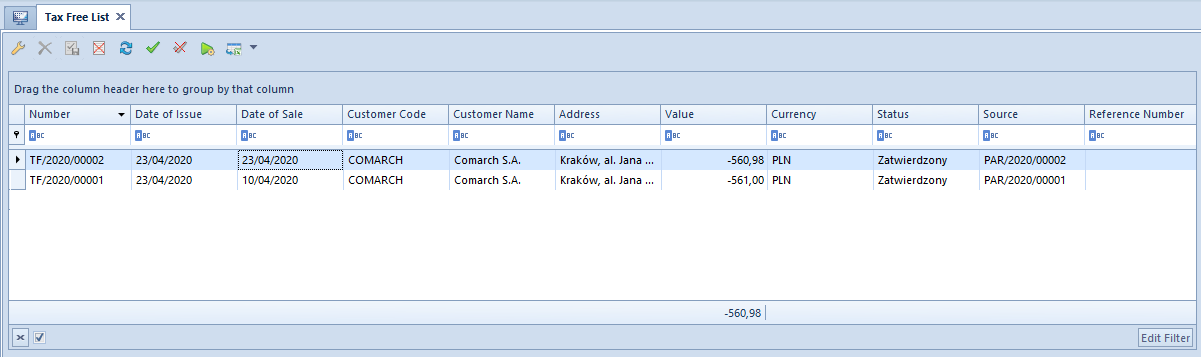

The list of Tax Free documents is available from the level of main menu, in the tab Sales → Tax Free.

The list of documents has been described in article List of documents.

A TAX FREE document can be generated from a receipt printed on receipt printer. It is not possible to add a document manually to the system.

Upon selecting a R document in the list of receipts and clicking on the button [TF] placed in the group Generation, a form of a new TAX FREE document appears.

Detailed description of the document form and its tabs can be found in subcategory Document forms.

A Tax Free document can be generated:

- only from a receipt printed on receipt printer, it is not possible to generate a Tax Free from a receipt correction

- from one receipt

- if a receipt has Confirmed or Posted status

- if a receipt does not have any corrections or all its corrections have been canceled

- if no sales invoice has been issued to a receipt

- from a receipt to which no Tax Free document has been generated or Tax Free document generated to it has been canceled

In a Tax Free document, it is possible to check parameter Export Confirmed. By default, the parameter is unchecked and can be edited only in a confirmed document. In case the parameter gets:

- checked – a payment (debit) for document amount is created

- unchecked – the payment is deleted

The parameter is not available for edition, if:

- a Tax Free document has been included in CRS

- a Tax Free document has been posted

- the payment has been settled in full or partially

- the payment has been included in SRO or SPO

It is possible to issue a Tax Free document for an item of service type in accordance with the data included in the receipt. If Tax Free document is to be generated only for an item of merchandise type, it is necessary to issue separate receipts for merchandise and services.

e-Tax Free

From the 1st of January 2022 a traveler will be entitled to receive VAT tax return, if:

- a vendor issues and sends to the Tax Free system an electronic Tax Free document,

- the traveler exports purchased items outside the European Union

- a Customs Officer confirms the export of goods in the Tax Free system after checking the compliance between traveler’s data contained in the electronic Tax Free document and their data contained in the passport or another document identity document,

- the traveler presents a confirmed printout of the electronic Tax Free document received from the vendor – in case the traveler is leaving the European Union from the territory of a country different than Poland.

In relation to introducing the digitalization of settlements and document circulation, from the beginning of the January 2022, the process of sales in the system will require using on-line cash registers (changes introduced with the amendment to the Polish VAT law, within so-called SLIM VAT package).

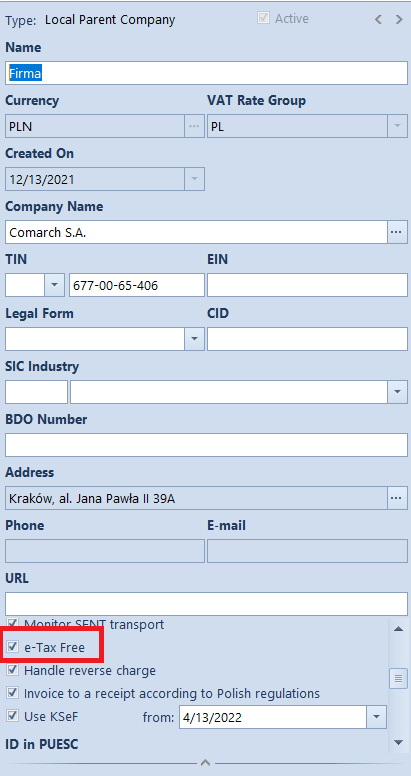

Changes to company form

On the company form, parameter e-Tax Free is available and it determines the availability of:

- fields related to electronic Tax Free on a document:

- actions responsible, e.g., for sending, canceling and receiving Tax Free status.

After selecting the parameter, an additional Tax Free tab is presented, where it is necessary to define:

- Tax Free Intermediary – customer being an intermediary entity in Tax Free

- User name and password necessary to establish the communication with the use of Web Service

- Certificate fingerprint and its validity

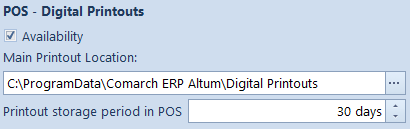

- On the form of the center with a defined POS workstation, there is the POS – Digital Printouts parameter with a checkbox Available. When selected, the following has to be specified:

- Main Printout Location – location where generated printouts are stored

- Printout storage period in POS – number of days during which POS printouts will be available. This option is set to 30 days, by default.

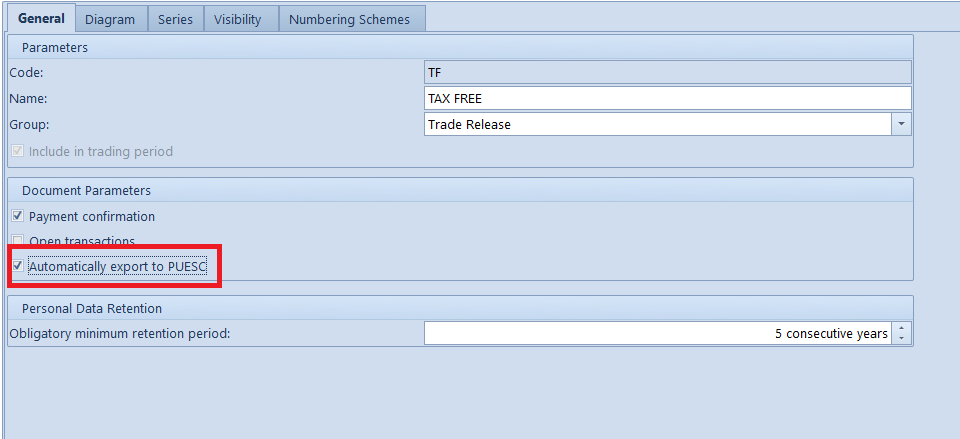

Furthermore, on the TF document definition in the company in which the e-Tax Free parameter is selected, the option of an automatic TF document dispatch during its confirmation has been added – Automatically export to PUESC and it is available in Document parameters group of parameters.

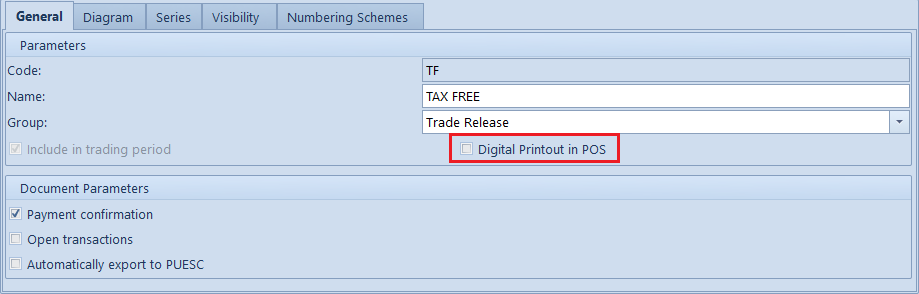

In the center with a defined POS workstation, option Digital printouts in POS is available. This parameter is only available when the checkbox Available is selected for POS – Digital Printouts option on the center form.

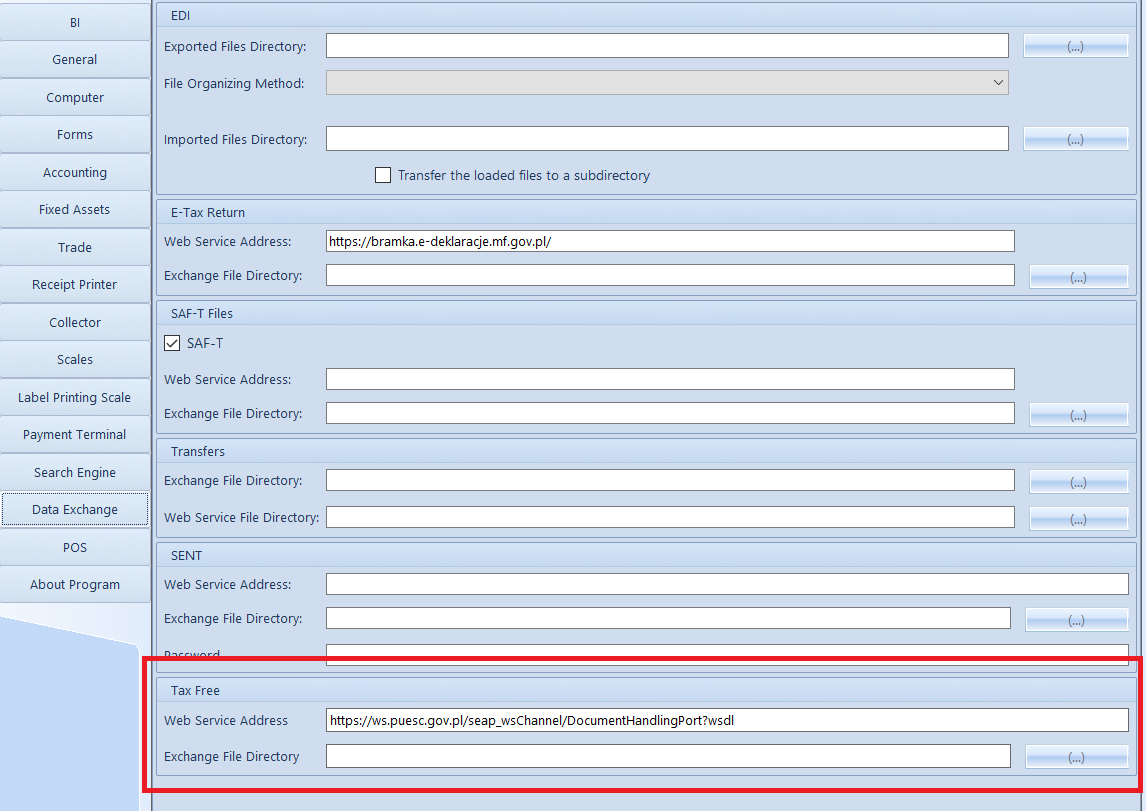

Tax Free data exchange configuration

In the system configuration: System → Configuration → Data exchange, new section with Tax Free parameters has been added, where data necessary for logging-in to PUESC and the localization of XML files storage are saved. The section is visible after checking the parameter Tax Free in the company/center to which the operator is currently logged-in. In the section, the following fields are available:

- Web Service address

- Data exchange directory to which are sent and from which are received all XML files

Changes to employee form

On the employee form, Tax Free tab has been added, which is available only if on the company form, the parameter e-Tax Free is checked. The tab contains the following fields retrieved from the PUESC account:

- E-mail address and Password

- SISC ID

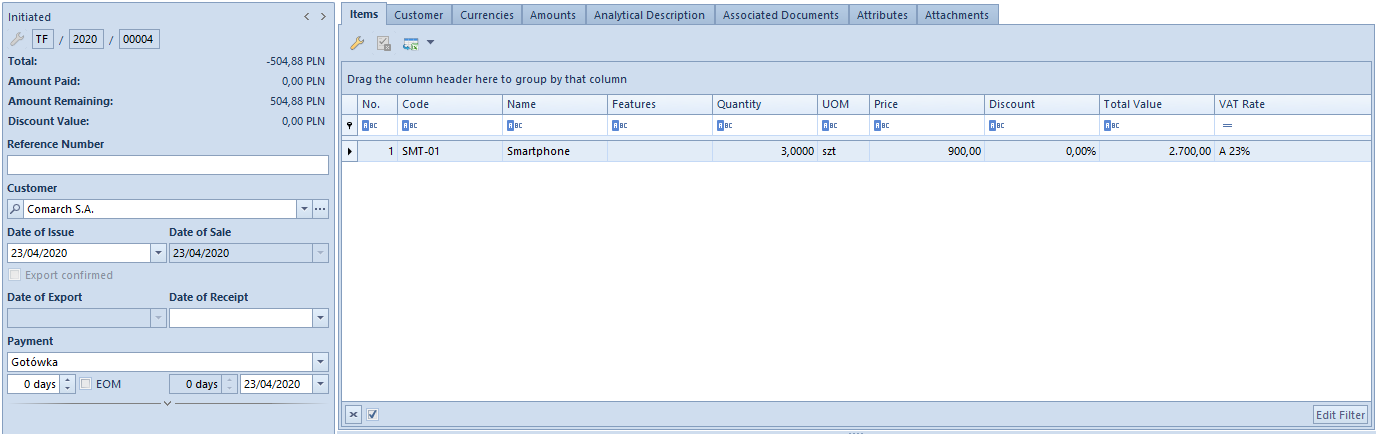

Changes to the Tax Free document

The TAX FREE document form is adapted to the data exchange with PUESC and extended by additional fields used during the electronic communication:

- Intermediary – by default, it is retrieved from the field Tax Free Intermediary, available in a center of company type (with the possibility of changing it)

- USN Number – unique document number assigned by PUESC

- e-Document Status – information regarding document status returned by PUESC

- Date Sent – date of uploading the document to PUESC which updates the status of e-document to Registered

- Date Exported – date of exporting goods from a member country

- Date of Receipt – date of export confirmation

- Amount To Refund – amount of VAT refund completed automatically with the use of Tax Free Reimbursement action

- Refund Date – date of VAT tax refund – completed automatically with the use of Tax Free Reimbursement action

In the Customer tab of the TF document, the following fields are available:

- Date of Birth – the value of the field is retrieved from the customer form and it can be filled-in manually for Undefined customer

- Bank Account Number – number retrieved from the customer form; it can be changed if more than on account number is assigned to a given customer

To optimize the work with the list of TF documents, the following columns were added: e-Document Status and Unique System Number.

To enable exporting documents to the PUESC platform and performing operations related to that process, new button group e-Tax Free has been added and it contains the following actions:

- [Export TF] – this button is active only if the document is confirmed and the e-Document status is Not Sent. After selecting export and correct validation by the system, the TF document receives a system number and its status is changed to

- Get status – button active for documents with the following e-Document statuses: Registered, Export Confirmed, Export Partially Confirmed.

- Invalidate TF – allows for invalidating a document that should not be sent to PUESC (active only for documents with Registered status). After clicking on the button, an additional window is opened, where the user can enter the reason for invalidating. After the operation is confirmed, such document gets Invalidated

- Pay TF – operation available for TF documents with Registered status, used for handling documents, when the traveler leaves the country from a member country different than Poland and wants to get VAT refund. In such case the traveler must send to the vendor the export confirmation with custom stamps of a given country and the vendor, on the basis of the confirmation, must enter in the TF document payment to the system. This option is also available for statuses Export Confirmed and Export Partially Confirmed, when export of goods was confirmed ad the Polish border and the vendor wants to report VAT tax refund on PUESC and settle the document. After clicking on the [Pay TF] button, and additional field with the following fields is opened:

- Date Exported – date from the document provided by the traveler, which confirms export of goods out of an EU member state (only when settling at the border of an EU member state different than Poland)

- Exporting Country – EU member state from which goods were exported (only when settling at the border of an EU member state different than Poland)

- Refund Date – date on which the VAT amount was refunded to the traveler

- Amount To Refund – VAT amount of goods subject to refund. The amount should not be higher than the amount of the TF document and lower than 0.

Once the data correctness is verified and the data is updated in the system, a message with status Refunded is returned.

Batch operations on Tax Free

Over the list of TF documents, new E-Tax Free group of buttons has been added, which contains buttons used for executing batch operations:

- Export TF

- Get Status

After executing a batch operation in a dedicated window, a log containing information regarding the status of execution of a given operation is displayed.

TAX FREE printout

Due to the changes, the existing printout has been expanded to include new mandatory information:

- Non-cash refund

- Cash refund

- Unique system number

- Date of birth (of the customer)

- Cash register number

- Issuer’s first and last name

- SISC ID

- Document confirmation date and time

- “I have received a tax refund in the amount of ………. USD …… cents“, – text to be filled in manually

Integration with Global Blue platform

To activate the functionality, select the parameter Upload documents via Global Blue platform in the company definition under the POS Workstations tab → Tax Free Integration with Global Blue Platform section.

In the company definition, continue to Tax Free tab and complete the parameters in the new section Tax Free Integration with Global Blue Platform section:

- Payment amount must be greater than – specify the minimum amount of transaction in the system currency. If the value in the receipt exceeds the limit specified in the configuration, the vendor can issue a tax free document.

- Document must be issued on/in – this parameter specifies the date up to when a tax free document can be issued from the date of sale. Selectable values are:

- the same day

- month of purchase + defined number of months

- date of purchase + defined number of days

- date of purchase + defined number of months

Selecting one of the values based on additional days/months activates an additional parameter to specify the number of additional days/months.

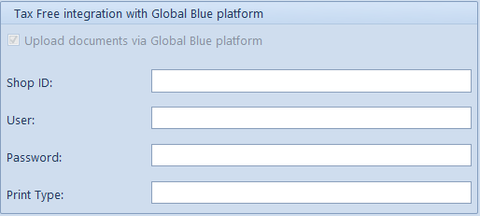

Furthermore, in the POS center definition, complete the following data:

- Shop ID

- User

- Password

- Print Type

The data is uploaded to Comarch POS system.

In the tax free document list, there is an additional column Uploaded via Global Blue (hidden by default). If a document was loaded via Global Blue platform, the Global Blue Number is presented in the document header instead of the USN Number.