Payment rounding for the Belgian market

Cash payments for the sale of goods and services in Belgium must from 2019 be rounded up to 5-euro cents (0.05 EUR) and its multiples. Coins in denominations of 1- and 2-euro cents are still legal tenders, but they are used more rarely.

In order to comply with the above regulations, rounding of cash payments in EUR has been introduced in the Comarch POS application for the following types of documents:

- Receipt

- Sales invoice

- Advance sales invoice

- Receipt correction

- Sales invoice correction

- Advance sales invoice correction

This functionality is activated with the Round Off Cash Payments To parameter available in the Company center definition under the POS Workstations tab It is set automatically to BE, provided that the Belgian VAT rate group is set on the company form.

Rounding amount

In the headings of sales documents, a new value Rounding is now displayed.

POS Agent offline mode – shortage management

Shortages are now supported when working offline or when the POS Agent service is unavailable. In case of insufficient resources in Comarch ERP Standard, a shortage will be created for documents issued in Comarch POS, so as the documents could be properly synchronized to the ERP system. To active shortage support, the following parameters need to be selected in Comarch ERP Standard:

- POS Agent – support offline mode – available under System/Configuration/POS

- Sell below stock levels – available in POS center definition

Export transactions on POS

In accordance with the VAT law, Comarch POS has introduced support for export sales and intra-Community delivery of goods for the following document types:

- Sales invoice

- Sales invoice quantity correction (including manual corrections)

- Advance sales invoice

- Advance sales invoice correction

- Sales order

- Sales quote

- Sales order release (SOR)

The following changes have been made to the ERP Standard system so that it works with the new functionality:

- VAT rates for export documents are synchronized from ERP Standard (Configuration/VAT Rates) to POS

- transaction type in a SO release document generated in the ERP Standard to a sales invoice issued in POS is retrieved from the values specified in the invoice and is not editable

- when converting a manual invoice correction from POS to a quantity correction in the ERP Standard, the value in the Transaction Type field is additionally validated. If that value in the correction is different than in the source invoice, the documents are not associated and the correction is saved as a manual correction.

Mode for adding items to an inventory report

A new parameter Mode for adding items to a report with selectable values below has been added in the company definition and in the center definition under POS Workstations tab → Inventory section.

- Standard – after scanning/adding an item in POS, the item is added to the report with the quantity of 0

- Scan Mode – after scanning/adding an item in POS, the item is added to the report with the quantity of +1

Synchronization of weighed code of type Other

A weighed code of type Other and with a proper structure, i.e., with a dot between the integer and decimal weight, can now be synchronized. For this purpose, on the form of weighed code of Other type under the menu Configuration à Trade/Warehouse à Weighed Codes, the parameter Synchronize to POS has been added (deselected by default).

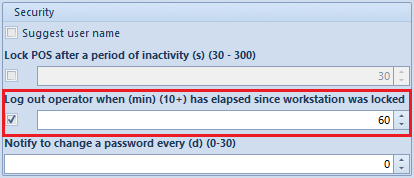

Logging out the locking operator when (min)(10+) has elapsed since point of sale was locked

In the company/center definition under the POS Workstations tab → Security section, a parameter has been added for logging the operator out of the POS when a specified number of minutes has elapsed since the point of sale was locked. This parameter can be set to a minimum of 10 minutes and a maximum of 1440 minutes (24 hours).

Other changes

- In the company/center definition under the POS Workstations tab, a parameter has been added to block sales invoice generation when VAT number in provided in POS (deselected by default)

- In the company/center definition under the POS Workstations tab, a parameter has been added to verify VAT status of a business entity (deselected by default)