File JPK_KR_PD

From January 2026, CIT taxpayers will be required to submit a new report, the so-called CIT SAF-T, in the form of two standard audit files:

- JPK_KR_PD – accounting records and income tax settlement

- JPK_ST_KR – fixed and intangible assets

Changes related to the new structure of the JPK_KR_PD file have been introduced in Comarch ERP Standard system.

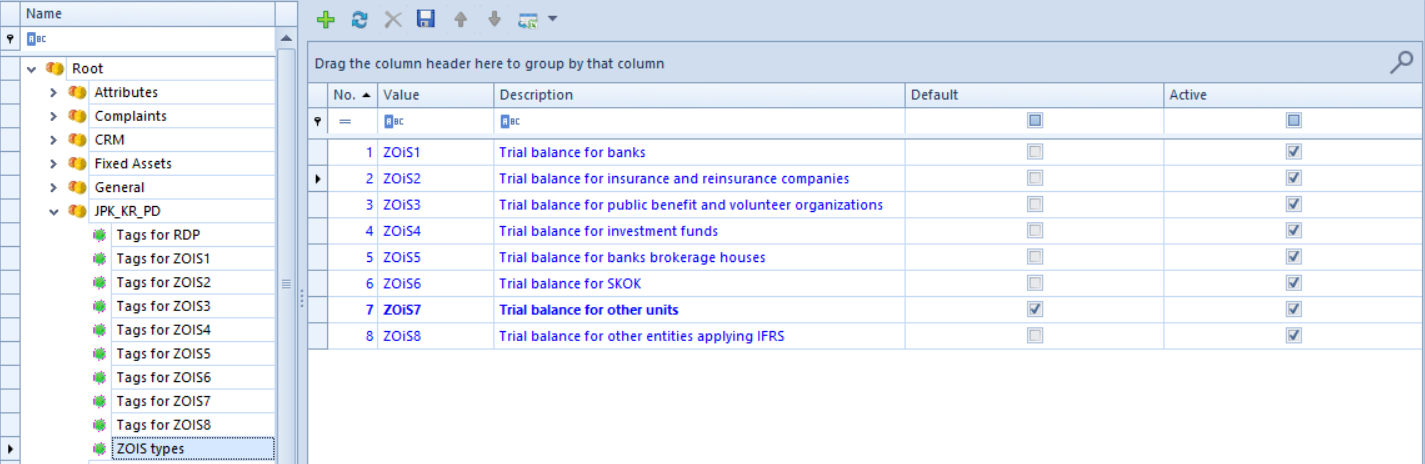

New generic directory

A new directory group JPK_KR_PD with the directories below (active by default) has been added under the menu Configuration/Generic Directories:

- ZOiS Types – types of trial balance, depending on the type of business, the type selected by default is: ZOiS7 Trial balance for other entities, changeable

- Tags for RDP – a predefined list of tags to mark accounts for income tax

- Tags for ZOiS1 type – a predefined list of tags concerning ZOiS for banks

- Tags for ZOiS2 type – a predefined list of tags concerning ZOiS for insurers and reinsurance companies

- Tags for ZOiS3 type – a predefined list of tags concerning ZOiS for public benefit and volunteer organizations

- Tags for ZOiS4 type – a predefined list of tags concerning ZOiS for investment funds

- Tags for ZOiS5 type – a predefined list of tags concerning ZOiS for brokerage houses

- Tags for ZOiS6 type – a predefined list of tags concerning ZOiS for SKOK

- Tags for ZOiS7 type – a predefined list of tags concerning ZOiS for other entities

- Tags for ZOiS8 type – tags can be defined by an operator

A tag can be completed when importing the chart of accounts from a properly configured file. Tags can only be imported for ZOiS1-ZOiS7 types.

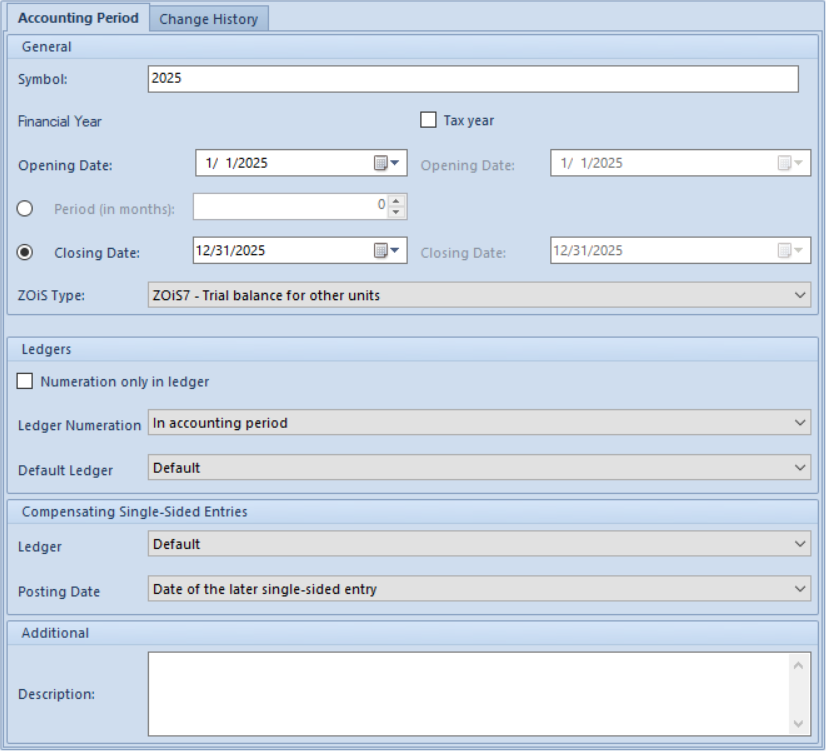

New fields on accounting period form

New parameters have been added on the accounting period form (Configuration/Accounting/Accounting Periods) under the General section for accounting periods with an opening date after 12/31/2024:

- Tax year – selected optionally, used to specify the opening and closing dates of the tax year if they are different from the dates of the financial year. By default, these dates are completed according to the dates of the financial year.

- ZOiS Type – select the type from ZOiS1 to ZOiS8, depending on the type of business. For the first accounting period, the ZOiS type specified in the generic directories as default is set, and it is changeable. For subsequent accounting periods, the ZOiS type is retrieved from the previous period. The setting affects the list of account tags that is displayed on the account form in the Tags section. The type is changeable until tags are assigned on the chart of accounts.

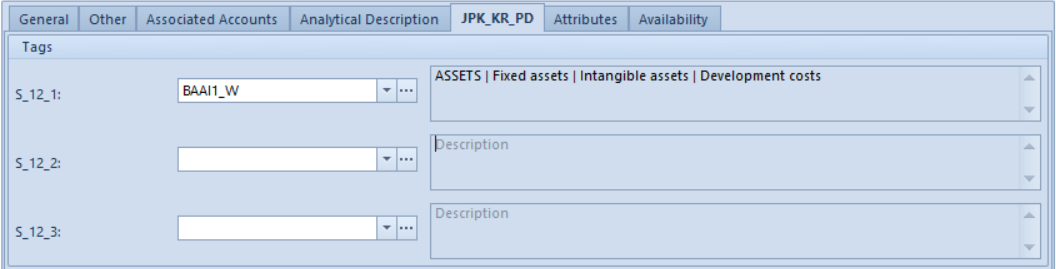

Account tags

According to the new regulations, tags must be sent to the SAF-T file for each ZOiS type and account:

- S_12_1 – a mandatory tag resulting from the regulation on the additional scope of data to be provided in the books of account; the list of tags depends on the selected ZOiS type. This tag applies to the assignment of an account to the financial statement (trial balance, profit and loss account).

- S_12_2 – a mandatory tag resulting from the regulation on the additional scope of data to be provided in the books of account. This tag applies to the assignment of an account to the financial statement (trial balance, profit and loss account).

- S_12_3 – a mandatory tag resulting from the regulation on the additional scope of data to be provided in the books of account (PD); the tag list is common for all ZOiS types. This tag is used to calculate the income tax statement.

Each account uploaded to the JPK_KR_PD file (the lowest level accounts with journal entries, including off-balance sheet accounts) should have a corresponding tag.

Uploading tags

Tags can be assigned to an account on the form of account in the new tab JPK_KR_PD. The tag assigned to a general account is automatically transferred to all its subsidiary accounts. Tags are also copied when transferring the chart of accounts to the next accounting period.

It is now possible to import/export chart of accounts with assigned tags.

Changing tags in a single batch

It is now also possible to change tags on accounts in a single batch. To do this, in the menu Accounting/Chart of Accounts, select the button [JPK_KR_PD Tag] from the Batch Change button group and then the respective batch change parameters and tags. This action requires that the operator be assigned to the operator group with the privilege Batch changes to accounts – JPK_KR_PD tags available under Other Permissions tab.

New columns in the chart of accounts

The following new columns have been added in the chart of accounts:

- S_12_1

- S_12_2 (hidden by default)

- S_12_3 (hidden by default)

They inform about the tags added to an account. Hovering the mouse cursor over a tag symbol displays its description.

Generating and exporting a JPK_KR_PD file

JPK_KR_PD file can now be generated and exported to the Ministry of Finance website. A file can be created under the menu Main/SAF-T.

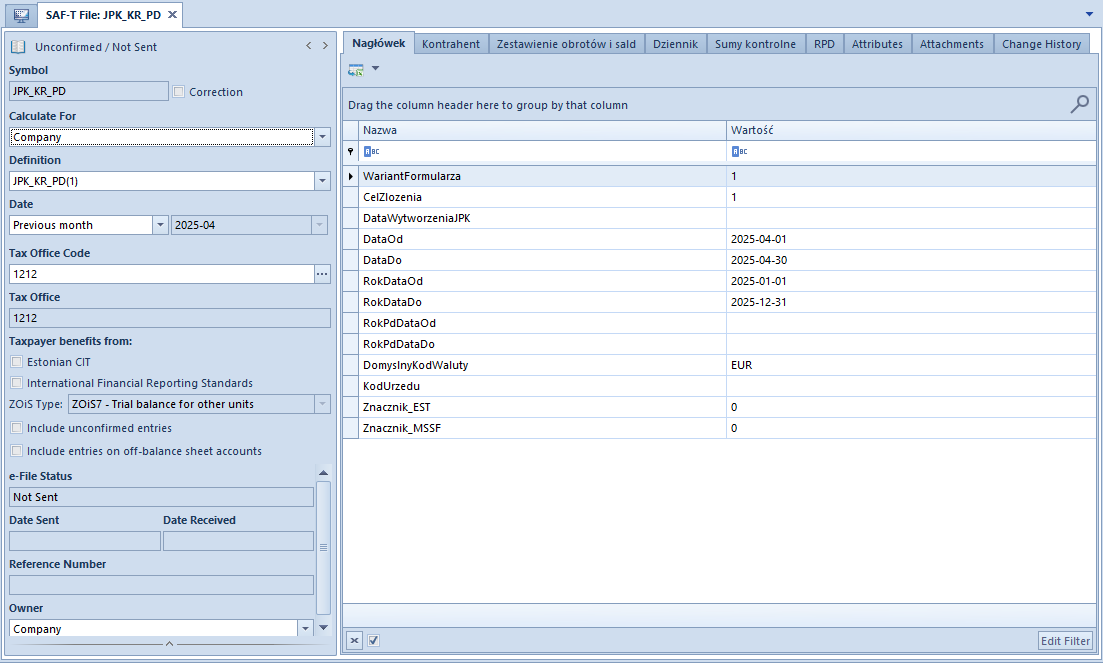

In the side panel of the file, you can specify the general parameters against which the data are retrieved when recalculating the file, e.g. you can select the company for which to retrieve the data, the date range for which the file is to be generated and the tax office code. File-specific parameters have also been added:

- Taxpayer benefits from:

- Estonian CIT – deselected by default, changeable

- International Financial Reporting Standards – this parameter is automatically selected if the ZOiS8 type has been selected on the accounting period form

- ZOiS Type – the value of this parameter is copied from the accounting period form and is not editable

- Include unconfirmed entries – deselected by default, changeable

- Include entries on off-balance sheet accounts – deselected by default, changeable

The main pane of the JPK_KR_PD file is composed of the following tabs:

- Header – after the file has been recalculated, the general information, corresponding to the parameters set in the side pane, is displayed in the tab. Also, a reason for submission is presented (1 – original file, 2 – correction) and a date range for which the file is submitted.

The taxpayer and tax office data are retrieved from company form → Tax Returns tab.

- Customer/Vendor – after the file has been recalculated, the tab presents information about the customers/vendors (customer/vendor code, TIN prefix and TIN) whose names are in the journal entries posted in the period for which the SAF-T file is being generated.

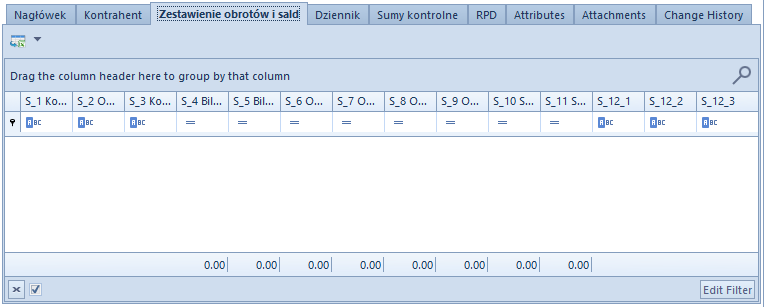

- Trial Balance – the tab lists the items from the trial balance, which are included in the JPK_KR_PD file

- Ledger – this tab lists the journal entries (Accounting/Ledger) and their single-sided entries (Accounting/Account)

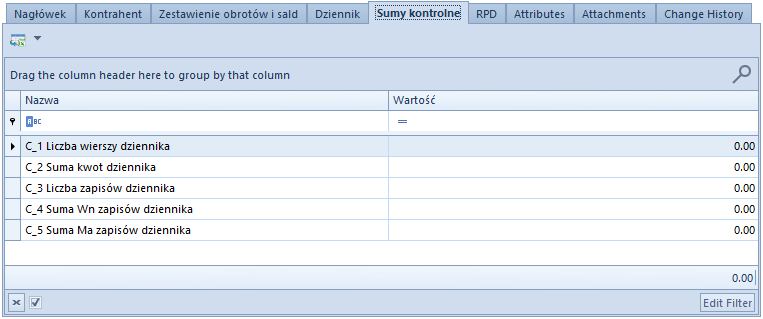

- Checksums – this tab presents information regarding the books of account.

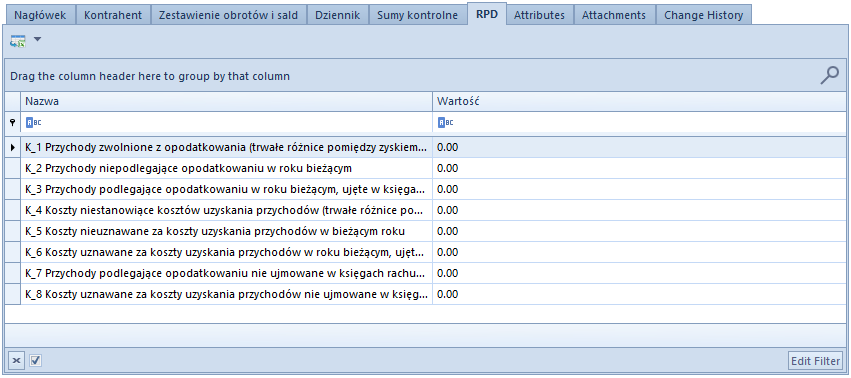

- RPD – displays tax settlement-related records. Values in this tab are not calculated automatically. Values can be entered manually only if the date range for which the file is being generated includes the last day of the accounting period.

- Attributes – contains a list of attributes and their values, which are assigned to the object

- Attachments – in this tab, you can add an attachment to a SAF-T file

- Change History – in this tab, you can view the operations performed on the file by users

New columns in trial balance

The following new columns have been added to trial balance: S_12_1, S_12_2, S_12_3 (hidden by default) containing description of account tags used for JPK_KR_PD.

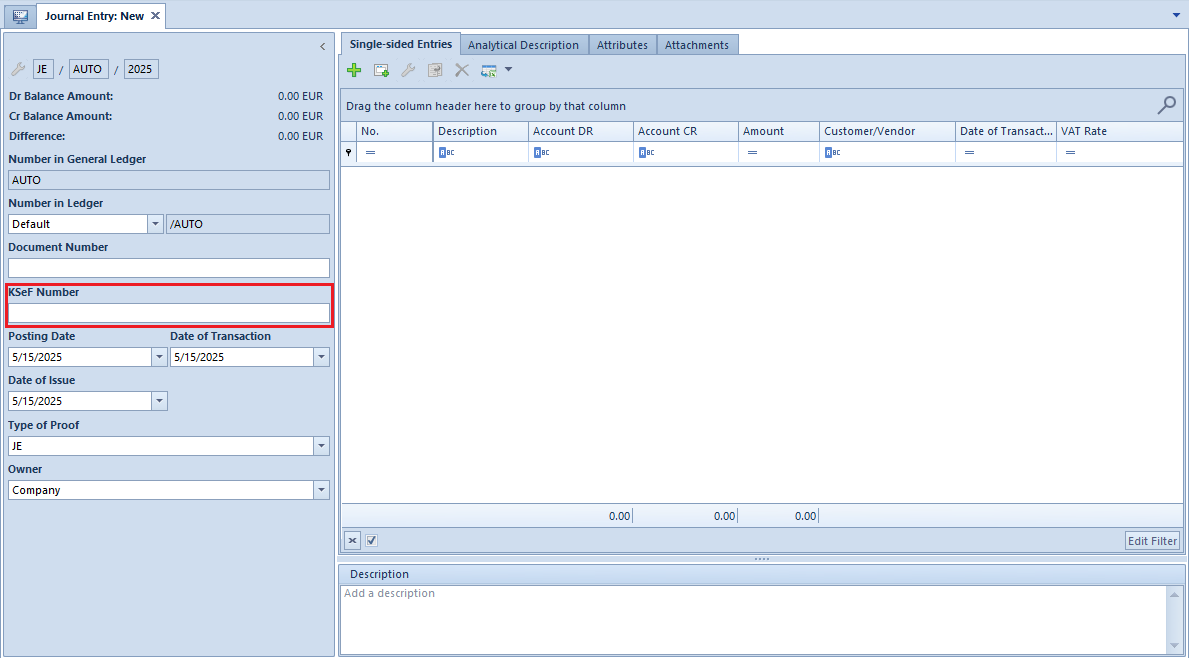

Changes in JE document

In a journal entry, there is a new field KSeF Number. In addition, KSeF number is now retrieved from the source document and it is not editable. This means that when you post an invoice/VAT invoice with a completed KSeF number, this number is transferred to its journal entry. For manually added journal entries, the KSeF Number field is active until the JE is confirmed.