In case if a payment is not paid within its due date, an additional fee is charged for each day of delay – so-called interest on arrears. The amount of such additional fee results from the interest rate outlined in statutory regulations and trade agreements. The interest rate can change in time since each interest rate has its validation dates determined. Defined interest rates are common for a whole company structure. An arrear amount is calculated on the basis of given document’s payment value.

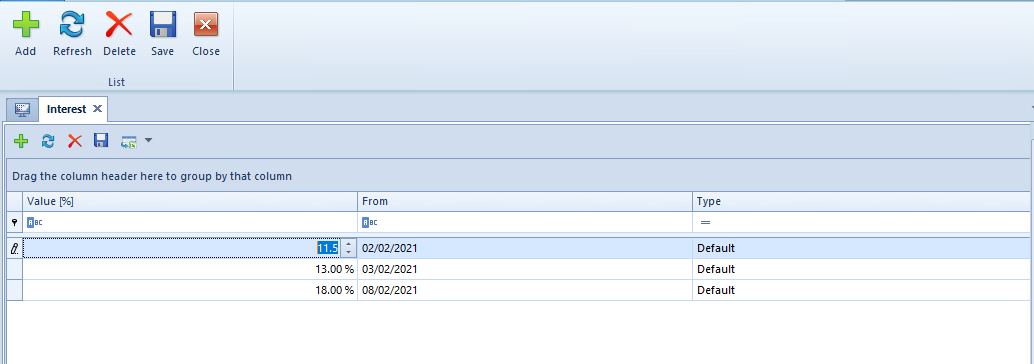

In the system, there are three statutory interest rates available, effective in particular periods. These rates can bee freely edited. The list of interest rates is available from the level of the menu Configuration → Finances, under the button [Interests].

To define new interest rate, it is necessary to select the button [Add] from the List group of buttons and complete the following data:

- Value [%] – interest rate with two decimal places precision. The system controls the uniqueness of values in case of the same date and type.

- From – interest effective date

- Type – indicates type of interest rate. It is possible to select values entered in generic directories.

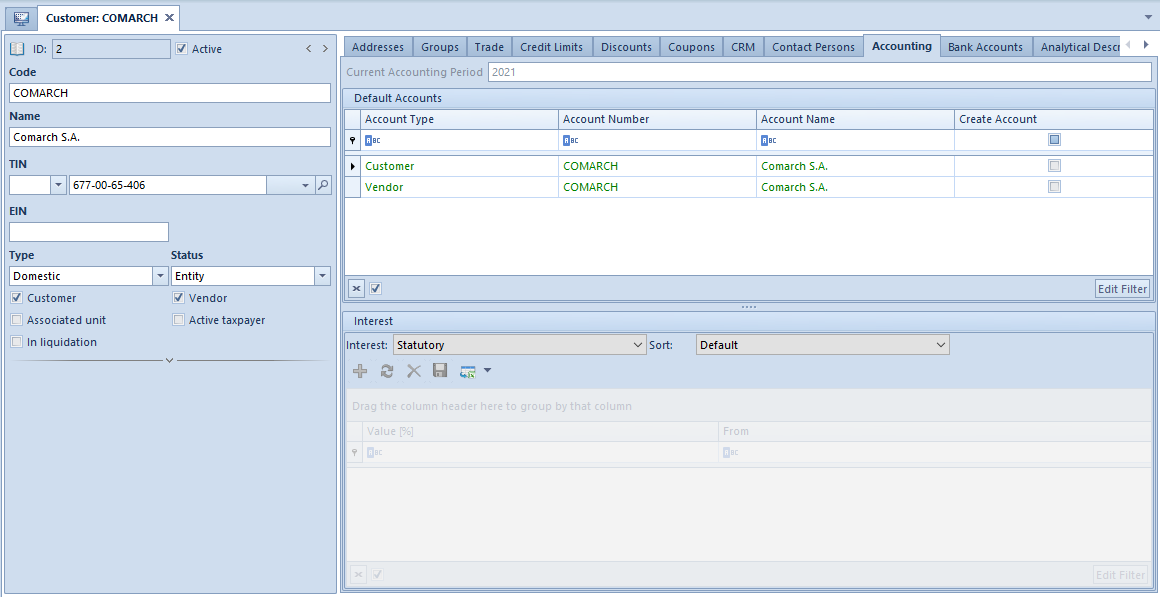

Interest on customer form

In the system, it is possible to assign statutory interest type or define new contractual interest for a customer. It can be done on customer form, in the tab Accounting, in the Interest panel.

To do so, it the field Interests, it is necessary to select one of the following values: Contractual or Statutory. If the option Statutory is selected, the Type field is automatically filled in with default value form Interest Rate Type directory, with a possibility to change it.

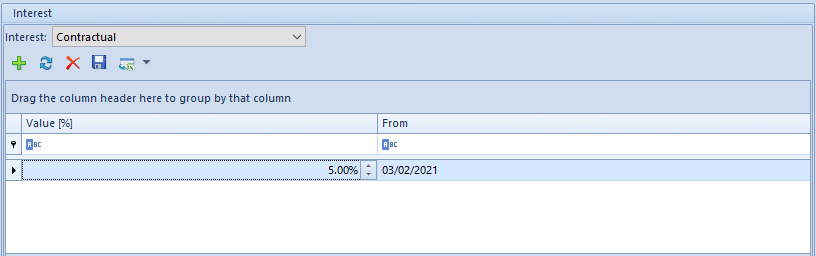

If the option Contractual is selected, the Type field is not available, however, the user can define own interest values. To do so, it is necessary to select [Add] button and complete the following columns: Value [%] and From.