A dunning letter is the subsequent reminder sent to a payer notifying him about receivables not paid within their due date and it may also include interest charged due to lack of payment within specified time.

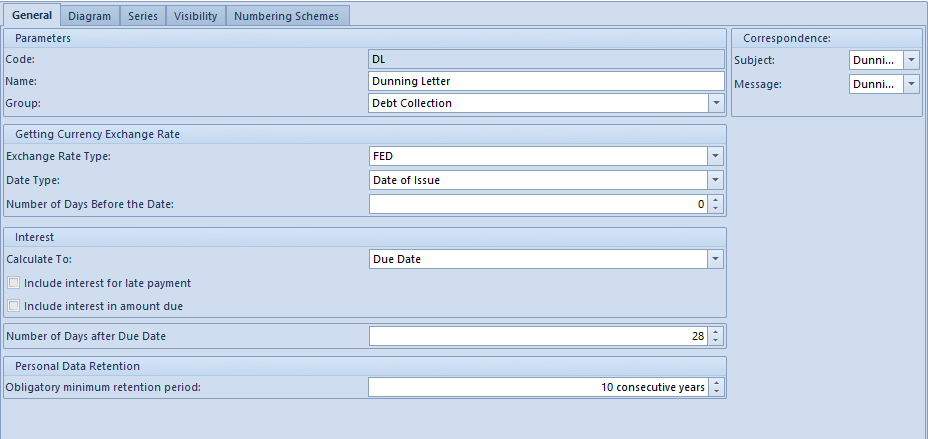

Configuration of parameters on Dunning Letter document type

On Dunning Letter document type, in tab General, it is possible to specify the following:

- Exchange Rate Type – for dunning letters issued in foreign currency. It is possible to select one of the <<exchange rates defined in the system configuration.

- Date Type – for dunning letters issued in foreign currency.

- <<Number of Days Before the Date – also for dunning letters issued in foreign currency

- Calculate To – possible dates are:

- Due Date – calculates interest for the number of days from an invoice payment date until the date of issue of a dunning letter

- Dunning Letter Due Date – calculates interest for the number of days from an invoice payment date until the payment date of a dunning letter

- Include interest for late payment – the parameters indicates whether the value of interest for a payment should include interest on overdue payment or interest on arrears only

- Include interest in amount due – the parameter indicates whether the interest value should be included in the amount Total on dunning letter

- Number of Days After Due Date – number of days after which a payment reminder will be sent. An integer number from the range (-99:99) should be entered in this field. When a negative value is entered, it is possible to start debt collection actions yet before the due date.

- Obligatory minimum retention period

- Subject – e-mail message subject. The values defined in <<generic directories are available.

- Message – e-mail message content. The values defined in <<generic directories are available.

In the table below, the rules of calculating interest for each configuration of parameters: Calculate to, Include interest for late payment, Include interest in amount due:

| No. | Parameter Settings | Action |

|---|---|---|

| 1. | Calculate To: Due Date Include interest for late payment: No Include interest in amount due: No | Interest is calculated only for the default against each payment In case of changing the interest rate in the interest calculation period, a separate record is displayed for each payment A Total amount does not include interest values Payment is created on the basis of costs. |

| 2. | Calculate To: Dunning Letter Due Date Include interest for late payment: No Include interest in amount due: No | Interest is calculated only for the default against each payment In case of changing the interest rate in the interest calculation period, a separate record is displayed for each payment A Total amount does not include interest values Payment is created on the basis of costs |

| 3. | Calculate To: Due Date Include interest for late payment: No Include interest in amount due: Yes | Interest is calculated only for the default against each payment In case of changing the interest rate in the interest calculation period, a separate record is displayed for each payment A Total amount includes interest values Payment is created on the basis of costs and interest values |

| 4. | Calculate To: Dunning Letter Due Date Include interest for late payment: No Include interest in amount due: Yes | Interest is calculated only for the default against each payment In case of changing the interest rate in the interest calculation period, a separate record is displayed for each payment A Total amount includes interest values Payment is created on the basis of costs and interest values |

| 5. | Calculate To: Due Date Include interest for late payment: Yes Include interest in amount due: No | Interest is calculated for the default and for late payment against each payment and its associated payment document In case of changing the interest rate in the interest calculation period, a separate record is displayed for each payment and each payment document A Total amount does not include interest values Payment is created on the basis of costs and interest values On the payments list of a dunning letter, there is an additional column Date of Payment presenting the date of c/b transaction completing a given payment |

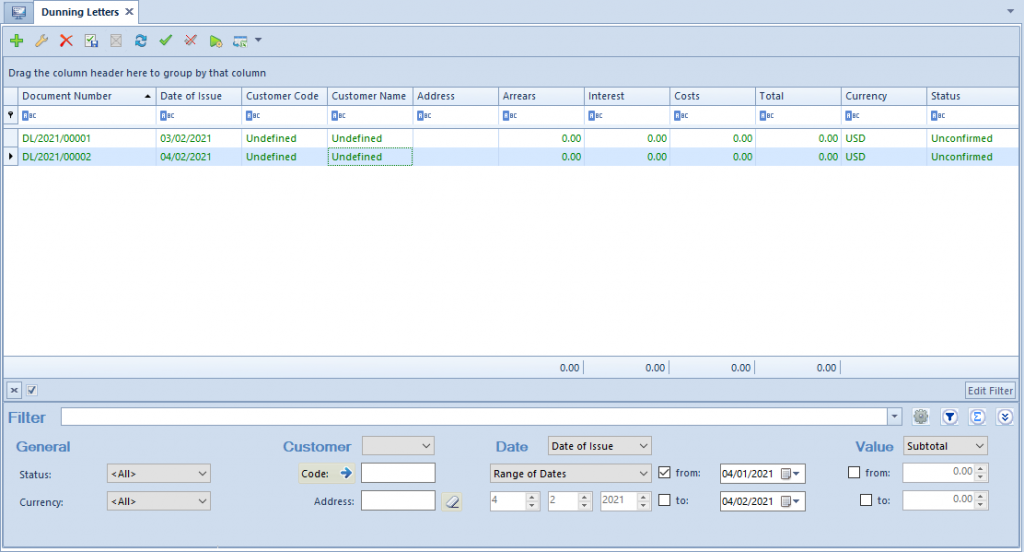

List of dunning letters

The list of dunning letters is available from the level of Finances → Payment Reminders. The list contains <<standard buttons.

The list is composed of the following columns:

- Document Number

- Date of Issue

- Customer Code

- Customer Name

- Address – customer’s address

- Arrears – total of amounts to be paid for receivables indicated in the dunning letter

- Interest – total of interest calculated for payments added to the dunning letter

- Costs

- Total – depending on the setting of the parameter Include interest in amount due in the <<dunning letter definition, this is a total of values Arrears and Costs or total of values of Arrears, Costs and Interest

- Currency

- Status

Detailed description of functioning of the filters can be found in category <<Searching and filtering data>

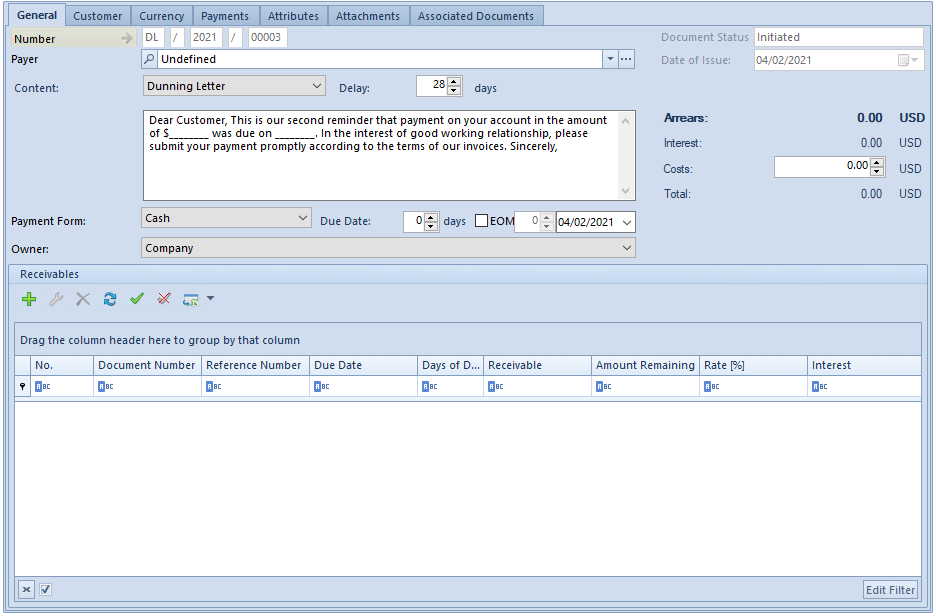

Adding a dunning letter

In order to add a dunning letter, click on [Add] from the List button group.

Tab General

- Number – number of subsequent dunning letter, consistent with the numerator

- Payer – selection of a customer from the list of customers

- Content – e-mail message content

- Zwłoka – liczba dni po terminie płatności określona na definicji dokumentu Wezwanie do zapłaty. Domyślnie jest to 28 dni, z możliwością zmiany. Przykładowo, jeżeli w polu Zwłoka zostanie wskazana liczba 10 to na dokument monitu mogą zostać dodane wyłącznie płatności, których termin płatności minął co najmniej 10 dni temu.

- Delay – number of days after due date, specified in the Payment Reminder document definition. Default value is 28 days and it can be changed at any moment. For example, if in the field Delay, number of days 10 is indicated, it means that a payment reminder document can include payments whose due date is expired for at least 10 days.

- Payment Form – retrieved from the form of a customer indicated as a payer

- Due Date – retrieved from the form of a customer indicated as a payer

- Owner – center of the company structure which is the issuer of a document

- Document status

- Date of Issue – the current date is set by default, without a possibility of changing it

- Overdue – a total of remaining amounts from receivables list

- Costs – it is possible to define a numeric value of costs associated with

maintenance of a specific payment reminder document - Total – depending on the setting of the parameter Include interest in amount due in the <<dunning letter definition, this is a total of values Arrears and Costs or total of values of Arrears, Costs and Interest

General → Receivables

The list is composed of the following columns:

- – ordinal number of added payments

- Document Number – system number of a receivable source document

- Reference Number – number of the receivable’s source document, provided by a user

- Due Date – payment due date

- Days of Delay – number of days between due date and payment reminder date of issue

- Receivable – receivable amount

- Amount Remaining – receivable amount to be paid

- Rate [%] – applicable <<interest rate retrieved from the form of a customer indicated as a payer

- Interest – interest amount charged for payment

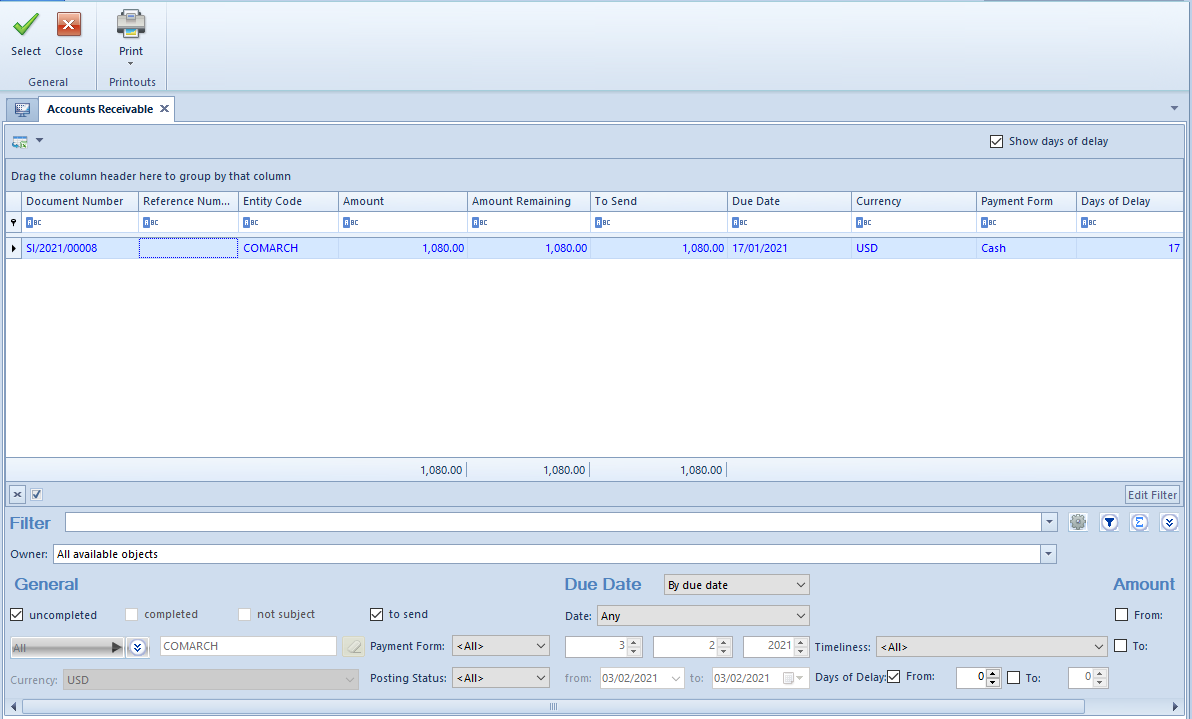

In order to add a receivable, click on [Add] from the Receivables button group. The button opens the list of receivables of a customer selected in the dunning letter, with number of days of delay bigger or equal to the value indicated in the payment reminder. Only payments of confirmed documents can be added to a payment reminder. the exception is an opening balance document.

Tab Customer

In this tab, there is data of a customer selected as the payer in the tab General displayed.

Tab Currency

In this tab, there is information regarding exchange rate and date of the currency of a dunning letter.

Tab Payments

Upon completing dunning letter costs, in this tab, payments of receivable type equal to the amount of costs appears. Their currency and exchange rate are consistent with values in the document.

Tabs Attributes, Attachments, Associated Documents, Change History

Detailed description of the tabs can be found in articles Tab Attributes, Tab Attachments, Tab Associated Documents and History.

On 6.10.2019 a dunning letter with the payment for SI 1/2019 was issued. The amount remaining to be completed for this payment is 8 000.00. On the day of issue of a dunning letter: 6.10.2017, the payment remains open. In dunning letter definition, the parameters of calculating to due date and including interest for late payment have been checked.

- Receivables value: 10 000 USD

- Late payment value: 2 000 USD

- Number of days after due date: 10

- Interest for late payment: 2000 USD *10*0,1/365 = 5.48 USD

- Default payment value: 8 000 USD.

- Number of days which passed since due date (from 5.10 to 6.10): 32 days

- Interest for default payment: 8 000 PLN*32*0,1/365 = 70.14 PLN

- Receivables in a dunning letter document will be presented as follow:

Receivables in a dunning letter document will be presented as follow:

| Document | Due Date | Date of Payment | Days of Delay | Receivable/Payment | Amount Remaining | Rate [%] | Interest |

|---|---|---|---|---|---|---|---|

| SI 1/2019 | 5.10.2019 | 5.20.2019 | 10 | 2 000 | - | 10 | 5.48 |

| SI 1/2019 | 5.10.2019 | - | 32 | 10 000 | 8 000 | 10 | 70.14 |