The possibility of applying the mechanism of split payment according to Polish law results from the act from 15 December 2017 amending the Goods and Services Tax Act. A payment for purchased goods or services with the use of the split payment mechanism is made in a total amount. Next, a relevant VAT amount is transferred by a bank to a separate account. As a result, the payment is divided into:

- sales subtotal amount which is transferred into vendor’s or service provider’s bank account

- tax amount which is transferred into vendor’s or service provider’s VAT account

The split payment mechanism may be used only in reference to transactions paid on account of other taxpayers. It can be used only for payments made by bank transfers in PLN.

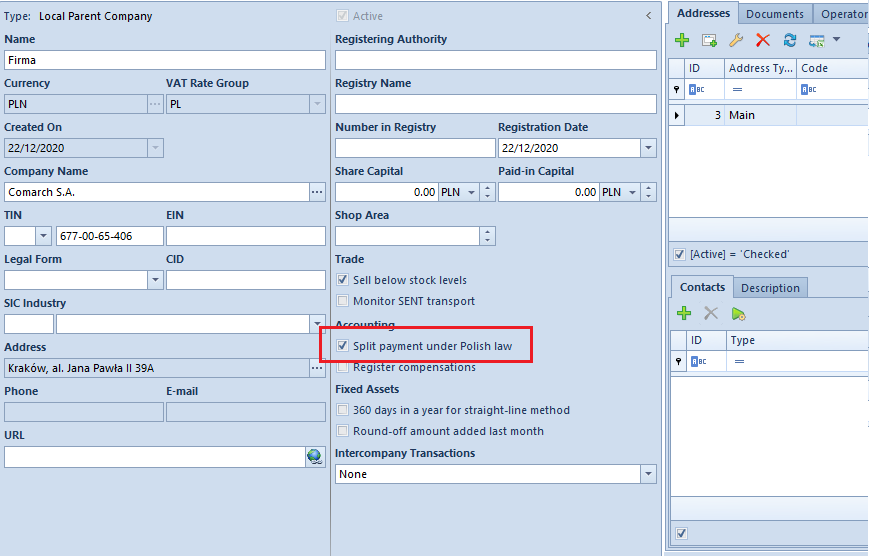

The split payment mechanism is only available in the system if the parameter Split payment under Polish law has been selected from the level of Configuration → Company Structure → Rights Structure in the definition of a center of the Company type. The parameter is unchecked by default and it can be activated at any moment.

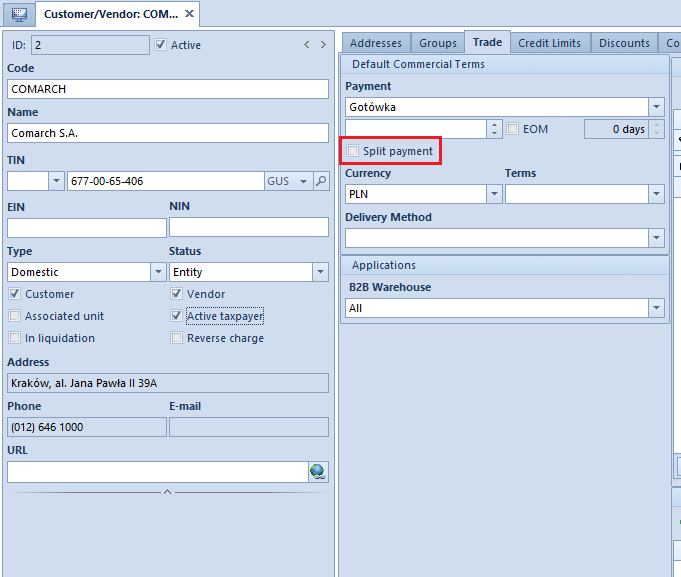

The system makes it possible to specify that by default payments with a given customer/vendor should be made in the split payment mode. A parameter enabling such configuration can be found on the <<customer group>> and the <<customer form>>.

It can be checked only if the following requirements are met:

- Customer status set as Entity

- Customer type set as Active taxpayer

- Payment currency set as PLN