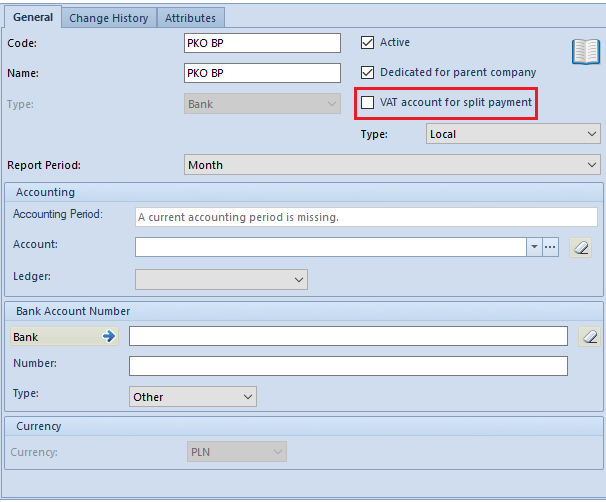

In the system, it is possible to define a bank account that would keep record of transactions made only on a special VAT account associated with a current account. Ti do so, it is necessary to select the parameter VAT account for split payment on the form of a Bank account.

To make the parameter VAT account for split payment available for selection, the following requirements need to be met:

- Account currency – PLN

- Account type set as Bank

- Account sort set as Local

If the user selects the parameter, the system will block the possibility to change the account’s currency and types.

The list of cash/bank accounts contains VAT Account column (hidden by default) which indicates whether on the definition of a given register the parameter VAT account for split payment is checked.

Each split payment transaction consists of two entries:

- main operation for the entire total amount

- additional operation which posts a VAT amount between a current account and a VAT account

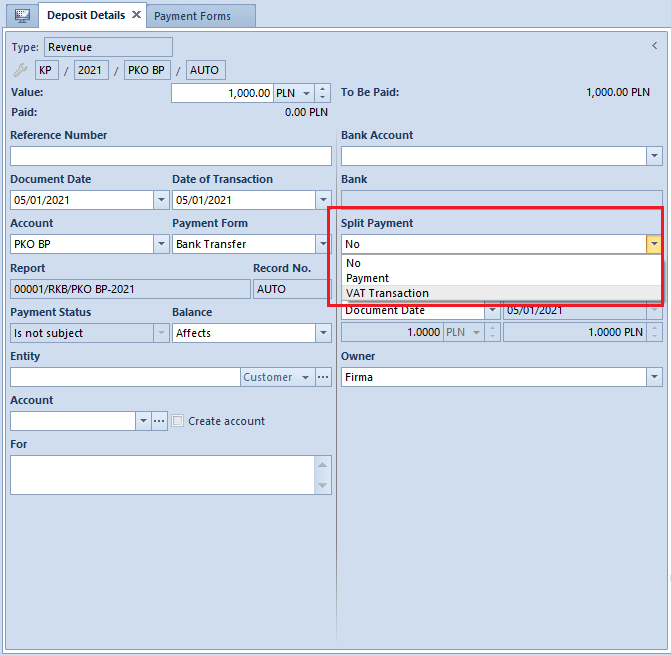

On the side panel of a bank transaction, there is a Split Payment control which, depending on the type of transaction, may assume one of the following values:

- No – it specifies that the split payment mechanism will not be used to pay for a given receivable/payable

- Payment – it specifies that the split payment mechanism will be used to pay for a given receivable/payable

- VAT Transaction – it tags marks the technical transaction of posting into a VAT account

In a transaction added to an account tagged as VAT account for split payment, the parameter is set automatically as Split payment: VAT Transaction without a possibility to change it and the value Is Not Subject is set in the column Payment with a possibility to change it.

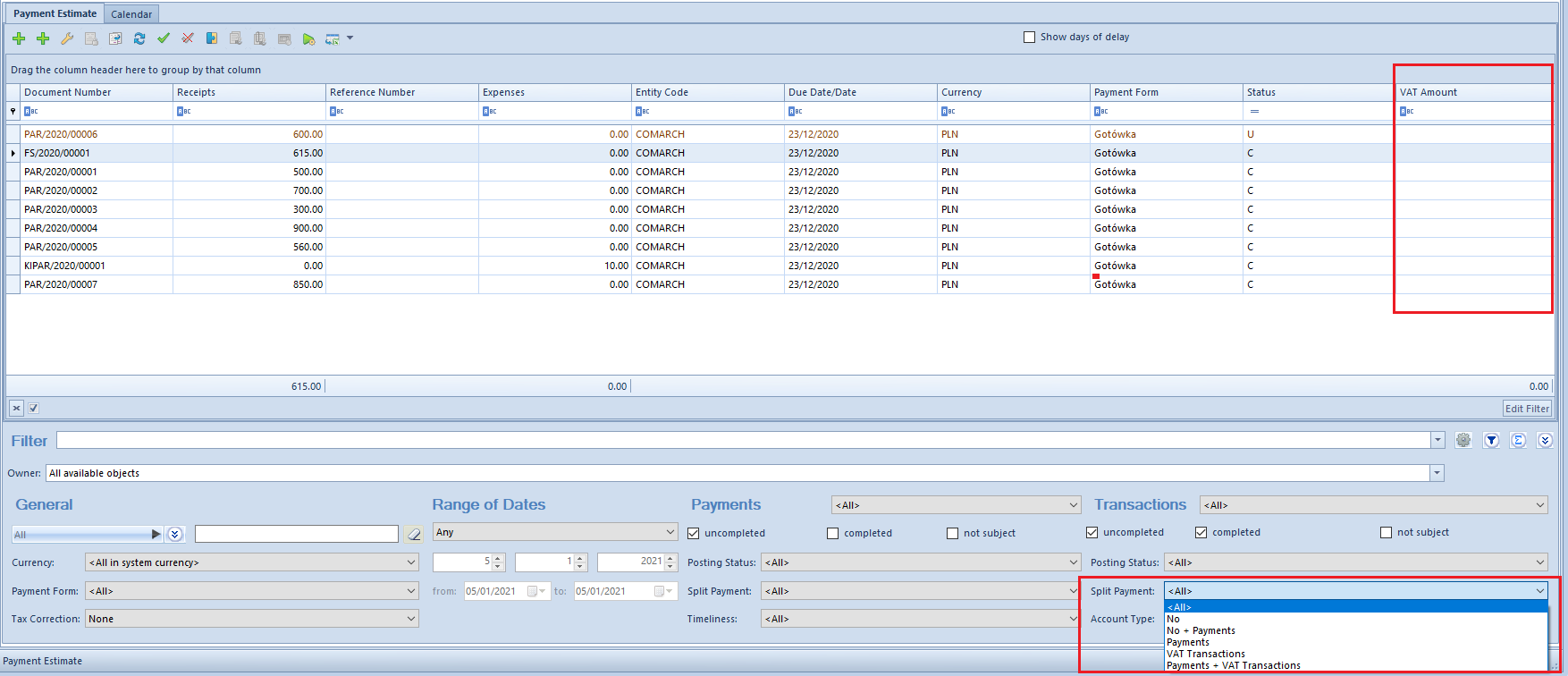

On the lists Payment Estimate and Customer/Vendor Payments, the user may filter bank transactions related to split payment. For that purpose, the filter Split payment with the following values is available:

- <All>

- No

- No + Payments

- Payments

- VAT Transactions

- Payments + VAT Transactions

It is also possible to display the column VAT Amount (hidden by default) which presents VAT amount for bank transaction tagged as Split payment: VAT Transaction.