Split payment mechanism in the export of statements of remittance orders and import of bank statements Split payment

In the system, it is possible to export statements of remittance orders containing payments marked as Split payment and import bank transactions relating to split payment mechanism – payment transaction or transactions of posting VAT amounts.

Exporting statements of remittance orders

Payments of split payment type may be exported with the use of the same format as the other payment or with the use of a separately defined transfer format.

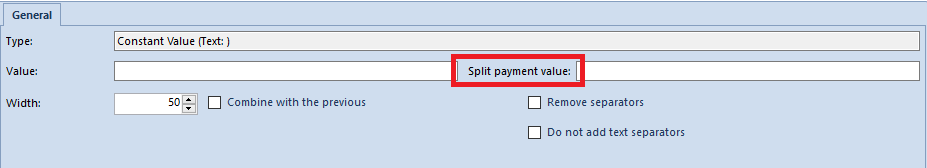

To properly handle a split payment transaction code, the user needs to modify a variable responsible for that transaction. For that purpose, it is possible to use the field Constant Value. Upon selecting this field in the format definition, it is necessary to edit it and fill in the field Split payment value with a relevant string of characters according to the requirements of a given bank.

The user may handle bank transfers connected with the split payment mechanism in one of the two ways:

- With the use of fields dedicated to split payment available in the transfer format definition

- With the use of the parameter Support split payment available for the field For

Handling transfers by means of dedicated fields

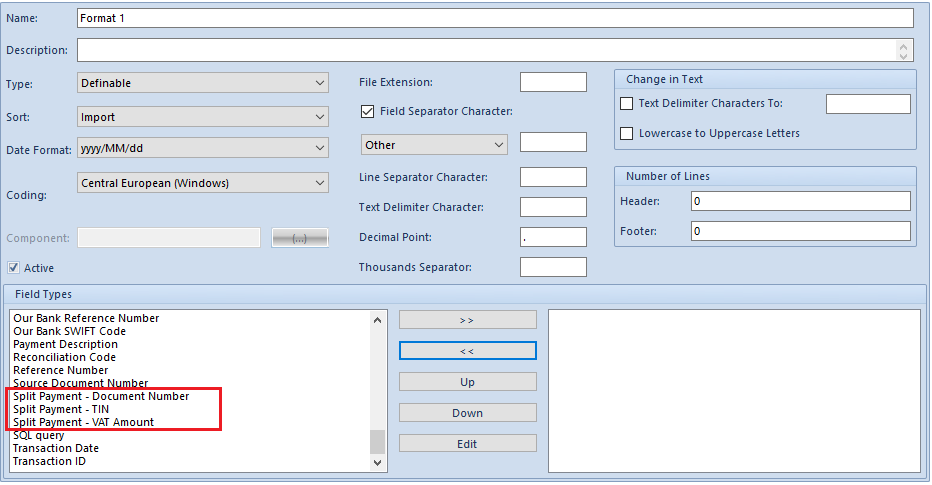

Fields contained in the transfer format definition which can be used to handle the split payment mechanism include:

- Split Payment – VAT Amount – a VAT amount to be sent from a payment

- Split Payment – TIN – a subject’s TIN transferred from a payment without hyphens and prefixes

- Split payment – document number – reference number from a payment

Parameter Support split payment

Another method of handling bank transfers related to the split payment mechanism uses the Support split payment parameter available in the transfer format definition for export in the case of the following fields:

- For

- For – Document Numbers

- For – Document Numbers and Amounts

- For – System Numbers and Amounts of Documents

- For – Document Numbers and Amounts

After selecting an appropriate field in the format definition, it is necessary to edit it and activate the parameter Support split payment. As a result, the system will automatically add the following string of characters before a transfer title in payments marked as split payments: /VAT/VAT Amount /IDC/Customer TIN /INV/Document number /TXT/Payment description

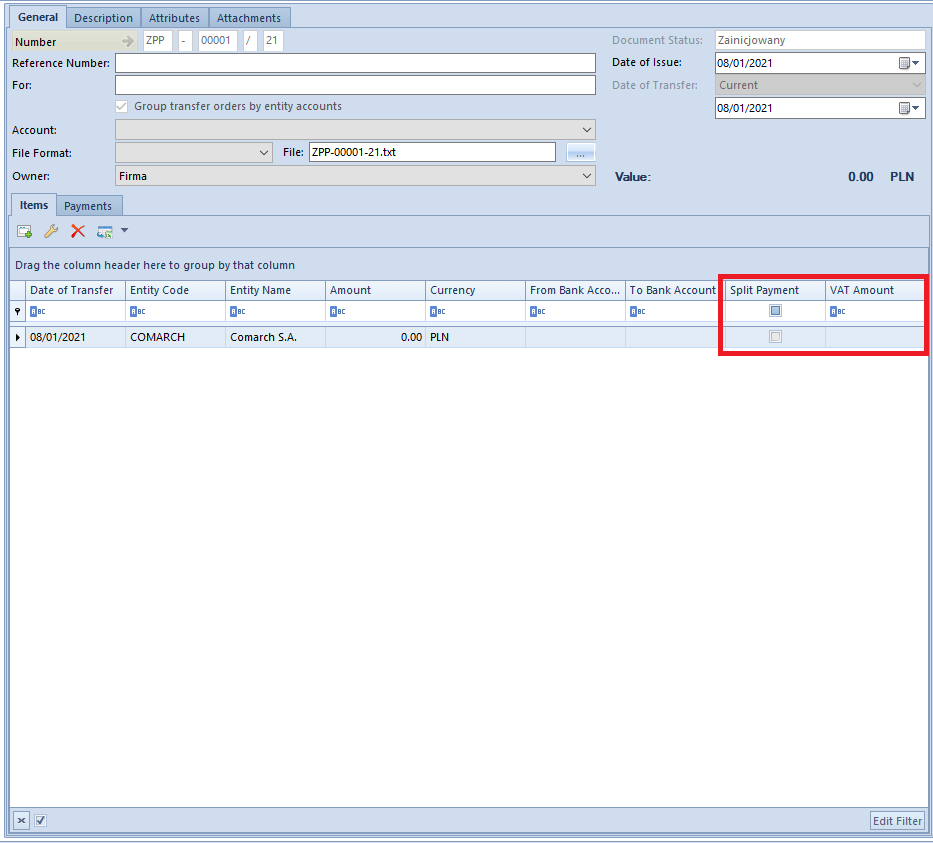

In a <<statement of remittance orders>>, in the Elements and Payments tabs, besides the standard columns, there are two columns available: Split Payment and VAT Amount. They inform whether a given payment is of the split payment type and present the value of a VAT amount to be sent for a given payment. The value of the column Split Payment is retrieved in accordance with the setting of the parameter Split payment in a given payment. The value of the column VAT Amount of a given SRO document is transferred from the payment. In case of changing of the transfer amount in an SRO document, the amount is updated automatically (proportionally to the transfer amount).

VAT Amount = 500 / 1230 * 230 = 93.50 PLN

To enable the export of a payment of the split payment type, the following information must be provided in it:

- VAT Amount

- Customer’s/venord’s TIN

- Document number

Importing bank statements

When importing a bank statement, the user will receive two entries for transactions of the split payment type:

- entry relating to the main operation for the entire total amount

- entry regarding split payment operation which posts a VAT amount between a current account and a VAT account

While importing most bank statements with the use of the MT940 format and importing flat files, the column for will display the same content for both the main transaction and the technical posting of VAT between accounts. After a bank statement import, the system will automatically select the following parameters in the transactions:

- Split Payment: Payment – in main transactions

- Split Payment: VAT Transaction – in technical (VAT) posting transactions.

In transactions recognized as Split payment: VAT Transaction will be automatically assigned with the parameter Payment: Is not subject with a possibility to change it by the user.