Changes to ZD notifications

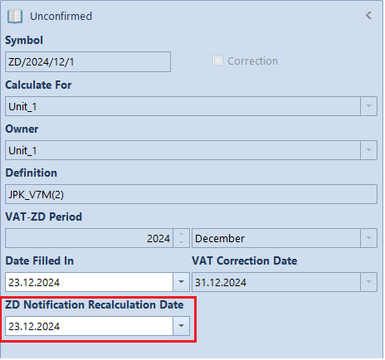

In the heading section of ZD notification, there is a new field ZD Notification Recalculation Date. It decides which documents will be included in Debtor and Creditor tabs. When recalculating a ZD notification correction, the recalculation date can be changed to the date specified in the original ZD notification.

Documents in the Debtor/Creditor tab are recalculated according to the date specified in the ZD Notification Recalculation Date field.

Example

Open VSI issued on 04.06.2021 with due date 18.06.2021. The invoice was still not paid in September 2021, thus when recalculating a JPK_V7M for September 2021, that invoice was included in the ZD notification. Both the JPK_V7M and the ZD notification were recalculated on 20.10.2021.

When issuing a correction to the JPK_V7M for September 2021, a ZD notification correction is generated, which recalculation date is automatically set to 20.10.2021. Based on this date, the documents from 2 years ago are retrieved counting from the beginning of the calendar year, i.e. 01.01.2019 – 20.10.2021, whereas for tax returns issued from 10.2021, documents from 3 years ago are retrieved lawfully.

When issuing a correction to the JPK_V7M for September 2021, a ZD notification correction is generated, which recalculation date is automatically set to 20.10.2021. Based on this date, the documents from 2 years ago are retrieved counting from the beginning of the calendar year, i.e. 01.01.2019 – 20.10.2021, whereas for tax returns issued from 10.2021, documents from 3 years ago are retrieved lawfully.