Credit limit is a trade credit-related functionality. This is a relationship in which the parties extend credit to each other without the involvement of a bank. With this form of crediting, the recipient does not pay right away for the purchased goods or services but after a certain period of time.

In order for a user to be able to control the value of merchant credit, the operator group to which the user is assigned must have the Modification of credit limits permission (Configuration → Company Structure → Operator Groups → Other Permissions).

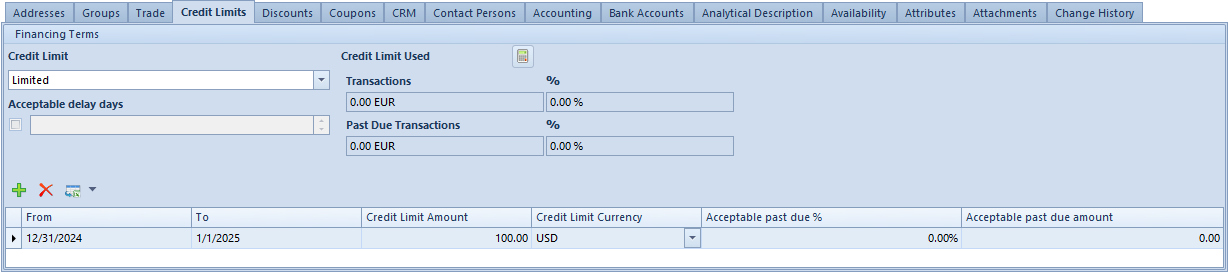

Furthermore, a credit limit needs to be defined on customer form under Credit limits tab. This tab is not available for entity registered as a vendor only.

The following credit limits can be defined:

- open – when Credit limit – Open parameter is selected, a customer is allowed to borrow from a vendor in unlimited amount, the list of credit limits is grayed out and no limits are taken into account.

- from alternate customer’s form – this type of credit is used to grant a single pool of credit to multiple customers. Selecting the option From alternate customer’s form deactivates the credit limit section and activates the field for selecting a customer.

- limited – to define this type of credit limit, select the [Add] button in the Credit Limit Used Selecting the button adds a new row to specify the following:

- From/To – time range within which the specified credit limit is applicable. Dates can be selected using the built-in calendar under the arrow button.

- Credit Limit Amount – credit limit value a customer may use within the previously specified time range

- Credit Limit Currency – the currency in which a credit is granted to the customer. A drop-down list contains all currencies defined in the system. The default currency of credit limit is the one associated with the customer.

- Acceptable Past Due % – this value can be defined after the Acceptable days past due parameter is selected

- Acceptable Past Due Amount

Once the credit limit type is selected, you can set the allowed number of days past due and in the credit limit line also how much the overdue percentage should be:

- Acceptable days past due – this parameter validates the maximum number of days past due. If the payment is late by more than the specified number of days, the system reacts as if the credit limit has also been exceeded for the open credit limit option.

- Past Due Transactions – shows the amount of credit limit used after the maturity date

If credit limit is activated for a customer, then the system validates whether it is exceeded whether there are any overdue payments. The amount of debt does not increase the value of the used credit limit. However, it does affect the possibilities for document confirmation.

The number of credit limits is not limited by the system. In the list, they are colored according to the period for which they were defined:

- black – credit limit from a past period

- light green – active credit limit

- green – credit limit covered today

- blue – credit limit with start date later than today’s date

- red – misdefined credit limit

You must also specify the level of credit limit control when confirming documents for released items to configure trade credit (Configuration → Company Structure → Company → Documents → definition of selected document type).

By editing the settings of these document types: SI, SO, R and SOR, you can specify an alternate control method for each of them. Selectable options are:

- Don’t control – when confirming a document, the system does not validate whether the customer for whom the document is issued has a sufficient credit limit to cover the resulting payable, it simply grants the credit.

- Warn – if the customer does not have sufficient funds to cover the payable, the system notifies the operator that the credit limit has been exceeded.

- Block sales transactions – the system blocks document confirmation and requests payment if the credit limit of the customer for whom the document was issued has been exceeded; the document is saved in the database as unconfirmed.

Calculating available credit limit

Above the list of defined credit limits, there is a calculation button for calculating the amount and percentage values and informing about transactions and overdue transactions.

The following values affect the balance of the credit limit:

Increase in balance

- Balance of receivables:

- Open amounts of all payments of Receivable type

- Total amounts of all SOR documents not associated with SI

- Values of confirmed sales orders, the processing of which has not started (no documents have been generated from them)

- Balance of deposits/withdrawals:

- Open amounts of all cash/bank transactions of Deposit type

Decrease in balance

- Balance of payables:

- Open amounts of all payments of Payable type

- Total amounts of all POR documents not associated with PI

- Values of confirmed purchase orders, the processing of which has not started (no documents have been generated from them)

- Balance of deposits/withdrawals:

- Open amounts of all cash/bank transactions of Withdrawal type