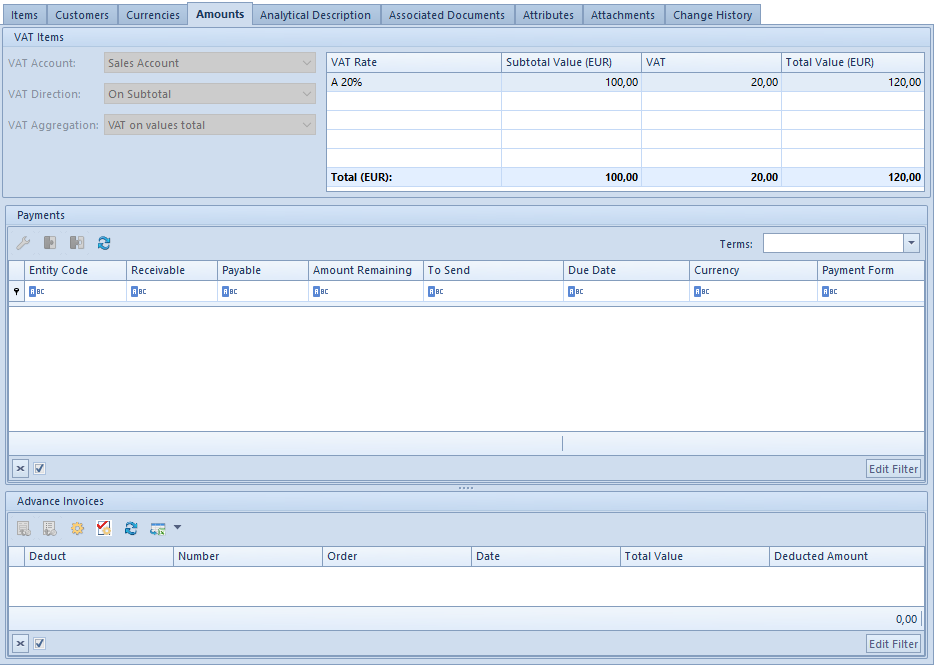

This tab presents detailed information regarding document’s VAT amounts, associated payments and advance invoices. The tab is not present on purchase/sales inquiries. On other documents it is divided into two or three sections: VAT Items, Payments, Advance Invoices.

VAT Items

This section allows for defining the following data:

VAT Account – defines VAT account in which a VAT invoice is registered. VAT accounts are defined in Accounting module.

VAT Direction – determines method of calculation of VAT, which can be calculated on subtotal or total prices. A default value for this field for individual documents can be defined in documents definitions. The exception are advance invoices and receipt, for which the parameter always assumes the value On Total and is not editable. Depending on entered settings, item prices on documents are displayed and edited as total or subtotal prices.

In a document definition, the user can select one of three options defining the default VAT direction on particular documents – on subtotal, on total and depending on customer status.

If the option Depending on customer status has been selected, then:

- if a document is being issued for a customer/vendor with status Entity, the system sets the direction as On Subtotal

- if a document is being issued for a customer/vendor with status Retail Customer, the system sets the direction as On Total

When changing the customer on a document in definition of which the parameter concerning the method of calculating VAT is set as Depending on customer/vendor status, the system changes the direction of VAT calculation only on condition that there are no items added to the document yet.

VAT Aggregation – defines values on which the VAT has to be calculated. There are two possibilities:

- Total of VAT Items – each item has its value of VAT calculated separately, including its subtotal and total value. Total VAT value for the whole document is equal to the VAT total of individual items and the combined subtotal and total value of a document is the sum of items with the subtotal value and the sum of items with total value, respectively.

- VAT on values total – depending on the setting of the parameter VAT Direction, each document item has its total or subtotal value calculated. If there are items with different VAT rates, the system divides them into groups and sums items value in each of them. Then It calculates VAT on each group value. The total VAT value of a document is equal to the total of all the rate groups. It is a default value of the parameter VAT Aggregation for most documents.

In the case of advance invoices, VAT aggregation always assumes the value VAT on values total and is not editable.

A default value of the VAT Aggregation parameter on a document can be specified in particular documents definitions.

Subtotal/Total value of one document and particular items may slightly differ, depending on settings of the parameters VAT Aggregation and VAT Direction.

Reverse charge – the parameter allows for reverse charge handling on a document. The value of the parameter is retrieved from customer/vendor form and can be changed until the Transaction Type is changed into a different than National or until the document is confirmed. More information regarding reverse charge handling can be found in article Reverse charge.

VAT table is filled in automatically after adding an item in the tab Items of a document. It presents summary of a whole document, both in the system currency and in the document currency. If a document contains items with different VAT rates, then the VAT table shows totals of values split into particular VAT rates.

In the case of final invoices (sales and purchase) which include advance invoices, VAT tables for particular VAT rates present advance values derived from those advance invoices. These values are presented with the sign “- “.

The user can edit VAT table records on unconfirmed purchase invoices, advance purchase invoices and on their corrections. Such an edition concerns subtotal value, VAT value and total value, both in the system currency and with the document currency, with a reservation that on a purchase invoice including advance invoices there is no possibility of modifying values referring to those advance invoices.

Such a solution makes possible to determine the above-mentioned values in accordance with the values derived from an invoice/correction received from a vendor. Discrepancies appear if on an invoice issued by a vendor have been applied methods of VAT calculation (on subtotal/total, total of VAT items, VAT on values total) different than when registering a document in Comarch ERP Standard.

Usually, the differences are minor, however the scope of changes which can be used by an operator in Comarch ERP Standard is wide. Limits result mainly from the character of modified documents. The scope of edition of particular documents is presented in the following table:

| Document | Field edition scope | |||

| Subtotal (SV) | VAT | Total (TV) | ||

| calculation direction On Subtotal | calculation direction On Total | |||

| PI/API | SV ≥ 0 | VAT ≥ 0 | 0 ≤ VAT ≤ TV | TV ≥ 0 |

| SIQC/APIVC | SV ≤ 0 | VAT ≤ 0 | TV ≤ VAT ≤ 0 | TV ≤ 0 |

| SIVC | any edition | |||

Edition of one value in a table record causes an automatic change of the other values of that record and of the table summary. However, the change of one of currency document items causes change only on the other values in a given currency. The values in currencies different than the modified one remain without changes and are not recalculated. A possible change has to be made by the operator.

During the edition, the system maintains the principle: subtotal + VAT = total. An exception is a situation when all the values have value equal 0, then the system “artificially” modifies one of the values. If VAT on a document is calculated on total on the level of 0,01 and on PIQC/APIVC on the level of -0,01. The same applies to documents on which the VAT is calculated on subtotal, for PI/API the system sets value on the level of 0,01 and for PIQC/APIVC on the level of -0,01.

Change made in the VAT table has an impact on document header value and on payment value. It does not have any impact on value of document items.

Amounts

The second part of the Amounts tab contains a list of payments associated with a given document, which similarly as the VAT table is filled automatically with data, immediately after entering an item into a document.

Immediately above the list there is Terms field, which in case of applying appropriate settings on customer/vendor form, is automatically uploaded or its value can be selected manually from a predefined terms list defined in Configuration (Finances) Types of Terms. It is not possible to specify terms on a receipt.

While issuing a document, the system suggests one payment for the document basing on the values of fields in document header, particularly on the value of field Payment Method. The user can edit it or add another one (e.g. when customer pays partially in cash and partially by card or in several instalments). If the document value decreases, the system appropriately decreases payment with the latest due date and, in case it is necessary – deletes it. If the document value increases, then, if the document contains one payment, the system appropriately increases its value and if the document contains many payments, the system adds another payment.

Changes can be applied on payments only until a document is completely paid. Only invoices (SI/ASI/PI/API) and receipts are subject to completion. It is not possible to complete a document before it is confirmed. Payments on orders and quotes documents are only expected payments and they are not subject to completion. More information concerning dividing, combining and completing payments can be found in category Payments.

The list contains the following information:

Entity – payer’s name

Receivable – value of receivable

Payable – value of payable

Amount Remaining – amount remaining to be paid

Due Date – payment date by which a customer should settle their payment with vendor. In the case of payments on quotes and order, the field may contain information about number of days from invoice date until when the payment must be made.

Currency – symbol of the currency in which the payment has been generated. It is automatically consistent with the document payment, unless the user has changed it. However, it should be remembered that a document can be issued in a currency that is different than the payment currency.

To Send – the field informs about amount which should be entered in a transfer document in order to clear the payable in respect of a vendor

Advance invoices

The third part of the tab Amount is called Advance. Until a document is confirmed, this panel displays all advance invoices fulfilling the following criteria:

- they have Confirmed status

- the customer on advance invoice is the same as the customer on final invoice

- the currency of the advance invoice is consistent with the currency of the final invoice

- they have not been fully completed on another final invoice

- center defined on an advance invoice is available for a center selected in a final invoice

- they are not marked for deduction on another unconfirmed final invoice

- they have not been fully corrected

- the value of the parameter Reverse charge in advance invoice header is the same as the value of this parameter in final invoice header

After a document is confirmed, only the invoices which have been deducted on a given invoice are displayed.

Advance invoices are handled with the use of the following buttons:

[Edit Advance Payment] – displays preview of a selected advance payment without possibility of editing it

[Edit Order] – displays preview of a selected order without possibility of editing it

[Check Amount to Deduct] – opens a window containing information about the number of a currently highlighted advance invoice and the amount to deduct defined by the operator, as well as a list containing the following columns:

- VAT Rate – information about VAT rates included in a given advance invoice

- Advance Payment – value of advance payment assigned to a given VAT rate

- Remaining to Deduct – amount remaining to deduct for a given VAT rate derived from a given advance invoice (this is the value of the maximum advance payment for a given VAR rate reduced by the amount already deducted on other final invoices and corrected by corrections issued to advance invoices)

[Recalculate Deducted Amount] – displays a window total of amounts that can maximally be deducted from advance invoices with checked parameter Deduct. It allows for entering value from a range from 0 to the maximum amount that can be deducted. Splitting the amount between marked advance invoices is performed in accordance with the selected FIFO/LIFO option of the parameter Method of dividing deducted amount among advance invoices on SI/PI document definition

[Update] – updates advance invoices list

[Export to Spreadsheet] – the button allows for exporting data to an Excel spreadsheet with possibility to select one of the options: DataAware (default option) or WYSIWYG. The user can set default export mode from the level of System Configuration Computer Default Export Mode.

In case of selection of the following export mode:

- DataAware – generated file presents data in accordance with conditioning rules applied to the list

- WYSIWYG – generated file presents data in a layout similar to the layout displayed on the screen

The list contains the following fields:

Deduct – selected parameter decides whether a given advance invoice has to be deducted from a final invoice

Number – advance invoice number

Order – number of purchase/sales order to which an advance invoice has been issued

Date – this column contains date of issue for ASI or date of receipt for API

Total Value – total value of a given advance invoice

Deducted Amount – amount which has to be deducted from a given advance invoice. Upon checking parameter in column Deduct, field in column Deducted Amount becomes editable. By default, it displays a maximum value of advance payment that can be deducted from a given advance invoice. The operator can specify a different amount, but the maximum amount possible to deduct cannot be exceeded.