General information

An FDP document is registered in the system in order to calculate the depreciated value of a fixed asset. Depreciation is a type of cost related to gradual wear and tear of fixed assets and intangible assets. However, it does not generate cash outflow.

An FDP document can be generated:

- automatically when saving a fixed asset form

- with the use of button [Depreciation/Amortization]

- manually

An FDP document is generated automatically while saving a fixed asset of Fixed Asset or Intangible Asset type, provided that the Value Updated at the Beginning of Period has been specified on the fixed asset form for any of the depreciation areas. An FDP document created this way, on item details, has date:

- of transaction set to the last day of the previous calendar year − if all depreciation areas are associated with a calendar year

- of transaction set to the last day before the accounting period including date of physical addition of a fixed asset − when all depreciation areas are associated with an accounting period

Values specified in an FDP document affect the parameters Write Offs at the Beginning of Period and Write Offs in Current Year available on the form of fixed asset.

Description of how to generate write-offs using the option [Depreciation/Amortization] can be found in article Generating depreciation and depreciation plan.

An FDP document can be registered from the level of:

- the menu Fixed Assets → Fixed Asset Documents

- the menu Fixed Assets → Fixed Assets upon selecting first particular fixed asset records

- the Fixed Asset Documents tab on the form of fixed asset

An FDP document can be generated to the fixed assets for which a FA document has been generated and which have not been fully disposed or sold. To add an FDP document, select the button [Add Document] followed by the option [Depreciation] available in the drop-down list. A form for entering data will open.

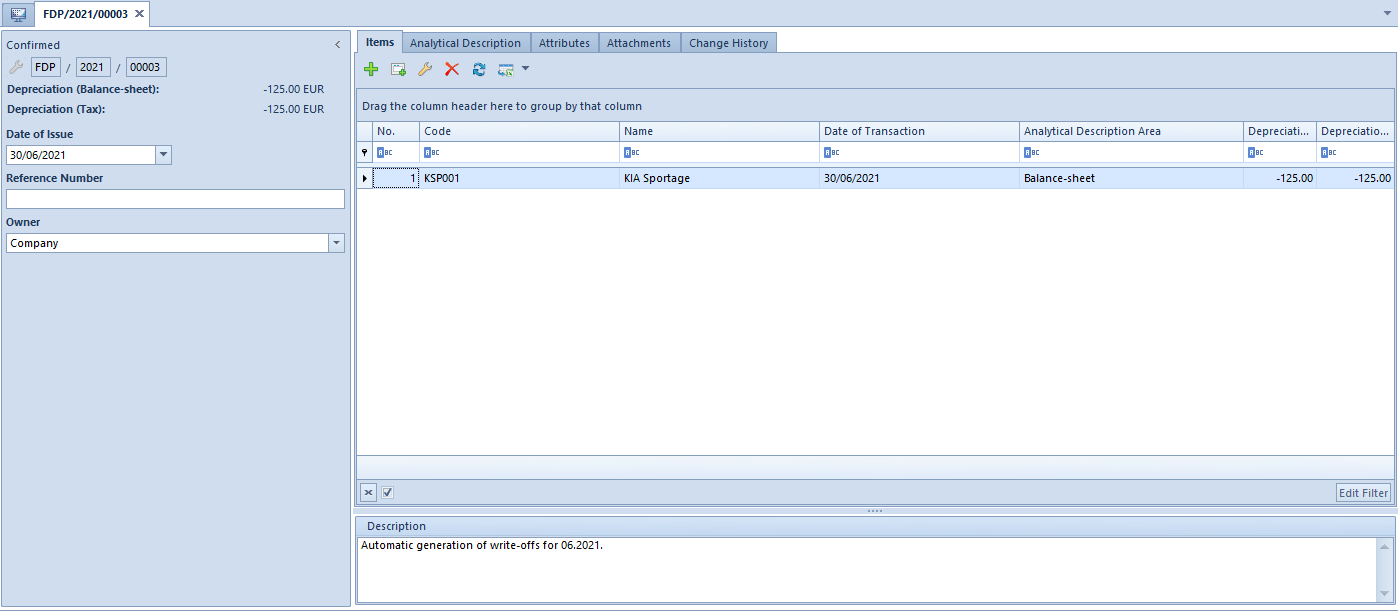

The FDP document form is composed of the following elements:

Side panel

Number – document number granted automatically by the system according to the document numbering definition.

Depreciation (Balance-Sheet/Tax/IAS-IFRS) – fields of information purpose. Their visibility depends on the activated depreciation areas in the system configuration window. They present total values of items for particular depreciation areas.

Date of Issue

Reference Number – number entered by the user for the purpose of additional identification of the document

Owner – center to which the user registering a document is assigned. This field is not editable.

Tab Items

In the system, it is possible to add document items in two ways: directly in the table or through form.

Adding GDP document item in the table

To add an item directly in the table, select the button [Add] from the button group Items. A new row will appear in the item table. Here it is necessary to select a fixed asset as well as to complete the following columns: Date of Transaction, Analytical Description Area, Depreciation (Balance-Sheet/Tax/IAS-IFRS) as well as the column Description that is hidden by default.

Adding FDP document item through form

To add FDP items through form, select the button [Add Through Form] from the button group Items.

A window Item Details will open, containing the following fields:

Side panel

Code – fixed asset code selected from the fixed asset form

Name – value completed automatically on the basis of the fixed asset form. The names of fixed assets are displayed in the system logon language.

Date of Transaction – the date of transaction is by default copied from document header and is changeable

Analytical Description Area – selectable from among the depreciation areas activated in the system configuration window. The analytical description areas that on a fixed asset form have been selected in the Analytical Description tab are activated by default. Depending on the selected options, the document can be described analytically according to the values of the indicated depreciation area.

Depreciation (Balance-Sheet/Tax/IAS-IFRS) – available options that can be completed depend on the depreciation areas activated in the system configuration window and on the fixed asset form. The value that is specified first for one of the active areas is copied automatically to other areas (both active and inactive areas). Changes to either of the active value are not copied to other active areas.

Description – section for additional information on a given document item. In FDP documents generated via the option [Depreciation/Amortization], the description is automatically filled with the following information “Automatic generation of write-offs for [month and year]”. The same description appears in an FDP document after the parameter Write Offs at the Beginning of Period is specified on the form of fixed asset.

Tabs Attributes and Attachments

Detailed description of the tabs Attributes and Attachments can be found in articles Tab Aittributes and Tab Attachments.

Tab Analytical Description

From the level of document item, in the field Analytical Description Area it is possible to specify a depreciation area by which the values of analytical description can be completed in fixed asset documents from. Depreciation areas can be selected from among the areas activated in the system configuration window.

Detailed description of the functionality can be found in category Analytical description.

Tabs Attributes, Attachments and Change History

Detailed description of the tabs Attributes, Attachments and Change History can be found in articles Tab Attributes, Tab Attachments, Change history.