A value correction allows for:

- changing sales or purchase

- correcting a given value of a document

- changing document item value by a specific percentage

Such a change is made in relation to price/value provided on the source document. In the case of advance invoice corrections, only advance payment amount can be corrected, not price of items.

In order to issue a value correction, it is necessary to mark a relevant document on the list and click on button [Correct – Value] in the main menu in the group of buttons Corrections. The form of a correction with the filled in data, which is similar to the source document form, will be opened. The following fields are editable:

- document date

- reference number

- field Handled By

- center issuing a document

- description

- VAT account

- price and quantity of a given subitem

Values of the other fields must be consistent with those in the source document; therefore, they are inactive.

By default, the price/value after the correction is equal to the price/value before the correction. In order to make changes:

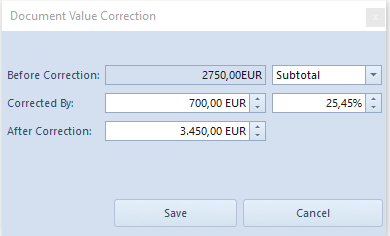

- it is possible to select button [Correct Value], which opens a window containing the following fields:

- Before Correction – this field is not editable, it presents document value before correction in the document currency. In case other corrections have been issued previously, they are included in the filed Before Correction.

- Field allowing to indicate whether total or subtotal value should be corrected. Its value is set according to the VAT direction on the document with a possibility of changing it. The change does not result in changing VAT direction for the whole document.

- Correct by – field allowing to insert an amount by which the whole document value should be decreased or increased

- Field with percentage value – allows for specifying percentage by which document value should be corrected

- After Correction – document value after correction

After saving introduced changes, correction value is divided into individual correction items:

In case VAT direction in a document is the same as VAT direction in the correction window, value from field Corrected By will be divided, proportionally to correction item values, subsequently into items of that correction.

In case it is not possible to divide the entire corrected value, the system divides the maximum possible value and displays appropriate message.

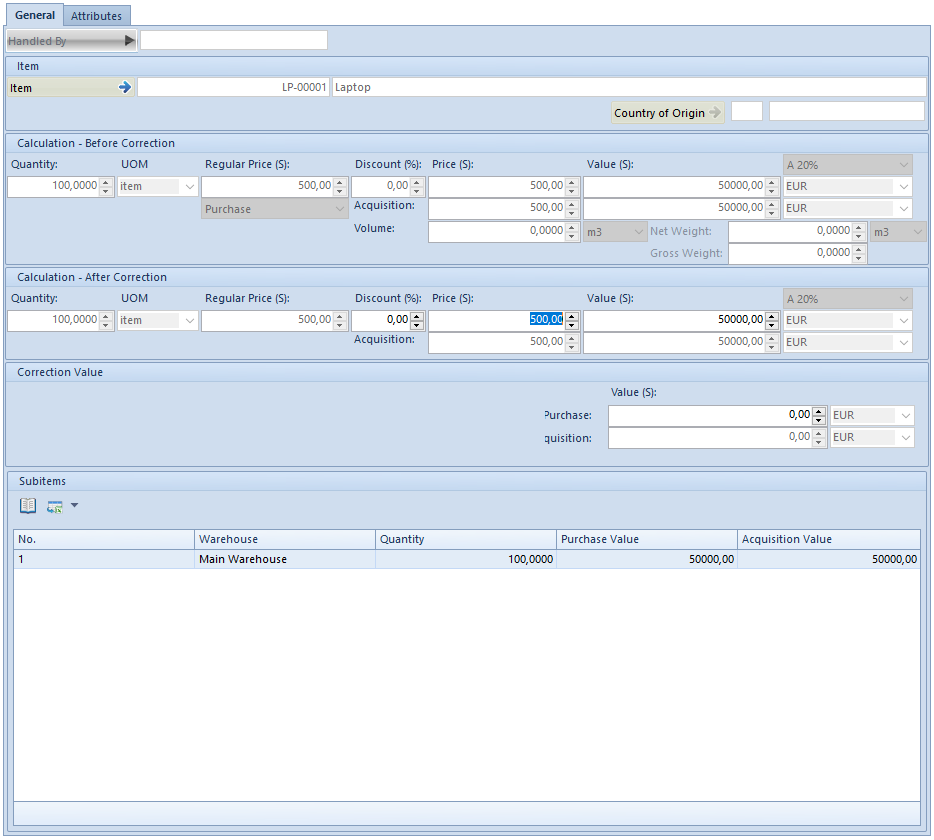

- in prices/values, it is necessary to edit individual correction items

The edition form of items of a value correction is almost identical to the edition form of items or a quantity correction. Unlike the quantity correction, the discount, the price and value of an item are editable in section Calculation – After Correction as well as the value in section Correction Value. When changing values of one of these fields, the value of others is automatically recalculated. In addition, value corrections of documents for released items do not have section Subitems, but their corrections include fields with acquisition value and prices, however, these fields are not editable.

The value correction, in contrast to the quantity correction, can be issued “in plus” as well as “in minus”. In the first instance, the price/value of item is increased in relation to the price of the source document, in the other – the price is decreased. An exception is constituted by advance invoice corrections which can be issued only “in minus” and which decreases the amount an advance payment deposited.

After inserting correction value, the system automatically calculates new item price/value. However, it is not possible to edit values directly on subitems, as it is possible in the case of quantities on quantity corrections. If an item contains more than one subitem, the system divides value of the correction proportionally to all subitems.

Description:

Document Item quantity Item price

SI 10 5

SIVC1 10 7 (previous value: 5)

SIVC2 10 6 (previous value: 7)

The combined correction value is equal to the sum of the values of corrections of the individual items.

The VAT table is calculated in a similar way as in the other documents. Furthermore, it should be remembered that any VAT rates of items cannot be modified in a correction, which means that the items being corrected have the same VAT rates as the ones in the source document.

Confirmation and cancelation of value corrections of warehouse documents for received items results in:

- generation of cost corrections to confirmed warehouse documents (SOR, IR-, WM-. WM+), which are releasing the resources from POR or IR+ being corrected, and to their quantity corrections (SORQC, IR-QC)

- update of purchase costs in initiated and unconfirmed warehouse documents (SOR, IR-, WM-) which are releasing the resources from POR or IR+ being corrected

- update of values of resources from POR or IR+, which are still in stock