VAT rate correction allows for correcting VAT rate for the following documents:

- sales invoice

- receipt

- SO release

There is also a possibility to issue a manual VAT rate correction to receipts and sales invoices.

In order to issue a VAT rate correction, it is necessary to mark a relevant document on the list and click on button [Correct VAT Rate], which opens correction form with the filled in data, is similar to the source document form. The following fields are editable:

- document date

- field with the reason for correction

- reference number

- payment method

- due date

- field Handled By

- reason for VAT exemption

- delivery method

- reference number

- center issuing the document

- customers ‘/vendors ‘addresses

- description

- VAT account

- attributes

- analytical description

- VAT rate on a given item

The other fields must be consistent with the source document; therefore, they are inactive.

A user can change VAT rate from the level of:

- items list – to do so, in column VAT Rate After Correction, it is necessary to expand the list and select appropriate VAT rate

- item details – do to so, it is necessary to edit an item and in section Calculation – After Correction, in the field with VAT rate, indicate a correct value

Form of item details allows for editing VAT rate in the section Calculation – After Correction. Changing the value of this field causes an automatic recalculation of subtotal or total value and of correction value.

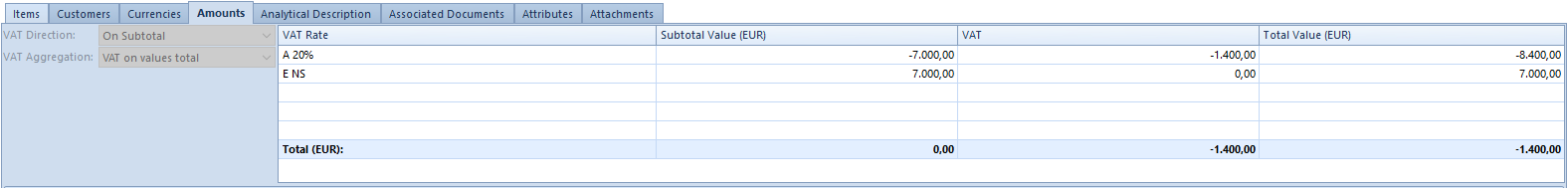

In case VAT rate correction document is issued:

- on total – a correction subtotal value is calculated

- on subtotal – a correction total value is calculated

A VAT table contains two records: the first one is retrieved from the source document and the second record applies to the modified VAT rate.

A VAT rate correction can be issued:

- to a confirmed SI/R/SOR document

- to a trade document from which one warehouse document has been generated

- when the associated document has been confirmed/posted

- only to a trade document if it is associated with a warehouse document

- when all the corrections, that are associated with the source document, have been confirmed

A VAT rate correction can be confirmed only when all the items, aggregated in a warehouse document into one item, have been corrected in the invoice.

Confirmation of VAT rate correction generates the following:

- a relevant warehouse document (if the source document is associated with a warehouse document)

- VAT invoice correction

- Payment (if VAT direction is set in a document to: From subtotal)

Cancellation of VAT rate correction (SITC, RTC) cancels automatically a warehouse document and its correction from the level of VAT accounts.