Contents

General information

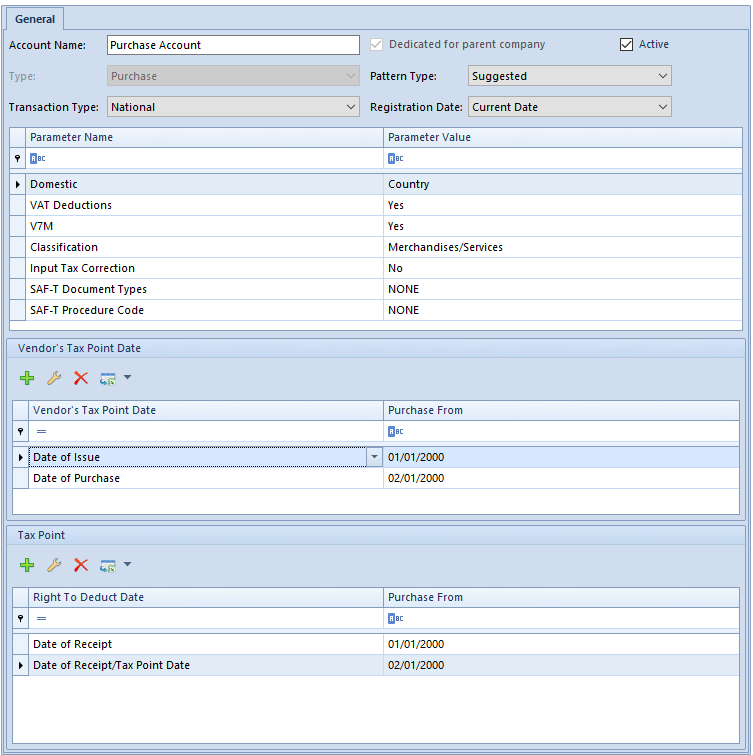

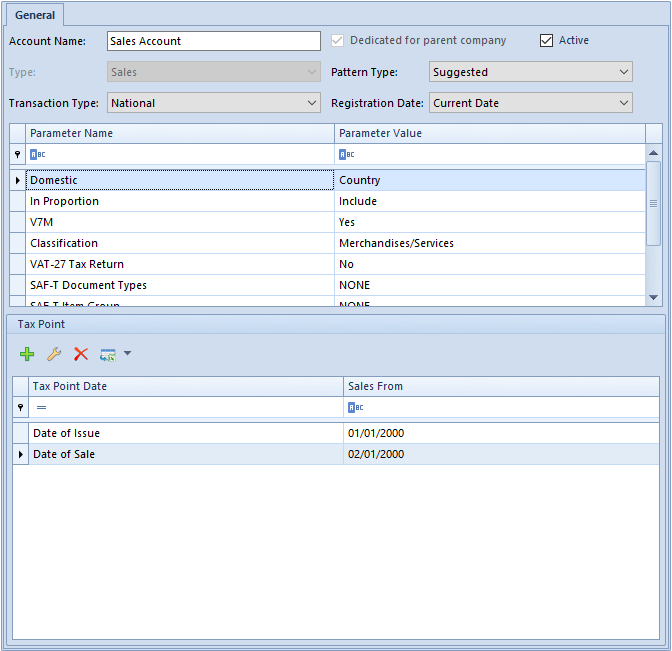

In order to add a VAT account, it is necessary to click on appropriate branch of the accounts tree (Sales or Purchase) and then click [Add Account] button in the Accounts button group. A form for entering of data appears.

Mandatory fields:

Account Name – VAT account unique name

Other fields:

Dedicated for the parent company – this parameter decides whether a given account is available only in the Parent Company and its child centers. The parameter is editable if an operator is logged-in to the parent company.

Accounts with selected parameter Dedicated for the parent company cannot be used in centers of Company type and in their child centers.

Default parameter setting during addition of new VAT account:

From the level of VAT account list for a user logged in to the parent company or to a center right below the parent company on the structure tree – it is selected, but it is possible to deselect it

- From the level of VAT account list for a user logged in to a center of Company type or to its child center – it is deselected and its selection is blocked

- From the level of the rights structure in the parent company – it is selected, but it is possible to deselect it

- From the level of the rights structure in a center of Company type – it is deselected and its selection is blocked

Rules regarding addition and availability of VAT accounts are described in article <<Object availability – Objects>>>.

Type – the type of account is entered, by default, depending on the branch the account is being added to (Purchase type or Sales type). The field cannot by edited.

Pattern Type – there are two pattern types possible to select:

- Suggested – when adding a VAT invoice, it is possible to modify the VAT parameters and the tax point. If parameters of a VAT invoice item are different from those set in the header, they are marked in red.

- Obligatory – when adding a VAT invoice to an account, it is possible to edit the VAT parameters and the tax point. These values are not editable.

Transaction Type – allows the assignment of the default type of transaction to a given account. The type is selected from the list that is defined in the system along with the assigned VAT parameters. By default, there are three types of transactions available: National, Intra-Community, and Non-EU. Additional types of transactions are specified on the list of VAT parameters available in tab Configuration → Accounting → VAT Parameters.

Registration Date – it allows for defining according to which date documents will be registered in a VAT account. This parameter determines also which date will affect the way invoices are numbered within a VAT account (No.). However, it does not affect the numerator of VAT invoices.

Parameters panel – displays all the VAT parameters associated with a given type of transaction. The panel is divided into two columns: Parameter Name and Parameter Value. Appropriate values for a given parameter are specified from the level of Configuration → Accounting → VAT Parameters.

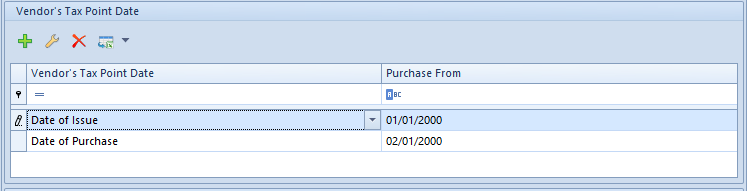

Vendor’s Tax Point Date – panel available in definition of an account of Purchase type

A user can specify according to which the vendor’s tax point will be determined. Moreover, it is possible to set a range of dates for this setting (column Purchase From). A tax point can be edited or added from the level of Tax Point Definitions list available in tab Configuration → Accounting → Tax Point.

Proper definition of a tax point is set by date of sale in VSI and VSIC documents and by date of purchase in VPI and VPIC documents.

This section is unavailable in French version of a database.

Tax Point Date – panel available in definition of an account of Sales type

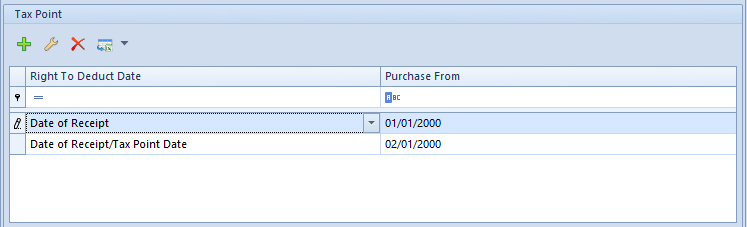

Allows for specifying a definition according to which the right to deduct VAT tax will be determined. Moreover, it is possible to set a range of dates for this setting (column Purchase From). A tax point definition can be edited or added from the level of Tax Point Definitions list available in tab Configuration → Accounting → Tax Point.

The date of the right to deduct VAT tax (from 01.01.2014) is determined on the basis of the following condition: If the date of receipt is earlier than the date of vendor’s tax point, then the vendor’s tax point date (Definition symbol: Date of Receipt/Tax Point Date)

Variant A

- A VSI was issued with date of purchase: 01.15.2014, the date of issue: 01.01.2014 and the date of receipt 01.02.2014,

- Vendor’s tax point Date of purchase – 01.15.2014

- Tax point Vendor’s Tax Point Date – 01.15.2014 (Date of receipt earlier than the vendor’s tax point date)

Variant B

- A VSI was issued with date of purchase: 01.15.2014, the date of issue: 01.01.2014 and the date of receipt 01.17.2014,

- Vendor’s tax point Date of purchase – 01.15.2014

Tax point Vendor’s Tax Point Date – 01.17.2014 (Date of receipt later than the vendor’s tax point date)

Vendor’s tax point date

- from 05.01.2013 to 12.31.2013 is determined according to condition From the date of issue (definition symbol: Date of Issue)

- from 01.01.2014 is determined according to condition From the date of transaction (definition symbol: Date of Purchase)

Right to deduct date:

- from 05.01.2013 to 12.31.2013 is determined according to condition From the date of receipt (definition symbol: Date of Receipt)

- from 01.01.2014 is determined according to condition: If the date of receipt is earlier than the vendor’s tax point date, then the vendor’s tax point date (definition symbol: Date of Receipt/Tax Point Date)

Variant A

- A VPI was issued with date of purchase: 12.31.2013, date of issue: 01.01.2014, and date of receipt: 01.15.2014

- Vendor’s tax point: Date of issue – 01.01.2014

- Tax Point Date of Receipt – 01.15.2014 (date of receipt is later than the vendor’s tax point date)

Variant B

- A VPI was issued with date of purchase: 01.15.2014, date of issue: 01.01.2014, and date of receipt: 01.02.2014

- Vendor’s tax point Date of Purchase – 01.15.2014

Tax point Vendor’s Tax Point Date – 01.15.2014 (date of receipt is earlier than the vendor’s tax point date).

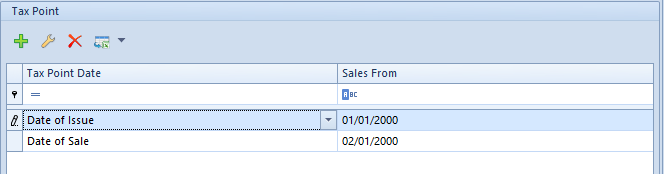

Tax Point Date – panel available in definition of an account of Sales type

A user can specify according to which the tax point date will be determined. Moreover, it is possible to set a range of dates for this setting (column Sales From). A tax point definition can be edited or added from the level of Tax Point Definitions list available in tab Configuration → Accounting → Tax Point.

from 05.01.2013 to 12.31.2013 is determined according to condition From the date of issue (definition symbol: Date of Issue)

from 01.01.2014 is determined according to condition From the date of transaction (definition symbol: Date of Sale)

Variant A

A VSI was issued with date of sale: 12.31.2013 and the date of issue: 01.01.2014

Tax point Date of Issue – 01.01.2014

Variant B

A VSI was issued with date of sale: 01.15.2014 and the date of issue: 01.01.2014

Tax point: Date of sale – 01.15.2014.

Adding VAT subaccount

To add a VAT subaccount, it is necessary to check the parameter Add subaccounts available on the parent branch (Purchase/Sales). Checking this parameter automatically generates a default subaccount.

The user is able to change the name of automatically generated subaccount and add new subaccounts with the use of option [Add Subaccount] in the Accounts button group. After selecting it a form for entering of data appears.

The subaccount form is the same as that of VAT account. VAT parameters and pattern are also determined according to the same rules. The only difference is the lack of parameter Date of Registration.

When being added, a new subaccount assumes the default setting Pattern Type from the parent account. If this type is Suggested, the new subaccount will also have this type set, by default and the same applies to obligatory accounts. In case of suggested accounts, it is possible to change pattern type of their subaccounts to Obligatory. All subaccounts of obligatory accounts must have obligatory pattern. All subaccounts with obbligatory pattern have obbligatory patern set by default and it is not possible to change it. If pattern type is changed for an account to Obligatory, all its subaccounts inherit this pattern, by default.

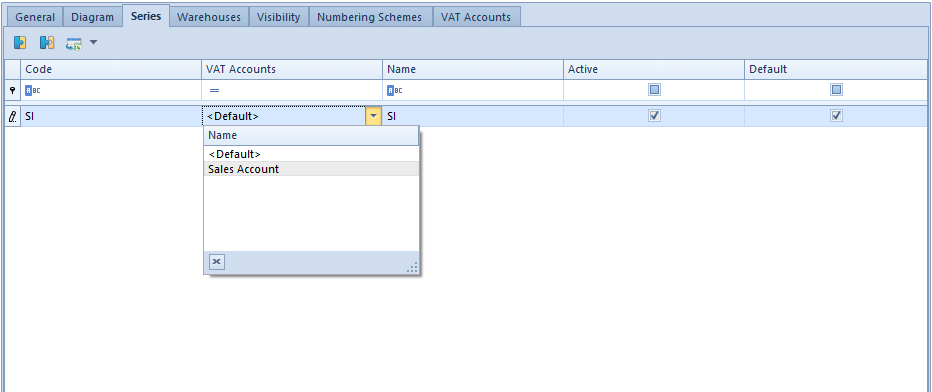

Associating VAT account/subaccount with document series

It is a common situation that numerators of individual documents include unique series. Comarch ERP Standard system allows for associating a specific series of a document with VAT account/subaccount. Owing to that, in an issued document, there is an account/subaccount assigned to the document series uploaded, and upon confirming the document, an entry is added in a proper registry.

In order to associate a specific document series with selected VAT account/subaccount, go to Series tab on a given document type definition in a company or a center and assign the account/subaccount.

In VAT Account field there are two options available for selection:

- <Default> – VAT account will be uploaded onto a document with given series according to settings for a given document type in particular company/center

- One of VAT accounts/subaccounts assigned to a given document type definition (added in tab VAT Accounts of the definition)

When issuing a trade document, account/subaccount default for a given document type or account/subaccount associated with series is assigned. The user can change that account/subaccount directly on a document in Amounts tab.